Trading apps that accept mpesa

M-pesa started as a mobile payment and money sending tool for person-to-person transactions in kenya, but it has grown to include consumer-to-business and B2B transactions, including payment of salaries to workers in very remote areas.

Top-3 forex bonuses

It works by allowing individuals to deposit their cash to an account electronically through one of the M-pesa shops. Today, it’s a successful mobile money service in africa. Some forex brokers do not accept major currencies. But to stay relevant internationally, they accept payment methods for in-demand currencies. One of the most popular examples of these payment platforms is M-pesa, a mobile money system that uses the SIM card’s USSD feature.

Meet the forex brokers that accept payments via M-pesa

Trading is a global service and foreign exchange (forex) brokers usually work with traders from different countries. It’s important for traders to work with brokers who accept major currencies, especially in their region of origin.

Some forex brokers do not accept major currencies. But to stay relevant internationally, they accept payment methods for in-demand currencies. One of the most popular examples of these payment platforms is M-pesa, a mobile money system that uses the SIM card’s USSD feature.

M-pesa started as a mobile payment and money sending tool for person-to-person transactions in kenya, but it has grown to include consumer-to-business and B2B transactions, including payment of salaries to workers in very remote areas. It works by allowing individuals to deposit their cash to an account electronically through one of the M-pesa shops. Today, it’s a successful mobile money service in africa.

Forex brokers that accept M-pesa

Many well-regarded international forex brokerage companies use M-pesa, including fair forex. The widely accessible and easy to use platform guarantees big opportunities for businesses to expand their operations in african markets. Apart from fair forex, here are other brokers that accept payments via M-pesa.

The XM group is one of the global brokers that provide easy M-pesa deposits and withdrawals. The company’s account approval process is simple and handy, which makes the broker an appealing choice for traders. Unlike other brokers that deal with proof of residence issues upon opening an account, XM gets the approval without such issues.

All you need is an ID or any document validating your identity. If you encounter problems with the registration process, get in touch with their customer service team for swift support.

Liteforex

Another brokerage company accepting M-pesa is liteforex, a customer-oriented broker that allows deposits for the residents of tanzania and kenya. Its minimum deposit requirement is 1070, which, if you convert to USD, amounts to $10.

Their unique selling point is their customer-oriented policy, which simplifies the account opening process. They do not use any complex platform; just the common ones, such as the MT4 and MT5 trading platforms.

Templerfx

This company is known as the pioneer of the M-pesa deposits in kenya. Opening an account with templerfx is straightforward. Simply provide a document proving your residence in kenya plus an ID. Also, the company offers many payment methods, including electronic wallet, debit card, and bank wire.

If you wish to learn more about other brokers who accept M-pesa deposits, how M-pesa payment works, or how fair forex can help, get in touch with us today.

Top forex brokers that accept mpesa deposits in kenya

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

- Regulated

- :available on all devices

- :101 trading tools

- :demo account available

- :trading signals available

- :24/7 support

- :trading community

- 12 trading platforms

- :6 account types

- :150+ trading platforms

- :15+ funding methods

As a writer of forex content; one of the questions that I’m constantly asked is to recommend a good forex broker that accepts mpesa deposits in kenya.

Of course, they aren’t so many.

And just until recently, the few brokers who provided mobile payment solutions were either unreliable or new.

In this post, we list forex brokers that accept mpesa deposits and withdrawals in kenya.

Some of these brokers are strict to forex trading. Others are diverse and also provide options trading on the side.

1. XM forex.

How to fund your XM broker account with safaricom – mpesa.

To deposit money to your XM account with mpesa,

- Login to your account. Or register here if you are new to XM forex.

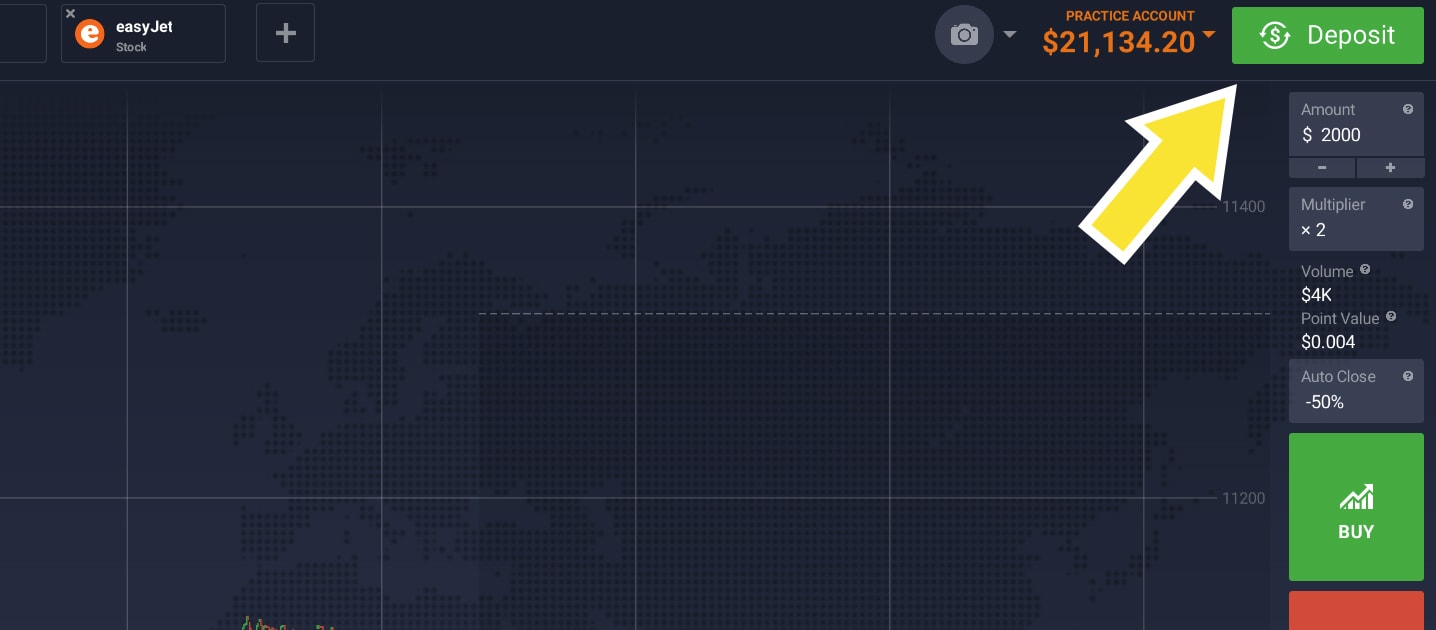

- Click on the quick deposit button on top of your trading chart.

