Tickmill forex review

Claud 18 june, 2019 reply compared platform trading conditions with other brokers, it's just better.

Top-3 forex bonuses

Tickmill reviews and comments 2021

Tickmill is scam broker they don't give your money back. Be careful & don't waste your time.

K. Sudesh ranga 16 april, 2020 reply

I chose tickmill through a referal from a forex education centre and it totally disappointed me. The online team is not 24 hours and they can barely do anything when you talk to them. Even after they arrange for a call back, it does not happen on many occasions. On top of them, they do not exercise margin calls like most brokers. My positions got wiped out just like that. And even after they liquidated some of my positions, my margin continues to be negative though my positions are in positive. Till date, this had not been resolved as they are always slow in replies. Recommend all to avoid this broker at all cost!

Vincent lim 15 april, 2020 reply

I chose tickmill accidentally, when I didn't understand anything in forex, but I was lucky that I didn't run into a rogue, but got into a good company, although all the chances were against me. First I opened there a demo account, then a real one, and soon decided to withdraw some money - on trial, would they not deceive you. Brought out. Then I began to quietly trade, and since then two more times I have withdrawn relatively small amounts - two times $ 300 each. There were no obstacles, only at the very first withdrawal it was a little long, scans of documents were required, but the next time they were no longer required.

Malcolm 25 july, 2019 reply

I usually do not write reviews, but here the situation is different, tickmill is a relatively young broker. I've been trading here for a month, and managed to withdraw, and I could bargain with the manager, I can confirm that I had a good deal of trying to make my debut. For a couple of weeks you will not make an objective conclusion about the company, but judging by what has already happened, and if there is something that will force me to stop working with the company, then it’s logical that I will not be silent, like everyone here, but as long as the stones do not fly towards the broker, then there are few newcomers here, they usually choose monopolists in the market, and this is a young broker, only those who are looking for it will find it, and the reason why there is not enough negative for you broker to maintain the level of service, after all, they are interesting for now.

Antony 18 july, 2019 reply

I work with three forex brokers companies simultaneously, including tickmill. I use different trading strategies with different brokers, so I can't guarantee 100% comparison accuracy, but it feels more comfortable with tickmill. First of all, I speak about situations when the price is going up and down and does not catch your stop, although the candle crossed it. But it can be a matter of strategy and selected tools, I can't vouch for it. But in principle I can advise with a clear conscience, a good broker, only maybe not for beginners.

Claud 18 june, 2019 reply

I do not like to praise people or companies for nothing. But I am going over the facts on the experience of working with tickmill. This is quite a powerful STP broker from experienced major companies. The interbank market access is an highly important moment for me since there is no conflict of interest with the broker. This is seen immediately both in execution and real spreads that you observe in the terminal. As to spread without additional commissions, it is very adequate for them, the broker does not pull three skins from the client. With this, the spreads in their specifications correspond to those in real trading. They are not moving apart too much, even with extra volatility, as a pound has been observed recently. Just recently, the week on dollar/yena started with a gap and I was standing up for sale. The price opened at 40 points with a gap and immediately closed the deal. I planned to take 50 pips off the taka and took more than 90 off. Fact! I appreciate them for their honesty towards their clients.

Sergio 27 may, 2019 reply

Not bad broker, but kridex offers better spread, lower commissions, higher leverage nad faster execution

I love tickimil and they the best broker, but I am not sure why the withdrawals comes in half half. This is a good broker ever

Belinda 4 may, 2019 reply

Very good. Problem is leverage. Too small!

I have a serious problem with the bonus you provide us with.You're saying that "we can withdraw any profit we make"but why is it difficult to withdraw our profit.Even the log in details doesn't go through. What's wrong.I need help

Sharl 31 january, 2019 reply

Are serious about what you saying cos I was also asked to do the same but I haven't. Not sure if I should go ahead or just drop everything.

David 28 august, 2019

Tickmill trading bonus is a scum. Made 700usd and after they told mi to fund account so that I can withdraw then I did so nd since that day I'm still waiting to receive my profit so be careful guys

Thabo 12 november, 2018 reply

I've been trading for a couple of years now and have tried out many brokers, but tickmill has really made a difference for me. Really reliable broker, with great execution. Plus, I've never had any issues with withdrawals.

Fraud company. One of their representative name - sumit lakeshri in india took 12,000 INR from me to deposit funds in tickmill & now since last 20 days his number is switch off. Fraud company & fraud executive. Don't attend call from tickmill.

Sagar 10 july, 2017 reply

Have you tried any methods to recover your investment? I hired a refund solution professonial to retrieve my funds.

Christie 2 august, 2017

Compared platform trading conditions with other brokers, it's just better.

Jozefntou1 14 march, 2017 reply

**wanted to add 5 stars!! But website put 1 star?

Jozefntou1 14 march, 2017

For sure this broker can be recommended. Trading is profitable here. The orders are executed instantly. I prefer forex trading with advantage on its ECN pro account with minimum deposit $ 25. ECN spreads are fluctuating but great widening is not observed. I like to trade chinese yuan against USA dollar. The environment allows the yuan to trade freely and forecast the movements of it taking advantage of the exchange rate fluctuation. The broker even credits positive slippage to my account… sometimes there is a negative one during news release – get used to it trading with other brokers. Do not think it is possible to avoid it completely.

Ingmar 21 june, 2016 reply

Excellent broker. One of the best. Good prices. Competitive.

Timay10 13 august, 2016

Don’t like it at all. Though, I heard many good things about tickmill. But I lost my money several times here because of slippage. In reviews they say that there is no slippage (I’ve read). “you got me all misty-eyed,” - as my favorite character says. The price moves up and down regardless of what is requested. The connection with the platform is often interrupted. I faced the problems with closing of positions and execution of the orders. Moreover, usually fast withdrawals suddenly just stopped. I could not get my money immediately already twice waiting for withdrawals during a week. Wouldn’t recommend this broker. I’m leaving.

I have been trading with tickmill nearly around 7 months with their clas sic account. I have gone through some profits and losess in my trading account. I can say they are really have good spreads start from 1.2pips for EURUSD in their clas sic account. I think their trading platform for offshore broker are really awesome, and I noticed in 7months I trade with tickmill, I never has disconnecting problem, or freezing chart problem. Customer services are polite. Wide range payment methods, including famous e-payment methods in my country. I hope in near future they will have more regulations and offer swap free account.

Arsen 2 february, 2016 reply

Opened an ECN account with them and deposit small amount , $100 to test their executions. My plan was do news trade with this broker,because they claimed as ECN. To be honest, my news trade was executed perfectly. Their spreads when news were litlle bit high , around 1.2-2 pips when news, but no problem,. As long as my trade executed fairly. Made some profits and some losses, got 40% profits, and decide to withdraw my profits, and recieved it fast in my skrill account. Good broker with good services. They are fair and not mess with your account with you made some profits.

Mahesaroni 26 january, 2016 reply

I have a ECN account with them. The execution is fast and the spread is very good, never had an issue with trading , like delayed trades, freezing chart , or any other problems that usually happen with another brokers, if you are a news trader, you need to adjust your stoploss with their widening spreads. Depositing money in any brokers are always smooth ,however tickmill withdrawing process is fast. A good forex broker with good attitude so far.

