100 usd

100 U.S. Dollar = 82.7849 euro saturday, 16 january 2021, 22:00 new york time, sunday, 17 january 2021, 04:00 brussels time

Top-3 forex bonuses

100 U.S. Dollar (USD) to euro (EUR)

100 U.S. Dollar = 82.7849 euro

Saturday, 16 january 2021, 22:00 new york time, sunday, 17 january 2021, 04:00 brussels time

Following are currency exchange calculator and the details of exchange rates between U.S. Dollar (USD) and euro (EUR).

Enter the amount of money to be converted from U.S. Dollar (USD) to euro (EUR), it is converted as you type. Also, you can convert in the reverse direction (from EUR to USD).

Currency information

- U.S. Dollar (USD) is the currency used in united states, east timor, puerto rico, equador.

- U.S. Dollar currency symbol: $

- U.S. Dollar coins available: 1¢, 5¢, 10¢, 25¢, 50¢, $1

- U.S. Dollar banknotes available: $1, $2, $5, $10, $20, $50, $100

- Central bank: federal reserve bank

- Gold price in united states (in U.S. Dollar)

- Euro (EUR) is the currency used in europe, greece, cyprus, montenegro, italy, spain, france, portugal, belgium, austria, netherlands, germany, finland, kosovo, french guiana, luxembourg, slovenia.

- Euro currency symbol: €

- Euro coins available: 1c, 2c, 5c, 10c, 20c, 50c, €1, €2

- Euro banknotes available: €5, €10, €20, €50, €100, €200, €500

- Central bank: european central bank

- Gold price in europe (in euro)

Details of U.S. Dollar to euro exchange rates

Conversion from U.S. Dollar (USD) to euro (EUR)

| 1 USD = 0.83 EUR |

| 2 USD = 1.66 EUR |

| 4 USD = 3.31 EUR |

| 5 USD = 4.14 EUR |

| 10 USD = 8.28 EUR |

| 20 USD = 16.56 EUR |

| 25 USD = 20.70 EUR |

| 50 USD = 41.39 EUR |

| 100 USD = 82.78 EUR |

| 200 USD = 165.57 EUR |

| 250 USD = 206.96 EUR |

| 500 USD = 413.92 EUR |

| 1000 USD = 827.85 EUR |

| 2000 USD = 1,655.70 EUR |

| 2500 USD = 2,069.62 EUR |

| 5000 USD = 4,139.25 EUR |

| 10000 USD = 8,278.49 EUR |

| 20000 USD = 16,556.98 EUR |

| 25000 USD = 20,696.23 EUR |

| 50000 USD = 41,392.45 EUR |

| 100000 USD = 82,784.90 EUR |

| 200000 USD = 165,569.80 EUR |

| 500000 USD = 413,924.50 EUR |

| 1000000 USD = 827,849.00 EUR |

| 1 EUR = 1.21 USD |

| 2 EUR = 2.42 USD |

| 4 EUR = 4.83 USD |

| 5 EUR = 6.04 USD |

| 10 EUR = 12.08 USD |

| 20 EUR = 24.16 USD |

| 25 EUR = 30.20 USD |

| 50 EUR = 60.40 USD |

| 100 EUR = 120.80 USD |

| 200 EUR = 241.59 USD |

| 250 EUR = 301.99 USD |

| 500 EUR = 603.97 USD |

| 1000 EUR = 1,207.95 USD |

| 2000 EUR = 2,415.90 USD |

| 2500 EUR = 3,019.87 USD |

| 5000 EUR = 6,039.75 USD |

| 10000 EUR = 12,079.50 USD |

| 20000 EUR = 24,159.00 USD |

| 25000 EUR = 30,198.74 USD |

| 50000 EUR = 60,397.49 USD |

| 100000 EUR = 120,794.98 USD |

| 200000 EUR = 241,589.95 USD |

| 500000 EUR = 603,974.88 USD |

| 1000000 EUR = 1,207,949.76 USD |

U.S. Dollar (USD) to euro (EUR) chart

Here is the USD to EUR chart. Select a time frame for the chart; 1 month, 3 months, 6 months, year to day, 1 year and all available time which varies from 7 to 13 years according to the currency. You can also, download the chart as a png or jpeg image or as a pdf file or directly print the chart by clicking on the corresponding button in the top right of the chart.

100 usd

The USD is the abbreviation for the U.S. Dollar, the official currency of united states of america and the world's primary reserve currency.

Key takeaways

- The USD is the abbreviation for the U.S. Dollar, the official currency of united states of america and the world's primary reserve currency.

- The USD is the most traded currency in the international foreign exchange market, which facilitates global currency exchange and is the largest financial market in the world, with a daily average volume of over $5 trillion.

- USD accounts for approximately 88% of all foreign exchange transactions, according to a 2016 bank for international settlements (BIS) report.

