Forex option brokers

If you have an interest in trading forex, then you will need to find a suitable broker.

Top-3 forex bonuses

We believe that our list above contains the best brokers for this particular form of trading. For more guidance on how to choose the right broker for you, please see below. The amount of online brokers in the market means that there'a s a lot of competition between brokers to try and attract new customers. This is great news for traders, as the end result of this is ultimately that most brokers work that bit harder to give their customers the best deals.

Best brokers for forex options

The following online brokers are all great choices for traders looking to trade options where the underlying security is foreign currencies. In our opinion, these forex options brokers are of the highest quality and we can strongly recommend signing up at any one of them.

The forex market, where foreign currencies are traded, is an incredibly liquid and fast moving market. Forex options are a great way to combine the trading opportunities in that market with the flexibility and versatility that contracts offer, and the trading based on foreign currencies is becoming more and more popular. Forex options are commonly used for hedging purposes as well as for speculating to make profits.

- One of the most trusted names

- Get up to $600 cash credit

- Forex education center to help your trading

- Offering 90 days free trade commission

- Training area for learning the basics of forex

- Trade with over 50 currency pairs

- Fully customizable forex charting

- Very competitive pricing in the market

- Excellent customer support and service

If you have an interest in trading forex, then you will need to find a suitable broker. We believe that our list above contains the best brokers for this particular form of trading. For more guidance on how to choose the right broker for you, please see below.

How we rank brokers

Choosing which broker to sign up with is often one of the most challenging decisions facing traders, and it's certainly one of the most important. The main reason choosing an online broker is so hard is largely because there are so many of them to choose from. A simple internet search would reveal a huge range of brokers offering their services and most of them are perfectly good.

However, while it's relatively easy to find a decent broker the difficulty is in choosing which one is the most suitable for your own requirements. Not all traders need the same things from their broker, so a broker that might be a good choice for one trader may not necessarily be a good choice for you.

It is with this in mind that we created a comprehensive section on this site, dedicated to detailing the best brokers. Rather than simply produce a single list of the best services, we have actually made recommendations in a number of different categories to help you find a broker that is best for a particular purpose.

Key factors for forex brokers

We believe it's also helpful to offer some advice on how to choose which of our recommendations might be best for you. So, in addition to the recommended online forex options brokers listed above we have also covered some of the specific things you should be considering when selecting one to sign up at.

- Commission structure

- Sign up incentives

- Speed & quality of transactions

- Customer service

Commission structure

Trading forex options typically involves making a number of transactions on a regular basis, which means you should try and use an online broker that charges relatively low commissions on each trade. We should point out that it is not necessarily a simple matter of choosing the very cheapest broker, as there are other factors to also take into account, but the commission structure should definitely be a big consideration.

It's important to choose a broker that has a commission structure that is suitable for the type and the amount of transactions that you will be making because, not all brokers charge their commissions in exactly the same way.

Some places charge a fixed amount of commission per contract being traded, while others charge a percentage of the value of each trade. A particularly common structure is a fixed amount per trade that covers a certain amount of contracts, and then an extra charge for each additional contract in the trade.

If you have an approximate idea of the average value of each trade you will be making, and the amount of contracts in each trade, then you can do some simple calculations and work out what structure is likely to offer you the best value in the long run. It is worth noting that a number of traders offer customers a choice of plans.

As well as the commissions that are charged per trade, a lot of brokers have a schedule of additional fees too. These can include annual or monthly account management fees, charges for using certain tools, or charges for depositing and withdrawing. Although the commissions will usually make up the majority of the costs involved with using a broker, these additional fees can sometimes be substantial too so it is worth checking out everything that a options broker charges.

Sign up incentives

The amount of online brokers in the market means that there'a s a lot of competition between brokers to try and attract new customers. This is great news for traders, as the end result of this is ultimately that most brokers work that bit harder to give their customers the best deals.

One particular method that's used by brokers is to offer some kind of incentive to new customers in order to encourage them to open an account with them. A common incentive is bonus funds that are added to your account when you make your first deposit, giving you extra money to trade with. Other incentives include free or reduced rate commissions for a period of time after joining, or some form of rebate on commissions once you have made a certain amount of trades.

Please be aware that most of these sign up incentives will come with terms and conditions. If you do claim a sign up bonus then you will usually have to pay a certain amount in commissions before you will be able to make a withdrawal from your account. Some of these bonuses can in fact never be withdrawn and can only be used for the purposes of making trades, although you do get to keep any profits that you make when using the bonus.

The terms and conditions at the best brokers will usually be perfectly fair, but you should make sure you understand what they are before signing up and depositing your funds.

Speed & quality of transactions

Trading options and forex options in particular often requires quick reactions and it can be essential to move quickly in order to enter or exit a position at precisely the right time if a trade is going to be profitable. Because of this, it's vital that your broker executes your transactions as quickly as possible after your order is placed.

Just a short delay can result in your order not getting filled at the best prices or possibly not getting filled at all, which can obviously impact your profits. To be fair, the best online brokers are all very good in this respect but it is still something that you should be conscious of.

Customer service

A lot of traders don't even think about the quality of the customer service when they are signing up with an online broker. It probably isnвђ™t the most important thing to consider, but it is still much better to get good customer service as a poor service can be very frustrating to say the least.

Of course, if you stick to using reputable brokers then the chances are that you will have very little need to contact customer service вђ“ but there are bound to be some occasions when you encounter a problem or have a question you want to ask. A good way to test the customer service at an online broker is to give them a call or send them an email with some questions before you sign up, and see how quickly they respond and how helpful they are.

Summary

The best advice we can give on this subject is really just to put some thought into choosing an online broker. If you spend a little bit of time and effort into thinking about exactly what you want from your options broker then it makes it much easier to determine which broker is best for you.

We have made the task much easier for you, as you can be safe in the knowledge that all of the places we have recommended are very good, but it is still worth comparing our recommendations yourself and working out which one is the most suitable for you and your own requirements.

