How to fund a trading account

The company behind is earn2trade LLC, with a registered office in 30 N gould st.

Top-3 forex bonuses

STE 4000, sheridan, WY 82801.

- Topsteptrader 20% discount (automatic discount on all account sizes - ignore the popups on their site, my automatic discount is higher)

The best funded trader program of 2021

Funded trading accounts offer the best of both worlds. You can make money doing something you love, while at the same time not risking any of your capital. A funded trader program is especially appropriate for beginners. But what is the best funded trader program? Let's go through the list of all providers, their pros and cons.

Transparency: we may get compensated when you click on links in this article.

Best funded trader programs

- Best for trading futures: topsteptrader

- Best for trading forex: topstepfx

- Best newcomer: earn2trade

What makes a good funded trader program?

Good funded trader programs help you to get started by offering education, webinars, and support. At the same time, excellent institutional-grade trading platforms and trustworthy funded trading account partners are important.

Are funded trader accounts worth it?

The main benefit of funded trader accounts is the limited risk factor. There is a small monthly fee for real-time data and the platform. In return, you gain access to a funded account once you proved that you have the right skills needed to be successful. Once you got funded, you keep up to 80% of the profit and request a payout to your checking account.

7 best funded trader programs

1. Topsteptrader

As an industry leader and one of the fastest-growing companies in the united states, topsteptrader has the brand-power and reputation that traders trust. To participate in its funded account program, you first need to complete the trading combine. Here, you enter a real-time simulated futures account with $30,000 to $150,000 of paper currency to test if you're ready for the real thing.

- You can apply the software, make profits and control against large drawdowns

- You show consistent profitability and manage risk in the process

- Complete steps 1 and 2 in at least 15 days

Other requirements include:

- You meet your accounts profit targets

- You only trade permitted products during permitted times

- You do not hit or exceed the daily loss limit

- You do not hold positions into major economic releases

- You follow topsteptraders scaling plan

So let's assume you have what it takes. Once you complete the trading combine, you enter the funded trader program. Here, the topsteptrader team allocates capital to your account and lets you trade in real-time with zero personal risks.

So what happens when you start trading?

- You keep your first $5,000 in profits and 80% thereafter

- You can expand your asset-base to include trading EUREX products

- You can withdraw your profits at any time, and there is no wire fee for withdrawals over $500

- Your trades have zero commissions and zero clearing fees using tstrader.

Topsteptrader discloses the official company name and address on their website: topsteptrader, LLC, 130 south jefferson suite 200, chicago, illinois 60661.

We recommend starting with the free trial topsteptrader provides.

Limited time offer

- Topsteptrader 20% discount (automatic discount on all account sizes - ignore the popups on their site, my automatic discount is higher)

For a detailed look at the entire service, check out our complete topsteptrader review.

2. Topstepfx

Currency specialists rejoice, this one's for you. As the currency wing of topsteptrader above, topstepfx funded accounts have the same eligibility requirements. First, you need to complete the trading combine and demonstrate you can apply toptrader's software, implement a winning strategy and manage risk at the same time.

It's a necessary step to ensure that toptrader's capital is safe in your hands. Once you start trading, you keep your first $5,000 in profits and take home 80% of your winnings thereafter. You can also withdraw your profits at any time, and there is no wire fee for withdrawals over $500

Now, what separates topstepfx from topsteptrader?

Well, topstepfx funded account balances include buying power of up to $500,000.

And how is this done? In a word - leverage. Currency positions have leverage ratios as high as 100:1. Compared to topsteptrader, the excess leverage with topstepfx is extremely risky. However, as we mentioned, it's not your money.

With topstepfx financing the positions, you can always trade risk-free without worrying about reprisal. Keep in mind, you do need to prove your skills first. If you're a profitable currency trader that lacks the capital to make major moves, a topstepfx funded trader program may be just what you're looking for.

Topstepfx belongs to topsteptrader, and their company name, address and phone are visible on the website: topsteptrader, LLC 130 south jefferson suite 200 chicago, illinois 60661.

Limited time offer

- Topstepfx 20% discount (automatic discount on all account sizes - ignore the popups on their site, my automatic discount is higher)

For a top-to-bottom rundown of all the service has to offer, see our topstepfx review.

3. Earn2trade

Earn2trade offers two different funded trading programs. The gauntlet program and the gauntlet mini program.

The regular gauntlet program is focused on trading the futures market, where you manage a $25,000 virtual account for 60 days. During this time, you have to trade at least 30 calendar days and once per week. Your target is to reach the 10% profit target and never hit the 10% maximum drawdown.

Successful candidates receive a guaranteed funding offer from their partner helios trading partners.

The new gauntlet mini is a program similar to topsteptrader and oneup trader. You pay a monthly fee, and you have to trade according to the rules. Trading lessons, webinars, and access to journalytix (TM) are included in the monthly price.

After completion, you receive an offer for a funded trading account. Both programs come with an 80%/20% profit split, where you keep the 80%.

The company behind is earn2trade LLC, with a registered office in 30 N gould st. STE 4000, sheridan, WY 82801.

Limited time offer

- Earn2trade 50% discount on the 50k account, 20% discount on any other account sizes.

You find all details and a platform walk-through in the comprehensive earn2trade review.

Let's get it straight, the list of the best funded trader programs already ends after the top 3. Topsteptrader, topstepfx and earn2trade programs begin at about $100 per month. All of the following funded trading account providers offer educational packages along with a potential option to let you trade a funded account at some given time.

Those vendors ask you to pay prices from $2,000 all the way up over $15,000, and some of them do not reveal their company address.

If you are looking for a funded trader account with an excellent price-performance ratio, you may focus on the top 3:

- Topsteptrader (futures trading) topsteptrader free trial or 20% off (automatic discount at the checkout - ignore the popups on their site, my automatic discount is higher)

- Topstepfx (forex trading) topstepfx 20% discount (automatic discount at the checkout - ignore the popups on their site, my automatic discount is higher)

- Earn2trade (futures trading) earn2trade 20%-40% discount (discout applied automatically).

4. Oneup trader

Whether if you just starting out or a seasoned professional, onup trader offers a platform where you can showcase your skills and make some money along the way.

There are two steps to get started:

- Get evaluated

- Get funded

The evaluation process begins with oneup's trading evaluation program. The team puts you through a real-time day trading simulator where you can trade, track, measure and showcase your abilities.

Once you pass the evaluation, you get introduced to oneup's funding partners. Once you start trading, the first $8,000 in profits are yours to keep, and after that, you take home 80% of all winnings.

What are some other benefits?

- Choose funding options from $25,000 up to $250,000

- Simplified funding goals with no hidden fees or fine print

- Trade from home, your favorite coffee shop or wherever you want

- Advanced analytics and data that help you become more successful

- Discuss, collaborate and share ideas with one-up trader's community members

- Full transparency and disclosure regarding all services and requirements

Unfortunately, oneup trader does not disclose any information about the company and their address and contact data on the website. Also, there is no information available on what company will fund your account and how many traders got funded so far.

The oneup trader review covers every detail about the funded accounts, but again, the missing information about the company details and ways to contact them should let you become more cautious.

5. Maverick trading

As one of the top prop trading firms out there, maverick trading offers the opportunity to learn from its experts and - if you have what it takes - join the firm as a full-time trader.

