Can you actually make money on forex

Consistency matters when currency trading and if you are applying the trading plan in a consistent manner, you should be able to reap the rewards of the edge your trading plan gives you.

Top-3 forex bonuses

More importantly, by being consistent, when a trader is not seeing their profitability increase or they are seeing their profit drop, they can zero on each step they take to find the issue.

Is forex trading really profitable and can you do it?

One question that comes up a lot is: is forex profitable?

Many times this question comes from retail traders that are not finding any success with their trading approach. When I say “trading approach”, I don’t just mean their trading strategy.

Your trading approach is much more than a trading strategy and we will cover that later.

The short answer is yes, forex trading is profitable.

The slightly longer answer is yes, trading in the forex market is profitable but chances are you won’t make any money.

How do I know trading forex can be profitable? Because I’ve been swing trading forex since 2008 and make money. In fact, you can take a look at my free forex chart setups that I post every week using technical analysis and then update any trades at the end of the week.

Everything in those chart is for one reason: to teach you how to use a simple approach to trading forex to make profits.

It’s one thing to make money trading and an different thing to keep the profits.

Your biggest job as A forex trader

I’ve mentioned it many times in my trading posts but the number one job you have as a trader, is a risk manager. If you do not understand risk…if you do not manage your trades in the proper way, you will lose.

If you are risking too much per trade to withstand a string of losing trades, you will be out of trading faster than you imagined.

If you continue to move your stops around to avoid taking a loss, you will eventually lose your account. Your broker will be happy because you are probably a retail trader and your broker banks your loss, but you won’t be.

Your second job as a trader is simple: enter trading orders.

If you are trading, you’ve done your homework and are trading a strategy that has a verifiable edge in the market. You have made a trading plan complete with which setups to take, how you will exit, where you will take your loss.

You’ve outlined which currencies you will trade and the style of trading you will be doing. Day trading is popular but swing trading currencies is how I trade the retail market. If I day trade, it is not often, is not forex, and is done in the futures markets with the occasional options trading play.

Your job as a trader is to execute the trading plan when your setups take place. You enter your trading orders, manage your trades, and take your profit and loss the way it is set out in your trading plan.

Without a trading plan, you are doomed to fail.

How long can you trade with profits?

Consistency matters when currency trading and if you are applying the trading plan in a consistent manner, you should be able to reap the rewards of the edge your trading plan gives you.

You will take a loss and sometimes many in a row. You will see your trading account fluctuate and it can be painful to see at times. The expectancy of your trading system is what should keep you glued to the trading plan during the times of an equity curve down swing.

The truth is you will have a losing day.

You will have a losing week.

At times, your month may be at break-even or worse, at a loss.

These are the realities of trading and if you are asking about being profitable over the long run, the answer is yes if you are trading a positive expectancy trading strategy.

One week of loss or even a month of not being profitable does not make for trading failure. It must be expected. You must expect to lose and also to imagine that you have yet to take the biggest loss of your trading career.

You read that right. Think that you have yet to experience the most painful loss of all. Expect that a multiple of risk loss is around the corner.

It will remind you that the biggest trading job you have is trading your emotions for a proper mindset and to protect your trading capital.

What is forex money management?

Forex money management is simply about risk. In short, if you take big risks, you can make a lot of money in short period of time but the bad side of that is that a few bad high risk trades and you lose a lot. Wins and losses come in a random distribution.

You never know if that next trading will be a winner.

When you trade a lot, over trader, that’s bad forex money management. When take a lot of risk in a trade, that’s bad forex money management.

Learning forex money management is the easiest thing. But doing it, applying it, sticking to it when everything else doesn’t seem to be working is really hard…and all it comes down to is mindset.

What is A good mindset?

There are many books written about the trading mindset but before I list a few – a great mindset is useless if you are trading a flawed trading strategy.

- You understand that you are not worried about the day to day trading account fluctuations because you are focuses on the long term.

- When a trading loss or trading profit does not bother you, but you see it as part of the whole process to keep growing your account.

- You know that risk management can help you last a very long time in trading forex and failure to follow it is the fastest way to part with your money.

- You understand the negative impacts of greed and fear and learn to control it.

Trading the forex market is a business and like any business, you have to approach it with a professional approach and like most companies, have a “trading resolution”, something you abide by at all times.

The four mindset points above can be a great place to explore.

