Deposit xm

The XM standard account is available under every jurisdiction and with a very good value $5 being the minimum deposit here, it is easy to see why many choose to trade with it.

Top-3 forex bonuses

Again, the minimum XM deposit through an ewallet is only $5. This can be made through neteller, skrill, perfect money, or a host of others dependent upon your country. At this time XM paypal deposits are not available.

XM minimum deposit guide (2021)

Trading with a top forex broker like XM is a forward step in the trading career of anyone looking to break into the sector.

Our XM review details exactly what is on offer with this broker providing extensive access to a wide range of markets.

Here we will take a closer look at the financial side of things.

The XM minimum deposit to be exact.

This is something which can certainly influence how you trade so it is well worth noting.

We will look at the minimum deposit for XM by funding method and account type to make sure that we cover all traders.

Table of contents

69.75% of retail CFD accounts lose money

XM account base currency

As with most top brokers, XM accounts are available with many several base currencies. The XM base currency is the one that you trade with and effectively depends upon which account and regulatory type you fall under.

If you have an XM standard or micro account, you can look forward to choosing every major currency as your XM base currency. Also included are PLN and HUF as other options as well as ZAR and SGD.

Russian RUB is available only if you are located outside of cysec and FCA regulatory areas.

If you are an XM zero account holder, you can access USD or EUR as base currencies with JPY available under global market regulation.

XM ultra-low account holders can select between five base currencies. These are EUR, USD, GBP, AUD, and CHF.

If you are an XM shares account holder, USD only is available for trading with.

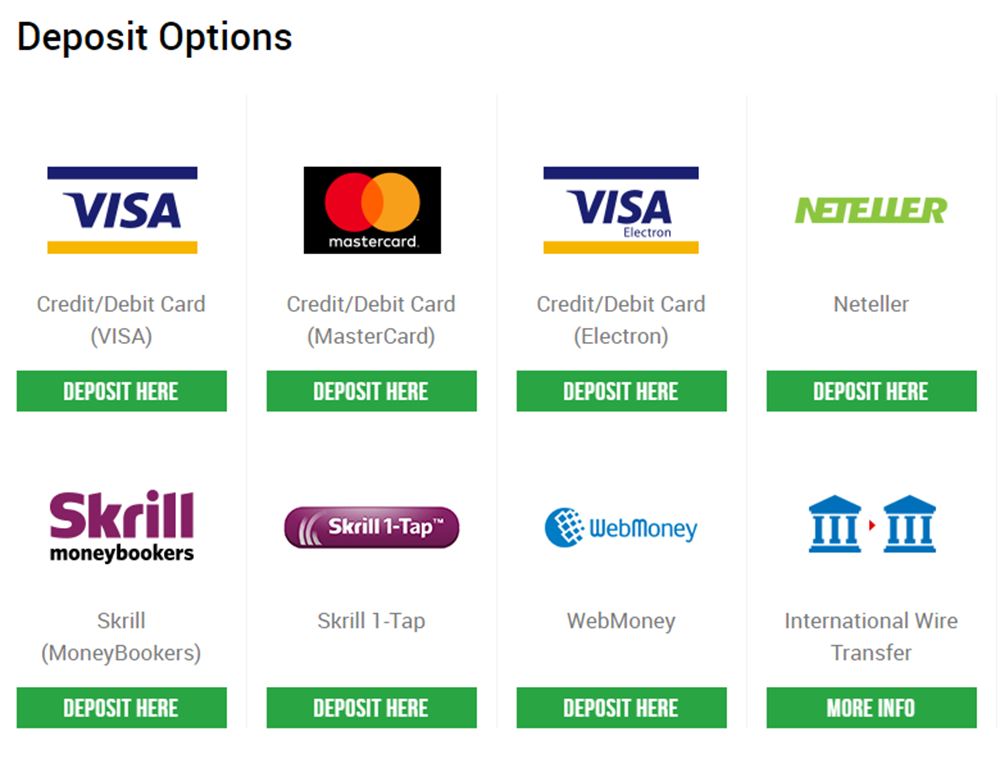

XM funding and deposit methods

Again there is a range of XM deposit methods available to traders. These will depend on the country in which you live and not the regulatory jurisdiction you fall under.