Specializing in equities, options and forex, the team offers support, technology and training that help you every step of the way.

So how do you get funded?

- Submit your application

- Improve your skills using maverick's trading simulators, tests and strategy courses

- Prove your skills by showing you can implement the trading plan, manage risk and produce profits

- Receive a funded account where you keep 70-80% of your profits and get paid every month.

Through its dedicated team, maverick trading promotes diversity, respect and transparency.

Before officially joining the firm, the team will outline all expectations as well as discuss the inherent risks of day trading.

Compared to the top three above, the pricing is significantly higher since they include more extensive education in their program costs. You need about $6,000 to get started and you need to put $5,000 of your own funds at risk once you get funded.

For more information on what all that means, see the maverick trading review.

6. Try day trading

Trydaytrading can cost you more than $15,000! When you first begin the try day trading funded trader program, the team starts by outlining the two most important ways to reduce risk:

- They assign a professional trading coach that teaches you how to trade

- They provide access to try day trading's proprietary leading indicator software

They also offer a 30-day trial. Anyway, the 30-day trial costs you more than $400. A bit hefty for a trial period! And more than $15,000 for their main service seems to be too expensive. Remember, for that money, you could use topsteptrader's trading combine about 150 times!

There is no company name mentioned on their website, only the address in utah. The google reviews seem to be good at first, but clicking on the details you notice that a curious pattern.

The detailed try day trading review covers all of the bells and whistles.

7. Tradenet

Tradenet is not available to residents in the united states. With four pricing options, you can decide which tradenet funded trader program is right for you. Led by meir barak, the site states that it has educated over 30,000 students worldwide on how to become better traders.

All of the funded account programs come with a 14-day money-back guarantee. That way, you can test out the service risk-free before deciding if you want to continue on. The costs are relatively high compared to the competitors mentioned in this best funded trader program comparison.

Please, also keep in mind that tradenet does not offer those funded accounts themself. Instead, they connect you with investment firms once you purchased one of their educational packages.

I found various addresses; one is limassol cyprus, one in israel and the united kingdom.

If you're interested in learning more about tradenet's funded trader programs as well as its education courses and live trading chat room, check out our tradenet review.

Funded trader program summary

There's no doubt funded trader programs have plenty of benefits. Many providers offer exceptional service and can be a great addition to your trading toolkit. Whether it's access to advanced software or the idea of using someone else's money to trade - funded accounts offer a risk-free way to compete against the best.

More importantly, the knowledge you obtain is invaluable. Considering their own money is at stake, providers will do everything in their power to ensure you succeed. They don't want you draining their bankroll, right?

So what this means for you is:

- Greater guidance,

- Mentorship and

- Coaching compared to other services.

As well, when competing in the arena, you're surrounded by other advanced traders. This will help you increase your skill-set and have you climbing up the ladder in no time.

When deciding between the options above, you really can't go wrong with most of them.

Topsteptrader is the market leader and receives our highest rating, followed by topstepfx, and earn2trade.

I am a bit undecided about maverick trading, tradenet, oneup trader and try day trading. The reason is that for some you have to pay between 2,000 and $16,000 to join their programs, some do not disclose any contact and company details.

Their prices are higher because they included extensive trading education courses in their funded trader programs. So it depends on you what you want to trade and what your focus is. If you are looking purely for a funded trader account, then topsteptrader and earn2trade are the best choices.

If you are looking for excellent education, then I recommend you to read my comprehensive best trading courses blog post. And if you really consider joining the expensive funded trader programs, then make sure to read the detailed reviews first.

How to fund a trading account

Acceptable deposits and funding restrictions

Acceptable deposits

You may deposit between $50 and $150,000 when funding a new account with electronic funding through the online application. Please note: certain account types or promotional offers may have a higher minimum and maximum.

You may deposit up to $250,000 per day when depositing funds to an existing account. There is no minimum.

Transactions must come from a U.S. Bank account in U.S. Funds.

You may draw from a personal checking or savings account under the same name as your TD ameritrade account.

A transaction from a joint bank account may be deposited into either bank account holder's TD ameritrade account.

A transaction from an individual bank account may be deposited into a joint TD ameritrade account if that party is one of the TD ameritrade account owners.

A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Maximum contribution limits cannot be exceeded. We do not provide legal, tax or investment advice. Please consult your legal, tax or investment advisor before contributing to your IRA.

Funding restrictions

ACH services may be used for the purchase or sale of securities.

Funds may post to your account immediately if before 7 p.M. ET; next business day for all other. You can then trade most securities.

For ACH and express funding methods, until your deposit clears—which can take 3-4 business days after posting—we restrict withdrawals and trading of some securities based on market risk. This includes—but isn’t limited to—options, cryptocurrency, cannabis securities, some foreign securities and most stocks priced under $5 per share.

All electronic deposits are subject to review and may be restricted for 60 days.

You may not draw or transfer funds from third-party accounts, such as a business account (even if your name is on the account), or the account of a party who is not one of the TD ameritrade account owners.

Not all financial institutions participate in electronic funding. Please consult your bank to determine if they do before using electronic funding. You may be charged an ACH return fee if your bank rejects the transfer. Please note: a transfer reject may occur subsequent to account opening and/or after your account is credited for the amount of your electronic funding request.

Wire transfer

Fund your TD ameritrade account quickly with a wire transfer from your bank or other financial institution.

Standard completion time:

There is no minimum initial deposit required to open an account. To avoid a rejected wire or a delay in processing, include your active TD ameritrade account number. Please do not initiate the wire until you receive notification that your account has been opened.

Standard completion time:

If your bank is located in the united states

ABA transit routing # 121000248

TD ameritrade clearing, inc.

Your nine-digit TD ameritrade account number

* required for timely and accurate processing of your wire request.

Please contact TD ameritrade, and not wells fargo bank, with questions or concerns about a wire transfer. Please do not send checks to this address.

If your bank is located outside the united states

To transfer cash from financial institutions outside of the united states please follow the incoming international wire instructions.

International currency wire requests: TD ameritrade receives a referral fee from a third-party service provider on eligible currency exchange transactions. To facilitate the currency exchange process, banks receive revenue based on an assessed currency markup rate.

Acceptable deposits and funding restrictions

Acceptable deposits

Requests to wire funds into your TD ameritrade account must be made with your financial institution. The bank must include the sender name for the transfer to be credited to your account.

A rejected wire may incur a bank fee. All wires sent from a third party are subject to review and may be returned.

A wire from a joint bank/brokerage account may be deposited into a TD ameritrade account by either or both of the joint account owners.

A wire from an individual bank/brokerage account may be deposited into a joint TD ameritrade account if that person is one of the TD ameritrade account owners.

Wire transfers that involve a bank outside of the U.S. Require an intermediary U.S. Bank. The name, address, and SWIFT or sort code of the intermediary bank must be included.

We are unable to accept wires from some countries.

Check

Simply send a check for deposit into your new or existing TD ameritrade account.

Standard completion time:

Use mobile app or mail in

Mobile-friendly

Mobile deposit

Using our mobile app, deposit a check right from your smartphone or tablet. Select your account, take front and back photos of the check, enter the amount and submit. There are no fees to use this service.

