Globex360 nasdaq

During the nineties, for example, nasdaq stocks soared amidst a wave of speculative trading interest.

Top-3 forex bonuses

Companies worth only millions only a short while ago attained multi-billion valuation - only to see these valuation figures collapsed to zero when the bubble burst. Easy come, easy go. Another area to watch out for are federal reserve meetings and the release of FOMC minutes. Any change in interest rates beyond market expectations can cause violent swings in the SPX. For example, if investors were expecting a 0.25% hike but the central bank raised it by 0.5% - this may cause prices swing massively after the announcement.

Best brokers for trading NASDAQ 100, US-TECH 100

�� > compare CFD brokers > best brokers for trading NASDAQ 100, US-TECH 100

Compare NASDAQ brokers

NASDAQ brokers can offer access the popular US tech 100. Compare NAS100 brokers to choose the broker that offers the cheapest fees and the best trading platform to help you make money. These brokers are authorised and regulated by the FCA.

Plus 500

What is nasdaq 100?

The nasdaq 100 index (ticker: NDX) is the equity index comprised of the 100 largest companies listed on the nasdaq market. For those unfamiliar with the term nasdaq, it stands for National Association of Securities Dealers Automatic Quotations.

Currently, nasdaq is one of the largest stock exchanges in the world. Setup in 1971, nasdaq has a longstanding history of hosting growth company. It gained its popularity because nasdaq was the first exchange to trade stocks electronically. At that time, it was a quantum leap in share trading. (see GMG's guide to nasdaq)

Currently, some of the world's biggest tech companies are components of the nasdaq 100. For example, the five largest stocks of the index are apple, microsoft, amazon, facebook and google (see below):

Nasdaq 100 is capitalisation weighted, this means that companies with higher market capitalization carry a higher weightage in the index.

Can you trade the nasdaq 100 index?

Yes, you can. There are multiple financial products derived from the underlying nasdaq 100 index that you can trade with, including:

- Futures

- Options

- Exchange-traded funds (link)

- Investment funds

- Spread trading

The biggest ETF based on the nasdaq 100 index is the QQQ ETF (ticker: QQQ). For many years, this ETF is one of the most traded instruments in the US market. Investors like to gain exposure to the nasdaq through this ETF.

What is the attraction of nasdaq 100?

Nasdaq indices (100 and composite) are the most-followed equity indices in the world. NDX is attractive to investors and traders alike because:

- Nasdaq 100 is a growth index - you can participate in the best success stories

- Nasdaq 100 offers good liquidity - some of the NDX components were the most valuable in the world at one time or another (apple, microsoft, and amazon)

- Nasdaq 100 offers better relative performance than many other large-cap indices

Moreover, the index is volatile enough to attract traders. Therefore, daily liquidity of the index is good.

What drives the nasdaq 100?

Stock markets are driven by a wide variety of factors, including some of the following:

- Macro factors (e.G. GDP, unemployment, business indicators etc)

- Monetary factors (e.G., quantitative easing, rates movements, yield curve etc)

- Technical factors (e.G., new highs)

For the nasdaq 100, another factor to watch out for is speculative bubble.

During the nineties, for example, nasdaq stocks soared amidst a wave of speculative trading interest. Companies worth only millions only a short while ago attained multi-billion valuation - only to see these valuation figures collapsed to zero when the bubble burst. Easy come, easy go.

Next, if you are trading NDX short term, you will need to pay attention to news flow and data announcements because they can have massive impact on the index over the short term.

Another area to watch out for are federal reserve meetings and the release of FOMC minutes. Any change in interest rates beyond market expectations can cause violent swings in the SPX. For example, if investors were expecting a 0.25% hike but the central bank raised it by 0.5% - this may cause prices swing massively after the announcement.

Studying the reaction of the market to these factors are important.

How to trade the nasdaq 100 using technical indicators?

To trade the nasdaq profitably requires a good trading strategy, of which technical indicators may come in handy. Technical indicators include:

- Trend indicators like moving average

- Price action

- Oscillators

- Support & resistance levels (see GMG guide on support/resistance)

- Patterns like breakout and reversals

For example, you may use the moving averages to judge whether the index is still trending or due for a reaction.

Another favourite indicator is a break of resistance or support levels. Look at the nasdaq 100 ETF (QQQ) below. It was clear that the breakout above the 195 key resistance last month resulted in a persistent rally into 204 (see below). This resistance, now broken, may even convert into resistance.

Bear in mind, however, the different traders will gravitate towards different trading styles. Therefore you must find the technical indicators that best support your trading objectives.

Publishers

A way to uninstall globex360 MT4 terminal from your system

This page is about globex360 MT4 terminal for windows. Here you can find details on how to remove it from your computer. It was coded for windows by metaquotes software corp. . Take a look here where you can get more info on metaquotes software corp.. You can read more about on globex360 MT4 terminal at https://www.Metaquotes.Net. Globex360 MT4 terminal is frequently installed in the C:\program files (x86)\globex360 MT4 terminal directory, subject to the user's option. The full command line for uninstalling globex360 MT4 terminal is C:\program files (x86)\globex360 MT4 terminal\uninstall.Exe. Note that if you will type this command in start / run note you might get a notification for admin rights. Globex360 MT4 terminal's main file takes around 13.13 MB (13765720 bytes) and is called terminal.Exe.

The executable files below are part of globex360 MT4 terminal. They take about 27.44 MB ( 28776136 bytes) on disk.

- Metaeditor.Exe (13.15 MB)

- Terminal.Exe (13.13 MB)

- Uninstall.Exe (1.17 MB)

This data is about globex360 MT4 terminal version 4.00 alone.

How to erase globex360 MT4 terminal from your computer using advanced uninstaller PRO