Understanding USD

The USD is the most traded currency in the international foreign exchange market, which facilitates global currency exchange and is the largest financial market in the world, with a daily average volume of over $5 trillion. As such, the USD is considered a benchmark currency and is readily accepted in transactions worldwide. USD accounts for approximately 88% of all foreign exchange transactions according to a 2016 bank for international settlements (BIS) report.

The USD has been the official currency of the united states since the passage of the national currency act of 1785. Before that, the united states used a patchwork system of unreliable continental currency, british pounds, and various foreign currencies. At first, the dollar was denominated only in coins, with paper currency introduced in 1861, and its value was keyed to the relative prices of gold, silver, and copper.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

100 egyptian pound (EGP) to U.S. Dollar (USD)

100 egyptian pound = 6.3857 U.S. Dollar

Sunday, 17 january 2021, 05:00 cairo time, saturday, 16 january 2021, 22:00 new york time

Following are currency exchange calculator and the details of exchange rates between egyptian pound (EGP) and U.S. Dollar (USD).

Enter the amount of money to be converted from egyptian pound (EGP) to U.S. Dollar (USD), it is converted as you type. Also, you can convert in the reverse direction (from USD to EGP).

Currency information

- Egyptian pound (EGP) is the currency used in egypt.

- Egyptian pound currency symbol: ج.م

- Egyptian pound coins available: 5, 10, 20, 25, 50 piastres, 1 pound

- Egyptian pound banknotes available: 5, 10, 25, 50 pt, 1, 5, 10, 20, 50, 100, 200 LE

- Central bank: central bank of egypt

- Gold price in egypt (in egyptian pound)

- U.S. Dollar (USD) is the currency used in united states, east timor, puerto rico, equador.

- U.S. Dollar currency symbol: $

- U.S. Dollar coins available: 1¢, 5¢, 10¢, 25¢, 50¢, $1

- U.S. Dollar banknotes available: $1, $2, $5, $10, $20, $50, $100

- Central bank: federal reserve bank

- Gold price in united states (in U.S. Dollar)

Details of egyptian pound to U.S. Dollar exchange rates

Conversion from egyptian pound (EGP) to U.S. Dollar (USD)

| 1 EGP = 0.06 USD |

| 2 EGP = 0.13 USD |

| 4 EGP = 0.26 USD |

| 5 EGP = 0.32 USD |

| 10 EGP = 0.64 USD |

| 20 EGP = 1.28 USD |

| 25 EGP = 1.60 USD |

| 50 EGP = 3.19 USD |

| 100 EGP = 6.39 USD |

| 200 EGP = 12.77 USD |

| 250 EGP = 15.96 USD |

| 500 EGP = 31.93 USD |

| 1000 EGP = 63.86 USD |

| 2000 EGP = 127.71 USD |

| 2500 EGP = 159.64 USD |

| 5000 EGP = 319.28 USD |

| 10000 EGP = 638.57 USD |

| 20000 EGP = 1,277.14 USD |

| 25000 EGP = 1,596.42 USD |

| 50000 EGP = 3,192.85 USD |

| 100000 EGP = 6,385.70 USD |

| 200000 EGP = 12,771.39 USD |

| 500000 EGP = 31,928.48 USD |

| 1000000 EGP = 63,856.96 USD |

| 1 USD = 15.66 EGP |

| 2 USD = 31.32 EGP |

| 4 USD = 62.64 EGP |

| 5 USD = 78.30 EGP |

| 10 USD = 156.60 EGP |

| 20 USD = 313.20 EGP |

| 25 USD = 391.50 EGP |

| 50 USD = 783.00 EGP |

| 100 USD = 1,566.00 EGP |

| 200 USD = 3,132.00 EGP |

| 250 USD = 3,915.00 EGP |

| 500 USD = 7,830.00 EGP |

| 1000 USD = 15,660.00 EGP |

| 2000 USD = 31,320.00 EGP |

| 2500 USD = 39,150.00 EGP |

| 5000 USD = 78,300.00 EGP |

| 10000 USD = 156,600.00 EGP |

| 20000 USD = 313,200.00 EGP |

| 25000 USD = 391,500.00 EGP |

| 50000 USD = 783,000.00 EGP |

| 100000 USD = 1,566,000.00 EGP |

| 200000 USD = 3,132,000.00 EGP |

| 500000 USD = 7,830,000.00 EGP |

| 1000000 USD = 15,660,000.00 EGP |

Egyptian pound (EGP) to U.S. Dollar (USD) chart

Here is the EGP to USD chart. Select a time frame for the chart; 1 month, 3 months, 6 months, year to day, 1 year and all available time which varies from 7 to 13 years according to the currency. You can also, download the chart as a png or jpeg image or as a pdf file or directly print the chart by clicking on the corresponding button in the top right of the chart.

