Does tickmill accept us clients

The maximum leverage available is 1:500, but varies depending on the asset:

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Top-3 forex bonuses

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

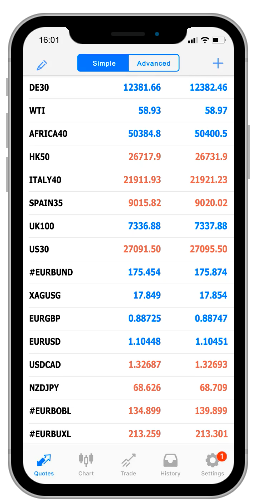

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

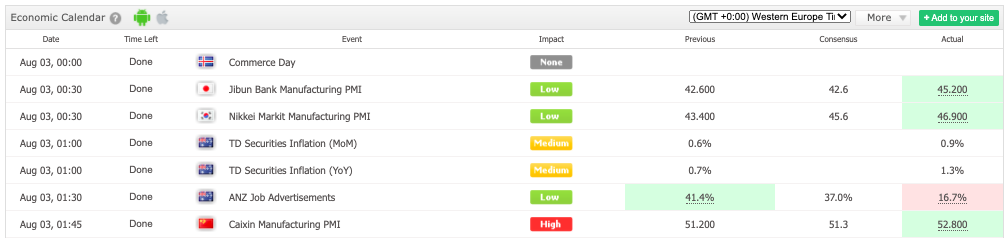

Additional features

The broker offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan, or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email –[email protected]

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords, and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Their internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade, or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

But traders from united states, canada, japan, bangladesh, nigeria, pakistan, kenya are not allowed by the broker.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities |

Fxglory is an online forex broker providing clients with trading in forex and commodities. This review will look at the read more

101investing.Com is a cysec-regulated broker offering over 250 cfds on the MT4 trading platform. This review unpacks the login process, read more

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Does tickmill accept us clients

Tickmill reviews and ratings

| Website | https://tickmill.Com/ |

| live chat | YES |

| telephone | +852 5808 2921 |

| broker type | non deal desk (NDD) |

| regulations | FCA and FSA |

| min deposit | $100.00 |

| account base currency | USD, EUR, GBP, PNL |

| max leverage | 500:1 |

| trading platforms | metatrader 4, webtrader |

| markets | forex, index CFD trading, precious metals, energy, cryptocurrencies, bonds |

| bonus offered | $30.00 welcome bonus |

| funding options | credit / debit card, china union pay, bank transfer, dotpay, skrill, neteller, fasa pay |

Tickmill review 2021

Overview

This UK-based FCA and FSA-regulated brokerage firm based in the republic of seychelles offers trading to institutions and retail clients globally. Its forex business offers gold and silver as well as 62 currency pairs (including cryptocurrency) for trading. The broker have a lower minimum deposit compared to some of the other brokers on this list. It is a great broker firm for beginners to try their hand.

Accounts

Tickmill offers various types of accounts for various trader profiles. Commission-free classic accounts for beginners, pro accounts, VIP accounts for those who trade a lot and want special service, and islamic accounts. Traders will be thrilled to find the demo account offers metatrader 4 for testing, and includes real-time prices and volatility.

Minimum deposit

$100 in classic and pro accounts, 50,000 minimum balance in VIP accounts.

Maximum leverage

Features

Tickmill offers two platforms to trade on. Metatrader 4 is the main platform. For those who want to trade quickly through their browsers without downloading any software, there is the web trader.

Tickmill also offers a variety of tools including forex margin and currency calculators, autochartist for technical analysis, forex calendar, and myfxbook autotrade. The tickmill VPS keeps the MT4 eas and signals running when the customer is offline. One-click trading option enables quicker real-time trading.

Promotions like the introducing broker service allows traders to earn commissions on reference. A multi account manager is also available.

Educa tion

Webinars and video tutorials are available.

Deposits/withdrawals

Several funding options are available to customers, and withdrawals are processed within one working day.

Customer service

24/7 via online chat or email, and support lines on weekdays.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

Established in 2015, tickmill is an online forex and CFD broker that is regulated in multiple jurisdictions. They provide online trading services to their retail and institutional clients across the globe, offering over 80 tradable instruments across currency pairs, stocks, indices, bonds, metals, energies, and other commodities via flexible trading platforms. The broker offers quality trading conditions, including competitive spreads and commissions, good execution speeds without requotes, prompt customer support services, and helpful trading tools. However, they do not provide enough educational resources.

Tickmill review introduction

In this tickmill review, we will take a look at some of the most important factors worth considering when choosing a forex broker for your online trading needs. This includes trading platforms, trading tools, research and education, account funding options, customer support and broker regulation.

You may also wish to view my best forex brokers based on countless hours that I have spent researching and testing hundreds of brokers, all of which you can see in my forex broker reviews. You can also use my free trading tool to compare forex brokers including tickmill.

Tickmill platforms & tools

Tickmill provides their clients with the metatrader 4 (MT4) platform, which is the most popular trading platform among forex traders. MT4 is available as a web trading terminal that runs on most modern browsers, desktop applications for mac and windows computers, and mobile apps for ios and android compatible devices. The broker also provides a FIX API connection to private and institutional who maintain a minimum account balance of $500,000.

In addition to the tools that come with the trading platforms, the broker provides a selection of useful tools, such as autochartist, technical chart patterns, fibonacci patterns, volatility analysis, key levels, market reports, performance statistics, myfxbook autotrade, economic calendar, trading calculators, tickmill VPS, and one-click trading

Tickmill research & education

The broker has an FAQ section on their website, which answers some common trading questions. Apart from that, and probably the news section, there are no education materials provided by this broker.

Tickmill trading accounts

The broker offers 3 account types:

- Classic account: minimum deposit $100, minimum lot size 0.01, max leverage 1:500, floating spreads from 1.6 pips and no commissions

- Pro account: minimum deposit $100, floating spreads from 0 pips, a $2 commission, minimum lot size 0.01, and max leverage 1:500

- VIP account: floating spreads from 0 pips, a $1 commission, minimum deposit $50,000, minimum lot size 0.01, max leverage 1:500,

Non-professional EU traders have a maximum leverage of 1:30. There may be additional fees, so check with the broker.

Tickmill account funding

Tickmill accepts a good variety of deposit and withdrawal methods, including bank transfer, credit card, and online payment processors, such as skrill, neteller, fasapay, and unionpay. Bank transfers may take 3-7 business days to be processed, while credit cards and online payment methods are processed in less than a day.

Tickmill customer service

Customer support service is available from monday to friday during trading hours. Support is offered in english, italian, spanish, russian, chinese, indonesian, vietnamese, and arabic. You can reach the support team via phone, online chat, and email

Tickmill regulation

Tickmill is a brokerage brand operated by 3 related companies within the tickmill group, which are regulated in different jurisdictions, as follows:

- Tickmill UK ltd is authorized and regulated by the financial conduct authority (FCA) — the agency that supervises financial service firms in the UK

- Tickmill europe ltd is licensed and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company.

- Both tickmill uk and tickmill europe also abide by the ESMA rules and follow the mifid II

- Tickmill ltd is regulated as a securities dealer by the financial services authority (FSA) of seychelles

Tickmill review summary

Tickmill is an online broker that is regulated in multiple jurisdictions. They provide trading services in over 87 instruments via the MT4 platform, offering competitive spreads and commissions, advanced trading tools, and fast executions.

It is worth mentioning that some of the trading products and services in this tickmill review may differ or not be available to traders in some countries due to regulations. As brokers terms can change over time, please verify all information is up to date directly from the tickmill broker website which you can visit by using the link below.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill

Spreads

Liquidity

Commissions

Support

Regulation

Features

- MT4 platform

- Advanced trading tools like autochartist, technical chart patterns, fibonacci patterns, and volatility analysis

- A good selection of tradable instruments

- Multi-regulated broker

- Competitive trading conditions

Best forex robots

Forex robotron

Forex cyborg

Forex flex EA

Forex scalping EA

5 pips A day

Get my free forex robot!

Sign up now and receive instant access to my free forex robot download with over 40 technical indicators and 11 candlestick patterns built in. *please use a real email address as you will be sent the download link*

Best forex brokers

Pepperstone

IC markets

Pages

- Best forex robots 2021

- Forex robot reviews

- Forex robot ratings

- Free forex robot download

- Best forex brokers 2021

- Forex broker reviews

- Forex broker ratings

- Compare forex brokers

- Forex trading system reviews

- Forex trading system ratings

- Forex trading tool reviews

- Forex trading tool ratings

- Forex signal reviews

- Forex signal ratings

- Forex trading course reviews

- Forex trading course ratings

- Contact me

- Privacy policy

- Terms & conditions

Categories

- Forex brokers

- Forex robots

- Forex signals

- Forex trading courses

- Forex trading guides

- Forex analysis

- Forex basics

- Forex indicators

- Forex strategies

- General trading

- Trading psychology

- Trading software

- Forex trading systems

- Forex trading tools

Recent posts

- Bitcoin VS forex – which one is the best option

- Cedarfx lends support to combat climate change

- Cedarfx review

- Bitcoin exchange: what to consider for choosing the right bitcoin exchange?

- The different methods to acquire bitcoin

- What are the challenges faced by bitcoin and its users and need to be overcome?

- Forex robotron review

- Forex cyborg review

- Forex scalping EA review

- Forex flex EA review

All information on the forex geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the forex geek and any authorized distributors of this information harmless in any and all ways. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Does tickmill accept us clients

Trading categories

B2B categories

Quick look

Tickmill is a CFD and ETD broker that was established in 2014 and operates globally from its headquarters in london. As a global broker it is regulated by several entities, including the financial conduct authority in the UK. This top tier regulation adds an extra level of trust and a perception of safety to the broker.

One reason that active traders like tickmill is the low spreads and fees it offers with some of its accounts. It is known to be one of the lowest commission brokers for forex traders, and it makes opening an account fast and easy. With many different options for deposits and withdrawals, funding an account is also fast and easy.

On the downside there is a limited number of assets available for trading, including a complete lack of stocks and cryptocurrencies. The trading platforms offered are the metatrader 4 and CQG; the former is appreciated by experienced traders since they are familiar with the platform, but new traders sometimes complain that MT4 is outdated in its design and user interface.

- Regulated by the FCA

- Low spreads and fees

- Metatrader 4 is the desktop, mobile, and web platform

- No stock or cryptocurrency trading

- No two-factor authentication for greater security

- United states citizens and residents not accepted as clients.

Broker regulation

Tickmill is regulated in a number of jurisdictions, and the coverage for traders depends on their country of residence. In the UK the broker is regulated by the financial conduct authority (FCA) under registration number 717270. Traders here are also protected under the financial services compensation scheme with provides insurance for deposits up to ВЈ85,000.

European traders fall under the regulation of the cyprus securities and exchange commission (cysec), with license number 278/15. The broker also complies with the financial instruments directive 2014/65/EU or mifid II and is covered by the investor compensation fund that protects deposits up to €20,000.

Other jurisdictions fall under the regulation of the seychelles financial services authority (FSA) under license number SD008. In all cases deposits are fully segregated, and clients also benefit from negative balance protection.

Tickmill is also regulated by the labuan financial services authority (labuan FSA) in malaysia and the financial sector conduct authority (FSCA) in south africa.

Account types

There are three account types offered at tickmill for forex and CFD traders:

Classic вђ“ this is the basic level account with a minimum deposit of $100 and access to 62 currency pairs as well as a variety of indices, commodities, and bonds. The classic account comes with no commissions and variable spreads that start at 1.6 pips. This is the beginner level account.

Pro вђ“ this next level is considered more suitable for experienced traders. It still has a $100 minimum deposit, but also comes with a $4 round trip commission, and spreads that begin at 0 pips for forex trading. On indices, bonds and oil there is no commission payable.

VIP вђ“ this is the top tier account, made specifically for high volume traders. With $50,000 minimum deposit clients at the VIP level get 0 pip spreads, commissions of just $2 per round trip for forex trades, and no commissions on cfds on indices, oil and bonds.

Additionally in november, 2020 tickmill launched also trading in futures (currently available to clients of tickmill UK ltd)

The clients can trade futures across 5 global exchanges such as CME, CBOT, NYMEX, EUREX, COMEX with wide range of contracts covering commodities, precious metals, currencies, bonds and stock indices.

In addition to the live accounts, tickmill also has a demo account available where clients are able to test the MT4 and CQG platforms and the trading conditions of the broker without risking losses. Demo accounts are free and anyone is able to open one to see if tickmill really does have the fastest execution times in the industry. Traders who follow the religion of islam are also able to take advantage of a swap-free islamic account.

Trading platforms

The only platform offered at tickmill is the venerable metatrader 4 platform, long touted as the worldвђ™s leading forex trading platform. It is a common choice, although some newer traders claim that the platform is outdated, and the user interface needs to be updated. Whether that is true of not is a matter of opinion, but what isnвђ™t a matter of opinion is the huge range of indicators available with MT4 and the power of its charting capabilities.

When it comes to trading exchange listed futures, tickmill provides clients with cqgвђ™s industry leading trading solution for access to global markets. The platform provides fast and reliable order routing via worldwide, co-located CQG hosted exchange gateways, superior market data visualisation with easy to use features and over one hundred studies for extensive and informed technical analysis trading.

Tickmill developed in-house trading platform profiles created to suit tradersвђ™ trading style and save valuable time setting up. Desktop solutions are available for desk-based traders and a mobile app for on-the-go traders needing easy access to the global markets.

Tickmill also offers some upgrades such as one-click trading and social trading via myfxbook. The downside is the 1.2 pip markup on social trades. Portfolio managers can also take advantage of the MT4 multi-trader terminal, and those who work with automated trading and robots can enjoy a 20% discount on VPS packages through a partnership with beeksfx.

Tickmill offers all the varieties of MT4, so you can download to desktop, trade through a browser with the web trader, or install the mobile app on your phone and trade on the go.

Because tickmill is primarily focused on forex trading it is great for currency traders, but not so great for trading other assets. While there are 62 different currency pairs to choose from there are just nine index cfds, four bonds, and three commodities. There are no stocks and cryptocurrencies at all. One can hope that tickmill chooses to include these important asset classes in the future to provide its clients with the opportunity to diversify their trading.

In november, 2020 tickmill launched also futures trading (currently available to clients of tickmill UK ltd). Clients can trade futures across 5 global exchanges such as CME, CBOT, NYMEX, EUREX, COMEX with wide range of contracts covering commodities, precious metals, currencies, bonds and stock indices.

Education and research

The blog at tickmill is one of the best educational resources provided by the broker. It is populated by eleven market experts who provide traders with market commentary and research on a regular basis. There are four sections, and including basic articles clients can also delve into technical and fundamental analysis, as well as market insights. The addition of this educational resource is well appreciated, and the presentation of subjects is quite comprehensive. Plus the content is regularly updated throughout the day, which we felt was one example of the excellent service provided by tickmill.

Thereвђ™s more than just the blog though. Tickmill also offers video tutorials, seminars and webinars, ebooks, and other educational content in several languages.

The video library is particularly comprehensive, and contains material in english, russian, spanish, arabic, and german. The only complaint is that these videos are not arranged by language, which sometimes makes it difficult to find content in your preferred language amidst all the videos.

The education is good, but the best value comes from the insights provided on the blog by the eleven experts.

Customer service

Customer service is available 24/5 via email or web form. In addition to the webform and email clients are also welcome to use an online chat function or to call directly on the telephone. In addition there is a detailed FAQ on the website that can answer most basic questions. Telephone and chat support from the seychelles office is available monday through friday from 7:00 to 16:00 GMT, while telephone and chat support from malaysia is monday through friday from 8:00 to 17:00 MST.

In conclusion

As a well respected and regulated broker tickmill provides excellent service to its clients. That said, the asset offering is somewhat limited, and those looking to trade something other than currencies may feel constrained by the lack of diverse offerings at tickmill. Given that the primary offerings are forex pairs it makes sense that tickmill chose metatrader 4 as the platform, since it is well known as the premier forex trading platform.

While the classic account avoids commissions, many traders might want to consider the pro account and its commission structure in order to take advantage of significantly lower spreads.

Tickmill stands out for its educational offerings, particularly the market commentary and education provided by the eleven experts that make up its research team.

We really think thereвђ™s a huge potential from tickmill, and forex traders will be very happy with the service offered. Other traders will miss a broader offering of assets, and that seems to be the greatest opportunity for improvement. Traders may want to give the broker a try to take advantage of its incredibly low spreads, and blazing fast execution speeds, but only if forex is your thing. Other traders should keep their eye on the broker for new assets that will make the broker more attractive.

While there is clearly a vast amount of untapped potential at tickmill, management should find a way to access that potential in an effort to attract new traders and retain existing ones. In the current environment, while traders may be better served at other brokerages, they would be wise to keep tickmill on their radar as this broker certainly could be a contender for any trader looking for new opportunities.

Does tickmill accept us clients

Best forex broker for canadians

Canadian forex brokers in 2021

Forex brokers from the USA , UK and europe are popular, but still, there are forex brokers in other countries that offer competitive forex services.

Canadian forex brokers offer various compelling benefits for day traders and investors. Forex trading is risky, irrespective of the forex broker you choose.

However, you can enjoy some form of protection for your money, if you choose a regulated forex broker.

Here you will find forex brokers accepting canadian clients in canada and even some offshore brokers.

Forex brokers in canada must provide protection to investors and traders through the canadian investor protection fund (CIPF).

This insurance guarantees up to $1 million for traders, when the forex broker applies for bankruptcy.

If the brokerage firm is liquidated, traders can get back up to $1 million. This is much greater than the £85,000 offered by the FCA for traders in the UK .

Traders who want to hold millions of dollars in their forex accounts, can safely choose canadian forex brokers because of the insurance protection.

Regulated FX brokers in canada

Below you find a list of regulated canadian forex brokers that have offices in canada and are fully licensed to operate as a FX broker.

Forex regulation in canada

There is no central regulatory authority in canada that regulates and authorizes financial firms.

Forex brokers are allowed to operate, without a valid license in canada.

While this provides flexibility for traders, it also increases the risk considerably.

The investment industry regulatory organization of canada ( IIROC ) is one of the main regulatory companies, overseeing financial companies.

It is responsible for monitoring forex brokerage firms that deal with OTC products and derivatives.

Forex regulation by province

There are other regulatory bodies, such as:

- The canadian securities administrators (CSA),

- The financial services commission of ontario,

- The alberta securities commission,

- The british columbia securities commission,

- The financial transactions and reports analysis centre of canada,

- The mutual fund dealers association,

- The canada revenue agency,

- The office of the superintendent of financial institutions,

- The ontario securities commission,

- The autorite des marches financiers (quebec).

In canada, the governing regulatory bodies differ, with respect to the province of the forex brokers.

This can be confusing for forex traders because the brokers can operate, even without a valid license.

The regulatory environment in canada is ambiguous because of the internal conflicts, between various regulatory bodies.

Here are our top picks for best forex broker for canadians

| Broker type | ECN |

| regulations | IFSC |

| min deposit | $100.00 |

| account base curreny | USD, EUR, GBP, AUD, CAD, bitcoin, gold, bitcoin cash, litecoin, ethereum and XRP |

| max leverage | 200:1 |

| trading platforms | metatrader 4/5 |

| Broker type | market maker |

| regulations | ASIC, B.V.I, FSA, FFAJ, FSCA, IIROC |

| min deposit | $100.00 |

| account base currency | USD EUR GBP AUD |

| max leverage | 400:1 / 30:1 EU clients |

| trading platforms | metatrade 4, avatradeact, web trading, avaoptions avatradego, mobile trading |

IIROC guidelines and offshore forex brokers

Forex brokers accepting canadian clients may seem impossible to find.

Strict regulations and general confusion on regulations keep some brokers from dealing with canadians.

There still are many forex brokers that accept residents of canada.

In an attempt to impose stringent regulatory requirements, the IIROC in canada follows the NFA and CFTC in the USA. IIROC regulated forex brokers do offer low leverages of 1:1 and up to 50:1.

This has discouraged many brokerage firms from getting IIROC regulations. With lower leverages offered, not many canadian traders are interested in canadian forex brokers.

In canada, canadian citizens are required to choose a forex broker regulated by the IIROC.

However, it is not illegal to choose some other global forex broker because numerous regulatory bodies work in various provinces of canada.

When you live in canada and want to choose an overseas forex broker, you should understand the legal consequences and consult a legal advisor, before heavily investing with a foreign forex broker.

Below you will find a list of international FX brokers that accept canadian citizens in 2021.

Does tickmill accept us clients

Compare forex brokers and ECN brokers

Tickmill

Tickmill - specs

Broker

Account

Payments

Costs

Trading

Platform

Products

Other

Promotions and offers

Our rating

The overall rating is based on review by our experts

Tickmill - profile summary

Tickmill is a forex broker . It started opening it's doors to clients in 2011 , establishing it's offices in seychelles , . Tickmill (forex broker) offers various trading accounts: mini account, standard account, ECN account and the minimum deposit for trading in forex (FX) is $100.

Tickmill offers accounts in: USD account, EUR account, GBP account with variable spreads. The lowest spread offered in eurodollar is 1.6 pips mini account.

It's platform (MT4 (ECN), MT4 desktop/mobile/ios/smartphone, myfxbook ) can be traded on desktop|mobile|ios|smartphone| , it offeres a NDD, personal coaching feed. The platform is set on GMT+2 and it offers a 5 digits decimal spacing on it's forex pairs. It's forex (FX) accounts offer a leverage of 500 : 1 standard account

On it's platforms: MT4 (ECN), MT4 , myfxbook, you can set trailing stoploss, no OCO orders, one click trading, furthermore it offers mobile trading, no webtrading and 62 fx pairs (+exotic). Among the foreign exchange products you can also trade, gold, silver, commodities.

Tickmill (forex broker) is regulated by FSA seychelles, and is a introducing broker for LMAX..

For all those wondering on the payment and withdrawal method, here is a list of funding methods:

Payments:bank wire, credit card, debit card, skrill, webmoney, neteller, fasapay, china unionpay

Withdrawals from your FX account:bank wire, credit card, debit card, skrill, webmoney, neteller, fasapay, china unionpay

Please take the opportunity to review tickmill, your feedback is appreciated.

Tickmill review and tutorial 2021

Go to the brokers list for alternatives

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Trade on majors, minors and exotics with up to 1:500 leverage.

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular alternatives to tickmill

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.Com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use tickmill from united states, canada, japan, bangladesh, nigeria, pakistan, kenya.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. This review will give you detailed information about the broker. At does tickmill accept us clients

Contents of the article

- Top-3 forex bonuses

- Tickmill review and tutorial

- Tickmill company summary

- Trading platforms

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

- Does tickmill accept us clients

- Tickmill reviews and ratings

- Tickmill review 2021

- Overview

- Accounts

- Minimum deposit

- Maximum leverage

- Features

- Educa tion

- Deposits/withdrawals

- Customer service

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill review

- Tickmill review introduction

- Tickmill platforms & tools

- Tickmill research & education

- Tickmill trading accounts

- Tickmill account funding

- Tickmill customer service

- Tickmill regulation

- Tickmill review summary

- Tickmill

- Features

- Best forex robots

- Get my free forex robot!

- Best forex brokers

- Does tickmill accept us clients

- Trading categories

- B2B categories

- Quick look

- Broker regulation

- Account types

- Trading platforms

- Education and research

- Customer service

- In conclusion

- Does tickmill accept us clients

- Canadian forex brokers in 2021

- Here are our top picks for best forex broker for...

- Does tickmill accept us clients

- Tickmill

- Tickmill - specs

- Tickmill - profile summary

- Tickmill review and tutorial 2021

- Tickmill company summary

- Trading platforms

- Popular alternatives to tickmill

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account