Is xm ecn broker

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows: access to liquidity providers around the globe

Top-3 forex bonuses

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

Top ecn brokers for 2021

We found 11 online brokers that are appropriate for trading ecn.

Best ecn brokers guide

ECN brokers

ECN brokers are brokers that use an electronic communication network, hence its name ECN forex market.

Many forex brokers have stepped into this new system and are also known as STP brokers, which means 'straight through processing'. Also refered to as non-dealing desk brokers or NDD brokers.

With ECN brokers the ECN system does the work of matching participants electronically.

ECN forex brokers trade as per the requests of clients and not against them for a fixed commission based on the number of transactions. Usually, the fee is less compared to non-ECN forex trading.

So, it can be said that ECN FX brokers facilitate trades on a network that is accessed by several forex traders.

What is ECN

When starting out many traders ask what is ECN? Who are the best ECN brokers? ECN is not rocket science, but simply an electronic system network that facilitates buyers and sellers to meet and execute trades.

The ECN is designed to match buyers and sellers that can trade and transact. If the match is not met, the network reflects the highest and lowest bids that are listed on it.

ECN forex benefits

The primary benefit of ECN forex is that traders can trade beyond the traditional trading hours. The availability here is comparatively wider and price feed has transparency too. All the ECN forex brokers access the same feed and so they trade at the defined price. Price manipulation is not possible with ECN brokers as recent price history is made available. No trader enjoys a built-in advantage over other traders on ECN.

ECN forex disadvantages something to be aware of when trading ECN forex is pre-trade-based commissions may be higher. The commission fees to use ECN forex is higher compared to non-ECN trading.

Choosing the best ECN brokers

Lately, ECN forex brokers are gaining popularity and their number is increasing by at least two-fold year- after-year.

It is important to know whether the ECN forex brokers you decide to trade with are able to meet minimum industry standards. Check your ECN brokers have a presence in your country. You and your ECN broker should be governed by the same legal system.

If you are in the UK, it is suggested to look for ECN brokers who have a presence there. Same if you are based in south africa, united emirates or anywhere else in the world.

Next, look for the regulation under which your broker is governed to check how safe your deposit is. Even for small investors, this is important.

Check the trading fees and commissions and check whether you are allowed to start with a demo account.

Real ECN brokers

The real ECN forex brokers will readily offer ECN-type of account and put your orders into the electronic network to match with another trader.

Ask the ECN brokers about liquidity provider and this should always be a tier-one bank.

We've collected thousands of datapoints and written a guide to help you find the best ecn brokers for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best ecn brokers below. You can go straight to the broker list here.

Reputable ecn brokers checklist

There are a number of important factors to consider when picking an online ecn trading brokerage.

- Check your ecn broker has a history of at least 2 years.

- Check your ecn broker has a reasonable sized customer support of at least 15.

- Does the ecn broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your ecn broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your ecn broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your ecn can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering ecn brokers.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below ecn brokers.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 ecn brokers of 2021 compared

Here are the top ecn brokers.

Compare ecn brokers min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are ecn brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more ecn brokers that accept ecn clients

Is xm ecn broker

Compare forex brokers and ECN brokers

XM - specs

Broker

Account

Payments

Costs

Trading

Platform

Products

Other

Promotions and offers

Our rating

The overall rating is based on review by our experts

XM is a forex broker . It started opening it’s doors to clients in 2009 , establishing it’s offices in cyprus , new zealand. XM (forex broker) offers various trading accounts: mini account, standard account and the minimum deposit for trading in forex (FX) is $5.

XM offers accounts in: USD account, EUR account, GBP account, JPY account, CHF account, AUD account, HUF account, PLN account, RUB account with variable spreads. The lowest spread offered in eurodollar is 1 pips.

It’s platform (MT4 desktop/mobile/ios/android/blackberry, web trader ) can be traded on desktop|mobile|ios|android|blackberry| , it offeres a expert trading guidance feed. The platform is set on GMT+2 and it offers a 5 digits decimal spacing on it’s forex pairs. It’s forex (FX) accounts offer a leverage of 888:1 standard account

On it’s platforms: MT4 , web trader, you can set trailing stoploss, no OCO orders, one click trading, furthermore it offers mobile trading, webtrading and 56 fx pairs (20+ exotic). Among the foreign exchange products you can also trade, gold, silver, stocks, indices, commodities, energies.

XM (forex broker) is regulated by cysec, FCA UK, ASIC, bafin, CNMV spain, AFM netherlands, FI sweden, FIN finland and other, and is a independent broker..

For all those wondering on the payment and withdrawal method, here is a list of funding methods:

Payments:bank wire, credit card, neteller, skrill, webmoney, western union, moneygram, china unionpay, SOFORT, ideal, paysafecard, QIWI, cashu, giropay, przelewy24, fasapay

Withdrawals from your FX account:bank wire, credit card, debit card, webmoney, skrill, neteller, QIWI, fasapay

Please take the opportunity to review XM, your feedback is appreciated.

7 REASONS TO TRADE AT XM. XM REVIEW 2021

Having tried out tons of different brokers over my years of trading, I find that none of them is even close to XM in terms of services and trading conditions. It’s actually quite surprising that not that much traders know how great XM services and trading conditions are. That is why today I will be writing this article to give you a throughout XM review – one of the best forex brokers of 2021.

Founded in 2009, XM now has over 1,500,000 clients from 196 countries which is an impressive enough number for us to trust. XM has also personally visited over 120 countries to meet with their clients and partners and hosted hundreds of seminars around the world to educate traders, enabling them to make better trading decisions. Below, I’m going to review XM based on many different criteria such as regulations, trading conditions and trading costs, trading platform , paying system and types of accounts.

Regulations of XM review

Regulation, commonly, is one of the most important things in forex market, which could indicate how reliable a broker is. Moreover, it is not easy to obtain a license of the regulation. Therefore, the brokers having the license are often trustworthy and reliable.

There are now still discussions on regulations between US&UK brokers and other brokers in the forex market. Most traders have chosen US&UK regulated brokers because they believe in US/UK financial management system. As a result, US and UK regulations are considered very good. Brokers which can acquire one of these regulations often have the best trading platforms, techniques, financial health and management systems… accordingly, XM broker is one of the best regulated brokers as it has a regulation from UK, which is FCA . It also obtains cysec from cyprus, ASIC from australia and FSB from south africa in order to serve the traders in these areas. With these regulations, XM is the most reliable broker which could protect traders in many countries from all over the world. Therefore, I can say that you can trust XM.

CLICK TO SEE XM REGULATIONS.

Trading costs and trading benefits of XM review

Trading cost

Cost of transactions is one of the most considerations of traders while joining into the forex market. Apparently, traders often prefer the brokers which have reasonable and low cost of transactions, especially scalpers who have many transactions at a time.

Accordingly, XM has the low spreads like FXCM and forex.Com, US and UK brokers. The spread is 1.7 pip for a EUR/USD for trading regular accounts. And 6$ commission for trading ECN account (other brokers charge around $7 for trading ECN account). Moreover, XM has the loyalty program. It will rebate an amount of money to your account automatically when you finish a lot/transaction. The rebated amount depends on your trading currencies, account types and trading time. This program is mostly preferred by the professional traders as it could minimize the transaction cost effectively.

