Tockmill

Select a payment method, fund your trading account and start trading. Tickmill.Com is owned and operated within the tickmill group of companies.

Top-3 forex bonuses

Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

FOREX

Access the world’s largest market and trade more than 60 currency pairs.

What is forex?

Foreign exchange, or forex for short, is quite simply a market where you’re able to exchange one currency for another. When you ‘sell’ a currency, there is a buyer for that currency somewhere else. Now, the exchange rate between those two currencies is what’s important when trading forex. The exchange rate is constantly fluctuating, and it’s these fluctuations that allow market speculators to earn from trading.

With a daily trade volume of $6.5 trillion dollars, the forex market itself is huge! It eclipses the likes of the new york stock exchange (NYSE) which, by comparison, has a trading volume of only $22.4 billion per day.

The forex market’s sheer size attracts a wide range of different participants, including central banks, investment managers, hedge funds, corporations, brokers and retail traders – with 90% of those market participants being currency speculators!

Why TRADE FOREX

with tickmill?

Our aim is to help our traders succeed by providing an exceptional trading experience.

Spreads from 0.0 pips. Access to 60+ currency pairs.0.20s average execution speed. All trading strategies enabled. Leverage up to 1:500.

CURRENCIES

| instrument | minimum spread | typical spread | long position | short position |

| AUDUSD | 0 | 0.1 | -2 | -1.6 |

| EURGBP | 0 | 0.4 | -3.87 | -0.78 |

| EURJPY | 0 | 0.5 | -4.3 | -0.8 |

| EURUSD | 0 | 0.1 | -5.2 | 0.2 |

| GBPAUD | 0 | 2.5 | -3.6 | -3.5 |

| GBPJPY | 0 | 1 | -2.3 | -3.4 |

| GBPUSD | 0 | 0.3 | -3.4 | -2.27 |

| USDCAD | 0 | 0.2 | -2 | -3.4 |

| USDCHF | 0 | 0.4 | 0.49 | -4.4 |

| USDJPY | 0 | 0.1 | -1.3 | -3 |

HOW-TO

trade forex

The value of each currency depends on the supply and demand for it, thus determining the ‘exchange rate’ between the two currencies, which is continually fluctuating. The exchange rate itself is basically the difference between the value of one currency against another.

It's this exchange rate that determines how much of one currency you get in exchange for another, e.G. How many pounds you get for your euros.

Now, when you’re trading forex, you’ll be trading currency pairs. So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other.

Learn to trade forex

FOREX

trading hours

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Your company video here? Contact ad sales

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally – and a regular winner of trade execution and trading conditions awards – tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmill’s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards) and best forex trading conditions 2017 (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies – USD, EUR, GBP, and PLN.

Account types

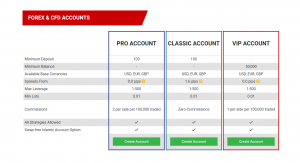

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account – A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account – this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 – note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account – this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account – this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmill’s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors – insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

