Investment in forex

A number of exchange-traded funds (etfs) and exchange-traded notes (etns) provide exposure to foreign exchange markets.

Top-3 forex bonuses

Some etfs are single-currency, while others buy and manage a group of currencies. The foreign exchange market is the world's largest financial market, accounting for more than $5 trillion in turnover each day. comprised of banks, commercial companies, central banks, investment firms, hedge funds and retail investors, the foreign exchange market allows participants to buy, sell, exchange and speculate on currencies. There are a number of ways to invest in the foreign exchange market.

How can I invest in a foreign exchange market?

The foreign exchange market is the world's largest financial market, accounting for more than $5 trillion in turnover each day. comprised of banks, commercial companies, central banks, investment firms, hedge funds and retail investors, the foreign exchange market allows participants to buy, sell, exchange and speculate on currencies. There are a number of ways to invest in the foreign exchange market.

Forex

The forex market is a 24-hour cash (spot) market where currency pairs, such as the EUR/USD pair, are traded. Because currencies are traded in pairs, investors and traders are betting one currency will go up and the other will go down. The currencies are bought and sold according to the current price or exchange rate.

Foreign currency futures

Foreign currency futures are futures contracts on currencies, which are bought and sold based on a standard size and settlement date. The CME group is the largest foreign currency futures market in the united states, and offers futures contracts on G10 as well as emerging market currency pairs and e-micro products.

Foreign currency options

Whereas futures contracts represent an obligation to either buy or sell a currency at a future date, foreign currency options give the option holder the right (but not the obligation) to buy or sell a fixed amount of a foreign currency at a specified price on or before a specified future date.

Etfs and etns

A number of exchange-traded funds (etfs) and exchange-traded notes (etns) provide exposure to foreign exchange markets. Some etfs are single-currency, while others buy and manage a group of currencies.

Certificates of deposit

Foreign currency certificates of deposit (cds) are available on individual currencies or baskets of currencies and allow investors to earn interest at foreign rates. For example, TIAA bank offers the new world energy CD basket, which provides exposure to three currencies from non-middle eastern energy-producing countries (australian dollar, canadian dollar and norwegian krone).

Foreign bond funds

Foreign bond funds are mutual funds that invest in the bonds of foreign governments. Foreign bonds are typically denominated in the currency of the country of sale. If the value of the foreign currency rises relative to the investor's local currency, the earned interest will increase when it is converted.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Investing in a foreign currency

Follow this guide to get started with forex.

For some traders and investors, investing in a foreign currency offers an exciting opportunity to speculate on the exchange rates between currencies around the world. While it is risky, many can walk away with a profitable foreign exchange, also called forex or FX. If you are new to investing in foreign currencies, here's what you need to know to get started.

In this guide:

What is investing in foreign currency?

When you travel around the world, you can't always use U.S. Dollars for purchases. Instead, you have to convert your money into euros, yen, pesos, or whatever currency is used by the country you are visiting.

When buying or selling money to travel, you probably noticed the exchange rate. This tells you how much of the other currency you get per dollar, and vice versa. These rates change regularly. The price changes are based on economic news, projected economic data, and other factors.

In forex trading, you buy a large amount of foreign currency just like you would buy a stock, bond, or mutual fund. Instead of trying to earn a profit through the value of that investment going up, you hope the U.S. Dollar value of that currency will move in the direction you're hoping for (up or down). When it does, you earn a profit when converting the currency back into dollars.

Steps to investing in foreign currency

Here are the steps to invest in foreign currency:

- Options — currency options give you the ability to buy or sell currency at a set price at a specific date and time. If the specifics work out in your favor, you can exercise the option for a profit. Learn more about options trading here.

- Futures — futures work like options in many ways. But instead of having the option to exercise at a set time, you are obligated to exercise the contract when it's up. Learn more about futures here.

- Funds –mutual funds and exchange-traded funds (etfs) often hold stocks and bonds, but they are not limited to those assets. A fund can also hold foreign currencies. Learn more about investment funds here.

- Diversify your portfolio — many investors focus heavily on stocks and bonds. Forex is a popular alternative to diversify your portfolio.

- Profit on international economic news — news and statistics enthusiastic can develop trading strategies around news releases, elections, and other current events.