Trading benefits

In forex system, XM lots back $3 (0.3 pip) to 10$ (1 pip) for each completed transaction and the rebated amount will increase by time for each trading lot. After the lot-back bonus, cost of transactions is now lower than FXCM and forex.Com brokers and spreads are decreased down to only 1 to 1.4 pips.

Moreover, XM also has the deposit bonus, which allows you to get money depending on how much you deposit it. This deposit bonus program can reduce your trading costs even more. You can get up to $5000 from their deposit bonus program, with the maximum deposit rate being 100%.

In short, it can be said that the original spread and commission are similar with other brokers. However, in fact, the actual cost is much lower after many completed transactions thanks to the lot-back bonuses and the deposit bonus. And there you have it, a broker with high-quality regulation (UK) yet has low transaction cost.

CLICK TO SEE XM SPREADS.

XM markets is one of the best in europe

According to finance magnates, brokers now have to compete with each other to build a good percentage of customers with good profit/loss ratio to support marketing and advertisement. To do this, brokers must provide many good resources for customers, while improving customer training. Brokers who use tricks to market, attract new customers, ignorant customers . Are currently having difficulty operating in europe because of the new ESMA law. Based on a survey conducted by finance magnates, XM markets is currently in the top 5 brokers with most profited customers in europe. Clients of XM markets lose money less than hundreds of other brokers in the world and they certainly make more profits.

Trading platforms of XM review

XM has the best up-to-date trading platform with automatic transfer system. Their trading platform can be used either on PC, smartphone or tablet and still doesn’t lose it performance. Personally, I find XM trading platform to be generally great with nothing to be complaining about. XM simply offers you all the tools that you’d need in order to make profits.

Payment system of XM review

In common, traders are usually not concerned about the payment system. This is a rookie mistake but understandable. They can only realize the importance of the payment system when they start depositing or withdrawing their win money. Most trusted forex brokers are overseas so when they transfer money, it can cost you some money to transfer. Some countries are very strict in order to transfer money over sea. It's even illegal to transfer money to forex brokers. Some payment methods are costly. In asia, if you make payment over sea by credit card, they will charge you around 1.7 - 4% in total. So, that why traders must choose brokers which have local payment methods to save deposit/withdrawal cost.

A good payment system will be really helpful for traders and it should be fast, free, and unlimited. These standards below are also the most common of the good payment systems:

- Fast deposit and withdrawal

- Local payment supported

- Low or even free-of-charge fee for deposit or withdrawal

- High minimum withdrawal limitations

It could be said in person that XM broker has the best payment system in asian countries such as china, thailand, indonesia. They allow traders to deposit through many free different international payment methods like: credit/debit cards, neteller, skrill, webmoney, perfectmoney, bitcoin, alipay, nganluong wallet. They have local banks such as: bank central asia, bank mandiri, bank negara indonesia, bank CIMB NIAGA, bank rakyat (indonesia), bangkok bank, bank of ayudhya, kasikorn bank, krung thai bank, siam commercial bank, kbank mobile banking (thailand).

Customer support of XM review

BRKV - needless to say, customer support is among one of the most important criteria for choosing a broker. It is obvious that the field of forex is very complicated, so traders will need as much help as possible. From my experience, there is nothing to complain about XM’s customer services since it’s been a smooth journey for me with no technical errors or any discomfort. If your native language isn’t english, it shouldn’t really be a problem for you as XM offers supports for well over 30 languages. Languages such as thai, chinese, indonesian, vietnamese, etc. Are always supported 24/7 and those countries also have local banking supports as well.

CLICK HERE XM OFFICES.

Account types of XM review

There are currently 3 account types offered by XM: micro, standard and zero, each designed to different trading needs. Micro account is always popular among new traders and beginners. Standard account is more suitable for regular uses and zero account is specifically for experts only.

XM micro account

The micro account is suitable for beginners with commission-free and the low spread . The minimum deposit is just $5, but the leverage is up to 1:888, which is relatively high. All accounts allow 200 orders at a time, and pending positions are included, with the negative balance protection from XM.

Check XM micro account here.

XM standard account

The standard account is for the experienced traders. The condition is similar to the micro account, but there are still notable differences: the offered contract size is a hundred time bigger - 100,000 for 1 lot. The minimum trading lots are equal for both MT platforms, and the lot restriction per ticket is 50 - a half compared to the micro account.

Check XM standard account here.

XM ultra low account

XM’s newest account, the ultra low account, is the total game changer. It offers trader the lowest spreads ever in XM (which is 0.7 pip) and even no commission. The base currency options are EUR, USD, GBP, AUD, ZAR, and SGD. You can choose the contract size as both micro and standard account. The highest leverage is 1:888.

Check XM ultra low account here.

There is also the XM islamic account for clients who follow the muslim faith. They are the free-swap type of account for islam traders.

Check XM islamic account here.

XM trading assets

Sometimes, people don't just trade currency pairs. When the market is too volatile because of big news or important events, you shouldn't trade forex. As a result, traders will look for other trading assets. A good forex broker must be able to provide a wide range of trading products for their clients. Let's take a look at all trading assets of XM:

- 50+ currency pairs

- Stock cfds

- Commodities such as cocoa, coffee, soy beans, or wheat.

- Equity indices

- Precious metals: gold and silver

- Energies

- Shares

XM trading advices

All in all, it’s in my opinion that XM is a great broker that should be recognized more. At first, their trading conditions seem to be just as good as the other US/UK brokers. But they also offer many different and beneficial bonus programs to help you reduce your trading costs. Together with other great features, they are surely one of the top best forex brokers . Moreover, XM has been around the forex market since 2009 and still, they haven’t got caught up in any shady business rumors. Their customers are always satisfied with their services and trading conditions and have no reason to ever leave their service. I myself am a long-time customer of XM as well so I can safely say that you can’t really go wrong trading with XM. In case any of you are still confused, I have a little advice below that are based on my experiences and time with XM broker:

- Micro account is a great trading environment if you want to learn more about the forex market.

- Cryptocurrency trading conditions are the best. Take advantage of it.

- XM should support payments via your local bank so if your local bank is supported, you should always utilize it since it doesn’t cost any fee.

- Day time spread in XM is always lower than night time’s spread. Thus, trading in daytime seems like a more sensible decision.

XM trading experience

Having traded forex for 5 years now and 2 years of that with XM, I think I would like to share my XM trading experience. XM is a great broker. It is certainly reliable, just as I mentioned before. What I find most wonderful about XM is that they have really low prices. With the ultra low account, you can easily cut down your trading cost and keep your trades cheap. Moreover, XM hostes great educational seminars. I attended some, actually. They can help you so much in forex trading.

Fanara filippo

Hey, I’m fanara filippo. I’m the founder of this site. I'm currently living in bangkok, thailand. I have been trading forex for more than 5 years. You can read my articles about the best forex brokers on this page. Let’s review brokers today.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

HOW MUCH ARE XM SPREAD AND COMMISSION? HOW TO CALCULATE IT?

It is believed that spread and commission are always the main concerns when traders want to choose a forex broker. That’s why many forex traders have asked us about XM spread and commission, since XM is one of the best forex brokers in 2018. However, traders should know that spread is not the ultimate factor to decide whether a broker is good or bad.