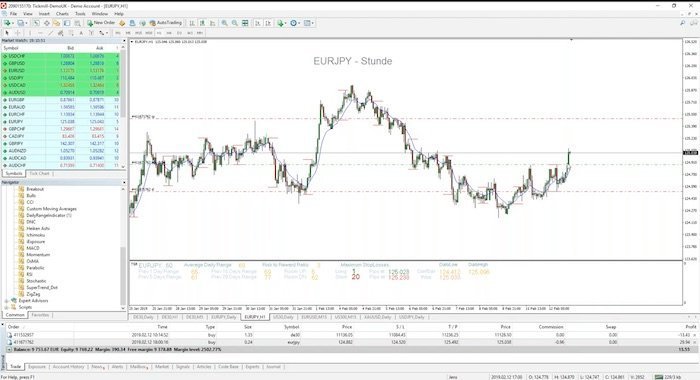

Trading platforms

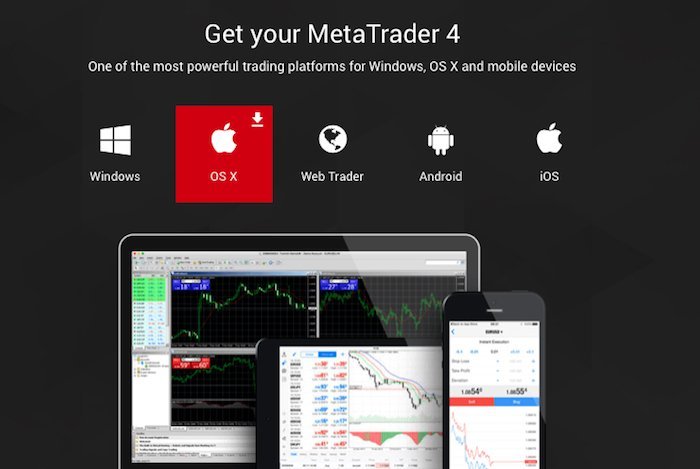

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

- FM home

- Retail FX

- Products

- Exclusive: tickmill launches futures trading on CQG platform

Exclusive: tickmill launches futures trading on CQG platform

According to tickmill co-founder, illimar mattus, the product has been in the works for over 18 months.

London-based brokerage firm, tickmill is expanding its product portfolio with the launch of futures trading to capitalize on the growing popularity for such instruments outside their traditional users.

“after partnering with CME, the world’s leading derivatives marketplace, we’re giving to our clients access to globally regulated futures exchanges, including NYMEX, COMEX, CBOT and EUREX. This will provide you with direct market access, giving you fast and reliable execution on our new CQG platform,” the UK broker told finance magnates.

According to duncan anderson, CEO of tickmill UK ltd, the product has been in the works for over 18 months and the company “intends to bring strong competition into futures and options space with competitive pricing, access to a wide range of markets and excellent customer service.”

As part of its plans, tickmill has partnered with top-tier regulated exchanges in order to lower trading costs and let them tap into their range of futures aimed at smaller investors.

The broker broadens its product line as clients’ desire to garner exposure to regulated markets has been increasing. The moves are a sign that more retail traders are looking to diversify their trading options and further marks how such regulated products are starting to appeal beyond a relatively small group of institutional investors.

Suggested articles

FBS copytrade launches a new card scanning feature!Go to article >>

Although heavily regulated with a limited ability to juice up their bets, exchange-traded derivatives offer certain advantages over traditional OTC products. The list includes standardization, liquidity, and elimination of default risk. Etds can be also used to hedge exposure or speculate on a wide range of financial assets like commodities, equities, FX and even interest rates.

Tickmill is a group of companies with UK FCA, cypriot cysec, SC FSA, south african FSCA and malaysian LFSA licenses.

Tickmill has recently reported strong financial results for the fiscal year 2019, having bested its equivalents from the year before. Additionally, the net revenue stood at $68.6 million, marking a 52.1% increase from 2018’s result of $45.1 million. Moreover, net profit came in at $37.7 million, an increase of 91.4% compared to 2018’s figure of $19.7 million.

On the trading volumes front, tickmill disclosed that in 2020 its platforms process over 9 million trading transactions per month and in march 2020 its turnover hit the all-time record of $170 billion in notional value.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tickmill review

In a FAST-MOVING market, choose a STABLE BROKER

Table of contents

Introduction

Tickmill is one of the most credible and reliable forex brokers in the market. Founded in 2014 with its headquarters in london – UK, this company has been providing quality brokerage services to users across the world from the past six years. Users of this broker get to access various financial markets like forex, soft/hard commodities, indices, bonds, etc.

Compared to other brokers with the level of tickmill’s market experience, this broker proved to be heavily regulated with some of the top tier financial regulators. Tickmill offers four types of well curated accounts and users get to pick the ones that is most appropriate to them. Demo trading facility is also available for users which could help novice traders to get the hang of the platform they are going to use.

This broker offers their services on the MT4 trading platform which is highly accepted by traders across the world. Using this platform, users get to trade on both desktops (windows/mac), and smartphones (android/ios). Apart from these, there are various other services this broker provides for their users like trading bot services called autochartist, VPS and many more.

The unique selling proposition of this broker is the lowest fees they offer. When compared to other regulated brokers, tickmill charges very less commissions and trading fees. Options to deposit and withdrawal are also many and are typically not charged. On the flip side, users get to access limited number of asset classes when compared to other brokers of this range.

