Trading real account

FXCC does not provide services for united states residents and/or citizens. FXCC brand is an international brand that is authorized and regulated in various jurisdictions and is committed to offering you the best possible trading experience.

Top-3 forex bonuses

Forex trading account types

At FXCC we offer range of ECN accounts to suit all traders. Whatever your level of trading

experience or demands, we believe we have the right account for you.

Start with a risk-free demo trading account

Whether your new or an experienced trader, a risk free demo account is a great way to experience the benefits of

ECN trading with FXCC.

Practice your forex trading skills or test new strategies with zero investment.

- Real-time prices and real forex market volatility

- Access to full-featured metatrader4 trading platform

Our ECN XL account has all the features and benefits you would expect and demand from an ECN/STP broker who has always been right at the cutting edge of industry development. A broker who has helped to shape the future of the industry. In fact at FXCC we believe this ECN account is not basic at all. It is one of the most advanced trading accounts, packed full of features and benefits, currently available in the forex industry.

At FXCC we often use a motto that we have adopted over the years; "from small acorns great oaks will grow". Every ECN trader starts somewhere that is why every FXCC client is treated as an individual, a VIP, who will enjoy a personal, unrivalled level of service. Clients can open a ECN XL account with only $500 and enjoy the same level of dedicated full support and service as if they are a VIP client. You will enjoy leverage up to 1:200 and you will be able to take advantage of the ECN/STP model of forex trading we helped to pioneer.

FXCC brand is an international brand that is authorized and regulated in various jurisdictions and is committed to offering you the best possible trading experience.

FX central clearing ltd (www.Fxcc.Com/eu) is regulated by the cyprus securities and exchange commission (cysec) with CIF license number 121/10.

Central clearing ltd (www.Fxcc.Com & www.Fxcc.Net) is registered under the international company act [CAP 222] of the republic of vanuatu with registration number 14576.

RISK WARNING: trading in forex and contracts for difference (cfds), which are leveraged products, is highly speculative and involves substantial risk of loss. It is possible to lose all the initial capital invested. Therefore, forex and cfds may not be suitable for all investors. Only invest with money you can afford to lose. So please ensure that you fully understand the risks involved. Seek independent advice if necessary.

FXCC does not provide services for united states residents and/or citizens.

Copyright © 2021 FXCC. All rights reserved.

Trading real account

What we dream of is that from very first day we are going to be profitable every single day! Look at these great profits we are piling up!

And yet reality is made of losses too!

So I’ve created a completely hypothetical spreadsheet of our performance: every cell displays the daily profit/loss, and every box of 5 cells is a week of trading.

This time we are accounting for losses too: you can see first 2 weeks are in loss, following 3 are in profit, this could resemble the optimal performance of a good trader.

So I’ve repeated than this for 52 weeks to obtain this beautiful and optimistic chart of our first year of trading!

But the reality is that we want to enjoy our life as a trader right? So I’ve added a couple of inactive weeks where the p/l line goes flat, and also 3 withdrawals from our profitable account.

I am myself a funded-trader with earn2trade since I participated in and won the gauntlet at the end of 2018; earn2trade pays to the profitable trader the first 5k he withdraws at a 100%, after that helios will take its 20% profit share (this could be 30%, based on your performance) monthly: in this chart you can see how the p/l line goes down a little every month after my first withdrawal; the other funders like savius take their profit share every time you withdraw; topsteptrader as well offers the first 5k at 100%, while oneuptrader goes as far as to 8k at 100%.

I plan on letting my account grow nicely before taking any withdrawal: the further I’ll be from the drawdown the better I’ll trade.

Remember: broker and platform fees have been accounted for in the trading profit&loss, these are taken immediately! While the data fee (105$ monthly per product) will need to be paid out by you! Some funders ask you to pay directly, others will take it from the profit in your account. Obviously the costs for your trading platform are on you.

So while the first unrealistic projection was to grow our account from 25k to almost 80k in the first year, the truth is that even by being a consistently profitable trader our account will be (remember that this is pure speculation) closer to 37k at the end of the first year: but you enjoyed 2 weeks of holiday, and a nice 15k$ withdrawn in your bank account!

Furthermore you have 1 full year of trading with real money under your belt, while you had zero risk on your savings! Not a bad experience right?

The following year you will keep your successful strategy exactly as is and yet perhaps make the most of this growing account to, let say, double your size in contract? That is double your profit!

So year 2: 2 weeks of holiday, and 30k $ withdrawn!

The sky is the limit! Don’t be greedy, use your wisdom, and your life will be fulfilled and happy.

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

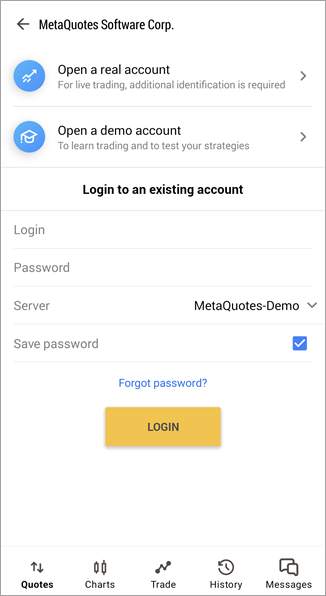

Live account opening

Live accounts, unlike demo, cannot be opened straight from the platform. They can only be opened by brokerage companies under certain terms and conditions. However, a real account request can be easily sent to a broker from the trading platform.