Break out a pen and paper and jot down those four ideas about mindset. Expand on them and ask what they mean to you.

One word to be A successful currency trader

If I had to use one word to describe the best trader, I would use the word consistency.

By using that one word, I am assuming that everything from your trading plan to the forex broker you will use has been detailed.

The job you have trading currencies is to implement that trading plan. How? With consistency. Traders that do everything in a consistent manner are sticking to a proven edge.

More importantly, by being consistent, when a trader is not seeing their profitability increase or they are seeing their profit drop, they can zero on each step they take to find the issue.

It is difficult to find where a problem is if you are constantly switching gears.

This is why I never think it is a good idea to take trading signals from people you don’t know. Too much trust goes into the word of someone else – someone who is not responsible for your trading account. How can you fix a strategy if you don’t know how the trading signals are generated?

In the end, I believe everyone has the chance to become successful and profitable when trading. The issue is if they will take the steps required to do so.

I also believe that most won’t do what is required and will continue to look for the easy way or the “secret sauce”.

There is no magic. It’s called hard work on the right things. I hope my trading blog and the setups I post every week are helping you gain some ground in your quest to be a profitable trader.

Can forex trading make you rich?

Can forex trading make you rich? Although our instinctive reaction to that question would be an unequivocal "no,” we should qualify that response. Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

But first, the stats. A bloomberg article in nov. 2014 noted that based on reports to their clients by two of the biggest forex companies at the time—gain capital holdings inc. (GCAP) and FXCM inc.—68% of investors had net losses from trading currencies in the prior year. While this could be interpreted to mean that about one in three traders does not lose money trading currencies, that's not the same as getting rich trading forex.

Key takeaways

- Many retail traders turn to the forex market in search of fast profits.

- Statistics show that most aspiring forex traders fail, and some even lose large amounts of money.

- Leverage is a double-edged sword, as it can lead to outsized profits but also substantial losses.

- Counterparty risks, platform malfunctions, and sudden bursts of volatility also pose challenges to would-be forex traders.

- Unlike stocks and futures that trade on exchanges, forex pairs trade in the over-the-counter market with no central clearing firm.

Note that the bloomberg numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading. On jan. 15, 2015, the swiss national bank abandoned the swiss franc's cap of 1.20 against the euro that it had in place for three years. as a result, the swiss franc soared as much as 41% against the euro on that day.

The surprise move from switzerland's central bank inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolvent, and took FXCM, then the largest retail forex brokerage in the united states, to the verge of bankruptcy.

Unexpected one time events are not the only risk facing forex traders. Here are seven other reasons why the odds are stacked against the retail trader who wants to get rich trading the forex market.

Excessive leverage

Although currencies can be volatile, violent gyrations like that of the aforementioned swiss franc are not that common. For example, a substantial move that takes the euro from 1.20 to 1.10 versus the U.S. Dollar over a week is still a change of less than 10%. Stocks, on the other hand, can easily trade up or down 20% or more in a single day. But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains (and losses).

A trader who shorts $5,000 worth of euros against the U.S. Dollar at 1.20 and then covers the short position at 1.10 would make a tidy profit of $500 or 8.33%. If the trader used the maximum leverage of 50:1 permitted in the U.S. (ignoring trading costs and commissions) the profit is $25,000, or 416.67%.

Of course, had the trader been long euro at 1.20, used 50:1 leverage, and exited the trade at 1.10, the potential loss would have been $25,000. In some overseas jurisdictions, leverage can be as much as 200:1 or even higher. Because excessive leverage is the single biggest risk factor in retail forex trading, regulators in a number of nations are clamping down on it.

Asymmetric risk to reward

Seasoned forex traders keep their losses small and offset these with sizable gains when their currency call proves to be correct. Most retail traders, however, do it the other way around, making small profits on a number of positions but then holding on to a losing trade for too long and incurring a substantial loss. This can also result in losing more than your initial investment.

Platform or system malfunction

Imagine your plight if you have a large position and are unable to close a trade because of a platform malfunction or system failure, which could be anything from a power outage to an internet overload or computer crash. This category would also include exceptionally volatile times when orders such as stop-losses do not work. For instance, many traders had tight stop-losses in place on their short swiss franc positions before the currency surged on jan. 15, 2015. However, these proved ineffective because liquidity dried up even as everyone stampeded to close their short franc positions.

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Can you really become a millionaire from forex trading?