Ardian 15 january, 2016 reply

I've trading with tickmill for 4 months and what i can say, they are honest broker. Trade with their no commisions account and satisfied with their spreads, 1.2 pips for EURUSD is perfect spreads for trading either scalping or intraday. However it is variable spreads, so sometimes i got 2.0 pips. But it is normal if we trade with variable spreads broker. Their customer service is good, professional and polite when answering my questions. But i will love them more if they are add more trading platform like ctrader. Overall as a happy clients , so far, they are doing a great job and i hope they can maintain and stick with their quality in future. Sorry if i have error in grammar since english is not my mother language

Verry2114 8 january, 2016 reply

Move to tickmill from my old broker. And i am satisfied with tickmill trading conditions. My old broker compare with tickmill ?My old brokers charge 5 pips spread and $50 commisions, so i am very satisfied with tickmill

and different with my old broker, their platform never freeze in high impact news. Fast withdrawal. What i can expect more?

Daftar2ijak 21 november, 2015 reply

As a white label partner, you can offer your clients the same award-winning technology and broad product range enjoyed by thousands clients worldwide, under your own brand.

Malenchelon 24 december, 2015

My trading style is to put all of my balance in one trading. That is why i only deposit as low as possible and take profit as much as possible. And market only need move 50.0-100.0 pips against my open trade before i got stop out

other broker ban my trading style. I do not know why. And some of other let me do my style and delete my profit after that. Which is unfair. In my tickmill ECN account, i can trading using my style without any problem. They accept my style.And have no problem withdrawing my profit

Daftar2ijak 27 october, 2015 reply

One of best broker for arbitgeur trader, open an ECN account to test my arbitrage EA with small deposit and i am notice my arbitrage EA working smooth here smooth execution for my EA transaction cost is not expensive i will see how my portofolio grow here.

Riza 18 august, 2015 reply

Is it problem to trade with tickmill and use the bank which is their liquidity providers ( barclays? Or it can affect some how?

Gabriel 16 march, 2019

I click close the newly appear lossing trade but this time it update immediately as a loss. Their explanation was you have a cache problem!!

Ben dunn 10 august, 2015 reply

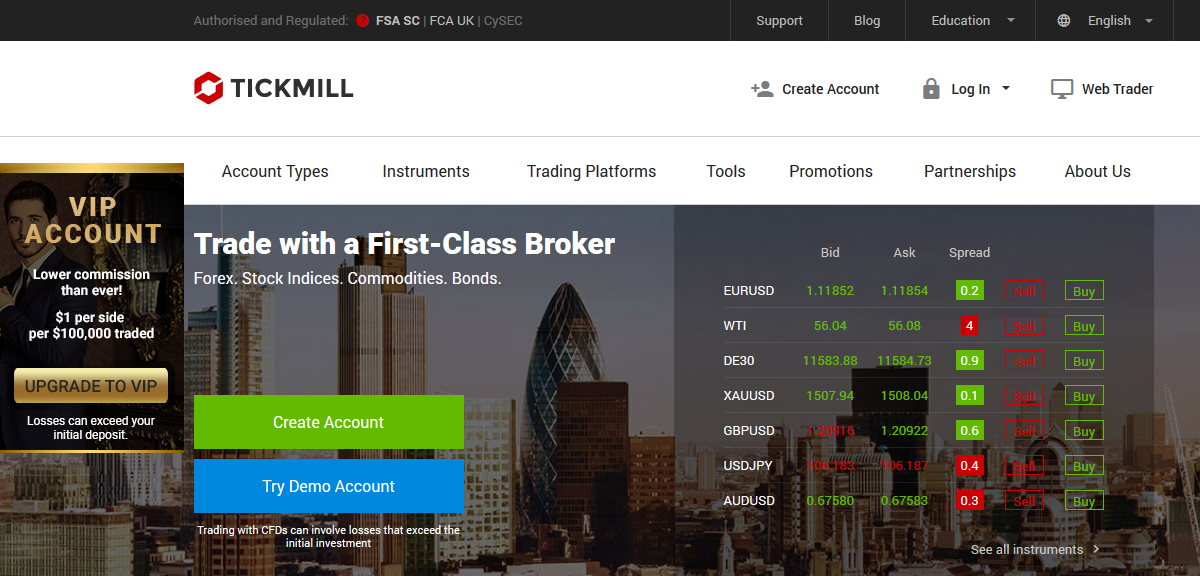

Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the financial conduct authority (FCA) and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and.