Forex option brokers

TRADE FX & OPTIONS VISUALLY

structure any FX or option trade with our unique interactive page the historical chart shows you the past, and confidence interval shows you where the market may be heading profit/loss chart shows your risk and reward, and updates live

STREAMING PRICES FOR 40+ CURRENCY PAIRS & GOLD

custom market watch pages load quickly implied volatility curves give you the full market picture visualise current and historical implied volatility, and realised volatility

TRADE SPOT FX FROM CUSTOM CHARTS

set entry and closing limits directly from the chart – get a clearer picture see instantly how limit orders impact trade risk and profitability interactive sliders allow you to set entry limit or stop, and closing take profit and/or stop loss orders

IMPLEMENT ANY OF 13 TOP OPTION STRATEGIES

trade spot, calls, puts, and combination strategies from a clear menu spreads are automatically reduced for combination strategies, like spreads and risk reversals new integrated strategy guide helps you to structure your trade right

bar charts show net exposure by currency pair and by single currency special pages offer summary of portfolio risk, including delta, vega, and theta open positions page shows each trade’s risk measures, with full sort and filter capabilities

FX OPTIONS PUTS YOU FIRMLY IN THE DRIVERS SEAT

Forex options and beyond

Create the optimal portfolio - choose from over 40 currency pairs and any combination of CALL and PUT options in one single account. Execute straddles, strangles, risk reversals, spreads, and other strategies, with just one click.

Avaoptions gives you total control over your portfolio, letting you balance risk and reward, to match your overall market view.

Take a view, hedge or trade to generate income

BUY options to hedge risk or take a view, SELL options to generate income – it’s easy with our intuitive trading platform. Expirations available on business days – choose from overnight, to one-year expiration, at any strike price you set.

Avaoptions includes a wide selection of professional risk management tools, portfolio simulations, and much more. Powerful desktop and mobile platforms can empower your trades.

Flexible orders mean absolute control

Trade CALLS and PUTS with stop and limit orders, which can be triggered by a pre-determined premium level, mean added control over trade entry and exit. Trade strategies for improved pricing efficiency.

Built with money managers in mind

We offer full money management functionality to let you trade multiple accounts with one single ticket.

Forex option brokers

TRADE FX & OPTIONS VISUALLY

structure any FX or option trade with our unique interactive page the historical chart shows you the past, and confidence interval shows you where the market may be heading profit/loss chart shows your risk and reward, and updates live

STREAMING PRICES FOR 40+ CURRENCY PAIRS & GOLD

custom market watch pages load quickly implied volatility curves give you the full market picture visualise current and historical implied volatility, and realised volatility

TRADE SPOT FX FROM CUSTOM CHARTS

set entry and closing limits directly from the chart – get a clearer picture see instantly how limit orders impact trade risk and profitability interactive sliders allow you to set entry limit or stop, and closing take profit and/or stop loss orders

IMPLEMENT ANY OF 13 TOP OPTION STRATEGIES

trade spot, calls, puts, and combination strategies from a clear menu spreads are automatically reduced for combination strategies, like spreads and risk reversals new integrated strategy guide helps you to structure your trade right

bar charts show net exposure by currency pair and by single currency special pages offer summary of portfolio risk, including delta, vega, and theta open positions page shows each trade’s risk measures, with full sort and filter capabilities

FX OPTIONS PUTS YOU FIRMLY IN THE DRIVERS SEAT

Forex options and beyond

Create the optimal portfolio - choose from over 40 currency pairs and any combination of CALL and PUT options in one single account. Execute straddles, strangles, risk reversals, spreads, and other strategies, with just one click.

Avaoptions gives you total control over your portfolio, letting you balance risk and reward, to match your overall market view.

Take a view, hedge or trade to generate income

BUY options to hedge risk or take a view, SELL options to generate income – it’s easy with our intuitive trading platform. Expirations available on business days – choose from overnight, to one-year expiration, at any strike price you set.

Avaoptions includes a wide selection of professional risk management tools, portfolio simulations, and much more. Powerful desktop and mobile platforms can empower your trades.

Flexible orders mean absolute control

Trade CALLS and PUTS with stop and limit orders, which can be triggered by a pre-determined premium level, mean added control over trade entry and exit. Trade strategies for improved pricing efficiency.

Built with money managers in mind

We offer full money management functionality to let you trade multiple accounts with one single ticket.

Best options broker trading platform

Wayne duggan

Contributor, benzinga

For traders specifically looking to trade options, choosing the best options trading platform can be particularly crucial. Most major brokers have options trading capabilities, but not every platform is geared specifically for options trading. Below, we’re taking a look at the top choices for these trading platforms, from free options trading to paid platforms.

Best options brokers:

- Best for passive investors: charles schwab

- Best technology: tradestation

- Best for beginners: TD ameritrade

- Best for margin accounts: interactive brokers

- Best for mobile traders: E*TRADE

- Best derivatives only broker: tastyworks

- Best for social traders: gatsby

- Honorable mention: eoption

In general, options trading is a very profitable offering for brokers, so there are plenty of great deals out there for traders.

Best for options traders

Low commissions are just the tip of the iceberg when it comes to choosing the best option trading platform. Traders need to consider hidden fees, such as platform fees and data fees.

Different traders have different skill levels, trading strategies, and needs. Options trading can be complicated, and beginners need to make sure to find a platform with plenty of educational resources and guidance. Advanced traders need to look for professional-grade features and research. Before choosing the right broker , each trader needs to consider his or her trading style and which features are most important in maximizing profitability.

Here’s an overview of some of the top option-trading platforms based on several different criteria.

Commissions

Account minimum

Best for

- 3 trading platforms perfectly in sync makes matching your platform to your skill level a snap

- Excellent futures trading education for new traders

- $0 account minimum means anyone can start trading

1. Charles schwab

What do you need schwab to do for you?

Help you save for retirement? Trade stocks or options? Or more?

If you’re a passive investor, schwab can guide you through handling your money to prep for retirement. Schwab leads you through the process:

- Use theretirement savings calculator to understand where you are currently and how much you can (and want to!) save.

- Strategize. Learn how to save, then estimate your retirement needs.

- Build your portfolio, all the while keeping your long-term goals and risk tolerance in mind.

- Choose the right plan for you, whether you prefer tax-advantaged growth or have your own business.

If you’re a trader, schwab makes online stock trading affordable. It offers $0 online equity commissions for:

- U.S. Stocks, including over-the-counter stocks (otcs), ipos and more.

- Schwab stock slices, or fractional shares: want to own any company in the S&P 500 for as little as $5? You can!

- International stocks: you can trade american depositary receipts (adrs), foreign ordinaries and canadian stocks through schwab.

