$100 forex trading plan

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Top-3 forex bonuses

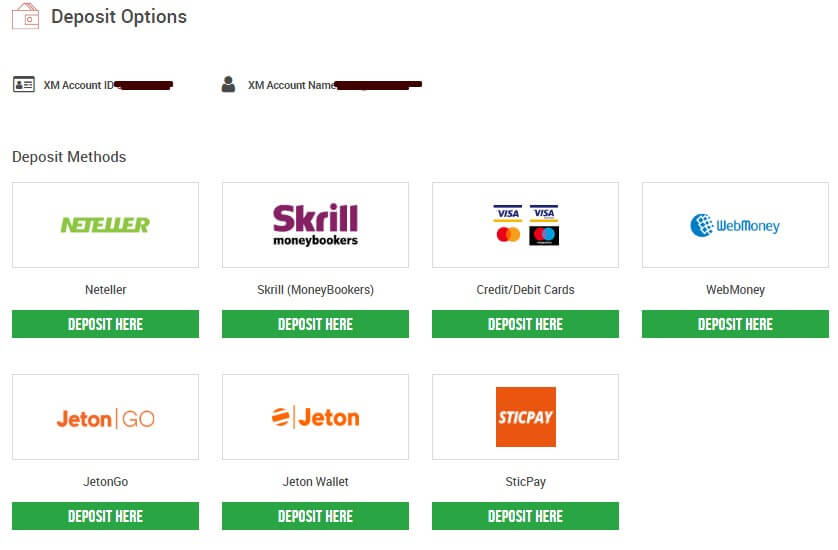

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

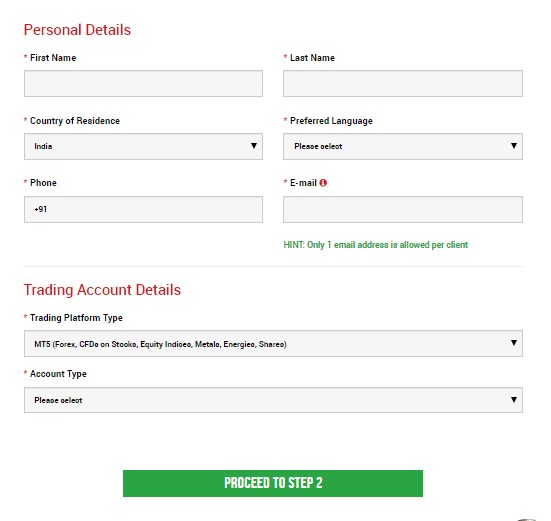

Step 2: filling the personal details

Fill all the box with accurate details

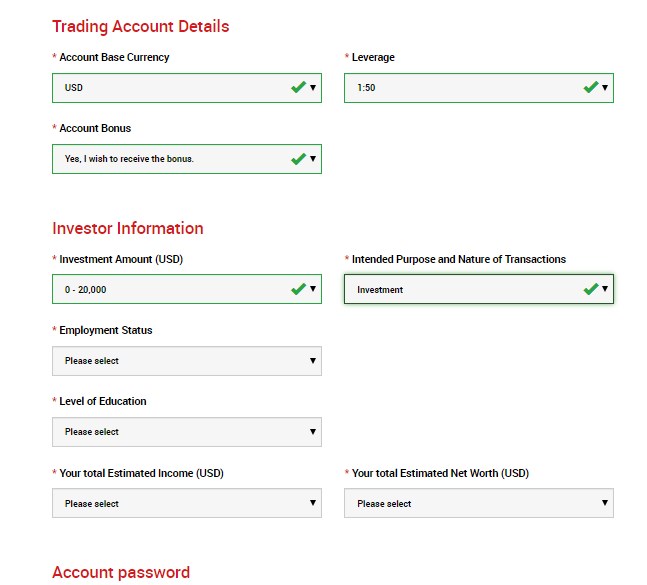

Step 3: investor information & trading account details

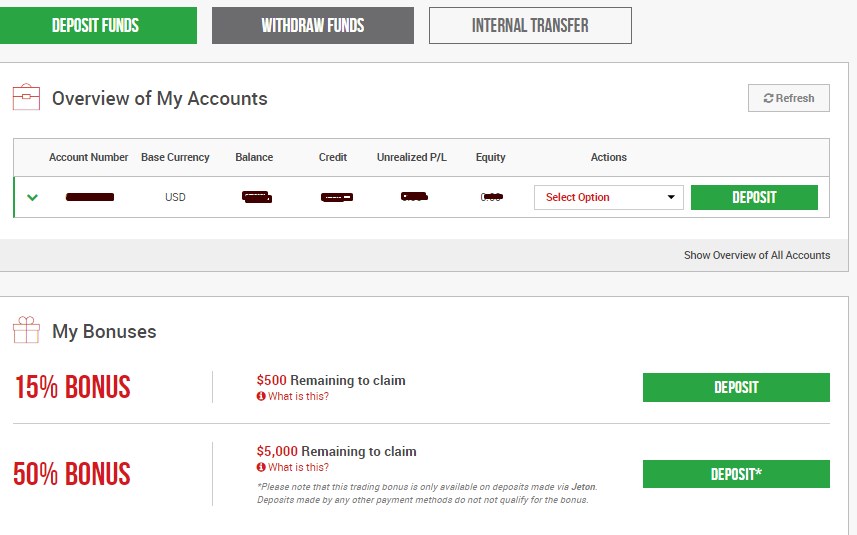

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

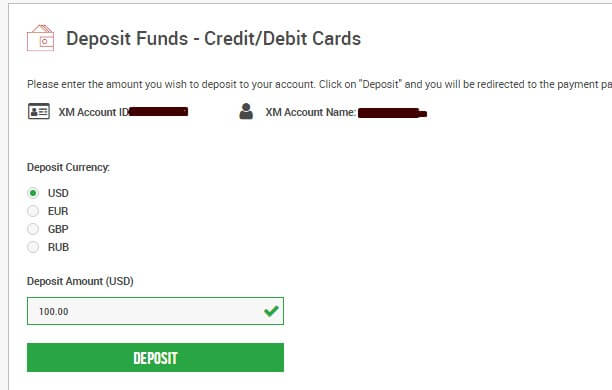

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to trade forex with $100

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Many people realize that $100 doesn’t buy much these days, but if you want to trade the forex market, $100 can get you started and could even generate a new source of income you can earn at home. If you manage to develop and implement a successful trading plan, then your first $100 forex account could ultimately change your life for the better.