Regulation: FCA UK, cysec, FSA seychelles

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

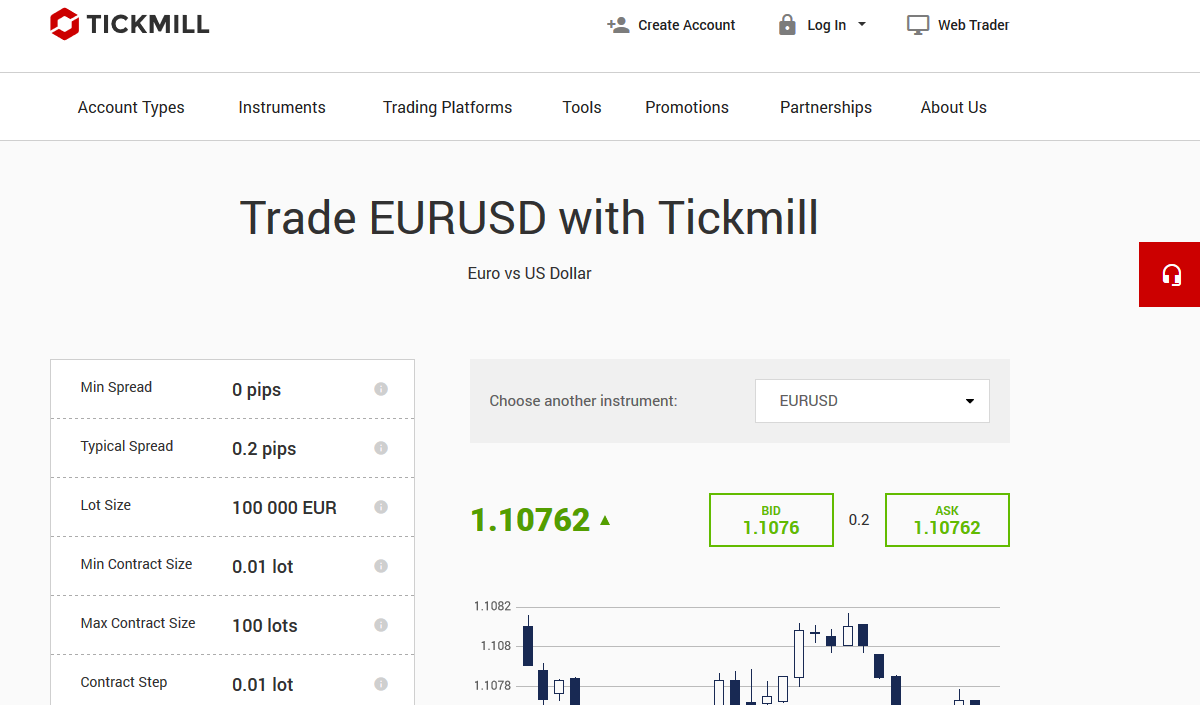

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

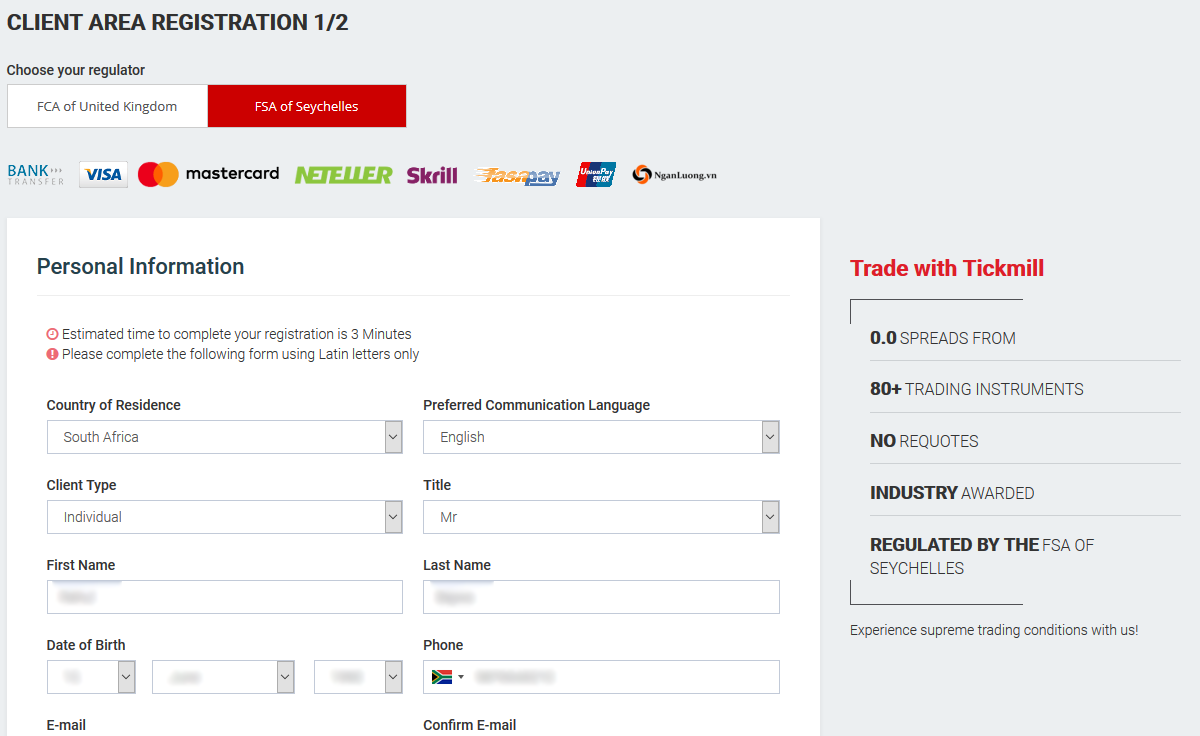

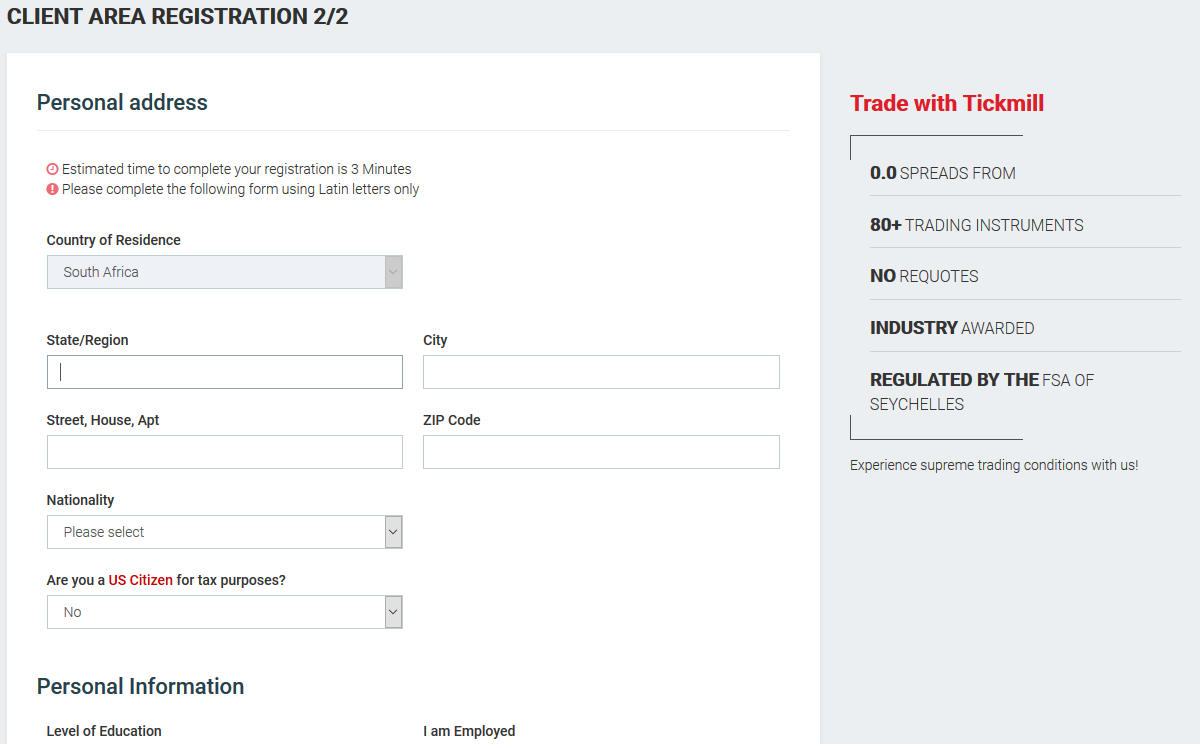

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

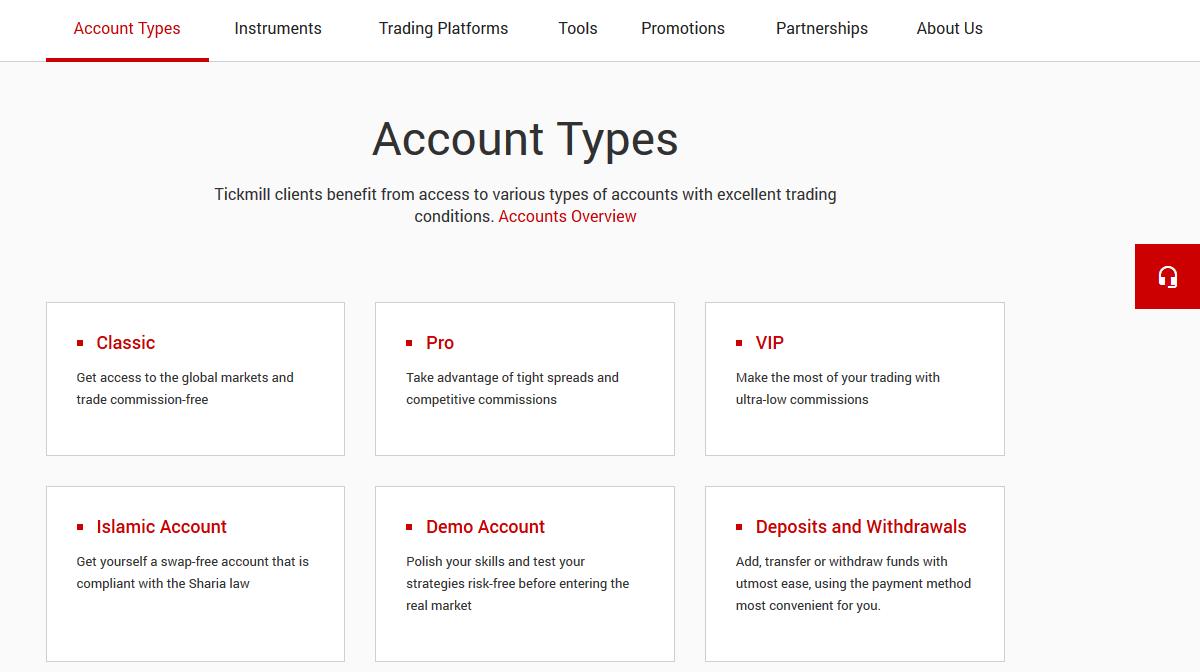

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

Established in 2015, tickmill is an online forex and CFD broker that is regulated in multiple jurisdictions. They provide online trading services to their retail and institutional clients across the globe, offering over 80 tradable instruments across currency pairs, stocks, indices, bonds, metals, energies, and other commodities via flexible trading platforms. The broker offers quality trading conditions, including competitive spreads and commissions, good execution speeds without requotes, prompt customer support services, and helpful trading tools. However, they do not provide enough educational resources.