Tap on on the account management page. Select "open a real account".

You will need to fill in a simple form, similar to the one used for demo accounts, and to additionally attach two documents to confirm your identity and address. A preliminary account will be opened for you on the broker's server, with a zero balance and a disabled trading option.

Soon after opening the preliminary account, a representative of the brokerage company will contact you to finish the real account opening procedure. After that the preliminary account is converted to the real one, and you can start trading from it.

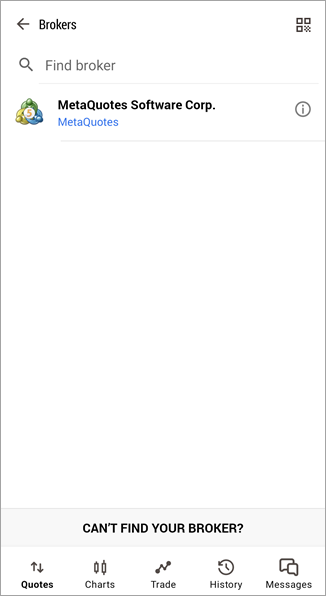

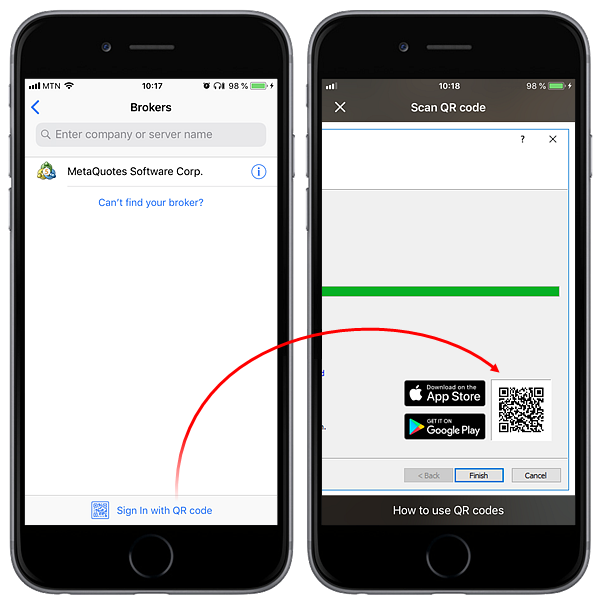

Select a server

At this stage, you need to select a server (a brokerage firm), on which the live account will be opened. By default, the list does not display all available servers.

In order to find the server of your broker, start typing its name into the search bar.

To select a found server, tap on its line.

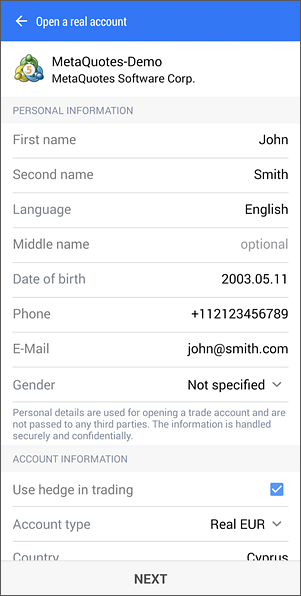

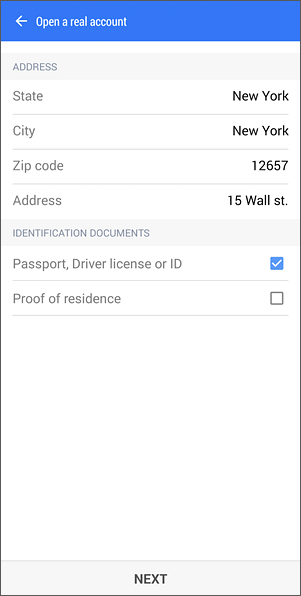

Personal details and documents

Enter your valid personal information:

- Name – your full name.

- Phone – contact phone number in an international format. For example, +74951234567.

- E-mail – e-mail address, for example: "john@smith.Com".

Below you should attach photos of your documents to verify your identity and address.

- The main identity verification document is a passport. A brokerage company may also accept other documents, such as a driver's license.

- For address confirmation, you may use you bank account statement or current utility bill. The documents must contain your full name and address.

All photos must be readable and clear. Make sure your documents are fully visible.

To attach a document, click on the corresponding line. Then choose the attachment method:

- Camera – open a camera to take a picture of the document. Before sending, you can view the image or take a new photo if necessary.

- File – upload an image from the smartphone memory. Only the images that you select will be used.

Then tap "open account" at the bottom of the window.

Your personal details and documents will be sent to a broker via the internal email. Once you complete account registration, the appropriate outgoing email will be available in your mailbox.

The newly created preliminary account will be connected after registration. You will also receive an email with the login, the main and investor passwords of the created account.

Soon after account registration, a representative of the brokerage company will contact you.

Open an account

Two types of accounts are available in the trading platform: demonstration (demo) and real. Demo accounts provide the opportunity to work in a training mode without real money, allowing to test a trading strategy. They feature all the same functionality as the live ones. The difference is that demo accounts can be opened without any investment and, therefore, one cannot expect to profit from them.