On the other hand, if you plan to just get into the currency market to make a few practice trades or to gamble a bit, then a loss of $100 usually won’t break the bank for most people.

The key to success as a forex trader consists of having a viable trading plan that you can easily stick to, no matter whether you’re trading with $100 or $1,000,000 in your margin account. Read to learn how to get started trading forex with $100.

Step 1: research the market.

Knowledge is power. These words take on a special meaning when applied to trading in the forex market that holds the top position for trading volume among the world’s financial markets. Knowing more about markets and trading in general increases your chances of succeeding when you trade forex.

Of course, if you just want to take a quick gamble with your $100, then you wouldn’t need to learn much more than how to enter orders in your brokerage account using an online trading platform.

To achieve any level of consistent long-term success, however, you will need to acquire a certain amount of knowledge about currencies and the fundamental factors that influence their relative valuation. Most online brokers provide ample educational resources for new traders that can include articles, ebooks, webinars and tutorial videos. All of these can help you learn more about the forex market before you begin risking money.

You will probably also need to learn how to analyze a market’s behavior to have a better chance of predicting its future direction. The 2 principal analytical market research methods for traders consist of fundamental and technical analysis.

Fundamental analysis

This method analyzes the impact of economic releases and news on the market. Each currency’s relative value generally reflects the state of that particular nation’s economy and its geopolitical situation compared with the currency it is quoted relative to.

Below are the most important news events and indicators watched by fundamental forex analysts:

- Geopolitical shifts and other major news events

- Central bank monetary policy and benchmark interest rate levels

- Gross domestic product (GDP)

- Employment statistics (non-farm payrolls, unemployment rate, weekly initial jobless claims, etc.)

Fundamental analysis gives you an important edge when you trade. Not only can it help predict longer term exchange rate trends, but it can also help explain and predict sharp short-term movements, such as those that coincide with significant economic releases.

Most online forex brokers include a news feed with their trading platform to help you perform fundamental analysis. Another important resource for fundamental trading is the economic calendar that lists all the important upcoming economic releases for various major economies.

Technical analysis

You can study the forex market using technical analysis such as charts and computed technical indicators — a common method to determine the levels of supply and demand in the market that can influence and predict an exchange rate’s future movement.

By looking at exchange rate charts you can identify common patterns with predictive value. You could also use a variety of popular indicators based on market observables to help predict short- and long-term trends in the market.

These indicators can include moving averages, momentum oscillators, overbought or oversold indicators and volume figures. Some important indicators include the moving average convergence divergence indicator (MACD), the relative strength index (RSI) and the 200-day moving average, to name just a few.

Trading volume is another important market observable to give an indication of how much activity accompanies a particular market move. Also, support and resistance levels suggest the degree of supply and demand existing at different exchange rate levels.

The charts themselves can also give important information to use and act upon. For example, a fascinating system of interpreting and trading candlestick charts was originally developed by japanese rice merchants. These informative charts indicate the opening and closing exchange rates, the range of the currency pair and whether the exchange rate increased or decreased for each period displayed on the chart.

Overall, technical analysis provides a relatively objective way to analyze the forex market that can work well for predicting short-term market moves. Many scalpers and day traders use technical analysis to inform their trading activities.

Step 2: open a demo account.

Most online forex brokers provide clients with a fully functional demo account, which reflects market conditions but does not require you to make a deposit.

The forex platforms provided by these brokers generally have comprehensive technical analysis tools such as charting and indicators that incorporate into the chart. If the broker supports the popular metatrader 4 platform developed by metaquotes, then you can automate your trading with expert advisor (EA) software you can buy or develop yourself.

The reason opening a demo account makes sense is so that you can get a feel for the market and learn how to use a broker’s trading platform without committing any funds. You can also use a demo account to begin working out your own trading strategy and putting it into a trade plan.

By learning how to take risk as a forex trader and seeing how disciplined you are when dealing with taking profits and losses, you can also determine if you have the necessary mindset to become successful as a forex trader.

Once you’ve opened your demo account and have begun trading with virtual money, you can start developing a trading plan. If you plan on success, remember that the more you know, the easier developing a trading strategy becomes. Take the time to review as many of the online educational resources on trading that you can, so that your trading plan has a solid foundation in best practices.

Step 3: fund an account and start trading.

Once you’ve traded in your demo account and worked out a trading plan you feel confident with, you can fund a live account and make your first real trade. Although trading in a live account may seem identical to trading in a demo account, you’ll have to deal with the emotional swings that come with winning and losing money, even if you’re only risking $100.

Fortunately, any viable trading plan can be traded with a $100 account since most brokers will let you trade in micro units or 0.01 lots. After you’ve refined your trading plan and have increased your working capital with profitable trading, you can then increase the size of your trading units. Avoid taking larger than expected losses by incorporating a sound money management component into your trading plan.

If you’re a beginning trader, you may want to restrict your trading activities to one particular currency pair before taking positions in multiple pairs in your account. Each currency pair differs in the way it trades because of the underlying fundamentals of the component currencies.

Trading plan

A trading plan defines your financial goals and how you are going to trade to achieve them. It is all too easy to say “I am going to transform $10,000 into $250,000 in one year trading forex” without having specific details about how what currencies to trade, how often, over what timeframe, and with what risk of loss. Without the details, it is just a fancy fiction, and unlikely to come true. A real trading plan includes those details about key components.

In practice, a trading plan is always a work-in-progress because we learn from experience and from reading about new techniques and mind-sets.

Choosing a currency pair

The first point in your trading plan is what currencies to trade, whether benchmark currency pairs like EUR/USD or GBP/USD, or currencies with less liquidity like the USD/CAD and AUD or NZD/USD. Perhaps you like cross rates because typically they are less volatile, such as EUR/JPY. You may consider exotics like emerging market currencies (turkish lira, south african rand) or even exotic cross rates (lira/rand).