- You can fund XM with VISA, mastercard, skrill, neteller, astropay, bitcoin, webmoney, and dusupay. But for the purpose of this blog, click on dusupay.

- Scroll down to the mobile payment method and click on safaricom mpesa.

- Enter your phone number and the amount you wish to deposit.

- Confirm that you want to fund XM forex via dusupay.

You will see this message after clicking continue –

Payment pending.

If you have followed the steps correctly, your account will be credited soon.

8. Check your phone for push notification from dusupay and enter your mpesa pin to complete the transaction.

2. Iron trade.

Updated on 8/13/2019 – before opening an account with iron trade or investing your money with the platform, know you can lose all your investments. Another thing, people who have invested in iron trade in kenya have reported trouble in withdrawing their money.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

It is owned and operated by bartoli management S.A of address 306 premier building, albert street, victoria, mahe, republic of seychelles .

Iron trade offers forex and options trading with the lowest trading time in the market.

You can open a trade that runs for 30 seconds and get 80% returns (or more) when you win.

The best thing about iron trade is, it operates 24 hours – 7 days a week.

Take note that deals made during the weekend are over the counter deals (OTC).

What’s the meaning of OTC?

Over the counter, trade means a transaction made between two parties without publishing it anywhere. These types of deals are unique to iron trade and can be a source of income when forex is off.

Is the iron trade platform user friendly?

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

It is easy to open an iron trade account, navigate, and to actually trade on the platform.

To confirm that it is, in fact, easy to use and that the OTC option works just fine; I opened an iron trade account over the weekend;

Traded on the demo account, lost, recovered, and made some profits.

Does iron trade accept mpesa deposits?

Yes, in fact; the system is so easy to use and very convenient.

You will be redirected to the dusu pay page with an option to choose your preferred payment choice.

Payments are localized such that if you are in kenya you can use mpesa; cameroonians can use MTN money to deposit to iron trade; ghanaians can use mobile money; nigerians to use mastercard, verve, and visa; rwandan traders can use MTN mobile money to deposit; tanzanians can use mobile money and the people of uganda can make a deposit to iron trade with either airtel money or MTN mobile money.

Payments in iron trade are safe and secure and you can deposit ksh. 1,000 minimum.

3. Expert option.

How to fund your expert option account in kenya.

There are 11 easy ways to deposit money to your expert option account in kenya. You could use your visa card, mastercard, maestro, yandex money, qiwi, crypto, perfect money, fasapay, webmoney, neteller, or skrill. But perhaps the only method you’d want to learn how works is the newly introduced mpesa deposit method.

How to use mpesa to deposit money to your expert option account.

Login to your expert option account or register here if you are new to trading. Now click on the deposit button on the top right corner of your browser and choose mpesa.

Enter your mpesa number and click continue.

Enter your mpesa number again and click pay. Your number must not have a (+) sign at the beginning. In case of any difficulty in payment, just reply to the live chat pop up on your computer and you will get instant help.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

You will get a push notification (on your phone) asking if you want to pay the specified amount to flutterwave account number expertoti… enter your mpesa pin to complete the transaction.

Your account will be updated instantly.

Remember, after your first deposit you won’t be able to change your deposit and withdrawal method.

4. Templerfx.

Templerfx is one of the most popular forex brokers in kenya. And a pioneer of forex deposits via mpesa.

Like most international brokers, templerfx is licensed to the financial services authority (FSA) of saint vincent and the grenadines.

You can trade forex, metals, energies, cfds and spot indices on templerfx.

How to deposit money to templerfx.

Templer accepts deposits from different wallets from across the world.

People in russia can use alfa-bank to make a quick deposit; georgians, kazakhstanis, and ukrainians can use self-service terminals for instant deposits.

Kenyan and tanzanians can use mpesa for mobile wallet deposits. Nigerians, south africans, europeans, and people of aisa – can use: – skrill, perfect money, contact, visa, mastercard, leader, OK pay, paxum, name it..

The minimum deposit in templer is ksh. 100.

Are spreads in templer good enough for newbies?

Here’s a sneak peek of templer contract specifications.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

5. Olymp trade.

Olymp trade is so far the best option trading broker in the world.

If you don’t have an account with olymp trade already, register.

Olymp trade does not currently accept mpesa deposits but I believe it is a service that they will soon integrate.

At the moment though, you can deposit from mpesa via skrill to olymp trade.

It is also possible to deposit to olymp trade from mpesa via neteller.

6. EGM securities accepts mpesa deposits.

EGM securities is a local broker in kenya that provides a platform for trading both forex and cfds.

Hard as it is to believe, EGM is the only FX company that is regulated in kenya under the capital markets authority.

To start trading in EGM you need to deposit at least $200 or $5000 depending on if you want to start trading with an executive or a premium account.

Unlike it’s international competitors spreads in EGM are high at 1.6 with a maximum leverage of 1:400.

EGM supports MT4 trading and it also accepts mpesa deposits.

7. IQ option.

When we talk about options trading, which trading platform comes to your mind?

- Expert option?

- Binomo?

- Avatrade?

To most of us, we think IQ option when we think trading.

And even though IQ option isn’t currently as popular to kenyans as the wildebeest migration is to the serengeti; it is still a broker to recon with.

IQ option doesn’t currently accept mpesa deposits.

However, you can still deposit from mpesa to IQ option via skrill or neteller.

8. FXTM accepts mpesa deposits

| |

|---|---|

| MT4 | ✓ |

| MT5 | ✓ |

| minimum deposit | $10 |

| ECN (minimum deposit | $200 |

| mpesa deposit kenya | available |

| start trading | register |

Did you know that FXTM is now the only international and most reputable forex broker that offers almost all the local deposits solutions to almost all african countries?

- Nigerians can deposit to FXTM using nigeria local bank wire transfer

- Indonesians can deposit using indonesian local transfer

- Algerians can deposit with algerian local transfers (local currency supported)

- Kenyans can deposit to FXTM using mpesa ( join FXTM )

- Pakistani can deposit to FXTM using local transfer for india and pakistan

- People of malaysia can deposit using online banking malaysia services

- Traders from afghanistan can deposit with afghani local transfers services

- Chinese traders can deposit to FXTM using china online banking (P) services

- Traders from tanzania can deposit using tanzanian local transfers (BRK)

- FXTM traders from vietnam, thailand, and iraq can also deposit using local transfer services

FXTM also accepts all E-wallets including dusupay which allows rwanda and ugandan traders to deposit using MTN mobile money.