Wondering for example if you can make a minimum deposit in ZAR?

The answer is yes, you can deposit in any currency, this includes ZAR. These funds will then simply be converted into your base currency for trading on your account.

Wire transfer

XM deposit by wire transfer is, of course, available and widely used. This funding method is available to traders worldwide and there is an minimum deposit of $60 in place here.

With that said, you will incur a fee if the wire transfer you make falls below $200. If the deposit is above this amount, then not only will XM waive any fees they charge, they will also cover any fee you would usually incur from your own bank side. Therefore, although it is not explicitly required, it is in your best interest to deposit more than $200.

Credit cards

Credit card deposits are available through both visa and mastercard at XM. These are accessible to traders around the world with a minimum deposit amount of just $5.

There are no fees associated from the broker side, but again if your financial provider does levy a fee, this will be covered for anything over a $200 deposit by XM.

Ewallet

Again, the minimum XM deposit through an ewallet is only $5. This can be made through neteller, skrill, perfect money, or a host of others dependent upon your country. At this time XM paypal deposits are not available.

Cryptocurrency deposit in the form of bitcoin is available but again this will depend on your location to determine if this option is open to you or not. There are no fees from the broker side for deposits through these methods.

Other XM deposit options

Other XM deposit options available include both western union and moneygram although these will depend on your location and fees may be applied for these services although not from the broker side.

Various local methods and local bank transfer deposits may also be open to you depending on your area. These minimum deposits will vary.

69.75% of retail CFD accounts lose money

XM minimum deposits

As with most low deposit forex brokers, beyond the funding methods, the XM broker minimum deposits may also depend on the account type you are holding. Here is a rundown of what to expect depending upon the account type you have.

Standard account

The XM standard account is available under every jurisdiction and with a very good value $5 being the minimum deposit here, it is easy to see why many choose to trade with it.

Islamic accounts are also available if you should require them.

Micro account

Again, the XM minimum deposit on their micro accounts is suitably small at just $5. These accounts facilitate trading in micro lots at excellent rates and are available to all traders in every regulatory area. Islamic traders are also catered for.

XM zero account

Changing things up slightly, we arrive at the XM zero account. This account type is available under cysec, FCA, and most of the countries regulated under the XM global market regulatory framework.

The spreads here are unbeatable starting at 0 pips although commissions are charged on trading. The XM minimum deposit for trading on these accounts is still just $100. This represents good value since you can also have access to your own VPS. Again islamic, shariah law compliant accounts are available.

Ultra low account

This XM low spread account type is available to traders based in australia and within the XM global market regulatory framework. This account comes with extra low spreads and no commission to worry about.

The minimum deposit on this account type is $50.

Shares account

Finally, the XM shares account which focuses on shares trading is available only within the XM global market regulatory area and with a $10,000 minimum deposit.

Related guides:

69.75% of retail CFD accounts lose money

Deposit bonus

XM bonus amounts and XM deposit bonuses are available though not to those regulated under cysec or FCA rules. Also, although you can receive bonuses under certain circumstances with XM, the bonus amounts themselves are typically not eligible to withdraw, though any profits derived from them usually are.

No deposit bonus

Unlike many brokers, an XM no deposit bonus is available. This means you can effectively start trading without any real money. While you cannot withdraw the bonus funds, you can withdraw any profits made from them.

This XM bonus amount is in the form of a $30 welcome bonus or the equivalent amount based on your account.

XM bonus program

An XM bonus program is in place. This program provides for a 50% deposit bonus up to $500 and then a further 20% deposit bonus on amounts up to $4500. This can be redeemed through trading with the broker. The only exception with this is that it is not available with XM ultra-low accounts.

69.75% of retail CFD accounts lose money

Members area access

Use your MT4/MT5 real account number and password to log in to the members area.

New to XM?

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

We are using cookies to give you the best experience on our website. Read more or change your cookie settings.

Risk warning: your capital is at risk. Leveraged products may not be suitable for everyone. Please consider our risk disclosure.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Change settings

Please select which types of cookies you want to be stored on your device.