Volatility is just one criterion for choosing a currency to trade. You can research volatility by eyeballing charts, by looking at volatility tables online, or by devising your own spreadsheet and applying the standard deviation function. If you choose volatility as the primary criterion, be sure to look at the data in the timeframe you plan to trade. A currency may have low day-to-day volatility that masks high hourly volatility, and that does you no good if you are trading the one-hour timeframe.

Another criterion for selecting a currency to trade is trendedness. Measuring trendedness is a complicated statistical process that most traders have no interest in or the qualification to perform — and it changes over time – but you can eyeball charts of the various currencies to detect those that spend the least amount of time range-trading and the most amount of time with a directional slope, either hand-drawn or with the linear regression. Again, be sure to look at the same timeframe you will be trading.

A third criterion is whether you have knowledge and insight into the fundamentals of the country issuing the currency. A good example is the explicit plan by the government of australia to reduce dependence on mining and to diversify the economic base, influencing interest rate management in recent years, plus a willingness on the part of top officials to jawbone the currency lower to promote non-mining exports, among other goals.

Choosing a timeframe

Trading requires focus and concentration, no matter how well you set up your trades in advance. Your choice of timeframe is heavily dependent on other activities in your life, including a day job. If you have a day job without constant access to your screen during the time you want to trade, you have chosen a wrong timeframe to trade. Say you are in the new york time zone and want to trade the hourly chart from 8:30 to 11:00 EST, the most active and liquid time to trade forex in that time zone. If you have a day job, chances are good that your boss would not approve of you frittering away most of the morning on your personal trading account. Yet if you wait until you get home at night at 19:00 EST, you will be stuck with the less active and illiquid new zealand and australian forex sessions. If that is the only time you have available to devote to trading, you need to trade the NZD, AUD, JPY or another asian currency.

To stick with the EUR/USD, the only solution is to change timeframes from one-hour to daily. It is not unheard of for a trader to relocate his home base from an inauspicious trading location to a better one — we know one trader who moved from california to switzerland to be on top of the european session.

A second consideration in choosing a timeframe is what you can see on the chart with your own eyes. Forex traders like to emphasize that forex prices are fractal, meaning that you cannot tell without a label whether a chart is of one-hour bars or daily or weekly bars. This is true, up to a point. But logically, an obvious reversal followed by series of big-bar higher highs with higher lows on a daily chart has more meaning than the same set of characteristics on an hourly chart. This is because on the hourly chart, the move can easily fizzle and fade away, whereas on the daily chart, it is more likely to have staying power. If you are looking at an hourly chart and cannot detect trends and patterns, widen the timeframe to a longer one.

A third consideration in choosing a timeframe is your capital stake. If you have a large capital stake – $25,000-50,000 — you are free to trade in any timeframe, including the daily. If you have a small capital stake, like $2,000-5,000, prudence dictates you should trade in a shorter timeframe, like 4-hour or 60-minute. You are not risking your capital when you are out of the market.

Choosing technical tools

Some technical tools will be more easily understood and applied than others. Some traders take to patterns like a duck to water, and some cannot get the hang of it, or find the reliability quotient of patterns too low. There is no single correct technical indicator or set of indicators for any specific currency or any specific timeframe. Everything works, and what is important is what works for you. The old joke has it that if you put ten traders in a room with one chart and one indicator, you will get ten different outcomes. This does not mean the trader with the highest gain is “right” and the other nine are wrong. The trader with the highest gain may have had a bigger starting capital stake or a higher propensity to take risk (or both). The trader with the smallest gain may be the best trader if his trading style results in staying in the game for a longer period of time.

The standard way to select technical tools is to backtest them on your currency and your timeframe. For example, you may like the MACD. You would test the hypothesis “what gains and losses would result from applying the MACD (and only the MACD) on my currency over the past X periods?” in the early days of technical analysis, traders spent countless hours performing backtests. Backtests have two problems:

- Conditions, especially volatility and trendedness, change over time (so you need a very long backtest period to cover them all).

- It is tempting to tweak the parameters of the indicator to “fit” the data in your period.

Backtesting has fallen out of favor because of these problems, and also because traders lack the data, software, or patience to invest hundreds of hours on a procedure that is inherently inadequate. The effort-to-reward ratio is low. But the fact remains that backtesting is the only way to estimate whether a technique that appeals to you will actually work on your currency pair in your timeframe. At the least, you should apply your technical indicator to a chart and count up how many times it signaled the correct trading decision versus the number of times it would have delivered a loss. It is important to note that no indicator is correct 100% of the time and every indicator fails sometimes. This is a fact of trading life you must accept, but you do not have to accept an indicator, however appealing, that fails more often than it succeeds.

Choosing the rate of return

Your rate of return is a function of risk-reward analysis, a complicated topic covered further in our course. Let’s go back to the opening paragraph here and examine your goal of converting $10,000 into $250,000 in a year of forex trading. In order to achieve that goal, you need information on exactly what trades you need to take to earn that much. For example, if you make a net $10 per trade (after factoring in losses), you would need to make 25,000 trades, or 104 trades per day, assuming 240 trading days per year. This is obviously silly. What if you make $100 per trade? That would take 2,500 trades or 10.4 trades per day. To make $250,000 in year doing only one trade per day would mean you would need to make $1,041.62 per day.

Okay, which currencies move 100+ points every day, and do it in a manner that you can identify with your technical tools and take advantage of? Right away, we see that it is not reasonable to expect to make $250,000 from a starting capital stake of $10,000. Besides, you will experience long streaks of losses in forex trading. Everyone does, without exception. In order to evaluate how much ending rate of return you can reasonably expect, you need to know your gain/loss ratio. If you are just starting out in trading, clearly you do not have a historical record of your gains and losses, so you are stuck with eyeballing your chosen indicators on charts to guess what they might be.