Trade options with schwab for less — and gain more technology (like streetsmart edge on schwab.Com and schwab mobile apps). You’ll find:

- $0 base + $0.65 per options contract

- Intuitive tools and platforms

- Support from options specialists

- Education and expert commentary

Schwab’s idea hub canvasses the market for trade ideas based on market action, volatility, earnings and income-based strategies. Its trade and probability calculator helps you assess the potential risk, reward and pricing scenarios of a trade before you take action. You can also place single, multi-leg and conditional orders using the intuitive all-in-one trade ticket.

Finally, schwab’s walk limit order type works your options orders for you to try to obtain a favorable execution price.

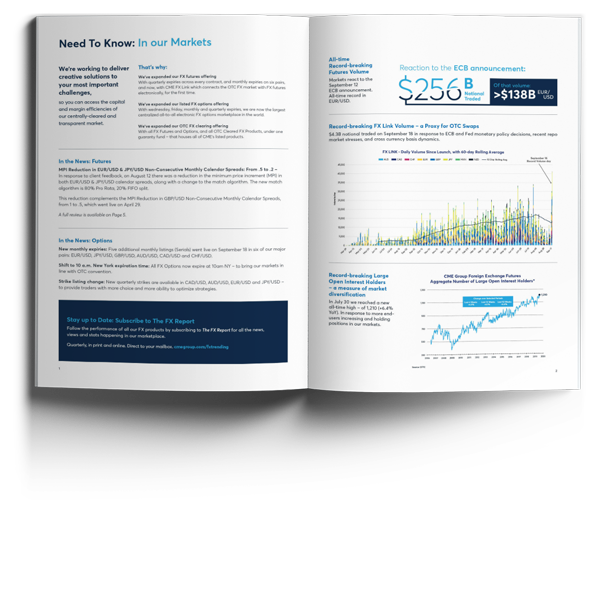

FX options

Benefit from our award-winning FX options platform, the market depth you need, the products you want and the tools you require to maximize your options strategies across 24 FX options contracts, available nearly 24 hours a day.

NEW find out everything any participant needs to know to trade FX options – from a 50% fee reduction on trades for customers with large risk transfer needs, to recent liquidity stats to how to get involved.

Show me

FX options

| clearing | globex | floor | clearport | product name | product group | subgroup | cleared as | volume | open interest |

|---|---|---|---|---|---|---|---|---|---|

| EUU | EUU | EUU | EUU | EUR/USD monthly options | FX | majors | options | 5,942 | 163,963 |

| GBU | GBU | GBU | GBU | GBP/USD monthly options | FX | majors | options | 985 | 81,812 |

| JPU | JPU | JPU | JPU | JPY/USD monthly options | FX | majors | options | 1,559 | 53,483 |

| CAU | CAU | CAU | CAU | CAD/USD monthly options | FX | majors | options | 1,739 | 51,224 |

| ADU | ADU | ADU | ADU | AUD/USD monthly options | FX | majors | options | 2,179 | 38,496 |

| 3EU | 3EU | 3EU | 3EU | EUR/USD weekly friday options - week 3 | FX | majors | options | 306 | 730 |

| 3JY | 3JY | 3JY | 3JY | JPY/USD weekly friday options - week 3 | FX | majors | options | 260 | 353 |

| 3AD | 3AD | 3AD | 3AD | AUD/USD weekly friday options - week 3 | FX | majors | options | 12 | 334 |

| 4EU | 4EU | 4EU | 4EU | EUR/USD weekly friday options - week 4 | FX | majors | options | 409 | 0 |

| WE3 | WE3 | WE3 | WE3 | EUR/USD weekly wednesday options - week 3 | FX | majors | options | 0 | 0 |

Follow FX options: get the FX report, straight to your inbox

Keep up-to-date with what’s happening in the FX marketplace. Sign up to receive product news, market trends, expert views, and statistics about our markets – from G10 to emerging markets, across futures, options and FX link.

- Be among the first to read the FX report – delivered straight to your inbox

- Stay connected in real-time – access more insights across our complex, and access developments over time in FX options

- Act faster – sign up once and save time in the future.

What are FX options?

What are FX options? And why should you consider trying them out? On this platform, we take a closer look at these exciting currency derivatives. To start with, FX options incorporate elements of forex and traditional options. Sounds interesting? Let’s get specific.

FX options are also known as forex options or currency options. They are derivative financial instruments, in particular, forex derivatives.

With an FX option, one party (the option holder) gains the contractual right to buy or sell a fixed amount of currency at a specific rate on a predetermined future date. Upon contract formation, the holder (buyer) has to pay a fee to the seller for acquiring the option. This fee is called the premium.

We can understand FX options as commitments; to future transactions in forward contracts and for predetermined prices. What is important is that the buyer of an FX option has no obligation to exercise his right. Contrary, the seller is bound to the contract if the holder declares to exercise his option.

FX option pricing

From the holder’s point of view, an FX option contract fulfills the same purpose as an insurance policy. The probability of a contractual claim determines the cost of the insurance. This price is usually calculated by using statistical assumptions.

The price of a forex option tries to represent the measure of risk. The premium maps two crucial figures, in particular. Firstly, the likelihood that the holder will use his policy in the future, and secondly, the expected loss for the issuing company.

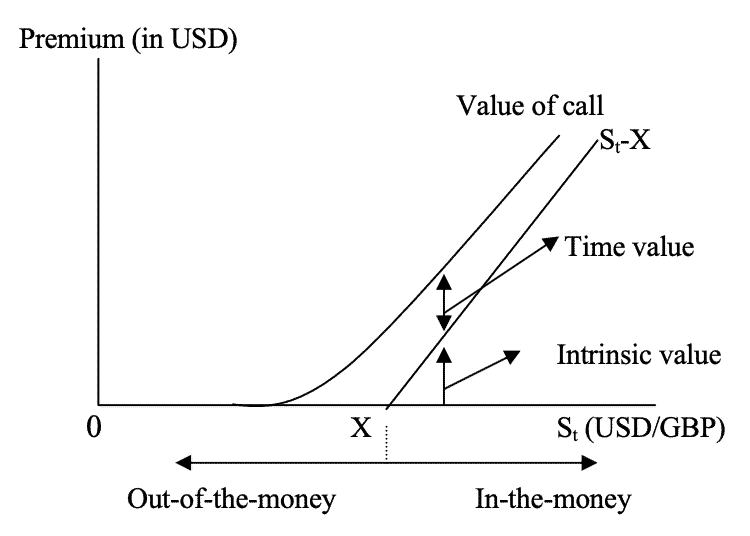

The price of the currency option, the premium, can be split into two different components, the intrinsic value and the time value.

