$500

Additionally, we've (finally) witnessed calamp's management team transition out of automotive vehicle financing and into considerably higher-margin, consistent cash flow ventures.

Top-3 forex bonuses

More specifically, the company's software-as-a-service (saas) subscriptions are helping businesses better manage and track their fleets, as well as improve supply-chain visibility. Having averaged close to a 10% dividend yield over the past two decades, annaly is an income seeker's dream stock.

Got $500? Here are 3 great stocks under $10 to buy now

Don't let their low share prices fool you -- these companies can deliver big time for shareholders.

If you entered 2020 not knowing whether you had the stomach to be an investor in the stock market, your question has almost certainly been answered. That's because we've witnessed record-breaking volatility in equities this year, including the fastest bear market decline in history, as well as the strongest quarterly rally in decades.

The thing about volatility is that it opens the door for long-term investors to buy into great companies on the cheap. While I'm not saying the road to riches won't be filled with speed bumps, investors who look beyond the near term are often handsomely rewarded for their patience.

Plus, what's remarkable about investing in the stock market is that you don't need to be rich to become rich. Starting out with even $500 can be more than enough to put you on the path toward financial freedom.

The question is, where to put your $500 to work? Although tech stocks with triple-digit share prices have proved unstoppable for months, perhaps the most intriguing bargains can be found in stocks with share prices under $10. Below are three great stocks you can buy right now that all sport a single-digit share price.

Image source: getty images.

Sirius XM

One of the smartest stocks investors can buy right now is satellite-radio operator sirius XM (NASDAQ:SIRI) , which can be had for just $6 a share.

As some of you may know, sirius XM is the only satellite-radio company. This doesn't mean it's completely devoid of competition, as terrestrial and online radio operators are always fighting for listeners, just the same. But having a satellite system in space means that sirius XM has relatively fixed transmission and operating expenses, no matter how many new net-paying subscribers the company enrolls. Over time, this is a formula for slow-but-steady margin expansion.

What's even more exciting for sirius XM shareholders is how the company generates its revenue. Despite acquiring pandora, an ad-based streaming content provider, in february 2019, the vast majority of sirius XM's revenue is generated from subscriptions.

During the coronavirus disease 2019 (COVID-19)-impacted second-quarter, ad revenue slumped 31% from the prior-year period, but subscription sales actually rose 3%. Since subscribers are less likely to cancel their plans when economic hiccups arise, the fact that they've accounted for 83% of sirius XM's sales in 2020 (year to date) suggests sirius XM is uniquely positioned among radio operators to survive a recession and emerge stronger than before.

Sirius XM has exceptional plan-pricing power, so its shareholders should expect consistent mid-single-digit growth.

Image source: getty images.

Annaly capital management

Though mortgage real estate investment trusts (reits) haven't exactly been on anyone's shopping list in recent years, annaly capital management (NYSE:NLY) should be.

Mortgage reits like annaly borrow at lower short-term interest rates, then acquire assets or lend at a higher long-term yield. The difference between this long-term yield and short-term borrowing rate is the net interest margin, and the wider the gap, the more profitable mortgage reits typically are.

In annaly's case, the yield-curve inversion from last august was the absolute worst thing that could have happened, as it meant short-term borrowing costs were eclipsing long-term yield opportunities, at least for a brief period of time. However, history has shown that as the U.S. Economy rebounds from a recession, this gap between long-term and short-term yields tends to widen considerably over time. This means annaly's net interest margin should broaden pretty significantly over the next couple of years.

Furthermore, mortgage reits typically buy two types of assets: agency and non-agency. Agency assets are backed by a government agency in case of default but typically have lower yields, whereas non-agency assets have no federal backing but offer superior yields. Annaly almost exclusively invests in safer agency-only mortgage-backed securities. This means it's protected in the event of defaults, which has allowed the company to use leverage to its advantage.

Having averaged close to a 10% dividend yield over the past two decades, annaly is an income seeker's dream stock.

Image source: getty images.

Calamp

Another great stock under $10 that investors can buy with confidence is mobile technology-solutions provider calamp (NASDAQ:CAMP) .

As with most cyclical companies, calamp has faced some big challenges due to the coronavirus pandemic and the threat of ongoing trade-war instability between the U.S. And china. The good news is that many of these issues are in the process of resolving, which will clear a path to steady growth and profitability for internet of things up-and-comer calamp.

On the production side of the equation, calamp has been aggressively reducing its reliance on china for its telematics equipment. At one time, chinese imports accounted for between 70% and 80% of the company's telematics solutions. This is now down to closer to 50%. With calamp able to outsource beyond china, the potential for geopolitical risk to disrupt its bottom line has been greatly reduced.

Additionally, we've (finally) witnessed calamp's management team transition out of automotive vehicle financing and into considerably higher-margin, consistent cash flow ventures. More specifically, the company's software-as-a-service (saas) subscriptions are helping businesses better manage and track their fleets, as well as improve supply-chain visibility.

Even with the company's sales down 10% to $80 million in the quarter ending in may, saas revenue was up 10% from the prior-year period to $28 million. As saas grows into a larger piece of the pie, calamp's margins are going to climb.