Demo account opening #

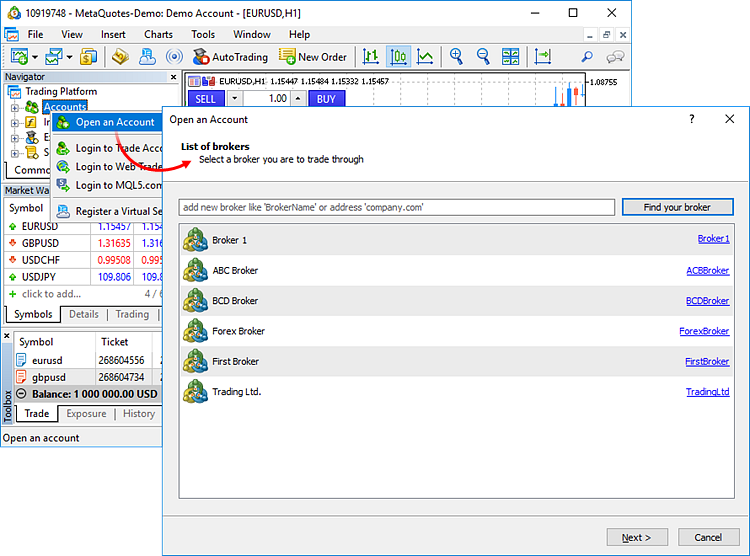

Click " open an account" in the file menu or in the context menu of the navigator window.

The account opening procedure consists of several steps:

Select a server

A broker is selected during the first step. If the desired company is not shown in the list, please type its name and click "find your broker". Alternatively, you can type the address of the server instead of the company name. Once you find the desired company, select it and click "next".

If the brokers list becomes too long, you can delete unnecessary companies by pressing the "delete" key.

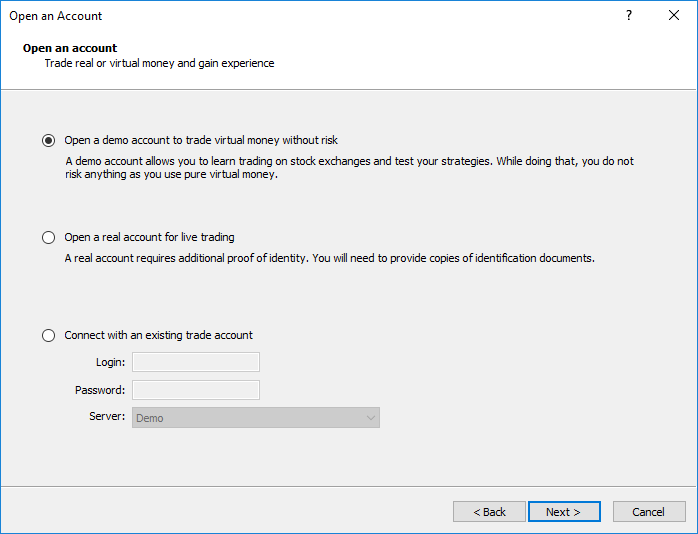

Account type #

Enter the details of your existing account or create a new one.

Choose this option to connect to an existing trading account. You will need to specify the account number, the password and the server name.

Select this option to open a demo account. Demo accounts help users learn trading and test trading strategies. All trading operations only involve virtual money.

Select this option to request opening of a real account. Trading operations are performed using real money on such accounts, therefore you will need to provide broker detailed information about yourself, as well as ID and proof of address documents. The broker will check provided information and contact you to complete the account opening procedure.

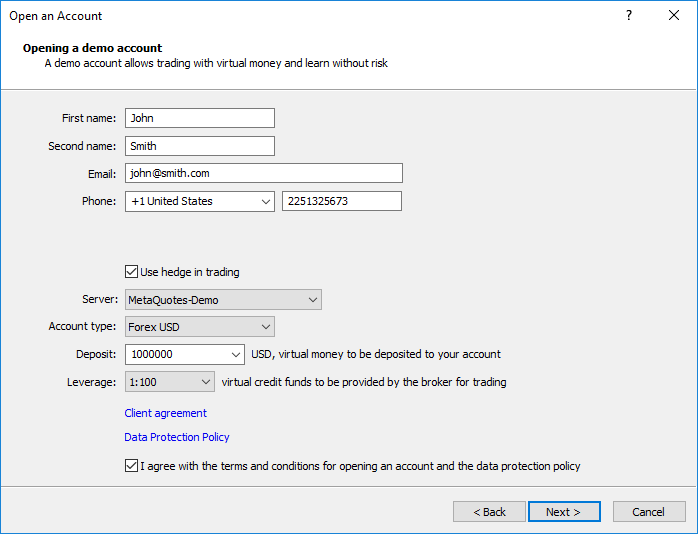

Personal details

Enter your personal details:

Personal details

- First name — the name of the user consisting of at least two characters.

- Second name — the second name (surname) of the user consisting of at least two characters.

- Email — email address, e.G. "smith@company.Net".

- Phone — contact phone number in international format. Example: +74951234567.

Account parameters

- Use hedge in trading — enable the option if you want to open an account with the hedging position accounting system, which allows having multiple open positions of the same symbol, including opposite positions. Otherwise an account with the netting system will be opened. The option affects account types available for selection.

- Account type — select a type from the drop down list.

- Deposit — the initial deposit in the basic currency. Selected from a drop down list.

- Currency — this field cannot be edited, the deposit currency is indicated here. This parameter depends on the account type specified.