10 best binoculars under 100 and 150 dollars – 2021 edition

This review is all about the best binoculars under 100 and 150 dollars. If you are looking for binoculars without breaking your piggy bank then you are in the right place.

Truth be told, not everyone can afford to splash thousands of dollars on a spanking new pair of binoculars. More importantly, not everyone needs an expensive pair of binoculars.

For some of us, a basic or moderate pair of binoculars that costs less than $100 or $150 is all we need. That being said, there are some excellent options in the under $100 price point that are worth a look at.

And after extensive research on the subject and field testing some of the binoculars under 100 dollars, we have come up with a list. A list of the best compact binoculars under 100 and under 150 dollars.

So, whether you are a newbie or a veteran in the binoculars world, tag along with me as we explore how to find the best cheap binoculars with quality.

OUR TOP 3 bino under 100 dollars pick

Adasion 12x42 binoculars

Gosky 10x42 binoculars

Bushnell h2o binoculars

OUR TOP 2 bino under 150 dollar pick

Nikon 8250 aculon a211 16x50 binocular

Celestron – nature DX 8x42 binoculars

What to consider before buying the best low cost binoculars

Frankly speaking, cheap things are never good, this is somewhat true for binoculars. Nevertheless, it is possible to get a decent binocular for less than 100 dollars or slightly more or less under 200 dollars.

Needless to say, the binoculars in this price range are not the best like the rangefinder binoculars which are more than $1000. In this regard, there are somethings you should be ready to compromise on when you decide to shop in this price range.

The trick is knowing what to compromise on and what not to. Let us look at some of the important things you should look for in a budget binocular.

If you need more cheaper than 100 dollars there some entry level cheap bino out there which I listed here