There are 2 types of traders, which are long term investors and scalpers. Long term investors don't care about spreads much because they open just a small number of orders each year but those are extremely high volume orders. They can win up to hundreds pip per order. So for them, the spread rate ranging from 1 to 2 pips is acceptable. They only care about the broker’s credibility, quotes quality, and swap. On the other hand, when it comes to scalpers, they do care about spreads. It is because they open a lot of orders daily. So they have to pay a lots for spreads. They only win some pips per trade. So 1 or 2 pips spread really matters to them. They prefer those low spread brokers. However, spread should not be the only thing to pay attention. A lot of things contribute to the total trading cost of a broker, so I would like to recommend a broker that has reasonable trading cost and is one of the top largest forex brokers. That is XM.

How much are XM spread and commission?

If you only look at XM spread and commission, you might think their spreads are high. It is actually the opposite, XM spreads are in top lowest spread brokers. Let me explain to you now. According to real data tracking, XM spreads for 6 main currency pairs such as: EUR/USD, USD/JPY, and GBP/USD… are around 1.7 pip. Their spread rate is just the same as their main competitors in the forex market like FXCM, FXTM, forex.Com, or fxpro. However, when we talk about spread and commission, it means that we are referring to the trading cost. What does the trading cost of a broker include?

- Spread

- Commission

- Swap

- Slippage

- Bonus

- Rebate

XM spread and commission are similar to other best forex brokers. For swap, they charged the same amount as bank interests. So, they are not much different. For slippages, there isn't any complaints about XM slippages that I know about. Their quotes are really good, if not the best in the market. You can see that XM spread, commission, swap, and slippage are the same as other broker. So the things that make the differences are bonuses and rebate.

Check out XM spreads for the most traded currency pairs compared to other brokers:

| EUR/USD | AUD/USD | GBP/USD | NZD/USD | USD/CAD | USD/CHF | USD/JPY | |

| exness | 0.5 pip | 0.7 pip | 0.7 pip | 1 pip | 0.9 pip | 0.6 pip | 0.6 pip |

| XM | 0.8 pip | 1.1 pip | 1.1 pip | 1.5 pip | 1.2 pip | 1.1 pip | 0.8 pip |

| hotforex | 1.2 pip | 1.5 pip | 1.8 pip | 1.9 pip | 1.9 pip | 1.9 pip | 1.7 pip |

| FXTM | 0.8 pip | 0.5 pip | 0.9 pip | 1.1 pip | 0.6 pip | ||

| FBS | 1.1 pip | 0.8 pip | 0.9 pip | 4 pip | 3 pip | 7 pip | 2 pip |

| forex.Com | 1.2 pip | 1.2 pip | 1.4 pip | 3.2 pip | 2.3 pip | 2 pip | 1.2 pip |

| fxpro | 1.1 pip | 0.7 pip | 1.3 pip | 0.7 pip | 1.3 pip | 1 pip | 109 pip |

| pepperstone | 1.1 pip | 1.1 pip | 1.4 pip | 1.3 pip | 1.2 pip | 1.4 pip | 1.2 pip |

| saxo bank | 0.7 pip | 0.5 pip | 0.8 pip | 0.7 pip |

XM bonus programs

XM is the only broker who offers the best bonuses and rebate compared to other top brokers. When you first register an account in XM, you can instantly claim a 30-dollar welcome bonus from XM. This is not a high value bonus but the real benefit of it is that you can withdraw the profit made from this bonus much easier than other brokers'. You just need to trade 0.1 lot to withdraw the profit. Get XM 30$ welcome bonus here.

You also can get the 100% deposit bonus of XM. There are not many brokers that can offer this type of bonus. Why? Because at XM, you can withdraw all of the bonus profit. It means that this is a real bonus. Clients can withdraw bonus profit, so it costs brokers a lot of money. Get XM deposit bonus here.

XM rebate program will rebate you from $3 to $10 per lot traded. It means that they will rebate 0.3 - 1 pip per USD lot. Moreover, the longer you trade with XM, the higher the amount of rebate you will get. So let’s calculate the whole thing again. At the beginning, XM charges us 1.7 pip spread for EURUSD. But they will cashback us on bonus and rebate programs. So, the final spreads are around 1 pip. The good thing is their quote quality is in very good. So, that why the winning rate of XM clients are higher than other brokers. Check XM rebate program here.

Lowest XM spreads

Check out this list of the lowest spreads on each currency pair of XM broker

For more currency pairs, click here.

About XM commission

Just like all other brokers, XM charges traders commission for trading ECN because their ECN spread is nearly zero. So, the main income of ECN brokers is commission. XM charges $6 of commission for ECN trading. This seems to be a normal commission rate. But actually, it’s lower than many other ECN brokers. Conclusion: XM original spreads are normal and just as much as other top forex brokers. Yet, they offer welcome bonuses, deposit bonuses, and rebate programs. So, the final calculated spreads are much lower than that of other brokers. They are just around 1 pips. And there you have it. A broker among the top best forex brokers in the world that has very low transaction cost. Open XM account here.

XM quick review

Launched in 2009, XM belongs to trading point holdings ltd, the official regulatory body of XM is CYTEC - the official license provider, in conjunction with the european union to ensure the broker operates transparently and anti money laundering. Currently, XM is serving more than 1 million customers, from 196 different countries, supporting 20 languages, with 16 comprehensive trading software and 25 secure payment methods.

XM offers a wide range of products for customers to choose from. In addition to forex, XM also has cfds and stock indices, commodities, stocks, metals, energy from the same trading account, including XM micro account and XM standard account. All are transparent and transparent from spreads to commissions with no hidden fees and orders are executed quickly in less than 1 second.

What is spread?

Spread is the difference between the ask price and the bid price. It is the transaction fee that you must pay for the brokers or banks. The unit of spread is pip. The higher the spread, the higher the trading cost. That’s why most traders want to trade with the low spread brokers. There are 3 types of forex brokers: market maker, STP, and ECN. For first 2 types, their main income is spreads. That’s why their spreads are much higher than that of ECN brokers. When they get quotes from liquidity providers, they will add the transaction fee (spread) to those quotes. For ECN brokers, they will provide the exact quotes that liquidity providers provided. Therefore, they have to charge commission as it is their main income.

XM fixed spread and XM variable spread

If fixed spread is usually provided by dealing desk or market maker house, then floating spread will be provided by STP and ECN platforms or no dealing desk.

Fixed spreads remain the same no matter what market conditions occur. Spreads are not affected. It is always kept the same.

Variable spreads will not be controlled by the forex brokers but they are always changing and is usually provided by ECN, STP or non-dealing desk. This is because the exchange will receive the exchange rate of the current currency pair from the liquidity providers themselves, and notify this price to traders without any intervention. Thus, the brokers will not control spread, the whole price difference or fluctuation will depend on the general fluctuations of the market.

How to calculate spread?

At XM, when you open a position to buy EUR/USD, there will be two prices appearing on your MT4 platform screen: ask = 1.12345 and bid = 1.12359. Therefore, the spread now is ask - bid = 0.00014 = 1.4 pip. So what does this “1.4 pip” mean? It means that you have to pay 1.4 pip for XM to open an order to buy EUR/USD. Now if you want to buy 1 lot of EUR/USD, the spread you have to pay is 100,000 x 1.4 x 0.00014 = 19.6 USD. That’s how you calculate the spread.