Tickmill review introduction

In this tickmill review, we will take a look at some of the most important factors worth considering when choosing a forex broker for your online trading needs. This includes trading platforms, trading tools, research and education, account funding options, customer support and broker regulation.

You may also wish to view my best forex brokers based on countless hours that I have spent researching and testing hundreds of brokers, all of which you can see in my forex broker reviews. You can also use my free trading tool to compare forex brokers including tickmill.

Tickmill platforms & tools

Tickmill provides their clients with the metatrader 4 (MT4) platform, which is the most popular trading platform among forex traders. MT4 is available as a web trading terminal that runs on most modern browsers, desktop applications for mac and windows computers, and mobile apps for ios and android compatible devices. The broker also provides a FIX API connection to private and institutional who maintain a minimum account balance of $500,000.

In addition to the tools that come with the trading platforms, the broker provides a selection of useful tools, such as autochartist, technical chart patterns, fibonacci patterns, volatility analysis, key levels, market reports, performance statistics, myfxbook autotrade, economic calendar, trading calculators, tickmill VPS, and one-click trading

Tickmill research & education

The broker has an FAQ section on their website, which answers some common trading questions. Apart from that, and probably the news section, there are no education materials provided by this broker.

Tickmill trading accounts

The broker offers 3 account types:

- Classic account: minimum deposit $100, minimum lot size 0.01, max leverage 1:500, floating spreads from 1.6 pips and no commissions

- Pro account: minimum deposit $100, floating spreads from 0 pips, a $2 commission, minimum lot size 0.01, and max leverage 1:500

- VIP account: floating spreads from 0 pips, a $1 commission, minimum deposit $50,000, minimum lot size 0.01, max leverage 1:500,

Non-professional EU traders have a maximum leverage of 1:30. There may be additional fees, so check with the broker.

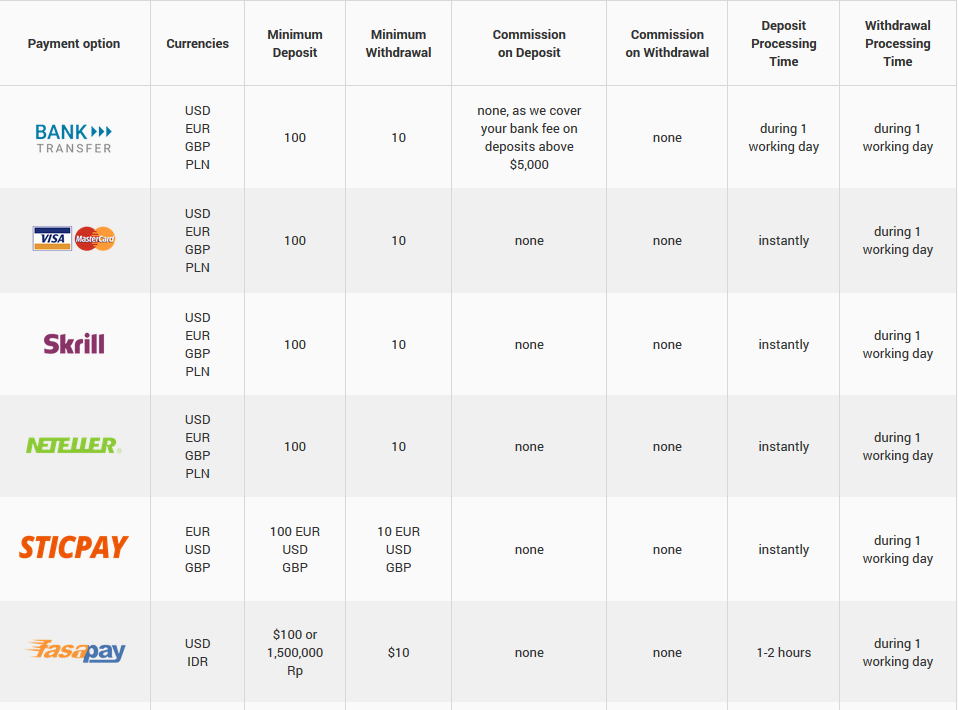

Tickmill account funding

Tickmill accepts a good variety of deposit and withdrawal methods, including bank transfer, credit card, and online payment processors, such as skrill, neteller, fasapay, and unionpay. Bank transfers may take 3-7 business days to be processed, while credit cards and online payment methods are processed in less than a day.

Tickmill customer service

Customer support service is available from monday to friday during trading hours. Support is offered in english, italian, spanish, russian, chinese, indonesian, vietnamese, and arabic. You can reach the support team via phone, online chat, and email

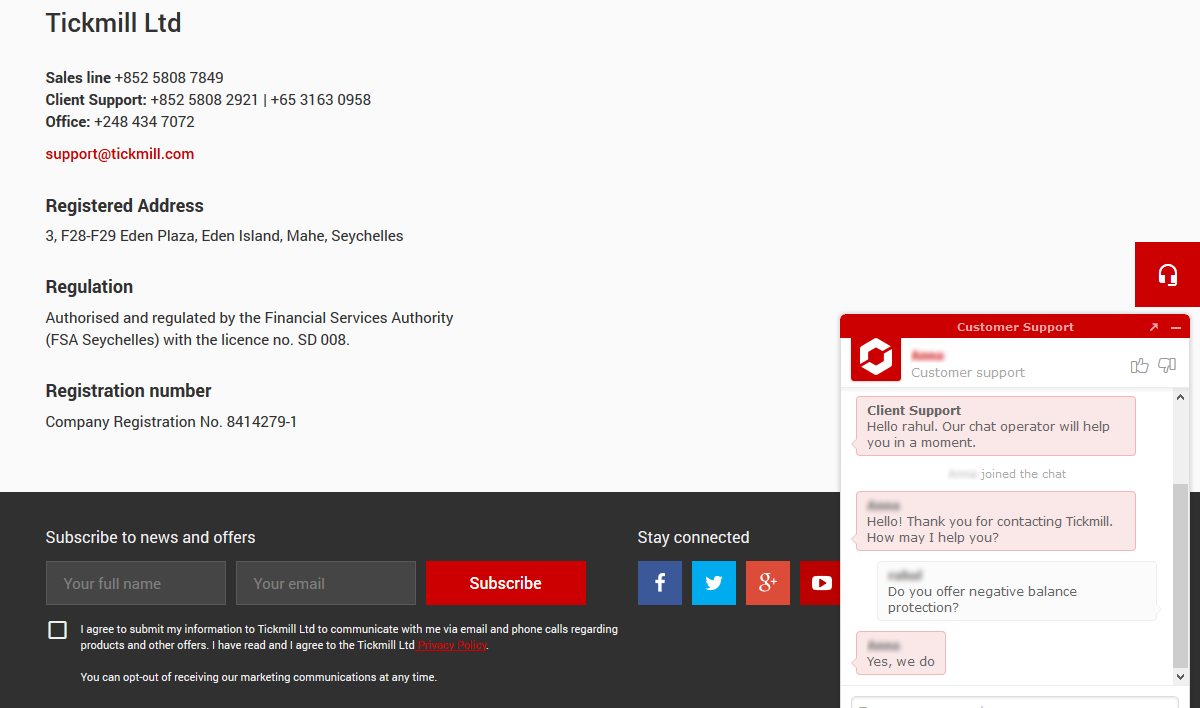

Tickmill regulation

Tickmill is a brokerage brand operated by 3 related companies within the tickmill group, which are regulated in different jurisdictions, as follows:

- Tickmill UK ltd is authorized and regulated by the financial conduct authority (FCA) — the agency that supervises financial service firms in the UK

- Tickmill europe ltd is licensed and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company.