The intrinsic value is the difference between the current FX spot price and the strike price of the option. We call the excess part of the premium the time value. It’s the difference between the premium and the intrinsic value.

Jargon FX option trading

| expression | description |

|---|---|

| in-the-money | if an option has intrinsic value, we say that the option is in-the-money (ITM) |

| out-of-the-money | if an option has no intrinsic value, we say the option is out-of-the-money (OTM) |

| at-the-money | the strike price and the current spot exchange rate are equal (ATM) |

A currency option will be worthless if it is OTM or ATM on its expiration date. Therefore, the holder will allow the option to expire.

Intrinsic value

The intrinsic value is the amount of money we could realize through exercising our option, under the assumption that the FX spot rate will equal the current rate on the expiration date. The reason is that the time value will always be zero when the currency option expires.

Hence, a forex call option has intrinsic value if the FX spot price is above its strike price. A forex put option has intrinsic value if the FX spot price is below its strike price.

Time value and implied volatility

The calculation of the time value is far more complex. The reason is that many parameters influence the time value. The dominant parameters are the volatility of the underlying currencies and the time left until the expiration.

Higher implied volatility increases the price of the forex option because there is an increased chance for profitable movements. Calculating the time value even addresses the difference in the interest rates between the two currencies. Such embedded interest rate differentials in currency trades are called FX swap rates.

The closer the expiry date gets, the more the time value declines. At the expiration, it is zero. The time value of an option is maximal when the option is at-the-money. At this moment, the complete premium equals the time value, and there’s no intrinsic value.

The most common statistical method for european FX options pricing follows the garman-kohlhagen model, which calculates a log-normal process. It is a modification of the well-known black-scholes model for standard option pricing and takes the two risk-free interest rates of a currency pair into account.

Why do we use FX options?

The FX options market is the options market with the highest depth and liquidity in the world. Market participants can use different strategies for limiting risks and increasing profits.

Traders: fixing potential risks

If the FX rate moves against our position in the FX spot market, we have a loss. By acquiring a forex option, we can remove the risks of unpredictable losses; our minus will always be limited to the premium then.

This strategy works like an insurance contract. If the market moves against us, the option protects us by limiting and fixing the potential minus. On the other hand, we can still profit from favorable FX rates should the market move in our direction.

FX options have the advantage that the upside is unlimited. At the same time, we can only lose what we have paid for the contract. Thus, we can develop sophisticated trading strategies. Because you cut your losses and speculate for potentially unlimited wins, you don’t need to win 50% or more of your trades.

Since we know our maximal loss before, position sizing in the spot market can happen with easy and predefined strategies. Another advantage for traders is that they can work without stop-losses for open positions in the spot market. Buy a contract and let the markets decide. Forget about permanently checking your stop-losses, which only leads to mental mistakes – peace of mind.

Hedging with FX options

This type of option is also beneficial for hedging FX risk in portfolios when the direction of movements in exchange rates remains uncertain for some time. That’s why forex options are handy financial derivatives, especially for portfolio managers.

Currency market turbulence and massive exchange rate fluctuations can happen due to unforeseen events in the world economy or politics. By utilizing FX options, we can protect ourselves against these sudden movements in exchange rates.

Contrary to the purchaser, the option seller’s risk is potentially unlimited. He will always receive the fixed premium for taking over the risk. That’s why an option seller needs a considerable amount of liquidity.

FX option types

Two different types of options exist per FX pair because of the two underlying currencies.

The purchaser of an FX call option has the right to buy the underlying currency. The seller of the call option has an obligation to sell the underlying currency if the purchaser exercises his right. An FX put option gives the purchaser the right to sell the underlying currency. The seller of the put option must sell the underlying currency if the purchaser exercises his right.

In all FX transactions, one purchases a currency for another one. Therefore, every single currency pair trades both as a call and put.

FX option styles

There are different FX options styles which you can classify.

Forex options may differ in the dates on which we may exercise them. European FX options may only be exercised on the expiration date and not earlier. American FX options are more flexibly styled products. We can exercise them at any time until their expiry dates.

Both american and european options belong to the class of vanilla options. Vanilla options include all options for which the payoff is calculated similarly.

The second class is called exotic options. Their price calculation is often very challenging and less transparent because they are traded OTC. An example is binary FX options. To protect consumers, they are forbidden in many countries.

Forex option contracts – important terms

Strike price

the strike price or exercise price is the price at which the option buyer has the right to either buy or sell the underlying currency. The strike price has to be determined in advance and is part of the option contract.

Expiry date

the expiry date (expiration date) is the last date at which the option may be exercised. After this date, the option contract expires.

Delivery date

only relevant if the option is exercised. It’s the date when the currency exchange finally happens.

Premium

the cost of purchasing the FX option. The buyer has to pay upfront for the premium, i.E., at the time of purchase. The premium is calculated based on risk assumptions and depends on different factors. For instance, the difference between the current price and strike price of the underlying FX rate, and the time between the purchase and the expiry are significant.

Exercise

exercising the option means using the right that has been granted by buying the option. If the buyer decides to exercise the option, then the seller will be informed, and the guaranteed FX transaction will happen.

An example

A european EUR/USD option could give the holder the right to sell €1,000,000 and buy $1,200,000 on december 01. Here, the agreed strike price is EUR/USD 1.20.

If the exchange rate is lower than 1.20 on december 01, then the holder will exercise the option. If the EUR/USD rate drops to 1.15, then his profit in USD is (1.20 – 1.15) x 1,000,000 = 50,000 if he uses the option. Also, he can buy back EUR in the spot market at a lower exchange rate of 1.15 then.

As you can see, we eliminate the upside risk in EUR/USD by paying the premium. At the same time, the holder can still profit from a drop in the currency rate.

Where can I trade forex options?

Look for a broker that offers FX options trading. Some brokers provide direct market access to the future and options exchanges such as the CBOE or EUREX. Others offer their own OTC contracts. Additionally, the minimum deposit and fees can be different.

Recap FX options

What do we do with FX options?

We obtain the right to buy or sell currency for the strike price on the expiry date.

We have no obligation to exercise this right.

The premium is the cost we pay.

How does an FX option work?

The option price consists of intrinsic and time value.

There are FX call and FX put options for both market directions.

American options can be exercised anytime on or before the date of expiration.

European options can only be exercised on the date of expiration.

When and why should I use currency options?

Your risk is limited to the price of the option.

Traders trade market volatility, or they trade without classic stop-loss strategies.