Mobile check deposit not available for all accounts. Other restrictions may apply. See mobile check deposit service user agreement for complete terms and conditions.

Standard completion time:

Less than 1 business day

Mailing checks:

Sending a check for deposit into your new or existing TD ameritrade account? Make checks payable to "TD ameritrade clearing, inc." (except third party checks)

For non-iras, please submit a deposit slip with a check filled out with your account number and mail to:

Regular mail: PO box 2760, omaha, NE 68103-2760

Overnight mail: 200 S 108th ave., omaha, NE 68154-2631

For iras, please submit an IRA deposit slip with a check filled out with your account number and mail to:

Regular mail: PO box 2789, omaha, NE 68103-2229

Overnight mail: 200 S 108th ave., omaha, NE 68154-2631

Standard completion time:

Acceptable deposits and funding restrictions

Acceptable check deposits

We accept checks payable in U.S. Dollars and through a U.S. Bank, as well as checks written on canadian banks. Checks written on canadian banks can be payable in canadian or U.S. Dollars.

Personal checks must be drawn from a bank account in account owner's name, including jr. Or sr. If applicable.

Checks from joint checking accounts may be deposited into either checking account owner's TD ameritrade account

Checks from an individual checking account may be deposited into a TD ameritrade joint account if that person is one of the account owners.

For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD ameritrade account.

Third party checks (e.G. Husband, wife, business, etc.) payable to TD ameritrade account owner and endorsed over to TD ameritrade can also be made payable to TD ameritrade clearing, inc. / FBO the TD ameritrade account owner and the TD ameritrade account number. "FBO" stands for "for the benefit of."

example: TD ameritrade clearing, inc. / FBO your name

Investment club checks should be drawn from a checking account in the name of the investment club. If a member of the investment club remits a check in their name, the check must be payable to: "TD ameritrade clearing, inc. / FBO the investment club name."

You can deposit checks written on canadian banks using a printable form for non-IRA deposits or IRA deposits.

Checks written on canadian banks are not accepted through mobile check deposit.

Unacceptable deposits

Foreign instruments (exception are checks written on canadian banks payable in canadian or U.S. Dollars)

Thrift withdrawal orders

Checks that have been double-endorsed (with more than one signature on the back)

Third party checks not properly made out and endorsed per the rules stated in the "acceptable deposits" section

Checks dated over six months old

Please note: there may be other situations when a remittance is unacceptable.

Availability of funds

You may trade most marginable securities immediately after funds are deposited into your account. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering (IPO) stocks or options during the first four business days. This holding period begins on settlement date.

Account transfer from another firm

Transfer stocks, options, etfs and other assets into your TD ameritrade account from another firm.

Standard completion time:

Retirement rollover ready

Transfer assets from another brokerage firm

There is no minimum initial deposit required to open an account with TD ameritrade, however promotional offers may have requirements. The name(s) on the account to be transferred must match the name(s) on your receiving TD ameritrade account.

After you log in, please go to my account > account transfer and submit a separate transfer request for each account you are requesting to transfer. Include a copy of your most recent statement.

Standard completion time:

Retirement account transfer (roll over 401(k) or IRA)

The name/title of your new TD ameritrade account must be the same as the name/title of the account at the firm you are transferring from.

A rollover is not your only alternative when dealing with old retirement plans. Learn more about rollover alternatives or call 800-213-4583 to speak with a retirement consultant.

Standard completion time:

The money is still in your former employer's account

Call your plan administrator (the company that sends you your statements) and let them know you want to roll over assets to your new TD ameritrade account.

Ask your administrator to mail a check made payable to "TD ameritrade clearing, inc., for the benefit of your name, account number: xxxxxxxxx".

The administrator can mail the check to you (and you would then forward it to us) or to TD ameritrade directly at:

How do you fund a forex account?

The forex (FX) market is where currencies from around the world are traded. A foreign exchange account is typically what is used to trade and hold foreign currencies online. Using these accounts is easier than it has ever been in the past. Typically, you will just need to open a new account, deposit the amount of money you choose in your country’s currency, and then you are free to sell and buy currency pairs as you see fit.

Key takeaways

- Forex accounts are used to hold and trade foreign currencies.

- It is easier than ever for individuals to participate in forex trading, due to the development of margin accounts and electronic trading.

- You can invest in forex with as little as $1,000.

- The biggest difference between trading equities and trading on forex is the amount of leverage required.

- Forex accounts can be funded by credit card, wire transfer, personal check, or bank check.

In the past, currency trading was limited to certain individuals and institutions. That's because the funds required to play were significantly higher than for any other investment instrument. However, with the development of electronic trading networks and margin accounts, requirements have changed. Although nearly 75% of forex trading is still done by large banks and financial institutions, individuals are now able to invest in forex with as little as $1,000—thanks in large part to the use of leverage. Despite these changes, making high returns on highly-leveraged currency trades can be difficult, and will require a good amount of patience and skill.

How forex trading works

By using a margin account, investors essentially borrow money from their brokers. Of course, margin accounts can also be used by investors to trade in equity securities. The main difference between trading equities and trading forex on margin is the degree of leverage that is provided.

For equity securities, brokers usually offer a 2:1 leverage to investors. On the other hand, forex traders are offered between 50:1 and 200:1 leverage. This means that traders need to deposit between $250 and $2,000 to trade positions of $50,000 to $100,000.

Learning the ins and outs of investing in a market that contains foreign currencies can be a useful skill to develop in today’s hyper-connected world.

How to fund a forex account

Forex traders are usually given several options when deciding how they will deposit funds into trading accounts. Credit card deposits have by far become the easiest way. Since the development of online payment services, digital credit card payouts have become increasingly efficient and secure. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day.

Investors can also transfer funds into their trading accounts from an existing bank account or send the funds through a wire transfer or online check. When choosing to perform a wire transfer, keep in mind that most banks will charge about $30 per wire, and there may be a delay of two to three days before the amount will show in the recipient’s account for the first transfer performed.

Traders are also usually able to write a personal check or a bank check directly to their forex brokers. The only problem with using these other methods is the amount of time that is needed to process the payments. For example, paper checks can be held for up to 10 business days (depending on the individual’s bank and the state) before being added to a trading account.

Transfer of funds to your trading account

Very common question when opening such account is, whether one should fund it from his own account? The answer is definitely yes.

Regulations you need to adhere to dictate that any funds invested need to come directly from your name and your name only, into an account that is set up in your name and your name only. You cannot use a check from a friend or family member to fund your account.

The best way to fund your account is via a bank wire or credit card directly from your checking or savings account.

A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Wire transfers are fast and highly secure.

Sending money to a trading account via credit card or debit card is easy, secure and the fastest way to fund your trading account and start to trade.

FAQ

What is the fastest way to fund my trading account?

Most of traders fund their trading accounts with a credit card. It`s the fastest way. Almost immediately you will see your money on your trading account. It`s cheaper than classic bank wire transfer. Online brokers do not charge any commission on your deposits.

Can I later send more funds to my trading account?

Yes, you can. In case that traders are satisfied with the services of the chosen online broker they fund their accounts over again.

Don`t I have to worry about entering a credit card number and a CVV code?

You don`t have to worry about the safety. All online brokers have completely safe online payment methods. It cannot be misused and it`s completely safe and most common way of funding accounts.