In short, connected devices are a huge opportunity this decade, and calamp is right in the thick of it.

A start-up that wants to undersell the drug industry raises another $500 million

A pharmaceutical start-up that thinks it can undersell the entire drug industry got off to a quick start in its first year in business, grabbing rights to a handful of drugs, including two that could make it a player in the hottest cancer drug market sometime in the next few years.

Now comes the hard part: getting doctors to prescribe its cheap drugs, instead of brand-name competitors backed by big marketing budgets.

On monday, the privately held company, called eqrx, announced that it had closed a $500 million funding round, bringing the total it has raised to $750 million. First unveiled last january, eqrx aims to sell cheaper copycat drugs to compete directly with brand-name therapies.

These wouldn’t be generic drugs or biosimilars, but unique medications that go head-to-head with new drugs still under patent protection. The company says it has moved faster in its first year than anticipated, and while eqrx won’t say when it expects its first drug to come to market, CEO alexis borisy says it could be “in the next handful of years.”

The company believes it has proven that it can find plenty of inexpensive copycats, or so-called fast followers, to fill its pipeline.

That leaves the second part of its model: selling the drugs without spending much money marketing them.

“there’s no question that the big challenge ahead of us . Is that adoption of a drug that works as well or better than the existing drug, that costs less, that costs less to patients, and is rigorously studied, is not nearly immediate,” says dr. Peter bach, a co-founder of and adviser to eqrx, who works as director of memorial sloan kettering’s center for health outcomes. “in any normally functioning market, it would be nearly immediate.”

The announcement of eqrx closing its new funding round comes on the first morning of the annual J.P. Morgan healthcare conference, usually the biggest event on the calendar of health-care executives and investors, which draws thousands of people to a cluster of hotels and conference rooms in downtown san francisco. This year’s conference is virtual, and it seems likely to drive far less investment and drug development news than it has in years past.

The conference follows a year when pharmaceutical and biotech firms have taken the unlikely and unfamiliar mantle of national heroes, rushing covid-19 vaccines through development that have demonstrated near-miraculous rates of efficacy. The gush of good feeling has pushed aside perennial criticism over high drug prices, criticism that is a rare point of agreement for both republicans and democrats in washington.

Yet even as the criticism has faded from public debate, drug prices have continued to rise. The prescription drug discount website goodrx (ticker: GDRX) counts 636 prescription drugs whose prices have been raised this month, with an average list price increase of 4.2%.

Eqrx did not disclose the identity of its new investors, but said that all the participants in the series A round of financing announced last year had also participated in the new series B. That group includes alphabet (ticker: GOOGL) subsidiary GV, the life sciences investment firm casdin capital, and the venture capital fund section 32.

The company also said that it had raised money from “market-leading payers and health systems that cover more than 20% of insured lives in the U.S.”

That buy-in could help eqrx compensate for a diminished marketing budget. “we’re building deep, strategic long-term partnerships with payers and health-care systems, both in the U.S. And abroad,” CEO borisy says.

But the company’s strategy brings with it plenty of risk, as barron’s reported last year. While eqrx can likely skip the costly basic research step that makes up a substantial portion of most biotech and pharmaceutical companies’ R&D budgets, it will still likely need to fund preclinical research on their experimental therapeutics, not to mention human tests.

And legal battles are all but certain, as companies whose products are targeted by eqrx look for ways to hold off the competition in court.

Eqrx has remained relatively quiet in the year since its founding, but a number of companies it bought drugs from have announced those deals in recent months. Two of those companies are chinese: cstone pharmaceuticals licensed non-chinese rights to eqrx for two cancer drugs, a so-called anti-PD1 inhibitor and an anti-PD-L1 inhibitor, for $150 million up front and up to $1.15 billion in milestone payments. And hansoh pharma , another chinese biopharmaceutical firm, licensed non-chinese rights to their EGRF inhibitor almonertinib, another cancer drug, for $100 million up front and undisclosed milestone and royalty payments.

The company also licensed rights to another experimental cancer drug, called lerociclib, from G1 therapeutics (ticker: GTHX), a massachusetts-based biotech.

The anti-PD-1 and anti-PD-L1 inhibitors, if approved by the food and drug administration, would put eqrx in the middle of one of the most important, and fastest-growing, cancer drug markets. The anti-PD-1 inhibitor would compete with merck ’s (MRK) keytruda, also an anti-PD-1 inhibitor, and others from bristol myers squibb (BMY) and regeneron (REGN), among others.

“they’re all roughly $150,000 per year per patient” in the U.S., borisy says of the anti-PD-1 and anti-PD-L1 market, not including customary rebates. (merck cites a list price of $9,869.94 for keytruda on keytruda’s website, or roughly $171,000 per year.) “you really don’t have any effective price competition there whatsoever.”

Borisy would not say how much he plans to charge for the drugs. But he says that his costs to get his drug to market are “an order of magnitude less” than the industry standard, and that he plans to spend little on sales and marketing, relative to industry practices. He says that he will set similar global prices for all developed economies, and suggested that he would consider pricing eqrx’s anti-PD-1 and anti-PD-L1 inhibitors at half the current european prices, which are already a fraction of the U.S. Prices.