Some traders claim to have a 5:1 gain/loss ratio, meaning they make $5 for every $1 they lose. This may be true sometimes but it unlikely to be true over long periods of time. If someone has a technique for making a 5:1 win/loss ratio and they promote that technique, pretty soon a lot of traders would apply it and make it less effective (by front-running it, for example). This is why the 18-day moving average is sometimes used — to front-run the 20-day. In practice, you should be very happy with a 3:1 ratio, or a 2:1 ratio. Even a 1.5:1 ratio will keep you in business with a decent rate of return — higher than what is available in the “risk-free” sovereign bond market.

The need to develop an actual, real-time gain/loss track record is the primary reason a trading plan is always a work in progress. You may find that you wanted to trade, say, the benchmark EUR/USD, but given the time you have and time of day you have available to trade, and given technical tools that work for you, you get a better gain/loss ratio from trading AUD/JPY. Long run, staying in the trading business is more important than making a quick buck and giving it all back.

Choosing a broker or platform

It may seem as though choosing a broker/platform comes first, but that would be to allow the broker to dictate or at least influence your other choices. Choosing a broker comes last, after you know what currency behavior you can identify and indicators you like. For example, not every broker/platform offers the capability to draw linear regression channels. If you find linreg channels useful, find another broker.

You can choose a proper broker for your trading style using a plethora of parameters in our forex brokers section.

$100 forex trading plan

How to turn $100 to $1000 or more trading forex

Turning $100 to $1000 or more trading forex

To be a successful trader, you need to understand how leverage works . It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to point of no return. Although, if the trade works to your favor, you can gain significantly.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “possible” but not easy! And is always risky.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to turn $100 to $1000 or more

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA , easymarkets and XM .

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

How to develop a trading plan

Sometimes there is a misconception that you need highly evolved market knowledge and years of trading experience to be successful. However, we often see that the more information we have the more difficult it is to create a clear plan. More information tends to create hesitation and doubt, which in turn allows emotions to creep in. This can prevent you from taking a step back and looking at a situation subjectively.

If you don’t know where you are going, any road will get you there. In trading, if you don’t set out a plan for your trades and develop strategies to follow you have no way to measure your success. The vast majority of people do not trade to a plan, so it’s not a mystery why they lose money. Trading with a plan is comparable to building a business. We are never going to be able to beat the market. In general it’s not about winning or losing, it’s about being profitable overall.

Why a trading plan is important

When trading, as in most endeavors, it’s important to start at the end and work backwards to create your plan and figure out what type of trader you should be. The most successful traders trade to a plan, and may even have several plans that work together. Always write things down. Why? Because it will help you stay focused on your trading objectives, and the less judgment we have to use the better. A plan helps you maintain discipline as a trader. It should help you trade consistently, manage your emotions, and even help to improve your trading strategy. It is also important to use your plan. Many people make the mistake of spending all their time creating a plan, then never implementing it.

Key components to develop a trading plan

- Trading plan structure and monetary goals

- Research and education

- Strategy using fundamental and technical tools

- Money and risk management

- Timing

- Trade mechanics, documentation, and testing

How to build a trading plan

Make sure you do your own research and build a plan according to your needs. Find confidence in what you know. The tools you have selected for your strategy are key, from the type of chart to the specific drawing tools to even the most elaborate of strategies. Test your plan in the beginning to make sure you are on the right track. After you have begun trading, continue testing it regularly. This allows you to measure your success by clearly seeing what works and what does not work. From there you can tweak elements that might be weaker and not contributing to your overall goal. Ask yourself the following questions (the answers to these will assist you in the foundation for your trading plan and should be referred back to regularly to insure that you are on track with your plan.)

Why am I trading?

If your immediate answer is, “to make money” you should stop right there. If the only goal is to make as much money as fast as we can, we are ultimately doomed, because it will never be enough. Managing your losses should be your primary goal. This will create an environment in which profits can be generated.

What is your motivation?

Solid retirement? New career? Spend more time with family and friends?

Ask yourself, “what are my strengths and weaknesses?”

- How do I maximize my strengths to minimize my weaknesses?

- An example of a weakness is a need to constantly watch one’s trades. Is your laptop on the pillow, waking you up in the middle of the night to monitor trades? It’s really difficult to make intelligent decisions when you’re half awake.

Is the amount of money I have to trade with sensible to achieve my goals?

Look at things in percentages; remember leverage is a double-edged sword. That is why risk and money management are key.

Deciding what type of trader you are can be tough; especially since the trader you want to be can be very different from the type of trader you should be based on your behaviors and characteristics. Once you have laid out your goals, risk appetite, strengths, and weaknesses it should become apparent which type of trading fits you best. You will notice three columns in the chart; they are labeled short, base and long. Base equals the timeframe charts you spend the majority of your time, if you are not sure, this is the timeframe chart that you keep going back to. Short and long are the timeframe charts that you refer to confirming or denying what is happening in the base timeframe chart. A common mistake traders make is jumping around randomly between chart timeframes.

How to match your goals to a trading style

Once you decide what type of trader you are, you should begin to invest yourself into education and research. Make continual learning a priority, each person’s strategy or methodology is unique and cannot be duplicated. Therefore your plan is most successful when it is based on your individual needs. Evaluate your needs and the effort required. Make sure you understand why you are placing trades. An initial investment maybe monetary but will benefit you over the long-term. Time and research should be continuing investments. Research by way of following current global events and keeping up to date on current analysis tools will help educate you further on all aspects of trading. Ask yourself, “am I a fundamental or technical trader?”

Creating a strategy using fundamental and technical tools is key, but we first need to learn a little about each of these types. Some traders choose to use fundamental analysis to assist with their trading decisions. This type of analysis is based on the news. News can be considered anything ranging from economic, political, or even environmental events. As a result, fundamental analysis is much more subjective.

Other traders may choose to use technical analysis to drive their trading decisions. This type of analysis is more definitive and relies more on the math and probabilities behind trading. The specific type of analysis used can be an indicator. They could be either leading or lagging. There are very few leading indicators available, which may give an idea of where the market is going to go. Fibonacci is the most popular, but most misused and misunderstood.

After determining some of the types of analysis you will use, it’s time to develop a trading strategy. This can be through fundamental analysis, technical analysis, or a combination of both. It is key that you develop a strategy and include it as a part of your trading plan.