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period of XM bank wire transfer withdrawal was 5 days in my last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders safe, XM takes all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use to trade, become familiar with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

XM deposit bonus: policies and limitations

Platform

Expiration

Min. Volume

If you are someone who trades on the forex market for a while now, you shall definitely know the XM forex broker. As that is undeniably one of the most reliable and trustworthy ones out there. However, if you are a beginner, you shall undeniably consider taking a look at it. This is a broker you should go for if you are looking for trust and reliability, as well as if you are seeking for the beneficial XM deposit bonus.

With the metatrader 4 and metatrader 5 platforms, the brokerage gives you a wide spectrum of ways to increase your trading profit. Moreover, that allows you to get the deposit bonus we will talk about in more details in that article. Reliability is vital for one to make a deposit with a broker and this is why we have decided to highlight the main points of the XM deposit bonus. However, now without any hidden conditions, XM gives you an impulse with their new deposit bonus for you to start trading right away. Should you or shouldn’t you go for it? Find out in the XM bonus review!

XM deposit bonus description

XM forex broker guarantees that your account will be increased by 50% for any deposit below $1,000. Thus, if you deposit, for instance, $50, then you will get an additional bonus of $2.50. And your trading capital will reach $7.50.

However, the maximum amount of the bonus that might be received equals $500. That means that you are granted a 50%-bonus only until your deposit does not exceed $1,000.

Once your deposit amount is more than $1,000, you will still have that 50% added on the first $1,000 of your deposit. Also, 20% will be given as a bonus for any amount more than that.

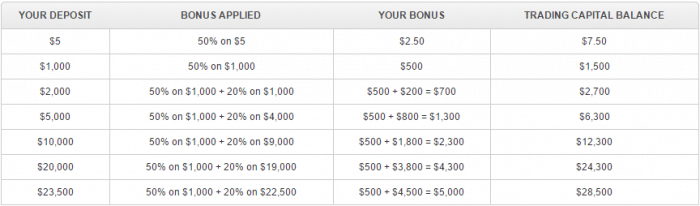

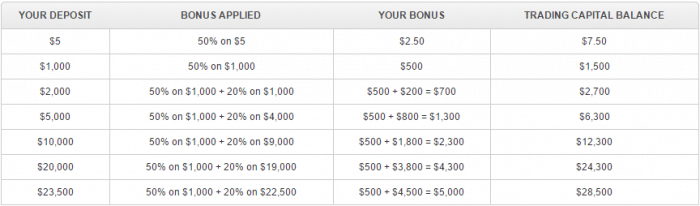

This means if you deposit an amount of USD $22,500, your account balance will become USD $28,500. The math on this is pretty simple and you can see it in more details in this table:

Any account holder can have his own bonus! No matter if you are a new customer or have been trading with XM for years. However, as you see from the table above, the biggest bang for your buck can be achieved with actually a $1,000 worth deposit.

XM bonus limitations

That is important to mention that the bonuses are not available on the XM ultra low account, as well as on the XM shares account.

This is not a limited one-time deal offer. If a client an XM bonus deposit worth $250 four times, $125 will be added each time to the account until it reaches the $1,000. However, the maximum bonus a person can receive is $5,000. Trading bonus is there to help new and existing clients to hold their positions open for a longer period. XM forex bonus is not eligible for clients registered under trading point of financial instruments ltd and trading point of financial instruments UK ltd.

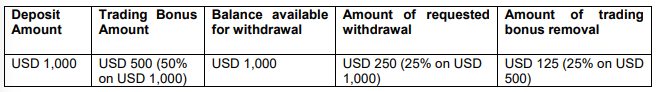

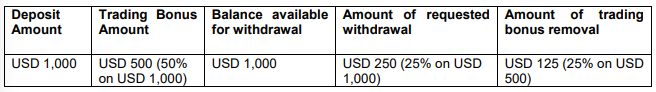

XM trading bonus withdrawal policies

Even though getting a deposit bonus is easy with that broker, the withdrawal procedure is not that primitive. And is rather targeted to make traders leave the funds on their accounts.