- Trade around the clock — unlike the stock market, which has fixed hours, forex markets are almost always open somewhere. Some forex platforms support 24-hour trading, so you never have to wait for the markets to open.

- High volatility — news travels fast among forex traders, and these markets tend to move quickly. Forex markets are often more volatile than stock and bond markets.

- Less predictable markets — when investing in U.S. Stocks, you can count on company guidance, financial reports, and other data to predict the future. Forex markets can take big swings with less warning.

- Many bad investment options — investor junkie recommends working with reputable companies to manage your portfolio. There are some bad players in the industry that offer poor products with extremely high risk, which can be made worse with margin trading.

- 409 views

- 0 comments

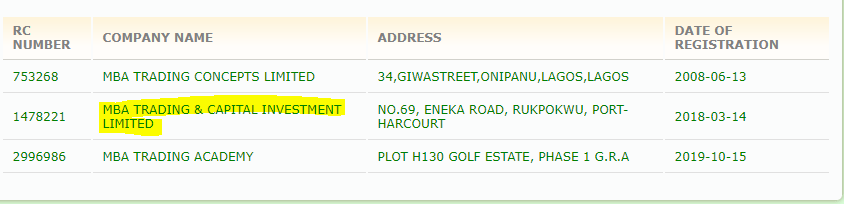

- They are investing in a real proven legal business.

- It is a registered company.

- The presence of branches in various part of the country.

- They offer forex training – that is they teach you how you can become financially independent.

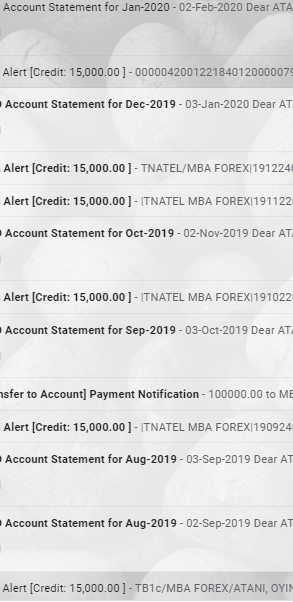

- The average waiting time to get your investment income is 7 days and it has never exceeded that time range.

- They are customer-friendly and always open to assist

- Work into any of their branches and tell them you want to make an investment , if you dont know a branch closest to you call +2347000002000 for directions – the minimum is a $1000.

- You would be directed to the accounting department; you make a transfer or pay via the best method convenient to you.

- After the money has been confirmed, you would fill in your details.

- And your legal document would be prepared and handed over to you.

- MBA gives investors NGN 360000 – NGN4,500000 a whopping 15% ROI every month and NGN5,000000 10% for 6 months.

- At the expiration of the 6 months, an investor can withdraw his initial investment amount.

- Any investor who wants to roll over must first print out his statement of account for citing and verification before the rollover can be effected.

- Deciding whether to invest in the foreign exchange markets (forex) or stocks/stock indexes depends on he trader's or investor's risk tolerance and trading style.

- Specific elements to compare include volatility, leverage, and market trading hours.

- Broadly speaking, the equities markets—blue chip stocks and index funds—suit a buy-and-hold investor, while active traders often prefer the fast-moving forex.

- Volatility. This is a measure of short-term price fluctuations. While some traders, particularly short-term and day traders, rely on volatility in order to profit from quick price swings in the market, other traders are more comfortable with less volatile and less risky investments. As such, many short-term traders are attracted to the forex markets, while buy-and-hold investors may prefer the stability offered by blue chips.

- Leverage. A second consideration is leverage. In the united states, investors generally have access to 2:1 leverage for stocks. The forex market offers a substantially higher leverage of up to 50:1, and in parts of the world even higher leverage is available. Is all this leverage a good thing? Not necessarily. While it certainly provides the springboard to build equity with a very small investment—forex accounts can be opened with as little as $100—leverage can just as easily destroy a trading account.

- Trading hours. Yet another consideration in choosing a trading instrument is the time period that each is traded. Trading sessions for stocks are limited to exchange hours, generally 9:30 A.M. To 4pm eastern standard time (EST), monday through friday with the exception of market holidays. The forex market, on the other hand, remains active round-the-clock from 5 P.M. EST sunday, through 5 P.M. EST friday, opening in sydney, then traveling around the world to tokyo, london and new york. The flexibility to trade during U.S., asian and european markets—with good liquidity virtually any time of day—is an added bonus to traders whose schedules would otherwise limit their trading activity.