- Leverage — ratio between borrowed and owned funds for trading; select one of the available variants from the drop down list.

Links to broker's agreements are shown in this block. Read them carefully. The number of links and types of agreements available depend on the selected broker.

If you agree with account opening terms and the broker's data protection policy, tick the appropriate box and click "next". After that, the account will be created.

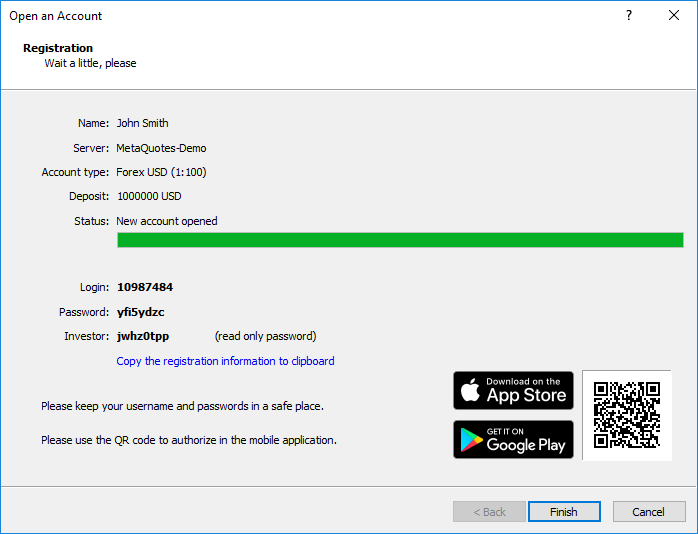

Account registration

Once an account is created on a selected server, details will be shown in the dialog window:

The upper part of the window contains brief information about the account; the lower part shows its details:

- Login — the number of the opened account.

- Password — a password to access the account. This is a master password, which allows trading from this account.

- Investor — investor password. The password allows connecting to the account to view its state and analyze price dynamics, but it does not allow trading.

A QR code is shown below, using which you can instantly connect to this account from the mobile platform. Open the mobile application, go to the "new account" section and click "sign in with QR code". Point your camera at the QR code, and the trading account will be instantly connected, without the need to specify login, password and server values.

After clicking finish, the newly created account is automatically connected to the trade server. It also appears in the accounts section of the navigator window. If you click cancel in this window, connection to the trade server is not performed and the account is not added to the navigator window, though it is already created. You can connect to the server later using the account details.

If you have any problems with registration, please contact your broker's technical support team.

Live account opening #

Directly from the trading platform, you can send a request to open a live account, on which you can trading using real money. You will need to fill out a few simple forms, and to additionally provide documents to confirm your identity and address.

Choose the option "open a real account for live trading" and specify the required data:

Depending on broker's settings and applicable legislation, you can be requested to fill in information on employment, income and trading experience. In particular, such account opening requirements apply to mifid regulated brokers (the markets in financial instruments directive).

Once you fill in all fields, a preliminary account with the zero balance will be opened for you on the broker's server. Although you cannot trade on a preliminary account, you can monitor price dynamics, perform technical analysis and test strategies.

Soon after opening the preliminary account, a representative of the brokerage company will contact you to finish the procedure of real account opening. After that the preliminary account is converted to the real one, and you can start trading from it.

An informational email is additionally sent to you via the internal mailing system when a preliminary account is opened.

Accounts in the navigator window are marked with appropriate icons depending on their type: — a demo account, — a preliminary account, — a live account.

Contest accounts #

The platform features a special account type, which can be used for various trading contests and competitions. They operate similarly to demo accounts and are marked with a blue icon in the navigator window. Such accounts can only be opened by a brokerage company. When you are connected to such an account, the "contest account" title is displayed in the platform window header.