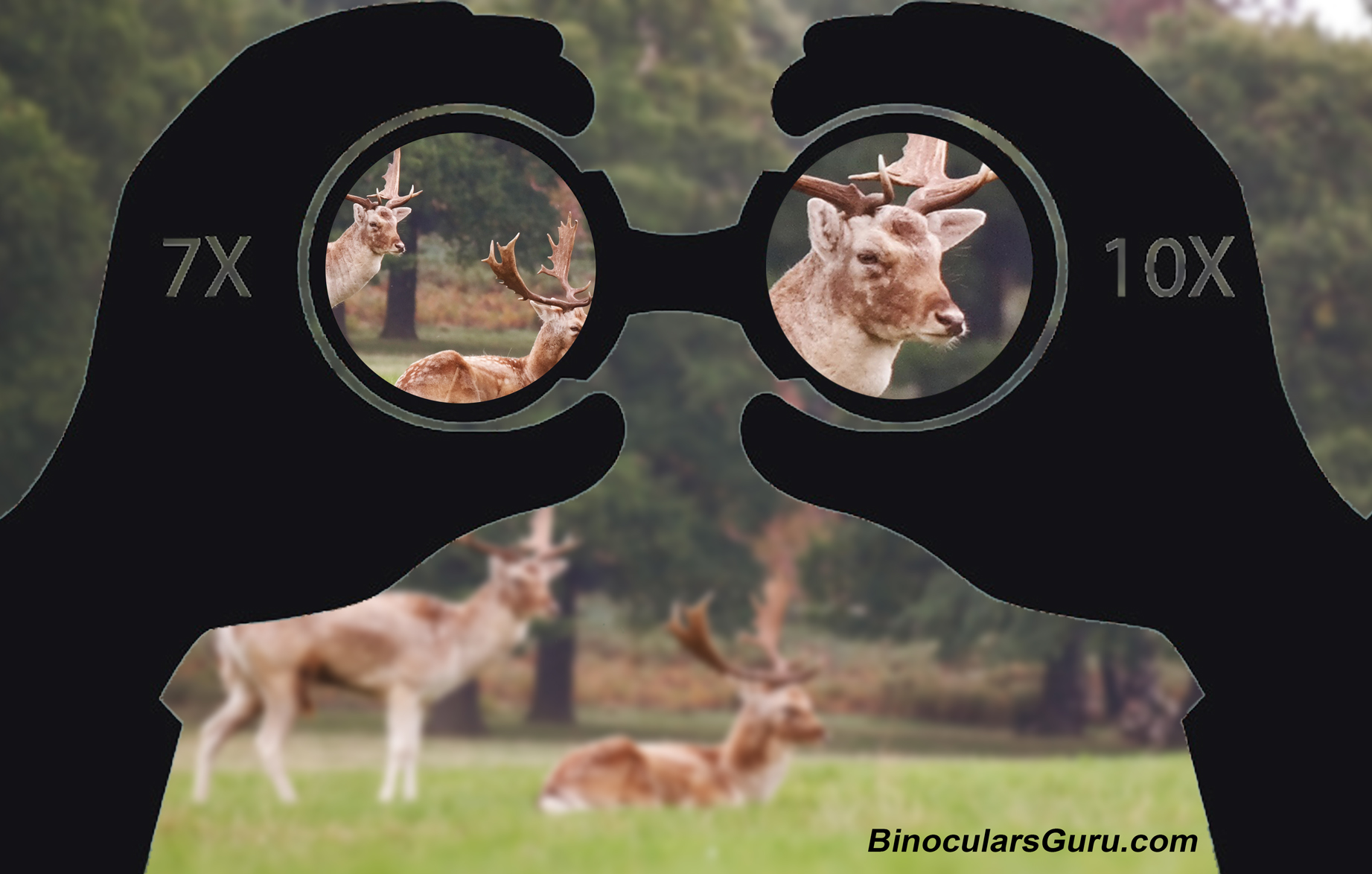

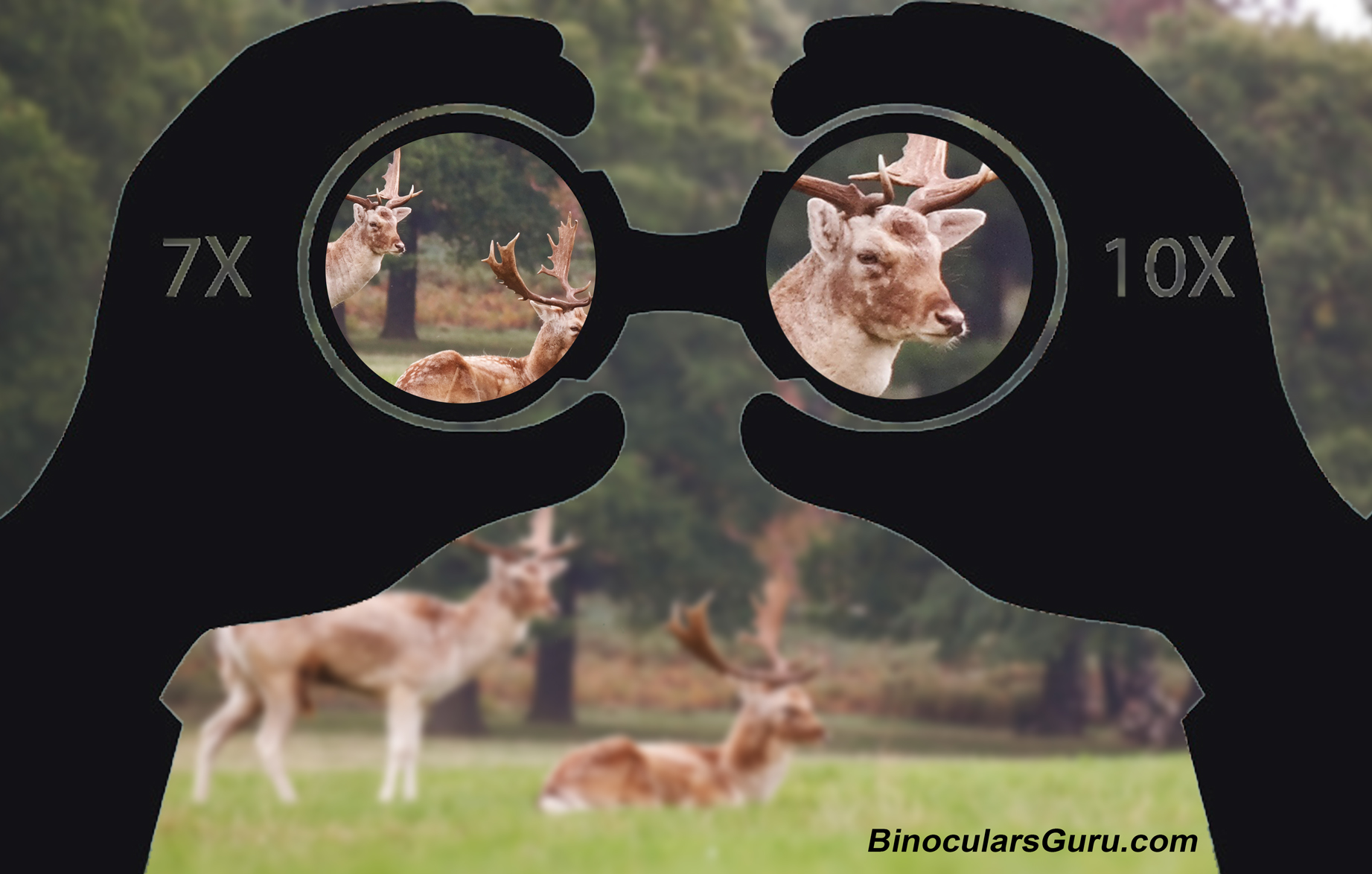

Magnification

The magnification of most binoculars in the under $100 price point range from 6X to 15X. Choosing the right magnification will be critical.