- Volatility. The volatility and liquidity of the e-mini contracts are enjoyed by the many short-term traders who participate in stock market indexes. Let's say that the major equity index futures trade at an average daily notional value (the total value of a leveraged position’s assets) of $145 billion, exceeding the combined traded dollar volume of the underlying 500 stocks. The average daily range in price movement of the e-mini contracts affords great opportunity for profiting from short-term market moves. While the average daily traded value pales in comparison to that of the forex markets, the e-minis provide many of the same perks that are available to forex traders, including reliable liquidity, daily average price movement quotes that are conducive to short-term profits, and trading outside of regular U.S. Market hours.

- Leverage. Futures traders can use large amounts of leverage similar to that available to forex traders. With futures, the leverage is referred to as margin, a mandatory deposit that can be used by a broker to cover account losses. Minimum margin requirements are set by the exchanges where the contracts are traded, and can be as little as 5% of the contract's value. Brokers may choose to require higher margin amounts. Like forex, then, futures traders have the ability to trade in large position sizes with a small investment, creating the opportunity to enjoy huge gains—or suffer devastating losses.

- Trading hours. While trading does exist nearly around the clock for the electronically traded e-minis (trading ceases for about an hour a day to enable institutional investors to value their positions), the volume may be lower than the forex market, and liquidity during off-market hours could be a concern depending on the particular contract and time of day.

- Major pairs: the major pairs are made up of seven different currencies. Roughly 80% of forex trades consist of these currencies.

- Minor pairs: these pairs are not traded as often. Often, they involve the major currencies trading against each other instead of trading against the united states dollar. This includes currencies like the canadian dollar, which is represented as CAD.

- Regional pairs: these pairs are classified according to where they are in the world. For example, one collection of regional pairs is from scandinavia.

- Exotic pairs: exotic pairs involve trading a major currency for a currency from an emerging economy or a small economy.

- Forex marketplaces are open 24 hours a day.

- You can go long or short on any position.

- High volatility gives you many trading opportunities.

- You can get more out of your investment by using leverage.

- You can pick a variety of currency pairs.

- Top-3 forex bonuses

- How can I invest in a foreign exchange market?

- Forex

- Foreign currency futures

- Foreign currency options

- Etfs and etns

- Certificates of deposit

- Foreign bond funds

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Investing in a foreign currency

- Follow this guide to get started with forex.

- What is investing in foreign currency?

- Steps to investing in foreign currency

- Types of foreign currency investments

- Risks and advantages of investing in forex

- What you need to invest in foreign currency

- Enter the world of forex with care

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- Investments

- Investing is easy!

- Home → reviews

- Investing in mba forex

- Here are a few things I like about MBA forex:

- How to invest in MBA forex

- Quick notes about MBA

- Wrap up

- Investing in forex vs. Stocks

- Comparing forex to blue chip stocks

- Comparing forex to indexes

- Tax treatment: forex vs. Equities

- The bottom line

- Forex investing strategies

- Daily or weekly trend following

- Carry trading

- Day trading

- Fundamental trading

- What is forex trading?

- What is forex trading?

- Forex pairs

- Is forex better than stocks?

- Is it safe to do forex trading?

- How do I start trading forex?

- The advantages of forex trading

Open a brokerage account — first, you need a place to hold your foreign currency. That's a brokerage account. Open one to get started if you don't already have a favorite brokerage. We recommend using one of the following discount brokers:

| highlights |

Types of foreign currency investmentsWhile you can buy and sell foreign currency directly, many traders use different tools to invest in currencies. Here are a few popular methods to get into forex trading with a brokerage account: Some investors may use one of these investments as a hedge. Currency hedging is a combination of trades designed to offset other risks. It may also be useful for expats who want to keep accounts in multiple currencies. You could also get the currency directly from your bank in some cases. And some online banks allow you to hold foreign currencies. Forex is riskier and more complicated than some other types of investments, so your options here are a bit more limited than with other asset classes. Risks and advantages of investing in forexForeign currency investing can be exciting, but it isn't for everyone. Before getting started with forex, it's a good idea to look at the risks and advantages of this type of investment. What you need to invest in foreign currencyTo buy or sell foreign currency, you need a brokerage account that supports this type of asset. If your broker doesn't allow you to invest directly in foreign currency-related options or futures, most support a wide range of etfs and mutual funds that give you FX exposure. We've already said it, but it's important to emphasize that foreign currency investing is very risky. You need to fund your account to get into the forex. Make sure it is money you can afford to lose if things don't go as planned. Enter the world of forex with careForex is an exciting place to invest, but it's a more expert area of the investment landscape. Newer investors should start with less risky assets before dabbling in currencies. Like every investment, there are risks and rewards with forex trading. You should look at all of your options before deciding. To try out forex without risking any real money, look for a brokerage with paper trading, which works like a stock market game. Once you feel comfortable, head to your favorite brokerage to get started. The minimum capital required to start day trading forex:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg) Martin child / getty images It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0. And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading. But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account. Risk managementDay traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade. Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value. :max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png) Pip values and trading lotsThe forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025. For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent. Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots. When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk. Stop-loss ordersWhen trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall. Capital scenarios$100 in the accountAssume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100). If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want. You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital. $500 in the accountNow assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk). Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5. Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity. $5,000 in the accountIf you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots. Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk. With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy. Recommended capitalStarting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading. InvestmentsTried and tested investment solutions for those who like to keep up with the times. Funds under management (USD):  Record returns on a PAMM account - over 180,000%  Some 19,000 investors have currently parked their funds in the PAMM service  Record returns on a PAMM account - over 180,000%  Some 19,000 investors have currently parked their funds in the PAMM service Investing is easy! Decide which product to invest in  Select a PAMM account or portfolio from the ratings  Invest funds and keep track of your returns! PAMM accountsPAMM accounts, originally developed by alpari, are now a forex industry standard. They enable investors to earn without trading themselves, while allowing traders to earn some extra income for successfully managing investors' funds. PAMM portfoliosPAMM portfolios are a tried and tested solution that allow investors to minimise their risk by spreading their funds across several PAMM accounts, combining them into one portfolio. PAMM portfolios provide earning opportunities to both managers and investors.     TradingAnalysisOther© 1998-2021 alpari limited This site is operated by AI accept solutions limited (registered at 17 ensign house, admirals way, canary wharf, london), a subsidiary of alpari limited. The alpari brand:Alpari limited, suite 305, griffith corporate centre, kingstown, saint vincent and the grenadines, is incorporated under registered number 20389 IBC 2012 by the registrar of international business companies, registered by the financial services authority of saint vincent and the grenadines. Alpari is a member of the financial commission, an international organization engaged in the resolution of disputes within the financial services industry in the forex market. Risk disclaimer: before trading, you should ensure that you've undergone sufficient preparation and fully understand the risks involved in margin trading. This site is operated by AI accept solutions limited (registered at 17 ensign house, admirals way, canary wharf, london), a subsidiary of alpari limited. Home → reviewsMBA training and capital investment is a world-class forex training and forex investment companies in nigeria which was established by maxwell odum with the vision of impacting into the populace the knowledge of forex trading and creating sustainable income source. I found out about MBA forex and capital investment in july 2019 during my nysc days, A team from MBA forex uyo came to our camp during one of our skill acquisition entrepreneurship department (SAED) lecture, to training corps members on how to trade forex of which subsequently an investment opportunity was introduced – A 15% monthly return on investment (ROI) for 6 months. I was sceptical of this newfound investment opportunity as I was well aware of what MMM and other ROI programs did to its investors. I did some research about mba forex and noticed that it was a registered company with rc number 1478221 and has been existing for more than three years but got registered with the CAC in 2018.  