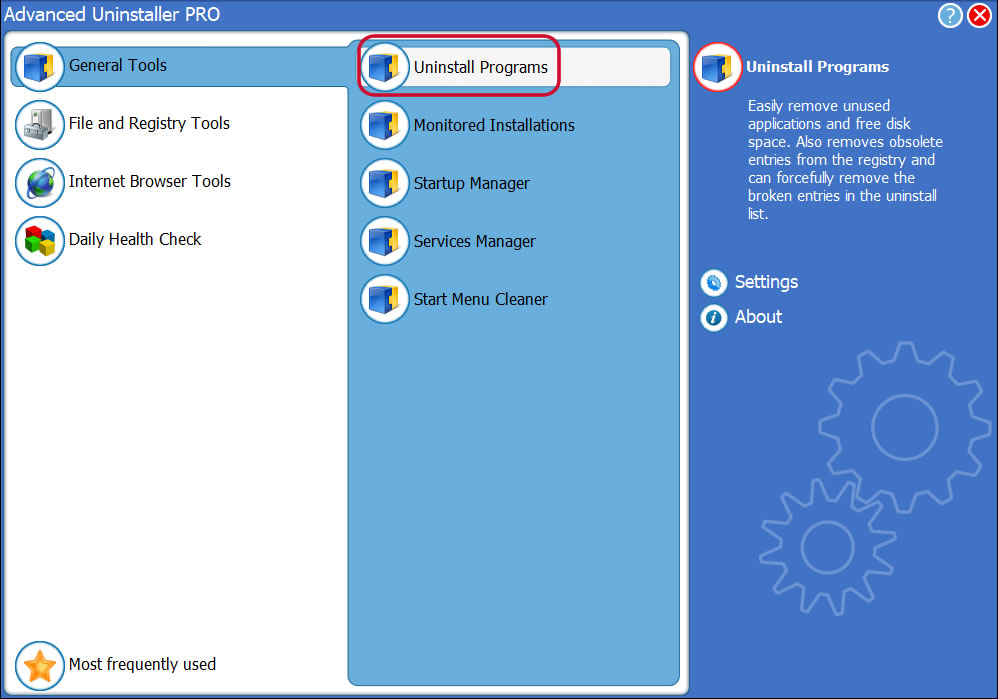

Globex360 MT4 terminal is an application released by the software company metaquotes software corp.. Some users want to uninstall this program. Sometimes this is efortful because deleting this manually requires some know-how related to windows internal functioning. The best EASY solution to uninstall globex360 MT4 terminal is to use advanced uninstaller PRO. Here is how to do this:

1. If you don't have advanced uninstaller PRO on your windows system, install it. This is good because advanced uninstaller PRO is a very efficient uninstaller and all around tool to optimize your windows PC.

- Navigate to download link

- Download the setup by clicking on the green DOWNLOAD button

- Set up advanced uninstaller PRO

2. Start advanced uninstaller PRO. It's recommended to take your time to get familiar with advanced uninstaller PRO's interface and wealth of functions available. Advanced uninstaller PRO is a powerful package of tools.