A strategy is a step-by-step systematic approach to how and when we are going to use tools developing a sequence of analysis. Here is what we can expect to see in a trading strategy:

- The types of analysis tools (fundamental, technical, or both)

- When and how the analysis tools will be used

- The timeframes to use the tools

- The sequence of analysis

- High probability trade, description of what to look for

- Types of orders to use

This sequence will lead us to what a high probability trade looks like visually based on the indicators and analysis we are using. Since we have what we need for our strategy, let’s take a look at the money and risk management side of trading.

Talking about money and risk management can be a difficult step for many people. Trying to determine what your risk tolerance is can be even harder. Ask yourself, “how much money do I really have to trade with?” be honest with what is truly available to you. One mistake that people make is thinking that trading is an investing or holding activity, and keep depositing money. Trading is not a deposit and hold activity. Liquidation can and does happen when 100% of the total margin requirement of all open positions is no longer met. Those who make money may not have more winning trades than losing; they may just manage their losing trades so the winning ones make them profitable overall. It can be easier to win fewer times and still be profitable. A common characteristic of new traders is to quickly take profits but let losing trades run, consequently they have to maintain a higher risk to reward ratio.

Let’s think in terms of probability. It is helpful to use the 3% rule and always have a cushion. This is an example of the 3% rule in action: 3% on a $10,000 account is equal to $300 risk per trade. Then divide the cost of risk by the account equity, to get the number of losing trades or $10,000/$300 or 33.3 trades. These answers will help you determine if you can meet your goals. It allows you to give yourself room for flexibility. Traders limit their trading and the plan if there is not enough room for the losses. When developing your trading plan and approach it’s important to take other costs into consideration, some may have more of an impact than others, but all contribute to your investment in a trading plan. Assuming we have the right strategy decided and how much equity to risk, let’s figure out timing.

Timing when trading can be everything. When do the markets open? When do they close? What instruments (like currency pairs) am I trading? Some markets are open when others are closed or they may overlap. Here are the open and close times for some of the major markets. More volatility occurs at market opening and closings but also when reports or news are released. The beauty of trading some instruments is the ability to trade them even if the market you physically reside in is closed. The illustration below shows the overlap of markets that are open. Notice the times where more than two markets are open simultaneously. From 8am eastern time or 1pm GMT to 12pm eastern time or 5pm GMT, it displays the most markets open globally. Picking your times to trade or watch the market maybe easier since there is likely a market open somewhere in the world.

It’s important to answer the tough questions first, that is what will separate you from the vast majority of those losing money trading.

Make sure you are prepared, continued research and education will be your best weapon in your continued success.

$100 forex trading plan

How to turn $100 to $1000 or more trading forex

Turning $100 to $1000 or more trading forex

To be a successful trader, you need to understand how leverage works . It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to point of no return. Although, if the trade works to your favor, you can gain significantly.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “possible” but not easy! And is always risky.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to turn $100 to $1000 or more

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA , easymarkets and XM .

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

IQ option – how to make at least $100 an hour trading forex – simple step by step tutorial

Read users stories related to forex position trading efectivo, IQ option – how to make at least $100 an hour trading forex – simple step by step tutorial.

New trading tutorial������ https://youtu.Be/zurtrrznnw0

open an account (real or demo) from here: https://goo.Gl/xdqnqp

for ios users: https://goo.Gl/ltkaag

So IQ option recently added a new trading instrument, FOREX. And I’m excited to bring to you my first forex trading tutorial.

In this video, we are going to look at a basic trading pattern in forex on IQ option. It is basically about determining the trend and using it to predict price movements.

We will use candlesticks with time interval: 30 minutes. We will use the following indicators: EMA – period 21 (red), EMA – period 13 (red), WMA – period 5 (light blue), and the awesome oscillator (periods 34 and 5).

Here’s how it works. When the blue line is below the two red lines, and they are all moving downwards, we have a downward trend. When the blue line is above and the three lines are moving upwards, we have an upward trend.

We can tell whether the trend will change or remain the same just by how much the three lines are spread apart. If the lines appear to be diverging (spreading away from each other) or are far apart, the trend is likely to continue and this is a good time to open a position (by simply clicking “buy” if the trend is upwards or “sell” if the trend is downwards).

So here, the blue line is below the two red lines and we can see that they are spreading apart. We can also see an array of red bars (we only need at least two) below the zero line on the awesome oscillator. Clearly, we have a steady downward trend and this is a good time to open a position. In this case, we open a “sell” position. This is referred to as “going short”, (similar to a put option in binary trading).

In the case of an upward trend, we were going to open a “buy” position. This is referred to as “going long”, (similar to a call option in binary trading). Looks like our prediction was correct. If we close the position now, we get $75 profit from our initial investment of $50.

Conversely, if the lines are converging or moving close to each other, it means the trend is weak and the best at that point is to wait.

Be sure to set a realistic target profit and maximum loss, and stick to the plan. Otherwise you might as well consider yourself gambling. If you hit your target profit, don’t get too excited and expect the profit to grow further. Close the position immediately. In like manner, if you hit your maximum loss, don’t keep waiting and hoping for things to get better. That miracle might never show up. So we now close the position at a profit of $50.3, about 100% of our investment of $50.

Let us now look at a “buy” signal. The blue line is above the other two, and we can see that they are spreading apart. We just need at least two green candles and at least two green bars above the zero line on the awesome oscillator. Clearly, we have an upward trend and it looks like it’s going to go on for some time. This is certainly a good time to go long.

And… we were right again! We’ve closed the position with a profit of $47.73 from our initial investment of $100.

You can try iq forex here: https://goo.Gl/zqk5gv

Music:

“motherlode”

kevin macleod (incompetech.Com)

licensed under creative commons: by attribution 3.0

http://creativecommons.Org/licenses/by/3.0/

Forex position trading efectivo, IQ option – how to make at least $100 an hour trading forex – simple step by step tutorial.

What is a placement trader?

A placement investor is a sort of investor that holds a placement in a possession for a long period of time. The holding period might vary from numerous weeks to years. Besides “buy and also hold”, it is the longest holding period amongst all trading styles.