There are some questions that are frequently asked by novice traders:

- How much money can I make through forex trading every month?

- How many trade setups will I have every day and how many pips can I make every month?

- Can I start with a $100 account and grow it to a million?

- …

Among all the frequent questions, there is one question which is asked by some novice traders more often:

Can I become a millionaire through forex trading?

I have two clear answers for this question and I explain about each of them in details:

- Yes, you can.

- No, you cannot.

Making lots of money through forex trading is completely dependent on some special conditions.

When someone has the proper conditions, he can make millions through forex trading.

When he doesn’t have the proper conditions, he will do nothing but wasting of time and money.

What are those conditions?

You can increase your wealth and become richer through forex trading and become a millionaire or even a billionaire.

However, if you are among those who want to turn a $500 or even a $5000 account into millions, then I have to tell you that you have to be patient enough.

I am not saying that it is impossible to make millions with forex.

Anything is possible in this world.

However, you have to be patient, because it can’t be done overnight, or even in one year.

You will be faced with some challenges that finding a good broker that doesn’t cheat you is the biggest one.

Many forex brokers (market maker brokers) don’t let you grow your account consistently, because in most cases, your profit is their loss.

Forex is not a get-rich-quick scheme

Forex is not a get-rich-quick scheme

It is not too easy to make a living through currency trading. Someone has to teach you the right techniques, otherwise you can’t get anywhere on your own.

It is the same with the stock trading and all other kinds of tradings and investments.

To make money consistently through forex trading and maybe to become a millionaire finally, you have to pass some important stages.

There are so many jobs that you can follow and become a millionaire.

It is not the job that has to make you a millionaire.

It is “you” who has to follow the job properly to become a millionaire.

For example, there are so many millionaire real estate agents and brokers in big cities like new york.

However, there are a lot more agents who cannot even cover their monthly expenses in the same cities.

All agents are in the same areas, have access to the same markets and customers, ruled under the same jurisdictions, use the same advertising media and… .

But, how can some of them become millionaires, and most of the others fail to have even one sale per month?

Whatever the reason is, it has nothing to do with the real estate business itself, because it is the same for all the agents and brokers.

The reason is in the agents and brokers behavior, life and work style.

Behavior, life and work style

Forex trading is like that too.

It possible to become a millionaire through forex trading, as it is possible to become a millionaire through stock trading, programming, marketing, importing and exporting, constructing, and…

The more important question is “how?”

There are two things that you have to do to become a millionaire forex trader:

2. You have to develop the trading discipline in yourself.

You can’t become rich through forex trading, without having these two at the same time.

It is not even possible to make a living without having the discipline, whether you master the trading techniques or not.

I’ve never seen even one single retail forex trader who has become able to become rich or millionaire without following the proper techniques and having the discipline it takes.

Even I’ve never seen a forex trader who has been able to make a living like this.

There is no consistently profitable and professional currency trader who doesn’t trades forex with the proper technical analysis methods.

When you have a big capital, you can trade currencies through a bank account, instead of retail brokers. But most people still have to be patient to reach this level.

And, as bank accounts are not leveraged, you will trade with more peace of mind. But you should start small at the beginning.

Those who don’t believe in what I explained above can spend some time and money on forex trading at least through having small live accounts with retail forex brokers.

I am 100% sure that they will remember what I’ve explained above, and will be back to this site after wasting lots of time and money. The reason is that most novice traders start trading with real money before they do the above two things: (1) developing proper techniques and (2) discipline.

How can you become a consistently profitable forex trader?

Unlike what most people think, it is not possible to start making money right after learning the forex trading basics and a trading strategy.

There is something very important that most people don’t consider:

To learn how to trade forex, become a consistently profitable trader and hopefully a millionaire, first you have to find a mentor who teaches you the currency trading techniques and help you to develop the discipline in yourself.

Additionally, you’d better to have an income that covers your expenses and leaves you some free time to sit at the computer and learn how to trade with peace of mind.

You can make any money through forex trading and any other kinds of trading when you DON’T HAVE TO make money and you don’t have financial problems. Therefore, having a source of income is a big help.

False forex success stories

Most people think that they can learn to make money through forex trading within a very short time, and become a full-time forex trader who makes thousands or even millions of dollars.

This is is not true at all.

There are so many false forex millionaires stories over the internet.

Be careful not to be deceived by them.