Bach says that the company is moving forward with a number of products at once to get noticed from the health-care ecosystem.

“this will be very hard to do, and it’s one of the reasons we’re taking this sort of, get several products, get big enough we can’t be ignored [approach],” bach says. “it will be hard to get health-care transformation if you get one product [in] one narrow niche. The more you provide a solution set that starts to show up in people’s spreadsheets, and people’s lives . I think the more you have a chance at this.”

6 famous discontinued and uncommon U.S. Currency denominations

A completely cashless society sounds clean and convenient, and although we've made huge strides, we're not quite there yet. Despite the magic of paypal, square, credit cards, and mobile wallets, some of us need to carry around a handful of greenbacks.

While we can choose from a rich array of singles, fins, sawbucks, jacksons, $50s, and benjamins, there are several other denominations that the U.S. Treasury has discontinued—or that are just plain rare. Here are the most notable ones.

Key takeaways

- There are still 1.2 billion $2 notes in circulation.

- A $500 or $1,000 bill may be worth more than its face value.

- Recalled in 1969, there are fewer than 400 $5,000 bills in existence.

- The $10,000 bill was the largest denomination ever to be printed for public consumption.

- Collectors cannot legally hold a $100,000 bill.

$2 bill

:max_bytes(150000):strip_icc()/TwoDollar-59f61682519de20011ef60f4.png)

The first $2 bills were printed in 1862. They originally featured a portrait of alexander hamilton but were later redesigned to portray thomas jefferson. Aesthetically, the $2 bill is something to behold. The reverse side features a reproduction of one of the most famous paintings in american history—"declaration of independence" by john trumbull.

Excluding the decade from 1966 to 1976, $2 bills were printed uninterruptedly since the civil war. yet the average american who doesn't handle cash for a living can go years without seeing one. While the $2 note is still in circulation and the bureau of engraving and printing recognizes it as legal tender—it is considered to be the rarest currency denomination in the U.S. there were still 1.3 billion notes in circulation in 2019.

$500 bill

:max_bytes(150000):strip_icc()/500-59f61bbc6f53ba00115cf254.jpg)

The treasury minted several versions of the $500 bill, featuring a portrait of president william mckinley on the front. The last $500 bill rolled off the presses in 1945, and it was formally discontinued 24 years later in 1969.

Like all the bills featured here, the $500 bill remains legal tender. Most $500 notes in circulation today are in the hands of dealers and collectors. That being said, should you come into possession of a $500 bill, you'd find that its market value far exceeds its face value, with even worn specimens commanding upward of a 40% premium on the open market.

Although no longer in circulation, the $500 bill remains legal tender.

$1,000 bill

:max_bytes(150000):strip_icc()/1000-59f619aa845b34001122fbb7.jpg)

The original $1,000 bill featured alexander hamilton on the front. When someone presumably realized that it might be confusing to have the same former secretary of the treasury on multiple denominations, hamilton was replaced with that of another president—the 22nd and the 24th, grover cleveland. Like its smaller cousin, the $500 bill, the $1,000 bill was discontinued in 1969. and like the $500 bill, the $1,000 bill would seem to have a lot more use now than it did then.

Why? Inflation, of course. The consumer price index (CPI) was at an estimated 36.8 back in 1969. As of december 2019, U.S. CPI sat at over 256, meaning a $1,000 bill today would be the equivalent of a relatively modest $153 bill during the summer of love. does it make any sense that we've lost larger denominations as the value of a dollar has gotten progressively smaller? The treasury argues that keeping the denominations inconveniently small minimizes the possibility of money laundering.

That being said, hold onto a $1,000 bill that finds its way into your palm even more tightly than you would a $500 bill. There are only 165,372 of these bills bearing cleveland's visage still in existence.

$5,000 bill

:max_bytes(150000):strip_icc()/ScreenShot2017-10-29at2.16.37PM-59f61b4f03f4020010eb2d43.png)

The $5,000 bill was initially issued to finance the revolutionary war and was only officially printed by the government when the civil war began. The bill was graced with a portrait of james madison. President richard nixon ordered that the bills be recalled in 1969 due to fear of criminals using them for money laundering activities.

Finding a $5,000 bill today takes pluck, luck, and significantly more than $5,000. Fewer than 400 of these notes are believed to exist.

$10,000 bill

:max_bytes(150000):strip_icc()/10000-59f61a2268e1a2001016ccd4.jpg)

Salmon P. Chase may be the most accomplished politician in our nation's history never to have served as president. But even though he was a governor of, and senator from, ohio, served as secretary of the treasury under abraham lincoln and became chief justice of the supreme court, chase is remembered by most people as the guy on the $10,000 bill.

The largest denomination ever printed for public consumption, the $10,000 bill never got much use. This lack of use is understandable, given that its value outstripped the net worth of the average american during most of the time the bill was available. The bill was first printed in 1918 and was part of the 1969 purge of large currencies. like its $5,000 counterpart, only a few hundred authenticated samples survive.