- Both tickmill uk and tickmill europe also abide by the ESMA rules and follow the mifid II

- Tickmill ltd is regulated as a securities dealer by the financial services authority (FSA) of seychelles

Tickmill review summary

Tickmill is an online broker that is regulated in multiple jurisdictions. They provide trading services in over 87 instruments via the MT4 platform, offering competitive spreads and commissions, advanced trading tools, and fast executions.

It is worth mentioning that some of the trading products and services in this tickmill review may differ or not be available to traders in some countries due to regulations. As brokers terms can change over time, please verify all information is up to date directly from the tickmill broker website which you can visit by using the link below.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill

Spreads

Liquidity

Commissions

Support

Regulation

Features

- MT4 platform

- Advanced trading tools like autochartist, technical chart patterns, fibonacci patterns, and volatility analysis

- A good selection of tradable instruments

- Multi-regulated broker

- Competitive trading conditions

Best forex robots

Forex robotron

Forex cyborg

Forex flex EA

Forex scalping EA

5 pips A day

Get my free forex robot!

Sign up now and receive instant access to my free forex robot download with over 40 technical indicators and 11 candlestick patterns built in. *please use a real email address as you will be sent the download link*

Best forex brokers

Pepperstone

IC markets

Pages

- Best forex robots 2021

- Forex robot reviews

- Forex robot ratings

- Free forex robot download

- Best forex brokers 2021

- Forex broker reviews

- Forex broker ratings

- Compare forex brokers

- Forex trading system reviews

- Forex trading system ratings

- Forex trading tool reviews

- Forex trading tool ratings

- Forex signal reviews

- Forex signal ratings

- Forex trading course reviews

- Forex trading course ratings

- Contact me

- Privacy policy

- Terms & conditions

Categories

- Forex brokers

- Forex robots

- Forex signals

- Forex trading courses

- Forex trading guides

- Forex analysis

- Forex basics

- Forex indicators

- Forex strategies

- General trading

- Trading psychology

- Trading software

- Forex trading systems

- Forex trading tools

Recent posts

- Bitcoin VS forex – which one is the best option

- Cedarfx lends support to combat climate change

- Cedarfx review

- Bitcoin exchange: what to consider for choosing the right bitcoin exchange?

- The different methods to acquire bitcoin

- What are the challenges faced by bitcoin and its users and need to be overcome?

- Forex robotron review

- Forex cyborg review

- Forex scalping EA review

- Forex flex EA review

All information on the forex geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the forex geek and any authorized distributors of this information harmless in any and all ways. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill reviews and comments 2021

Tickmill is scam broker they don't give your money back. Be careful & don't waste your time.

K. Sudesh ranga 16 april, 2020 reply

I chose tickmill through a referal from a forex education centre and it totally disappointed me. The online team is not 24 hours and they can barely do anything when you talk to them. Even after they arrange for a call back, it does not happen on many occasions. On top of them, they do not exercise margin calls like most brokers. My positions got wiped out just like that. And even after they liquidated some of my positions, my margin continues to be negative though my positions are in positive. Till date, this had not been resolved as they are always slow in replies. Recommend all to avoid this broker at all cost!

Vincent lim 15 april, 2020 reply

I chose tickmill accidentally, when I didn't understand anything in forex, but I was lucky that I didn't run into a rogue, but got into a good company, although all the chances were against me. First I opened there a demo account, then a real one, and soon decided to withdraw some money - on trial, would they not deceive you. Brought out. Then I began to quietly trade, and since then two more times I have withdrawn relatively small amounts - two times $ 300 each. There were no obstacles, only at the very first withdrawal it was a little long, scans of documents were required, but the next time they were no longer required.

Malcolm 25 july, 2019 reply

I usually do not write reviews, but here the situation is different, tickmill is a relatively young broker. I've been trading here for a month, and managed to withdraw, and I could bargain with the manager, I can confirm that I had a good deal of trying to make my debut. For a couple of weeks you will not make an objective conclusion about the company, but judging by what has already happened, and if there is something that will force me to stop working with the company, then it’s logical that I will not be silent, like everyone here, but as long as the stones do not fly towards the broker, then there are few newcomers here, they usually choose monopolists in the market, and this is a young broker, only those who are looking for it will find it, and the reason why there is not enough negative for you broker to maintain the level of service, after all, they are interesting for now.

Antony 18 july, 2019 reply

I work with three forex brokers companies simultaneously, including tickmill. I use different trading strategies with different brokers, so I can't guarantee 100% comparison accuracy, but it feels more comfortable with tickmill. First of all, I speak about situations when the price is going up and down and does not catch your stop, although the candle crossed it. But it can be a matter of strategy and selected tools, I can't vouch for it. But in principle I can advise with a clear conscience, a good broker, only maybe not for beginners.

Claud 18 june, 2019 reply

I do not like to praise people or companies for nothing. But I am going over the facts on the experience of working with tickmill. This is quite a powerful STP broker from experienced major companies. The interbank market access is an highly important moment for me since there is no conflict of interest with the broker. This is seen immediately both in execution and real spreads that you observe in the terminal. As to spread without additional commissions, it is very adequate for them, the broker does not pull three skins from the client. With this, the spreads in their specifications correspond to those in real trading. They are not moving apart too much, even with extra volatility, as a pound has been observed recently. Just recently, the week on dollar/yena started with a gap and I was standing up for sale. The price opened at 40 points with a gap and immediately closed the deal. I planned to take 50 pips off the taka and took more than 90 off. Fact! I appreciate them for their honesty towards their clients.

Sergio 27 may, 2019 reply

Not bad broker, but kridex offers better spread, lower commissions, higher leverage nad faster execution

I love tickimil and they the best broker, but I am not sure why the withdrawals comes in half half. This is a good broker ever

Belinda 4 may, 2019 reply

Very good. Problem is leverage. Too small!

I have a serious problem with the bonus you provide us with.You're saying that "we can withdraw any profit we make"but why is it difficult to withdraw our profit.Even the log in details doesn't go through. What's wrong.I need help

Sharl 31 january, 2019 reply

Are serious about what you saying cos I was also asked to do the same but I haven't. Not sure if I should go ahead or just drop everything.

David 28 august, 2019

Tickmill trading bonus is a scum. Made 700usd and after they told mi to fund account so that I can withdraw then I did so nd since that day I'm still waiting to receive my profit so be careful guys

Thabo 12 november, 2018 reply

I've been trading for a couple of years now and have tried out many brokers, but tickmill has really made a difference for me. Really reliable broker, with great execution. Plus, I've never had any issues with withdrawals.

Fraud company. One of their representative name - sumit lakeshri in india took 12,000 INR from me to deposit funds in tickmill & now since last 20 days his number is switch off. Fraud company & fraud executive. Don't attend call from tickmill.

Sagar 10 july, 2017 reply

Have you tried any methods to recover your investment? I hired a refund solution professonial to retrieve my funds.

Christie 2 august, 2017

Compared platform trading conditions with other brokers, it's just better.