In my experience, the best compact binoculars under 100 are those with a magnification of 8X paired with a 42 mm objective lenses diameter.

A higher magnification in this price range may result in poor image quality. Thus, I recommend sticking with a magnification of between 6X and 10X.

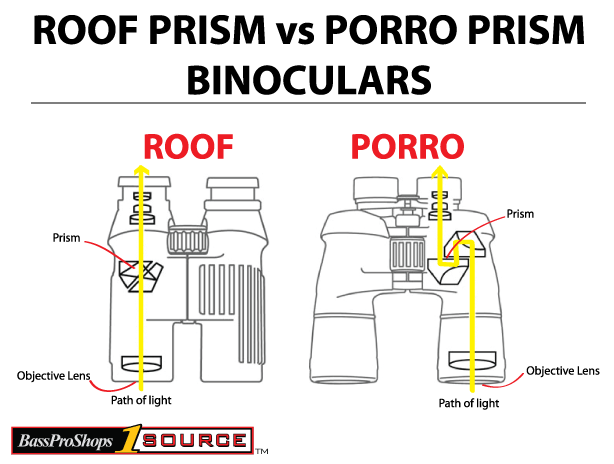

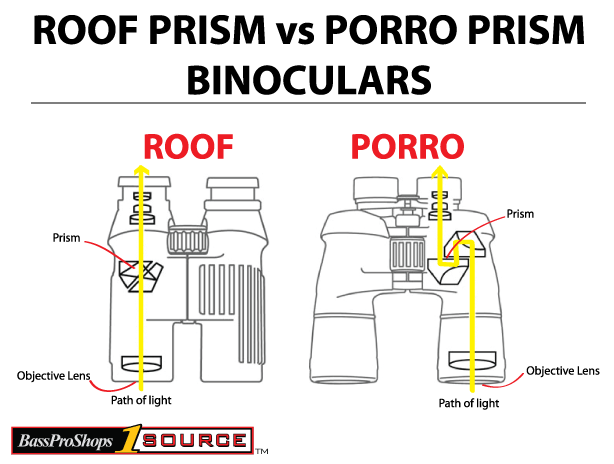

Porro prism or roof prism

Roof prism binoculars are rare to find in the below 100 dollars price point. The reason being that roof prism binoculars are expensive to manufacture. Additionally, prism specific coatings are rare at this price point.

Traditional porro prism binoculars dominate the under 100 price point. Therefore, it is better to invest in a porro prism binocular in this price point than a roof prism one. However, if you do get a roof prisms binocular, I recommend settling on it.

Coating types

Anti-reflective coatings are used to minimize glare and improve brightness. A binocular can either be multi-coated or fully multicoated. Fully multicoated is always better.

However, fully multicoated binoculars tend to be more expensive. Therefore, in this price range, you might have to settle for multi-coated. Nonetheless, if you do find one that is fully multicoated go for it.

Glass type

Binoculars that cost less than 100 feature either a bak-7 or a bak 4 prisms glass. While bak-7 glass is more common at this price point, there are some that feature the bak-4 glass. Thus, the best binoculars under $100 have a bak-4 glass.