None of the real millionaires or billionaires, like george soros, have made their wealth through forex or stock trading without following strong strategies. However, they are experienced business people who make a lot of money through several sources of income they have.

Then they invest a portion of their wealth in currency, stock, real estate… markets to increase their wealth: A short term investment strategy that makes you a millionaire

This is how they’ve become millionaires or billionaires. Their increase their wealth through forex or stock trading while they have other sources of income.

Therefore, if you like to become a millionaire, first you have to have a good source of income that makes a reasonable amount of money that not only covers your expenses, but also leaves some money for your trading and investments.

Then you can start learning how to trade.

You have to keep on learning and practicing until you become a consistently profitable trader. That’s why we enable our trading students to develop a source of income too.

The hassles of following too many trading strategies

Some traders the hard way of following too many trading strategies, robots and time-frames, and sitting at the computer for several hours per day.

That is the hard way which can hardly take you to your destination.

The simpler and easier way is learning the forex trading basics, and then a simple and strong trading strategy.

Then you have to master your trading strategy through demo trading.

When you succeed to make profit consistently for 12 consecutive months at least, you can open a small live account and start practicing with it.

If you can make profit consistently for 12 consecutive months with your live account too, the way you could make profit with your demo account, then all you have to do is that you keep on trading with your live account to grow it, or adding some more money to it. But don’t make your account too big. You will be faced with lots of negative emotions when you are still new and you want to trade with a too big account.

A source of income is really good

To become a full-time forex traders who makes money consistently, you have to spend some time. I already explained it above.

If you don’t have an income currently, or if your income is not enough to give you time and mind freedom to learn forex, you should develop a source of income that covers your life and enable you to open a live account in the currency market when it is the time.

You can keep making money with your source of income until you are ready to open a trading account. If your income is enough to trade through a bank account later when you are ready to do it, it will be even better.

Trading through a bank account will have a lot more advantages compared to trading through forex brokers.

The only problem of trading through a bank account is that you have to have a lot of money because banks don’t offer any leverage.

Therefore, to become able to trade through a bank account, you have to have a lot of money already.

That is why I emphasized on having a strong source of income earlier in this article.

If you want to become a millionaire forex trader, you must have a good income and backup.

Turning a small $5000 account into a million dollar account is possible theoretically.

You can do it slowly and surely when you become a consistently profitable trader and you have enough patience. However, you have to be a patient and disciplined forex trader to do it. And, you can’t do it alone. You need the mentors technical and emotional support.

Do it the right way:

You need to become a professional trader through learning the best and most accurate technical and fundamental analysis techniques. This is the only thing that makes you a professional trader who can consistently make profit.

When they become consistently profitable forex traders eventually, they have enough money to open live accounts or even professional live forex trading accounts with the banks to trade professionally and increase the money they make.

This is how they can become millionaire forex traders while they also have some other good sources of income to support their forex and stock trading investments.

So, the answer of this question that whether it is possible to become a millionaire through forex trading is in the facts that I explained in detail above.

Be careful not to be deceived by the scam mentors or brokers. They are there to make money from your losses, not to make you a millionaire.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