Tickmill is now in position to claim that it possesses way above 100,000 traders which have jointly opened more than 250,000 active accounts.

Tickmill.Com is owned and operated within the tickmill group of companies.

– tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 – 32 old jewry, london EC2R 8DQ, england),

– tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),

– tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA)

– tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927

– tickmill asia ltd – regulated by the financial services authority of labuan malaysia (license number: MB/18/0028).

Addresses and phones

Addresses:

tickmill UK ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill europe ltd, registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus

tickmill south africa (pty) ltd, registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town

tickmill ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill asia ltd, registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia

Phones:

+852 5808 2921

+6087-504 565

+44 203 608 6100

+357 25041710

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Review of the tickmill broker вђ“ 2021

| foundation year | 2014 |

| headquarters | seychelles |

| country | 3, F28-F29 eden plaza, eden island, mahe, seychelles and london, cyprus |

| telephone | +44 203 608 6100 |

| fax no. | No |

| regulated by | FCA UK, cysec, FSA SC |

| min. Deposit | 100 USD |

| max leverage | 1:500 |

| withdrawal methods | wire transfer, credit card, debit card, neteller, skrill , paypal, moneybookers, mastercard , cashu |

| funding methods | wire transfer, credit card, debit card, neteller, skrill , paypal, moneybookers, mastercard , cashu |

| base currencies | USD, EURO, GBP |

| tradable options | forex currencies, cryptocurrency, commodities, indices, stocks, bonds, futures |

| web trading | yes |

| mobile trading | yes |

| type of broker | STP/ECN |

| min. Spreads | 0.01 pips |

| free demo account | yes |

| mini accounts | yes |

| VIP accounts | yes |

| managed accounts | yes |

| segregated accounts | yes |

| swap free accounts | yes |

| promotion | $30 forex no deposit bonus* only for FSA clients |

Tickmill is a forex and cfdвђ™s based broker that was founded in the year 2014. The broker is regulated by most of the international financial authorities including (FCA) financial conduct authority. They are getting more and more clients day by day for their good services.

According to tickmill, currently, they have more than 111,000 registered traders and 263,000 accounts.

The group tickmill is regulated by the FCA with the registration number 717270 also they are regulated by FSA with the license number SD008. The broker providing guarantees of traders funds with the FSCS (financial services compensation scheme). The company having a total of ВЈ85,000 deposit value.

Account types of the tickmill broker

There are three types of account services offering byв the broker tickmill which are pro, classic, and VIP account.

To open a pro and classic account, clients need to deposit a minimum of $100 or an equivalent amount in other currency.

Spreads start from 0.0 pips in pro and 1.6 pips in the classic account. There is no minimum balance required for pro and classic accounts but to open a VIP type account clients have to keep a total of $50,000 amount in the VIP account. The maximum leverage is 1:500 for all types of accounts.

There are other types of accounts designed for muslim traders that called islamic account. A lot of muslim traders wants a swap-free account, tickmill designed an islamic account for them which absolutely swaps free account.

Platforms to trade with tickmill

Most of the traders trust the MT4 platform. Tickmill offers this platform to trade with them. Traders can access the platform from mobile or computer. To trade via mobiles clients have to use MT4 apps by downloading from the app store such as google play store, apple store, etc. There is a web trader available for any users they can use it from any internet browser or download a desktop application.

Payment method and withdrawal options

There are a lot of options available for traders for making payments and withdraw profits. Tickmill offers so many E-wallets including skrill, neteller, webmoney, fasapay, unionpay, stickpay, and others. Also, they are accepting bank transfers, any type of visa, and mastercard.

Customer service & management

The customer service department is very fluent. All of the modern customer services are available including support call center, email support, and live chat support.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

- FM home

- Retail FX

- Products

- Exclusive: tickmill launches futures trading on CQG platform

Exclusive: tickmill launches futures trading on CQG platform

According to tickmill co-founder, illimar mattus, the product has been in the works for over 18 months.

London-based brokerage firm, tickmill is expanding its product portfolio with the launch of futures trading to capitalize on the growing popularity for such instruments outside their traditional users.

“after partnering with CME, the world’s leading derivatives marketplace, we’re giving to our clients access to globally regulated futures exchanges, including NYMEX, COMEX, CBOT and EUREX. This will provide you with direct market access, giving you fast and reliable execution on our new CQG platform,” the UK broker told finance magnates.