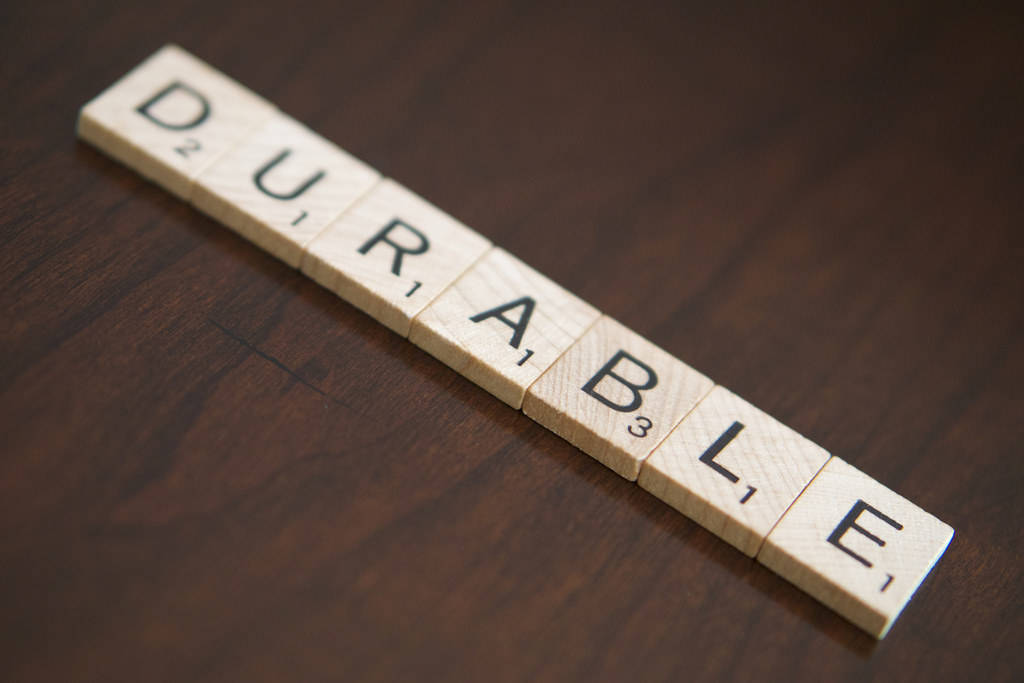

Durability

How durable a binocular should be will depend on what you want to use it for. Most binoculars that cost less than 100 are either waterproof or fogproof.

For birdwatching purposes, you can forgo, one of the two. However, for hunting purposes, I highly recommend getting binocular that is both fog and waterproof. In fact, the best hunting binoculars under 100 should be waterproof and fog proof.

Summary of what to look for in a best binoculars under 100 dollars

The most important aspect of a quality binocular is durability and the quality of glass.

In this price range under 100 or 150 USD, it will be not wise to think of getting swarovski or leica glass but can you still find a decent glass in your budget.

For that reason always check is the lens is fully multicoated or not. The more its coated the more is better.

To check simply observe the objective lenses and if i see red, green, purple or even any other reflection then you are holding a coated lens. If there's no artificial reflection or clear glass then the bino has no coating in its glass.

Also, try to get BAK 4 prisms glass and check the durability features. Whether it waterproof, shockproof, fully rubberized housing, and so on.

If you can afford more than 200 dollar but can not exceed above 300 price range then try these binoculars under 300 picks.

The best binoculars under 100 reviews

Gosky 10x42 binoculars for adults

The awesome thing about the gosky 10X42 is that it features the roof prisms design. It is rare for find a roof prism binocular costing less than 100 dollars especially one with a 10x magnification.

Apart from the prism design, this gosky unit also boasts of fully multi-coated optics, which are also rare at this price point. And the awesomeness does not end there; this binocular weighs 23 ounces making it one of the lighter options in this price range. The exterior is covered with a rubberized armor that protects it from harsh weather conditions.

The best wines under $100

FRANSCHOEK VALLEY, SOUTH AFRICA - FEBRUARY 18: agronomist-viticulturist deborah isaacs inspects the . [+] cabernet franc grapes being harvested at anthonij rupert wyjn's L'ormarins estate and vineyards on the slopes of the groot drakenstein mountains on february 18, 2020 in the in the franschhoek valley in the western cape province of south africa. South african wineries have been allowed to finish the 2020 harvest and work in their cellars after winemaking processes were deemed "essential services” during the country's covid-19 corona virus lock-down. The country has over 93,000 hectares of vines grapes under cultivation producing over 420 million liters of wine annually, of which over 50% is exported according to official industry statistics. (photo by david silverman/getty images)

If your mom is a wine drinker, she could probably use a few extra bottles right about now. It’s a complicated purchase, however. There are literally thousands upon thousands to choose from. They range in price from the cost of a gallon of gas to the entire car itself. And there are seemingly endless styles of red, white, rose, sparkling. So let’s keep things simple. For those that want to curry extra favor with the matriarch this time of year without breaking the bank, here’s a list of stupendous liquids spanning a multitude of flavors—none of which will set you back more than $100. In fact, almost all of them are under the $50 mark.

The cutrer 2017 vintage chardonnay

Bottle of white.

This part is easy. If you can’t find an exceptional bottle of white for under $100 you most certainly are not trying—or you’re getting terribly fleeced. Point in case, the 2018 domaines barons de rothschild lafite aussières blanc . An acid-forward yet smooth chardonnay from the pays d’oc region in the south of france—it pairs wonderfully with grilled chicken or seared seafoods. And it’s less than $13 a bottle.

If mom prefers your chardonnay from the new world, sonoma-cutrer in sonoma county, california, bottles an elegant example. The cutrer is a structured springtime sipper brimming with the aromas of stone fruit, and offering a touch of minerality before its concise finish. It typically retails for $27 a bottle.

For sauvignon blanc preferences, check out the 2017 vintage from sterling vineyards. A sophisticated blend of apple, pear and melon aromas, precedes a medium-bodied liquid that balances its crispness against a fading echo of orchard fruit. You can fetch this one for $25. Or go a little bit more tropical with mary’s sauvignon blanc from trinchero napa valley. Pineapple and mango notes abound in this springtime sensation that’s as aromatic as it is refreshing. Add to that a theme value for the holiday, too. The bottle is named in honor of mary trinchero—matriarch of one of the most notable families in california winemaking.

This documentary wants to bring whisky to your screen and glass

The perfect scotch whiskies to celebrate burns night 2021

Terramagra is arcudi wines’ newest label: A stylistic midpoint between old and new worlds

Cabernet sauvignon from napa valley

Bottle of red.