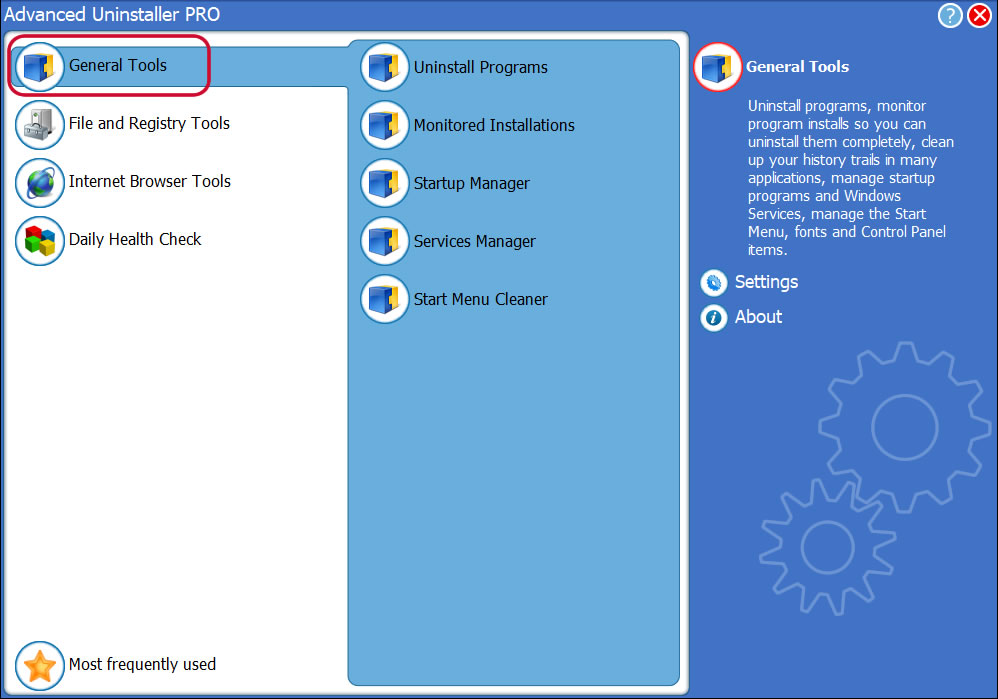

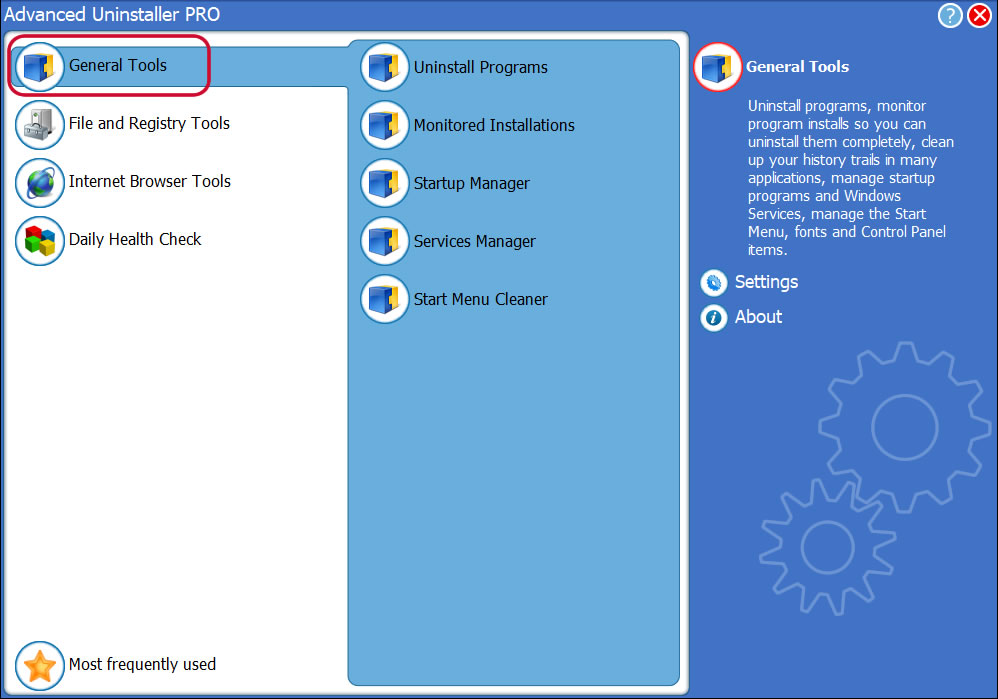

3. Press the general tools category

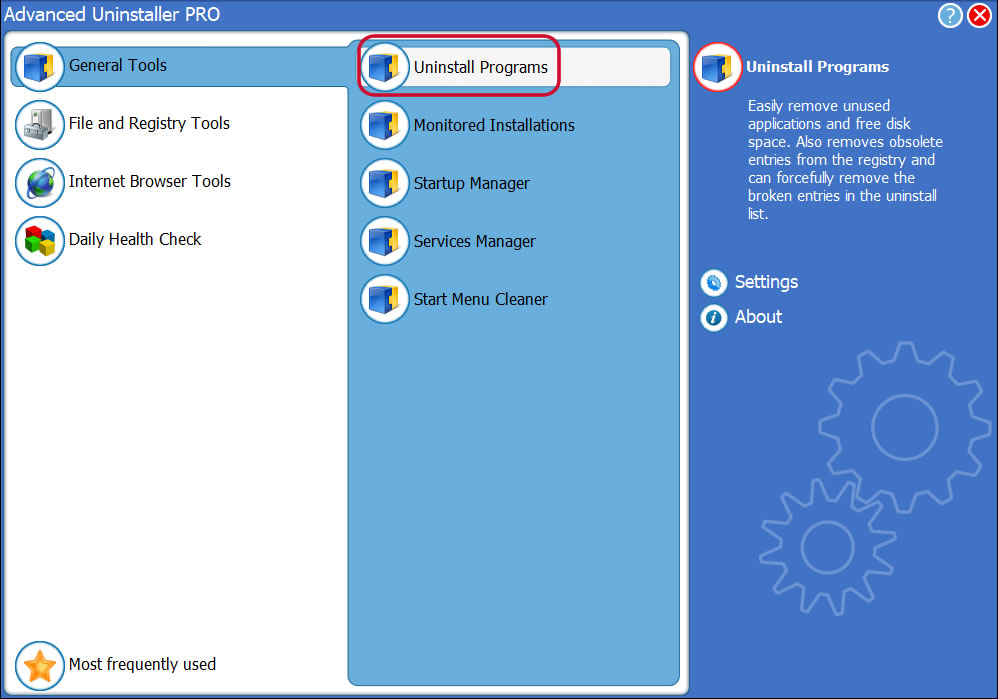

4. Activate the uninstall programs button

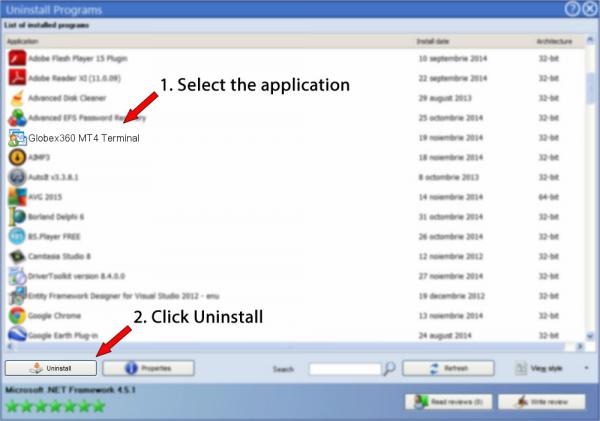

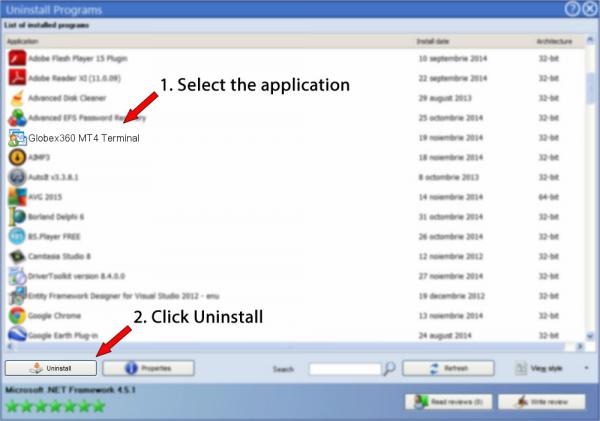

5. A list of the applications existing on the PC will appear

6. Navigate the list of applications until you locate globex360 MT4 terminal or simply activate the search feature and type in "globex360 MT4 terminal". If it is installed on your PC the globex360 MT4 terminal program will be found automatically. After you select globex360 MT4 terminal in the list of programs, the following information regarding the program is available to you:

- Safety rating (in the lower left corner). This explains the opinion other users have regarding globex360 MT4 terminal, ranging from "highly recommended" to "very dangerous".

- Reviews by other users - press the read reviews button.

- Technical information regarding the app you wish to remove, by clicking on the properties button.

For instance you can see that for globex360 MT4 terminal:

- The software company is: https://www.Metaquotes.Net

- The uninstall string is: C:\program files (x86)\globex360 MT4 terminal\uninstall.Exe

7. Press the uninstall button. A confirmation page will show up. Accept the removal by pressing the uninstall button. Advanced uninstaller PRO will automatically uninstall globex360 MT4 terminal.

8. After uninstalling globex360 MT4 terminal, advanced uninstaller PRO will ask you to run a cleanup. Click next to start the cleanup. All the items that belong globex360 MT4 terminal which have been left behind will be detected and you will be asked if you want to delete them. By uninstalling globex360 MT4 terminal with advanced uninstaller PRO, you are assured that no windows registry items, files or directories are left behind on your disk.

Your windows system will remain clean, speedy and ready to serve you properly.

Disclaimer

This page is not a piece of advice to uninstall globex360 MT4 terminal by metaquotes software corp. From your PC, we are not saying that globex360 MT4 terminal by metaquotes software corp. Is not a good application for your PC. This text simply contains detailed instructions on how to uninstall globex360 MT4 terminal in case you want to. The information above contains registry and disk entries that our application advanced uninstaller PRO discovered and classified as "leftovers" on other users' computers.

2019-10-28 / written by dan armano for advanced uninstaller PRO

Compare brokers for trading NASDAQ 100

For our trading nasdaq 100 comparison, we found 20 brokers that are suitable and accept traders from united states of america.

We found 20 broker accounts (out of 147) that are suitable for trading NASDAQ 100.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The NASDAQ-100

The nasdaq is an american stock market owned and operated by nasdaq inc. It is the second largest in the world by market capitalisation, after the new york stock exchange. The nasdaq-100 (NDX) is a modified capitalisation-weighted index composed of 100 of the largest equity securities listed on the nasdaq. It includes companies from a wide spectrum of nonfinancial industries, such as technology, health care, and retail. The nasdaq-100 is the premier large-cap growth index and provides the basis for benchmarking numerous investment products. Around 50 billion etps (exchanged traded products) were benchmarked to the nasdaq-100, according to a study by the nasdaq research team in 2015.

Nasdaq-100 was launched on january 31st, 1985, presenting itself as an alternative to the NYSE indices. It created two separate indices: the nasdaq-100, which consists of stocks from industry, retail, technology, telecommunication, healthcare, biotechnology, transportation, media & services; and the nasdaq financial-100, which consists of insurance firms, banking companies, brokerage, and mortgage companies. Nasdaq expected these to be used as benchmark indices by market participants, anticipating a healthy derivatives market to develop around them. The index was rebalanced to a modified market cap index on december 21st, 1998, followed by special rebalance effective from may 2nd, 2011.

Composition

The index comprises 100 of the largest non-financial organisations, based on market capitalisation, that are listed on the nasdaq stock market. The past three decades have seen nasdaq-100 evolve from being the market’s technological index to a leading indicator of strong growth potential companies, who are leading industry-wide innovation. Companies included in the nasdaq-100 have driven economic growth in the recent years and they represent a shift in the business world in the 21st century. By the end of 2014, 448 stocks had been a member of the nasdaq-100 since its inception. In recent years, somewhere between 7 to 15 stocks have been added or removed each year. The top ten companies who have held the highest weights in the index during the recent years are apple, microsoft, amazon, google, facebook, gilead sciences, intel, cisco & comcast. The main sectors included in nasdaq 100 as at the 30th june 2019 were: technology – 53.48 %; consumer services – 24.63%; health care – 11.10%; consumer goods – 5.49%; industrials – 4.33%; and telecom – 0.97%.