$100,000 bill

:max_bytes(150000):strip_icc()/100000-59f61a67685fbe0011391eae.jpg)

Featuring a portrait of woodrow wilson, the $100,000 note was actually a gold certificate that was never circulated or issued for public use. The bureau of engraving and printing created them during the great depression in 1934, for conducting official transactions between federal reserve banks. only 42,000 of the $100,000 bills were ever printed.

While the $100,000 bill can not be legally held by collectors, some institutions like the museum of american finance display them for educational purposes. the smithsonian museum and some branches of the federal reserve system (FRS) also have these rare bills in their possession.

Only have $500 to invest? Buy these 3 great stocks

You can profit from several seeming unstoppable trends with these three stocks.

Sure, it takes money to make money. However, that adage scares away some people who don't think they have enough money to even begin investing in stocks.

The reality is that you can get started investing even if you don't have a ton of money to start. Do you only have $500 to invest? Buy these three great stocks to begin making more money sooner rather than later.

Image source: getty images.

1. Apple

Thanks to apple's (NASDAQ:AAPL) recent stock split, you could buy a share for less than $125 at monday's closing price. Buying apple (NASDAQ:AAPL) is like buying a pretty sizable slice of the overall market. The tech stock makes up nearly 7% of the S&P 500 index, a higher weight than any other stock. If the stock market is going up, there's a pretty good chance that apple is, too.

Apple could be at the cusp of another nice run. The company holds its big apple event today, when it's expected to announce its newest iphone version. This highly anticipated new version will be the first to support high-speed 5G networks.

It's possible that up to 350 million of the close to 950 million current iphone users will upgrade to the new 5G-equipped model. If so, this launch could be the biggest upgrade cycle in apple's history.

While the iphone is still the biggest moneymaker for apple, the company's services segment has emerged as a top growth driver. Don't be surprised if the 5G launch also creates additional momentum for these businesses.

2. Sea limited

There aren't many stocks you can buy for well under $500 that allow you to profit from three huge trends -- online gaming, e-commerce, and digital payments. But at only $167 per share at monday's close, sea limited (NYSE:SE) does just that.

Sea limited generated nearly 56% of its total revenue in the second quarter from its online gaming apps. The company's garena free fire game hit a record-high peak daily active user count of over 100 million in Q2. It's the highest-grossing mobile game in latin america and in southeast asia and ranked no. 3 globally in mobile game downloads.

Around 40% of sea's total Q2 revenue stemmed from its shopee e-commerce platform. Shopee stands as the largest e-commerce platform in indonesia. It ranks no. 1 among shopping app downloads in southeast asia as well as first in the region for average monthly active users. The popularity of the platform is also driving increased adoption for its seamoney mobile wallet.

Sea isn't profitable yet, and its shares trade at a sky-high price-to-sales multiple of nearly 27. However, with the company's strong presence in three booming areas plus its enviable position in the fast-growing regions of southeast asia and latin america, this stock should be a big winner over the long run.

3. Teladoc health

You might have to find a few extra bucks or buy partial shares of one of these three stocks to fit teladoc health (NYSE:TDOC) into a $500 investing budget. But with the healthcare stock trading at around $218, buying teladoc shouldn't be too much of a stretch.

With teladoc, you'll own a stake in the top player in the exploding telehealth market. The COVID-19 pandemic has enabled telehealth to really hit its stride, and demand for telehealth won't fade after the pandemic is over. A recent harris poll survey found that consumers now view telehealth as "an indispensable part of the healthcare system."

Got $500? Here are 3 great stocks under $10 to buy now

Don't let their low share prices fool you -- these companies can deliver big time for shareholders.

If you entered 2020 not knowing whether you had the stomach to be an investor in the stock market, your question has almost certainly been answered. That's because we've witnessed record-breaking volatility in equities this year, including the fastest bear market decline in history, as well as the strongest quarterly rally in decades.

The thing about volatility is that it opens the door for long-term investors to buy into great companies on the cheap. While I'm not saying the road to riches won't be filled with speed bumps, investors who look beyond the near term are often handsomely rewarded for their patience.

Plus, what's remarkable about investing in the stock market is that you don't need to be rich to become rich. Starting out with even $500 can be more than enough to put you on the path toward financial freedom.

The question is, where to put your $500 to work? Although tech stocks with triple-digit share prices have proved unstoppable for months, perhaps the most intriguing bargains can be found in stocks with share prices under $10. Below are three great stocks you can buy right now that all sport a single-digit share price.

Image source: getty images.

Sirius XM

One of the smartest stocks investors can buy right now is satellite-radio operator sirius XM (NASDAQ:SIRI) , which can be had for just $6 a share.

As some of you may know, sirius XM is the only satellite-radio company. This doesn't mean it's completely devoid of competition, as terrestrial and online radio operators are always fighting for listeners, just the same. But having a satellite system in space means that sirius XM has relatively fixed transmission and operating expenses, no matter how many new net-paying subscribers the company enrolls. Over time, this is a formula for slow-but-steady margin expansion.