What if I enter the credit card information, click on deposit and I don`t see the money on my trading account?

Most likely you don`t have allowed payments over the internet. You have to request your bank to allow the internet payments. Don`t worry about abuse. The money stayed in your bank account.

How to withdraw my money?

Most online brokers have an easy way how trader can withdrawal their money. You have just to fill an easy withdrawal form and your money will be send to your bank account back.

Deposit and withdrawal of your invested money is safe in case you choose licensed and regulated broker. Your money is safe.

Fund my account

Four easy ways to fund

Up to three business days 1

Transfer money is a free service that allows you to move money between E*TRADE accounts and from outside financial institutions.

A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions.

Transferring an account simply means moving all of your assets (cash and securities) from an outside financial institution to E*TRADE.

Up to five business days

Choose from two convenient ways to deposit checks into your account: by mobile check deposit 2 using our E*TRADE mobile app or by mail.

Transfer money is a free online service that allows you to move money between E*TRADE accounts and from outside financial institutions. It's easy, convenient, and 100 percent protected by our exclusive E*TRADE complete protection guarantee.

- Select the appropriate accounts from the from and to menus and enter your transfer amount.

Enter the date you want the transfer to occur in the date field.

В

funds availability

Funds are available for investment immediately.

Funds are available for withdrawal by:

- 2nd business day if submitted by 4 p.M. ET, and

- 3rd business day if submitted after 4 p.M. ET.

Funds are debited within 2-3 business days from E*TRADE bank/ brokerage account

Check the status of your request in transfer activity. You'll also receive updates online via alerts.

Wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. Wire transfers are fast and highly secure.

Wire money to your E*TRADE securities account:

- Complete and print out our E*TRADE securities wire transfer form.

- Send the completed form to your other financial institution and ask them to wire funds to E*TRADE securities.

The receiving institution information:

E*TRADE securities LLC

PO box 484

jersey city, NJ 07303-0484

ABA routing number: 056073573

- The amount you want to wire

- Your eight-digit E*TRADE securities account number. (your account number can be found on the complete view page when you first log on.)

- Your name and address

Wire money to your E*TRADE bank account:

- Complete and print out our E*TRADE bank wire transfer form.

- Send the completed form to your other financial institution and ask them to wire funds to E*TRADE bank.

The receiving institution information:

E*TRADE bank

c/o E*TRADE financial corporation

PO box 484

jersey city, NJ 07303-0484

ABA routing number: 256072691

- The amount you want to wire

- Account number (if it's a new account, use your social security number instead)

- The name, address, and phone number of the primary account holder

If your financial institution is located outside of the united states

The receiving institution information:

Wells fargo bank, N.A.

420 montgomery street

san francisco, CA 94104

SWIFT code: WFBIUS6S

for the benefit of: E*TRADE securities

ABA routing number: 056073573

- The amount you want to wire in US dollars

- Your eight-digit E*TRADE securities account number

- Your name and address

Same business day if received before 6 p.M. ET

Check the status of your request in the transfer activity. You'll also receive updates online via alerts.

Transferring an account simply means moving all of your cash or securities from an outside financial institution to E*TRADE. Consolidating assets will simplify your life and make managing your finances much easier with the value, tools, and guidance E*TRADE provides.

NOTE: this option is only available for funding brokerage accounts.

Log on and use our easy transfer an account feature for the quickest delivery. It will guide you step-by-step through the process.

You'll want to have the following information from your monthly statement handy:

- The name of the delivering financial institution

- Your account number at that financial institution

- The registration (ownership of the account)

If you prefer, or if you are changing the account registration, you can complete our paper account transfer form and mail it to the address provided.

Funds availability

Due to COVID-19, processing of deposits by mail may be subject to delays. For convenience, we recommend using the E*TRADE mobile check deposit feature.

Choose from two convenient ways to deposit checks into your E*TRADE bank or E*TRADE securities brokerage account.

Mobile check deposit

Use the E*TRADE mobile app to securely deposit checks directly into your E*TRADE account. 2

- Launch E*TRADE mobile and go to check deposit

- Enter the amount and select your account

- Sign the back of the check and write "for electronic deposit only at E*TRADE" next to or underneath your signature

- Snap a picture of the front and back of your endorsed check

- Tap submit to make your deposit

Download E*TRADE mobile

Mail a check

For checks made payable to E*TRADE (E*TRADE securities, LLC or E*TRADE bank):

- Write your eight-digit account number on the memo line.

- Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature.

- Attach a deposit slip (if you have one)

For checks made payable to you:

- Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature.

- Attach a deposit slip (if you have one)

Mail your brokerage deposits to:

Regular US mail

E*TRADE securities LLC

PO box 484

jersey city, NJ 07303-0484

Overnight mail

E*TRADE securities LLC

harborside 2

200 hudson street, suite 501

jersey city, NJ 07311-1113

Mail your bank deposits to:

Regular US mail

E*TRADE bank

attention: deposit operations

c/o E*TRADE financial corporation

PO box 484

jersey city, NJ 07303-0484

Overnight mail

E*TRADE bank

harborside 2

200 hudson street, suite 501

jersey city, NJ 07311-1113

Funds deposited to your brokerage account will be available for investing or withdrawal on the fourth business day after the date of deposit (items received prior to 4 p.M. ET). For funds deposited to your bank account, generally the first $225 will be available on the first business day after the date of deposit (items received prior to 4 p.M. ET), an additional $5,300 will be available on the second business day after the date of deposit, and the remaining amount will be available on the fourth business day after the date of deposit.

Checks, drafts, and securities certificates can also be deposited to your brokerage account in person at many of our E*TRADE branches nationwide (not available for bank deposits).

Check the status of your request in the transfer activity. You'll also receive updates online via alerts.

ETRADE footer

About us

Service

Quick links

Connect with us

Check the background of E*TRADE securities LLC onв FINRA's brokercheckв andв see

E*TRADE securities LLC and E*TRADE capital management, LLCВ relationship summary.

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

Securities products and services offered by E*TRADE securities LLC. Member FINRA/SIPC. Investment advisory services offered by E*TRADE capital management, LLC, a registered investment adviser. Commodity futures and options on futures products and services offered by E*TRADE futures LLC, member NFA. Bank products and services offered by E*TRADE bank and E*TRADE savings bank, both federal savings banks and members FDIC. Stock plan administration solutions and services offered by E*TRADE financial corporate services, inc. All separate but affiliated subsidiaries of E*TRADE financial holdings, LLC.

Securities, investment advisory, commodity futures, options on futures and other non-deposit investment products and services are not insured by the FDIC, are not deposits or obligations of, or guaranteed by, E*TRADE bank or E*TRADE savings bank, and are subject to investment risk, including possible loss of the principal amount invested.

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors.

В© currentyear E*TRADE financial holdings, LLC, a business of morgan stanley. All rights reserved.В E*TRADE copyright policy

How to open a brokerage account: A step-by-step guide

The ascent is reader-supported: we may earn a commission from offers on this page. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

Choosing the right brokerage account can seem like a difficult process, but it doesn't have to be. By deciding what type of account you want, and then comparing several online stock brokers, you should be able to choose the one that best meets your needs.