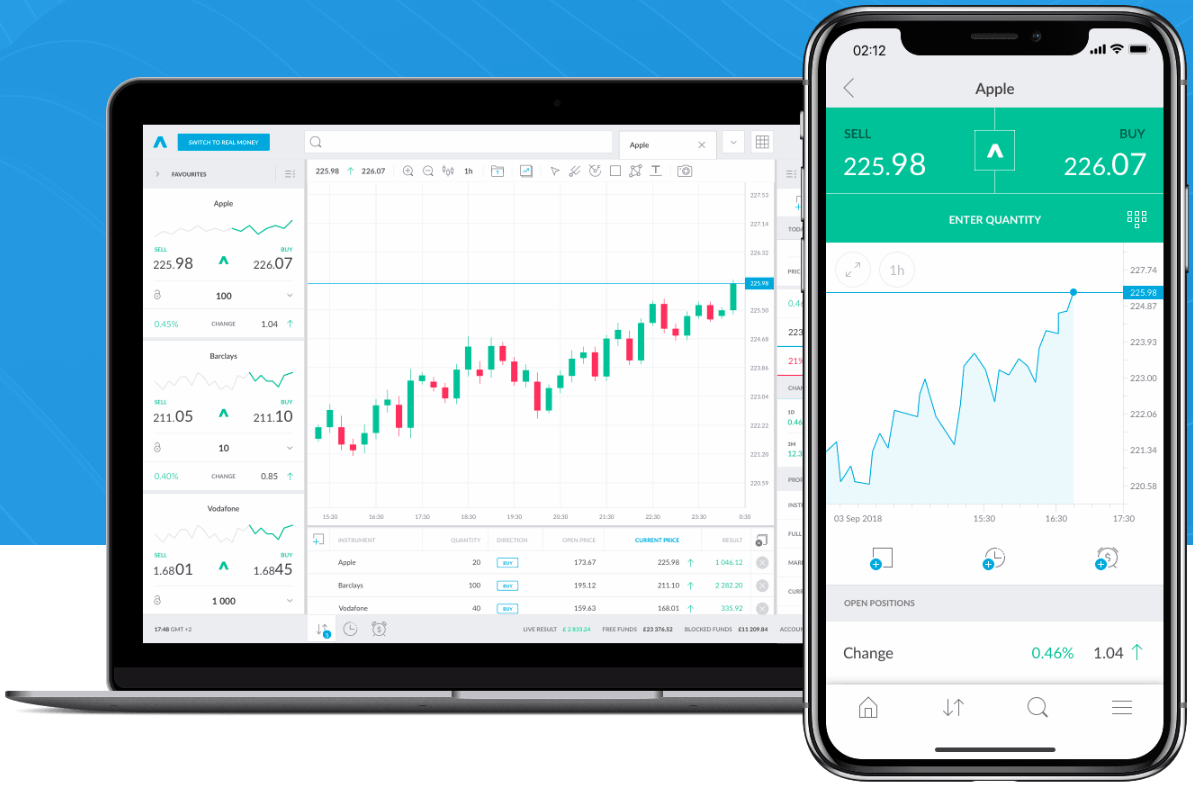

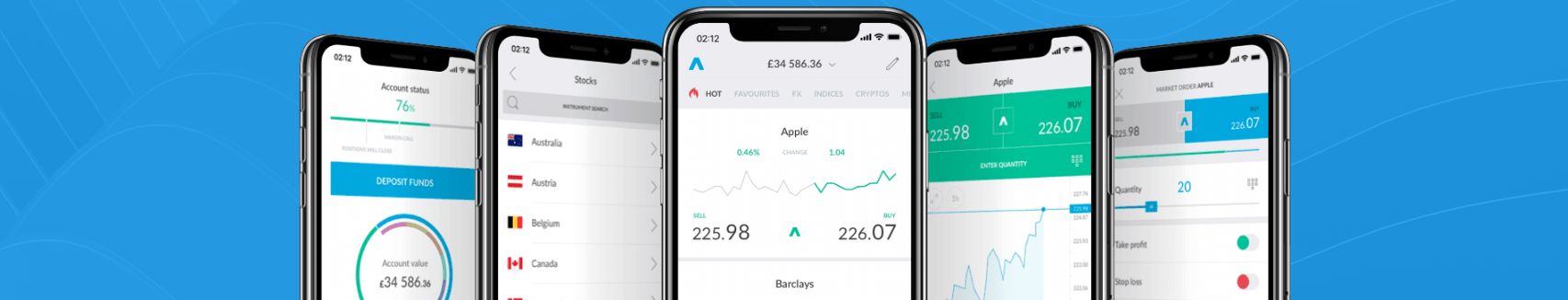

Trading212 review and tutorial 2021

Go to the brokers list for alternatives

Trading 212 offer a truly mobile trading experience. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment.

Trade major cryptocurrencies with the tightest spreads. Chose from micro lots and speculate on bitcoin, ethereum or ripple without a digital wallet.

Trading 212 is an online brokerage aiming to make the world of trading securities and forex more accessible. Our review of the trading212 service includes information on the platform, trading fees, the demo account (and pro account), minimum deposit and payment methods.

We also review the mobile app and offer tips on how to get the best from this broker.

Based in london, the company boasts an easy to use mobile app, with a range of features and functionality making it easy for anyone to start trading across a wide variety of asset classes.

While they offer a solid service, there are enough shortcomings to make other brokers a better choice for most traders.

Recent amendments to margin requirements will have come as a shock to many traders. The rise to 50% margin will cripple many portfolios.

Trading platform

The trading platform trading 212 runs on is an extremely strong element of this brokerage service.

Optimised for the mobile user’s experience, the platform is very simple to navigate around, yet offers a powerful range of features, charts and analysis without feeling clunky or overburdened.

One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously.

Some investors may prefer more complex or feature rich platforms, often found on MT4 – but equally, many will appreciate the custom-built, bespoke feel of the trading 212 app.

The demo account allows traders to experiment with platforms and find the one that suits them best.

Assets / markets

Trading 212 boasts a huge range of over 1800 tradable assets.

These include over 150 forex pairs, a comprehensive range of cryptocurrencies, including ripple, ethereum and bitcoin, as well as more traditional asset types such as indices, stocks and commodities.

Spreads / commission

Trading 212 offers relatively tight spreads, although admittedly not the tightest in the market.

Some assets have better spreads than others, with spreads on cryptocurrencies remaining competitive.

One area trading 212 where does well is commission, offering absolutely commission-free trading across a range of asset classes. This is now the norm among leading brokers.

They do, however, charge fees for currency conversion, although this also isn’t unusual.

In late 2020 however, the brand suddenly raised margin requirements to 50%. This kind of change, completely out of the blue, leaves traders with considerable uncertainty over their capital requirements.