P.S mobile money deposits are instant.

9. Hot forex kenya

Hotforex is the latest forex broker to accept mpesa deposits in kenya.

If offers different account types to different traders. Accounts which include: –

A. A micro account which only needs a $5 deposit to activate

B. A premium account that needs $100 to activate and an auto account.

You can trade over 47 different currency pairs, gold, and metals, oil and energies, commodities, stocks and indices with hotforex.

And even more interesting, you can deposit and withdraw money to the broker via all these methods

- Bank transfer

- Credit card

- Debit card

- Boleto

- China unionpay

- Fasapay

- NETELLER

- Mpesa

- Skrill

- Webmoney

- Yandex money

Forex brokers that accept mpesa in kenya

In this article, I am going to review the forex brokers that accept mpesa in kenya. Mpesa payment system for forex brokers is extremely popular right now.

Over the past few years, mpesa has become one of the most widely-used payment methods for forex and has amassed quite a large number of traders who consider it to be the top payment system for forex trading.

M-pesa has managed to achieve this by offering a great solution to some of the central issues surrounding payment, such as simplicity, speed, and convenience. Due to this, I am going to look at the forex brokers that accept mpesa in kenya.

Below they are forex brokers that accept mpesa in kenya

- 1. XM GLOBAL

- 2. Hotforex

- 3. Exness

- 4. Grand capital

- 5. EGM securities (fxpesa)

- 6. Liteforex

- 7. FXTM

- 8. Expertoption

- 9. IQ option

- 10. Superforex

- 11. Olymp trade

- 12. Iron trade

1. XM GLOBAL

One of most rated broker with 10 years in existence they accept M-pesa for depositing and withdrawals.

Apart from them accepting M-pesa transactions, XM global easily verify trading accounts. Unlike other forex brokers who have issues with proof of residence when opening an account, XM global just accepts a kenyan identity card (ID) only for kenyan clients. You can check our guide on how to verify an account here.

Once you open your account, you will have access to either the metatrader 4 or MT5 trading platforms that will allow you to trade hundreds of assets including forex currencies, cfds, equity indices, precious metals such as gold, and energy cfds that include crude oil.

XM offers different account types that are micro account, standard account, forex islamic accounts, and XM zero account. You can choose the type of account you’d like to use when opening your trading account. I’d highly recommend the standard account if you have a deposit above $100 and the micro account if your account opening balance is less than $100.

Spreads on all account types start from as low as 0.1 pips depending on the currency you are trading and the time at which you are trading. XM covers all funds transfer fees regardless of which payment processor you use. All withdrawals are processed and sent to your mpesa account on the same day as requested.

The minimum deposit XM accepts is $5.00 only while on withdrawals they accept a minimum withdrawal of of $5.

You can check our full review and tutorial on XM here.

2. Hotforex

Hotforex makes it in the list of the best forex brokers in kenya that accept M-pesa. But that’s not even why I have so much love for this broker.

The hotforex trading platform offers a lot of innovative trading tools. I particularly like their social trading feature that is christened hfcopy.

With hotforex’s hfcopy feature, you get to follow and copy trades of successful forex traders who are in the platform. This is the type of account that I would recommend you open if you want to trade with hotforex.

The account type will still let you deposit and withdraw money using mpesa, and you get the benefit of increased profitability by simply emulating successful traders on the platform. Click here to open an hfcopy account now.

- You retain 100% control of your account – withdraw your funds when you want

- Save time and energy by automatically copying trades of the most successful traders on the platform

- Set the ratio at which you want to copy a strategy provider – don’t over-leverage

- You can follow more than one strategy provider and increase your chances of turning a profit.

The process of depositing money into your hotforex account using mpesa is as straight forward as it gets. Check out my hotforex review on hotforex here

3. Exness

Exness is one of the other forex brokers that have a wide client base in kenya, partly because the broker accepts mpesa, and mostly because there is nothing to not like about exness. The broker has been serving traders since 2008. Instant trade executions and unlimited leverage on MT4 accounts makes this forex broker one of the best for retail traders.

Exness account types

Exness offers account types that cater for every type of trader (see the table below).

- In any case you do not have trading experience and you’d like an account to learn and practice trading, the standard cent account with a minimum deposit of $1 and staggering unlimited leverage comes highly recommended.

- Exness offers a social trading platform that allows you to copy successful forex traders. This is for if those who don’t have the necessary mastery to trade profitably but still desire to make money from trading,

- If you want to trade for a decent profit that you can live off, the pro account with a minimum deposit of $200 and a maximum spread of $200 is what you’d want.

- For traders whose only goal is to milk the market, the raw and zero account types are the way to go. These account types charge commissions to trade. If you trade heavily, this is the way to go.

4. Grand capital

Grand capital is an online forex broker that also offers CFD and cryptocurrency trading. It comprises two companies, both named grand capital ltd, based in st vincent and the grenadines and seychelles. The broker does not appear to have regulation from a major financial authority. However, it is a member of both serenity and the financial commission, which are dispute resolution and compensation bodies.

They offer up $500 no deposit bonus.

5. EGM securities (fxpesa)

EGM securities (fxpesa) is the first broker to regulated in kenya in 2018 by capital markets authority as a non-dealing online forex broker. The broker opened the first office in africa in nairobi kenya. EGM securities offer multiple deposit and withdrawal channels including mobile payment channels such as M-pesa.

EGM securities is the company behind fxpesa. They rebranded the trading platform to fxpesa. You can open an account here.

The company has since established a fully-resourced staff complement of qualified and experienced professionals across various disciplines including compliance, finance, operations, IT in nairobi, kenya.

EGM securities is a local broker in kenya that provides a platform for trading both forex and cfds. EGM was the first forex company that is regulated in kenya under the capital markets authority.

To start trading in EGM you need to deposit at least $100 depending on if you want to start trading with an executive or a premium account.

Unlike its international competitors spreads in EGM are high at 1.6 with a maximum leverage of 1:400. EGM supports MT4 trading and it also accepts mpesa deposits.

6. Liteforex

If you’ve ever dreamed of trading with a customer-centric forex broker that accepts mpesa, liteforex is the way to go. No other broker offers customer support to the level that liteforex does. Opening an account is a breeze and funding it using mpesa is even easier. You will fall in love with the ease of doing business at liteforex.