The top ten securities by weight as at 1st may 2019 were as follows:

| TICKER | SECURITY | WEIGHT |

|---|---|---|

| AAPL | APPLE INC. | 10.70% |

| MSFT | MICROSOFT CORP | 10.57% |

| AMZN | AMAZON.COM INC | 10.12% |

| FB | FACEBOOK INC | 5.01% |

| GOOG | ALPHABET CL C CAP | 3.89% |

| GOOGL | ALPHABET CL A CMN | 4.43% |

| CMCSA | COMCAST CORP A | 2.34% |

| INTC | INTEL CORP | 2.73% |

| CSCO | CISCO SYSTEMS INC | 2.93% |

| NFLX | netflex | 1.98% |

Eligibility for nasdaq-100 inclusion

The eligibility criteria for any stock to be included in nasdaq-100 are as follows:

- Listing – the primary listing in the US must be exclusive to the nasdaq global market or the nasdaq global select market. Securities that were dually listed on other US markets prior to jan 1st, 2014 and have continuously maintained such a listing, are the exception to the rule.

- Security types – security types eligible for listing include common stocks, adrs and tracking stocks. Close-ended funds, convertible debentures, etfs, llcs, limited partnership interests, preferred stocks, rights, warrants and derivative securities are not eligible to be included in the index.

- Market capitalisation – there are no qualifying criteria for market capitalisation as such, inclusion is only determined based on the top 100 largest companies in the eligible industries by market capitalisation.

- Liquidity – A minimum of 3 months average daily trading volume (ADTV) of 200,000 shares.

- Security seasoning criteria – the security must have ‘seasoned’ in either the nasdaq, the NYSE or the NYSE amex for at least 3 months, excluding the month of the initial listing

How the value of nasdaq-100 is derived

The nasdaq-100 is a modified market capitalisation-weighted index, which means that its value is derived from the aggregate value of index share weights of each index security, multiplied by the last trading price of the security, which is then divided by the divisor of the index. The divisor serves the purpose of scaling down the obtained aggregate value, which is more desirable for the practical use of the index.

The base value of the index was set at 250, and reset to 125 when it closed at 800 on december 31st, 1993.

The index value is calculated on each trading day, based on the last traded price, once per second for the whole trading window of the day.

How to trade the nasdaq-100

The index can be traded through financial institutions such as brokers and serves as an underlying asset for a variety of products. These include exchange-traded funds (etfs) and derivative instruments such as futures, options, and contracts for difference (cfds).

Etfs are funds whose value reflect the value of an index as they are composed of shares that are present in the index itself. The etfs attempt to track the index as closely as possible. Etfs can be traded on the exchange and can be bought as individual stock, allowing traders to follow the index with just one holding.

Another way of speculating on the movement of the indices without owning the shares is through cfds. As cfds allow users to speculate on the value of the index, traders can go for long contracts when they believe the index will move up and the price will therefore increase; or go short on the CFD when they believe the index is going down and prices will therefore decline. Cfds are usually highly leveraged products, which means that traders can have a large holding for a relatively small margin. Margin refers to the proportion of the trade that is required to be put down as deposit.

CFD products are highly popular for the nasdaq-100 index.

Benefits of CFD trading on nasdaq-100

- Enables access to one of the most popular and growth oriented indices in the market without the requirement of actually owning shares in the underlying companies.

- Maximises the potential of the portfolio by using leverage – although it must be noted that this can also go against the trader when markets move in the opposite direction to which they have speculated.

- Allows traders to take a speculative stance on the overall market movement, whether they believe it will move up, or down.

- Cuts down the cost of a portfolio of companies by trading on the index.

- Availability of a large pool of regulated brokers who provide a platform to trade on NSD-100 cfds, making it convenient for traders.

However, it is necessary to keep in mind that cfds are highly leveraged products and pose a considerable risk of loss of capital. Only experienced traders with the right risk appetite should venture into trading in these instruments.

Authorised and regulated online CFD broker plus500 offers a US-TECH 100 (NQ) CFD which is based on the E-mini nasdaq 100 futures, itself based on the underlying nasdaq 100 index. Trades in the instruments are offered at a spread of 1.7, with a minimum contract size of 1, and an initial margin requirement of 0.33. The intuitive platform calculates the minimum trade sizes and margins required to place a trade automatically. The manual calculation is as follows: CFD margin = V (lots) × contract × market price × margin rate, %.

Current value of nasdaq-100 index

Conclusion

Nasdaq-100 is one of the most comprehensive market indices that captures the overall movement of 100 market mover stocks. The index is well diversified in sectoral allocation and has beaten multiple other indices in its returns. The index serves as the benchmark and underlying value for numerous other instruments such as etfs and multiple derivative products such as cfds. Cfds for the nasdaq-100 are readily available and offered by many regulated brokers, such as plus500 and avatrade. The trading platforms offered by these brokers are user-friendly and compatible on hand held devices as well as desk top computers.

Why choose forex.Com

for trading NASDAQ 100?

Forex.Com scored best in our review of the top brokers for trading nasdaq 100, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade NASDAQ100

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Compare synthetic indices brokers

Synthetic indices brokers let you trade on the volatility of markets. Compare brokers for boom and crash markets and choose a broker that can let you trade on stocks and shares in the volatility 75 index.

Plus 500

VXX and VXZ (its sister fund) were the first etns (exchange traded notes) made available for volatility trading in the united states. To properly understand what VXX is, you need to understand how its value is assessed, and how barclays (britain’s foremost multinational banking and financial services company) earns equity from running it, and what it actually tracks.

Typically speaking, VXX trades like any other stock. As such, it can be sold, bought, or sold short whenever the market is open for trading, and that includes both pre-market and after-market timeframes. The average daily volume consists of 75 million shares, and its liquidity and spread status is very good; the bid–ask spreads are just a penny. Here are a few of the best brokers for trading VXX volatility

How to trade the VXX

You can read more about how to use volatility etns (VXX & VXZ) to protect your stock portfolios in our guide below written by jackson wong phd

With this in mind, brokers that typically have tight spreads don’t have the same issue with trading VXX. Spread betting broker IG index, for example, has a relatively high average spread of on etns such as VXX and VXZ however, they do offer one of the widest ranges of accessable markets and are listed on the LSE.

Similarly, forex broker CMC markets, while having a good average spread already, has an extra sweetener for large-scale investors. It has a “big trader rebate scheme” with its own modern trading platform. If you’re after a long-term growth strategy with a large amount of capital, trading VXX with CMC markets could be a wise move.

CFD broker saxo offers VIX cfds as well as DMA VIX on exchange futures contracts. MT4 broker XTB offers the ability to create your own basket of assets to trade so you can trade volatilities indices against other assets like gold and USDJPY.

Whichever of the best brokers for trading VXX volatility or CFD trading platforms you decide to go with, ensure that you do thorough research to mitigate risk and maximise your potential return on investment.