So your mom is more one for the red juice. That’s understandable. What wouldn’t be understandable is paying hundreds of dollars for a single bottle when so many exemplary selections—wearing two-digit price tags—will adequately ‘wow’ her.

Full of earth and pepper, yet still entirely graceful, the 2016 reserve syrah from goose ridge vineyards is a steal at $50 a bottle. It ages for nearly two years in predominantly new oak barrels. So, while it will continue to reveal itself over time, it demonstrates a brilliant degree of depth if mom chooses to uncork it as soon as its received.

For fans of the rich and full-bodied, turn to the 2016 cabernet sauvignon from louis M. Martini. The acclaimed napa valley producer has here crafted a finely-oaked gem with hints of tobacco and plum in alternating sips. You can reasonably expect this $40 a bottle to continue developing for nearly a decade longer.

When you’re anxious to show your mom other prominent cabernet regions, take her on a sensory tour of the colchagua valley in chile. There, los vascos is bottling an estate grown cab brimming with black fruit. Joining the plum and currant are chocolate and roasted coffee notes—a full-bodied joy for only $20.

Want to splurge on something from the old world, instead? If your mom prefers the big wines of northern italy, you can make her very happy with the 2015 oddero barolo roche di castiglione. Rose petals, mint, sage, raspberries are all here in abundance, and they’re certain to evolve for years to come in this $68 label.

Perhaps a bottle of rosé instead.

If you’re thinking pink this mother’s day, there’s never been an easier time to shop rosé. The bright and colorful style is as hip as ever and a real crowd pleaser as the weather warms. The platonic ideal can be found in the southeastern corner of france, a region known as the côtes de provence. The rose M de minuty 2019 from chateau minuty helped define the premium rosé category—a blend of grenache and cinsault grapes that lend peach and apricot notes its vibrant bouquet. Its enduring elegance marks its $27 price point as shockingly reasonable. Even more so the the LOT 720 | 2018 HAUT ALPES from cameron hughes. Here’s a $13 wine that serenades with floral aromas and a subdued minerality on the tongue. Produced from wines that grew 2,000 feet above sea level, it yields a unique drinking experience you might not be expecting from the category.

Not to be outdone, new world rosé shines quite spectacularly when given a chance. Order mom a bottle of the 2019 sylviane rosé from ehlers estate and she most certainly won’t be disappointed. The $32 bottling out of st. Helena in napa valley pours a bright pink and offers equally vibrant aromas. Raspberry, watermelon, and even a touch of fresh vanilla radiate from the glass.

For all the joy your mom has brought you over the years, it’s time to return the favor. Any of these bottles serve as a fine way to start. Happy mother’s day!

SANTA YNEZ, CA - APRIL 03: despite the COVID-19 pandemic and california lockdown, vineyard and . [+] winery owners continue farming and planning for the upcoming fall grape harvest as viewed on april 03, 2020, near santa ynez, california. Because of its close proximity to southern california and los angeles population centers, combined with a mediterranean climate, the rural coastal regions of santa barbara county have become recognized as a premium grape-growing region and major tourist destination. (photo by george rose/getty images)

10 best binoculars under 100 and 150 dollars – 2021 edition

This review is all about the best binoculars under 100 and 150 dollars. If you are looking for binoculars without breaking your piggy bank then you are in the right place.

Truth be told, not everyone can afford to splash thousands of dollars on a spanking new pair of binoculars. More importantly, not everyone needs an expensive pair of binoculars.

For some of us, a basic or moderate pair of binoculars that costs less than $100 or $150 is all we need. That being said, there are some excellent options in the under $100 price point that are worth a look at.

And after extensive research on the subject and field testing some of the binoculars under 100 dollars, we have come up with a list. A list of the best compact binoculars under 100 and under 150 dollars.

So, whether you are a newbie or a veteran in the binoculars world, tag along with me as we explore how to find the best cheap binoculars with quality.

OUR TOP 3 bino under 100 dollars pick

Adasion 12x42 binoculars

Gosky 10x42 binoculars

Bushnell h2o binoculars

OUR TOP 2 bino under 150 dollar pick

Nikon 8250 aculon a211 16x50 binocular

Celestron – nature DX 8x42 binoculars

What to consider before buying the best low cost binoculars

Frankly speaking, cheap things are never good, this is somewhat true for binoculars. Nevertheless, it is possible to get a decent binocular for less than 100 dollars or slightly more or less under 200 dollars.

Needless to say, the binoculars in this price range are not the best like the rangefinder binoculars which are more than $1000. In this regard, there are somethings you should be ready to compromise on when you decide to shop in this price range.

The trick is knowing what to compromise on and what not to. Let us look at some of the important things you should look for in a budget binocular.