Recommended alternatives to trading212

Leverage

Leverage is offered at rates of around 1:300 for professional accounts, higher than many other brokers. Leverage increases risk of losses, as well as profits, so traders must use it wisely.

The maximum leverage does not need to be used for every trade.

Retail traders in the EU will see leverage capped at 1:30 (or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of 1:2)

Mobile apps

Trading 212 has a purpose-built app for mobile users (available on ios and android). It offers full functionality, even allowing trades to be conducted directly from visualisations, a feature unavailable on many other mobile apps. The user experience is excellent, with clear navigation and well thought out data visualisations.

The download is quick and simple, and the mobile application is the flagship product for trading212. The app has therefore been developed with active traders in mind, and is among the best in the industry.

Payment methods

Trading 212 offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets. Full details are available in the FAQ section on the website – but most mainstream funding methods are available. You can withdraw money directly into your bank account (although there are minimum withdrawal limits imposed), and money should be in your account within 2-3 business days.

Demo account

Trading 212 allows users to easily toggle between ‘real’ and ‘practice’ accounts, removing the hassle of setting up two separate accounts. Setup is very simple, taking under a minute for a new account to be up and running. The same account can be ‘switched’ between real and practise funds, simplifying the use of both accounts.

Download the app

Offers and promotions

Trading 212 offer a range of offers to its users, including an up to date economic calendar, detailed (but succinct) technical analysis for each tradable asset, a daily world news update, and a whole host of educational video and written tutorials explaining critical trading concepts, graphs and analysis. Users can browse comprehensive forums for further advice, and the FAQ section is well organised and extensive.

Bonuses

Trading 212 aren’t currently running any active bonus offers, although in the past they have offered a £50 welcome bonus for making a deposit. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading.

Regulation and licensing

Trading 212 is fully compliant with the latest EU regulations. They are regulated by the FCA in the UK, the FCS in bulgaria, making it one of the most heavily regulated online brokerage services on the market.

That means all trades are fully licensed and users can feel safe and secure conducting business on trading 212. Filling the position of ‘the most popular trading app’ brings with it a certain level of scrutiny in the press. So, the company has rigorous financial controls and measures in place to ensure it remains fully compliant with the latest regulations.

Additional features

Trading212 offers a range of auxiliary features to support its core trading app. These include a detailed economic calendar, daily financial news updates, an in-depth education section with detailed explanations and tutorials of how various elements of trading work, summaries of key industry concepts and terms, and guides on how to use charts to conduct analysis.

Negative balance protection is also offered to regulated traders.

Account types at trading212

Trading 212 technically only offers one account type, meaning fees, charges and leverage are the same for all users. This fits in with the company ethos of ‘democratising trading’. All trades are commission free, and it’s simple to switch between ‘demo mode’ and real mode – the key difference is choosing to fund your account.

Pro account

Trading212 do offer ‘professional’ accounts. These allow regulated users to access higher levels of leverage in exchange for waiving regulatory protection. Traders can apply directly when they open an account, but must meet certain criteria (trading experience, trade frequency and capital) before being accepted for a pro account.

Company details

Trading 212 started out in bulgaria as a company called avus capital, before being incorporated in the UK in 2013. That means the company is regulated both by the financial services commission in bulgaria, and the FCA in the UK.

Over the last five years, trading 212 has continued to rapidly grow its user base, and its trading app has been downloaded over 12 million times, making it one of the most popular trading apps in the world. Users can trade stocks, forex pairs, indices, etfs and even cryptocurrencies.

Benefits

Trading 212 has a lot to offer potential users. The primary benefit is commission free trading across a broad range of asset types. Particularly for frequent users, these small charges can quickly add up, eating into what can already be tight margins. It’s an extremely attractive prospect for those looking to enter the marketplace for the first time.

Another key benefit is the simplicity and usability of the trading 212 mobile app. Free to download, easy to navigate and with a deep layer of functionality, it removes a huge amount of the complexity often associated with trading assets, without sacrificing on features. Finally, the range of educational material available is a key draw for those looking to learn more about financial markets.

Drawbacks

Leverage is lower than many other online brokers for pro clients, with many competitors offering tighter spreads. More experienced investors may prefer the more commonly used metatrader 4 platform to the bespoke trading 212 app. Metatrader 4 (MT4) integration is also missing at present.

Frequent users could potentially find the focus on mobile off-putting, as many prefer to use a terminal, usually with multiple screens, for more complex analysis.

Finally, some potential users may not enjoy the simplicity of trading 212: they could be looking for trading platforms with a greater focus on managed services, automated trading or the ability to copy the trades of successful users.

Trading 212 trading hours

The platform is available to use 24/7. However, markets for different asset classes are open at a variety of times, so there is a knock-on effect on users’ ability to trade some financial instruments at particular times. This has to be considered on an asset by asset basis.

Contact details / customer support

Trading 212 have an excellent, highly responsive customer service team with an average response time of just 47 seconds. Customer support is available 24 hours a day across a variety of platforms and in 16 different languages, with support centres spread all over the globe.

Safety and security

The trading 212 app has been downloaded several million times, with huge numbers of transactions being processed every day.

The core systems underpinning the service are robust and secure, and examining the FAQ section of the website reveals a company committed to the safety and security of user data and finances.

The level of regulation the company adheres to means users can feel reassured that trading 212 is an incredibly secure platform.