Portfolio managers and businesses hedge forex risks.

Forex brokers for US traders (accepting US clients)

Below you will find a list of forex brokers accepting US traders as clients. Due to the strict and complicated regulatory environment, it became quite a challenge for FX companies to operate in the US. To make it worse, thanks to the dodd-frank act and the memorandum of understanding, many licensed forex brokers all over the world stopped accepting US clients. Still, there are some offshore countries where local authorities haven't yet imposed the restrictions. Unfortunately, most unchained brokers are not regulated, although that’s exactly the reason why there’s an opportunity to open a trading account with them. Notable benefits of going offshore: no hedging prohibition, no FIFO rule application and trading leverage is much higher.

Over the last decades, the forex market in the US has emerged as one of the most regulated markets anywhere in the world. Rules that were introduced and backed up by federal laws have made it very difficult for brokers and traders alike to operate in the US forex market. For many years, only three brokers operated in the US forex market: oanda, GAIN capital LLC (forex.Com) and TD ameritrade. Others were either put out of business or were forced to close down as a result of the strangulating environment created by the regulators, backed up by the dodd-frank wall street reform and consumer protection act of 2010.

What changed?

After the global financial crisis of 2008 which had its origins in the US subprime mortgage market, there were general calls for better regulation of the various markets operating in the united states. The dodd-frank act was a direct consequence of this agitation. This law strengthened the commodities and futures trading commission, enabling it to oversee not just the conventional financial markets, but also the swaps market which was valued in trillions of dollars.

Changes to the way business was conducted in the US financial markets were sweeping and aggressive. Some of the changes which were directly targeted at the retail segment of the market were as follows:

- A) introduction of leverage caps in forex and options, pegging leverage at 1:50 for forex majors, and 1:20 for forex minors, and forex options trading.

- B) elimination of hedging ability via the introduction of the first in, first out (FIFO) rule. Thus rule states that a position on an asset must first be closed before another can be opened on the same asset. The FIFO rule effectively ended the hedging style of traders placing opposing positions on the same asset.

- C) stratification of traders in the FX market was institutionalized, as these rules were targeted at the so-called “unsophisticated’ investors, defined as traders with assets that are less than $10million, as well as small businesses. Professional and commercial traders (investment banks) were largely exempted from these changes.

According to the CFTC, these rules were meant to protect the retail clients from overexposing their money to the market and from taking excessive risk. But to what extent these rules have actually protected the retail consumers of forex products in the US is anyone’s wildest guess.

What the regulators of the US financial markets will not readily reveal, is that many traders in the US simply exited the US market and migrated their accounts to brokerage platforms in other countries. Forex brokers located in the US have had whatever market share they had badly eroded, and brokers without the kind of purposeful structure that the former US brokers suddenly emerged as less desirable but ready alternatives to traders who were unwilling to trade under the new conditions in the US.

In other words, the dodd-frank act actually stifled the forex brokerage business in america and the statistics do not lie. During the good times, more than 40 retail FX brokers were serving both US and international clients. Ever since dodd-frank became law, that number dwindled to the three brokers mentioned above, and the international clientele base simply moved away from the US and on to brokerages in the UK, europe, australia and the caribbean. A lot of the damage in the US forex brokerage business environment came as a result of the $20million bond which was imposed as a requirement for starting a forex brokerage business in the US. Tax reporting requirements have also scared off many brokerages from accepting US clients. Clearly, no foreign forex company wants to get the same kind of attention that huawei got from the US government in 2019, or what tiktok got in 2020.

What are the current options for US forex traders?

In 2019, some brokers made moves to re-enter the US market. Unfortunately, the COVID-19 pandemic slowed down the process dramatically. Still, some new brokers managed to enter the US forex market in recent years, so traders now have more choice than before.

So what is the current state of the US market as it concerns US forex traders?

1) consumer-friendly regulators

Regulators in the US have made a series of changes designed to improve trading outcomes for US forex traders. For instance, the commodities and futures trading commission (CFTC) has made its weekly CFTC positioning report (also known as the commitment of traders report, or COT) more readily available. This report shows what the major players in the commodities and currency markets are doing. Using this information, summaries of which are found on some MT4 platforms of US forex brokers, traders can consider their positions against the backdrop of the institutional speculators are trading. This provides for more informed trade decisions.

Additionally, the CFTC is now more reachable as a number of channels are now open so the public can make complaints or submit inquiries and observations.

2) more robust database of providers

Everyone working in the industry must be registered with the CFTC and NFA. The NFA has taken it a step further by requiring biometric registration of those who provide services to traders, be it brokerage services or fund management. This biometric information can be shared with the federal bureau of investigation (FBI), and this has been a strong deterrence against wrongdoing by brokers. When last did you hear of US forex brokers swindling customers of their funds?

The CFTC database of providers is very vast. All floor traders/brokers, introducing brokers, swap dealers, retail forex dealers, commodities pool operators (cpos) and commodities trading advisors (ctas) who are licensed to provide services to US forex traders are all on this database.

If you are approached by anyone claiming to be any of these, you can easily contact the CFTC for near-instant verification. Even those who are not listed on the CFTC database by reason of exemption must appear on the NFA database, and the reason for the CFTC exemption provided.

3) expanded list of US-regulated forex brokers

There used to be a time when more than 70 brokers operated in the US forex market. The dodd-frank act thinned them out to just 3, and it remained this way for a nearly a decade. At the present day, there are now 8 regulated forex brokers in the US. Oanda, forex.Com (GAIN capital) and TD ameritrade retained their positions, and are now joined by ATC brokers, IG US, interactive brokers, ally invest and thinkorswim (now owned by TD ameritrade).

4) leverage caps

The 2018 ESMA rules in europe forced all local brokers to set a 1:30 leverage limit for all major FX currency pairs. In the US, this cap remains at the 1:50 level introduced in 2010. US forex traders will continue to enjoy what now seems to be the most liberal leverage caps in the tier 1 regulatory jurisdictions.

5) credit-based funding for customer forex accounts

Bank drafts and direct debits from a bank-linked ATM card are now the recognized means of account funding for US forex traders. The use of credit cards is now prohibited.

These are some of the changes that US forex traders have faced in 2020. 2020 also marked the year of the COVID-19 global pandemic that has completely changed the face of the global economy. However, while many other economic sectors have been badly hit, forex trading and other forms of financial market activity have thrived. In fact, the massive job losses and furloughs across the world that left millions without a source of income, drove the same people to the financial markets. Many brokerages have witnessed a surge in new trading account registrations as well as inquiries about trading. COVID-19 has changed the face of financial trading and it is likely that a number of changes as to how forex is traded in the US are coming.