If you need more cheaper than 100 dollars there some entry level cheap bino out there which I listed here

Magnification

The magnification of most binoculars in the under $100 price point range from 6X to 15X. Choosing the right magnification will be critical.

In my experience, the best compact binoculars under 100 are those with a magnification of 8X paired with a 42 mm objective lenses diameter.

A higher magnification in this price range may result in poor image quality. Thus, I recommend sticking with a magnification of between 6X and 10X.

Porro prism or roof prism

Roof prism binoculars are rare to find in the below 100 dollars price point. The reason being that roof prism binoculars are expensive to manufacture. Additionally, prism specific coatings are rare at this price point.

Traditional porro prism binoculars dominate the under 100 price point. Therefore, it is better to invest in a porro prism binocular in this price point than a roof prism one. However, if you do get a roof prisms binocular, I recommend settling on it.

Coating types

Anti-reflective coatings are used to minimize glare and improve brightness. A binocular can either be multi-coated or fully multicoated. Fully multicoated is always better.

However, fully multicoated binoculars tend to be more expensive. Therefore, in this price range, you might have to settle for multi-coated. Nonetheless, if you do find one that is fully multicoated go for it.

Glass type

Binoculars that cost less than 100 feature either a bak-7 or a bak 4 prisms glass. While bak-7 glass is more common at this price point, there are some that feature the bak-4 glass. Thus, the best binoculars under $100 have a bak-4 glass.

Durability

How durable a binocular should be will depend on what you want to use it for. Most binoculars that cost less than 100 are either waterproof or fogproof.

For birdwatching purposes, you can forgo, one of the two. However, for hunting purposes, I highly recommend getting binocular that is both fog and waterproof. In fact, the best hunting binoculars under 100 should be waterproof and fog proof.

Summary of what to look for in a best binoculars under 100 dollars

The most important aspect of a quality binocular is durability and the quality of glass.

In this price range under 100 or 150 USD, it will be not wise to think of getting swarovski or leica glass but can you still find a decent glass in your budget.

For that reason always check is the lens is fully multicoated or not. The more its coated the more is better.

To check simply observe the objective lenses and if i see red, green, purple or even any other reflection then you are holding a coated lens. If there's no artificial reflection or clear glass then the bino has no coating in its glass.

Also, try to get BAK 4 prisms glass and check the durability features. Whether it waterproof, shockproof, fully rubberized housing, and so on.

If you can afford more than 200 dollar but can not exceed above 300 price range then try these binoculars under 300 picks.

The best binoculars under 100 reviews

Gosky 10x42 binoculars for adults

The awesome thing about the gosky 10X42 is that it features the roof prisms design. It is rare for find a roof prism binocular costing less than 100 dollars especially one with a 10x magnification.

Apart from the prism design, this gosky unit also boasts of fully multi-coated optics, which are also rare at this price point. And the awesomeness does not end there; this binocular weighs 23 ounces making it one of the lighter options in this price range. The exterior is covered with a rubberized armor that protects it from harsh weather conditions.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

So, let's see, what we have: 100 U.S. Dollar (USD) to euro (EUR) exchange rate today. Historical exchange rates and charts. | worldforexrates at 100 usd

Contents of the article

- Top-3 forex bonuses

- 100 U.S. Dollar (USD) to euro (EUR)

- Currency information

- Details of U.S. Dollar to euro exchange rates

- Conversion from U.S. Dollar (USD) to euro (EUR)

- U.S. Dollar (USD) to euro (EUR) chart

- 100 usd

- Understanding USD

- Fxdailyreport.Com

- How to start forex trading with $100

- Fxdailyreport.Com

- How to start forex trading with $100

- 100 egyptian pound (EGP) to U.S. Dollar (USD)

- Currency information

- Details of egyptian pound to U.S. Dollar exchange...

- Conversion from egyptian pound (EGP) to U.S....

- Egyptian pound (EGP) to U.S. Dollar (USD) chart

- 10 best binoculars under 100 and 150 dollars –...

- OUR TOP 3 bino under 100 dollars...

- OUR TOP 2 bino under 150 dollar...

- What to consider before buying the best low...

- Magnification

- Porro prism or roof prism

- Coating types

- Glass type

- Durability

- Summary of what to look for in a best binoculars...

- The best binoculars under 100 reviews

- The best wines under $100

- This documentary wants to bring whisky to your...

- The perfect scotch whiskies to celebrate burns...

- Terramagra is arcudi wines’ newest label: A...

- 10 best binoculars under 100 and 150 dollars –...

- OUR TOP 3 bino under 100 dollars...

- OUR TOP 2 bino under 150 dollar...

- What to consider before buying the best low...

- Magnification

- Porro prism or roof prism

- Coating types

- Glass type

- Durability

- Summary of what to look for in a best binoculars...

- The best binoculars under 100 reviews

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!