How to access ewallet

The best script for building the modern web fintech application. Present your product, start up, or portfolio in a beautifully modern way.

Top-3 forex bonuses

Turn your visitors in to clients.

Ewallet, the smart choice for your business.

Sell using your countries currency and cryptocurrency.

Pay in a snap with the easy and elegant interface which gives you an outstanding experience.

Don't believe us? Take a tour on your on and don't miss a perk.

Better for you and your customers

Customer support.

We’re here to help you and your customers with anything, from setting up your business account to seller protection and queries with transactions.

Quicker and simpler access to funds.

Payments you receive go to your ewallet balance in moments, and you can withdraw funds to your bank account.

Sell on your website. With your currency

Accept payments from customers in unlimited currencies or cryptocurencies and build markets without the hassle of accepting foreign cards.

Ewallet will drive your product forward

Present your product, start up, or portfolio in a beautifully modern way. Turn your visitors in to clients.

Responsive design

Ewallet is universal and will look smashing on any device.

User design

Ewallet takes advantage of common design patterns, allowing for a seamless experience for users of all levels.

Clean and re-usable code

Download and re-use the ewallet open source code for any other project you like.

Main features

The best script for building the modern web fintech application.

- -- bootstrap 4 stable

- -- E-commerce

- -- unlimited ( withdrawal / deposit ) methods

- -- ( send / receive ) money

- -- ( create / load ) vouchers

- -- 6 color skins

- -- currency exchange

- -- unlimited currencies

- -- earn by transaction fees

- -- crossbrowser

- -- user roles

How ewallet work: this simple guide will help you

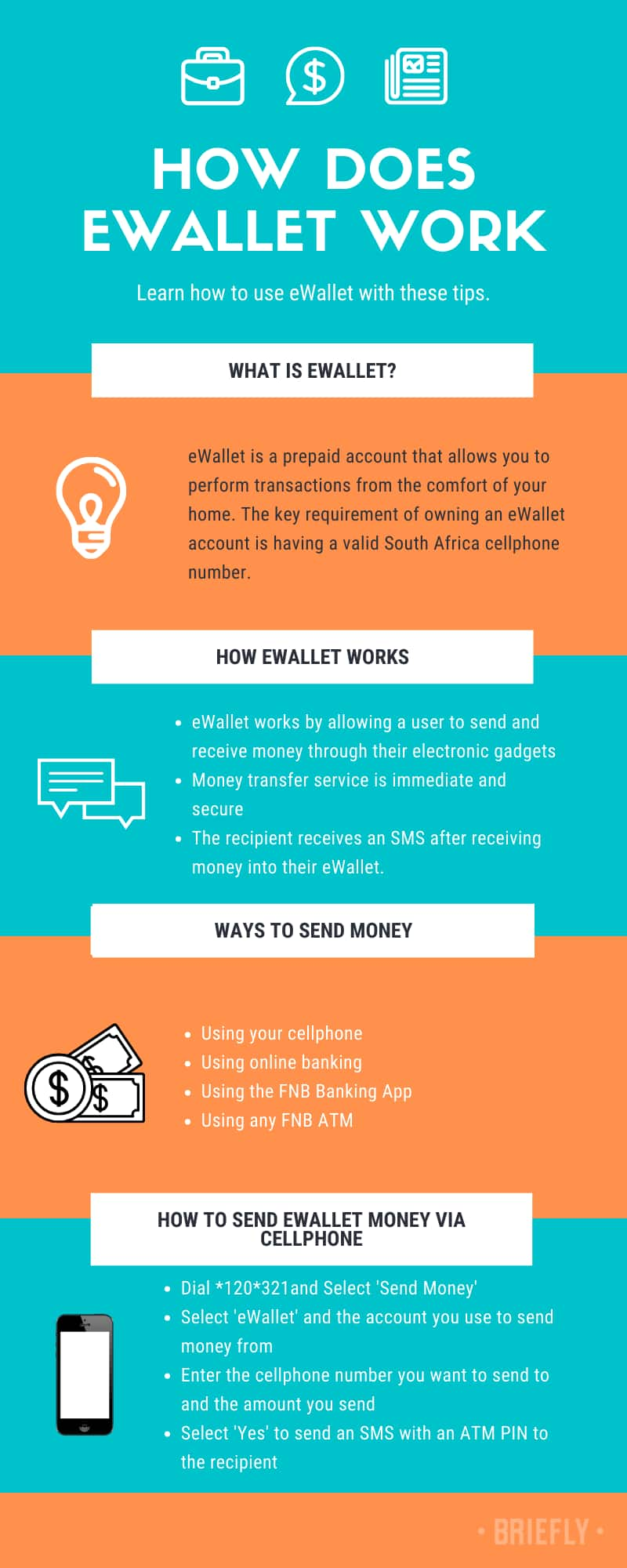

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How does ewallet work

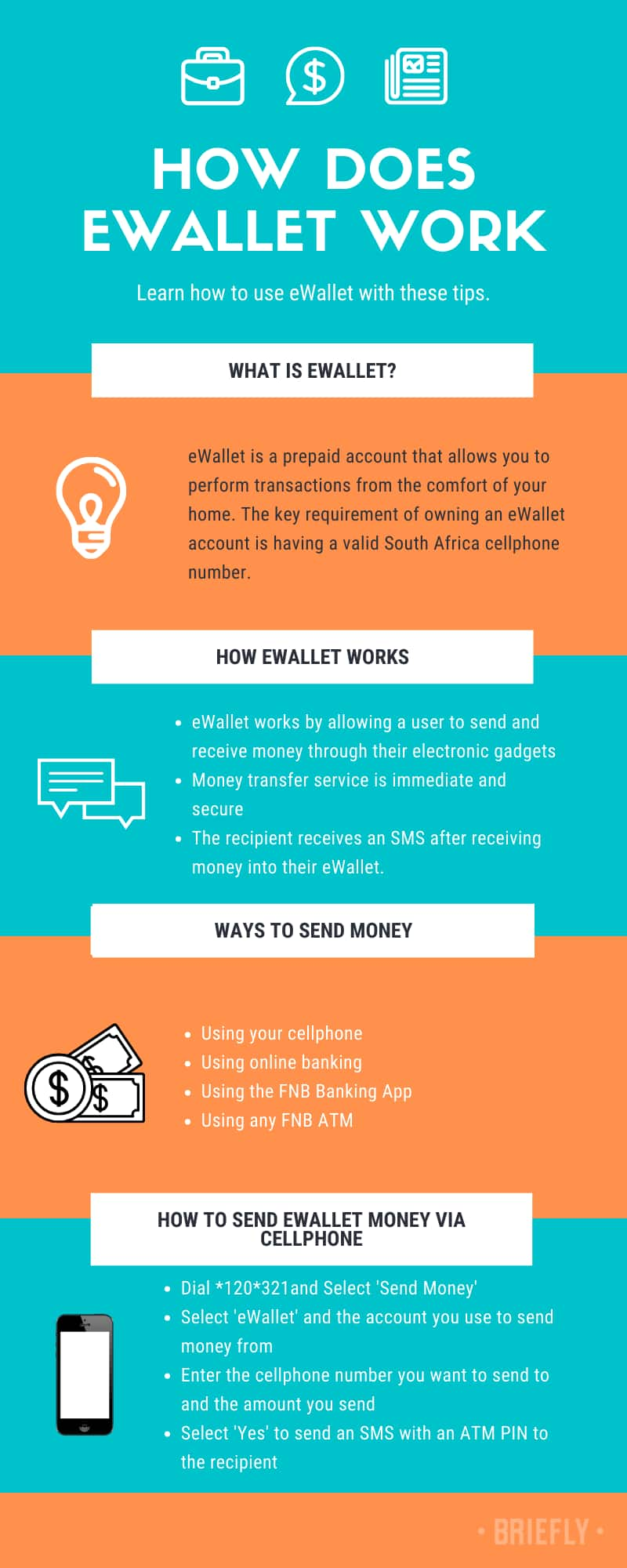

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

How to access ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

Ewallet, the smart choice for your business.