According to duncan anderson, CEO of tickmill UK ltd, the product has been in the works for over 18 months and the company “intends to bring strong competition into futures and options space with competitive pricing, access to a wide range of markets and excellent customer service.”

As part of its plans, tickmill has partnered with top-tier regulated exchanges in order to lower trading costs and let them tap into their range of futures aimed at smaller investors.

The broker broadens its product line as clients’ desire to garner exposure to regulated markets has been increasing. The moves are a sign that more retail traders are looking to diversify their trading options and further marks how such regulated products are starting to appeal beyond a relatively small group of institutional investors.

Suggested articles

FBS copytrade launches a new card scanning feature!Go to article >>

Although heavily regulated with a limited ability to juice up their bets, exchange-traded derivatives offer certain advantages over traditional OTC products. The list includes standardization, liquidity, and elimination of default risk. Etds can be also used to hedge exposure or speculate on a wide range of financial assets like commodities, equities, FX and even interest rates.

Tickmill is a group of companies with UK FCA, cypriot cysec, SC FSA, south african FSCA and malaysian LFSA licenses.

Tickmill has recently reported strong financial results for the fiscal year 2019, having bested its equivalents from the year before. Additionally, the net revenue stood at $68.6 million, marking a 52.1% increase from 2018’s result of $45.1 million. Moreover, net profit came in at $37.7 million, an increase of 91.4% compared to 2018’s figure of $19.7 million.

On the trading volumes front, tickmill disclosed that in 2020 its platforms process over 9 million trading transactions per month and in march 2020 its turnover hit the all-time record of $170 billion in notional value.

Tickmill review

Established in 2015, tickmill is an online forex and CFD broker that is regulated in multiple jurisdictions. They provide online trading services to their retail and institutional clients across the globe, offering over 80 tradable instruments across currency pairs, stocks, indices, bonds, metals, energies, and other commodities via flexible trading platforms. The broker offers quality trading conditions, including competitive spreads and commissions, good execution speeds without requotes, prompt customer support services, and helpful trading tools. However, they do not provide enough educational resources.

Tickmill review introduction

In this tickmill review, we will take a look at some of the most important factors worth considering when choosing a forex broker for your online trading needs. This includes trading platforms, trading tools, research and education, account funding options, customer support and broker regulation.

You may also wish to view my best forex brokers based on countless hours that I have spent researching and testing hundreds of brokers, all of which you can see in my forex broker reviews. You can also use my free trading tool to compare forex brokers including tickmill.

Tickmill platforms & tools

Tickmill provides their clients with the metatrader 4 (MT4) platform, which is the most popular trading platform among forex traders. MT4 is available as a web trading terminal that runs on most modern browsers, desktop applications for mac and windows computers, and mobile apps for ios and android compatible devices. The broker also provides a FIX API connection to private and institutional who maintain a minimum account balance of $500,000.

In addition to the tools that come with the trading platforms, the broker provides a selection of useful tools, such as autochartist, technical chart patterns, fibonacci patterns, volatility analysis, key levels, market reports, performance statistics, myfxbook autotrade, economic calendar, trading calculators, tickmill VPS, and one-click trading

Tickmill research & education

The broker has an FAQ section on their website, which answers some common trading questions. Apart from that, and probably the news section, there are no education materials provided by this broker.

Tickmill trading accounts

The broker offers 3 account types:

- Classic account: minimum deposit $100, minimum lot size 0.01, max leverage 1:500, floating spreads from 1.6 pips and no commissions

- Pro account: minimum deposit $100, floating spreads from 0 pips, a $2 commission, minimum lot size 0.01, and max leverage 1:500

- VIP account: floating spreads from 0 pips, a $1 commission, minimum deposit $50,000, minimum lot size 0.01, max leverage 1:500,

Non-professional EU traders have a maximum leverage of 1:30. There may be additional fees, so check with the broker.

Tickmill account funding

Tickmill accepts a good variety of deposit and withdrawal methods, including bank transfer, credit card, and online payment processors, such as skrill, neteller, fasapay, and unionpay. Bank transfers may take 3-7 business days to be processed, while credit cards and online payment methods are processed in less than a day.