Peter pan

Hey, I’m peter pan. I am a writer currently resided in thailand. For my forex experience, I have been trading with many forex brokers from all over the world for 5 years now. I hope that my articles about forex brokers can help you succeed in this market just like me.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

XM (XM.Com) review

XM review

XM (XM.Com) is one of the best forex brokers with the most favorable conditions in the market. High leverage, fast execution, tight spreads, and excellent response make them truly top notch. They have been on the receiving end of 2 regulatory fines, but have amended the issues, and are generally consider highly trustworthy in the FX community. In addition the context arena functionality is both interesting, and innovative. Very recommended.

Important facts

- Company: trading point of financial instruments pty ltd, trading point of financial instruments ltd ,and trading point of financial instruments UK ltd.

- Payment options: multiple local payment methods like debit/credit cards, neteller, skrill, bank wire transfer, etc.

- Platforms: MT4 for both mac and windows, XM webtrader and various mobile platforms, MT5

- Accounts available in: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Minimum deposit: $5

- Regulation: regulated by cysec of cyprus, ASIC of australia and FCA (UK).

- Social trading: N/A.

- Support options: phone, callback, live chat and email.

Platform(s)

XM offers its customers the ever popular metatrader 4/5 platform for both mac and windows. The XM version of metatrader works just as one would expect it too and allows users to automatically trade the available markets using expert advisors, with only one restriction. Expert advisors may not place more than 200 pending orders at one time, this will only affect a very small number of expert advisors. In addition to offering metatrader 4/5, XM also offers a strong web trading platform which allows clients of the brokerage to manage and open positions from any computer with an internet connection. Those who want to trade on the move will also be pleased to hear that the brokerage offers a range of mobile trading applications which allow clients to monitor, manage and open positions wherever they are. Currently XM provide mobile trading applications compatible with the majority of smartphone devices. The range of platforms offered by XM.Com is impressive and should be enough to satisfy the majority of traders.

Trading conditions

- Leverage: up to 30:1 on forex (leverage applies to all the EU regulated entities of the group. Leverage depends on the financial instrument traded)

- Scalping: allowed

- Expert advisors: allowed

- Trailing stops: yes

- Spreads: variable, typical spread on EUR/USD 1.8 pips.

- Minimum pip distance on stop/limit orders: 4 pips.

XM operate a dealing desk for phone orders, but state that the vast majority (99%>) of orders are processed using an STP execution model. This means that the vast majority of client orders are processed through to one of the brokerages liquidity providers. STP brokerages are favoured by many traders as the interests of the brokerage and the client are better aligned. XM is competitive in regards to spreads, with the typical spread on the EUR/USD being around 1.8 pips but as a STP broker spreads are of course variable. XM also offers traders the ability to take advantage of significant amounts of leverage with the brokerage offering flexible leverage of up to 30:1, it is important to realise that leverage can work for you and against you. XM allows for clients to engage in a wide range of trading strategies and allows clients to scalp and hedge their positions. Additionally the use of expert advisors is permitted, with clients being able to use any type of expert advisor they please. Though XM.Com require clients to have less than 200 pending orders open at any one time to ensure that servers run smoothly. Overall, the trading conditions on offer with XM.Com are very favourable.

Instruments

- Number of currency pairings: 57

- Other instruments: stocks cfds, commodities cfds, equity cfds, precious metals cfds, energies cfds and cryptocurrencies cfds

The brokerage focuses mainly on forex, with XM offering a total of 57 different cfds of a high variety. The range of currency pairings on offer include pretty much every pairing the average retail trader is going to be interested in trading. In addition to offering a good range of FX pairings, XM also allows its customers to trade a range of equity, precious metal and commodity contracts-for-difference (CFD’s). While the range of CFD’s is relatively limited the ability to trade a range of different instruments all from one platform is something which may be attractive to many traders who want to trade indices, precious metals and commodities on the side.

Customer service

- Support methods: live chat, phone, call back and email.

- Telephone numbers: A selection of international phone numbers.

- Support languages: arabic, chinese, english, french, german, greek, hindi, hungarian, indonesian, japanese, korean, polish, malay, portuguese, spanish and russian.

In all my personal dealings with the firm they have been nothing but helpful and I have never encountered any major problems. Support is available through a number of different methods and the brokerage provides support in a number of different international languages. Overall the brokerage appears to try its very hardest to provide a high level of customer care.

Regulation

- Regulated: based and regulated in cyprus by cysec. XM is additionally regulated by ASIC of australia and FCA (UK).

- Mifid regulated: yes, XM can accept clients from throughout the european union.

- US traders: XM does not take on US customers as the firm lacks the necessary US regulatory approval.

- Regulatory record: fined by the CTFC back in 2010 and received a 10,000 euro fine from cysec in 2013.

The brokerage is regulated by cysec of cyprus, ASIC, and is also a registered with the british FCA. With cyprus being a member of the european union and therefore party to mifid the brokerage is able to offer it services to all residents of the european union. Trading point of financial instruments ltd. The firm which operate XM has had a couple of run ins with regulators since they begun offering forex trading services back in 2010. In 2010, the brokerage received a $140,000 fine from the CTFC for accepting US clients despite the fact US regulatory law prevents US residents from opening accounts with firms not regulated by relevant US authorities. Trading point ltd weren’t the only brokerage to be targeted by the CTFC, with around 24 brokerages being on the receiving end of CTFC action. More recently the firm were fined a total 10,000 euros by cysec for failings relating to the brokerages anti-money laundering and client segregation procedures. In the announcement cysec stated that the firms previously clean regulatory record played at mitigating role regarding the size of the fine, with the firm having ensured that it now fully complies with cysec regulation. In 2015, XM.Com became regulated in australia by ASIC further adding to their range of regulatory licences and allowing the firm to operate in australia and take on australian clients.

Overall

XM is one of the better retail forex brokerages offering its clients the ability to take advantage of tight spreads and excellent execution. Those looking for a STP brokerage to trade with should give XM some serious consideration

Top 10 best MT4 ECN forex brokers of 2021

Top rated:

Looking for the best solution to have a forex ECN account and use it with the famous MT4?

The term ECN stands for electronic communication network, and indicates those forex brokers that offer direct market access to their clients, connecting them directly to their liquidity providers (large banks and market makers).

In this post we have collected the 5 most famous broker in the world that will allow you to access their ECN using the popular metatrader 4, thus using an MT4 ECN platform.

Here’s our top 5 of the best forex brokers for MT4 ECN for 2021.

(this post is part of the best ECN brokers and MT4 brokers series)

Table of contents

Top 10 of the best forex MT4 ECN brokers 2021

1. Pepperstone

The first broker to feature is an australian giant, pepperstone, which, with their razor account, will give you access to their vast ECN using the metatrader 4 trading platform which is known and trusted. Trading with pepperstone you can make the most of their range of social trading features and a pepperstone standard account trading through MT4 is also available to choose depending on your trading needs.

The minimum deposit with this broker still remains competitive too on the scale of ECN forex brokers at $200. Combine this with the spreads starting from 0 pips and an active trader program that helps lower trading costs through rewarding loyalty and trading volume and it is easy to see the attraction of this top broker to all traders both new and experienced.