One of the areas that create problems for most kenyans is account verification. Luckily, with liteforex, that’s an issue of the past. If you don’t have a utility bill that’s in your name, you will be able to verify your account using your KRA pin.

Liteforex offers mpesa deposits in kenya and tanzania. Any fees incurred when depositing money into this broker is instantly refunded.

It supports the two most popular forex trading platforms MT4 and MT5. Additionally, both android and ios apps are available for traders who prefer to trade forex on their mobile devices.

Liteforex is an old and well-established forex broker. At the time of writing this review, the company is clocking 15 years in operation. It is one of the best forex brokers and is constantly rated among the 100 top forex broker firms in the world.

7. FXTM

These forex brokers are particularly suited to kenyan traders as they accept mpesa as a means of depositing and withdrawing money from your forex account.

Depositing money into your FXTM account using mpesa is a walk in a park. Once you’re logged in, select african payment solutions as the mode of payment and walk through the next steps of depositing. On the final step, you’ll be prompted to enter your mpesa pin, and that’s it. Withdrawing your profits is also as easy.

8. Expertoption

.</p><br /><h2 id=) 9. IQ option

9. IQ optionOver the few short years that it has been operational, IQ option has won numerous awards praising the quality of its services and its reliability. Today, it has been recognized as one of the leading brokers in the industry as well. IQ option is a regulated broker under the jurisdiction of the cyprus securities exchange commission (cysec) under the name of holding company IQ option europe.

10. Superforex

11. Olymp trade

Olymp trade is one of the most popular online brokers in the industry, with over 25,000 clients currently trading on its platform every day.

Olymp trade has been operational since 2014, and the firm has a reputation for continuing to improve their trading platform with each successive year.

In terms of fees, olymp trade charges a fixed rate overnight fee on overnight trades, which is limited to 15% of the total investment amount.

Olymp trade is regulated by the international financial commission (IFC) and headquartered in st. Vincent and the grenadines.

However, concern has been raised in the past about the legitimacy of the international financial commission, and users may want to conduct a little bit of research into this body before deciding whether to consider olymp trade as a completely trustworthy broker.

The reason for this is because funds are generally only considered safe when a broker is regulated by an official body such as the UK financial conduct authority (FCA), the cyprus securities & exchange commission (cysec), or the australian securities & investments commission (ASIC).

12. Iron trade

It is owned and operated by bartoli management S.A of address 306 premier building, albert street, victoria, mahe, republic of seychelles.

Iron trade offers forex and options trading with the lowest trading time in the market. You can open a trade that runs for 30 seconds and get 80% returns (or more) when you win.

The best thing about iron trade is, it operates 24 hours – 7 days a week. Take note that deals made during the weekend are over the counter deals (OTC). It is easy to open an iron trade account, navigate, and actually trade on the platform.

You can check out our fully review and tutorial on irontrade.

We will keep updating more forex brokers that accept mpesa in kenya with time.

I hope this article helped you to highlight forex brokers that accept mpesa in kenya. We will keep updating it once we come across new brokers that accept mpesa. You can also check our forex signals telegram channel. Finally, don’t forget to leave a comment below.

Now that you wet your toes, we are ready to start swimming lessons… let’s jump right in. We will now read more

In this chapter we will show you which trading strategies you can combine to get the best results (two is read more

In will discuss how to maximize your profits while minimizing your risk, using one of the most important tools of read more

In this chapter you will learn about the relationship between stocks, indices, and commodities to the forex market. In addition, read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Forex brokers that accept M-pesa

Forex brokers that accept M-pesa offer the opportunity to deposit and withdraw funds from a forex account using the M-pesa payment channel. The M-pesa payment channel is particularly popular in kenya and tanzania, but its popularity is also increasing throughout afghanistan, mozambique and india. M-pesa is coined from a swahili term: “m” stands for “mobile” and “pesa” stands for “money”. M-pesa is a mobile payment method set up by vodafone’s kenyan partner, safaricom as a means of transferring payments using mobile phone technology.

This payment solution was devised as a means of helping unbanked populations get financial inclusion. Most payment channels on forex platforms require access to conventional banking methods. Without financial inclusion, the unbanked are locked out of this market. For the large unbanked populations in africa and other areas, M-pesa has changed this narrative and offers access to the forex market via forex brokers that accept M-pesa on their platforms.

What forex brokers accept M-pesa

The number of forex brokers that accept M-pesa for deposits and withdrawals is still relatively low. Despite this fact, some big international forex brokers offering good trading conditions already do support using M-pesa. Here is a list of some of the most popular brokers that allow forex trading and support the use of M-pesa as a funding method.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89% of retail investor accounts lose money when trading cfds.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

¹ variable spreads vary according to the current market conditions, recorded for EUR/USD on 06.05.2020 at 10:42 GMT+1.

* available to traders outside the european economic area.

Why forex brokers accept M-pesa?

Forex brokerage services were not originally offered to many emerging market economies until a full decade after the market was deregulated in 1997. Therefore, some of the peculiarities of the traditional financial systems of these economies were not accommodated in the design of payment channels for forex trading. The use of credit cards, bank wires and e-wallets all depends on the users within the target markets, owning and operating bank accounts. Given that some countries in africa have unbanked populations that are as high as 85%, forex brokers that target such market using conventional payment channels typically miss out on a huge segment of their target market. Some FX brokers have realized this and are now offering payment channels that are specifically tailored towards the unbanked populations in these underserved countries. This is how M-pesa came to be used as a payment channel that targets countries where there is a good penetration of mobile technology without commensurate financial inclusion. Ironically, some of these countries have large populations of people who already operate in the online gaming niche, where M-pesa features prominently. While nearly 50% of the whole population of kenya has an mpesa account, in other african countries, such as ghana, rwanda, or tanzania often dominate other mobile money providers such as airtel money, MTN mobile money, tigo pesa, ecocash or orange money.

M-pesa as a funding method

M-pesa targets the unbanked populations and is a form of mobile money. It enables the user to use his or her phone number as the account number. Typically, the regulators of the communications industry mandate the telecom companies to register all SIM card owners in a country using biometric registration methods. Therefore, a phone number can be assigned to an individual with a biometric stamp, ensuring that the number is unique to the individual and cannot be duplicated anywhere else. This process in itself enhances the know-your-customer requirements that forex brokers must fulfil when onboarding a new client.

The user then registers on the M-pesa platform and is assigned a unique set of login details. Verification of the user’s identity and address is done through submission of a government-issued ID card and other relevant documents.

Benefits of FX brokers that use M-pesa

The benefits of using an FX broker that accepts M-pesa are as follows:

- A) very fast deposits and withdrawals: transaction times are very fast, as transfers are done instantly.

- B) it is cashless, which means that traders do not need to carry large amounts of money. In countries with high denomination notes and high exchange rates to the US dollar, this is very convenient.

Drawbacks of FX brokers that use M-pesa

What are the drawbacks of using forex brokers that accept using M-pesa?

- A) the initial verification process can be strenuous

- B) the use of M-pesa is not widely available on forex platforms. This narrows the user’s choice of brokers.

Choosing a forex broker that accepts M-pesa

Presently, not many forex brokers accept M-pesa on their platforms, but the list is growing. You can either use one of the brokers listed above in which we verified they support M-pesa payment system or you can use online forums and other information sources to find out what the experience of other users of M-pesa forex brokers have been. Also, pay attention to other parameters to gauge the broker’s performance. You can do some test transactions to see how easy it is to make a deposit or withdraw funds from a set of M-pesa compliant forex brokers. You can also check out the quality of customer service from your first interaction with the forex broker as a prospect. Using these methods, you will find a forex broker that accepts M-pesa that is good for you.

Expert option kenya review for 2020 | direct mpesa deposit accepted

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

Are you an options trader in kenya?

Have you tried making a deposit on other platforms and failed because – apparently your bank sees binary options trading as a gambling activity?

Well, here’s some good news for you. Expert option now accepts direct mpesa deposits from east african traders. Meaning, you can now fund your expert option account with mpesa and withdraw easily using the same method.

But for those who don’t really have any prior experience with trading,

What is expert option?

Expert option is a binary options trading platform that allows traders to make money over the internet by predicting the outcome of financial assets over a given period of time. Interestingly, you can access expert option both via web browser and via the expert option mobile trading app.

E.O apps.

- Expert optionandroid app download.

- Expert optionios app download.

- Webtrader app.

Is it safe to trade in expert option broker?

Expert option has been in existence since 2014 with over 21,590,358 traders already registered and trading safely. Adding to that fact, expert option is licensed and regulated by the vanuatu financial services commission with license number 15014.

How to trade in expert option.

Trading in expert option is easy. It is just like trading in olymp trade or in IQ option.

If you have previous trading experience with these top brokers then you may as well be good to go with this broker. And that’s not to say that trading for beginners is complicated.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

In the next few paragraphs, I will give a step by step guide on how to trade with expert option. But first, I need you to log in to your account or register here if you are new.

Login to your account or register here if you are new to trading.

Note: – A new account comes with $10,000 demo units which you can use for practicing how to trade so you don’t have to worry about losing real cash.

Choose an asset to trade.

There are over 100 assets in expert option spread in across 5 instruments – currencies, cryptocurrencies, stocks, and commodities. Different assets promise a different return on investment. Pick an asset with the highest percentage if you want maximum returns.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

Enter the amount you wish to trade. You can use the plus and minus signs on the chart to adjust the amounts.

Now click on the green or red button on your chart to execute your first trade.

Clicking on the up button (the green button) means you are predicting that the value of the asset (EUR/USD) will rise. At the end of the trading time ( often 1 minute but can go up to days depending on your selection),; you win if the asset goes up.

Likewise, clicking on the red button (also known as down trade or put) makes you profits if the asset price goes down at expiration.

Expert option broker account types.

If you choose to trade with this broker then you will notice that there are 5 different account types on the platform. Namely: –

- Micro account.

- Basic account.

- Silver account.

- Gold account.

- Platinum.

- Exclusive account.

Each account type has some interesting features which are unlocked by set deposit amounts.

Micro account.

Designed for those who prefer light start. You can activate this account by making a deposit of $10 to your trading account. Other than experiencing real account trading, the only other benefits that you get from expert option are: –

- Free education materials.

- The maximum number of simultaneously open deals.

- Maximum deal amount.

Basic account.

This is the commonly used account type by beginners. Deposit $50 to activate. Like in a micro account, you will get free training materials with this account type. The maximum deal amount is increased to $25. And you can open 10 simultaneous deals.

Silver account.

Deposit at least $500 to activate. Benefits include: –

- An increased deal amount – $250.

- Increased maximum number of simultaneously open deals (15).

- Daily market reviews and financial research.

Gold account type.

- Increased asset profit up to 2%.

- Maximum deal amount $ 1000.

- Maximum number of simultaneously open deals (30).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

Deposit $2500 to activate account type.

Platinum account type.

- Increased asset profit up to 4%.

- Maximum deal amount $2 000.

- Maximum number of simultaneously open deals (no limit).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

Deposit $5000 to activate account type.

Exclusive account type.

- Increased asset profit by up to 6%.

- The maximum deal amount $ 3000.

- The maximum number of simultaneously open deals (no limit).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

How to fund your account in kenya.

There are 11 easy ways to deposit money to your expert option account in kenya. You could use your visa card, mastercard, maestro, yandex money, qiwi, crypto, perfect money, fasapay, webmoney, neteller or skrill. But perhaps the only method you’d want to learn how works is the newly introduced mpesa deposit method.

Expert option kenya review for 2020 | direct mpesa deposit accepted

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

Are you an options trader in kenya?

Have you tried making a deposit on other platforms and failed because – apparently your bank sees binary options trading as a gambling activity?

Well, here’s some good news for you. Expert option now accepts direct mpesa deposits from east african traders. Meaning, you can now fund your expert option account with mpesa and withdraw easily using the same method.

But for those who don’t really have any prior experience with trading,

What is expert option?

Expert option is a binary options trading platform that allows traders to make money over the internet by predicting the outcome of financial assets over a given period of time. Interestingly, you can access expert option both via web browser and via the expert option mobile trading app.

E.O apps.

- Expert optionandroid app download.

- Expert optionios app download.

- Webtrader app.

Is it safe to trade in expert option broker?

Expert option has been in existence since 2014 with over 21,590,358 traders already registered and trading safely. Adding to that fact, expert option is licensed and regulated by the vanuatu financial services commission with license number 15014.

How to trade in expert option.

Trading in expert option is easy. It is just like trading in olymp trade or in IQ option.

If you have previous trading experience with these top brokers then you may as well be good to go with this broker. And that’s not to say that trading for beginners is complicated.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

In the next few paragraphs, I will give a step by step guide on how to trade with expert option. But first, I need you to log in to your account or register here if you are new.

Login to your account or register here if you are new to trading.

Note: – A new account comes with $10,000 demo units which you can use for practicing how to trade so you don’t have to worry about losing real cash.

Choose an asset to trade.

There are over 100 assets in expert option spread in across 5 instruments – currencies, cryptocurrencies, stocks, and commodities. Different assets promise a different return on investment. Pick an asset with the highest percentage if you want maximum returns.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

Enter the amount you wish to trade. You can use the plus and minus signs on the chart to adjust the amounts.

Now click on the green or red button on your chart to execute your first trade.

Clicking on the up button (the green button) means you are predicting that the value of the asset (EUR/USD) will rise. At the end of the trading time ( often 1 minute but can go up to days depending on your selection),; you win if the asset goes up.

Likewise, clicking on the red button (also known as down trade or put) makes you profits if the asset price goes down at expiration.

Expert option broker account types.

If you choose to trade with this broker then you will notice that there are 5 different account types on the platform. Namely: –

- Micro account.

- Basic account.

- Silver account.

- Gold account.

- Platinum.

- Exclusive account.

Each account type has some interesting features which are unlocked by set deposit amounts.

Micro account.

Designed for those who prefer light start. You can activate this account by making a deposit of $10 to your trading account. Other than experiencing real account trading, the only other benefits that you get from expert option are: –

- Free education materials.

- The maximum number of simultaneously open deals.

- Maximum deal amount.

Basic account.

This is the commonly used account type by beginners. Deposit $50 to activate. Like in a micro account, you will get free training materials with this account type. The maximum deal amount is increased to $25. And you can open 10 simultaneous deals.

Silver account.

Deposit at least $500 to activate. Benefits include: –

- An increased deal amount – $250.

- Increased maximum number of simultaneously open deals (15).

- Daily market reviews and financial research.

Gold account type.

- Increased asset profit up to 2%.

- Maximum deal amount $ 1000.

- Maximum number of simultaneously open deals (30).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

Deposit $2500 to activate account type.

Platinum account type.

- Increased asset profit up to 4%.

- Maximum deal amount $2 000.

- Maximum number of simultaneously open deals (no limit).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

Deposit $5000 to activate account type.

Exclusive account type.

- Increased asset profit by up to 6%.

- The maximum deal amount $ 3000.

- The maximum number of simultaneously open deals (no limit).

- Priority withdrawal.

- Daily market reviews and financial research.

- Education materials.

How to fund your account in kenya.

There are 11 easy ways to deposit money to your expert option account in kenya. You could use your visa card, mastercard, maestro, yandex money, qiwi, crypto, perfect money, fasapay, webmoney, neteller or skrill. But perhaps the only method you’d want to learn how works is the newly introduced mpesa deposit method.

IQ option M-pesa – deposits and withdrawals

IQ option supports in some countries a popular mobile money payment system called M-pesa. Despite the fact that this funding method is particularly popular in kenya, traders from other african countries as well as from romania, albania and india and a couple of other countries use it too. In this article, you are going to find out how to make a deposit and withdrawal on the IQ option platform when using mpesa.

Does IQ option accept M-pesa?

Yes, IQ option accepts M-pesa for deposits and withdrawals. In order to make a deposit via this mobile money system, you have to open an IQ option free account. Once you do that, you can follow the simple guide below this paragraph. The minimum IQ option deposit amount when using M-pesa is 10 USD and the minimum withdrawal amount is 2 USD. If your M-pesa account is in kenyan shilling or other currency, your deposit will be converted to USD.

How to make a deposit on the IQ option platform when using M-pesa?

Here is a simple guide on how you can make a deposit when using M-pesa.

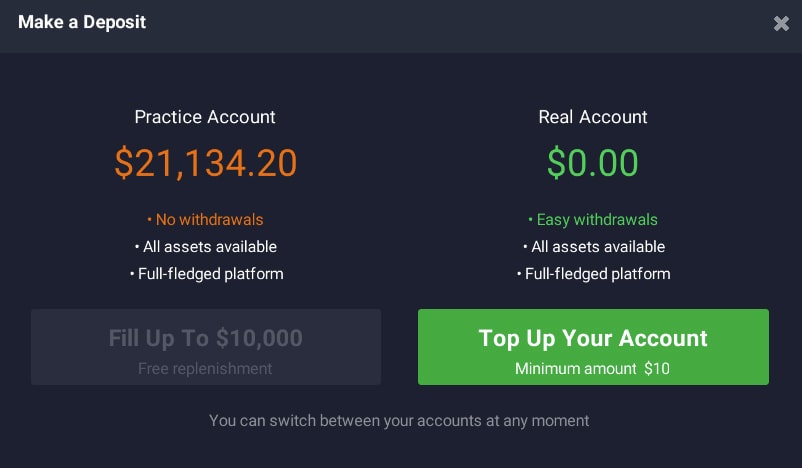

1#STEP, login to your IQ option account, or create a new one for free (84% of retail CFD accounts lose money)

2#STEP, click in the top right corner on the deposit button

3# step, select the right option “top up your account”

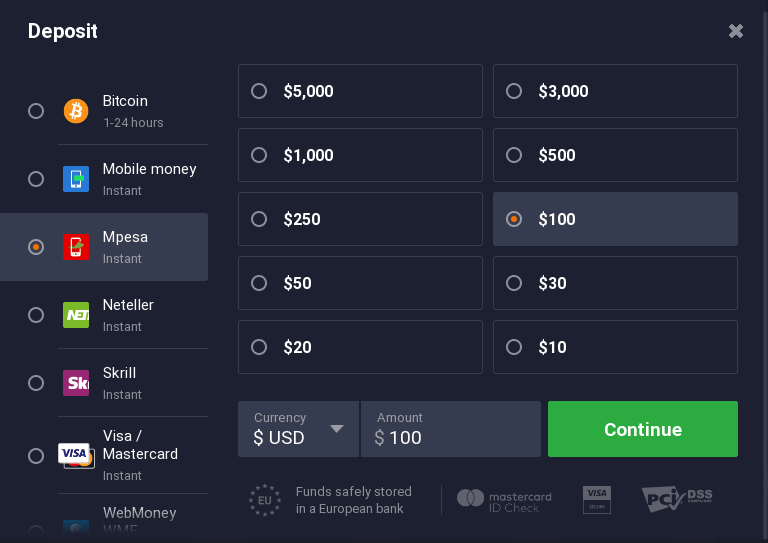

4# step, from all the available deposit methods, choose mpesa, select amount you want to deposit to IQ option and click continue.

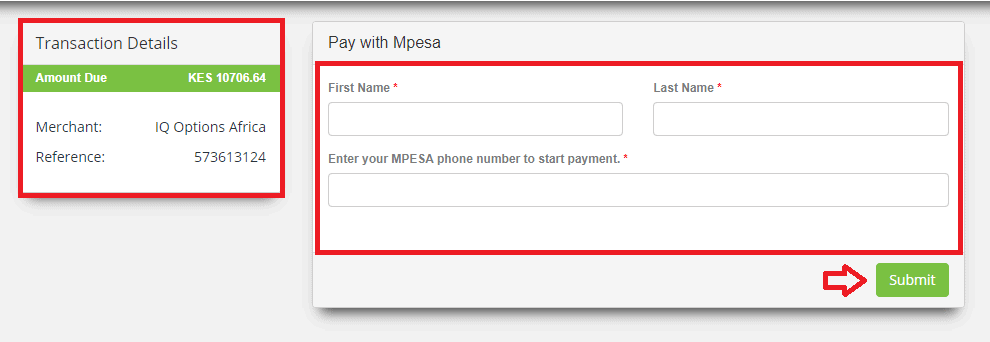

5# step, you will be redirected to a secure payment gateway where you have to fill in your name and your MPESA phone number (the safaricom number).

6# step, if you clicked the submit button a pop-up window will show on your mobile phone where you verify the transaction. Once you have done that, wait for a couple of seconds and your funds will be loaded to your IQ option account.

How to make a withdrawal when using M-pesa?

The instructions on how to withdraw money from IQ option when using mpesa are pretty much the same as when making a deposit. Instead of clicking on the deposit button, click on the withdraw button when you are logged in your real account.

Are there any fees for M-pesa deposits and withdrawals?

According to the IQ option official website, the broker does not charge any deposit or withdrawal fees (with the exception of wire transfer). It, therefore, means, that there are no deposit or withdrawal fees when using M-pesa. Please note, that despite the fact IQ option does not charge any deposit or withdrawal fees, M-pesa might.

How to convert your bitcoin to MPESA

So, you are holding some bitcoin in your wallet and want to turn it into MPESA. How do you do that? Read on to find out how to convert bitcoin to MPESA.

Why would you need to convert bitcoin to MPESA?

Unfortunately, very few retailers in kenya accept bitcoin as payment.

That means that you need kenyan shillings to pay rent, pay your electricity bill, buy food, and pay for your car’s fuel.

Fortunately, MPESA allows users to carry out all these transactions and more with ease.

Therefore, if you are cash-strapped and have some bitcoin in your wallet, you can convert it to MPESA to gain liquidity.

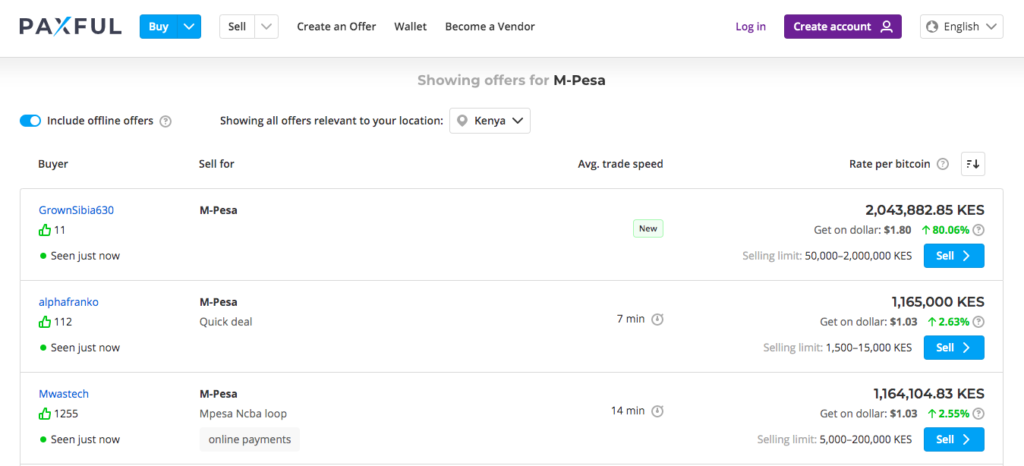

How to convert bitcoin to MPESA using paxful

Africa’s leading peer-to-peer bitcoin marketplace, paxful, is a platform where users can buy and sell BTC from each other with an array of payment methods such as MPESA.

Here is how you can convert BTC to MPESA on paxful:

- Create an account on paxful. Note that you will need to verify your phone number, home address, and identity through the KYC process. To complete KYC, you will need to upload a document with your home address and name. The document could be a bank statement or an internet bill. If you already have an account on paxful, log in.

- Next, transfer your bitcoin from your personal wallet to the platform wallet.

- Go to sell bitcoin to search for available offers.

- Select your preferred payment method. In this case, you will choose MPESA.

- Enter your currency and the amount you want to trade.

- Choose your country and click “search for offers.”

- The platform will show you a list of buy offers based on your search. Preferences. Scroll through the list and choose a buyer with a good rating and reputation. Also, check other details like the selling limit, the buyer’s rate, the transaction terms, and the platform fee.

- Once you find a suitable buyer, enter the amount you want to trade in KES and click “sell now.”

- If the platform supports chats, converse with the buyer to kick start the trade. Additionally, discuss the payment method and share the payment details. In this scenario, you will share with each other your MPESA numbers and registered names.

- Once the buyer sends the MPESA payment and you confirm it, release the bitcoin. Your trade is now complete and you have converted bitcoin to MPESA. However, before you log out, leave your trade partner some feedback.

Sell bitcoin to someone in your local area

If you know people in your local area that trade bitcoin, you could contact them to initiate a trade in person or via a messaging app.

Since you already know the person and the level of trust is high, the trade should take place smoothly and within minutes.

However, you will have a set a fair price to make the trade attractive. Also, note that you can only trade with someone if they have enough money in their MPESA account to pay you. Therefore, if the bitcoin is worth a lot, and the buyer does not have that much money, you will have to look for another trader or carry out a smaller trade.

At that point, it may just be easier (and probably cheaper) to trade on an online marketplace, like paxful.

Forex trading big

Reap big in currency trading

What you need to know about using M-pesa to trade forex

You probably already know that M-pesa is the king of mobile money services. What you might not be aware of is that in the third quarter of 2019 alone, 655.95 million of kenya’s 810.9 million mobile money transactions happened via the nation’s leading mobile finance app.

Indeed, M-pesa has become such a crucial part of developing the global transition towards using digital cash. In order to fully understand the current role of this game-changing app in the foreign exchange market, we first need to take a closer look at how it fits into the disruptive fintech sector.

The rise of digital payment apps

In the last couple of years, mobile and digital payment channels have been growing in popularity throughout the world.

In the western world, apps like paypal one touch and apple pay have set consumer standards and raised expectations for both security and convenience in mobile payments. The resulting surge in confidence with digital payment methods has, in turn, spurred newcomers to join the digital currency game.

For instance, petal card is a new credit card and financing app that wants to make it easier for consumers with zero credit history to raise their scores. Meanwhile, other apps like venmo and zelle are designed for sending money to family and friends—a more social approach to fintech compared to most other prominent digital payment platforms.

In kenya, M-pesa had already achieved mainstream popularity even before most of the aforementioned apps and platforms saw mass use.

The global financial impact of M-pesa

Through M-pesa, kenya became the world leader in mobile payments back in 2015. Despite the nation’s low ranking in the world economy, at the time, it was already easier to pay for a taxi through a mobile phone in nairobi, the country’s capital, than in places like london, hong kong, or new york.

While the world’s fintech developers have since caught up to M-pesa, kenya’s mobile payments king has already made an indelible mark on world finance.

In 2018, kenya’s first regulated online forex broker—EGM securities—allowed kenyans to use M-pesa and other mobile payment channels to participate in the global forex market.

Today, apart from the few locally registered forex brokers, many other brokerage firms now accept transactions through M-pesa. This includes some of the most prominent names in the forex trading industry, such as XM group, tickmill, octafx, plus500, and many others.

How do I use M-pesa to start forex trading?

Aspiring traders can start by picking a forex broker or brokerage firm, which can connect them to the rest of the market. In this article on how to choose the right tools for forex trading, we explained that you need to select the right platform for trading currencies online.

Nowadays, nearly all brokerage firms offer mobile platforms for making trades, which will make it easier to integrate your M-pesa with your new brokerage account. Using M-pesa and managing all your trading through one mobile device can greatly simplify the way you trade, which in turn may improve your chances of success.

The more you can simplify your trading and eliminate complicated transactions, the better you can focus on gleaning trading insights from the news, charts, signals, or indicators from which you can develop your trading strategies.

On the other hand, if you prefer the flexibility of trading via a web-based platform that’s not confined to one device, you can choose to do so and still integrate your M-pesa account for managing money transfers to and from your brokerage account.

By using M-pesa as a forex trading tool, you’ll be joining the growing number of forex traders from kenya, afghanistan, tanzania, india, south africa, and other countries throughout the world who are realizing the convenience of streamlining brokerage payments through the innovative east africa’s mobile payments technology.

Your forex broker of choice can tell you more about the specific steps you need to take to pay for your account via M-pesa.

M-pesa beyond forex

Recently, kenyan telecom company safaricom and south africa’s vodacom gained full ownership of M-pesa from the UK’s vodafone—one of its original developers.

In a statement explaining the acquisition, the two african companies said that the joint venture is aimed at having full control over the M-pesa brand and accelerate the development of the tech for new local markets.

For the foreseeable future, it’s safe to say that M-pesa will continue to be a leading disruptor not just in the forex markets, but also in the global development of fintech itself.

So, let's see, what we have: M-pesa is a popular mobile payment tool that services clients in kenya. Learn more about the brokers who accept payments via this platform. At trading apps that accept mpesa

Contents of the article

- Top-3 forex bonuses

- Meet the forex brokers that accept payments via...

- Forex brokers that accept M-pesa

- Top forex brokers that accept mpesa deposits in...

- 1. XM forex.

- How to fund your XM broker account with safaricom...

- 2. Iron trade.

- What’s the meaning of OTC?

- Is the iron trade platform user friendly?

- Does iron trade accept mpesa deposits?

- 3. Expert option.

- How to fund your expert option account in kenya.

- How to use mpesa to deposit money to your expert...

- 4. Templerfx.

- How to deposit money to templerfx.

- Are spreads in templer good enough for newbies?

- 5. Olymp trade.

- 6. EGM securities accepts mpesa deposits.

- 7. IQ option.

- 8. FXTM accepts mpesa deposits

- 9. Hot forex kenya

- Forex brokers that accept mpesa in kenya

- 1. XM GLOBAL

- 2. Hotforex

- 3. Exness

- 4. Grand capital

- 5. EGM securities (fxpesa)

- 6. Liteforex

- 7. FXTM

- 8. Expertoption

- 9. IQ option

- 10. Superforex

- 11. Olymp trade

- 12. Iron trade

- Forex brokers that accept M-pesa

- What forex brokers accept M-pesa

- Why forex brokers accept M-pesa?

- M-pesa as a funding method

- Benefits of FX brokers that use M-pesa

- Drawbacks of FX brokers that use M-pesa

- Choosing a forex broker that accepts M-pesa

- Expert option kenya review for 2020 | direct...

- What is expert option?

- E.O apps.

- Is it safe to trade in expert option broker?

- How to trade in expert option.

- Expert option broker account types.

- Micro account.

- Basic account.

- Silver account.

- Gold account type.

- Platinum account type.

- Exclusive account type.

- How to fund your account in kenya.

- Expert option kenya review for 2020 | direct...

- What is expert option?

- E.O apps.

- Is it safe to trade in expert option broker?

- How to trade in expert option.

- Expert option broker account types.

- Micro account.

- Basic account.

- Silver account.

- Gold account type.

- Platinum account type.

- Exclusive account type.

- How to fund your account in kenya.

- IQ option M-pesa – deposits and withdrawals

- Does IQ option accept M-pesa?

- How to make a deposit on the IQ option platform...

- How to make a withdrawal when using M-pesa?

- Are there any fees for M-pesa deposits and...

- How to convert your bitcoin to MPESA

- Why would you need to convert bitcoin to MPESA?

- How to convert bitcoin to MPESA using paxful

- Forex trading big

- What you need to know about using M-pesa to trade...

- The rise of digital payment apps

- The global financial impact of...

- How do I use M-pesa to start forex...

- M-pesa beyond forex