Jozefntou1 14 march, 2017 reply

**wanted to add 5 stars!! But website put 1 star?

Jozefntou1 14 march, 2017

For sure this broker can be recommended. Trading is profitable here. The orders are executed instantly. I prefer forex trading with advantage on its ECN pro account with minimum deposit $ 25. ECN spreads are fluctuating but great widening is not observed. I like to trade chinese yuan against USA dollar. The environment allows the yuan to trade freely and forecast the movements of it taking advantage of the exchange rate fluctuation. The broker even credits positive slippage to my account… sometimes there is a negative one during news release – get used to it trading with other brokers. Do not think it is possible to avoid it completely.

Ingmar 21 june, 2016 reply

Excellent broker. One of the best. Good prices. Competitive.

Timay10 13 august, 2016

Don’t like it at all. Though, I heard many good things about tickmill. But I lost my money several times here because of slippage. In reviews they say that there is no slippage (I’ve read). “you got me all misty-eyed,” - as my favorite character says. The price moves up and down regardless of what is requested. The connection with the platform is often interrupted. I faced the problems with closing of positions and execution of the orders. Moreover, usually fast withdrawals suddenly just stopped. I could not get my money immediately already twice waiting for withdrawals during a week. Wouldn’t recommend this broker. I’m leaving.

I have been trading with tickmill nearly around 7 months with their clas sic account. I have gone through some profits and losess in my trading account. I can say they are really have good spreads start from 1.2pips for EURUSD in their clas sic account. I think their trading platform for offshore broker are really awesome, and I noticed in 7months I trade with tickmill, I never has disconnecting problem, or freezing chart problem. Customer services are polite. Wide range payment methods, including famous e-payment methods in my country. I hope in near future they will have more regulations and offer swap free account.

Arsen 2 february, 2016 reply

Opened an ECN account with them and deposit small amount , $100 to test their executions. My plan was do news trade with this broker,because they claimed as ECN. To be honest, my news trade was executed perfectly. Their spreads when news were litlle bit high , around 1.2-2 pips when news, but no problem,. As long as my trade executed fairly. Made some profits and some losses, got 40% profits, and decide to withdraw my profits, and recieved it fast in my skrill account. Good broker with good services. They are fair and not mess with your account with you made some profits.

Mahesaroni 26 january, 2016 reply

I have a ECN account with them. The execution is fast and the spread is very good, never had an issue with trading , like delayed trades, freezing chart , or any other problems that usually happen with another brokers, if you are a news trader, you need to adjust your stoploss with their widening spreads. Depositing money in any brokers are always smooth ,however tickmill withdrawing process is fast. A good forex broker with good attitude so far.

Ardian 15 january, 2016 reply

I've trading with tickmill for 4 months and what i can say, they are honest broker. Trade with their no commisions account and satisfied with their spreads, 1.2 pips for EURUSD is perfect spreads for trading either scalping or intraday. However it is variable spreads, so sometimes i got 2.0 pips. But it is normal if we trade with variable spreads broker. Their customer service is good, professional and polite when answering my questions. But i will love them more if they are add more trading platform like ctrader. Overall as a happy clients , so far, they are doing a great job and i hope they can maintain and stick with their quality in future. Sorry if i have error in grammar since english is not my mother language

Verry2114 8 january, 2016 reply

Move to tickmill from my old broker. And i am satisfied with tickmill trading conditions. My old broker compare with tickmill ?My old brokers charge 5 pips spread and $50 commisions, so i am very satisfied with tickmill

and different with my old broker, their platform never freeze in high impact news. Fast withdrawal. What i can expect more?

Daftar2ijak 21 november, 2015 reply

As a white label partner, you can offer your clients the same award-winning technology and broad product range enjoyed by thousands clients worldwide, under your own brand.

Malenchelon 24 december, 2015

My trading style is to put all of my balance in one trading. That is why i only deposit as low as possible and take profit as much as possible. And market only need move 50.0-100.0 pips against my open trade before i got stop out

other broker ban my trading style. I do not know why. And some of other let me do my style and delete my profit after that. Which is unfair. In my tickmill ECN account, i can trading using my style without any problem. They accept my style.And have no problem withdrawing my profit

Daftar2ijak 27 october, 2015 reply

One of best broker for arbitgeur trader, open an ECN account to test my arbitrage EA with small deposit and i am notice my arbitrage EA working smooth here smooth execution for my EA transaction cost is not expensive i will see how my portofolio grow here.

Riza 18 august, 2015 reply

Is it problem to trade with tickmill and use the bank which is their liquidity providers ( barclays? Or it can affect some how?

Gabriel 16 march, 2019

I click close the newly appear lossing trade but this time it update immediately as a loss. Their explanation was you have a cache problem!!

Ben dunn 10 august, 2015 reply

Tickmill is an award-winning global ECN broker, authorised and regulated in the UK by the financial conduct authority (FCA) and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and.

Regulation: FCA UK, cysec, FSA seychelles

Tickmill forex review

Tickmill reviews and ratings

| Website | https://tickmill.Com/ |

| live chat | YES |

| telephone | +852 5808 2921 |

| broker type | non deal desk (NDD) |

| regulations | FCA and FSA |

| min deposit | $100.00 |

| account base currency | USD, EUR, GBP, PNL |

| max leverage | 500:1 |

| trading platforms | metatrader 4, webtrader |

| markets | forex, index CFD trading, precious metals, energy, cryptocurrencies, bonds |

| bonus offered | $30.00 welcome bonus |

| funding options | credit / debit card, china union pay, bank transfer, dotpay, skrill, neteller, fasa pay |

Tickmill review 2021

Overview

This UK-based FCA and FSA-regulated brokerage firm based in the republic of seychelles offers trading to institutions and retail clients globally. Its forex business offers gold and silver as well as 62 currency pairs (including cryptocurrency) for trading. The broker have a lower minimum deposit compared to some of the other brokers on this list. It is a great broker firm for beginners to try their hand.

Accounts

Tickmill offers various types of accounts for various trader profiles. Commission-free classic accounts for beginners, pro accounts, VIP accounts for those who trade a lot and want special service, and islamic accounts. Traders will be thrilled to find the demo account offers metatrader 4 for testing, and includes real-time prices and volatility.

Minimum deposit

$100 in classic and pro accounts, 50,000 minimum balance in VIP accounts.

Maximum leverage

Features

Tickmill offers two platforms to trade on. Metatrader 4 is the main platform. For those who want to trade quickly through their browsers without downloading any software, there is the web trader.

Tickmill also offers a variety of tools including forex margin and currency calculators, autochartist for technical analysis, forex calendar, and myfxbook autotrade. The tickmill VPS keeps the MT4 eas and signals running when the customer is offline. One-click trading option enables quicker real-time trading.

Promotions like the introducing broker service allows traders to earn commissions on reference. A multi account manager is also available.

Educa tion

Webinars and video tutorials are available.

Deposits/withdrawals

Several funding options are available to customers, and withdrawals are processed within one working day.

Customer service

24/7 via online chat or email, and support lines on weekdays.