What does the future hold for US forex traders?

So what possible changes can US forex traders hope to see in 2021 or in the years to come?

1) changes to margin rules

It is likely that forex traders in the US may face changes to margin rules on their accounts. US forex brokers are expected to have rolled out the phase 5 and phase 6 rules on uncleared margin, known as UMR 5 and UMR 6. UMR stands for uncleared margin rules. These rules have to do with how buy side participants in the forex market handle initial margin and variation margin among all counterparties in the market. Compliance with the UMR 5 and 6 means that there is a consolidated margin threshold of 50 million units of either the EUR or the USD that must be adhered to, among other requirements.

These rules were originally conceived in the aftermath of the 2008-2009 global financial crisis to enable firms handle risk better, and were meant to be implemented in phases. UMR 1 commenced in 2017. Full compliance with phase 5 UMR rules was to kick in by september 2020, but has been moved by a year to september 2021. While the full details of these rules would be out of the scope of this piece, suffice it to say that these new rules would make it harder for new players to enter into the retail FX brokerage space in the US. It would also stretch the resources of existing brokerages in terms of compliance with these rules. Ultimately, the entry point for opening a forex trading account may climb dramatically, putting it out of the reach of many. If you have been thinking of opening a US forex trading account, this may be the best time to do it.

2) advancements in technology

Algo adoption is expected to grow, whole artificial intelligence (AI) will start to feature more prominently in the development of market trading software. 2021 may be the year when US forex traders who want to maintain an edge in their trading may have to start using tools and software that can perform smarter analysis and make more rational trading decisions.

3) blockchain-based platforms

2021 may be the year when blockchain-based trading platforms may start to hit the US forex market. Some brokerages in japan and singapore have started to experiment with these platform types. Perhaps 2021 may be the year that we could see these used more widely in the US. Will this signal the beginning of the end for the MT4, or will metaquotes respond accordingly?

4) increased volatility on the US dollar, euro and british pound

Coronavirus vaccines will be out in 2021, but the availability of these vaccines seem to be geographically defined. Countries like the US and UK are buying up stocks in advance, so it is likely that these vaccines will not go round the world. Remember the dark days of the HIV epidemic when there was disproportionate access until PEPFAR and the global fund kicked in? This is probably what will happen unless something is done about the situation. COVID-19 will continue to dominate headlines, along with attempts to rescue the global economy. It is looking like there will be a change of guard at the white house. 2021 will see more volatility on the US dollar, euro and british pound.

It is prudent to say that there may be other occurrences in 2021 which have not been captured here, but which cannot be ruled out. Nobody can predict the future with 100% certainty.

Closing note

One of the best things that consumers of any product can enjoy is the power to choose, and to be able to make that choice from a wide range of service providers. This is what the dodd-frank law has taken away from US forex traders… but things have changed. Aside from a few forex brokerages operating in the US, there are a number of offshore forex brokers expressing willingness to take US traders on their platforms.

There are a number of advantages and also drawbacks to this arrangement. In terms of benefits, this is what US forex traders will enjoy when they use the offshore brokers presented in the list below.

- A) the ability to hedge trades is a risk management tool. The FIFO rule basically prevents this from happening. Realizing this great folly in the US forex brokerage setup, the offshore brokers in the list provide below have created a system which allows traders to hedge, even if it means placing opposing positions on the same asset.

- B) the CFTC has argued that the leverage caps protect retail traders by stopping them from overexposing their capital and accounts to the market. The leverage caps imposed a high minimum capital requirement on forex accounts opened in the US. This requirement only served to lock out a large segment of the trading public. With the forex brokers for US traders introduced here, you get lower capital requirements you can actually meet. You also trade with a wider spectrum of leverage, which allows you to trade under non-restrictive leverage conditions.

- C) your greatest asset as a consumer (the power to choose) is restored. You have a choice of not just a few brokers, but many ones. If a broker does not match your requirements, move to the next one on the list.

The brokers featured in the list below have been carefully selected to offer you a forex brokerage service that rivals what you can get anywhere in the world, and under non-restrictive conditions. They are great for beginners who can make a transition from a demo account to a lightly funded live account, just to ensure they can understand what live trading is all about before they get more heavily committed. ECN style accounts are also available for those who prefer to trade directly with the FX interbank market. There is a lot of choice for you as you go through this list of brokers, one after the other.

Best forex brokers in US 2021

The brokers below represent the best forex in the USA.

Your capital is at risk

Your capital is at risk

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Capital at risk

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Capital at risk

75% of retail CFD investors lose money

Market maker, no dealing desk, STP

75% of retail CFD investors lose money

Your capital is at risk

ASIC, CFTC, FCA, FSA(JP), IIROC, MAS, mifid, NFA

Your capital is at risk

Best forex brokers in the USA

Headquarters : cannon bridge house, 25 dowgate hill, london EC4R 2YA, UK

Your capital is at risk

In the US, IG claims spreads (the difference between buy and sell prices) are 27% lower than its top competitors. Signing up for an account is fast and easy, and it takes just a few clicks at access the popular metatrader4 (MT4) platform. IG owns the north american derivatives exchange (NADEX), though the two operate separately. They also own dailyfx.Com, a free forex news & research website. Read more to learn about IG and whether or not it makes sense for your forex trading needs.

IG is a popular platform for trading cfds in europe. The company recently expanded the united states and offers a wide range of foreign exchange assets for traders looking to test their luck in the fast-paced FX marketplace.

Forex.Com

Headquarters : 135 US highway 202/206 bedminster, new jersey, 07921

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Capital at risk

Forex.Com is currently one of the larger online brokers that is cornering the U.S online retail trading scene. The trading platform is owned and managed by a holding company known as GAIN capital which is in direct competition with FXCM for the domination of the U.S market. Highly regarded by many traders for their integrity, forex.Com is definitely one of the better online forex brokers for traders to partner with.

Etoro

Regulated by: ASIC, cysec, FCA, mifid

Headquarters : kanika international business center 7th floor, 4 profiti ilia street germasogeia, limassol, cyprus

75% of retail CFD investors lose money

Etoro was founded in 2007 and is authorised and regulated around the world through its different subsidiaries. This includes regulation from the cyprus securities and exchange commission (cysec), the UK financial conduct authority (FCA) and the australian securities and investments commission (ASIC).