Spread betting on market volatility using the VIX

The VIX is a contract traded on the CBOE that measures volatility in the market. The price is dependent on how much the price of the S&P 500 moves and has been around since 1993.

It’s no secret that most spread betting clients make money when the market is moving one way or another. It is the basic principle of trend. If there is one it is easier to follow and therefore make money. So the VIX provides a visualisation of how easy it is to make money, it is also a fairly predictable indicator.

You can either trade the VIX through futures contracts on the CBOE market of by placing a bet through a spread betting broker.

The market moves through cycles of volatility and activity and boring non movement. These movements were traded by options contract strategies, but since 2004 when the VIX futures was introduce anyone can have a go. A good indicator to keep an eye on.

How to use volatility etns (VXX & VXZ) to protect your stock portfolios

When asked what he thought of the stock market, JP morgan quipped: ‘it will fluctuate’. Indeed. Markets go up and down – and when prices are down, investor fear increase and volatility spikes. This is simply because of higher market uncertainty. Given volatility’s inverse behaviour to prices, volatility indices are usually known as the ‘fear gauges’.

One of the most established volatility indices is the VIX index. This index is based on the options on the S&P 500 index (SPX), the most-watched US equity index. SPX is a very broad measure of the US stock market and it tracks the cream de la cream of US listed firms.

But you can not trade an index directly. Neither can you trade volatility directly like you trade stocks. To do that, you need derivatives – like futures and options – to make a bet on the direction of the index. Thus VIX futures (based on the VIX index) were created at around 2004 to facilitate trading and hedging of volatility.

Sensing a growing demand for retail volatility products, astute finance firms like barclays pushed this concept further by creating a series of exchange traded notes (ETN). These notes were based on VIX futures (nearest two).

What brokers offer VXX and VZN trading and volatility indices?

You can compare the best CFD brokers for trading VXX here or take a look at the individual reviews for brokers below:

What is volatility trading?

In 2009, barclays created two of the earliest volatility etns – VXX and VXZ (its sister fund). These etns were made available for volatility trading in the united states just like any other stocks (prospective here).* they can be sold, bought, or sold short whenever the market is open for trading, and that includes both pre-market and after-market timeframes. The current market cap of VXX is around $800 million. The average daily volume consists of 40 million shares, and its liquidity and spread status is very good. The bid–ask spreads are just a penny.

For example, the chart below shows the typical spread from IG index. In other words, moving in and out of volatility products are not overly expensive here in the UK.

To trade volatility etns successfully, however, you need to remember two things:

- Volatility etns are not meant for long-term holdings

- Volatility etns are high risk and prices can swing wildly over a short period of time

You can judge this from the price movements of VXX in 2018. Throughout the year, prices went from $28 to $50 twice. Daily 5-10% moves occur regularly; overnight price gaps further amplify this swings. So, how exactly do you use VXX to hedge against your long-only portfolio?

The general rule of thumb is to buy a small amount when the product is down for some time. Why? This is because markets tend to go up slowly and go down quickly, especially as we are on a bull cycle.

For example, VXX can roll lower continuously for six months and then, all of a sudden, surge. This price behaviour is typical (red circle, below). Accordingly, when VXX is down, buy some and hold for a few weeks before selling out. Of course, you may very well sell at a loss, but try to think of this as as the cost of protection for your share portfolio. The trick is to time your entry because VXX can move very fast.

Other entry signals for VXX include: 1) A bullish crossover of VXX against some medium-term moving average such as the 50 or 100-day moving average, or 2) corrective setbacks after hitting multi-week highs, ie, around $32.

In all these cases, the advice is to limit the holding period because volatility etns can depreciate over time. Of course, having stop-losses on these positions are critical. Also, if you had timed VXX’s rally correctly, use trailing stops to protect your profits.

Publishers

A way to uninstall globex360 MT4 terminal from your system

This page is about globex360 MT4 terminal for windows. Here you can find details on how to remove it from your computer. It was coded for windows by metaquotes software corp. . Take a look here where you can get more info on metaquotes software corp.. You can read more about on globex360 MT4 terminal at https://www.Metaquotes.Net. Globex360 MT4 terminal is frequently installed in the C:\program files (x86)\globex360 MT4 terminal directory, subject to the user's option. The full command line for uninstalling globex360 MT4 terminal is C:\program files (x86)\globex360 MT4 terminal\uninstall.Exe. Note that if you will type this command in start / run note you might get a notification for admin rights. Globex360 MT4 terminal's main file takes around 13.13 MB (13765720 bytes) and is called terminal.Exe.

The executable files below are part of globex360 MT4 terminal. They take about 27.44 MB ( 28776136 bytes) on disk.

- Metaeditor.Exe (13.15 MB)

- Terminal.Exe (13.13 MB)

- Uninstall.Exe (1.17 MB)

This data is about globex360 MT4 terminal version 4.00 alone.

How to erase globex360 MT4 terminal from your computer using advanced uninstaller PRO

Globex360 MT4 terminal is an application released by the software company metaquotes software corp.. Some users want to uninstall this program. Sometimes this is efortful because deleting this manually requires some know-how related to windows internal functioning. The best EASY solution to uninstall globex360 MT4 terminal is to use advanced uninstaller PRO. Here is how to do this:

1. If you don't have advanced uninstaller PRO on your windows system, install it. This is good because advanced uninstaller PRO is a very efficient uninstaller and all around tool to optimize your windows PC.

- Navigate to download link

- Download the setup by clicking on the green DOWNLOAD button

- Set up advanced uninstaller PRO

2. Start advanced uninstaller PRO. It's recommended to take your time to get familiar with advanced uninstaller PRO's interface and wealth of functions available. Advanced uninstaller PRO is a powerful package of tools.

3. Press the general tools category

4. Activate the uninstall programs button

5. A list of the applications existing on the PC will appear

6. Navigate the list of applications until you locate globex360 MT4 terminal or simply activate the search feature and type in "globex360 MT4 terminal". If it is installed on your PC the globex360 MT4 terminal program will be found automatically. After you select globex360 MT4 terminal in the list of programs, the following information regarding the program is available to you:

- Safety rating (in the lower left corner). This explains the opinion other users have regarding globex360 MT4 terminal, ranging from "highly recommended" to "very dangerous".

- Reviews by other users - press the read reviews button.

- Technical information regarding the app you wish to remove, by clicking on the properties button.

For instance you can see that for globex360 MT4 terminal:

- The software company is: https://www.Metaquotes.Net

- The uninstall string is: C:\program files (x86)\globex360 MT4 terminal\uninstall.Exe

7. Press the uninstall button. A confirmation page will show up. Accept the removal by pressing the uninstall button. Advanced uninstaller PRO will automatically uninstall globex360 MT4 terminal.

8. After uninstalling globex360 MT4 terminal, advanced uninstaller PRO will ask you to run a cleanup. Click next to start the cleanup. All the items that belong globex360 MT4 terminal which have been left behind will be detected and you will be asked if you want to delete them. By uninstalling globex360 MT4 terminal with advanced uninstaller PRO, you are assured that no windows registry items, files or directories are left behind on your disk.

Your windows system will remain clean, speedy and ready to serve you properly.