2. Admiral markets

Second on our list of the best brokers for an account with a MT4 ECN we find admiral markets, the important russian-born broker. They are a very well known and trusted market maker type of broker who are comprehensively regulated by both the FCA and cysec. This provides for a high level of trust. Once you have opened your ECN MT4 account here you will find more than 4,000 assets to select from that also include bonds, etfs, and crypto. A huge range for all traders.

Both standard and prime accounts are available with MT4 here through a good value $100 minimum deposit and a very competitive spread. That spread starts from 0 pips if you are aprime account holder, or a still very competitive 0.5 pips if you are trading from a standard account type.

3. Vantage FX

Founded in 2009, this australian broker has fast risen to a position of trust and credibility from their more than a decade in the forex trading industry. They are comprehensively regulated across the globe by no less than ASIC, the FCA, and CIMA, so you have many options as a trader looking for lexibile regulation as well as an ECN MT4 broker. With vantage FX you are free to select from three account types, standard, raw ECN, and pro ECN that come with $200, $500, and $20,000 respective minimum deposits.

Your options for trading are also extensive, with more than 150 cfds available to trade and a range of 40 forex pairs to choose from. Their islamic trading account availability and conditions also make the broker a favorite of islamic traders with spreads from 0 pips.

4. FP markets

Another australian broker to make our listing of the top MT4 ECN brokers is FP markets. They have many years of experience in the industry also, having been founded in 2005. This market maker broker offers ECN trading with STP execution to all of its traders and with that brings extensively trusted regulation to the traders through ASIC and cysec.

As a forex trader with FP markets, your trust in opening and trading with them is rewarded through the offering of very low spreads that start from just 0 pips to accompany the lightning fast execution. MT4 is available on the two accounts offered here at FP markets in the form of a standard, and raw account. The minimum deposit also remains appealing and accessible to traders with an amount of just $100 of the equivalent.

5. IC markets

Rounding off our collection of top australian brokers who also happen to be among the best MT4 ECN forex brokers is IC markets. They are among the best known brokers in australia and around the world with their regulation coming through the oversight of both ASIC and cysec. This has garnered a long lasting trust from many traders in IC markets and they are well renowned as a top broker for trading forex in particular.

This positive reputation is bolstered further by the fact that spreads continue to remain competitively low. You can find that these start from just 0.1 pips in many cases across a very wide choice in markets that includes trading in indices, commodities, stocks, futures, bonds, and cryptocurrencies. Another great selling point especially for new traders is the no minimum deposit required, although $200 is recommended by the broker.

6. FBS

FBS are the next broker to make our selection as one of the top MT4 ECN brokers in the industry. They are a household name by now to many forex traders around the world and offer an excellent choice in terms of regulation to traders with both cysec and IFSC oversight in place. The range of markets they offer trading in, as well as the low minimum deposits available help in attracting new traders to the broker in particular.

This FBS minimum deposit is just $1 for a cent account, $100 for a standard account, and $1,000 for an ECN account, with fixed zero account also available at $500. A free demo account and islamic trading accounts are also available. If you are into copy trading, FBS have their own great copytrading platform that is liked by many, and spreads remain great, generally starting from 0.5 pips.

7. Fxpro

One of the absolute best brokers from many points of view. Among many things, fxpro gives you the chance to exploit their advanced NDD network through the MT4 platform. They are a long established name in the industry and the trust of traders here is also bolstered by the FCA regulation in place as well as the fact that fxpro have won more than 60 awards over the years.

They are also attractive to newer forex traders in the sector thanks to the low minimum deposit of just $100 that allows a great deal of accessibility in getting started with an ECN forex broker. The spread too is appealing and that starts from 0 pips on forex. For those looking for choice, fxpro also has a lot to offer. Markets in futures, crypto, shares, indices, and commodities are all open to be traded here.

8. Roboforex

Next on our list of MT4 ECN brokers is roboforex, the famous cypriot broker. Roboforex offers both an ECN system and a hybrid system, so make sure you’re choosing the right account. They are also regulated by two of the top regulatory bodies in the forex world in the form of both cysec and the IFSC of belize providing more options for traders to consider.

When you have opened your account, you will find that there are 5 specific account types available with a competitive minimum deposit starting from only $10. This includes the ECN accounts where trading spread starts from a very attractive 0 pips on some markets. If you are regulated outside europe by the IFSC you can also benefit from a host of bonuses, while rebates on trades are available worldwide. The proprietary copy trading platform provided is also well-liked by the many roboforex traders who use it.

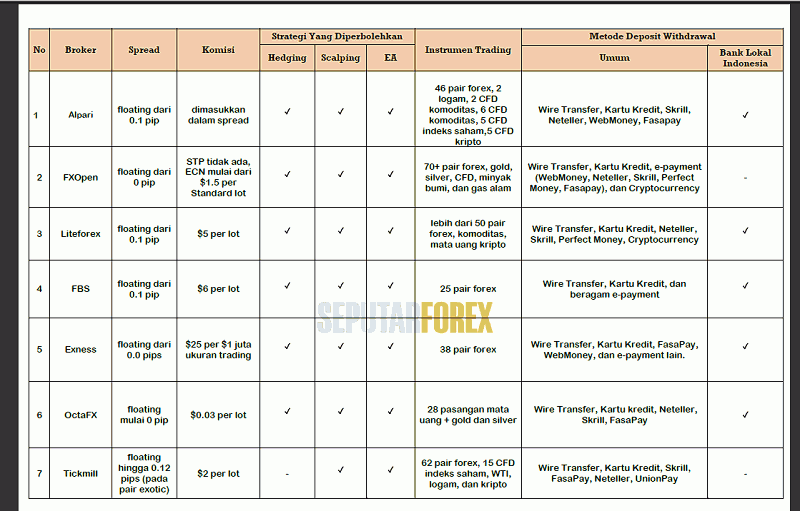

7 broker ECN/STP terbaik untuk trader indonesia

Memilih broker yang menyediakan layanan ECN/STP terbaik membutuhkan pengamatan cermat, khususnya jika anda mengutamakan kenyamanan untuk trader indonesia.

Dalam memilih broker forex, banyak sekali pertimbangan yang perlu dilakukan agar tak salah mendaftar di broker yang kurang ideal dengan kemampuan modal maupun metode trading andalan kita. Salah satu jenis broker yang digemari tapi biasanya kurang ideal dengan kondisi trader indonesia adalah ECN. Padahal, solusi dari permasalahan itu bisa ditemukan di broker ECN/STP terbaik yang memiliki layanan kondusif untuk trader indonesia.

Mengapa broker ECN banyak dicari?

Sebagai pemahaman awal, pembagian broker menurut eksekusinya dibagi menjadi 3, yaitu broker dealing desk, non dealing desk, dan hybrid. Broker dealing desk sering juga disebut sebagai broker bandar, karena mereka menciptakan pasar mereka sendiri. Sebaliknya, broker non dealing desk akan melempar order yang mereka terima langsung ke pasaran, sehingga diyakini bisa memberikan harga dan eksekusi terbaik, serta meminimalkan risiko manipulasi dari broker. Banyak trader menganggap broker non dealing desk adalah yang mampu menawarkan fasilitas ECN (electronic communication network), sehingga dari sinilah muncul ketertarikan besar terhadap broker ECN.