The broker offers a wide range of products through the etoro trading platform and mobile app and includes the ability to trade on more than 2,000+ financial CFD instruments covering stocks, indices, commodities, currencies and cryptocurrencies. Users can also access ready-made copyportfolios, open investing accounts with zero commission, professional accounts and access social trading services via copytrader which is etoro’s most popular feature.

Oanda

Regulated by: ASIC, CFTC, FCA, FSA(JP), IIROC, MAS, mifid, NFA

Headquarters : 795 folsom st floor 1, suite 1038 san francisco, CA 94107

Your capital is at risk

The broker offers 2 types of trading accounts: a standard account and premium account. Both accounts offer 24 hours a day, 5 days a week support, the ability to trade forex, indices, metals, commodities and bond cfds, as well as institutional-grade execution on OANDA trade, the broker’s own, proprietary – and award-winning – trading platform for desktop, web and mobile as well as on metatrader 4.

OANDA provides impressive trading tools, research and education solutions such as autochartist, a forex order book and MT4 open order indicator, webinars, events and marketpulse for all the latest news and technical research.

How to choose a forex broker (as a US trader)

Considered the world’s largest market, the forex market never closes. It runs 24 hours a day and 7 days a week. Affected by numerous external factors, the forex market offers traders huge profitable opportunities for those who dare to dabble in it. The U.S forex industry is considered the most active forex industry around the world. Under U.S financial regulations, only brokers which are registered with the NFA or CFTC are permitted to accept traders from the U.S. Hence, this severally limits the choice of forex brokers which U.S based traders can choose.

How to choose a forex broker (as a US trader)

If you are a U.S trader who wishes to participate in retail forex trading, there are a few things that you should be aware off first before you decide which broker you wish to sign up with. This article will look at those areas which include:

- Regulated by competent regulatory agency

- Suitable and reliable trading platforms

- Competitive trading cost

- Having suitable trading accounts

- Reliable customer service

General regulation & US regulation

The forex market being an OTC (over the counter) market is one of the most difficult markets to regulate since there is no central exchange where forex trading activities are being carried out. Because of the unregulated nature of the OTC market, to protect U.S based investors from being scammed, the US government has introduced a regulatory framework to require all financial services providers to be a registered member of an authorized exchange. In short, the broker must be a member of the natural futures association (NFA) or the commodity futures trading commission (CFTC). However for the U.S, the main regulatory agency which is responsible for regulating forex trading is the NFA.

The NFA was established in 1982 and is a self-regulatory, non-profit organization. Its main responsibility includes the following:

- Approving and licensing of forex brokers

- Ensuring all approved brokers are in compliance with regards to their capital requirement

- Monitoring for fraudulent activities and stop such activities

- Reviewing the compulsory audited reports submitted by the brokers

In other words, the NFA ensures that all brokers operating in the U.S financial trading industry are operating with integrity, transparency and in compliance of their regulatory requirements. To help forex traders verify the regulatory status of brokers, the NFA has also provided a verification system known as called background affiliation status information center (BASIC) where traders can log in and check if a broker is an approved broker that is in compliance with all the regulatory requirements.

Trading platform & software

There are two main types of platforms adopted by brokers, proprietary which are built and designed in house by the broker or generic/white labeled platforms which are built by a third party and feature the brokers branding, such as their logo. The most popular example of this is the metatrader4 by metaquotes. This is adopted by most if not all forex brokers on the market today. Other popular examples are the sirix platform and the ctrader. It’s worth test-driving the proprietary platforms first in order to decide if their structure and interface suits you as a trader.

As the trading platform is the most important part of the broker’s operation, most brokers offer their clients a choice of a few different kinds of trading platforms.

Desktop platform/download

Depending on the trader’s preference, there is usually a choice of a desktop trading platform which traders can download and install onto their desktop computers such as the metatrader 4 platform.

Webtrader

Alternatively if they do not wish to download and install any software, they can opt for a web based trading platform which can be accessed using a web browser.

Mobile trader

For traders who find themselves on the move and wish to keep in touch with all the developments in the financial markets, they can use mobile trading apps which can be downloaded and installed onto their smartphones or mobile devices.

What is most important when evaluating a trading platform is to ensure that it is user friendly and comes with all the necessary tools that will help a trader trade more effectively. Important tools that feature on trading platforms include advanced charting systems with the ability to incorporate indicators and studies. This is particularly useful for those traders that rely on trading strategies. Other features a live market news stream to keep the trader update, although sometimes this features on the brokers website rather than on the platform, economic calendar of upcoming events, live support directly from the platform and the ability to trade from charts.

Commissions, spreads & leverage

Trading costs represent a huge determinate factor of a trader’s ability to make profit when trading forex. The higher the cost of trading, the more prices have to move in the trader’s favor before he can make profit from his trade. Hence, it is crucial that you pay close attention to the commissions and spreads that a broker will levy on your trade.

Commissions

In the forex industry, most brokers do not charge their traders any commission on the trades that they make. However in cases where the broker is a non dealing desk (NDD) where the trader’s order is transmitted directly to the liquidity pool, the broker will typically charge traders a small commission for their service. The key benefit of trading with a NDD broker is the raw interbank spreads which traders will have access to.

Spreads

The normal trading cost which a trader will incur is the spread which they pay on the asset traded. The spread is just the difference between the BID and ASK price. Spreads can be in the form of fixed spreads or in the form of variable spreads.

Fixed spreads

Fixed spreads as their name implies are fixed and higher than variable spreads. They are suitable for traders who want to know beforehand the spread that they will pay before executing a trade.

Variable spreads

Variable spreads on the other hand although lower than fixed spreads can fluctuate depending on the volatility in the market.

Leverage

One major limitation which forex traders in the U.S will face is the leverage which they can get from their brokers. Because of the regulatory requirements imposed by the NFA, forex brokers in U.S can only offer their clients a maximum of 1:50 leverage ratio. Leverage is the ability to multiply your capital in order to gain more exposure to the market. So 1:50 leverage means your invested capital will be worth 50 times more than its face value. Leverage comes with extra reward but also increases the risk level, so should be used carefully by novice traders.

Account types

The type of trading accounts that are provided by a forex broker in the U.S depend on the primary focus of the broker. If the main focus of the broker is the small retail trader, the broker will most likely provide their clients with the ability to trade in lots smaller than the standard lot size of 100,000 units of currency. These types of trading account are called micro and mini account.