What's even more exciting for sirius XM shareholders is how the company generates its revenue. Despite acquiring pandora, an ad-based streaming content provider, in february 2019, the vast majority of sirius XM's revenue is generated from subscriptions.

During the coronavirus disease 2019 (COVID-19)-impacted second-quarter, ad revenue slumped 31% from the prior-year period, but subscription sales actually rose 3%. Since subscribers are less likely to cancel their plans when economic hiccups arise, the fact that they've accounted for 83% of sirius XM's sales in 2020 (year to date) suggests sirius XM is uniquely positioned among radio operators to survive a recession and emerge stronger than before.

Sirius XM has exceptional plan-pricing power, so its shareholders should expect consistent mid-single-digit growth.

Image source: getty images.

Annaly capital management

Though mortgage real estate investment trusts (reits) haven't exactly been on anyone's shopping list in recent years, annaly capital management (NYSE:NLY) should be.

Mortgage reits like annaly borrow at lower short-term interest rates, then acquire assets or lend at a higher long-term yield. The difference between this long-term yield and short-term borrowing rate is the net interest margin, and the wider the gap, the more profitable mortgage reits typically are.

In annaly's case, the yield-curve inversion from last august was the absolute worst thing that could have happened, as it meant short-term borrowing costs were eclipsing long-term yield opportunities, at least for a brief period of time. However, history has shown that as the U.S. Economy rebounds from a recession, this gap between long-term and short-term yields tends to widen considerably over time. This means annaly's net interest margin should broaden pretty significantly over the next couple of years.

Furthermore, mortgage reits typically buy two types of assets: agency and non-agency. Agency assets are backed by a government agency in case of default but typically have lower yields, whereas non-agency assets have no federal backing but offer superior yields. Annaly almost exclusively invests in safer agency-only mortgage-backed securities. This means it's protected in the event of defaults, which has allowed the company to use leverage to its advantage.

Having averaged close to a 10% dividend yield over the past two decades, annaly is an income seeker's dream stock.

Image source: getty images.

Calamp

Another great stock under $10 that investors can buy with confidence is mobile technology-solutions provider calamp (NASDAQ:CAMP) .

As with most cyclical companies, calamp has faced some big challenges due to the coronavirus pandemic and the threat of ongoing trade-war instability between the U.S. And china. The good news is that many of these issues are in the process of resolving, which will clear a path to steady growth and profitability for internet of things up-and-comer calamp.

On the production side of the equation, calamp has been aggressively reducing its reliance on china for its telematics equipment. At one time, chinese imports accounted for between 70% and 80% of the company's telematics solutions. This is now down to closer to 50%. With calamp able to outsource beyond china, the potential for geopolitical risk to disrupt its bottom line has been greatly reduced.

Additionally, we've (finally) witnessed calamp's management team transition out of automotive vehicle financing and into considerably higher-margin, consistent cash flow ventures. More specifically, the company's software-as-a-service (saas) subscriptions are helping businesses better manage and track their fleets, as well as improve supply-chain visibility.

Even with the company's sales down 10% to $80 million in the quarter ending in may, saas revenue was up 10% from the prior-year period to $28 million. As saas grows into a larger piece of the pie, calamp's margins are going to climb.

In short, connected devices are a huge opportunity this decade, and calamp is right in the thick of it.

The 9 best laptops under $500 in 2020

All products and services featured are independently selected by forbes shopping contributors and editors. When you make a purchase through links on this page, we may earn a commission. Learn more.

The best laptops under $500 can be surprisingly effective.

If there’s any lesson to be learned from the popularity of chromebooks and other budget portable pcs, it’s that you don’t have to spend a fortune to get a great laptop. In fact, some of the best laptops under $500 are such solid choices that many people may never need to spend more on a portable PC.

There’s a problem, though: right now, there aren’t a ton of $500-or-less laptops out there, thanks in part to the abnormal holiday shopping season which cleaned out inventories, not to mention the kids who recently headed back to school this past autumn. With so many kids learning remotely and parents trying to do the same for work, there was a rush for inexpensive laptops.

Even so, there are still some excellent choices around. You’ll just need to decide if you want a windows-powered laptop or if you can get by with a chromebook. Chromebooks are often substantially cheaper, so you can get a comparatively better chromebook than a windows PC for the same price. Once you know what you’re looking for, browse the list below, where we’ve rounded up nine of the very best laptops you can buy for under $500 today.