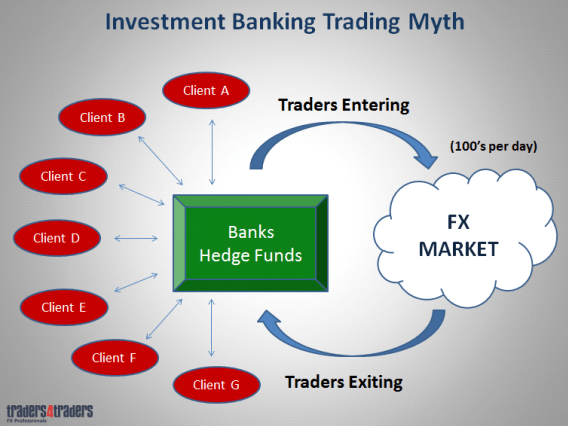

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

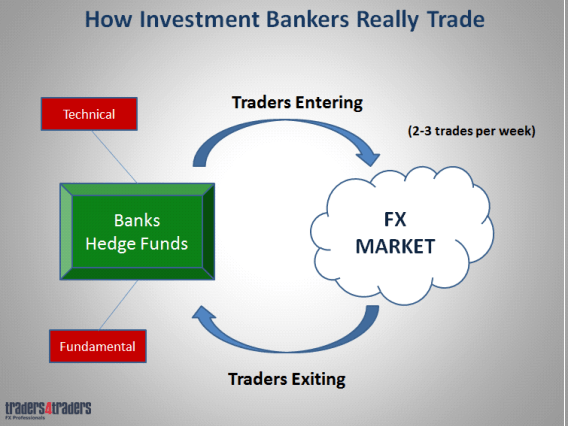

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

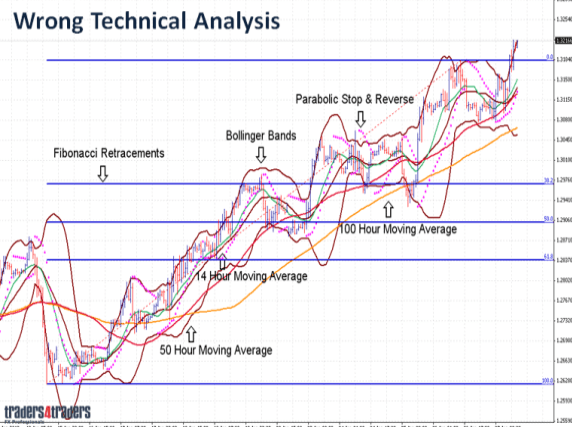

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

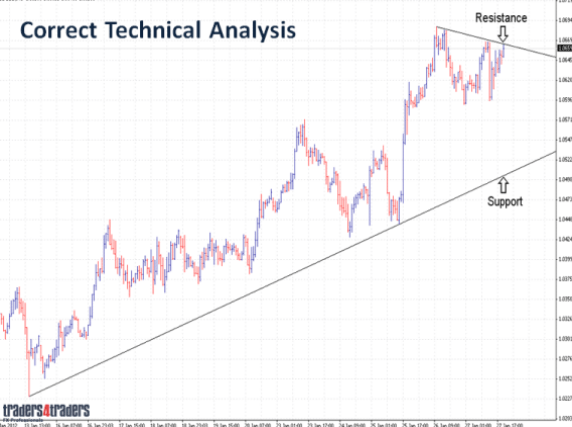

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

3 things I wish I knew when I started trading forex

Trading forex - what I learned

- Trading forex is not a shortcut to instant wealth.

- Excessive leverage can turn winning strategies into losing ones.

- Retail sentiment can act as a powerful trading filter.

Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. I started out aspiring to be a full-time, self-sufficient forex trader. I had been taught the 'perfect' strategy . I spent months testing it and backtests showed how I could make $25,000-$35,000 a year off of a $10,000 account. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. I was dedicated and I committed myself to the plan 100%.

Sparing you the details, my plan failed. It turns out that trading 300k lots on a $10,000 account is not very forgiving. I lost 20% of my account in three weeks. I didn't know what hit me. Something was wrong. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. It played a huge role in my development to be the trader I am today. Three years of profitable trading later, it's been my pleasure to join the team at dailyfx and help people become successful or more successful traders.

The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why. These are the three things I wish I knew when I started trading forex.

1) forex is not a get rick quick opportunity

Contrary to what you’ve read on many websites across the web, forex trading is not going to take your $10,000 account and turn it into $1 million. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. The old saying “it takes money to make money” is an accurate one, forex trading included.

But that doesn’t mean it is not a worthwhile endeavor; after all, there are many successful forex traders out there that trade for a living. The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income.

I hear about traders all the time targeting 50%, 60% or 100% profit per year, or even per month, but the risk they are taking on is going to be pretty similar to the profit they are targeting. In other words, in order to attempt to make 60% profit in a year, it's not unreasonable to see a loss of around 60% of your account in a given year.

"but rob, I am trading with an edge, so I am not risking as much as I could potentially earn" you might say. That's a true statement if you have a strategy with a trading edge. Your expected return should be positive, but without leverage, it is going to be a relatively tiny amount. And during times of bad luck, we can still have losing streaks. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Which in turn is how traders can produce excessive losses. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

Can you really make money trading forex?

Have you ever endured an endless conversation with an old friend who appears to have gotten rich overnight? Or perhaps you’ve recently spied your colleague opening a few trades in between meetings? Maybe you’ve just spent hours listening to inspirational speakers talk about how they left their day job to take on full-time trading and never looked back. Either way, if you’re interested in making money, you’ve come to the right place!