Another convincing factor was the fact that I knew forex was a real business and people raked in cash from it daily, as long as you know what you are doing. I also understood that to make a profit from forex, you need to have huge funds to move the market. To have an impact in this vast $7 trillion per day market is no child’s play, so MBA needed investor’s funds to make this a success, this was MBA business model and what they were trying to achieve. More conviction slide in when it got to my notice that the then “mama SAED” as she was fondly called was an investor in MBA, didn’t feel she would be lying then, because she got her reputation at stake Investing in mba forexWhen I left camp I had a substantial amount of money on me which I had saved up over time, and during that period I was looking for investment opportunities. For corps member then, an investment of NGN100,000 was made available for them, the minimum investment was $1000 which was NGN360,000 but a reduction was made strictly for corps members. After my documentation in the NYSC zonal office, 3 days later I proceeded to their office, mehn the office was well organized and of standard, I have silently weighed the company in my mind, as this wasn’t their main branch but was this well organized. I told the receptionist that I wanted to invest, she kindly directed me to the accounting department, where I made payment via POS. My passport was required and some information about me which included my bank account, I was then given an agreement which serves as a legal document bounding me and MBA for the 6 months contract. For the next six months, I was paid 15% of my money for 6 months which was NGN15000 * 6 =NGN90,000. Not bad I thought, at least better than banks.  By january 2020 my investment had elapsed and I was faced with the choice to renew the contract, collect my invested fund or roll-over. I went with the roll-over and it’s been four good months now, and I still enjoy the dividends of my investment. For rolling over your investment, your statement of account would be required, to ensure you were not paid twice due to error. After meeting the necessary requirement, a rollover would be initiated, you can even top-up your investment at this point. Here are a few things I like about MBA forex:How to invest in MBA forexTo invest in mba forex is absolutely easy and hassle-free: That’s it. Yea, that simple. Quick notes about MBAWrap upInvesting poises risk, all die an die, but invest wisely. MBA forex invests in a proven business of which they have the expertise, they also invest money into treasury bills. The high volatility of the forex market makes forex an opportunity zone for skilled forex traders. Any investment opportunity that comes your way, invest what you can afford to lose. Here are other business opportunities to look in to If you got any question do feel free to ask below. Forex investment companies in nigeria like MBA forex has help lifted up many to financial freedom. Kindly share your MBA FOREX experience below. Investing in forex vs. StocksToday's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange (or forex) markets. Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to make the best choice. The most important element may be the trader's or investor's risk tolerance and trading style. For example, buy-and-hold investors are often more suited to participating in the stock market, while short-term traders—including swing, day and scalp traders—may prefer forex whose price volatility is more pronounced. Key takeawaysComparing forex to blue chip stocksThe foreign exchange market (aka forex) is the world's largest financial market, accounting for more than $6.6 trillion in average traded value each day in 2019, according to the most recent bank for international settlements. many traders are attracted to the forex market because of its high liquidity, around-the-clock trading and the amount of leverage that is afforded to participants. Blue chips, on the other hand, are stocks of well-established and financially sound companies. These equities are generally able to operate profitably during challenging economic conditions and have a history of paying dividends. Blue chip stocks are generally considered to be less volatile than many other investments and are often used to provide steady growth potential to investors' portfolios. So what would be the key differences to consider when comparing a forex investment with one in blue chips? Should you trade forex or stocks?Comparing forex to indexesStock market indexes are a combination of stocks, with some sort of element—either fundamental or financial—which can be used as a benchmark for a particular sector or the broad market. In the U.S. Financial markets, major indexes include the dow jones industrial average (DJIA), the nasdaq composite index, the standard & poor's 500 index (S&P 500), and the russell 2000. The indexes provide traders and investors with an important method of gauging the movement of the overall market. A range of products provide traders and investors broad market exposure through stock market indexes. Exchange-traded funds (etfs) based on stock market indexes, such as the SPDR S&P 500 ETF trust (SPY) and the invesco QQQ, which tracks the nasdaq 100 index, are widely traded. Stock index futures and e-mini index futures are other popular instruments based on the underlying indexes. The e-minis boast strong liquidity and have become favorites among short-term traders because of favorable average daily price ranges. In addition, the contract size is much more affordable than