Sell using your countries currency and cryptocurrency.

Pay in a snap with the easy and elegant interface which gives you an outstanding experience.

Don't believe us? Take a tour on your on and don't miss a perk.

Better for you and your customers

Customer support.

We’re here to help you and your customers with anything, from setting up your business account to seller protection and queries with transactions.

Quicker and simpler access to funds.

Payments you receive go to your ewallet balance in moments, and you can withdraw funds to your bank account.

Sell on your website. With your currency

Accept payments from customers in unlimited currencies or cryptocurencies and build markets without the hassle of accepting foreign cards.

Ewallet will drive your product forward

Present your product, start up, or portfolio in a beautifully modern way. Turn your visitors in to clients.

Responsive design

Ewallet is universal and will look smashing on any device.

User design

Ewallet takes advantage of common design patterns, allowing for a seamless experience for users of all levels.

Clean and re-usable code

Download and re-use the ewallet open source code for any other project you like.

Main features

The best script for building the modern web fintech application.

- -- bootstrap 4 stable

- -- E-commerce

- -- unlimited ( withdrawal / deposit ) methods

- -- ( send / receive ) money

- -- ( create / load ) vouchers

- -- 6 color skins

- -- currency exchange

- -- unlimited currencies

- -- earn by transaction fees

- -- crossbrowser

- -- user roles

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

How to access ewallet

How can we help?

Browse through our frequently asked questions or search for your specific concern

What is ewallet?

Ewallet is a digital wallet solution that enables consumers, agents, merchants and corporations to make and receive their payments in an easy, fast and secure way. The service is available via smartphone applications for consumers; web portals, smartphone applications and direct interface using apis for agents, merchants and corporations.

What can I do with ewallet?

Consumer: you can use ewallet to

- Send/receive money to and from family and friends in the UAE (receiver is not required to have an ewallet account)

- Send money to your bank account

- Buy airtime for UAE mobile numbers from etisalat

- Pay etisalat bills

- Fund your ewallet account by depositing cash at any of our agents, kiosks or atms

- Make payments to any of our merchants

- Earn and redeem points on the etisalat smiles programme

To enjoy these benefits, explore our user-friendly app.

Merchant: you can use ewallet to

- Accept payments for goods/services rendered

- Empower your employees to receive payments for delivery services

- Send/receive money to and from suppliers or business partners in the UAE

- Send money to your bank account

- Pay salaries to your employees

FNB ewallet: the ultimate guide for sending/collecting/reversing ewallet

FNB ewallet is the most convenient way of sending money to friends and family members.

It allows FNB account holders to send money from bank accounts to any registered working cellphone number in south africa.

You're able to reverse ewallet should you send money to the wrong number.

FNB ewallet - send money instantly.

Ewallet is the best when coming to sending money via cellphone banking.

The FNB ewallet enables clients to send money to a cellphone number (your wallet), and the money can be accessed instantly, at any FNB atm.

You can send an e-wallet of up to R3,000.00 per day when using the mobile app or online banking. And up to R1,500.00 using cellphone banking or FNB atms.

It's only going to cost you R10.95 for transfers less than R1,000.00. And R13,95 for any amount over R1,000.00 to R3,000.00.

That's the most cost-effective way of sending money to family.

The person you're sending the money to, don't need to have an FNB account in order to receive the money. They only need a working cellphone number together and the pin to withdraw cash.

Here's how it works:

Sending an ewallet is fairly simple.

- As an account holder, follow these steps to send FNB ewallet:

- Access online banking, mobile app, atm or cellphone banking;

- Choose to send money;

- The select ewallet;

- Enter the cellphone number you want to send the money to;

- Choose whether the app should provide the pin to the recipient or not;

- Enter the amount you'd like to send;

- Confirm and complete the transaction

To withdraw money, the receiver needs to visit any of the nearest FNB atm.