If you’re one of the millions of people who have experienced any of those situations, getting stuck into forex trading would naturally seem like a no-brainer. The good thing is that trading can be an exciting and independent way to generate income . Even better is the fact that anybody can become a trader, as long as they’ve got a computer and an internet connection! In this article we’ll explore some of the ways in which people can really make money trading forex, and why so many individuals are choosing to do so.

Before we begin, it’s crucial to note that earning money through forex trading requires you to work hard and to work smart, too. The world of forex trading can be complex to understand as a beginner, but with the right amount of dedication and focus, you’ll be able to reach your goals in no time.

How to make money trading forex

One of the frequently asked questions by newcomers is how traders actually make their money from price movements that are usually rather small. As you may know, all forex currencies are traded in pairs, meaning that you buy one currency while selling another. The prices of both currencies in each pair are given as quotes, and the changes in value are measured in pips.

Now, let’s put this into perspective. The value of one pip is equal to the fourth decimal place of a currency quote. So, how can traders profit from such minuscule price changes? Leverage! Trading with high-leverage is, in fact, one of the main pull-factors to forex trading, allowing traders to open larger positions with less capital.

Longhornfx offers higher-than-average leverage settings of up to 1:500 on a wide variety of forex currency pairs and much more. Start trading today at longhornfx

Managing risks

While it’s highly possible to profit from trading forex, careless traders may also end up losing money. During periods of high market volatility, in particular, a trader’s positive trades can easily be turned on their heads in an instant.

Luckily, there are several tools that can be applied to help manage your risks (without having to be glued to your screen 24/7). When opening a position, traders can input a ‘stop loss’ order and/or a ‘take profit’ order to automatically control their risks.

With a stop loss, the trader can determine the maximum amount they are willing to lose before their trade closes automatically. With a take profit, the trader can set a target amount which, once reached, will close the position and send the profit to the trader’s account balance instantly.

Keep a trading journal

There are several ways in which traders can keep track of their successful trades, as well as the ones that didn't go quite according to plan. Keeping a trade journal is one way to monitor all your trading activity and continue to improve your performance.

A trading journal is only as good as its contents, so it’s up to each trader to decide how detailed and consistent they would like to be. You may prefer to write down your trading plan and reflect on how well you managed to stick with it, or simply write down all your profits and losses for a given period. You could also keep a written record of all the emotions you experience with each trade, if you’re interested in analyzing the psychological aspect of your trades.

Whichever method you choose, the information you gather in your journal will be useful to look back on as you continue to learn and grow as a trader!

With a minimum deposit of only $10 and a wide variety of tradable assets to choose from, longhornfx is the go-to broker for forex trading. Sign up at today and create your free account!

Can you really make money trading forex?

Forex traders are not only profitable, but they are also very happy too. Of course, there are always some that do not live up to their promises, cheat and run away with their profits. As a trader, you have to keep in mind that not all forex traders are profitable, even if they are trying very hard. Listed below are some factors that affect a trader’s success or failure in the market.

LUCKY: percentage of profitable traders in profit, FXSSI. So, earning more from winning trades is also part of what makes the broker rich. However, there is not such a huge percentage of forex traders who are truly profitable, according to the yearly reports submitted by these brokers. This means that you have to learn more about the different factors affecting the retail trader to be able to have a better grasp about the market.

Popular exchange – etoro

TRADER RATIO: the ratio of number of trades to the number of winning ones defines this factor. A high trader ratio indicates that a trader has a lot of wins while a low one shows that he has a lot of losses. With that, you will need to adjust your trading strategy accordingly to maximize your profitability. The best thing to do is to find out the trends of the currency pairs that you are trading on so that you can incorporate them with your trading strategy.

ACCOUNT FOR EVERY TRADER: you should have a trading strategy so that you know exactly how many profitable trades you can get in a given time. This way, you can avoid having many traders at the same time, leaving you with less opportunities to earn money. Keep track of the losses that you have incurred and try to minimize them as much as possible. It may require patience and self-restraint to not continue losing trades even if you have just made a few profits. As many traders say, if you keep losing, then stop losing.

LUCKY STONES: although luck plays a role in trading strategies, there is still an element of risk management involved. There are many types of software available today that can help traders reduce their risk level and improve their profitability . Some software provides statistics and technical analysis, which can make the analysis easier and faster. If you want to maximize your profit and minimize your loss, use the appropriate tools.