- Best overall laptop under $500:acer aspire 5

- Best thin and light laptop under $500:gateway 14.1" ultra slim notebook

- Best chromebook under $500:lenovo chromebook flex 5

- Best budget chromebook under $500:lenovo 3 chromebook

- Best gaming laptop under $500:lenovo ideapad 3

- Best terabyte laptop under $500:HP 14-DK1031DX 14" laptop

- Best 2-in-1 windows laptop under $500:XIDU philbook Y13

- Best 2-in-1 chromebook under $500:HP 2-in-1 14" chromebook

- Best all-day battery laptop under $500:HP stream 14" laptop

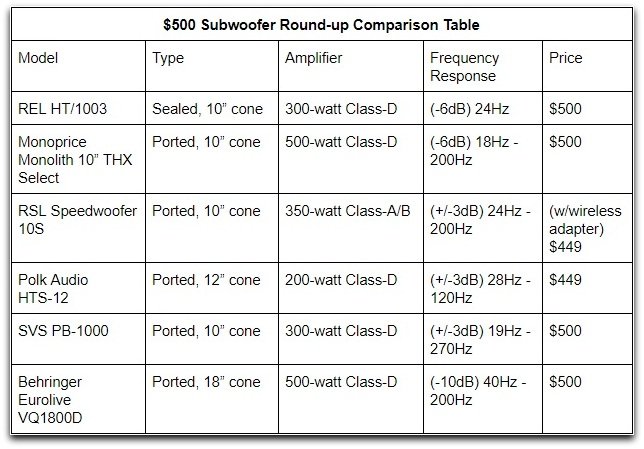

6 best powered subwoofers under $500 for 2020

Best $500 powered subwoofers for 2020

$500 has to be one of the most common budget ranges for shoppers looking for subwoofers. For most middle-class consumers, a $500 item is not cheap, but it isn’t really expensive either. It isn’t a sum that can’t be thrown away on a whim, but it isn’t likely to break the bank. That must be why that price range is so popular for subwoofer shoppers: they want something formidable but without putting a big dent in the bank account. Very tangible quality differences set in as subwoofers near the $500 range. The enclosures start to get a lot more solid and the drivers start to get serious motors. The amplifiers start getting dsps onboard along with 300-watt or higher amplification. These are generalizations, of course, and there are exceptions, but these are the tendencies that we see when we survey the subwoofer market in this price range.

With so many subwoofer shoppers in this price range, we have decided to upgrade our $500 subwoofer buying guide since it was getting a bit long in the tooth, having been published seven years ago. Many of those products are no longer available. Why did we choose these particular models for our present line-up? All loudspeaker design, including subwoofer design, carries trade-offs, and we try to determine which models make the best compromises for their targeted use. Different situations call for different subwoofers, and we look at what we think might be the best choices for those applications. We will try to briefly explain why we think our selections can do well for their intended use. So let’s now take a look at what seems to be the better options out there in this price range.

SVS PB-1000

The one holdover from our older $500 buying guide is the SVS’s PB-1000. In our view, it still remains one of the best well-rounded choices at its price point, even after all these years. It is a great balance of size, aesthetics, performance, and reliability. It is one of two subs in our list that can be expected to dig down to a solid 20hz as an in-room response. That is reaching near the lower limits of human hearing for low-frequency extension. The PB-1000 should be able to catch much of the very deep bass in modern action and science-fiction movies that other subs in this list would miss. Its continued popularity is due in part to its well-rounded and optimized design. You might find some same-priced subs that can exceed it in one part or another of its performance, and you can find subs that might be a bit smaller or better-looking, but in order to do any of that, sacrifices must be made somewhere else. SVS has weighed all of these factors and come up with a design that does everything reasonably well and nothing poorly, and that design has endured to this day, nearly 14 years after its first launch. And all of this comes on top of SVS’s famously good customer service, 45 day risk-free trial period, and above-average 5-year warranty. We should also mention its smaller sibling, the SB-1000, for those who need a smaller sub and are willing to give up some low-end performance for a small size.

Polk audio HTS-12

In 2017, polk audio launched their HTS subwoofer series consisting of the HTS-10 and HTS-12. Polk had enormous success with their low-cost PSW sub line and introduced the HTS for those looking for a step up from the psws. The HTS-12 is the subject of our focus here, with its combination of slick industrial design and performance. While polk subs are very widespread and can be seen in many systems using affordable subs, audio connoisseurs haven’t ever really considered them high performers, but polk tries to change that image with the HTS subs. The HTS-12 doesn’t dig the deepest in our round-up, but it should provide solid output down to 30hz which is deep enough to catch most of the bass in modern movies and almost all bass in music except for certain niche music genres. While audioholics didn’t end up reviewing the HTS-12, other professional reviews have given it quite a positive reception. Given its critical evaluation and our own brushes with the HTS-12, we see it as a competent performer, and it can often be had for less than its $449 MSRP. It is one of the nicest looking subs in our round-up not to mention one of the least expensive, and we expect it to have decent performance as well. It should add a hefty dose of thump to your sound system without being an aesthetic nuisance or blowing away your entire $500 subwoofer budget.