Here's your step-by-step guide for opening a brokerage account:

- Determine the type of brokerage account you need

- Compare the costs and incentives

- Consider the services and conveniences offered

- Decide on a brokerage firm

- Fill out the new account application

- Fund the account

- Start researching investments

1. Determine the type of brokerage account you need

What are your investment objectives? If you simply want to invest for a rainy day or for a certain relatively near-term goal, and don't necessarily want your money tied up until you retire, a traditional brokerage account is the way to go. These accounts don't have tax advantages -- you may have to pay tax on investment profits and dividends -- but you are free to withdraw your money whenever you'd like. For this reason, a traditional, or standard brokerage account is often referred to as a taxable brokerage account.

If you choose a traditional brokerage account, your broker will likely ask if you want a cash account or margin account. If you choose to apply for margin privileges, this basically means that you can borrow money to buy stocks, with the stocks in your portfolio serving as collateral. You'll pay interest on the borrowed money, and there are some inherent risks involved with investing on margin that you should be aware of.

On the other hand, if your goal is to save money for retirement, an IRA is the best bet. Traditional iras can get you tax deductions when you contribute to them, but you won't be able to use your money until you're 59-1/2. Contributions to roth iras don't give you a tax benefit when you make them, but qualified roth IRA withdrawals will be tax-free. Plus, you can withdraw roth IRA contributions (but not your investment profits) whenever you want. Finally, if you're self employed, there are some special options for you, such as a SIMPLE IRA, SEP-IRA, or individual 401(k). You can read through a more thorough guide to help you pick the best IRA as well.

It's also worth noting that many people choose to open multiple brokerage accounts -- such as a taxable account and an IRA, in order to keep their money in separate baskets.

2. Compare the costs and incentives

These days, virtually all of the major discount brokers offer commission-free trading. They may also offer you a discount to reward you for certain actions, such as transferring a large investment account from another broker.

That said, it's important to review each online brokerage firm's full pricing schedule, particularly if you plan on trading anything other than stocks (options, mutual funds, etfs, bonds, etc.), as these often come with their own costs. For example, many brokers charge a commission in the range of $0.50 to $0.75 per options contract, so even if the broker doesn't charge a base commission, options trading won't exactly be free.

Finally, many brokers offer incentives in order to attract business, and you don't need to be a millionaire to take advantage of them. I'm not saying that a good incentive all by itself should sway your decision, but it's definitely a piece of the puzzle worth taking into consideration.

3. Consider the services and conveniences offered

Pricing isn't everything -- especially for new investors. Of course, all other things being equal, it's best to find the lowest price, but here are a few other things you need to consider when picking a broker:

- Access to research: many brokers provide their own stock ratings, as well as access to third-party research from firms such as standard & poor's and morningstar.

- Foreign trading: some brokers offer the ability to convert money in your account into foreign currencies in order to trade on international stock exchanges. If this is important to you, make sure the broker you choose allows this.

- Fractional shares: this can be especially important to new investors, as you don't necessarily need to be able to afford an entire share to start investing in your favorite stocks.

- Trading platforms: the various brokerages offer a wide variety of trading software and mobile apps, and many actually allow people to test out their platforms before opening an account. For example, fidelity offers a demo version of its active trader pro platform for prospective clients to test-drive. Also, read some reviews of brokers' mobile apps if being able to access your account on the go is important to you.

- Convenience: some brokerages have large networks of local branch offices you can visit for face-to-face investment guidance, while others do not. For example, merrill edge customers can get one-on-one advice and guidance at more than 2,000 bank of america locations. Also, brokerages operated by banks offer customers the ability to connect their brokerage and checking accounts, transferring money between the accounts in real-time -- and may offer some sort of "relationship discount" for doing so. For this reason, it's also a good idea to check if your bank has an online brokerage, even if it's not mentioned here.

- Other features: this isn't an exhaustive list, so before you choose a broker, be sure to spend some time on its website exploring what it offers.

4. Decide on a brokerage firm

You've gathered your information about various firms' costs, fees and the conveniences they offer. For each brokerage, you should weigh the pros and cons as they pertain to your investment objectives, and determine which broker is right for you.

For more information, check out our top picks for the best brokerage accounts for beginners.

5. Fill out the new account application

You can apply to open a new account online, and this is generally a quick and painless process with online brokers. You'll need some identifying information, such as your social security number and driver's license. You may need to sign additional forms if you're requesting margin privileges or the ability to trade options, and the broker will need to collect information about your net worth, employment status, investable assets, and investment goals.

6. Fund the account

Your new online broker will probably give you a few options to move money into your account, including:

- Electronic funds transfer (EFT): transferring funds from a linked checking or savings account is a convenient way to fund the account. In most cases, the funds will post to the account on the following business day.

- Wire transfer: the quickest way to fund your account. Since a wire transfer is a direct bank-to-bank transfer of money, it often takes place within minutes.

- Checks: acceptable forms of check deposits and fund availability vary between brokers.

- Asset transfer: if you're rolling over a 401(k) or transferring existing investments from another broker, that's an acceptable funding method.

- Stock certificates: yes, these still exist. If you have a paper stock certificate, it can be deposited via mail into an online brokerage account.

As a final note, when funding your new account, be sure to keep your broker's minimums in mind. Many have different minimums for taxable accounts and retirement accounts, and they also may have different minimum requirements for margin accounts.

7. Start researching investments

Congratulations on taking the initiative and opening a brokerage account -- your future self will thank you for taking this important step on the road toward financial security.

Now comes the fun part: investing in stocks. Before diving in, it's a good idea to spend some time learning the basics of how to responsibly choose stocks, bonds, and/or funds, as well as how to create a well-diversified portfolio.

How to get the best funded trading accounts?

Fully funded trading account

A forex trading job is recognized to be one of the most challenging jobs in the market due to the sheer of variables that need to be considered before implementing any decisions.

The forex market is extremely volatile, and there are very few alternatives offered to traders to accumulate funds for their account. However, you don’t have to worry about money when you get selected to trade with a funded trading account. That happens when you show great experience and skill in making profitable trades, along with the consistency of your trade.

If you show a proprietary trading firm that you are skilled and talented, and can be counted among the top forex traders, you will get the chance to join some of the best-funded proprietary funds in the market.

What are funded trading accounts at A proprietary forex fund?

A forex funded trading account at a proprietary forex fund is one of the main goals for all forex traders because that is the pinnacle of their industry. There are a lot of great proprietary forex funds that are offering traders the chance to showcase their talent and skill with a funded trading account. At the5ers proprietary firm, we offer traders the chance to elevate their trading career to the next level. We offer traders with everything they need to be successful in forex trading , if they prove their skills, and have a track record of being a successful trader.

How to choose the best funded trading accounts?

Here are some important points to understand about how to choose a funded trading account, which traders tend to get confused about, or that firms manipulate the way they present them to confuse traders:

Share split

It is important to analyze this point together with the possible account size.

Most companies will offer 60% to 80% percentage of the profits for the trader in 100K to 300K accounts.

The5ers gives up to 1.28 million accounts with a 50%-50% split. So you keep a little less percentage of the profits, in a significantly larger trading account.

Remember that when you are taking the very same winning performance, the actual money-earning potential is what matters and not the percentage split.