Setting trading is basically the reverse of day trading. A placement investor is generally less worried regarding the short-term motorists of the costs of a possession and also market modifications that can temporarily reverse the price trend.

Setting traders put even more focus on the long-lasting efficiency of a possession. From such a perspective, the traders are more detailed to long-lasting financiers rather than to other traders.

Setting investor refers to an individual that holds a financial investment for an extensive period of time with the expectation that it will certainly appreciate in worth.

Setting traders are trend fans.

A successful position investor has to determine the entrance/ leave levels and also have a plan in place to manage risk, generally using stop-loss levels.

The objective of position traders is identifying patterns in the costs of safety and securities, which can continue for relatively extended periods of time, and also gaining make money from such patterns. Typically, position trading might provide lucrative returns that will certainly not be eliminated by high deal prices.

What is a placement?

A placement is the quantity of a safety, asset or currency which is owned by a specific, dealership, institution, or other financial entity. They can be found in 2 kinds: brief settings, which are borrowed and after that sold, and also long settings, which are owned and after that sold. Depending upon market patterns, movements and also changes, a placement can be successful or unprofitable. Reiterating the worth of a placement to mirror its actual present worth on the open market is referred to in the industry as “mark-to-market.”.

Settings described?

The term position is utilized in numerous circumstances, including the copying:.

1. Suppliers will certainly typically preserve a cache of long settings particularly safety and securities in order to help with quick trading.

2. The investor closes his position, resulting in an internet profit of 10%.

3. An importer of olive oil has an all-natural brief position in euros, as euros are continuously streaming in and out of its hands.

Settings can be speculative, or the all-natural consequence of a particular company. For instance, a money speculator can buy british pounds sterling on the assumption that they will certainly appreciate in worth, which is taken into consideration a speculative position. Nonetheless, a company which trades with the UK will certainly be paid in pounds sterling, providing it an all-natural long position on pounds sterling. The currency speculator will certainly hold the speculative position till she or he determines to liquidate it, safeguarding a revenue or limiting a loss. Nonetheless, the business which trades with the UK can not merely abandon its all-natural position on pounds sterling similarly. In order to shield itself from currency changes, the business might filter its revenue with a balancing out position, called a “hedge.”.

Area vs. Futures settings.

A placement which is created to be delivered immediately is called a “spot.” places can be delivered literally the following day, the following company day, or often after 2 company days if the safety in question requires it. On the deal day, the price is set yet it generally will not clear up at a fixed price, given market changes. Transactions which are longer than areas are referred to as “future” or “onward settings,” and also while the price is still set on the deal day, the settlement day when the deal is completed and also the safety delivered day can happen in the future.

Read users stories related to forex position trading efectivo and financial market news, analysis, trading signals and also foreign exchange financial expert evaluations.

Trading plan

A trading plan defines your financial goals and how you are going to trade to achieve them. It is all too easy to say “I am going to transform $10,000 into $250,000 in one year trading forex” without having specific details about how what currencies to trade, how often, over what timeframe, and with what risk of loss. Without the details, it is just a fancy fiction, and unlikely to come true. A real trading plan includes those details about key components.

In practice, a trading plan is always a work-in-progress because we learn from experience and from reading about new techniques and mind-sets.

Choosing a currency pair

The first point in your trading plan is what currencies to trade, whether benchmark currency pairs like EUR/USD or GBP/USD, or currencies with less liquidity like the USD/CAD and AUD or NZD/USD. Perhaps you like cross rates because typically they are less volatile, such as EUR/JPY. You may consider exotics like emerging market currencies (turkish lira, south african rand) or even exotic cross rates (lira/rand).

Volatility is just one criterion for choosing a currency to trade. You can research volatility by eyeballing charts, by looking at volatility tables online, or by devising your own spreadsheet and applying the standard deviation function. If you choose volatility as the primary criterion, be sure to look at the data in the timeframe you plan to trade. A currency may have low day-to-day volatility that masks high hourly volatility, and that does you no good if you are trading the one-hour timeframe.

Another criterion for selecting a currency to trade is trendedness. Measuring trendedness is a complicated statistical process that most traders have no interest in or the qualification to perform — and it changes over time – but you can eyeball charts of the various currencies to detect those that spend the least amount of time range-trading and the most amount of time with a directional slope, either hand-drawn or with the linear regression. Again, be sure to look at the same timeframe you will be trading.

A third criterion is whether you have knowledge and insight into the fundamentals of the country issuing the currency. A good example is the explicit plan by the government of australia to reduce dependence on mining and to diversify the economic base, influencing interest rate management in recent years, plus a willingness on the part of top officials to jawbone the currency lower to promote non-mining exports, among other goals.

Choosing a timeframe

Trading requires focus and concentration, no matter how well you set up your trades in advance. Your choice of timeframe is heavily dependent on other activities in your life, including a day job. If you have a day job without constant access to your screen during the time you want to trade, you have chosen a wrong timeframe to trade. Say you are in the new york time zone and want to trade the hourly chart from 8:30 to 11:00 EST, the most active and liquid time to trade forex in that time zone. If you have a day job, chances are good that your boss would not approve of you frittering away most of the morning on your personal trading account. Yet if you wait until you get home at night at 19:00 EST, you will be stuck with the less active and illiquid new zealand and australian forex sessions. If that is the only time you have available to devote to trading, you need to trade the NZD, AUD, JPY or another asian currency.

To stick with the EUR/USD, the only solution is to change timeframes from one-hour to daily. It is not unheard of for a trader to relocate his home base from an inauspicious trading location to a better one — we know one trader who moved from california to switzerland to be on top of the european session.

A second consideration in choosing a timeframe is what you can see on the chart with your own eyes. Forex traders like to emphasize that forex prices are fractal, meaning that you cannot tell without a label whether a chart is of one-hour bars or daily or weekly bars. This is true, up to a point. But logically, an obvious reversal followed by series of big-bar higher highs with higher lows on a daily chart has more meaning than the same set of characteristics on an hourly chart. This is because on the hourly chart, the move can easily fizzle and fade away, whereas on the daily chart, it is more likely to have staying power. If you are looking at an hourly chart and cannot detect trends and patterns, widen the timeframe to a longer one.