MUTUAL PROFITS: most traders think that they will make a fortune if they spend more time in learning the forex market system. But this is actually another reason why many traders lose money. Because they are too focused on this aspect, they forget to maximize their profit potential. Keep track of your profits and losses and only invest money that you can afford to lose.

TRADER RULES: one of the biggest reasons why many traders fail to earn a significant profit is because they follow bad trading strategies. These strategies are usually developed by amateur traders who lack the knowledge and expertise to consistently generate good results. When traders deviate from the tried and tested rules, they often encounter problems. But bad habits can be easily learned and corrected.

Ecourse profitable forex exchanges: A lot of experienced traders say that the best way to learn how to make money in the forex market is by getting involved in live trading. You should also get to know the most effective brokerages available in the market. There are many ecourse platforms today that provide tutorials on how brokers can help traders earn more money. These ecourse brokers are often the preferred trading platform because they allow traders to trade in real time and reduce brokerage fees.

Can you actually make money on forex

Trading currency is one of the main market trading options, along with stocks, commodities, and real estate. Each of these is unique in some way, but what unites them all is that there’s a buyer, a seller, and a market where the exchange takes place. In this post, we will go over the main things to consider if you want to get into currency trading.

The basics of making money through forex trading

Trading in foreign currencies on the foreign exchange market (forex) is popular with many people who are looking for low capital trading. There is no need to have a massive investment to get started. It’s also convenient to trade forex (FX) because a forex trading day lasts for 24 hours (no trading during weekends, though).

That said, the lifecycle of a typical forex beginner goes something like this.

- Get excited by a course that promises quick money and comfortable living.

- Sign up for a forex broker without ever doing any further research.

- Blow through a large amount of money in a short amount of days.

- Conclude forex is a scam, and no one makes money.

On the other hand, the top forex traders are using tried and true systems that they slowly developed or learned through much trial and error. This allows them to make consistent profits on them every single day. However, even these top performers experience slippage at some point. It’s a common problem when currency markets are fast-moving.

Slippage happens when losses are more substantial than expected. To account for this, successful forex traders reduce calculated net profits by 10%.

The difference between successful traders and those that don’t succeed is what separates any successful and unsuccessful person. Those people that are ultimately successful have typically tried a million things and lost a lot of money and time in the process. The only way they were able to discover something profitable that worked for them was by trying things over and over again until they found something that works.

Sure, they don’t go out there preaching about all of their failed systems and all the times they lost money, but who would be?

How to start with forex?

If I were to start over trading in financial markets with no knowledge, there are a few key places I would start.

- First, I would begin by reading books. They teach the theory behind trading in financial markets, which is key to successful long-term trading.

- Second, I would join every facebook group or reddit thread that talked about forex. Then I would ask questions in those groups. In addition to staying respectful, I’d try to help out by answering any questions that I could to those that knew even less than me.

- Next, I would understand that leverage can be a double-edged sword. Using excessive leverage can seriously damage what could otherwise be a successful forex trading strategy. A big part of not using excessive leverage is being realistic about expectations of the return on investment. At this point I’d also learn how to use a “stop-loss order”, which is essential to risk management.

- Finally, I would find people I trust and ask them for reputable brokers and courses that I could take. This one is probably the biggest key. There are probably hundreds of forex courses online that guarantee you a system that will make you money from day one. As with anything of that nature, a lot of them are scams. They are taught by people that learned how to trade forex, couldn’t succeed at it, and ended up just selling courses to make money.

Recommended forex posts:

Forex trading: demo account vs. Real-money trading account

Now, let’s get to the meat of the whole process-opening a forex account.

After you’ve done your reading, watched relevant videos, asked questions, and got the answers to as many unknowns as you could, you can open a demo account and put your knowledge to the test.

If you are not familiar with the term, a demo account is a practice account where you trade with pretend money. The obvious main benefit of starting your forex trading journey with a practice account is that should you slip up, you won’t lose actual money.

But there are other advantages as well. With a demo account you can:

- Watch the forex market move in real-time.

- Learn the industry jargon and how trading platforms work.

- Test out your knowledge and go crazy testing your theories.

- Try different currency pairs to find which ones will yield the best results for you.

- Compare various trading platforms and pick the one/s that you feel most comfortable to use.