Payout and growing terms

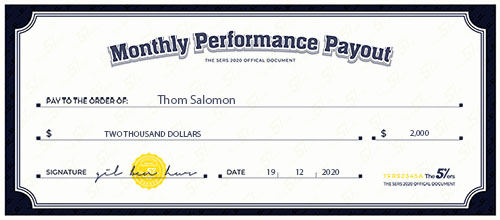

The5ers is the only fund that actually pays every month, no minimum, and no maximum applied.

The5ers is the only fund that pays and at the same time saves your milestone progression at the same level!

Meaning you pull out money every month, and you don’t hold your growth rate.

With other companies, you have to choose between taking the profits or leaving them for growth.

Terms

The duration & phases of the time you spend on being evaluated are also interesting to compare.

Most companies have 2 phases of testing before real funding and in most cases, those phases happen on demo accounts.

The5ers has only 1 evaluation phase, and it is actually on a live trading account. So practically you are already being funded – only with 1/4th of the account, you will get once you succeed. And you get paid for the profits made during the evaluation by the 50% split share.

Most companies will ask you to make a 10% profit on your evaluation account, in one month! Although it is possible to achieve, this objective doesn’t suit long term strategies and promotes overleveraging. With the 5ers you need to make 6%-7% in a maximum period of 6 months.

Weekends and nights

Look if you are allowed to leave open trades overnight and over the weekends.

Most companies won’t allow it.

The5ers.Com allows overnight and over the weekend trades, which is crucial for long term traders.

Recurring fees

In some companies, you will have to pay an initial fee plus a monthly fee.

With the5ers, there are no monthly payments. To get evaluated you only need to pay a one-time enrollment fee.

How to get qualified for a funded trading account

There aren’t any special qualities that qualify you for a funded trading account, other than proving your skills. You must show consistent results in forex trading and prove that your trading strategy is profitable. There are plenty of traders that get good results, but it can also be a fluke win, and to qualify for a funded trading account, you must showcase consistently profitable trades.

Sign up to evaluate your trading

When you sign up to trade with some of the best forex proprietary funds in the market, your trading style is going to be evaluated by the firm first. You will have to pay for the signup fee, but other than that there are no additional costs to be in a forex funded account program.

After a few weeks in testing, you will be totally in the risk-free trading zone

Once you have passed the initial evaluation, you will be tested for a few weeks, so that the proprietary firm can get a good feel of your trading style. Once you pass those few weeks, you will enter the risk-free trading zone, which is when you will be given your own funded trading account.

Get paid to trade forex

After proving yourself in the forex market with consistently profitable trades, you will earn the right to get paid to trade in the forex market. This is the best step for your trading career, as it allows you with the chance to test yourself among the best traders that are currently trading in the market.

Develop your trading career from home

When you get the chance to work with a forex funded account, your trading career is on the rise. It is best to choose a remote proprietary trading firm to work with, like the5ers, since they offer traders the chance to develop their trading career from home. This additional flexibility allows traders to trade in the market at their own time, and from wherever they choose to trade from.

Get high capital to trade

Once you are in the forex funded account program, you must keep showcasing your skills as a forex trader to climb even higher up the ladder. If you show great results while forex trading, then you will get a funded trading account with even bigger capital, so you can trade more. Only the top forex traders get that chance, and only after they apply the risk management requirements of the proprietary firm.

You can trade any trading strategy

One of the primary benefits of trading with a funded trading account is that you can trade any style without any fear of your style being compromised. You can choose any style, from scalping, day trading, to long-term position holding, swing trading, fundamentals analysis, or technical analysis trading strategies. The only thing you must keep in mind is that you must deliver profitable trades and results with your trading style.

Get your funded trading account with the5ers

There are a lot of forex proprietary firms in the market, but the5ers stands head and shoulders above them all. We are a remote proprietary trading firm, that offers some of the best forex proprietary trading funds on the market. Our forex funded account program has helped countless traders to develop their trading career, and if you are among the top forex traders in the market you should enroll now.

We have worked with some of the best forex traders in the market and offer them the following incentives, along with the best forex trading job.

Risk-free trading

Don’t risk your money anymore on the forex market. This is risk-free trading that allows you to not only think big but take more chances to get profitable trades in the market.

Develop a trading career

One of the biggest benefits of trading with our funded trading account is that we give all traders the chance to develop their careers. You will be assigned for the highest rewarding trading growth program, where you can build up your trading assets to make a substantial living.

Zero cost from your side

You don’t need to worry about the cost because there are none from your side when you work with the5ers funded trading account. You only pay for the signup fee and the rest is handled by the proprietary firm, so you get complete freedom to become the best trader you can.

Bring your own trading strategy

Worried about compromising your trading strategy? That isn’t even a consideration when you work with a funded trading account, because you have complete freedom as a trader to use your own trading strategy. That ensures that you don’t second guess yourself and keep using the trading strategies that made you successful.

Apply the fund risk management requirements to your own trading strategy

When trading with a forex funded trading account, you must follow the risk management requirements of the funded account. That ensures that you don’t take unnecessary risks that may jeopardize the capital in your funded account.

Final words about funded trading accounts

There are a lot of forex proprietary firms in the market today that are offering traders the chance to elevate their trading career. Choosing the right firm, like the5ers, will give you the chance to trade with some of the best forex traders in the industry.

If you want to receive an invitation to our weekly forex analysis live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our newsletter.

How to fund a trading account

Acceptable deposits and funding restrictions

Acceptable deposits

You may deposit between $50 and $150,000 when funding a new account with electronic funding through the online application. Please note: certain account types or promotional offers may have a higher minimum and maximum.

You may deposit up to $250,000 per day when depositing funds to an existing account. There is no minimum.

Transactions must come from a U.S. Bank account in U.S. Funds.

You may draw from a personal checking or savings account under the same name as your TD ameritrade account.

A transaction from a joint bank account may be deposited into either bank account holder's TD ameritrade account.

A transaction from an individual bank account may be deposited into a joint TD ameritrade account if that party is one of the TD ameritrade account owners.

A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Maximum contribution limits cannot be exceeded. We do not provide legal, tax or investment advice. Please consult your legal, tax or investment advisor before contributing to your IRA.

Funding restrictions

ACH services may be used for the purchase or sale of securities.

Funds may post to your account immediately if before 7 p.M. ET; next business day for all other. You can then trade most securities.

For ACH and express funding methods, until your deposit clears—which can take 3-4 business days after posting—we restrict withdrawals and trading of some securities based on market risk. This includes—but isn’t limited to—options, cryptocurrency, cannabis securities, some foreign securities and most stocks priced under $5 per share.

All electronic deposits are subject to review and may be restricted for 60 days.

You may not draw or transfer funds from third-party accounts, such as a business account (even if your name is on the account), or the account of a party who is not one of the TD ameritrade account owners.

Not all financial institutions participate in electronic funding. Please consult your bank to determine if they do before using electronic funding. You may be charged an ACH return fee if your bank rejects the transfer. Please note: a transfer reject may occur subsequent to account opening and/or after your account is credited for the amount of your electronic funding request.

Wire transfer

Fund your TD ameritrade account quickly with a wire transfer from your bank or other financial institution.