the full-sized stock index futures contracts. The e-minis, including the e-mini S&P 500, the e-mini nasdaq 100, the e-mini russell 2000, and the mini-sized dow futures are traded around the clock on all-electronic, transparent networks. So what would be the key differences to consider when comparing a forex investment with one that plays an index? Tax treatment: forex vs. EquitiesThese various trading instruments are treated differently at tax time. Short-term gains on futures contracts, for example, may be eligible for lower tax rates than short-term gains on stocks. in addition, active traders may be eligible to choose the mark-to-market (MTM) status for IRS purposes, which allows deductions for trading-related expenses, such as platform fees or education. In order to claim MTM status, the IRS expects trading to be the individual's primary business. IRS publication 550 covers the basic guidelines on how to properly qualify as a trader for tax purposes. traders and investors alike should seek the advice and expertise of a qualified accountant or other tax specialist to most favorably manage investment activities and related tax liabilities, especially since trading forex can make for a confusing time organizing your taxes. The bottom lineThe internet and electronic trading have opened the doors to active traders and investors around the world to participate in a growing variety of markets. The decision to trade stocks, forex or futures contracts is often based on risk tolerance, account size, and convenience. If an active trader is not available during regular market hours to enter, exit or properly manage trades, stocks are not the best option. However, if an investor's market strategy is to buy and hold for the long term, generating steady growth and earning dividends, stocks are a practical choice. The instrument(s) a trader or investor selects should be based on which is the best fit of strategies, goals, and risk tolerance. Forex investing strategies:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/business-financial-and-forex-concept--hipster-young-woman-freelancer-thinking-about-her-job-and-using-computer-laptop-showing-trading-graph-with-the-stock-exchange-trading-graph-screen-background-807201430-5b4270afc9e77c0037288c8d.jpg) Forex is one of those areas that most people feel is complicated. In reality, it's like many other forms of investment where a little knowledge can be dangerous. The good news for people out there looking for forex investing strategies is that there are enough strategies out there to meet any investment goal. You can be a simple long-term investor, or you can sit and watch the market every day looking for profit at every turn. As long as you want to learn forex trading, you can find a method that's right. Daily or weekly trend followingOne strategy that is a simple forex trading system is following the daily or weekly trends. Review the daily and weekly charts and find a trend that seems well supported and get in. The one caveat about this particular type of trading is that your moves that look small on the chart can span 100's of pips. This means that you need to trade small. Use a conservative allocation when you buy in and allow your trade to develop a bit. Set a reasonable stop and plan out a target. Beginners find this strategy easy because they don't need to watch the market constantly. Instead, they can trade when they have time. Carry tradingCarry trading is when you buy and hold a currency that pays a high-interest rate against a currency that has a low-interest rate. Each day a rollover is paid for the interest difference between the two currencies. The advantage of this is that even when your trade is not moving, money is deposited into your account daily. Also, since most forex trades are leveraged, you get paid on the size of your trade, not just the size of your capital. The downside to the carry trade is that the interest differentials are typically not that much compared to how much risk you are taking. Also, currency pairs that are good for carry trading typically have a strong reaction to any news that presents a risk to the global markets. In other words, as long as things are good, these pairs will rise and pay. If something goes wrong, sometimes unexpectedly, they will plunge very hard and very fast. If you are overleveraged, you can blow up your account in a blink. Day tradingThe forex market is always moving—twenty-four hours a day, six days a week. Although the most active forex trading times are specific, the forex market is always moving at least a little. Depending on what you like to trade, you can pick and choose your time. Most day trading strategies revolve around forex technical analysis, which has its positive points. The market can be very technical, and if you have a sharp eye and a plan, you can catch it and make some profit from it. Fundamental tradingSome investors have a more old-fashioned approach to investment. They prefer to invest in something that they understand rather than looking for a signal on their chart. For this more cautious investor, fundamental forex trading works best. Fundamental trading is when you follow the news for several countries and play the countries with strengthening economic trends, against the ones with weakening economic trends. This type of approach is pretty easy because it looks at how things shape up over the long term. The complicated portion of it is learning to understand the economic reports and compare them to other countries. While forex trading can feel complicated, it's something that anyone with patience and the ability to learn from their mistakes can gain some skill at over time. It takes some persistence. The system is designed in a way that frustrates most people. You need to step back, keep an eye on the big picture, and trade small, at least in the beginning. It's also smart to avoid those "100 percent accurate forex trading systems" on the internet until you have some experience under your belt. What is forex trading?Originally posted october 1, 2020 Many investors may be asking “what is forex trading?” foreign exchange is known as forex, FX or currency trading. Forex trading is essentially a marketplace where you can trade currencies from different countries. You have probably heard of people making millions through currency trading and wondered how it works. Since the forex market’s trading volume tops $6.6 trillion per day, there is a huge potential to earn money if you know what you are doing.  