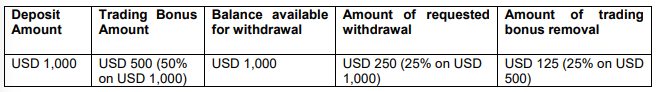

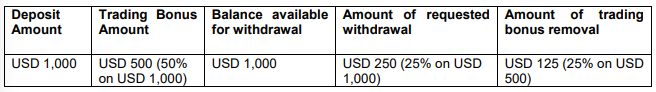

Therefore, when you are trying to withdraw funds from your XM bonus account, the broker will charge you with the amount of the bonus that will be proportional to the amount of the funds for withdrawal. Just to illustrate: imagine you deposited $1,000 and you were given $500 as a bonus (50%). Then you decided to withdraw $250 (25%) out of $1,000 available, as you still can’t withdraw the bonus. As a result, a total sum of $125 (25% of the bonus) will be removed.

But, for instance, if you have managed to generate some additional profit, then the picture will be a bit different. Imagine that you have deposited $1,000, received a $500 worth XM deposit bonus, and things turned out to be great for you. And you gained a profit of $2,000 from trading. Now you have $3,000 available to withdraw and you want to take them all out of the account. In that case, $500 of the bonus will be removed just because that will equal 100%. Maybe the table will help you to understand that easier:

Another XM bonus program

XM forex broker is constantly coming up with innovative bonus programs that will ensure that traders will stay loyal and interested. Thus, augmented XM points service was recently launched as an added bonus one may use while trading on the platform. You can subscribe and unsubscribe to that any time you want without any restrictions.

XMP has a status of reward for the loyal customer. Thus, as you trade, you received those bonus points that might be later transferred to the monetary bonus. That can be calculated in the following way:

However, in order to received XMP in the first place, you need to create an account and sign up for the loyalty program. There are several you may choose from XM executive, XM gold, XM diamond, XM elite.

If you are the part of the executive loyalty program, then you will receive 10XMP per lot straight away. If you are the gold loyalty program’s member, then you will receive 13XMP per lot after at least 30 days of trading. If you are a member of diamond loyalty program, then you will be guaranteed to receive 16XMP per lots only after 60 days of trading on the platform. Finally, if you are the holder of elite loyalty program, then you will be provided with 20XMP per lot after 100 days of trading with XM broker.

So, imagine you have 10,000XMP gained and you have decided to redeem 3,000XMP. Then, according to the formula provided above, you will receive $1,000 of bonus and will still have 7,000XMP on your account to convert and withdraw later.

However, there are some details worth mentioning when it comes to withdrawal of XMP from an account. For instance, you have 3,000XMP to redeem and you have gained an additional $1,500 while trading that you are allowed to withdraw. You have decided to withdraw only the part of it, $750, which is 50% of the total sum stored on the account. That means that the same 50% will be removed from your XMP bonus, which will equal $500 (3,000XMP / 3= $1,000). Take a look at the table below to understand the process better:

XM broker account types

There are various account options available while registering with the XM broker. Thus, you can choose between micro, standard and XM ultra low one. They differ depending on the size of lots, as well as the minimum deposit rate and leverage, availability of the bonus.

- The micro account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum deposit can be $5, the minimum trade volume is 0.01 lots, and there is no commission charged. However, you won’t be able to obtain an XM deposit bonus on that account.

- The standard account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum trade volume is 0.01 lots, the minimum deposit is $5 as well. And you can obtain bonus using that account.

- The XM ultra low account has a leverage of 1:1 to 1:888, the spreads can be as low as 0.6 pip, the minimum deposit should be at least $50, the minimum trade volume is 0.01 lots, and there is no commission charged. And you cannot get the bonus on that account as well.

Among the currencies available for trading there are:

- USD

- EUR

- GBP

- JPY

- CHF

- AUD

- HUF

- PLN

- RUB

Advantages

Even though we would recommend you to open an account with XM, there is one big benefit of the XM deposit bonus. It comes with a multi-account availability. When an XM bonus deposit comes to an account and then it’s transferred to another one, the bonus value will be transferred as well! The system calculates the share of the bonuses that should be transferred and makes sure you get an equal proportion on your other account. This is quite comfortable, as many brokers would simply remove your bonus if you try to move funds from one account to another.