Standard completion time:

There is no minimum initial deposit required to open an account. To avoid a rejected wire or a delay in processing, include your active TD ameritrade account number. Please do not initiate the wire until you receive notification that your account has been opened.

Standard completion time:

If your bank is located in the united states

ABA transit routing # 121000248

TD ameritrade clearing, inc.

Your nine-digit TD ameritrade account number

* required for timely and accurate processing of your wire request.

Please contact TD ameritrade, and not wells fargo bank, with questions or concerns about a wire transfer. Please do not send checks to this address.

If your bank is located outside the united states

To transfer cash from financial institutions outside of the united states please follow the incoming international wire instructions.

International currency wire requests: TD ameritrade receives a referral fee from a third-party service provider on eligible currency exchange transactions. To facilitate the currency exchange process, banks receive revenue based on an assessed currency markup rate.

Acceptable deposits and funding restrictions

Acceptable deposits

Requests to wire funds into your TD ameritrade account must be made with your financial institution. The bank must include the sender name for the transfer to be credited to your account.

A rejected wire may incur a bank fee. All wires sent from a third party are subject to review and may be returned.

A wire from a joint bank/brokerage account may be deposited into a TD ameritrade account by either or both of the joint account owners.

A wire from an individual bank/brokerage account may be deposited into a joint TD ameritrade account if that person is one of the TD ameritrade account owners.

Wire transfers that involve a bank outside of the U.S. Require an intermediary U.S. Bank. The name, address, and SWIFT or sort code of the intermediary bank must be included.

We are unable to accept wires from some countries.

Check

Simply send a check for deposit into your new or existing TD ameritrade account.

Standard completion time:

Use mobile app or mail in

Mobile-friendly

Mobile deposit

Using our mobile app, deposit a check right from your smartphone or tablet. Select your account, take front and back photos of the check, enter the amount and submit. There are no fees to use this service.

Mobile check deposit not available for all accounts. Other restrictions may apply. See mobile check deposit service user agreement for complete terms and conditions.

Standard completion time:

Less than 1 business day

Mailing checks:

Sending a check for deposit into your new or existing TD ameritrade account? Make checks payable to "TD ameritrade clearing, inc." (except third party checks)

For non-iras, please submit a deposit slip with a check filled out with your account number and mail to:

Regular mail: PO box 2760, omaha, NE 68103-2760

Overnight mail: 200 S 108th ave., omaha, NE 68154-2631

For iras, please submit an IRA deposit slip with a check filled out with your account number and mail to:

Regular mail: PO box 2789, omaha, NE 68103-2229

Overnight mail: 200 S 108th ave., omaha, NE 68154-2631

Standard completion time:

Acceptable deposits and funding restrictions

Acceptable check deposits

We accept checks payable in U.S. Dollars and through a U.S. Bank, as well as checks written on canadian banks. Checks written on canadian banks can be payable in canadian or U.S. Dollars.

Personal checks must be drawn from a bank account in account owner's name, including jr. Or sr. If applicable.

Checks from joint checking accounts may be deposited into either checking account owner's TD ameritrade account

Checks from an individual checking account may be deposited into a TD ameritrade joint account if that person is one of the account owners.

For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD ameritrade account.

Third party checks (e.G. Husband, wife, business, etc.) payable to TD ameritrade account owner and endorsed over to TD ameritrade can also be made payable to TD ameritrade clearing, inc. / FBO the TD ameritrade account owner and the TD ameritrade account number. "FBO" stands for "for the benefit of."

example: TD ameritrade clearing, inc. / FBO your name

Investment club checks should be drawn from a checking account in the name of the investment club. If a member of the investment club remits a check in their name, the check must be payable to: "TD ameritrade clearing, inc. / FBO the investment club name."

You can deposit checks written on canadian banks using a printable form for non-IRA deposits or IRA deposits.

Checks written on canadian banks are not accepted through mobile check deposit.

Unacceptable deposits

Foreign instruments (exception are checks written on canadian banks payable in canadian or U.S. Dollars)

Thrift withdrawal orders

Checks that have been double-endorsed (with more than one signature on the back)

Third party checks not properly made out and endorsed per the rules stated in the "acceptable deposits" section

Checks dated over six months old

Please note: there may be other situations when a remittance is unacceptable.

Availability of funds

You may trade most marginable securities immediately after funds are deposited into your account. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering (IPO) stocks or options during the first four business days. This holding period begins on settlement date.

Account transfer from another firm

Transfer stocks, options, etfs and other assets into your TD ameritrade account from another firm.

Standard completion time:

Retirement rollover ready

Transfer assets from another brokerage firm

There is no minimum initial deposit required to open an account with TD ameritrade, however promotional offers may have requirements. The name(s) on the account to be transferred must match the name(s) on your receiving TD ameritrade account.

After you log in, please go to my account > account transfer and submit a separate transfer request for each account you are requesting to transfer. Include a copy of your most recent statement.

Standard completion time:

Retirement account transfer (roll over 401(k) or IRA)

The name/title of your new TD ameritrade account must be the same as the name/title of the account at the firm you are transferring from.

A rollover is not your only alternative when dealing with old retirement plans. Learn more about rollover alternatives or call 800-213-4583 to speak with a retirement consultant.

Standard completion time:

The money is still in your former employer's account

Call your plan administrator (the company that sends you your statements) and let them know you want to roll over assets to your new TD ameritrade account.

Ask your administrator to mail a check made payable to "TD ameritrade clearing, inc., for the benefit of your name, account number: xxxxxxxxx".

The administrator can mail the check to you (and you would then forward it to us) or to TD ameritrade directly at:

How to open a brokerage account: A step-by-step guide

The ascent is reader-supported: we may earn a commission from offers on this page. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

Choosing the right brokerage account can seem like a difficult process, but it doesn't have to be. By deciding what type of account you want, and then comparing several online stock brokers, you should be able to choose the one that best meets your needs.

Here's your step-by-step guide for opening a brokerage account:

- Determine the type of brokerage account you need

- Compare the costs and incentives

- Consider the services and conveniences offered

- Decide on a brokerage firm

- Fill out the new account application

- Fund the account

- Start researching investments

1. Determine the type of brokerage account you need

What are your investment objectives? If you simply want to invest for a rainy day or for a certain relatively near-term goal, and don't necessarily want your money tied up until you retire, a traditional brokerage account is the way to go. These accounts don't have tax advantages -- you may have to pay tax on investment profits and dividends -- but you are free to withdraw your money whenever you'd like. For this reason, a traditional, or standard brokerage account is often referred to as a taxable brokerage account.

If you choose a traditional brokerage account, your broker will likely ask if you want a cash account or margin account. If you choose to apply for margin privileges, this basically means that you can borrow money to buy stocks, with the stocks in your portfolio serving as collateral. You'll pay interest on the borrowed money, and there are some inherent risks involved with investing on margin that you should be aware of.

On the other hand, if your goal is to save money for retirement, an IRA is the best bet. Traditional iras can get you tax deductions when you contribute to them, but you won't be able to use your money until you're 59-1/2. Contributions to roth iras don't give you a tax benefit when you make them, but qualified roth IRA withdrawals will be tax-free. Plus, you can withdraw roth IRA contributions (but not your investment profits) whenever you want. Finally, if you're self employed, there are some special options for you, such as a SIMPLE IRA, SEP-IRA, or individual 401(k). You can read through a more thorough guide to help you pick the best IRA as well.