Micro/mini account

The difference between a micro and a mini account is the lot size, 1,000 units for the mini account and 10,000 units for the mini account. Both these types of trading accounts are termed as “beginner friendly” as they have a low minimum deposit requirement.

Standard account

For some forex brokers, they do not differentiate between the different types of clients that they have. This type of broker usually offer only one standard type of trading account to cater to all their clients regardless of how much they invested.

VIP account

The third type of trading account that is offered by some brokers is the VIP trading account. VIP trading accounts are geared towards high net worth clients that demand more from their brokers. Usually this type of trading account comes with benefits such as dedicated account manager and fund management facility.

Customer service

The last thing that most traders have in their mind when evaluating a forex broker is customer support. The fact is, for any online based service industry, it represents the cord that links the trader to the broker. By entrusting their hard earned cash to the broker, it is only fair that the broker is responsive to any queries or problems that the trader may have while trading.

Hence, it is important to look for a broker that has provided traders with multiple methods of communicating with the support team. In addition, the support hours must be long enough to cover the trading hours and not be limited to office hours since the forex market is actually a 24 hours market. Another factor to consider when evaluating a broker’s customer support service is whether the support service is available in multiple languages or just one language.

Additional services

Apart from all the above mentioned factors, check out if the broker that you are evaluating is offering additional value added services. Additional services such VPS, social trading, educational resources and free trading signals are all value added services which can help tip the scale in a broker’s favor over other brokers in the industry.

Conclusion

We understand that for U.S traders, selecting the best forex brokers in the USA to work with can often be a frustrating and tedious process, given the fact that there are so many factors to consider. To help our readers, we have reviewed a selection of the key U.S forex brokers based on the criteria that we mentioned in this guide. So if you are looking for a U.S based forex broker that is dependable and reliable, we urge you to read our reviews of the best forex brokers in USA.

FX options tutorial and brokers

The new FX options from iqoption combine the best of both worlds – a derivative option with binary returns that trade like spot forex positions. Here we explain what an FX option is, how to trade them and which the best FX options brokers are.

FX options brokers

ESMA compliant

These options are compliant with the ESMA regulation and available to EU traders.

Like spot FX, your entry price for the FX-option is the price of the underlying pair at the time of your purchase.

Unlike spot FX the options come with a limited lifespan, there is an expiry, and your profits are based on a system of strike prices.

How do FX options work?

This is how they work. When you pull up a chart of the FX-option you will see a series of strikes (strike prices) to the right of the price action.

You will choose one of those strikes and the direction of the trade, whether you think prices will rise or prices will fall.

If you buy a call and price rises you can make profits after you clear a spread up to and until one of two things happens:

Expiry

If the option expires there are two possible outcomes. If the asset closes above your strike your trade is automatically closed at a profit, whatever profit is showing. If the asset closes below your strike the entire trade is a loss.

The second thing that can happen is that you decide to close the trade – yes, close the trade!

Unlike binary options the FX-options can be closed at any time so you can lock in whatever profits or losses you are showing before the option expires.

Strike prices

The strike prices are also important because of leverage, the further out of the money your strike price is the higher the return you can expect to receive.

The catch is that there is a window or spread to overcome that is tied to the amount of money you trade.

The break-even point is an amount equal to the amount you trade.

The deeper in the money your strike the easier it is to overcome but your profits will be smaller, the further out of the money your strike the harder it is to overcome but your profits will be larger.

Profit bar

There is a tool to the side of the chart that shows how much profit or loss you can expect from a position at the time of expiry.

The gauge is a handy guide but can be confusing because it moves up and down with the value of your open positions and can show losses immediately after you purchase an option.

The thing to remember is that the gauge will change, and that if your option is above the strike price you will not lose the entire trade.

Limited losses

Because you are buying contracts and not opening a spot position your losses will always be limited to the amount of money you trade.

This means that there are no short positions, if you are bullish you buy a call and if you are bearish you buy a put.

Expiry on these positions is usually about one hour but, again, that doesn’t really matter because you can buy or sell these options at any time, and even buy and sell the same option over and over again if it keeps making money.

Greeks

With the option having an expiry time, time decay becomes a factor for the pricing.

This can also be seen from the payout gauge. As an option gets nearer to expiry, the potential for price moves of a certain magnitude change. This can result in some very tempting payout percentages appearing as an option comes to close the closing.

Volatility and time decay are both in play when you trade FX options.

IQ option

Right now, these options are only available at IQ option. The range of markets is limited to the 5 major forex pairs, and the expiries are set at 1 hour intervals.

As the popularity of the product grows, expect further markets to be added, and more expiry options – particularly end of day.

So, let's see, what we have: recommendations of online options broker for trading forex options, and guidance on how to choose a forex options broker. At forex option brokers

Contents of the article

- Top-3 forex bonuses

- Best brokers for forex options

- How we rank brokers

- Key factors for forex brokers

- Summary

- Forex option brokers

- FX OPTIONS PUTS YOU FIRMLY IN THE DRIVERS SEAT

- Forex option brokers

- FX OPTIONS PUTS YOU FIRMLY IN THE DRIVERS SEAT

- Best options broker trading platform

- Best options brokers:

- Best for options traders

- FX options

- FX options

- Follow FX options: get the FX report, straight to...

- What are FX options?

- FX option pricing

- Why do we use FX options?

- FX option types

- FX option styles

- Forex option contracts – important terms

- An example

- Where can I trade forex options?

- Recap FX options

- Forex brokers for US traders (accepting US...

- What changed?

- What are the current options for US forex traders?

- 1) consumer-friendly regulators

- 2) more robust database of providers

- 3) expanded list of US-regulated forex brokers

- 4) leverage caps

- 5) credit-based funding for customer forex...

- What does the future hold for US forex traders?

- 1) changes to margin rules

- 2) advancements in technology

- 3) blockchain-based platforms

- 4) increased volatility on the US dollar, euro...

- Closing note

- Best forex brokers in US 2021

- Forex.Com

- Etoro

- Oanda

- How to choose a forex broker (as a US trader)

- How to choose a forex broker (as a US trader)

- General regulation & US regulation

- Trading platform & software

- Commissions, spreads & leverage

- Account types

- Micro/mini account

- Customer service

- Additional services

- Conclusion

- FX options tutorial and brokers

- FX options brokers

- ESMA compliant

- How do FX options work?

- Strike prices

- Profit bar

- Limited losses

- Greeks

- IQ option