Verdict

In conclusion, trading 212 is an online brokerage service for investors both new and experienced, with an excellently designed bespoke mobile app, commission free trading, a simple account structure and a whole host of additional educational features. Trading 212 offers fantastic levels of customer support and easy withdrawal of funds. All of this makes it a great option for would-be investors to explore.

On the flip-side, some potential investors may prefer a more browser-based broker, use of the popular metatrader 4 platform, or additional features like algorithmic/automated trading or the option of managed accounts.

Accepted countries

Trading212 accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use trading212 from united states, canada.

Best free stock market simulators

Dan schmidt

Contributor, benzinga

“practice makes perfect” rings true when you’re trading, especially if you’re looking for the best stock trading simulator. The best traders all practice with paper money before putting any real capital at risk. Here’s what you need to know.

Learn to beat the market with warrior trading's market simulator

Learn to beat the market with warrior trading's market simulator

Warrior trading’s new WT simulator platform is a real-time trade simulator with a powerful learning device. With warrior trading’s simulator, you will see how your trades would do in the current market conditions, as opposed to relying on historical data of past stock trades.

Best stock market simulators:

Take a look at benzinga’s top picks:

- Best overall: thinkorswim by TD ameritrade

- Best for day trading bear bull traders simulator– get 20% off lifetime memberships with BENZINGA20 at checkout

- Best for intermediate traders: tradestation

- Best for new investors: warrior trading

- Best for paper trading: ninjatrader free trading simulator

What’s a stock market simulator?

Ever play madden for xbox or playstation? Pretty much every football fan has simulated the NFL experience on a video game console. While playing virtual games won’t make you a better football player, it might make you a better stock trader. Paper trading allows novice investors to simulate the stock market experience by buying stocks and assets with fake cash.

With $100,000 in pretend capital, you can build a portfolio and test strategies without taking on any real risk. Want to see how different strategies work together? You might not be willing to take the risk if your own money is a stake. If it’s monopoly money, though, you’ll be more inclined to explore, take chances and learn from mistakes if your trades go wrong.

The goal of paper trading is to improve. You’ll learn to better identify chart patterns and trends and you might even feel a little pang of pain when one of your pretend trades blows up. Some paper trading platforms are connected to online brokerages, which means you need a real trading account to dabble in fake money. But most simulators can simply be downloaded and “funded” instantly and trading begins whenever the market opens.

Key qualities of the best stock market simulators

The top stock market simulators chosen by benzinga share a few common traits:

- They closely resemble the actual market. You want an authentic stock trading experience when paper trading, so simulators must feel like the real thing. Buying and selling stocks in real time is important, so it’s important to have access to more advanced securities and order types.

- Many securities are available. Buying and selling stocks is fun, but you might want to test some more conservative strategies such as buying and holding etfs and mutual funds. A good stock market simulator will let you trade triple-leveraged etns and hold mutual funds for 40 years.

- Useful research tools and stock charts are included. What good is trading if you can’t do any research? Stock charting tools are a necessity for any (real or fake) trading platform, and it doesn’t hurt to have access to conference calls, news reports or economic data, either.

Best stock market simulators

We’ve ranked the best stock market simulators. All of them offer terrific platforms, but the top selections on this list will have all the features an advanced trader can ask for.

Trading a real account

How long does it take me to practice on a demo account to start trading real money?

- This topic was modified 3 years ago by raccoonjaz .

Personally I would advise a minimum of 3 months trading same system or strategy. Get to learn the ins and outs

How long someone should take to trade using a demo account; I think this depends on some one’s/trader’s ability to get used to the platform and the level of acquiring the skill of trading. If you are a quick learner even 2_3months are good for you to start trading a real money account. But it can also take as long as 6months to a year as long as you feel you have not grasped the whole trading concept on the trading platform. More so if you have not made any consistent wins while using a demo account, I would advise you to keep practising on a demo until you can achieve consistent winning trades so that you don’t lose your real money without seeing any of the profits. Till then, practice on a demo until you feel you are ready to handle a real account.

A spread in forex trading is simply the difference between the ask price and the bid price.The spread covers your transaction costs, brokerage costs and it is calculated using pips.

For example,if you buy EUR/GBP at 0.87473/0.87492, the difference between 0.87473 and 0.87492 is 1.9 pips which is the spread. Learn more about spreads

How are the spreads?

When you enter a trade, you will realise that your trade will start in a negative value even when it is moving in your predicted direction. Another scenario would be at the close of a trade. When you have set a target level for your trade, you will realise that some times it reaches that exact level you have set and fails to close or closes a few pips below or above the target level. Why? Because of spread. It closes after it has covered the spread fixed on that currency pair.

Like a colleague said above, a spread is the difference between the ask price and the bid price.You can take it as a small cost you incur for holding a trade. This ranges from different currency pairs and different conditions in the market at the time you are trading. Some currency pairs have small spreads unlike the others and during release of very important economic news, spreads tend to increase. So as you trade, you can try to explore different currency pairs on a demo account. This will help you to know what to trade, when to trade and which size to use on your trade.

Fxdailyreport.Com

Forex trading is probably the only market where prospective traders can test strategies and systems without risking their money. In other markets like the stock market, investors have no room for error.

So, they must learn everything before getting started. With forex, you can learn on the job, but with fake money. This is done using a practice account, popularly known as a forex demo account.

So, what exactly is a forex demo account?