A third consideration in choosing a timeframe is your capital stake. If you have a large capital stake – $25,000-50,000 — you are free to trade in any timeframe, including the daily. If you have a small capital stake, like $2,000-5,000, prudence dictates you should trade in a shorter timeframe, like 4-hour or 60-minute. You are not risking your capital when you are out of the market.

Choosing technical tools

Some technical tools will be more easily understood and applied than others. Some traders take to patterns like a duck to water, and some cannot get the hang of it, or find the reliability quotient of patterns too low. There is no single correct technical indicator or set of indicators for any specific currency or any specific timeframe. Everything works, and what is important is what works for you. The old joke has it that if you put ten traders in a room with one chart and one indicator, you will get ten different outcomes. This does not mean the trader with the highest gain is “right” and the other nine are wrong. The trader with the highest gain may have had a bigger starting capital stake or a higher propensity to take risk (or both). The trader with the smallest gain may be the best trader if his trading style results in staying in the game for a longer period of time.

The standard way to select technical tools is to backtest them on your currency and your timeframe. For example, you may like the MACD. You would test the hypothesis “what gains and losses would result from applying the MACD (and only the MACD) on my currency over the past X periods?” in the early days of technical analysis, traders spent countless hours performing backtests. Backtests have two problems:

- Conditions, especially volatility and trendedness, change over time (so you need a very long backtest period to cover them all).

- It is tempting to tweak the parameters of the indicator to “fit” the data in your period.

Backtesting has fallen out of favor because of these problems, and also because traders lack the data, software, or patience to invest hundreds of hours on a procedure that is inherently inadequate. The effort-to-reward ratio is low. But the fact remains that backtesting is the only way to estimate whether a technique that appeals to you will actually work on your currency pair in your timeframe. At the least, you should apply your technical indicator to a chart and count up how many times it signaled the correct trading decision versus the number of times it would have delivered a loss. It is important to note that no indicator is correct 100% of the time and every indicator fails sometimes. This is a fact of trading life you must accept, but you do not have to accept an indicator, however appealing, that fails more often than it succeeds.

Choosing the rate of return

Your rate of return is a function of risk-reward analysis, a complicated topic covered further in our course. Let’s go back to the opening paragraph here and examine your goal of converting $10,000 into $250,000 in a year of forex trading. In order to achieve that goal, you need information on exactly what trades you need to take to earn that much. For example, if you make a net $10 per trade (after factoring in losses), you would need to make 25,000 trades, or 104 trades per day, assuming 240 trading days per year. This is obviously silly. What if you make $100 per trade? That would take 2,500 trades or 10.4 trades per day. To make $250,000 in year doing only one trade per day would mean you would need to make $1,041.62 per day.

Okay, which currencies move 100+ points every day, and do it in a manner that you can identify with your technical tools and take advantage of? Right away, we see that it is not reasonable to expect to make $250,000 from a starting capital stake of $10,000. Besides, you will experience long streaks of losses in forex trading. Everyone does, without exception. In order to evaluate how much ending rate of return you can reasonably expect, you need to know your gain/loss ratio. If you are just starting out in trading, clearly you do not have a historical record of your gains and losses, so you are stuck with eyeballing your chosen indicators on charts to guess what they might be.

Some traders claim to have a 5:1 gain/loss ratio, meaning they make $5 for every $1 they lose. This may be true sometimes but it unlikely to be true over long periods of time. If someone has a technique for making a 5:1 win/loss ratio and they promote that technique, pretty soon a lot of traders would apply it and make it less effective (by front-running it, for example). This is why the 18-day moving average is sometimes used — to front-run the 20-day. In practice, you should be very happy with a 3:1 ratio, or a 2:1 ratio. Even a 1.5:1 ratio will keep you in business with a decent rate of return — higher than what is available in the “risk-free” sovereign bond market.

The need to develop an actual, real-time gain/loss track record is the primary reason a trading plan is always a work in progress. You may find that you wanted to trade, say, the benchmark EUR/USD, but given the time you have and time of day you have available to trade, and given technical tools that work for you, you get a better gain/loss ratio from trading AUD/JPY. Long run, staying in the trading business is more important than making a quick buck and giving it all back.

Choosing a broker or platform

It may seem as though choosing a broker/platform comes first, but that would be to allow the broker to dictate or at least influence your other choices. Choosing a broker comes last, after you know what currency behavior you can identify and indicators you like. For example, not every broker/platform offers the capability to draw linear regression channels. If you find linreg channels useful, find another broker.

You can choose a proper broker for your trading style using a plethora of parameters in our forex brokers section.

How to develop a trading plan

Sometimes there is a misconception that you need highly evolved market knowledge and years of trading experience to be successful. However, we often see that the more information we have the more difficult it is to create a clear plan. More information tends to create hesitation and doubt, which in turn allows emotions to creep in. This can prevent you from taking a step back and looking at a situation subjectively.

If you don’t know where you are going, any road will get you there. In trading, if you don’t set out a plan for your trades and develop strategies to follow you have no way to measure your success. The vast majority of people do not trade to a plan, so it’s not a mystery why they lose money. Trading with a plan is comparable to building a business. We are never going to be able to beat the market. In general it’s not about winning or losing, it’s about being profitable overall.

Why a trading plan is important

When trading, as in most endeavors, it’s important to start at the end and work backwards to create your plan and figure out what type of trader you should be. The most successful traders trade to a plan, and may even have several plans that work together. Always write things down. Why? Because it will help you stay focused on your trading objectives, and the less judgment we have to use the better. A plan helps you maintain discipline as a trader. It should help you trade consistently, manage your emotions, and even help to improve your trading strategy. It is also important to use your plan. Many people make the mistake of spending all their time creating a plan, then never implementing it.