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

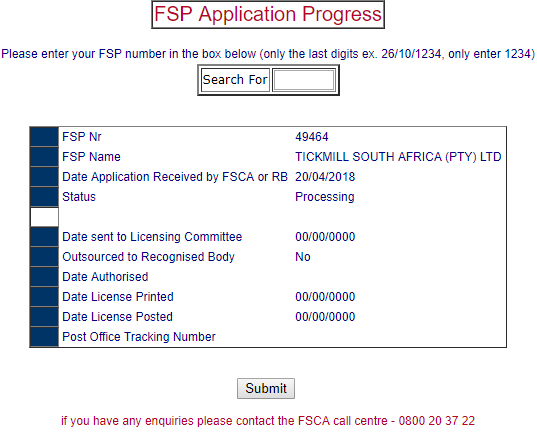

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

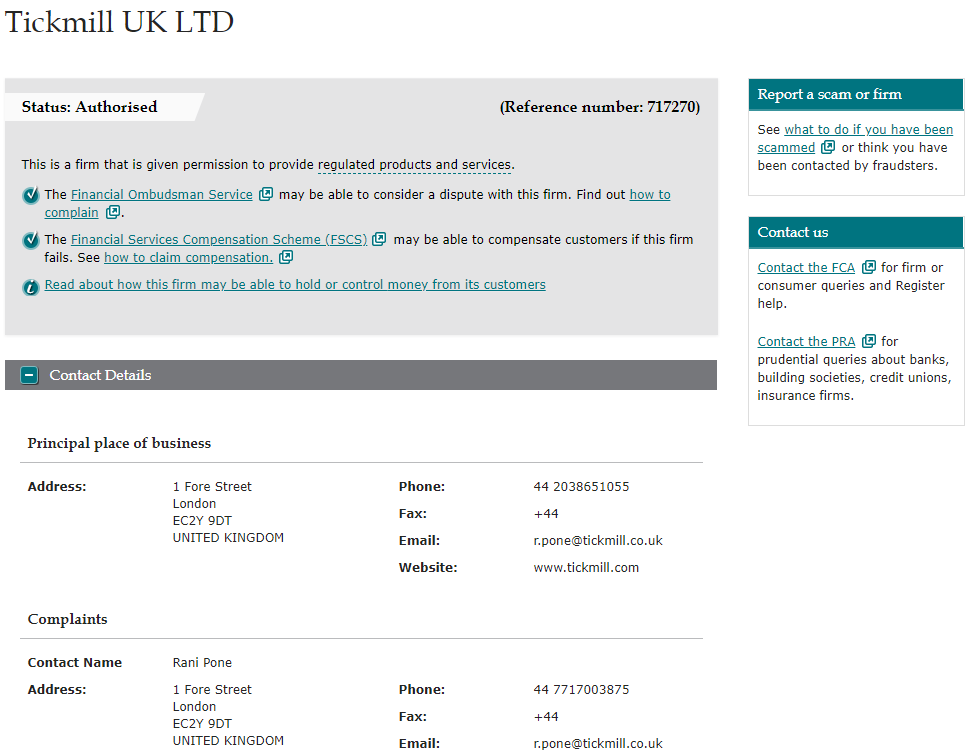

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

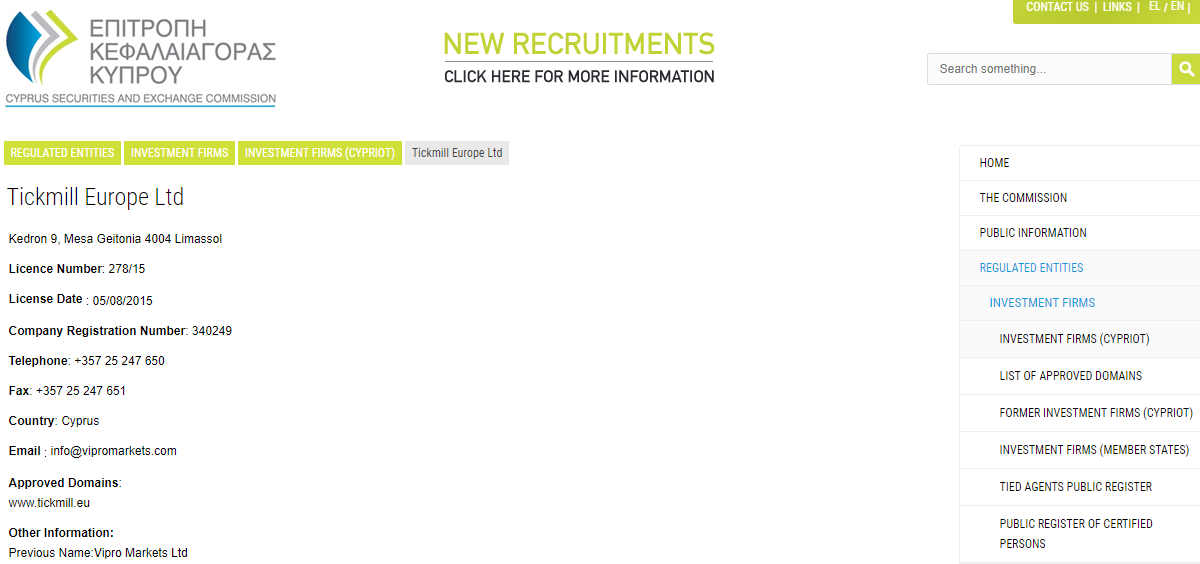

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Tickmill

- Company tickmill ltd, tickmill europe ltd

- Founded in 2014

- Online since 2015

- Offices in

- Credit/debit cards

- Fasapay

- Neteller

- Paypal

- QIWI

- Skrill

- Unionpay

- Webmoney

- Wire transfer

- Bafin, 146511

- Cysec, 278/15

- FCA (UK), 717270

- FSA (seychelles), SD008

- FSCA (south africa), 49464

Account types:

- Hedging

- Overnight interest rates (swaps)

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Forex 1:500

- Gold & silver 1:500

- CFD 1:500

- Oil 1:500

- Stocks 1:500

- Cryptocurrencies 1:20

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type fixed

- Spread on EUR/USD, pips 0

- Commission (one-way) per 1 std. Lot $2

- Trading instruments

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 1.6

- Minimum spread on EUR/USD, pips 1.2

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Minimum account size $50,000

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 0.2

- Minimum spread on EUR/USD, pips 0

- Commission (one-way) per 1 std. Lot $1

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Hedging

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Forex 1:300

- Gold & silver 1:300

- CFD 1:300

- Oil 1:300

- Stocks 1:300

- Cryptocurrencies 1:20

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 0.2

- Minimum spread on EUR/USD, pips 0

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Hedging

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

Reviews

22 reviews of tickmill are presented here. All reviews represent only their author's opinion, which is not necessarily based on the real facts.

One of the worst brokers I have used - and I have used MANY!

1. Their platform is literally constantly frozen and very very slow, you cannot do anything , especially there's good chance to trade! They seem to be really scared of you making any profit, so they kind of manually monitor you and cause all kinds of 'obstacles' for you.

2. Their customer service is like, ZERO - sometimes you doubt if they are a professional company or a one-man business.

3. Their trading conditions (spreads) are very mediocre, 2 pips or so for eurusd - you can easily find many others with better spreads but without this 'frozen' conditions.

4. Haven't tried withdrawal yet, as it's only my first day (right, first day only and they're already watching me and makingsure I can't make a profit. )

So good luck achieving anything good tickmill, I'm out asap.

That was just an 'incredible' experience. Should I just a bit exceeded my deposit with profit, and the fun has begun! I asked to withdraw my deposit when there was minimum amount for trading, they didn't give me money within week. I opened several trades in different time, from morning till night, and even with calm market without strong news slippages and execution was terrible! I could not close trade for more than 10 seconds and it led to blowing account. So they don't like traders who make money. It is disappointment instead of trading.

I have experience working on stock exchange in tehran so I started to trade forex with this broker and it has been excellent so far. Spreads are tight and narrow in london session also I avoid trading during low liquidity (asian session), I trade most liquid pairs like EURUSD and GBPUSD, USDJPY and never exceed 0.3 lot size and 50 pips stop loss. This broker treats me fair and pays my profit so I pray they won't change over time. I really like tickmill and recommend it to my stock trading fellows.