Disclaimer

This page is not a piece of advice to uninstall globex360 MT4 terminal by metaquotes software corp. From your PC, we are not saying that globex360 MT4 terminal by metaquotes software corp. Is not a good application for your PC. This text simply contains detailed instructions on how to uninstall globex360 MT4 terminal in case you want to. The information above contains registry and disk entries that our application advanced uninstaller PRO discovered and classified as "leftovers" on other users' computers.

2019-10-28 / written by dan armano for advanced uninstaller PRO

Compare brokers for trading NASDAQ 100

For our trading nasdaq 100 comparison, we found 20 brokers that are suitable and accept traders from united states of america.

We found 20 broker accounts (out of 147) that are suitable for trading NASDAQ 100.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The NASDAQ-100

The nasdaq is an american stock market owned and operated by nasdaq inc. It is the second largest in the world by market capitalisation, after the new york stock exchange. The nasdaq-100 (NDX) is a modified capitalisation-weighted index composed of 100 of the largest equity securities listed on the nasdaq. It includes companies from a wide spectrum of nonfinancial industries, such as technology, health care, and retail. The nasdaq-100 is the premier large-cap growth index and provides the basis for benchmarking numerous investment products. Around 50 billion etps (exchanged traded products) were benchmarked to the nasdaq-100, according to a study by the nasdaq research team in 2015.

Nasdaq-100 was launched on january 31st, 1985, presenting itself as an alternative to the NYSE indices. It created two separate indices: the nasdaq-100, which consists of stocks from industry, retail, technology, telecommunication, healthcare, biotechnology, transportation, media & services; and the nasdaq financial-100, which consists of insurance firms, banking companies, brokerage, and mortgage companies. Nasdaq expected these to be used as benchmark indices by market participants, anticipating a healthy derivatives market to develop around them. The index was rebalanced to a modified market cap index on december 21st, 1998, followed by special rebalance effective from may 2nd, 2011.

Composition

The index comprises 100 of the largest non-financial organisations, based on market capitalisation, that are listed on the nasdaq stock market. The past three decades have seen nasdaq-100 evolve from being the market’s technological index to a leading indicator of strong growth potential companies, who are leading industry-wide innovation. Companies included in the nasdaq-100 have driven economic growth in the recent years and they represent a shift in the business world in the 21st century. By the end of 2014, 448 stocks had been a member of the nasdaq-100 since its inception. In recent years, somewhere between 7 to 15 stocks have been added or removed each year. The top ten companies who have held the highest weights in the index during the recent years are apple, microsoft, amazon, google, facebook, gilead sciences, intel, cisco & comcast. The main sectors included in nasdaq 100 as at the 30th june 2019 were: technology – 53.48 %; consumer services – 24.63%; health care – 11.10%; consumer goods – 5.49%; industrials – 4.33%; and telecom – 0.97%.

The top ten securities by weight as at 1st may 2019 were as follows:

| TICKER | SECURITY | WEIGHT |

|---|---|---|

| AAPL | APPLE INC. | 10.70% |

| MSFT | MICROSOFT CORP | 10.57% |

| AMZN | AMAZON.COM INC | 10.12% |

| FB | FACEBOOK INC | 5.01% |

| GOOG | ALPHABET CL C CAP | 3.89% |

| GOOGL | ALPHABET CL A CMN | 4.43% |

| CMCSA | COMCAST CORP A | 2.34% |

| INTC | INTEL CORP | 2.73% |

| CSCO | CISCO SYSTEMS INC | 2.93% |

| NFLX | netflex | 1.98% |

Eligibility for nasdaq-100 inclusion

The eligibility criteria for any stock to be included in nasdaq-100 are as follows:

- Listing – the primary listing in the US must be exclusive to the nasdaq global market or the nasdaq global select market. Securities that were dually listed on other US markets prior to jan 1st, 2014 and have continuously maintained such a listing, are the exception to the rule.

- Security types – security types eligible for listing include common stocks, adrs and tracking stocks. Close-ended funds, convertible debentures, etfs, llcs, limited partnership interests, preferred stocks, rights, warrants and derivative securities are not eligible to be included in the index.

- Market capitalisation – there are no qualifying criteria for market capitalisation as such, inclusion is only determined based on the top 100 largest companies in the eligible industries by market capitalisation.

- Liquidity – A minimum of 3 months average daily trading volume (ADTV) of 200,000 shares.

- Security seasoning criteria – the security must have ‘seasoned’ in either the nasdaq, the NYSE or the NYSE amex for at least 3 months, excluding the month of the initial listing

How the value of nasdaq-100 is derived

The nasdaq-100 is a modified market capitalisation-weighted index, which means that its value is derived from the aggregate value of index share weights of each index security, multiplied by the last trading price of the security, which is then divided by the divisor of the index. The divisor serves the purpose of scaling down the obtained aggregate value, which is more desirable for the practical use of the index.

The base value of the index was set at 250, and reset to 125 when it closed at 800 on december 31st, 1993.

The index value is calculated on each trading day, based on the last traded price, once per second for the whole trading window of the day.

How to trade the nasdaq-100

The index can be traded through financial institutions such as brokers and serves as an underlying asset for a variety of products. These include exchange-traded funds (etfs) and derivative instruments such as futures, options, and contracts for difference (cfds).

Etfs are funds whose value reflect the value of an index as they are composed of shares that are present in the index itself. The etfs attempt to track the index as closely as possible. Etfs can be traded on the exchange and can be bought as individual stock, allowing traders to follow the index with just one holding.

Another way of speculating on the movement of the indices without owning the shares is through cfds. As cfds allow users to speculate on the value of the index, traders can go for long contracts when they believe the index will move up and the price will therefore increase; or go short on the CFD when they believe the index is going down and prices will therefore decline. Cfds are usually highly leveraged products, which means that traders can have a large holding for a relatively small margin. Margin refers to the proportion of the trade that is required to be put down as deposit.

CFD products are highly popular for the nasdaq-100 index.

Benefits of CFD trading on nasdaq-100

- Enables access to one of the most popular and growth oriented indices in the market without the requirement of actually owning shares in the underlying companies.

- Maximises the potential of the portfolio by using leverage – although it must be noted that this can also go against the trader when markets move in the opposite direction to which they have speculated.

- Allows traders to take a speculative stance on the overall market movement, whether they believe it will move up, or down.

- Cuts down the cost of a portfolio of companies by trading on the index.

- Availability of a large pool of regulated brokers who provide a platform to trade on NSD-100 cfds, making it convenient for traders.

However, it is necessary to keep in mind that cfds are highly leveraged products and pose a considerable risk of loss of capital. Only experienced traders with the right risk appetite should venture into trading in these instruments.

Authorised and regulated online CFD broker plus500 offers a US-TECH 100 (NQ) CFD which is based on the E-mini nasdaq 100 futures, itself based on the underlying nasdaq 100 index. Trades in the instruments are offered at a spread of 1.7, with a minimum contract size of 1, and an initial margin requirement of 0.33. The intuitive platform calculates the minimum trade sizes and margins required to place a trade automatically. The manual calculation is as follows: CFD margin = V (lots) × contract × market price × margin rate, %.