Sayangnya, fasilitas broker true ECN biasanya ditawarkan dengan spesifikasi khusus yang kurang bisa dijangkau oleh trader indonesia, terutama dalam hal deposit minimal dan metode deposit withdrawal. Selain itu, perlu diperhatikan bahwa broker ECN selalu membebankan biaya trading melalui komisi, bukan spread.

Solusi melalui broker ECN/STP

Perlu diketahui, jenis broker forex non dealing desk tidak hanya ECN. Ada satu lagi tipe broker yang juga digolongkan dalam jenis ini, yaitu STP (straight through processing). Tidak seperti broker ECN yang biasanya meminta deposit besar juga membebankan komisi, broker STP mendapatkan keuntungan dari spread yang dibebankan pada setiap transaksi trader. Selain itu, aturan depositnya pun bisa lebih terjangkau ketimbang broker ECN. Namun karena banyak trader masih mengunggulkan broker ECN ketimbang STP, agak sulit bagi broker STP untuk ikut bersaing dengan mereka yang sudah menyediakan layanan ECN secara eksklusif.

Untuk itulah, dewasa ini banyak broker yang tidak berfokus hanya pada layanan ECN atau STP saja, tetapi menawarkan berbagai variasi akun untuk mengakomodasi keduanya. Broker semacam ini biasa disebut sebagai broker hybrid, karena bisa menyediakan keuntungan ECN di satu akun, tapi juga dapat menyuguhkan keringanan spesifikasi trading dalam mode STP.

Ini dia broker ECN/STP terbaik untuk trader indonesia

Bagi anda yang masih awam, tentunya akan bingung memilih broker ECN/STP terbaik bagi trader indonesia. Berikut adalah 7 broker pilihan yang kami rekomendasikan bukan hanya karena kemampuannya menyajikan layanan ECN dan STP, tapi juga komitmennya untuk memfasilitasi keringanan bagi trader indonesia.

1. Alpari

Broker yang telah berdiri sejak tahun 1998 ini menyediakan akun ECN khusus bagi trader yang ingin mendapatkan keunggulan trading dengan market execution. Selain itu, komisi yang dibebankan akan dimasukkan dalam spread.

Di alpari, akun ECN dapat dioperasikan melalui platform MT4 dan MT5. Deposit minimal yang hanya sebesar $300 membuat alpari layak dimasukkan ke dalam daftar broker ECN deposit kecil. Akun ECN alpari menawarkan layanan trading dengan 46 pasangan mata uang, 2 logam, dan masih banyak lagi.

2. Fxopen

Dengan deposit hanya sebesar $100, fxopen merupakan salah satu broker ECN deposit kecil yang banyak diminati. Akun ECN dari fxopen memperbolehkan semua gaya trading mulai dari scalping, news trading, hingga penggunaan expert advisor.

Leverage yang ditawarkan oleh fxopen cukup menggiurkan, yaitu mencapai 1:500. Selain itu, tersedia VPS gratis untuk pemilik akun ECN, STP, dan crypto. Biaya komisi yang dipatok untuk akun ECN sebesar $1.5 per lot standard.

Menariknya lagi, fxopen juga menyediakan akun STP, yang diplot dengan deposit minimal hanya sebesar $10. Melalui jenis akun ini, fxopen memberikan kesempatan pada trader bermodal kecil dan menengah untuk mendapatkan keuntungan dari lingkup perdagangan ECN.

3. Exness

Dengan akun ECN yang ditawarkan, broker exness layak dimasukkan ke dalam daftar broker ECN/STP terbaik yang cocok untuk trader indonesia. Pada akun ECN ini, trader dapat menikmati leverage hingga 1:200 dan melakukan trading pada 38 pair forex. Strategi trading seperti scalping, news trading, juga trading otomatis dengan expert advisor pun dibebaskan di akun ECN broker exness.

Dengan spread rendah mulai 0.0 pips, komisi yang ditetapkan hanya sebesar $25 per $1 juta ukuran trading. Untuk semakin menambah kenyamanan trader indonesia, exness juga telah menyediakan fasilitas deposit bank lokal untuk klien tanah air. Sebagai penunjang aktivitas trading, akun ECN dari exness menggunakan platform metatrader 4 yang telah lazim di kalangan trader forex.

4. Liteforex

Pada akun ECN yang disediakan liteforex, ditawarkan leverage hingga 1:500 dan eksekusi tanpa requote. Broker yang telah berdiri sejak tahun 2005 ini juga memperkenankan scalping dan news trading.

Untuk mempermudah transaksi trader, liteforex juga menjadi broker ECN yang menerima deposit bank lokal. Saat ini, trader yang ingin membuka akun di liteforex bisa deposit melalui bank BCA, BRI, BNI, dan mandiri.

Deposit minimal pada broker ECN deposit kecil ini relatif terjangkau, hanya sebesar $50. Sementara itu, komisi trading yang dikenakan pada akun ECN liteforex adalah sebesar $5 per lot. Fasilitas lain menarik lain dari broker liteforex adalah tersedianya fitur social trading yang memungkinkan trader untuk saling membagikan strateginya.

5. FBS

Broker dengan pangsa pasar yang sangat besar di asia, khususnya indonesia ini, tidak ketinggalan juga menawarkan layanan khusus agar bisa menjadi broker ECN/STP terbaik. Dengan leverage sebesar 1:500 dan deposit minimal sebesar USD1000, akun ECN di FBS ditawarkan dengan kecepatan akses lebih prima dan stabil dari jaringan ECN currenex.

Strategi trading seperti EA, scalping, dan hedging dapat diterapkan pada akun ECN FBS. Komisi yang dikenakan adalah sebesar $6, dengan floating spread mulai dari 0.1 pip. FBS juga menyadari kebutuhan masyarakat yang mencari broker forex menggunakan deposit bank lokal. Sejauh ini, deposit bank lokal FBS dapat dilakukan melalui bank BCA, mandiri, BNI, BRI, dan OCBC NISP.

6. Octafx

Berbeda dengan broker-broker penyedia ECN/STP terbaik yang sudah disebutkan sebelumnya, octafx menyediakan akun ECN pada platform ctader. Pada halaman resminya, broker octafx merekomendasikan akun ECN untuk para trader progresif yang membutuhkan harga transparan dan eksekusi trading terbaik.

Komisi pada akun ECN octafx sebesar $0.03 per lot, dan spread minimal senilai 0 pip. Leverage yang diberikan adalah maksimal 1:500 untuk trading forex, sedangkan trading logam sebesar 1:200. Dengan deposit awal hanya $100, octafx menunjukkan bahwa mereka adalah broker ECN deposit kecil yang patut diperhitungkan.

7. Tickmill

Daftar broker ECN/STP terbaik dalam artikel ini ditutup oleh tickmill. Broker yang telah teregulasi FCA ini menawarkan akun ECN pro yang dapat dioperasikan pada berbagai macam platform trading. Deposit minimal pada akun ECN pro tickmill sebesar $25, dengan komisi untuk setiap 1 lot standard senilai $2. Sementara itu, rata-rata spread-nya adalah sebesar 0.12 pips.

Mengenai strategi tradingnya, broker yang mengukuhkan diri sebagai full STP ini memperbolehkan metode scalping dan penggunaan expert advisor. Sayangnya, tickmill belum memberikan fasilitas deposit dan withdrawal melalui bank lokal, dan hanya memiliki metode pembayaran seperti wire transfer dan E-payment.