Subscribe to receive updates about FX bonuses

Be the first one to find out about available forex trading bonuses that can be trusted

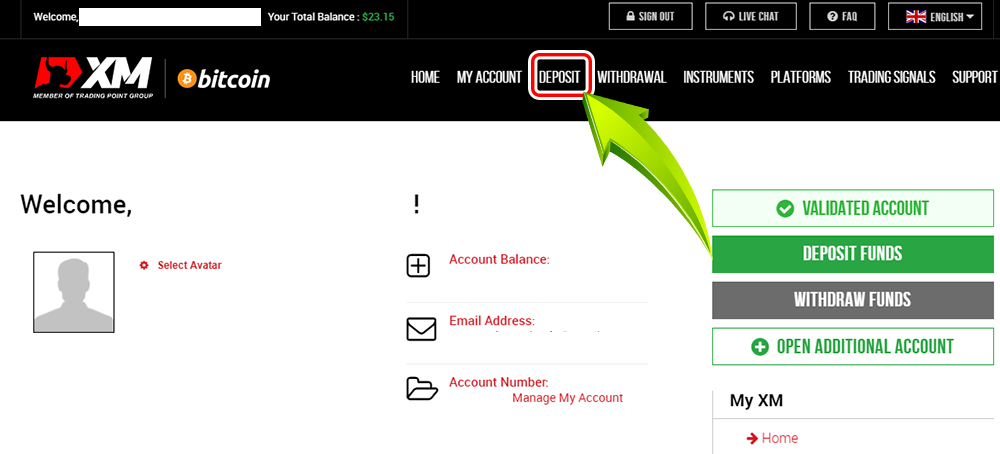

How to make a deposit into XM group / support immediate deposit in real time

Depositing fund to XM group is very simple completed in 2 minutes.

In addition to depositing fund into XM group by credit card, you can also deposit through many different ways such as VISA debit card, bank transfer, all supporting immediate deposit.

To trade with a real account, you will first need to upload account holder’s identification documents

If you have not uploaded your account identification documents, you need to activate your account at the reference page how to upload account holder’s identification documents.

Once your account is activated, the menu on the right of my account screen will show “account validated".

Step 1: click on the deposit button on my account

After logging into my account from XM group official website, you click on “deposit” on the menu at the top of the screen.

Step 2: select deposit method

Select a preferred deposit method (click on the deposit button).

Credit card (including VISA debit card) is a recommended credit deposit method because it is fairly simple and takes little time to confirm deposit

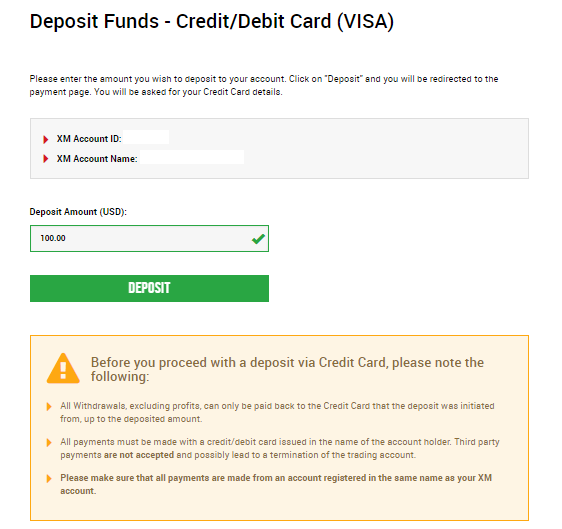

Step 3: enter the deposit amount

Below, I will introduce about deposit method by credit / debit card.

Enter the amount you wish to deposit into your account

Use your registered currency when opening an account. ※ if you have registered the trading currency in USD then you will enter the amount in US dollars.

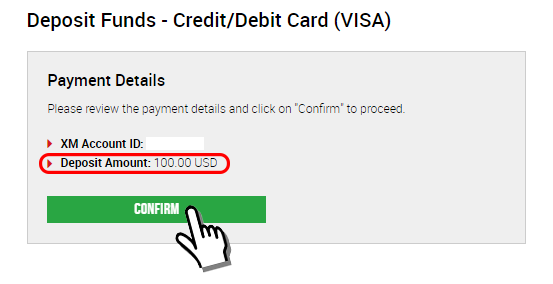

Check whether your account ID, name and deposit amout are correct.

Then, click on “deposit". The system will automatically jump to the confirmation page. If the information is correct then you click on “confirm".