Current value of nasdaq-100 index

Conclusion

Nasdaq-100 is one of the most comprehensive market indices that captures the overall movement of 100 market mover stocks. The index is well diversified in sectoral allocation and has beaten multiple other indices in its returns. The index serves as the benchmark and underlying value for numerous other instruments such as etfs and multiple derivative products such as cfds. Cfds for the nasdaq-100 are readily available and offered by many regulated brokers, such as plus500 and avatrade. The trading platforms offered by these brokers are user-friendly and compatible on hand held devices as well as desk top computers.

Why choose forex.Com

for trading NASDAQ 100?

Forex.Com scored best in our review of the top brokers for trading nasdaq 100, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade NASDAQ100

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Globex360 (PTY) LTD

Reviews (23)

Kindly stay away. Not a good broker at all. No customer service. The founders wanted a quick buck as the is no flow of their operations from validating accounts, withdrawals, and deposits. Emails are unprofessionally answered sies!! Its a disgrace to even call them a broker they are like our leading political party!! More.

Poor services! I deposited funds after my account was approved and they do not reflect on my account. You send them emails they do not respond, and you cannot even contact them.

Globex360 team.

Am really disappointed in your services with I've been getting from you'll lately,on the 28th of august 2020 I made a deposit to my

globex360 account but the funds didn't reflect.

So I decided that you'll should reversed my money on 1 september 2020 because I had to wait for more than days but still my funds aren't reverse on time.

I couldn't even trade this week��.

I would really appreciate if you'll be able to help.

Capitec account number :1704827165

branch no :470010

your sincerely

samkelo khumalo more.

Poor services! I deposited funds after my account was approved and they do not reflect on my account. You send them emails they do not respond, and you cannot even contact them.

Opening an account with globex360 (pty) ltd was by far easy and done timeously. I did not experience any hassle. A phenomenal feature of KYC/FICA introduced is a breeze to complete and gives superb relationship of transparency & security for me as a customer. A company that strives for accountability and longevity. Globex360 is the very best in africa! More.

Having a trusted broker with quuck services is what each and everyone needs when it comes to the foreign exchange market; i would recommend globex360 to everyone who needs a broker. Thank you for your great service

I bet everybody would feel very much pleased to have the most trusted business partner..Globex360 is also like the most trustworthy business partner you could ever have. I really appreciate the service �� more.

GLOBEX360 IS THE BEST BROKER IN AFRICA �� ����������

Being part of globex360 is the most exquisite moment of my life, there's no best broker that can exceed you guys, thanks to globex360 for making a lot of people feel at home. ❤

Globex360 is by far the best broker I’ve ever used since I started my forex trading journey. Easy and quick service is everything a beginner might want from a broker and I can attest that globex360 will give you exactly that.

Its a good broker .Fx goat team introduced me to this good broker.Keep up the good work .I appreciate the spread and fast withdrawal.Fx goat team tnx.

What a good broker. I had a good response from your financial team when my account was not showing money deposited. In few hours I got a confirmation, the next day I able to trade. Thanks so much. And keep the good work. More.

I have been waiting for my withdrawal for 2 weeks now. The support team never attends my emails

This broker has terrible service.

I've tried to get money I deposited with them for over a week.

The worse part is the people you contact for help. Just really don't care.

Please avoid bad service when it comes to your finance people.

Do youself a favor and try another broker more.

Globex has such an excellent support system for their clients , I’m always assisted on time , my withdrawals aren’t delayed and every query I have is resolved on time ☺️ I’m completely happy with them , sometimes we as clients we need to understand regulations better so that our money is protected #globex360 protects our money ✊

Great excellent service!!

Excellent services and I would recommend it to a beginner

Excellent service and helpful staff

Eunice ngithandiwe themba II

Excellent service the staff goes an extra mile to solving whatever issues one may have ….I had incorrectly refrenced a payment and lerato made sure I stayed calm while getting the finance department to resolve it …. Truly appreciate and recommend this broker more.

Excellent, efficient and reliable. A huge shout out to my account manager, kevin banks, his professionalism is simply the best.

Easy deposit & fast withdrawals. Less risk trade nasdaq with globex360

Plot your trading plan right, putting into consideration your strategy coordinate, note the necessary profits reporting points maintain runway heading,get to your destination without over trading make your profits, stop the trades, that's a smooth flight in the world of trading.

Those who take the opportunity shall not be in vail.

Globex360 nasdaq

Veracity markets MT4 terminal is a perfect traders workplace that allows trading in the financial markets (online trading). It provides the necessary tools and resources to analyze price dynamics of financial instruments, make the trade transactions, create and use automated trading programs (expert advisors). It represents the all-in-one concept and is derived from the most popular trading terminal in the world.

Veracity markets MT4 features

over 700 instruments including online trading 1 single login access spreads as low as 0.01 pips full EA (expert advisor) functionality VPS functionality built-in help guides handles a vast number of orders creates various custom indicators and different time periods

1 click trading technical analysis tools with 50 indicators and charting tools 3 chart types hedging allowed history database management, and historic data export/import full data back-up and security internal mailing system

Helpdesk

- Tel: +27 (0) 87 012 5545

- Email: help@veracitymarkets.Com

- Registered address: 1 energy lane, century city, 7441, south africa. Suite 305, griffith corporate centre,

P.O. Box 1510, beachmont kingstown,

st. Vincent and the grenadines. -->

Connect now:

Trading

Platforms

Partners

Promotions

Company

Legal and regulation

Veracity markets (pty) ltd is incorporated in south africa with registration number 2018/515174/07 and is a duly appointed juristic representative of nirvesh financial services (pty) ltd with registration number 2014/214417/07, which is an authorised financial services provider under the financial advisory and intermediary services act no 37 of 2002 – FSP4701. The website www.Veracitymarkets.Com is operated by veracity markets (pty) ltd based in south africa.

Clearing services

Veracity markets is an execution-only trading intermediary and makes use of regulated liquidity providers for clearing of its client trades.

High risk investment warning

Online trading consists of complex products that are traded on margin. Trading carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to veracity markets risk disclosure.

Disclaimer

The content of this page is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by veracity markets is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at veracity markets.

Regional restrictions

The information provided by veracity markets is not directed or intended for distribution to or use by residents of certain countries or jurisdictions including, but not limited to, united kingdom, australia, belgium, france, iran, japan, north korea and USA. The company holds the right to alter the above lists of countries at its own discretion.

Responsible trading policy

When it comes to trading on veracity markets platforms and using its features, we encourage responsible behavior among all our users and traders. Our “responsible trading policy” calls on traders to protect themselves from emotional decision making that can result in unnecessary losses. This web page and its products are intended exclusively for legally adult use, given that current legislation anywhere in the world does not permit account onboarding, trading, advising, binding in a legal contract to those under 18 years of age.

Safety of funds

At veracity markets (PTY) LTD, the safety of your funds is paramount to our business activity. With this in mind, all client funds are held in a segregated account separate from the companies funds.