There are more benefits to demo accounts; however, there’s something to keep in mind.

Only because a practice account uses pretend money doesn’t mean you should get sloppy with your practice currency trading. Think of it as a fire drill—there might not be a real emergency, but keeping it serious will help you in case things actually go south. In other words, once you’ve played around with your pretend money enough to know what works for you, treat your demo account as if you are trading with real money. This will give you a more realistic idea of what to expect once you dip your toes in the real-money forex pool.

Granted, not all forex trading platforms are the same. Go for reputable and secure ones, that also let you open demo accounts with real-time market data.

Technical analysis vs. Fundamental analysis

Just like you’d do when trading stocks, currency trading gets more precise when you know how to read charts. While it’s not the most exciting part of trading, going through numbers is key to a successful trade. Without it, all you do is gamble.

Again like with stock trading, traders go through technical and fundamental analysis upon which they base their trading strategy. Let’s quickly go over the difference between the two.

To do technical analysis, you would look at the past performance of the exchange rate of currency pairs. Technical analysis is what you typically see in movies about stock traders where they look at lines that go up and down. This is the market fluctuation, and the purpose of technical analysis is to predict where the market will go based on past performance.

Fundamental analysis is concerned with a country’s performance economy wise as shown by economic data such as GDP, employment, and inflation. Of course, other indicators come at play such as government stability, and the country’s international political and trade relations. All in all, the fundamental analysis approach attempts to predict a country’s currency value by assessing the country’s wellbeing.

So, which approach of the two should you pick? It might come as no surprise that it’d be best to learn both methods. What you can do is learn how to do both and, using a demo account, test them separately and together.

How to make money with forex fast?

Finally, let’s address the two questions that bug the most newcomers to the forex world.

The two things that new FX trader will ask is, “how much money will I make from the forex market?” and “how to make money fast on forex?”. The saying goes that the easiest way to get $1,000 in forex is to start with $5,000. This is a tongue-in-cheek answer but points to an issue that is not a joke. Many traders do lose money on forex.

Nevertheless, it is indeed possible to make money trading forex. In fact, plenty of people manage to make a consistent income trading forex daily, especially if they have an effective forex day trading strategy in place.

The fallacy is that it is easy money. Typically, when someone signs up to start trading forex, they do so under the false illusion that it is an easy way to make money. They are sold on expensive courses that feature wealthy millionaires in their yachts talking about how they do no work but make lots of money.

That very well may be so. But it is highly doubtful that those same wealthy millionaires weren’t working their butts off at some point in their life. It is also highly likely that those millionaires have lost a huge amount of money when starting trading forex and learning how to succeed in what they do. That is the nature of the game.

Bottom line, yes, forex traders really make money. People also lose money on forex. It all comes down to your mindset. Those that make money understand forex is a business and a hard one at that. They don’t have an “easy money” mentality.

The most important thing to remember can be summarized by jack D. Schwager-a US trader and author of the little book of market wizards where he writes: “there is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

Exclusive bonus: before investing in forex check out our report on 70+ forex brokers. Find out which brokers you need to avoid. Receive our exclusive report for free today.

So, let's see, what we have: many ask: is forex profitable? From personal experience, I can say that yes, forex is profitable. But it comes with A big "BUT". Anyone can profit in forex. At can you actually make money on forex

Contents of the article

- Top-3 forex bonuses

- Is forex trading really profitable and can you do...

- Your biggest job as A forex trader

- How long can you trade with profits?

- What is forex money management?

- What is A good mindset?

- One word to be A successful currency trader

- Can forex trading make you rich?

- Excessive leverage

- Asymmetric risk to reward

- Platform or system malfunction

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Can you really become a millionaire from forex...

- Can I become a millionaire through forex trading?

- How can you become a consistently profitable...

- False forex success stories

- The hassles of following too many trading...

- A source of income is really good

- Do it the right way:

- Fxdailyreport.Com

- What is copy trading ?

- Making money in forex is easy if you know how the...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- 3 things I wish I knew when I started trading...

- Trading forex - what I learned

- 1) forex is not a get rick quick opportunity

- Can you really make money trading forex?

- Can you really make money trading forex?

- Can you actually make money on forex

- The basics of making money through forex trading

- How to start with forex?

- Recommended forex posts:

- Forex trading: demo account vs. Real-money...

- Technical analysis vs. Fundamental analysis

- How to make money with forex fast?