What is forex trading?Imagine you own an oil tanker. After leaving the middle east with a shipment of oil, you drop it off in the united states. The buyer pays you in american dollars, but your company is based in europe. In order to bring your profits home, you have to convert your dollars into euros. Forex trading was originally a way to help companies exchange goods between different countries. Over time, savvy investors realized that they could make money by investing in different currencies. Because of changes in a country’s economy and monetary policy, a currency’s value can increase or decrease over time. For example, a single united states dollar was worth 226.63 japanese yen in 1980. In 2020, a dollar was worth 105.59 japanese yen. This means an investment of $1,000 in japanese yen in 1980 could be exchanged for $2,146.32 today. When you exchange currencies, you are always working with something known as a currency pair. You sell one currency while you buy another currency. These currencies are represented by a three-letter code. For example, the japanese yen is represented by JPY, and USD stands for the united states dollar. Meanwhile, EUR stands for the european union’s euro. The british pound is represented by GBP. Along with the yen and dollar, the euro and pound are the most commonly traded currencies. Because of this, you will often see currency pairs like USD/JPY, GBP/USD, GBP/EUR and EUR/USD. If you buy the USD/GBP pair, you are basically purchasing the united states dollar by selling the british pound. Forex pairsThe following are the four main kinds of forex pairs. Is forex better than stocks?Choosing whether you invest in the forex or the stock market depends on your risk tolerance and trading style. Each market has a different level of volatility. Equities tend to work better for buy-and-hold investors, but the forex market is popular among active traders. Forex is better than stocks in some cases, but it all depends on your personal situation. VolatilityVolatility is a key difference between stock markets and forex investments. A stock has high volatility if the price swings drastically in a short amount of time. Traders typically use the forex market’s volatility to make short-term profits. Trading hoursUnlike the stock market, the forex market is always open. Normally, the stock market is only open during the daytime on weekdays. If you want to trade throughout the day and night, the forex market can offer more flexibility. LeverageWith the forex market, you can use leverage to earn higher profits. Investors can normally get 2:1 leverage for stocks. Meanwhile, the forex market can offer 50:1 leverage. This means you can leverage an investment of $1 like it is worth $50. If you make a profitable trade, you will get substantially more in profits. Although, leverage can be a double edged sword and can lead to larger losses as well… Is it safe to do forex trading?Any investment involves some degree of risk. Forex trading can be risky if you use a significant amount of leverage. With leverage, it is possible to lose your entire investment and more if you’re not careful. Because of this, you should do your research and use practice accounts before you trade with real money. How do I start trading forex?When you trade in the forex market, you are buying one currency while selling another currency. On your last vacation, you probably conducted a forex trade without realizing it. When you arrived in another country, you might have exchanged your currency at a foreign exchange kiosk. Fortunately, you can also find online kiosks that allow you to take a position in a certain currency. Then, you can earn a profit if the change in prices moves in your favor. Spot transactionsSpot transactions are deals that are delivered within two business days or less. With the USD/CAD pair, spot transactions settle in just a single business day. These trades occur at the prevailing market rate. Forex rolloverIn general, most retail traders do not actually want to receive the currencies they purchase because they are just trying to earn a profit. Because of this, retail brokers will normally rollover trading position at the end of the day or close and settle the difference. When the trader eventually decides to close their trade, they can realize their profits or losses. Forex futuresA futures contract is when you make an agreement with someone else to deliver a certain amount of a currency at a set date. This date is known as the expiry. Once you agree to the contract’s terms, they are non-negotiable. Often, people buy and sell these contracts before they expire to realize the profits or losses right away. Forex forward transactionsWhen a transaction is settled later than the spot transaction, it is called a forward transaction. These prices are determined by changing the spot rate to accommodate the difference between each currency’s interest rates. Because a forward can be completely customized, you can change the amount of money or use a holiday as your settlement date. The advantages of forex tradingWhile there are downsides to any investment vehicle, forex trading offers a number of useful benefits. Forex trading has risks, so it’s important to do your research before you get started. Many brokers offer demo accounts you can use to practice trading before you use real money. Once you start trading, you can use leverage to increase your profits as you buy and sell currency pairs. So, let's see, what we have: there are a number of ways to invest in the foreign exchange market, including trading spot forex pairs, foreign currency futures, foreign currency options, etfs and etns, cds and bond funds. At investment in forex Contents of the article |

|---|