Pertimbangan dalam memilih akun ECN/STP terbaik

Pada umumnya, broker forex memberikan akun ECN sebagai salah satu opsi bersama beberapa pilihan akun lainnya. Jadi, suatu broker bisa menyajikan opsi akun dengan instant execution (di mana ia berperan sebagai dealing desk) berdampingan dengan opsi akun lain dengan market execution (ECN). Saat mendaftar di suatu broker, perhatikan dengan cermat opsi akun jenis apa yang anda pilih dalam formulir, karena kondisi trading masing-masing bisa sangat berbeda. Perhatikan rangkuman di bawah ini:

Untuk tampilan yang lebih jelas, silahkan unduh tabel di sini.

Akun ECN/STP cocok untuk trader yang memerlukan spread rendah dan eksekusi lancar. Contohnya adalah para pengguna strategi scalper, juga mereka yang mengandalkan robot trading. Karena itu, kebijakan broker dalam memperbolehkan penggunaan strategi-strategi itu sangat penting untuk diperhatikan.

Anda juga harus memperhatikan besar komisi yang dibebankan oleh masing-masing broker ECN/STP, karena hal itu berpengaruh pada biaya trading yang perlu dimasukkan dalam perhitungan manajemen risiko. Jangan sampai karena terlalu fokus pada kelancaran eksekusi dan kriteria lain, anda tidak memperhatikan komisi trading yang sebenarnya terlalu besar bagi batas toleransi risiko pribadi.

Selain itu, perhatikan pula pilihan metode deposit yang ditawarkan broker. Bagi trader indonesia, tentu saja pilihan terbaik adalah broker yang bisa menyediakan deposit langsung melalui bank lokal. Namun apabila anda sudah terpikat dengan suatu broker yang tidak menyediakan deposit bank lokal, maka bisa mencari yang menawarkan e-payment ramah trader indonesia, seperti fasapay dan webmoney.

Intinya, memilih broker ECN/STP terbaik untuk trader indonesia adalah kombinasi ideal antara strategi trading yang diperbolehkan, besar komisi dan spread, juga pilihan metode deposit withdrawal.

Anda ingin membagikan pengalaman mengenai trading forex pada broker-broker di atas? Atau memiliki pertanyaan mengenai broker forex? Berikan komentar anda pada kolom di bawah ini atau di forum tanya jawab seputarforex.

Profil dan review broker XM

Broker XM berdiri di bawah naungan XM global limited yang termasuk bagian dari perusahaan finansial XM group. Dari segi regulasi, XM global limited didukung oleh lisensi dari IFSC belize (60/354/TS/17). Sejak awal berdirinya, broker XM dengan cepat mendapatkan perhatian dari trader-trader di dunia, berkat berbagai keunggulan seperti spread yang rendah, layanan yang cepat, dan berbagai jenis tawaran menarik lainnya.

Mulai akhir 2011, broker XM pun mendapat respon yang hangat dari negara-negara di asia tenggara (malaysia, singapura, termasuk indonesia). Hingga kini, sudah lebih dari 1 juta trader dari seluruh dunia menggunakan jasa broker XM.

Saat ini, broker XM memberikan layanan dalam lebih dari 20 bahasa, termasuk bahasa indonesia. Ini sejalan dengan dedikasinya untuk memberikan kemudahan bagi para klien, termasuk dengan customer support yang siap 24 jam setiap senin hingga jumat. Kekhasan broker XM yang lain adalah tersedianya pilihan deposit dan penarikan yang bebas fee.

Yang menarik dari broker XM adalah konten riset dan edukasinya yang lengkap. XM menyediakan berita harian, riset kondisi pasar, seminar forex, hingga edukasi live yang diisi oleh 20 profesional multibahasa. Ada pula webinar mingguan berbahasa indonesia yang cocok diikuti trader pemula.

Hampir setiap hari ada webinar yang bisa trader ikuti. Materinya seputar dasar fundamental dan teknikal, memahami indikator trading, cara menentukan entry dan exit, analisa pasar mingguan, dan masih banyak lainnya. Jadwal webinar dipasang di situs resmi XM, lengkap dengan pemateri, pukul berapa digelar, serta hasil pembelajaran yang diharapkan.

Selain forex, XM menyediakan instrumen trading lain seperti CFD saham, komoditas, indeks, logam mulia, energi, dan saham global. Demi memaksimalkan kenyamanan klien, XM juga telah menyediakan platform trading meta trader 4 dan meta trader 5 berbagai versi.

Tidak puas dengan broker?? Berikan skor di sini

Informasi perusahaan XM

Kondisi trading di XM

Keuntungan trading di XM

Keunggulan broker XM

Prestasi broker XM

Performa handal broker XM pada dunia trading forex ditunjukkan dengan sederet penghargaan yang diperoleh selama ini. Penghargaan-penghargaan ini diberikan oleh berbagai media online dalam bidang forex, antara lain: world finance magazine, shares magazine, capital finance international magazine, city of london wealth management awards, FX168, dan lain sebagainya. Untuk lebih lengkapnya, daftar prestasi broker XM dapat dilihat pada tautan berikut ini .

Masih tentang broker XM

XM grand trading, promo eksklusif berhadiah mobil mewah

XM boyong 2 penghargaan di global forex awards 2020

Jangan lewatkan peluang untuk mendapat tambahan income dari setiap trading anda

Aku mau tanya, apa buat buka mt4 broker xm harus pake vpn?

Komentar : 34

@masha: mungkin menurut anda seperti itu. Tapi bagi penggemar kontes tentunya tidak seperti itu. Menurut saya ada 2 keuntungan mengikuti kontes trading: pertama, kita bisa dapat pengalaman untuk berkompetisi dengan trader lain, kedua kalau kontesnya demo kita bisa dapat dana cuma-cuma.

Poin kedua itu menurut saya adalah cara lebih realistis untuk buka akun trading tanpa modal. Ketimbang welcome bonus no deposit yang tahu-tahu ngasih modal gratis, tapi padahal jumlahnya cuma sedikit dan itupun banyak peraturan trading maupun withdrawnya.

Wah itu relatif sekali, maksud saya banyak faktor yang harus diperhitungkan, misalnya gaya trading anda itu biasanya seperti apa? Apakah posisi trading di tahan lama atau cuma bentar aja alias scalping?

Kedua, leverage dan ekspektasi untung yang diharapkan setiap bulannya berapa?

Oh itu, iya, saya kalau trading biasanya dibimbing sama anak saya, katanya dia sih posisinya ditahan rata-rata antara 1 sampai 5 hari. Itu termasuk gaya trading apa yah?

Terus kalau ekspektasi untung, kira-kira sekitar $ 100-500/posisi itu tadi, nah itu leverage-nya yang kontrol anak saya juga, saya cuma modalin aja. Jadi butuh berapa min. Modalnya yang bagus?

Kalau menurut pengalaman saya selama ini, belum ada masalah sih dari segi penarikan. Intinya sih, selama anda mengikuti peraturan dan tidak secara sengaja berusaha menyalahinya, seharusnya sih tidak ada masalah.

Kedua, tidak ada broker yang menjamin kemenangan pak, jadi bagaimana-bagaimana anda jg harus siap strategi seandainya ada posisi yang tidak berjalan sesuai ekspektasi. Contohnya menggunakan money management.