I opened account with them yet far long ago, and I was not pleased that they were throwing slippages in my trade after I made +35% of deposit so haven't traded for several months. I decided to check it recently, maybe they got to be more honest. Unfortunately, it is not so. Frankly, the same wonderful story again. After I profited and took my deposit, everything seemed to be fine for some short time and orders were executed approximately with the same execution speed as with my other brokers. When I got used to service of this broker again and started making stable profit by most of my trades, I experienced slippages and severe spread widening that is obviously because of my making profit. That is pretty enough for me so I am not going to check this broker ever again.

I've opened account with their FCA regulated entity. Everything in trading terms is good although its additional safety from FCA so now I can trade not worrying about safety. Lets see how they will keep up consistency of their good trading platform

Made 80 pip on may NFP with tickmill, +$300 profit from two trades on USD/JPY and EUR/USD. What I can say about them is. PERFECT BROKER. I've never have seen such fast NFP execution before.

To be honest as a newbie ,

Trading with ECN broker like tickmill is a new experience for me.

Because i am usually trade with fixed spreads broker that provide cent lot trading.

I heard rumors if in ECN brokers -spreads will be widening like crazy when financial event /news announced,

And ECN broker spreads will be bigger than any fixed spreads broker.

But i did not experience that with tickmill, in fact, i only had around 2.6 spreads widening with tickmill ecn when NFP .

And to compare with my old broker, i can say they have great server with fast executions.

Never encountered any delay . Trade with them with $75 deposit, and already withdrawed total $100 .

And i do not feel their server and excecutions become slower, like my old broker.

Over all , i am satisfied with them. |

However, if they have cent trading account / cent lot, many newbie traders will trade with them.

Perhaps one day , tickmill will provide such trading account

To be honest , i do not even care what is a brokers business models. Are they ECN, MM, STP DMA,

For me , forex trading is we are trade the quotes. If we are buy EURO/USD. Where the euro goes?

I mean. Come on. I only deposit few dollars in my trading account, and what i can expect?My order can move the market?Lol.

Sometimes it makes me laugh when an investor/trader. Said something high and sophisticated wheh they talk about broker.Like we must trade with ECN/DMA broker, because they forward trader order into the market? What kind of market?Lol. Fruit market?Fish market?

We are retail trader, trade the OTC instruments, decentralized market. So do not expect too much

For me, a good broker is they provide great trading conditions and paid my WD fast . That is why i stay with tickmill .

Trading here since 2015. For those who like to try FX or just for those who have it just a hobby, rather than earning money - it's was a good broker. Nice support, good conditions, but now - there are a lot of slippages happens, constant delays with withdraws.

I'd rather take a consideration not to deposit large amount of money. It's berable to trade here with depo not more than $100. Everything higher that point - say goodbye to your money.

I already tried many kind of brokers.

Some of them are scam, some of them are restrict certain trading strategies

I have many profit cancellations, and some of them dared not to pay my deposit.

I am not a good trader with average accuracy with intraday trading strategies but in my experience i have seen many traders complaining the brokers

But i think if a trader is a good trader. His strategy should work in every broker.

My strategy works perfectly with tickmill, the difference is i think tickmill provide cheaper trading cost,

I mean less slipage during volatile trades.

Demo testing has approx same results as on live

My previous ones, there was subsantial difference because of slipage at SL's

Never had any complaining to them if i make profit with news trading strategy, or even close my trade under a minute.

Never had any single WD problems. Good broker

I had have 6 months experience trading by demo account, and I was nervous at first when deciding to open a live account. Will it be different from my demo account? My friend suggested tickmill to me. I only deposited 300$ to check the trading environment. I was afraid that my order will be re-quoted, but it haven't happened since the day I traded. Everything is good, I love the low spread and acceptable commission. Can't say that I've earned so much money, or I win every battle. I lose as well, but not because of unreasonable things. It's a fair broker and I think my choice is absolutely right.

As you show the tickmill broker something good feature but the broker tickmill have some hidden condition to caught the people money around. There customer support and there manager also not professional meant they always give you a harassing support and waste your time specially and my personal analysis i can see this broker is so much risky to work with them. They will also cheat with you so my suggestion is leave this broker and tell to others that don't use it.

I have been trading with tickmill nearly around 7months with their classic account

I have gone through some profits and losess in my trading account.

I can say they are really have good spreads start from 1.2pips for EURUSD in their classic account.

I think their trading platform for offshore broker are really awesome, and I noticed in 7months I trade with tickmill, I never has disconnecting problem, or freezing chart problem.

Customer service are polite. Wide range payment methods, including famous e-payment methods in my country.

However they have issue with their regulation, and I’d like to see in near future if they consider add more regulation . And sadly they do not have swap free account.

Usually I don't post reviews for forex brokers . But this broker really something.

I have a ECN account with them.

The execution is fast and the spread is very good, never had an issue with trading , like delayed order, freezing chart , or any other problems that usually happen with another brokers, if you are a news trader, you need to adjust your stoploss with their widening spreads.

Depositing money in any brokers are always smooth ,however tickmill withdrawing process is fast.

A good forex broker with good attitude so far.

Read about tickmill in a forum , people are talking about their tiny spreads and very low commission.

Do some research and i read so many positive feedback out there. Seems they deliver what they promise.

Deposited 2K lets see how it goes.

Will update my review later

Submit your review

To submit your own forex broker review for tickmill fill the form below. Your review will be checked by a moderator and published on this page.

By submitting a forex broker review to earnforex.Com you confirm that you grant us rights to publish and change this review at no cost and without any warranties.Make sure that you are entering a valid email address. A confirmation link will be sent to this email. Reviews posted from a disposable e-mail address (e.G. Example@mailinator.Com) will not be published. Please submit your normal e-mail address that can be used to contact you.

Please, try to avoid profanity and foul language in the text of your review, or it will be declined from publishing.

TICKMILL

TICKMILL BROKER REVIEW

TICKMILL REVIEW AND INFORMATION

Is TICKMILL a safe and reliable broker? Is TICKMILL a good forex broker? Find the latest trader’s reviews for TICKMILL, get the details and information of TICKMILL trading broker. Find out all about initial deposits, regulations, features, platforms, customer support and much more when trading with TICKMILL broker.

TICKMILL RATING REVIEW

TICKMILL

TICKMILL is a comparatively high-tech forex broker and a CFD broker of choice for many traders because of its solid reputation. They offer a diversified portfolio and great trading conditions make it a broker worth considering. Traders have a choice of jurisdiction and account types, and this could be an especially attractive broker for clients with relatively small deposit size.

TICKMILL is a retail forex broker with connections to the armada markets which as of january 2015 has switched its focus on providing substantial liquidity and their services to banks, hedge funds, and forex brokers. They are headquartered in both the united kingdom and the seychelles, and they offer a choice of accounts in either location, although availability may be restricted based upon a client’s residence or tax status.

Tickmill offers traders the opportunity to trade a fairly wide range of instruments wrapped as cfds (contracts for difference) with 62 forex currency pairs and crosses, 15 global equity indices, the commodities of gold, silver and crude oil, and bitcoin paired with the U.S. Dollar.

TICKMILL is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

TICKMILL has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). Tickmill UK ltd, is licensed by the UK’s FCA. Tickmill europe ltd on the other hand, is regulated by cysec. Last, but not least, we have tickmill ltd. Which is sort of the parent company of the whole outfit. It is based in the seychelles and licensed by the local FSA.

European traders have to trade under the english license (FCA) or cysec livense, which brings further benefits. On the other side, international traders have to choose the FSA license.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion