Zcom trade

In terms of trader profiles, trademetria suits stocks, FX, cfds, futures, options, and even crypto traders.

Top-3 forex bonuses

It works with the most popular exchanges and brokers worldwide. You can find full information about the supported instruments and trading service providers here. You can filter your trades by date, instruments, applied strategy, instrument rankings, and more. You can also track equity growth over time and generate advanced reports on intraday performance and trading results.

Trademetria review

The importance of keeping a trading journal can't be highlighted enough, and we have talked about it times and times again. However, due to the abundance of available solutions on the market, it is often hard for many traders to find the one best tailored to their needs. This article will focus on a lesser-known yet considered by many as one of the best trading journal solutions on the market. Although it might have flown under-the-radar, after going through our trademetria review, you might have your new personal favorite. Let's find out why.

Transparency: we may get compensated when you click on links in this article.

What is trademetria?

Trademetria com is best described as an all-in-one trading journal, portfolio tracker, and trade analyzer software. The platform supports all the essential features to ensure you have everything you need to analyze your trades and improve your online trading performance. It can also be used to track cash related activities like platform fees, deposits, withdrawals, dividends, and therefore offering a complete solution to track every cent that goes in and out of your trading business.

The platform uses trading data from multiple accounts to estimate key metrics and monitor, analyze, and measure trading performance. The platform helps traders make better decisions by taking into account statistical evidence of what works and what doesn't. According to its site, the journal is used by tens of thousands of users worldwide.

Thiago ghilardi designed the solution. After graduating from a computer science program, he entered the trading world first as a prop trader and then as a founder of a trading company and a director at a major trading firm. He decided to launch trademetria after realizing that analyzing his trades was the most critical factor for his success.

Trademetria features and functionalities

The platform supports various features and functionalities that can prove helpful even to professional traders and seasoned investors. The trading journal allows you to:

Keep track of your trading history

The users can take advantage of a beautifully-designed and easy-to-use trade history monitoring tool that includes everything from individual and daily trade entries through image attachments to represent better the circumstances around the particular trade to adding trade remarks and descriptions.

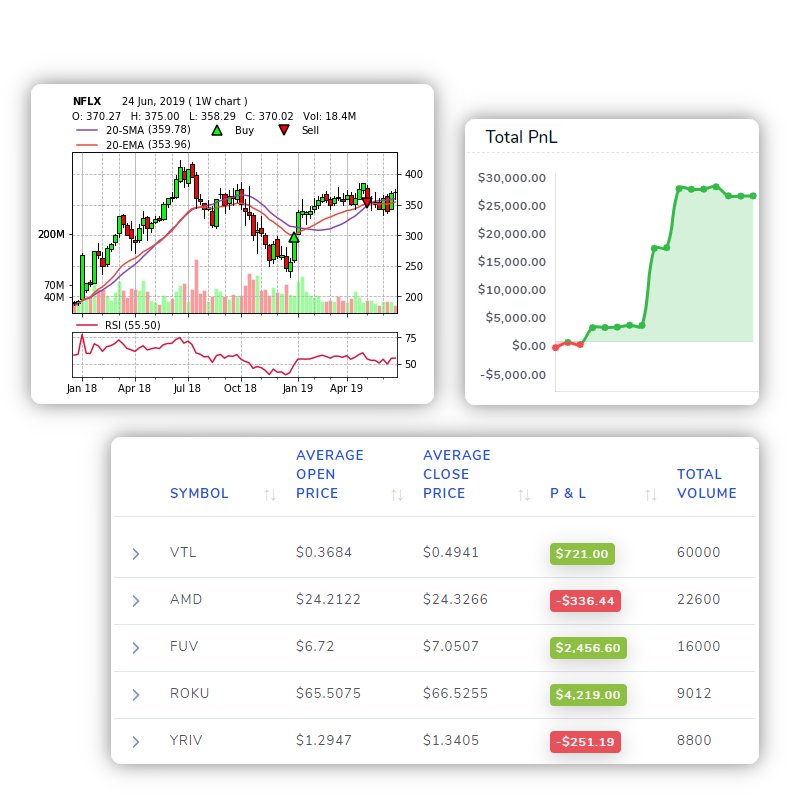

The order import option allows traders to transfer their trading history in CSV or custom files from most top brokers worldwide. After you input your trading history, you can analyze it through fully-featured customizable charts, displaying buy and sell entry points on various time frames. The charts support over 2,500 US equities, the majority of foreign equities, FX, and futures contracts.

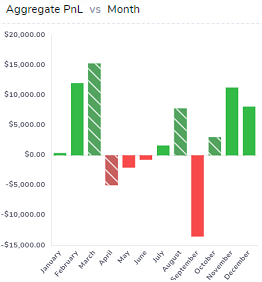

Analyze past performance

You can filter your trades by date, instruments, applied strategy, instrument rankings, and more. You can also track equity growth over time and generate advanced reports on intraday performance and trading results.

Thanks to the powerful reporting feature, the trader can get a summarized analysis of the best times to trade, the most favorable market conditions, the most common trade duration, the best-performing instruments, and the most successful strategies.

Monitor a variety of metrics on multiple accounts

The journal features over 30 key metrics that collectively help paint a complete picture of your trading habits, goal tracking, and how it affects your trading results.

If you want to track your open pnl or calculate your risk parameters like profit factor or R-ration of your portfolio, for example, you don't have to log-in to the platforms of all the brokers you trade with. Trademetria consolidates all your position into one screen and comes up with a collective summary of your performance.

The platform's goal is to help you find out what statistically works, your win rate and profit factor, whether you are wasting money due to poor risk management, what market conditions you perform better, and what daily habits can ruin your career.

Build a resilient risk management strategy

The platform gives you a fair representation of the expected risk before, during, and after you place a trade through the integrated risk management tools. You can also analyze risk in terms of dr. Van tharp's R multiples and auto plot or set your stops and targets and track how you fare to them.

Due to the advanced backtesting features, trademetria users can run simulations of their strategies and collect statistical evidence of what affects their performance. The backtests ensure easier discovery of areas that need improvement and helps find the best set of trading conditions (entry and exit points, trade duration, and more), depending on the market environment.

Platform fees

The best thing about the solution is the flexible payment schemes that make it a universal tool for all types of traders. The platform fees are divided into three tiers - free, basic, and pro.

The basic option costs $19.95 per month, while the pro option costs $29.95. If you choose to pay annually, you get a 30% discount, which brings the prices down to $169 and $249, respectively.

The key differences between the free, the basic, and the pro option are rooted in the number of order imports, real-time quotes, and accounts tracked. Also, advanced features like a pnl simulator, instrument and strategy rankings, trade exports, and others are supported only by the paid plans. You can find complete information about the supported features here.

It is safe to say that the free option can suit most beginner and even intermediate traders' needs. It supports 30 order imports per month, alongside three real-time quotes and dozens of other features.

Starting with the platform takes no more than 15 seconds. You aren't required to add a credit card, and you can cancel your subscription and your account at any point.

Who is trademetria good for?

The platform is used by traders and investors, trading schools, brokers, and proprietary firms. It is also offered as a white-label solution.

In terms of trader profiles, trademetria suits stocks, FX, cfds, futures, options, and even crypto traders. It works with the most popular exchanges and brokers worldwide. You can find full information about the supported instruments and trading service providers here.

Thanks to the supported functionalities like tracking intraday performance, trademetria is also suitable for day trading. The flexible payment options, especially the fact that it supports a free account, make the platform an excellent choice for advanced trading professionals and complete beginners who can test it at no cost.

Trademetria review summary

Trademetria is designed to cover all the basic features of a trading journal and a portfolio tracking platform, combined in an easy-to-navigate interface. And it does the job perfectly in that regard.

We can say that the trading journal is among the best solutions in terms of value-for-money. It brings everything you need to the table, and the free version delivers a robust set of features the platform has to offer. Trademetria is one of the most powerful state-of-the-art solutions to analyze your online trading activity, getting a clue about your most profitable strategies.

Trademetria pros and cons

Let's close the trademetria review with the pros and cons of the trading journal.

Qtradez™ - ninjatrader solution developers

Working with you to get the most out of ninjatrader

About us

Experienced

Experienced

Experienced

Developing on the ninjatrader platform since 2007 (version 6.5)

Affordable

Experienced

Experienced

We offer reasonable hourly rates and fixed bids on qualifying projects.

Effective

Experienced

Effective

We are dedicated to creating value in everything we build.

Let us know how we can work with you to reach your next trading goal.

Services

The qtradez™ difference

We have been working on trading solutions since 1999. After being introduced to ninjatrader in 2007 we decided to focus exclusively on it.

Our business is development and consulting. We do not sell any of our own products leaving us to provide best in class service to develop products and tools for you.

Consulting

From how to use ninjatrader® to the best way to create and support ninjatrader ecosystem products, we've got the knowledge and experience to get the job done.

Turn your great ideas in to working indicators and strategies

Trading is hard enough. Programming is not so simple either. Let us use our development expertise with your hard earned insights to create custom indicators and strategies to assist your trading so you can focus on continuing your mastery of trading.

Ninjatrader® 7 to 8 conversions

Still have indicators and strategies that need to be migrated to ninjatrader® 8? Conversions are not simple, but we have done many of them and in most cases we can quickly get your favorites from 7 working on 8.

Risk disclosure

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Full disclosure

Get more information on our rates, references, why you might need a consultant, how to get started etc. See our faqs.

Z.Com trade

Z.Com trade review

- Licensed and regulated by the FCA

- Over 400,000 clients worldwide

- No minimum deposit

- STP broker with fixed spreads and no commissions

- Bonuses

- Demo account

- Great customer support

- No commissions and fixed spreads

- No U.S. Traders allowed

- Few language possibilities for traders

- Only offers metatrader 4 platform

The name doesn’t sound familiar because Z.Com is actually quite new. It was launched in 2015, but do not be frightened off because of their short time in operation.

You see, Z.Com is owned and managed by the japanese conglomerate, GMO click group who has been operating since 2005.

GMO click group has been a popular trading organization in japan and asia and to gain favor in the united kingdom, Z.Com was launched.

Z.Com offers traders an excellent system of trading forex and cfds with leverages as high as 200 to 1.

Let’s take a closer look at Z.Com.

Z.Com trading platforms

In the start, Z.Com offered a proprietary platform that many traders liked, but the popularity of the metatrader 4 platform had Z.Com disband their in house platform and only carry the downloadable MT4.

Metatrader 4 comes with various graphs and charts and allows traders to set the system up the way that appeals to them most.

To get adjusted to the trading platform, Z.Com offers traders a demo account.

Plus, Z.Com does have apps for both android and apple based mobile systems because many traders now use their smartphones or tablets to trade anywhere, anytime.

Z.Com trading markets

Z.Com has a nice range of trading markets. Investors can surely find trades they would like to make.

Forex: average spreads start at 0.2 pips (EURUSD) for ECN accounts, traders have approximately 57 various currency pairs they can trade on.

Precious metals: Z.Com has several precious metal markets investors can trade in with some of the lowest spreads found.

Cfds: as I mentioned earlier, Z.Com has leverages up to 200 to 1. Cfds can be bought or sold on major indices as well as energies and various commodities.

Z.Com customer support

Z.Com is proactive with customer support and has representatives of various languages.

Live chat is available as well as an email address for questions or concerns. GMO click group is adamant about having high rated customer service.

Z.Com security & fairness

The GMO CLICK group contains regulated entities by the JFSA for its presence in japan, by the SFC in hong kong, and by the financial conuct authority (FCA) in the UK. Z.Com trade also participates in the UK financial service compensation scheme, which protects eligible claimants up to £50,000 in the unlikely event that Z.Com trade is unable to meet their financial obligations to you.

Plus, Z.Com keeps all client funds in separate accounts ensuring your money is safe and secure.

Last but not least, Z.Com uses top level encryption so your banking and personal information is completely safe.

Z.Com summary

Being a subsidiary of the GMO click group means this is a highly reliable forex and CFD broker. The company has won awards and holds the record of amounts traded in forex.

Being licensed and regulated by the united kingdom’s financial conduct authority tells us that this is a safe and reliable broker.

I would say that Z.Com does need to add some languages as the website is only available in english and chinese.

Overall, Z.Com is moving fast up the scale of being a leading united kingdom CFD and forex broker.

Qtradez™ - ninjatrader solution developers

Working with you to get the most out of ninjatrader

About us

Experienced

Experienced

Experienced

Developing on the ninjatrader platform since 2007 (version 6.5)

Affordable

Experienced

Experienced

We offer reasonable hourly rates and fixed bids on qualifying projects.

Effective

Experienced

Effective

We are dedicated to creating value in everything we build.

Let us know how we can work with you to reach your next trading goal.

Services

The qtradez™ difference

We have been working on trading solutions since 1999. After being introduced to ninjatrader in 2007 we decided to focus exclusively on it.

Our business is development and consulting. We do not sell any of our own products leaving us to provide best in class service to develop products and tools for you.

Consulting

From how to use ninjatrader® to the best way to create and support ninjatrader ecosystem products, we've got the knowledge and experience to get the job done.

Turn your great ideas in to working indicators and strategies

Trading is hard enough. Programming is not so simple either. Let us use our development expertise with your hard earned insights to create custom indicators and strategies to assist your trading so you can focus on continuing your mastery of trading.

Ninjatrader® 7 to 8 conversions

Still have indicators and strategies that need to be migrated to ninjatrader® 8? Conversions are not simple, but we have done many of them and in most cases we can quickly get your favorites from 7 working on 8.

Risk disclosure

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Full disclosure

Get more information on our rates, references, why you might need a consultant, how to get started etc. See our faqs.

The best trading journal to find and visualize your trading edge

Unparalleled fine-grained control over how you visualize and log your trading data

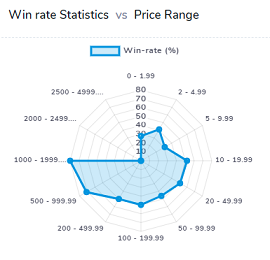

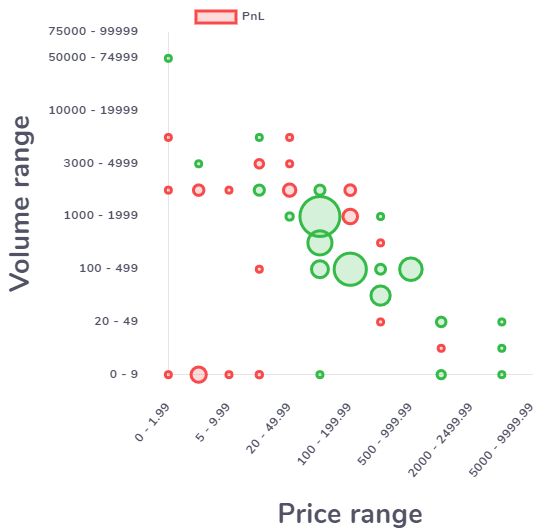

Over 50+ interactive charts help you to pin-point trades and setups from different perspectives

Share your trades, trading days and even your accounts as mentors, educators or students

Insights that matter

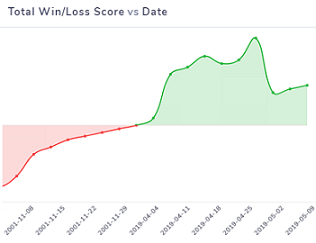

A dashboard that shows pnl, win-rate changes and related charts and a dedicated insights list for every single pnl and win-rate chart. Fully automatically generated for every configuration possible.

Emphasis on actionable stats

70+ statistics that covers every performance metric related to pnl, volume and no. Of trades for your entire trading account

Check how much your performance has varied and what are the best ranges to trade in using the auto insights list

Auto-insights are generated for price, volume ranges, time and win-rate of trades

Multiple visualizations

View and interact with different types of charts such as radar charts, treemaps and bubble charts.

Emphasis on perspective

With 70+ different base charts that combine your trading data with the market data, get a holistic view of your trading behavior

Almost every chart's can be customized to control the granularity of charting data. View up to 20 auto-generated ranges for every statistic which includes indicators, price and volume ranges, trade durations etc.,

Charts are organized into several groups such as date-related, trade-statistic related, performance-related etc., for easy accessibility

All markets supported!

We support importing and adding trades in all major currencies and currently have full data support for canada , india and US markets!

Want us to add more market support? Contact us!

SIMPLE UI

See in action how simple it is to explore and navigate trades and charts in tradesviz.

Different views for different data

A view for a trade, a trading day and a detailed trading calendar - pretty much all you need to quickly access and modify your trading data. Some of the information in these views include risk statistics, market events such as ipos, earnings, etc., on that day and full trade summaries.

Find the best setups

With every single data point selectable and explorable, there isn't a more flexible or an easier to use tool for traders to pin-point and zoom into your best setups and find your trading edges.

Design and edit charts the way you want

Choose from 6 chart types, 8 time frames, 9 indicators and plot almost any ticker. All indicators are individually customizable (period, color etc.,) + draw on any of the charts (or even any image uploaded to tradesviz) using our fully-online image editor.

Multi-context fully searchable tables

Trades table, symbol-grouped table and day-grouped table. 3 different ways to view your trade. Take a look at how a ROKU trade in the example below can be easily searched for and viewed in 3 different contexts. All tables come with logical (and, or) text searchable columns.

Other features

- Multi-group compare

- Import/export management

- Treemaps

- Advanced sharing

Best way to find the right strategy for you

Create up to 5 groups of trades each with over 20+ custom filters and chart them against each other and analyze them in 60+ charts. Stacked charts generated from these grouped comparison work similar to the normal charts allowing you to explore every single data point individually.

Easily manage your imports and exports

Every trades file imported can be downloaded and exported either as the original file or in the tradesviz format. The tradesviz export format can be imported again into the platform by using the import page - perfect for taking offline backups thus giving users full control over what they import/export.

Visualize your pnl, volume and trades

Filterable and customizable treemaps grouped by symbols, tags and sectors give you an overview of entire portfolio to quickly evaulate performance.

Fine-grained control over public sharing

Control every single aspect of what you share publicly. Every individual trading day and trade can be configured to only show certain data elements to the public if you decide to share them. Trading from several accounts? Choose only select accounts to share. Don't want to show your trading sizes? Disable pnl data.

Simple pricing

We offer a fully free plan with a lot of features to get beginners started with simple analysis and visualization. With our extremely competitive pricing and a large feature set, we believe the pro version will suit every trader who wants to get more advanced insights, analysis and flexibility in managing trades. The pro plan comes with 7-day free trial.

Z.Com trade forex broker broker review

Reviewer : justin freeman

Published: 19th november, 2020.

Broker information

- Company name: GMO-Z.Com trade UK limited

- Founded: 2012

- Country: UK

Platform info

- Platform: Z.Com trader & MT4

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA

- Minimum deposit: none

- Leverage: 1:200

- US clients: no

- Funding methods: wire, credit card, debit card, china unionpay, skrill, cheque

Featured forex broker

Avatrade was established in 2006 and is located in dublin, ireland. Offering trading services in over 150 countries with offices located worldwide. Avatrade is a forex broker that is committed to providing a safe trading environment and is fully regulated and licensed in the EU and BVI, with additional regulation in australia, south africa and japan.

Acknowledged as the retail forex industry volume leader, the GMO CLICK group officially launched its UK subsidiary Z.Com trade, in march 2015. Founded in japan in 2005, the group has offices in the global financial centres of tokyo, hong kong and london, with over 400,000 clients worldwide. GMO-Z.Com trade UK limited is authorised and regulated in the UK by the financial conduct authority (FCA), and its firm reference number is 622897.

Trading in leveraged products carries a high level of risk. Your losses may exceed your initial investment requiring you to make further payments.

Numbers do not lie, and the group’s volume awards and 400,000+ customer base are evidence that they are doing something right. Much of the group’s growth has been in japan, hong kong, and other parts of asia, and by adding london to its global footprint, the group are looking to bring the benefits of their service to more traders worldwide. The firm is proud of its flagship proprietary trading platform, Z.Com trader, and it does also offer MT4 and API connectivity. Aside from flexibility in its technology offerings, Z.Com trade provides some of the tightest spreads in the industry, that range in the fractions of a pip for major currency pairs and crosses.

Z.Com trade is authorised and regulated by the financial conduct authority (FCA) in the UK, and client funds are segregated in top tier financial institutions. Z.Com trade also participates in the UK financial service compensation scheme (FSCS), which can provide compensation of up to £50,000 per person per regulated entity.

With so many options and choices to make, it is also a valuable benefit to have highly capable customer service staff at the ready to assist you in setting up, getting the most out of the technology on offer, and with any other questions that you might have. These professionally trained reps speak several languages and can be reached via live chat, email, or telephone.

Features

Why trade with Z.Com trade? The firm lists these reasons:

・A subsidiary of the GMO CLICK holdings, inc., group of companies, headquartered in tokyo, established in 2005, and listed on the tokyo stock exchange

・growth benchmarks: $1 trillion in monthly volume in 2013 (first in the industry); volume leader in the world today; and over 400,000 global clients

・Z.Com trade is based in london and is authorised and regulated by the financial conduct authority (FCA) in the UK

・client funds are segregated in top-tier financial institutions, and the firm also participates in the UK financial service compensation scheme (which can provide compensation of up to £50,000 per person per regulated entity)

・deposits can be made by major credit or debit card, wire transfer, china unionpay or skrill at no additional charge. There is also no minimum deposit requirement.

・in-house developed online trading platform (Z.Com trader) with advanced charting support available, along with MT4 software and mobile apps

・tight spreads that range from 0.5 to 0.8 pips for major pairs and crosses

・broad array of currency pairs with up to 200:1 leverage available, supplemented by CFD trading in commodities and indices

・STP model, with fixed spread pricing available on Z.Com trader platform, and variable spread pricing on MT4/API

・multilingual customer service representatives, accessible via live chat, email, or telephone

Spreads and leverage

Being a volume leader allows Z.Com trade to offer extremely tight spreads, especially for major currency pairs. Spreads on Z.Com trader are fixed as low as 0.5 pips for USD/JPY and 0.6 pips for EUR/USD, with a maximum available leverage of up to 200:1 on selected currency pairs. For cfds in commodities or indices, leverage and margin requirements vary by asset choice.

Platform

A large enterprise with such resources also has the capability to develop their own software internally, without having to depend on a partner for innovative upgrades. Such is the case with Z.Com trade. Its proprietary flagship platform goes by the name of Z.Com trader and comes with an intuitive interface and advanced charting tool. The software is completely online and does not require any complicated downloads. For metatrader4 enthusiasts, the firm can also support MT4 which is operated on an STP model, offering an ultra-low latency solution with no “last look” execution. For professional traders their API service offers a more flexible and tailored option. Mobile apps are also available for ios and android, allowing users to trade from charts as well as lightning fast “one touch” trading.

Deposits and withdrawals

Z.Com trade accepts deposits via major credit and debit cards, skrill or by bank wire transfer, and does not charge any additional service fees. Withdrawal requests are processed promptly, and a charge is only made for international bank wire transfers. There is also no minimum deposit requirement, allowing you start with an amount you feel comfortable with.

Beginner’s and customer support

Customer service representatives have been professionally trained to assist you with any query that you may have. They can be accessed via live chat, email, or telephone. For beginners and experienced traders alike, support materials include platform guides, information on fundamental and technical analysis, pricing streams, advanced charting tools, news, and an economic calendar of significant events.

Conclusion

The opening of Z.Com trade is one more step by the GMO CLICK group of companies to solidify its dominance in the global forex trading arena. As per the words of its CEO, “we are excited to announce the full launch of Z.Com trade and with the strong foundation of the in-house technology and expertise that we have developed in our home market of japan, we look forward to connecting with even more traders around the world through our forex and CFD trading service.” with respect to this group, “big” is better. The benefits are plentiful – tight spreads, innovative services, and regulatory peace of mind. Z.Com trade is definitely worthy of your consideration.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Trading as a way of life

The key to success is emotional discipline

Trade the right strategies with high probabilities of success

You work from the comfort of your own home.

You set your own working hours.

What my fellow traders say about me

Amrik is one of the best traders I have seen in my life. His understanding of the market and adjustments of his options position is so awesome…its like a magician at work. HIS FOSS, EFOSS, ROSS, COSS and his adjustments in these strategies have earned him the title of THE BOSS.

Amrik and option strategies are synonyms. Live adjustments are his expertise be it positional or expiry trading . He changed the way i used to do expiry trading . He is on mission to change myth that retails cant be profitable from trading.

I have known amrik ji for over 2 years now….One of the most helpful persons I have known. He is a good friend and a great trader. I was lucky to have him as my mentor and his guidance and advice has helped me in a big way in my trading journey. The way he handles banknifty intraday flash moves with his adjustment skills is just unbelievable. There is still a lot to learn from him and his continuous guidance.

Z.Com trade forex broker broker review

Reviewer : justin freeman

Published: 19th november, 2020.

Broker information

- Company name: GMO-Z.Com trade UK limited

- Founded: 2012

- Country: UK

Platform info

- Platform: Z.Com trader & MT4

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA

- Minimum deposit: none

- Leverage: 1:200

- US clients: no

- Funding methods: wire, credit card, debit card, china unionpay, skrill, cheque

Featured forex broker

Avatrade was established in 2006 and is located in dublin, ireland. Offering trading services in over 150 countries with offices located worldwide. Avatrade is a forex broker that is committed to providing a safe trading environment and is fully regulated and licensed in the EU and BVI, with additional regulation in australia, south africa and japan.

Acknowledged as the retail forex industry volume leader, the GMO CLICK group officially launched its UK subsidiary Z.Com trade, in march 2015. Founded in japan in 2005, the group has offices in the global financial centres of tokyo, hong kong and london, with over 400,000 clients worldwide. GMO-Z.Com trade UK limited is authorised and regulated in the UK by the financial conduct authority (FCA), and its firm reference number is 622897.

Trading in leveraged products carries a high level of risk. Your losses may exceed your initial investment requiring you to make further payments.

Numbers do not lie, and the group’s volume awards and 400,000+ customer base are evidence that they are doing something right. Much of the group’s growth has been in japan, hong kong, and other parts of asia, and by adding london to its global footprint, the group are looking to bring the benefits of their service to more traders worldwide. The firm is proud of its flagship proprietary trading platform, Z.Com trader, and it does also offer MT4 and API connectivity. Aside from flexibility in its technology offerings, Z.Com trade provides some of the tightest spreads in the industry, that range in the fractions of a pip for major currency pairs and crosses.

Z.Com trade is authorised and regulated by the financial conduct authority (FCA) in the UK, and client funds are segregated in top tier financial institutions. Z.Com trade also participates in the UK financial service compensation scheme (FSCS), which can provide compensation of up to £50,000 per person per regulated entity.

With so many options and choices to make, it is also a valuable benefit to have highly capable customer service staff at the ready to assist you in setting up, getting the most out of the technology on offer, and with any other questions that you might have. These professionally trained reps speak several languages and can be reached via live chat, email, or telephone.

Features

Why trade with Z.Com trade? The firm lists these reasons:

・A subsidiary of the GMO CLICK holdings, inc., group of companies, headquartered in tokyo, established in 2005, and listed on the tokyo stock exchange

・growth benchmarks: $1 trillion in monthly volume in 2013 (first in the industry); volume leader in the world today; and over 400,000 global clients

・Z.Com trade is based in london and is authorised and regulated by the financial conduct authority (FCA) in the UK

・client funds are segregated in top-tier financial institutions, and the firm also participates in the UK financial service compensation scheme (which can provide compensation of up to £50,000 per person per regulated entity)

・deposits can be made by major credit or debit card, wire transfer, china unionpay or skrill at no additional charge. There is also no minimum deposit requirement.

・in-house developed online trading platform (Z.Com trader) with advanced charting support available, along with MT4 software and mobile apps

・tight spreads that range from 0.5 to 0.8 pips for major pairs and crosses

・broad array of currency pairs with up to 200:1 leverage available, supplemented by CFD trading in commodities and indices

・STP model, with fixed spread pricing available on Z.Com trader platform, and variable spread pricing on MT4/API

・multilingual customer service representatives, accessible via live chat, email, or telephone

Spreads and leverage

Being a volume leader allows Z.Com trade to offer extremely tight spreads, especially for major currency pairs. Spreads on Z.Com trader are fixed as low as 0.5 pips for USD/JPY and 0.6 pips for EUR/USD, with a maximum available leverage of up to 200:1 on selected currency pairs. For cfds in commodities or indices, leverage and margin requirements vary by asset choice.

Platform

A large enterprise with such resources also has the capability to develop their own software internally, without having to depend on a partner for innovative upgrades. Such is the case with Z.Com trade. Its proprietary flagship platform goes by the name of Z.Com trader and comes with an intuitive interface and advanced charting tool. The software is completely online and does not require any complicated downloads. For metatrader4 enthusiasts, the firm can also support MT4 which is operated on an STP model, offering an ultra-low latency solution with no “last look” execution. For professional traders their API service offers a more flexible and tailored option. Mobile apps are also available for ios and android, allowing users to trade from charts as well as lightning fast “one touch” trading.

Deposits and withdrawals

Z.Com trade accepts deposits via major credit and debit cards, skrill or by bank wire transfer, and does not charge any additional service fees. Withdrawal requests are processed promptly, and a charge is only made for international bank wire transfers. There is also no minimum deposit requirement, allowing you start with an amount you feel comfortable with.

Beginner’s and customer support

Customer service representatives have been professionally trained to assist you with any query that you may have. They can be accessed via live chat, email, or telephone. For beginners and experienced traders alike, support materials include platform guides, information on fundamental and technical analysis, pricing streams, advanced charting tools, news, and an economic calendar of significant events.

Conclusion

The opening of Z.Com trade is one more step by the GMO CLICK group of companies to solidify its dominance in the global forex trading arena. As per the words of its CEO, “we are excited to announce the full launch of Z.Com trade and with the strong foundation of the in-house technology and expertise that we have developed in our home market of japan, we look forward to connecting with even more traders around the world through our forex and CFD trading service.” with respect to this group, “big” is better. The benefits are plentiful – tight spreads, innovative services, and regulatory peace of mind. Z.Com trade is definitely worthy of your consideration.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

The cheapest domains in myanmar

Easy to use control panel page

Under the concept “user friendly but powerful” user are able to edit all the information including profile editing, DNS management, real time re-domain management (self-service)

Cheapest domain name registration cost in myanmar

.Com 13,000 MMK/yr .Net 17,000 MMK/yr

For 13,000 MMK only

Z.Com are the only direct partnership from myanmar with onamae, which allow us to provide lower domain cost with no agent!

At Z.Com, we have over 14 million of domain registered!

For pass 20 years experiences, there are over 14 million domain name registered around the world has proven that we are the safest and the strongest domain name company

Support by technical engineer

From Z.Com will assist and help you solve any problem contact us : 09-795834817 , E-mail or directly at headquarter, MICT park.

Whois privacy service (conceal domain owner) free !

For customers who do not wish to disclose the domain owner. For your safety and privacy domain. Customers can activate the service whois privacy for free! Through the control panel

General pricing

Let's start your domains!

People use our web hosting more than 750,000 website

- Top-3 forex bonuses

- Trademetria review

- What is trademetria?

- Trademetria features and functionalities

- Keep track of your trading history

- Analyze past performance

- Monitor a variety of metrics on multiple accounts

- Build a resilient risk management strategy

- Platform fees

- Who is trademetria good for?

- Trademetria review summary

- Qtradez™ - ninjatrader solution developers

- About us

- Experienced

- Experienced

- Experienced

- Affordable

- Experienced

- Experienced

- Effective

- Experienced

- Effective

- Services

- The qtradez™ difference

- Consulting

- Turn your great ideas in to working indicators...

- Ninjatrader® 7 to 8 conversions

- Risk disclosure

- Z.Com trade

- Z.Com trade review

- Z.Com trading platforms

- Z.Com trading markets

- Z.Com customer support

- Z.Com security & fairness

- Z.Com summary

- Qtradez™ - ninjatrader solution developers

- About us

- Experienced

- Experienced

- Experienced

- Affordable

- Experienced

- Experienced

- Effective

- Experienced

- Effective

- Services

- The qtradez™ difference

- Consulting

- Turn your great ideas in to working indicators...

- Ninjatrader® 7 to 8 conversions

- Risk disclosure

- The best trading journal to find and visualize...

- Insights that matter

- Multiple visualizations

- All markets supported!

- SIMPLE UI

- Different views for different data

- Find the best setups

- Design and edit charts the way you want

- Multi-context fully searchable tables

- Other features

- Best way to find the right strategy for you

- Easily manage your imports and exports

- Visualize your pnl, volume and trades

- Fine-grained control over public sharing

- Simple pricing

- Insights that matter

- Z.Com trade forex broker broker review

- Featured forex broker

- Features

- Spreads and leverage

- Platform

- Deposits and withdrawals

- Beginner’s and customer support

- Conclusion

- Trading as a way of life

- What my fellow traders say about me

- Z.Com trade forex broker broker review

- Featured forex broker

- Features

- Spreads and leverage

- Platform

- Deposits and withdrawals

- Beginner’s and customer support

- Conclusion

- The cheapest domains in myanmar

- Easy to use control panel page

- Cheapest domain name registration cost in myanmar

- At Z.Com, we have over 14 million of domain...

- Support by technical engineer

- Whois privacy service (conceal domain owner) free...

- General pricing

- Let's start your domains!

- People use our web hosting more than 750,000...

- US china trade war effect on global economy

- Causes of US china trade war

- Impacts of the united states-china trade...

- 1) slow global GDP growth

- 2) US manufacturing suffered

- 3) reduced trade flows between the US and...

- 4) china’s yuan depreciated

- 5) increased price of goods and reducing...

- 6) the structure of production changed

- Faqs

- 1. How does trade war affect the global...

- 2. How is the trade war affecting the...

- 3. How does the trade war affect...

- 4. Who is affected by the US china...

"the organization is the reliable company . I've became customer here since 2011. Email sever is very stable . Support staff , excellent service, excellent service, very impressed."

www.Oishigroup.Com

"the company is reliable the system works well and support staff , prompt service . We have the confidence and trust. To use with your design to me."

www.Cpall.Co.Th

"call the staff friendly I can talk to the support web site is not frequently down . Overall it's considered good."

www.Platinumfashionmall.Com

"I used netdesign services for 4 year. Staff is fully support with monitoring the at problems for me."

www.Krispykreme.Co.Th

"good fast service, customers are tracked continuously. Friendly staff by telephone call , live chat , email , and get help as well. I was impressed."

www.Comseven.Com

"quality of service from netdesignhost . Excellent customer care, spec & bandwidth good value. Stability."

www.Olympicthai.Or.Th

"I appreciate the service of officials support for fast intuitive interface . Operating system stability has never been a problem with the system here."

www.Disney.Co.Th

"good service staff in terms of applications and systems. Coordination troubleshooting is quick overall feeling okay."

www.Th.Boots.Com

US china trade war effect on global economy

A trade war is the last thing that any country would want as it weakens the entire global economy and disrupts people’s well-being. A trade war happens when one country retaliates against another by placing restrictions, like raising import on goods imported from other countries. A trade dispute is a controversial topic, and when a war breaks out between countries, some countries face huge losses while others reap the benefits of the fallen competition. The trade dispute is often looked at by critics as a protectionist policy to safeguard the interests of a nation’s domestic businesses. However, in the long run, trade wars or trade disputes, by whatever name they are called, are detrimental for the growth of local companies, consumers, and the economies at large.

Causes of US china trade war

The trade dispute between the united states and china began long back in 2018 when president donald trump started to impose a series of import tariffs on everything, starting from steel to aluminum to solar panels and even for washing machines. These import duties impacted goods from china, mexico, the european union (EU), and canada. To combat such challenges, canada also retaliated by imposing a series of temporary import duties on american steel and other goods. The EU also imposed tariffs in retaliation on american agricultural imports and other industrial products like harley davidson motorcycles.

In early 2018, president trump imposed a big fine over alleged intellectual property (IP) theft and significant tariffs on $500 billion worth of chinese products like steel and soy products. To this, again, china retaliated with a 25% import tax over 100 american products.

By may 2019, the united states’ tariffs on chinese imports impacted nearly $200 billion of imports. China also retaliated and imposed stiff import duties on major american imports. As per reports, the american government shouldered all the tariff costs imposed by china, which ended up as increased prices of goods that the end consumers had to bear; this went against the actual purpose of the war, and the united states’ citizens revolted against this policy.

Situations came under control in december 2019 when both the nations agreed to halt imposing any new import tariffs on each other and developed a mutual agreement to stop the war. However, this also did not go on smoothly as just before the final talks were about to begin between the two countries. Chinese authorities refused to make any changes in their company-subsidizing laws and insisted that the american government lift the current tariffs on chinese imports. The american president became furious at such a proposal from the chinese authorities and eventually doubled the tariff rates from 10% to 20% on $200 billion worth of chinese imports. In retaliation, china halted all american imports of farm products, and the raging war continued.

The chinese central bank also weakened the chinese currency “yuan” above the 7 per dollar reference rate, thereby hinting towards a raging currency war between the two countries. To this, both the nations realized that the aftermath of the currency war would be mutually destructive for both the nation and, therefore, both america and china agreed to a deal on january 15, 2020, to stop the war. However, the ongoing COVID-19 pandemic is yet again threatening further escalation of trade tensions between the two nations.

Impacts of the united states-china trade war

1) slow global GDP growth

Although there are no signs of immediate improvement with the outbreak of the COVID pandemic which has further escalated the trade tensions, both the nations are trying to move ahead to settle their disputes.

2) US manufacturing suffered

With the adverse effects of tariffs on the american manufacturing sectors as a way of retaliation by the chinese government, the american manufacturing wings also suffered a lot. Not only the US, but 70% of the entire world also depend on chinese raw materials and inputs to manufacture their final products. With the increase of the tariff rates, these inputs’ costs have risen, and the US manufacturing wings are suffering. Then again, the US manufacturers lost a huge share in the chinese market, as after the US imposed high tariffs on chinese goods, china retaliated this move by introducing their own tariff rates. So, these manufacturing companies are losing sales everywhere; they are losing the US’s domestic market and the international market in china. Yet again, they are losing to third world countries because of high costs of their products which they cannot adjust owing to the increased price of the inputs. Therefore, they are proving to be less competitive as compared to the alternative sources of supply.

3) reduced trade flows between the US and china

The war between the US and china has significantly reduced the US market share of chinese imports because of the reduced trade flows between the two nations. The trade war has already weakened the economic developments in china in the last two years, thereby resulting in the decline of foreign trade in both nations. China’s goods imports from the US manufacturers also decreased drastically by over 25% than what was last year. Due to the rapid fragmentation of production chains and the low demand of goods caused by trade disputes, foreign trade flows of goods from china’s neighboring countries have also been reduced to a great extent. The value of imports from the european union (EU) has almost come to a halt, which used to grow by more than 10% on an average every year.

4) china’s yuan depreciated

The U.S china trade dispute has brought in huge changes in the currency markets as well; the value of the chinese yuan has depreciated against the US dollar. On the financial ground, stock markets have become more volatile owing to the news of a war, which sparked anxieties and confusions amongst the investors. Then again, the news of U.S china negotiation developments disrupted the credit risk prices. The sudden rise in the credit risk prices coincided with the negotiations which were announced by both the nations in the month of may and august this year.

5) increased price of goods and reducing demand

The U.S china dispute has already disrupted the global economy, with both the nations at a huge loss. In the US, increased tariffs operate like an increased sales tax on imported goods that are levied on US consumers in the form of increased prices. The customers and the producers are liable to pay this increasing price of goods that ultimately damages the competitiveness, thereby reducing the demands for goods.

However, though the tariffs raise the prices of goods for the china’s government, they have a comparatively less direct impact on the producers due to the exemptions imposed by the chinese government on some intermediate inputs. For the US markets, both total imports and exports declined following the US china dispute (because of the difficulty in relocating to other locations), but china successfully diverted its exports away from the united states by expanding its reach in other markets and by increasing their total exports. This successfully set a chain reaction in motion; china increased exports to europe and other countries in southeast asia, which in turn increased their total exports to the united states.

6) the structure of production changed

The U.S. China trade disputes disrupted the structure of production in both china and the united states, though in different ways. Post the U.S. China trade dispute outbreak, the relative production shifted its focus away from agriculture, traded services, and manufacturing towards non traded services. However, for the chinese government, this relative shift was in favor of the traded and manufacturing services. To adjust to these changing scenarios, the chinese government excluded tariffs on some intermediate manufactured goods to improve the manufacturing and production sectors.

Thus, the effect of these uncertainties and reduced confidence are creating trade disputes between the two powerful nations and weakening the global economy, which is clearly evident from the deteriorating investment sentiments of people all over the world.

Faqs

1. How does trade war affect the global economy?

The dispute between the united states and china has weakened the global economic condition, leaving both nations at the worse off. Such a lose-lose trade war (where both the contenders are at their worst) compromises the stability of the global economy, and eventually the future growth prospects lands in a standstill.

However, according to some other trade analysts there is another long term effect of this trade dispute; china’s loss is other nations’ gain. According to the recent trade statistics, of the $35 billion worth of chinese export losses in the market of the united states, more than $21 billion was diverted to other countries, and the remaining $14 billion were captured by producers of the united states. Therefore, china’s losses turned out to be a boon to many other countries of the world.

For example, the imposition of US tariffs on china resulted in taiwan gaining $4.2 billion in additional exports to the united states by selling more office machinery and equipment. As china halted its exports to the united states, mexico increased its exports of electrical machinery, agri-food or transport equipment to the united states by $3.5 billion. Then the EU gained over $2.7 billion due to its increased exports of machinery equipment to the US. Viet nam’s exports of communication equipment and furniture to the US also swelled by $2.6 billion.

2. How is the trade war affecting the US economy?

The ongoing trade war has left both china and the US economically hurt. The raging war between the two powerful nations of the world has led to a sharp decline in bilateral trade, spiked high prices for the end consumers and resulted in trade diversion effects. Trade diversion means both the nations are now seeking ways to import products from countries that are not directly involved in the trade war.

As per current trade statistics the US consumers are bearing the heaviest brunt of the US tariffs imposed on china owing to the associated costs that have passed down to the US consumers. As a result, they have to import products from other countries at much higher prices. However, china has balanced its position by absorbing part of the tariff costs by creating its own tariff rates and reducing the prices of their exports to other countries apart from the US.

3. How does the trade war affect china?

China is economically hurt in this trade war. All its exports to the US have stopped leading to a huge loss on its economy. However, keeping in mind the mutual devastation, both the nations have now agreed to a negotiation to end the trade war, but unfortunately, that is very unlikely to happen soon owing to the ongoing COVID pandemic disrupting the global economy.

4. Who is affected by the US china trade war?

The ongoing trade war has negatively impacted both the nations but resulted in some advantages to other countries because of the trade diversion. As the US and china halted imports and exports to each other, both the nations began importing from other countries who benefited immensely by exporting products to these two nations at much higher prices. Mexico is at the biggest advantage by exporting products to the US. Trade diversion has also benefited the south east asian countries massively.

So, let's see, what we have: the importance of keeping a trading journal can’t be highlighted enough, and we have talked about it times and times again. Is trademetria the best choice? At zcom trade