RSL speedwoofer 10S

At $400 shipped, RSL’s speedwoofer 10S falls significantly below our $500 pricing for this roundup, but the inclusion of the wireless adapter brings the package cost up to $450, so we let it in. Indeed, we would still consider it a good value even if it were $500 as is reflected in our enthusiasm for it in review. The speedwoofer 10S is a small subwoofer that brings a big sound. It holds a flat response down to 30hz with very usable output below that point since the rolloff below its -3db point is gradual. In fact, in CEA-2010 burst testing, it was nearly able to hit 100db at a 2-meter distance which is very impressive when its size and cost are considered. It can throw quite a jab given its size. In addition to its performance, it can accommodate a speaker level connection as well as a wireless adapter, and it has RCA outputs as well, so it can be used in a wide range of setups. RSL has had enormous success with the speedwoofer 10S, and they have considerably upped its aesthetics quotient by making a white version available. Its size and connectivity make it flexible, its availability in white makes it stylish, and its recorded measurements prove it to be a performer. In addition to all of this is RSL’s renowned customer service and generous return policy that pays for return shipping within a 30-day window if you don’t want to keep it for any reason. We think that RSL can afford to have such a generous return policy because they know that the vast majority of buyers will want to keep their speedwoofer 10S subs. It's that good.

Monoprice monolith 10” THX select

Monoprice has gradually been changing their brand image from a destination for mere consumer electronics accessories to a manufacturer of serious consumer electronics, and the monolith line of high-end audio products is one of the pushes they implemented to make this happen. They knew they had to make a splash to effect this change in image, and so they did, by launching a string of THX-certified subwoofers. We were mightily impressed by the monolith subs in our reviews of the 10” THX select and 12” THX ultra, not to mention the massive 15” THX ultra, and so, at $500, the monolith 10” THX easily earns a place in this round-up. The monolith subs are built like tanks, and the 10” THX select is much heavier and larger than any other sub in our round-up in spite of “only” using a 10” driver. The 10” driver in question is a massive unit with a motor section that is nearly as large as the cone itself. It is powered by a 500-watt class-D amp which is the most powerful among the home audio subwoofers in our round-up. This is a sub where aesthetics takes a distant backseat to performance, so it might not look the prettiest, but, with the ultra-low distortion output mandated by THX certification, it could well sound the prettiest. Aside from the SVS PB-1000, the monolith 10” THX select is the only other sub in our round-up that can dig down to an honest 20hz. The 10” THX select gives you a lot of sub for your money. We should also mention the M-10S as its same-priced sealed counterpart for those who want monolith build quality but need a smaller sub.

REL HT/1003

REL acoustics has long been known as a manufacturer of higher-end audiophile subwoofers that emphasized music reproduction, but they have recently released a line of subwoofers that were made to tackle the requirements of home theater as we discuss in our preview article of the serie HT line. The HT/1003 from this line uses a 10” long-throw driver in a sealed enclosure and powers it with a 300-watt class-D amplifier. The driver has a very swank-looking carbon-fiber cone, and the enclosure has gently rounded edges with a polished top-plate, so the HT/1003 is fairly stylish for an affordable sub. What furthers its acceptance factor for other household members is its petite size: it is essentially a 13” cube. Further increasing spouse acceptance factor is the compatibility with REL’s HT-air wireless signal transmission which negates the need for a signal wire which is one less wire in the cabling situation. While we haven’t had a chance to experience the HT/1003 in person, we can see all the right ingredients are there for some good bass, and REL has left some positive impressions with us in the past. If you need a smaller subwoofer, the HT/1003 looks like a great solution in this price bracket.

Behringer eurolive VQ1800D

And now for something a little crazy. Up to now, the subwoofers we have been discussing hone audio subwoofers which should have a decent amount of output for their size and price, but they are forced to make design choices that limit output to find a place in an average household. That is fine since the applications that they are intended for are not ones that demand high output. But, what if you want blazing loud bass but are only working with a $500 budget? Enter the behringer eurolive VQ1800D. This is a $500 subwoofer that uses an 18” driver and a 500-watt class-D amplifier. Behringer claims that it can hit 124db at 1m which is very plausible given the design. If you combined all the other subwoofers listed in this round-up, they likely would not be able to hit that level of output. However, while you can use the VQ1800D as a sub for your home audio system, there are some pretty significant caveats to that since that is not its intended purpose. It’s intended for sound systems in large rooms like clubs or performance halls or even outdoor venues. The obvious catch is that it is big and industrial looking, so it gives absolutely zero concessions to aesthetics; it’s a big, ugly, black box.

Another caveat is that in order to have that kind of tremendous output, extension is sacrificed. Indeed, the -10db point is 40hz. That means it is going to miss much of the deep bass in movie soundtracks. This is a sub made for live music systems, and most acoustic instruments don’t really produce much bass below 50hz. Another catch is that with such a high port tuning frequency, the transient response may not be the sharpest. On top of all that, users will need to feed the VQ1800D with XLR inputs, and the voltage difference between consumer and professional signal standards can sometimes give rise to noise floor issues, although signal amplifiers are a reliable and inexpensive solution for that problem. If you can deal with these issues, and you like your music loud, like really loud, the eurolive VQ1800D just might be the sub for you. This seems like a particularly cost-effective solution for headbangers who like their metal loud or lovers of percussion who want realistic reproductions of a drum kit.

Subwoofer set up & optimization youtube discussion

Conclusion

See also:

About the author:

James larson is audioholics' primary loudspeaker and subwoofer reviewer on account of his deep knowledge of loudspeaker functioning and performance and also his overall enthusiasm toward moving the state of audio science forward.