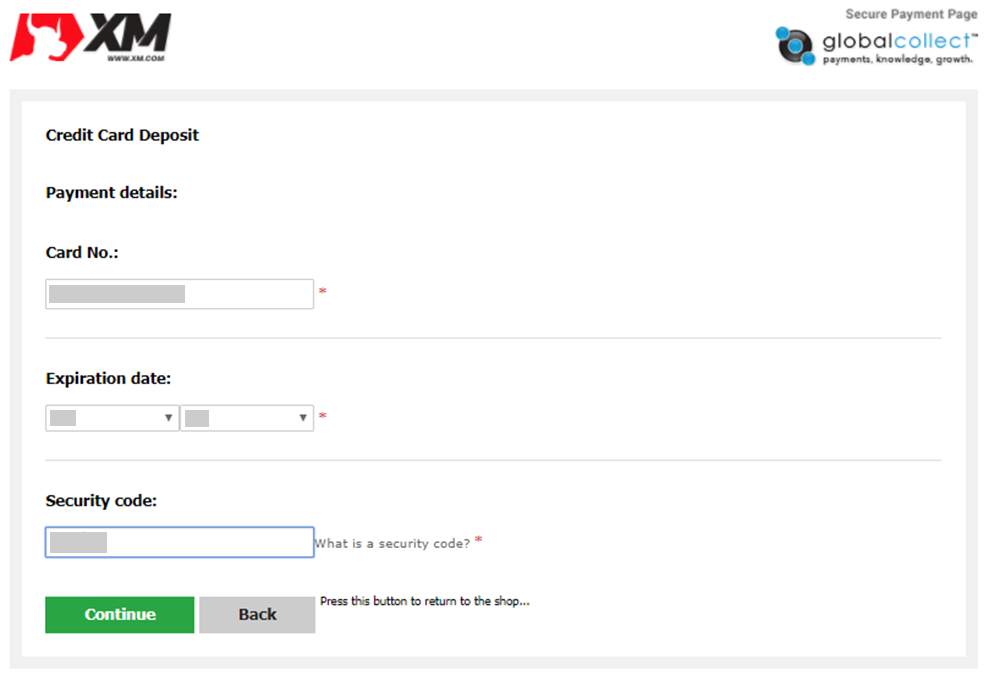

Step 4: enter credit card information

Next because the screen will show credit card information page, so please enter your credit card information (or debit card ).

If you have deposited before with credit card, some previous information should be saved. Confirm the information such as expiry period, … make sure everything is correct.

When the information is filled, click on “top up" the screen will appear this message “please wait while the payment is being processed”.

Be sure not to click the back button on your browser while the processing payment screen is shown

Step 5: deposit successfully completed

Deposit process is complete.

In case deposit is not reflected in the account?

Deposit methods other than credit card will not reflect in real time

Please contact XM group support if deposit by credit card is not immediately reflected in the account

In addition, if the deposit is made from a foreign-based account that is not the same with residency address registered at XM group, you need to attach card details and picture to XM group support for security reasons.

Please note that the above provisions will apply if you use a credit card issued by a foreign country or when traveling abroad.

Next step after depositting fund to XM group?

Once the deposit process is complete, your next step is to get your MT4 app downloaded from the XM group homepage.

If MT4 is already available, you can skip this step.

MT4 is a software used for forex trading. Besides PC , MT4 also comes in an app version on other devices, such as smartphone or, tablets . Even if you go out or without a computer you can still trade forex.

- Upload account holder’s identification documents (complete)

- Deposit to real account(complete)

- How to download MT4 for free (← next step)

- How to log into MT4

- Start trading with MT4

- Pin it

- LINE

- LINE

- RSS

- Feedly

- Copy

The latest forex news

Search

Download the latest version of MT4

Click on the image to download the latest version of MT4.

MT4 is an optimal foreign exchange transaction tool that can be used for free.

Trading hours

Trading sessions from sunday 22:05 GMT to friday 21:50 GMT

Winter time: (GMT+3) monday 00:05

Friday 23:50

summer time: (GMT+2) monday 00:05

Types of trading account

You can check the account type list!