On the screen, they need to choose cardless services.

- Select 'ewallet services'

- Key in your cellphone number and select 'proceed'

- Key in the ATM PIN you received via SMS

- Select the amount you want to withdraw

- Take your cash

- Make sure your transaction has ended or that you select 'cancel' before leaving the ATM.

How to reverse an ewallet payment?

Do you want to know how to reverse ewallet sent to the wrong number?

Here's an example of someone who couldn't reverse the ewallet payment and was dearly frustrated. The person sent a lot of money to the wrong number and it's practically impossible to reverse the transaction over a telephone call.

However, the FNB ewallet reversal is very simple nowadays with cellphone banking.

Here's how you can do it:

- Dial *120*321# on your mobile phone [USSD]

- Select alternative 4 for "send money" next

- Select alternative 3 for "ewallet reversal"

- Select the transaction that you want to reverse.

Thus far, that's the only quickest way of reversing the ewallet transaction.

There are no options to reverse ewallet on the app or online - unfortunately.

For further assistance, you must contact the ewallet call centre on 087 575 9405 to reverse the money.

How long does ewallet reversal take?

Unfortunately, your ewallet transaction reversal won't immediate.

According to experienced customers, it takes 4 working days for FNB to complete the ewallet reversal process and pay the money back to the sender.

That's if the recipient's number is working, imagine if you've sent money to a cellphone number that doesn't work.

Well, they'll still help you however it will take about 15 business days for the ewallet reversal to complete.

So, before clicking that sent button, double-check the cellphone is correct to avoid penalties

How much does it cost to reverse the ewallet transaction?

Now that you've managed to reverse an ewallet payment, how much is the bank going to charge you for the mistake?

The amount you'll be charged varies depending on the amount you've sent but charges the same amount as when you were sending.One client claimed was charged R50 fee to reverse an ewallet.

To avoid these inconveniences, always double-check and cross-check the cellphone number of the receiver of the money.

It's super easy to send ewallet via the app because it has access to your cellphone contact list to choose from.

Please note there may be a charge when requesting a reversal. If that (wrong-) person had already collected the money, unfortunately, FNB will not be held responsible and does not guarantee you'll get your money back.

FNB ewallet code – ultimate guide to FNB bank south africa ewallet USSD code

With the FNB ewallet code, you can make money transfers in and outside south africa. With a valid south african cellphone number, you can transfer funds to anyone in the country.

The FNB ewallet USSD code does not require internet access, and it allows you to send money to other family and friends.

You can also use the FNB ewallet service to withdraw funds from your first national bank ATM, buy electricity units, and top up prepaid airtime.

Use the list of table of contents below to jump to any section of the guide you may want to read:

The FNB ewallet USSD codes for sending and withdrawing funds are *120*277# and *130*277#.

What is the USSD code to access FNB bank south africa ewallet without airtime?

If you do not have airtime/credit on your cellphone, then dial *120*277#.

After dialing that code, you will then be able to buy airtime.

Next, you can continue with the ewallet transaction.

FNB ewallet code to withdraw money from ATM

If you want to withdraw cash from your FNB south africa bank account at the ATM using the ewallet service, the code to dial is *120*277* and press option 1 to withdraw cash.

After that, type 1 again to get your ATM PIN.

You can also dial this USSD code *120*277*1*1# to withdraw the money at the FNB south africa ATM.

Transfer code to access the mobile banking service at retail stores in south africa

You can make withdrawals at retail stores in all the provinces of south africa using your ewallet account.

The FNB ewallet USSD code to withdraw cash at retail stores is *120*277*4#.

Press the send button after dialing this USSD code.

After dialing the code, press 1 to get your retail PIN for the cash withdrawal.

Code to reverse wrong ewallet transfer

For most south africans, the main challenge is how to reverse FNB ewallet payment.

As soon as you realized that you have made a wrong ewallet transaction, follow these steps to reverse or cancel the money transfer:

- Dial this USSD code *120*321# to reverse the transaction.

- Enter option four (4) and press send.