Confused about what AV gear to buy or how to set it up? Join our exclusive audioholics E-book membership program!

You can soon claim $500 missing stimulus money for your kids. But you have to do your taxes first

The last day to file a claim for missing money has passed. Here's what you can do now, and how to estimate the total amount you should get.

You can still file to claim your missing $500 stimulus payment for child dependents. But not this year.

If you missed the deadline back in november to claim $500 for each qualified child dependent that was left out of your first stimulus check in error, it's almost time to file a claim. The same general process applies for people who didn't get the $600 owed for each child dependent in the second stimulus check . You'll be able to claim the additional amount as a recovery rebate credit when you file your 2020 tax return this year.

CNET's first stimulus check calculator and your adjusted gross income will help you determine the payment amount you were supposed to get in the initial check. Parents who pay or receive child support could each qualify for $500 per dependent with the first check, but they must share custody of a child dependent and may need to file a claim this year to get the payment. And in some cases, the IRS might also garnish a stimulus check to settle child support debts (that rule doesn't apply to the second check ).

Read on for more details about how to know if you're owed a payment and how you'll have to claim it now that tax time is almost here (hint: don't call the IRS ). Meanwhile, read up on the second stimulus check , including who qualifies for more stimulus money -- and who doesn't . Here's what's going on with a third stimulus check . This story was recently updated.

How can I find out if I'm eligible for a stimulus check with child dependents?

To be eligible for a payment, you must be a US citizen, a permanent resident or a qualifying resident alien . You must also have a social security number and can't be claimed as a dependent of another taxpayer .

Here's where things get tricky. On the surface, the rules to claim a first stimulus check -- with or without a child dependent -- including having an adjusted gross income under $99,000 (single people), $146,500 (heads of household) or $198,000 (married couples filing jointly). But, and here's the big catch, because of the way the IRS calculates your stimulus check , you may actually be entitled to some money if you claim a child on your taxes, even if you exceed the income limit.

The CARES act from march 2020 stipulates a $500 allowance per child dependent in addition to the $1,200 cap for single filers and up to $2,400 for couples filing jointly. (we've also calculated how much money you might be able to get for dependents in the second stimulus check .)

There may be specific details you'll want to explore if your child dependent is adopted, disabled (of any age) or a citizen of another country .

Get paid $500 to eat pizza and binge-watch netflix shows

Some people decided to use their extra time at home during the pandemic to brush up on skills that might make them more enticing to a potential employer. Others may have devoted their time to eating and watching TV. Either way, you may be interested in—and highly qualified for—the latest “dream job” contest, which involves getting paid $500 to eat pizza and binge-watch netflix shows . Here’s what to know.

How to binge watch all the television that matters

It is physically impossible to watch every episode of every good TV show. Yet we actually feel…

What the role entails

The successful candidate will get a free netflix account, a budget for pizza delivery and snacks and a $500 paycheck. The position requires staying home, eating and then rating takeout pizza, and watching and then rating three netflix original shows from the following list :

- The queens gambit

- Bridgerton

- Lupin

- Bling empire

- Night stalker: the hunt for a serial killer

- Cobra kai

- Surviving death

- Ozark

- Virgin river

- The umbrella academy

- Ratched

- Below deck

- Other (unlisted series you’d like to watch)

Then, you must review the shows based on their:

- Stories and plot lines

- “netflix and chill” suitability

- Acting quality and cheesiness

- Satisfaction of episodes and series endings

You’ll also rate the pizza based on its:

- Appearance and color

- Base texture and taste

- Topping ingredient quality, flavor and cheese gooeyness

- Value for money

10 shows to binge before their final seasons drop

It’s a new year, and a perfect time for fresh entertainment—or fresh to you, anyway. What I’m…

so, let's see, what we have: don't let their low share prices fool you -- these companies can deliver big time for shareholders. At $500

Contents of the article

- Top-3 forex bonuses

- Got $500? Here are 3 great stocks under $10 to...

- Don't let their low share prices fool you --...

- Sirius XM

- Annaly capital management

- Calamp

- A start-up that wants to undersell the drug...

- 6 famous discontinued and uncommon U.S. Currency...

- $2 bill

- $500 bill

- $1,000 bill

- $5,000 bill

- $10,000 bill

- $100,000 bill

- Only have $500 to invest? Buy these 3 great stocks

- You can profit from several seeming unstoppable...

- 1. Apple

- 2. Sea limited

- 3. Teladoc health

- Got $500? Here are 3 great stocks under $10 to...

- Don't let their low share prices fool you --...

- Sirius XM

- Annaly capital management

- Calamp

- The 9 best laptops under $500 in 2020

- 6 best powered subwoofers under $500 for 2020

- SVS PB-1000

- Polk audio HTS-12

- RSL speedwoofer 10S

- Monoprice monolith 10” THX select

- REL HT/1003

- Behringer eurolive VQ1800D

- Conclusion

- You can soon claim $500 missing stimulus money...

- How can I find out if I'm eligible for a stimulus...

- Get paid $500 to eat pizza and binge-watch...