Key components to develop a trading plan

- Trading plan structure and monetary goals

- Research and education

- Strategy using fundamental and technical tools

- Money and risk management

- Timing

- Trade mechanics, documentation, and testing

How to build a trading plan

Make sure you do your own research and build a plan according to your needs. Find confidence in what you know. The tools you have selected for your strategy are key, from the type of chart to the specific drawing tools to even the most elaborate of strategies. Test your plan in the beginning to make sure you are on the right track. After you have begun trading, continue testing it regularly. This allows you to measure your success by clearly seeing what works and what does not work. From there you can tweak elements that might be weaker and not contributing to your overall goal. Ask yourself the following questions (the answers to these will assist you in the foundation for your trading plan and should be referred back to regularly to insure that you are on track with your plan.)

Why am I trading?

If your immediate answer is, “to make money” you should stop right there. If the only goal is to make as much money as fast as we can, we are ultimately doomed, because it will never be enough. Managing your losses should be your primary goal. This will create an environment in which profits can be generated.

What is your motivation?

Solid retirement? New career? Spend more time with family and friends?

Ask yourself, “what are my strengths and weaknesses?”

- How do I maximize my strengths to minimize my weaknesses?

- An example of a weakness is a need to constantly watch one’s trades. Is your laptop on the pillow, waking you up in the middle of the night to monitor trades? It’s really difficult to make intelligent decisions when you’re half awake.

Is the amount of money I have to trade with sensible to achieve my goals?

Look at things in percentages; remember leverage is a double-edged sword. That is why risk and money management are key.

Deciding what type of trader you are can be tough; especially since the trader you want to be can be very different from the type of trader you should be based on your behaviors and characteristics. Once you have laid out your goals, risk appetite, strengths, and weaknesses it should become apparent which type of trading fits you best. You will notice three columns in the chart; they are labeled short, base and long. Base equals the timeframe charts you spend the majority of your time, if you are not sure, this is the timeframe chart that you keep going back to. Short and long are the timeframe charts that you refer to confirming or denying what is happening in the base timeframe chart. A common mistake traders make is jumping around randomly between chart timeframes.

How to match your goals to a trading style

Once you decide what type of trader you are, you should begin to invest yourself into education and research. Make continual learning a priority, each person’s strategy or methodology is unique and cannot be duplicated. Therefore your plan is most successful when it is based on your individual needs. Evaluate your needs and the effort required. Make sure you understand why you are placing trades. An initial investment maybe monetary but will benefit you over the long-term. Time and research should be continuing investments. Research by way of following current global events and keeping up to date on current analysis tools will help educate you further on all aspects of trading. Ask yourself, “am I a fundamental or technical trader?”

Creating a strategy using fundamental and technical tools is key, but we first need to learn a little about each of these types. Some traders choose to use fundamental analysis to assist with their trading decisions. This type of analysis is based on the news. News can be considered anything ranging from economic, political, or even environmental events. As a result, fundamental analysis is much more subjective.

Other traders may choose to use technical analysis to drive their trading decisions. This type of analysis is more definitive and relies more on the math and probabilities behind trading. The specific type of analysis used can be an indicator. They could be either leading or lagging. There are very few leading indicators available, which may give an idea of where the market is going to go. Fibonacci is the most popular, but most misused and misunderstood.

After determining some of the types of analysis you will use, it’s time to develop a trading strategy. This can be through fundamental analysis, technical analysis, or a combination of both. It is key that you develop a strategy and include it as a part of your trading plan.

A strategy is a step-by-step systematic approach to how and when we are going to use tools developing a sequence of analysis. Here is what we can expect to see in a trading strategy:

- The types of analysis tools (fundamental, technical, or both)

- When and how the analysis tools will be used

- The timeframes to use the tools

- The sequence of analysis

- High probability trade, description of what to look for

- Types of orders to use

This sequence will lead us to what a high probability trade looks like visually based on the indicators and analysis we are using. Since we have what we need for our strategy, let’s take a look at the money and risk management side of trading.

Talking about money and risk management can be a difficult step for many people. Trying to determine what your risk tolerance is can be even harder. Ask yourself, “how much money do I really have to trade with?” be honest with what is truly available to you. One mistake that people make is thinking that trading is an investing or holding activity, and keep depositing money. Trading is not a deposit and hold activity. Liquidation can and does happen when 100% of the total margin requirement of all open positions is no longer met. Those who make money may not have more winning trades than losing; they may just manage their losing trades so the winning ones make them profitable overall. It can be easier to win fewer times and still be profitable. A common characteristic of new traders is to quickly take profits but let losing trades run, consequently they have to maintain a higher risk to reward ratio.

Let’s think in terms of probability. It is helpful to use the 3% rule and always have a cushion. This is an example of the 3% rule in action: 3% on a $10,000 account is equal to $300 risk per trade. Then divide the cost of risk by the account equity, to get the number of losing trades or $10,000/$300 or 33.3 trades. These answers will help you determine if you can meet your goals. It allows you to give yourself room for flexibility. Traders limit their trading and the plan if there is not enough room for the losses. When developing your trading plan and approach it’s important to take other costs into consideration, some may have more of an impact than others, but all contribute to your investment in a trading plan. Assuming we have the right strategy decided and how much equity to risk, let’s figure out timing.

Timing when trading can be everything. When do the markets open? When do they close? What instruments (like currency pairs) am I trading? Some markets are open when others are closed or they may overlap. Here are the open and close times for some of the major markets. More volatility occurs at market opening and closings but also when reports or news are released. The beauty of trading some instruments is the ability to trade them even if the market you physically reside in is closed. The illustration below shows the overlap of markets that are open. Notice the times where more than two markets are open simultaneously. From 8am eastern time or 1pm GMT to 12pm eastern time or 5pm GMT, it displays the most markets open globally. Picking your times to trade or watch the market maybe easier since there is likely a market open somewhere in the world.

It’s important to answer the tough questions first, that is what will separate you from the vast majority of those losing money trading.

Make sure you are prepared, continued research and education will be your best weapon in your continued success.

So, let's see, what we have: here is the exact step to start forex with $100 with MT4, MT5 platforms. Features like daily analysis, forex market research, with 24/5 helpline. At $100 forex trading plan

Contents of the article

- Top-3 forex bonuses

- How to trade forex with $100 in just 5 minutes...