- Select 5 for ewallet reversal.

- Finally, choose the ewallet transaction you want to cancel or reverse.

That is how to reverse a wrong ewallet money transfer.

Recommended reading : how to use FCMB USSD code.

How do I get my FNB e-wallet PIN

How to find your first national bank personal identification number (PIN) is pretty straightforward.

To get your FNB ewallet PIN, follow the steps below:

- Dial *120*277*1# on your cellphone.

- Press 1 to request your ewallet PIN.

- FNB will send you a message containing your ewallet 4-digit PIN.

- Visit the nearest ATM and use your PIN for withdrawal.

- Please note the PIN expires within sixteen (16) hours.

- The code to dial for retail stores is *120*277*4*1#, then press 1 to get your FNB ewallet PIN.

That is all you need to know about the FNB bank south africa ewallet code for transactions.

This simple and easy guide was last updated on 15th january 2021 by thetransfercode

How to receive your high-ticket commissions from MOBE: ewallet account.

How to receive your high-ticket commissions from MOBE once you start promoting

As soon as you finish first 7 steps of your 21 step training in MOBE m you will be offered access to your referral links for lot of MOBE products. And to get paid with your commissions you will need to register into the MOBE ewallet system.

MOBE uses a system called ewallet for paying out all commissions

This is often the favorite step for a lot of consultants, and I can understand why - setting up your account with MOBE so we MOBE can transfer your money over to you once you start earning commissions.

Think of ewallet as being like MOBE’s own internal paypal system. Once you have set up your ewallet account, which should not take you more than 15 minutes, MOBE will be able to send your commissions to you and you will be able to transfer your money to any bank account you want.

Getting your credit card

You can even get a special type of credit card! This credit card is connected to your ewallet account and so you can start immediately spending your earned money once you get your commissions.

Setting up your ewallet account

The first step in setting up your MOBE ewallet account - you will simply need to enter your email address at the MOBE ewallet website. You should use the same e-mail address you use to login to MOBE 21 step training program.

Done? You should receive an email with the subject line, “ewallet registration” in about 10 minutes from now.

Your login details will be inside that email.

How to access MOBE ewallet account

To access your MOBE ewallet account - just login to www.Mobe.Globalewallet.Com and follow the steps to finish the sign up process. If you don’t receive an email after 10 minutes, it may be because you have already signed up in the past. In this case you should use the “forgot password” link.

Of course, once you do log in, do not expect to see any commissions just yet. That will come after you complete this entire program. So get your MOBE consultant links and start promoting.

Ready to change your life for the better?

So, let's see, what we have: ewallet, the smart choice for your business. Sell using your countries currency and cryptocurrency. Pay in a snap with the easy and elegant interface which gives you an outstanding experience. At how to access ewallet

Contents of the article

- Top-3 forex bonuses

- Ewallet, the smart choice for your business.

- Sell using your countries currency and...

- Better for you and your customers

- Customer support.

- Quicker and simpler access to funds.

- Sell on your website. With your currency

- Ewallet will drive your product forward

- Main features

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to access ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- Ewallet, the smart choice for your business.

- Sell using your countries currency and...

- Better for you and your customers

- Customer support.

- Quicker and simpler access to funds.

- Sell on your website. With your currency

- Ewallet will drive your product forward

- Main features

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to access ewallet

- How can we help?

- FNB ewallet: the ultimate guide for...

- FNB ewallet - send money instantly.

- How to reverse an ewallet payment?

- FNB ewallet code – ultimate guide to FNB bank...

- What is the USSD code to access FNB bank south...

- FNB ewallet code to withdraw money from ATM

- Transfer code to access the mobile banking...

- Code to reverse wrong ewallet transfer

- How do I get my FNB e-wallet PIN

- How to receive your high-ticket commissions from...

- MOBE uses a system called ewallet for paying out...

- This is often the favorite step for a lot of...

- Getting your credit card

- Setting up your ewallet account

- How to access MOBE ewallet account

- Ready to change your life for the better?