Category

- Latest information about XM group

- How to use XM group

- Overview of MT4

- How to make money by economic indicators

- How to open a free trading account

- How to download MT4

- How to open real account

- How to submit identification documents

- Basic use of MT4

- How to display an indicator in MT4

- How to make money by analyzing forex charts

- Forex trading for beginners

- How to use MT4 smartphone

- How to use MT5

- How to deposit/withdraw money on XM

- Overview of XM group

- Sitemap

- Frequently asked questions

- How to deposit money into real account

- How to make money

How to use XMP

XMP is short for XM points, XM points can be automatically accumulated in each trading session.

FAQ loyalty program

Frequently asked questions and answers about XMP

Economic calendar

Check the important indicators in a real time!

New post

This article introduces the points FX be .

At forex brokers’ XM group, a client can .

When starting MT4 for the first time, "T .

The MT4 high performance forex trading t .

There is a case where you can not sign i .

Latest post

XM is a trading name of trading point holdings ltd, which wholly owns trading point of financial instruments UK ltd (XM UK), trading point of financial instruments pty ltd (XM australia), XM global limited (XM global) and trading point of financial instruments ltd (XM cyprus).

XM UK is authorized and regulated by the financial conduct authority (reference number: 705428), XM australia is licensed by the australian securities and investment commission (reference number: 443670), XM global is regulated by the IFSC (60/354/TS/18) and XM cyprus is regulated by the cyprus securities and exchange commission (reference number: 120/10).

XM global (CY) limited with offices at 36, makariou & agias elenis, ‘galaxias’ building, 5th floor, office 502, 1061, nicosia, cyprus. Risk warning: forex and CFD trading involves significant risk to your invested capital.

Copyright © 2021 forex trading, leverage up to 888:1 all rights reserved.

Trading account types

XM CY trading account types

Micro account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 1,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots (MT4)

0.1 lots (MT5)

- Lot restriction per ticket

- 100 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

Standard account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

XM zero accounts

- Base currency options

- USD, EUR, JPY

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 0 pips

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 100$

The figures above should only be regarded as reference. XM is ready to create custom-tailored forex account solutions for every client. If the deposit currency is not USD, the amount indicated should be converted to the deposit currency.

You may be new to forex, so a demo account is the ideal choice to test your trading potential. It allows you to trade with virtual money, without exposing you to any risk, as your gains and losses are simulated. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

What is a forex trading account?

A forex account at XM is a trading account that you will hold and that will work similarly to your bank account, but with the difference that it is primarily issued with the purpose of trading on currencies.

Forex accounts at XM can be opened in micro, standard or XM zero formats as shown in the table above.

Please note that forex (or currency) trading is available on all XM platforms.

In summary, your forex trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

Similarly to your bank, once you register a forex trading account with XM for the first time, you will be required to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details.

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients’ members area are provided and constantly enriched with more and more functionalities and therefore giving our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your trading account login details will correspond to a login on the trading platform which matches your type of account and is ultimately where you will be performing your trades. Any deposits/withdrawals or other changes to settings you make from the XM members area will reflect on your corresponding trading platform.

What is a multi-asset trading account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices cfds, stock cfds, as well as cfds on metals and energies.

Multi-asset trading accounts at XM can be opened in micro, standard or XM zero formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM webtrader.

In summary, your multi-asset trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

- 3. Access to the XM webtrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details that will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including the depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients members area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform which matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM members area will reflect on your corresponding trading platform.

Who should choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, cfds on stock indices, as well as cfds on gold and oil, but it does not offer trading on stock cfds. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.

Access to the MT4 platform is available for micro, standard or XM zero as per the table above.

Who should choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices cfds, gold and oil cfds, as well as stock cfds.

Your login details to the MT5 will also give you access to the XM webtrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for micro, standard or XM zero as shown in the table above.

What is the main difference between MT4 trading accounts and MT5 trading accounts?

The main difference is that MT4 does not offer trading on stock cfds.

Can I hold multiple trading accounts?

Yes, you can. Any XM client can hold up to 8 trading accounts of their choice.

How to manage your trading accounts?