Refund policy

All the funds deposited with veracity markets is for the sole purpose of trading the financial markets on contract for difference. There is no physical delivery of any asset. The clients acknowledge that they incur profit or loss depending on the open and close price of the asset traded. Any funds deposited with veracity markets is the asset of the client and a liability on veracity markets. The client can request for a withdrawal of their unused funds held with veracity markets at anytime. Any funds lost while trading in financial markets with veracity markets is non-refundable and non-withdrawable.

Download forex robot (ea auto trading) for mt4 free

Forex robot free download every time, when we are talking about the forex best ever result than ever before, can say that we have to talk about the quick and best ever results with the great extent.

So there are many forex ea robot spots where we can rank inside the broker with the best ever formula for the new trading or the old one (no matter).

The first thing that we can say about the free forex expert advisors in a better way is to select the indicator which is best ever tool for the trading in the real world like a pro.

So the first you have to select the best editing and broking tool in the forex trading.

Our tool is that we have to get up with the trading is something new which can be used and help us for the perfection in the real forex expert advisor free download.

We will use the forex robot for the perfect game view in the best metatrader 4 expert advisor.

Free metatrader 4 expert advisor for MT4 or mt5

But the main problem is that what will be the best way to get in touch with the robot that can make us good for the perfect forex trading with the robotic trade.

So here we are going to teach the best way in the forex ea free download world so that we can get a better and best ever chance to be in touch with the most awesome design to get involve in the forex best ever results with the most perfection side in the forex trading so that we also can be so good with the perfect side in the best mt4 expert advisors.

You can get the best robot in the list of the robot forex over the internet. You can download the best ever forex robot for free for meta trader 4 in MQL5 code source free forex expert advisor download.

There are various application working on the script in this case so that there can be more awesome thing that can happen more and more thing for the perfection of the forex auto trading software free download over the internet that can make the best thing that can make our trade very awesome and handy to achieve the best ever results from the forex robot.

This all application can be downloaded over the internet and can be run on the metatrader4. All are exist on the trading thread as well over the internet.

Best forex robot free download

The best and easiest way to get in touch with this is you have to download this application,

Run it on the metatraders over the internet or offline and then go for the trading section to develop one time trading section in the list for the perfection and then go for the freshmen as well as for the enjoy because you have already passed the first and important step in the trading section that is the better and best way to trade like a real pro person.

There are also many robotic way to trade within the broker such like pair closer, ADX expert, MACD expert, cross hatch etc.

So you can use them also forex ea systems for the perfection of the robotic trade within the broker for quick and better results in the forex trading.

Globex360 review

"> updated: october 26, 2020

Summary

We do not recommend globex360 for south african traders due to the high cost of trading and the numerous complaints we have received. If you are looking for a good south african forex broker we recommend blackstone futures or khwezitrade instead.

Globex360 minimum deposits start at 100 USD, but trading costs are expensive. Spreads are wide, starting at 2 pips on the basic account. A large commission per trade is also charged on all accounts, which is unusual for a broker with such wide spreads. Full spreads are not published.

In addition, while globex 360 states that withdrawals are free, we have received multiple claims that deposits do not reflect to trading accounts and withdrawals do not reflect to bank accounts. Clients have also complained that customer service is extremely poor, or non-existent when it comes to funding issues.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for globex360

Is globex360 safe?

Globex360 was founded in 2017 in johannesburg and has been regulated by the FSCA since 2019 under FSP #50130. The FSCA has brought in a new licence for south african brokers called the ODP licence, but it is unclear if globex360 has applied for this yet.

Globex360 is an STP broker and operates without a dealing desk – though trade execution on basic accounts is instant, insinuating an automated dealing desk of some kind. Standard and professional accounts are both market execution.

Globex360 does not offer negative balance protection, stating that “negative balance protection is not guaranteed. The general practice is that we cover the negative balance, but all cases are reviewed on a case-by-case basis.”

We have received many complaints from south african traders with a globex360 login regarding deposit and withdrawal issues. We cannot prove that any of these allegations are true, but since the collapse of JP markets traders should be very careful when choosing a forex broker.

Should I trade with globex360?

We do not recommend globex360 for south african forex traders.

Even if the allegations of funding problems are untrue, globex360’s trading costs are unreasonably high and its forex education is poor. Even though globex360’s minimum deposit is quite low at 100 USD, it does not publish its complete spreads, trading accounts are not offered in ZAR, and the only platform available is MT4.

We recommend choosing another broker from one of our lists:

We only recommend well-regulated, honest brokers with good trading conditions.

So, let's see, what we have: NAS100 brokers let you trade the NASDAQ stock market. Compare NASDAQ trading platforms and you could get the best broker to trade NASDAQ. Our NASDAQ brokers list shows the best brokers who offer access to the NAS100 for trading; forex, spread betting, MT4 & cfds. Compare platforms to trade USA companies and stocks. At globex360 nasdaq

Contents of the article

- Top-3 forex bonuses

- Best brokers for trading NASDAQ 100, US-TECH 100

- Compare NASDAQ brokers

- What is nasdaq 100?

- Can you trade the nasdaq 100 index?

- What is the attraction of nasdaq 100?

- What drives the nasdaq 100?

- How to trade the nasdaq 100 using technical...

- Publishers

- A way to uninstall globex360 MT4 terminal from...

- How to erase globex360 MT4 terminal from your...

- Disclaimer

- Compare brokers for trading NASDAQ 100

- We found 20 broker accounts (out of 147)...

- Forex.Com

- The NASDAQ-100

- Composition

- Eligibility for nasdaq-100 inclusion

- How the value of nasdaq-100 is derived

- How to trade the nasdaq-100

- Benefits of CFD trading on nasdaq-100

- Current value of nasdaq-100 index

- Conclusion

- Why choose forex.Com for trading NASDAQ 100?

- Compare synthetic indices brokers

- How to trade the VXX

- Spread betting on market volatility using the VIX

- How to use volatility etns (VXX & VXZ) to protect...

- What brokers offer VXX and VZN trading and...

- What is volatility trading?

- To trade volatility etns successfully, however,...

- Publishers

- A way to uninstall globex360 MT4 terminal from...

- How to erase globex360 MT4 terminal from your...

- Disclaimer

- Compare brokers for trading NASDAQ 100

- We found 20 broker accounts (out of 147)...

- Forex.Com

- The NASDAQ-100

- Composition

- Eligibility for nasdaq-100 inclusion

- How the value of nasdaq-100 is derived

- How to trade the nasdaq-100

- Benefits of CFD trading on nasdaq-100

- Current value of nasdaq-100 index

- Conclusion

- Why choose forex.Com for trading NASDAQ 100?

- Globex360 (PTY) LTD

- Globex360 nasdaq

- Veracity markets MT4 features

- Helpdesk

- Connect now:

- Trading

- Platforms

- Partners

- Promotions

- Company

- Legal and regulation

- Clearing services

- High risk investment warning

- Disclaimer

- Regional restrictions

- Responsible trading policy

- Safety of funds

- Refund policy

- Download forex robot (ea auto trading) for mt4...

- Free metatrader 4 expert advisor for MT4 or mt5

- Globex360 review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for globex360

- Is globex360 safe?

- Should I trade with globex360?