Iya pak, terbuka untuk umum dan memang menggunakan real account. Nah, kalau saya sih daripada ngejar menang terus kepala jadi panas, mending pakai leverage besar (1:888) buat besarin untungnya,

Tapi kalo misalnya kalah, ya udah, toh yang kita pakai modalnya sudah kita batasi hanya sebesar itu saja, tidak lebih. Ya anggap saja itu uang kompetisi yang sudah siap kita relakan lah. Kalo menang ya senang, kalo kalah ya sudah hahaha

XMP bisa didapatkan setiap kali trading di akun standard ataupun micro (tidak di zero) dengan syarat posisi dibuka minimal 10 menit.

Untuk kontes sekarang sudah berakhir untuk pendaftar baru pak, tinggal menyisakan babak final saja.

TRADE DOLLAR INDEX DI US CASH 50 DAN US CASH100

APA BEZANYA DENGAN DOLLAR INDEX DI BROKER LAIN?

ADAKAH SPREADNYA TINGGI PAK?

MOHON MAKLUM BALAS T KSH

Bisa pak, di broker XM memang menyediakan akun trading CFD untuk emas:

kalau mau cek, silahkan cek di link ini

Hmm kayaqnya engga deh, kan biasanya harga emas itu di-listing 2 angka dibelakang koma, jadi kalo di broker XM misalnya harga saat ini 1250.00 terus spreadnya 0.4 ya berarti spreadnya 4 pip.

Wajarlah spread 4 pip di CFD komoditas, dulu aja saya pernah trading di broker lain, CFD emas juga, jatuhnya kena 5-8 pip. Itu dalam keadaan pasar normal.

Makanya harus hati2 dan modal kuat untuk trading di CFD emas, atau buka akun micro-nya kalau mau belajar dulu

Saya recommend broker XM untuk scalping gold, soalnya spreadnya rapat, nih buktinya

Silahkan dicoba, di akun zero XM, mantep bener scalping goldnya.

Hmm, per lot spreadnya sekitar 2 pip itu, boleh juga sih, saya dulu pernah trading di broker lokal dan spreadnya saja bisa sampai belasan pip per 1 lot, belum komisinya.

Menarik juga sih, saya coba deh trading gold di broker XM

Saya bimbang nih mau deposit di broker XM, ada yang bilang ni broker bucket shop lah terus scam lah apa lah, tapi ada juga yang bilang kalo mereka sudah untung sampai ratusan persen dari modal awal mereka.

Ada yang bisa kasih rekomendasi dan bukti supaya saya mulai tertarik untuk deposit?

Wah saya udah bolak balik trading di broker XM pak, sampe buka akun lebih dari satu (kalau dah sering trading pasti tahu alasannya buka banyak akun). Dari pengalaman saya sih, mereka fair-fair aja koq kalau soal penarikan dana.

Cuma ya itu, verifikasi identitasnya masih rada susah, saya aja sampe harus muter otak buat verifikasi akun2 tadi.

Broker XM menyediakan akun setara dengan standar ECN, yaitu akun zero XM. Kelebihan dari akun ini adalah spread mulai dari 0 dan leverage hingga 1:500

Menurut saya, ada beberapa hal yang perlu diperhatikan soal isu ini.

Pertama, istilah "entitas diduga bodong" yang bapak sebutkan, itu disampaikan oleh regulator indonesia, karena XM tidak mengantongi ijin dari regulator indonesia. Dalam hal ini, perhatikan bahwa setiap negara mengekspektasikan perusahaan apapun yang beroperasi di wilayahnya untuk teregulasi di negaranya. Kalau ada perusahaan punya klien di indonesia, tetapi tidak punya ijin operasi di indonesia, maka pasti di-cap illegal, walaupun perusahaan tersebut sudah punya lisensi AS atau inggris sekalipun yang jelas-jelas kriterianya lebih ketat.

Kedua, mengenai mengapa broker XM (dan beberapa broker lainnya yang "diduga bodong") tidak mencari ijin di indonesia? Masalahnya sekitar tahun 2014-2015 lalu, ada moratorium pemberian izin bagi perusahaan pialang berjangka asing. Jadi, broker asing tidak bisa minta lisensi sama sekali di indonesia.

Dari nomor satu dan nomor dua, bisa disimpulkan bahwa broker XM bukan "diduga bodong" karena melarikan dana nasabah ataupun karena ada kasus trader gagal WD, melainkan karena tidak punya ijin di indonesia.

Ketiga, terlepas dari "ilegal"-nya broker-broker asing seperti XM, tetap saja banyak trader indonesia mencari mereka. Kenapa? Karena di sisi lain, broker indonesia itu terms-nya sangat tidak kompetitif: nggak boleh swap free, lot terendah hanya boleh mikro, nggak boleh ECN, dll dlsbg. Jadi, biarpun dicap illegal oleh pemerintah, tetap saja mayoritas trader memilih broker asing.

Mengenai apakah situasi ini perlu ditinjau ulang. Ya, jika ingin memihak trader, memang perlu ditinjau ulang, khususnya soal moratorium pemberian ijin untuk broker asing itu. Namun, jika kita melihat arah kebijakan pemerintah, maka agaknya ini adalah sesuatu yang tidak mungkin terjadi. Pemerintah lebih mungkin men-cap ilegal lalu memblokir saja situsnya, tanpa mempertimbangkan kompetitif-tidaknya broker lokal, maupun soal bagaimana perspektif trader lokal.

So, let's see, what we have: fxdailyreport.Com many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are at is xm ecn broker

Contents of the article

- Top-3 forex bonuses

- Fxdailyreport.Com

- True ECN forex brokers

- Top ecn brokers for 2021

- Best ecn brokers guide

- Reputable ecn brokers checklist

- Top 15 ecn brokers of 2021 compared

- Is xm ecn broker

- XM - specs

- 7 REASONS TO TRADE AT XM. XM REVIEW 2021

- Regulations of XM review

- Trading costs and trading benefits of XM...

- Trading platforms of XM review

- Payment system of XM review

- Customer support of XM review

- Account types of XM review

- XM trading assets

- XM trading advices

- XM trading experience

- HOW MUCH ARE XM SPREAD AND COMMISSION? HOW TO...

- How much are XM spread and commission?

- XM bonus programs

- Lowest XM spreads

- About XM commission

- XM quick review

- What is spread?

- XM fixed spread and XM variable spread

- How to calculate spread?

- XM (XM.Com) review

- Important facts

- Platform(s)

- Trading conditions

- Instruments

- Customer service

- Regulation

- Overall

- Top 10 best MT4 ECN forex brokers of 2021

- Top 10 of the best forex MT4 ECN brokers 2021

- 1. Pepperstone

- 2. Admiral markets

- 3. Vantage FX

- 4. FP markets

- 5. IC markets

- 6. FBS

- 7. Fxpro

- 8. Roboforex

- 7 broker ECN/STP terbaik untuk trader indonesia

- Mengapa broker ECN banyak dicari?

- Solusi melalui broker ECN/STP

- Ini dia broker ECN/STP terbaik untuk trader...

- Pertimbangan dalam memilih akun ECN/STP...

- Profil dan review broker XM

- Keuntungan trading di XM

- Keunggulan broker XM

- Prestasi broker XM