It's also worth noting that many people choose to open multiple brokerage accounts -- such as a taxable account and an IRA, in order to keep their money in separate baskets.

2. Compare the costs and incentives

These days, virtually all of the major discount brokers offer commission-free trading. They may also offer you a discount to reward you for certain actions, such as transferring a large investment account from another broker.

That said, it's important to review each online brokerage firm's full pricing schedule, particularly if you plan on trading anything other than stocks (options, mutual funds, etfs, bonds, etc.), as these often come with their own costs. For example, many brokers charge a commission in the range of $0.50 to $0.75 per options contract, so even if the broker doesn't charge a base commission, options trading won't exactly be free.

Finally, many brokers offer incentives in order to attract business, and you don't need to be a millionaire to take advantage of them. I'm not saying that a good incentive all by itself should sway your decision, but it's definitely a piece of the puzzle worth taking into consideration.

3. Consider the services and conveniences offered

Pricing isn't everything -- especially for new investors. Of course, all other things being equal, it's best to find the lowest price, but here are a few other things you need to consider when picking a broker:

- Access to research: many brokers provide their own stock ratings, as well as access to third-party research from firms such as standard & poor's and morningstar.

- Foreign trading: some brokers offer the ability to convert money in your account into foreign currencies in order to trade on international stock exchanges. If this is important to you, make sure the broker you choose allows this.

- Fractional shares: this can be especially important to new investors, as you don't necessarily need to be able to afford an entire share to start investing in your favorite stocks.

- Trading platforms: the various brokerages offer a wide variety of trading software and mobile apps, and many actually allow people to test out their platforms before opening an account. For example, fidelity offers a demo version of its active trader pro platform for prospective clients to test-drive. Also, read some reviews of brokers' mobile apps if being able to access your account on the go is important to you.

- Convenience: some brokerages have large networks of local branch offices you can visit for face-to-face investment guidance, while others do not. For example, merrill edge customers can get one-on-one advice and guidance at more than 2,000 bank of america locations. Also, brokerages operated by banks offer customers the ability to connect their brokerage and checking accounts, transferring money between the accounts in real-time -- and may offer some sort of "relationship discount" for doing so. For this reason, it's also a good idea to check if your bank has an online brokerage, even if it's not mentioned here.

- Other features: this isn't an exhaustive list, so before you choose a broker, be sure to spend some time on its website exploring what it offers.

4. Decide on a brokerage firm

You've gathered your information about various firms' costs, fees and the conveniences they offer. For each brokerage, you should weigh the pros and cons as they pertain to your investment objectives, and determine which broker is right for you.

For more information, check out our top picks for the best brokerage accounts for beginners.

5. Fill out the new account application

You can apply to open a new account online, and this is generally a quick and painless process with online brokers. You'll need some identifying information, such as your social security number and driver's license. You may need to sign additional forms if you're requesting margin privileges or the ability to trade options, and the broker will need to collect information about your net worth, employment status, investable assets, and investment goals.

6. Fund the account

Your new online broker will probably give you a few options to move money into your account, including:

- Electronic funds transfer (EFT): transferring funds from a linked checking or savings account is a convenient way to fund the account. In most cases, the funds will post to the account on the following business day.

- Wire transfer: the quickest way to fund your account. Since a wire transfer is a direct bank-to-bank transfer of money, it often takes place within minutes.

- Checks: acceptable forms of check deposits and fund availability vary between brokers.

- Asset transfer: if you're rolling over a 401(k) or transferring existing investments from another broker, that's an acceptable funding method.

- Stock certificates: yes, these still exist. If you have a paper stock certificate, it can be deposited via mail into an online brokerage account.

As a final note, when funding your new account, be sure to keep your broker's minimums in mind. Many have different minimums for taxable accounts and retirement accounts, and they also may have different minimum requirements for margin accounts.

7. Start researching investments

Congratulations on taking the initiative and opening a brokerage account -- your future self will thank you for taking this important step on the road toward financial security.

Now comes the fun part: investing in stocks. Before diving in, it's a good idea to spend some time learning the basics of how to responsibly choose stocks, bonds, and/or funds, as well as how to create a well-diversified portfolio.

So, let's see, what we have: looking for the best funded trader program? Well, look no further. We gathered the 7 best options out there and breakdown which ones deserve your attention. At how to fund a trading account

Contents of the article

- Top-3 forex bonuses

- The best funded trader program of 2021

- Best funded trader programs

- What makes a good funded trader program?

- Are funded trader accounts worth it?

- 7 best funded trader programs

- 1. Topsteptrader

- 2. Topstepfx

- 3. Earn2trade

- 4. Oneup trader

- 5. Maverick trading

- 6. Try day trading

- 7. Tradenet

- Funded trader program summary

- How to fund a trading account

- Acceptable deposits

- Funding restrictions

- Wire transfer

- If your bank is located in the united states

- If your bank is located outside the united states

- Acceptable deposits

- Check

- Mobile deposit

- Mailing checks:

- Acceptable check deposits

- Unacceptable deposits

- Availability of funds

- Account transfer from another firm

- Transfer assets from another brokerage firm

- Retirement account transfer (roll over 401(k) or...

- The money is still in your former employer's...

- How do you fund a forex account?

- How forex trading works

- How to fund a forex account

- Transfer of funds to your trading account

- Fund my account

- Four easy ways to fund

- В funds availability

- Wire money to your E*TRADE securities account:

- Wire money to your E*TRADE bank account:

- Funds availability

- Mobile check deposit

- Mail a check

- ETRADE footer

- About us

- Service

- Quick links

- Connect with us

- Check the background of E*TRADE securities LLC...

- PLEASE READ THE IMPORTANT DISCLOSURES...

- How to open a brokerage account: A step-by-step...

- 1. Determine the type of brokerage account you...

- 2. Compare the costs and incentives

- 3. Consider the services and conveniences offered

- 4. Decide on a brokerage firm

- 5. Fill out the new account application

- 6. Fund the account

- 7. Start researching investments

- How to get the best funded trading accounts?

- Fully funded trading account

- What are funded trading accounts at A proprietary...

- How to choose the best funded trading accounts?

- How to get qualified for a funded trading account

- Sign up to evaluate your trading

- After a few weeks in testing, you will be totally...

- Get paid to trade forex

- Develop your trading career from home

- Get high capital to trade

- You can trade any trading strategy

- Get your funded trading account with the5ers

- Risk-free trading

- Develop a trading career

- Zero cost from your side

- Bring your own trading strategy

- Apply the fund risk management requirements to...

- Final words about funded trading accounts

- How to fund a trading account

- Acceptable deposits

- Funding restrictions

- Wire transfer

- If your bank is located in the united states

- If your bank is located outside the united states

- Acceptable deposits

- Check

- Mobile deposit

- Mailing checks:

- Acceptable check deposits

- Unacceptable deposits

- Availability of funds

- Account transfer from another firm

- Transfer assets from another brokerage firm

- Retirement account transfer (roll over 401(k) or...

- The money is still in your former employer's...

- How to open a brokerage account: A step-by-step...

- 1. Determine the type of brokerage account you...

- 2. Compare the costs and incentives