Generally, a forex demo account is a trial account funded with a specific amount of virtual currency. Some best forex brokers offer a specified amount, mostly $50,000 while others have a list of options, which range from as low as $1,000 to as high as $100,000. This means that traders can choose the level of account to use for practice depending on the amount they plan to invest in a real forex account.

On the other hand, a real account is not pre-funded by the broker. It comes with a zero balance, which means that the trader must make a deposit in order to start trading. But that is not the only difference.

The differences between a real account and a demo forex account

There are several reasons why differences occur between a real account and a forex demo account. One of the key factors contributing to this is that brokers are required to pay a certain fee to access data feed from the live market, which they can then provide to traders trading on a real forex account. As such, this can cause the differences below to occur.

Delay in order filling

When you are trading via a forex demo account, orders are filled automatically. There are no delays or no-fills. Every order placed is executed immediately because it does not matter whether there is another person on the other end of your request to fill it.

On the other hand, the situation is quite different when it comes to a real forex account. Here, brokers fill trader requests by submitting them to their liquidity providers, which include banks and large institutional investors. If there is no one at the end of your order ready to fill it at your requested rate (especially non-market orders), then the chances are that you will experience a delay before your order is taken.

Slippage in price

Because orders are filled depending on the prevailing prices in the live market, sometimes slippage will occur. Market slippage is a situation where the price of the asset jumps the preset trading conditions like stop-loss after a price gap or a massive instant change in the price of the asset.

Since the data feed for a forex demo account is simulated, traders do not experience slippage in their open positions, which makes it easier to execute certain trading strategies as compared to when trading via a real forex account.

Wider spreads

Most brokers that provide their services as market makers do not charge a described commission on trades. Instead, they take a percentage of the spread on every trade completed. This bumps up the spread offered on currency pairs like the EUR/USD, and USD/JPY by a few pips, which are then used to cover service costs.

And in the case of true ECN brokers or STP forex brokers where liquidity is sourced directly from a pool of big banks and institutional investors, they offer floating spreads, which means that they can change at any time. This is different when trading on a demo forex account because spreads don’t change, which makes it easier to execute various trading strategies with a higher degree of success.

Proof of identity and address

Trading via a practice demo account is simple, has no strict requirements, and is designed to get traders excited about opening a real account. However, the moment you start preparing to fund your account, you realize that there are a few more steps to cover.

Several brokers are very strict when it comes to funding your account. All brokers are strict when it comes to making withdrawals. As such, before you start using a real forex account, brokers will ask you to add and verify your identity and physical address.

This is mainly done for the security of your funds to ensure that when the time comes for the broker to process your withdrawals, they are sent to the actual account holder and not some masquerading to be you.

Emotional pressure

This is one of the most perspective-changing factors that traders experience after transitioning from a forex demo account to a real account. Psychologically, there is no pressure when trading using a demo account. This changes once you begin using a real account.

The main reason behind this paradigm shift in emotions is that with a real account, there is the risk of losing everything. So, it is easy to get scared and close positions early when the market is going against you. There is a flip side to this too. If the market is going your way, there is the risk of getting greedy and waiting before you close your open positions until things begin to go against you.

Then what follows shortly is panic, and before you know it, you have ditched the strategies that you practiced for weeks or months in a demo account. This is usually the beginning of the end, but it can also be turned around by taking a short break to calm down and refocus.

Final thoughts

In summary, a practice account can be an important starting point for a new trader. It is a risk-free account, which means that traders can practice different strategies without worrying about how much they could lose. This is where expert traders recommend that you make all the mistakes you can so that when you transition to a real account, there is barely any to make.

However, as we have discussed, there are some key differences between a real account and a forex demo account that could hamper your successful transition to real money trading. It is good to take note of them so that your are not surprised when slippage occurs or when your order is not filled in time.

So, let's see, what we have: forex trading account - open the best forex trading real accounts with FXCC, a regulated ECN broker. You can also start with a risk-free demo trading account with us; open your practice account with us today. At trading real account

Contents of the article

- Top-3 forex bonuses

- Forex trading account types

- Start with a risk-free demo trading account

- Trading real account

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

- Live account opening

- Select a server

- Personal details and documents

- Open an account

- Demo account opening #

- Select a server

- Account type #

- Personal details

- Personal details

- Account parameters

- Account registration

- Live account opening #

- Contest accounts #

- Trading212 review and tutorial 2021

- Trading platform

- Assets / markets

- Spreads / commission

- Recommended alternatives to trading212

- Leverage

- Mobile apps

- Payment methods

- Demo account

- Download the app

- Offers and promotions

- Bonuses

- Regulation and licensing

- Additional features

- Account types at trading212

- Company details

- Benefits

- Drawbacks

- Trading 212 trading hours

- Contact details / customer support

- Safety and security

- Verdict

- Accepted countries

- Best free stock market simulators

- Dan schmidt

- Learn to beat the market with warrior trading's...

- Learn to beat the market with warrior trading's...

- Dan schmidt

- Best stock market simulators:

- What’s a stock market simulator?

- Key qualities of the best stock market simulators

- Best stock market simulators

- Trading a real account

- Fxdailyreport.Com

- So, what exactly is a forex demo account?

- The differences between a real account and a demo...

- Delay in order filling

- Slippage in price

- Wider spreads

- Proof of identity and address

- Emotional pressure