Tickmill customer service

Customer support service is available from monday to friday during trading hours. Support is offered in english, italian, spanish, russian, chinese, indonesian, vietnamese, and arabic. You can reach the support team via phone, online chat, and email

Tickmill regulation

Tickmill is a brokerage brand operated by 3 related companies within the tickmill group, which are regulated in different jurisdictions, as follows:

- Tickmill UK ltd is authorized and regulated by the financial conduct authority (FCA) — the agency that supervises financial service firms in the UK

- Tickmill europe ltd is licensed and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company.

- Both tickmill uk and tickmill europe also abide by the ESMA rules and follow the mifid II

- Tickmill ltd is regulated as a securities dealer by the financial services authority (FSA) of seychelles

Tickmill review summary

Tickmill is an online broker that is regulated in multiple jurisdictions. They provide trading services in over 87 instruments via the MT4 platform, offering competitive spreads and commissions, advanced trading tools, and fast executions.

It is worth mentioning that some of the trading products and services in this tickmill review may differ or not be available to traders in some countries due to regulations. As brokers terms can change over time, please verify all information is up to date directly from the tickmill broker website which you can visit by using the link below.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill

Spreads

Liquidity

Commissions

Support

Regulation

Features

- MT4 platform

- Advanced trading tools like autochartist, technical chart patterns, fibonacci patterns, and volatility analysis

- A good selection of tradable instruments

- Multi-regulated broker

- Competitive trading conditions

Best forex robots

Forex robotron

Forex cyborg

Forex flex EA

Forex scalping EA

5 pips A day

Get my free forex robot!

Sign up now and receive instant access to my free forex robot download with over 40 technical indicators and 11 candlestick patterns built in. *please use a real email address as you will be sent the download link*

Best forex brokers

Pepperstone

IC markets

Pages

- Best forex robots 2021

- Forex robot reviews

- Forex robot ratings

- Free forex robot download

- Best forex brokers 2021

- Forex broker reviews

- Forex broker ratings

- Compare forex brokers

- Forex trading system reviews

- Forex trading system ratings

- Forex trading tool reviews

- Forex trading tool ratings

- Forex signal reviews

- Forex signal ratings

- Forex trading course reviews

- Forex trading course ratings

- Contact me

- Privacy policy

- Terms & conditions

Categories

- Forex brokers

- Forex robots

- Forex signals

- Forex trading courses

- Forex trading guides

- Forex analysis

- Forex basics

- Forex indicators

- Forex strategies

- General trading

- Trading psychology

- Trading software

- Forex trading systems

- Forex trading tools

Recent posts

- Bitcoin VS forex – which one is the best option

- Cedarfx lends support to combat climate change

- Cedarfx review

- Bitcoin exchange: what to consider for choosing the right bitcoin exchange?

- The different methods to acquire bitcoin

- What are the challenges faced by bitcoin and its users and need to be overcome?

- Forex robotron review

- Forex cyborg review

- Forex scalping EA review

- Forex flex EA review

All information on the forex geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the forex geek and any authorized distributors of this information harmless in any and all ways. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

So, let's see, what we have: tickmill offers forex, metals, commodities and indices trading with award winning trading platforms, tight spreads, quality executions & powerful tools at tockmill

Contents of the article

- Top-3 forex bonuses

- FOREX

- What is forex?

- Why TRADE FOREX with...

- CURRENCIES

- HOW-TO trade forex

- Learn to trade forex

- FOREX trading hours

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- Exclusive: tickmill launches futures trading on...

- According to tickmill co-founder, illimar mattus,...

- Suggested articles

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tickmill review

- Introduction

- Review of the tickmill broker вђ“ 2021

- Account types of the tickmill broker

- Platforms to trade with tickmill

- Payment method and withdrawal options

- Exclusive: tickmill launches futures trading on...

- According to tickmill co-founder, illimar mattus,...

- Suggested articles

- Tickmill review

- Tickmill review introduction

- Tickmill platforms & tools

- Tickmill research & education

- Tickmill trading accounts

- Tickmill account funding

- Tickmill customer service

- Tickmill regulation

- Tickmill review summary

- Tickmill

- Features

- Best forex robots

- Get my free forex robot!

- Best forex brokers