Deposits, withdrawals or any other functions related to any of your trading accounts can be handled in the XM members area.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM deposit bonus: policies and limitations

Platform

Expiration

Min. Volume

If you are someone who trades on the forex market for a while now, you shall definitely know the XM forex broker. As that is undeniably one of the most reliable and trustworthy ones out there. However, if you are a beginner, you shall undeniably consider taking a look at it. This is a broker you should go for if you are looking for trust and reliability, as well as if you are seeking for the beneficial XM deposit bonus.

With the metatrader 4 and metatrader 5 platforms, the brokerage gives you a wide spectrum of ways to increase your trading profit. Moreover, that allows you to get the deposit bonus we will talk about in more details in that article. Reliability is vital for one to make a deposit with a broker and this is why we have decided to highlight the main points of the XM deposit bonus. However, now without any hidden conditions, XM gives you an impulse with their new deposit bonus for you to start trading right away. Should you or shouldn’t you go for it? Find out in the XM bonus review!

XM deposit bonus description

XM forex broker guarantees that your account will be increased by 50% for any deposit below $1,000. Thus, if you deposit, for instance, $50, then you will get an additional bonus of $2.50. And your trading capital will reach $7.50.

However, the maximum amount of the bonus that might be received equals $500. That means that you are granted a 50%-bonus only until your deposit does not exceed $1,000.

Once your deposit amount is more than $1,000, you will still have that 50% added on the first $1,000 of your deposit. Also, 20% will be given as a bonus for any amount more than that.

This means if you deposit an amount of USD $22,500, your account balance will become USD $28,500. The math on this is pretty simple and you can see it in more details in this table:

Any account holder can have his own bonus! No matter if you are a new customer or have been trading with XM for years. However, as you see from the table above, the biggest bang for your buck can be achieved with actually a $1,000 worth deposit.

XM bonus limitations

That is important to mention that the bonuses are not available on the XM ultra low account, as well as on the XM shares account.

This is not a limited one-time deal offer. If a client an XM bonus deposit worth $250 four times, $125 will be added each time to the account until it reaches the $1,000. However, the maximum bonus a person can receive is $5,000. Trading bonus is there to help new and existing clients to hold their positions open for a longer period. XM forex bonus is not eligible for clients registered under trading point of financial instruments ltd and trading point of financial instruments UK ltd.

XM trading bonus withdrawal policies

Even though getting a deposit bonus is easy with that broker, the withdrawal procedure is not that primitive. And is rather targeted to make traders leave the funds on their accounts.

Therefore, when you are trying to withdraw funds from your XM bonus account, the broker will charge you with the amount of the bonus that will be proportional to the amount of the funds for withdrawal. Just to illustrate: imagine you deposited $1,000 and you were given $500 as a bonus (50%). Then you decided to withdraw $250 (25%) out of $1,000 available, as you still can’t withdraw the bonus. As a result, a total sum of $125 (25% of the bonus) will be removed.

But, for instance, if you have managed to generate some additional profit, then the picture will be a bit different. Imagine that you have deposited $1,000, received a $500 worth XM deposit bonus, and things turned out to be great for you. And you gained a profit of $2,000 from trading. Now you have $3,000 available to withdraw and you want to take them all out of the account. In that case, $500 of the bonus will be removed just because that will equal 100%. Maybe the table will help you to understand that easier:

Another XM bonus program

XM forex broker is constantly coming up with innovative bonus programs that will ensure that traders will stay loyal and interested. Thus, augmented XM points service was recently launched as an added bonus one may use while trading on the platform. You can subscribe and unsubscribe to that any time you want without any restrictions.

XMP has a status of reward for the loyal customer. Thus, as you trade, you received those bonus points that might be later transferred to the monetary bonus. That can be calculated in the following way:

However, in order to received XMP in the first place, you need to create an account and sign up for the loyalty program. There are several you may choose from XM executive, XM gold, XM diamond, XM elite.

If you are the part of the executive loyalty program, then you will receive 10XMP per lot straight away. If you are the gold loyalty program’s member, then you will receive 13XMP per lot after at least 30 days of trading. If you are a member of diamond loyalty program, then you will be guaranteed to receive 16XMP per lots only after 60 days of trading on the platform. Finally, if you are the holder of elite loyalty program, then you will be provided with 20XMP per lot after 100 days of trading with XM broker.

So, imagine you have 10,000XMP gained and you have decided to redeem 3,000XMP. Then, according to the formula provided above, you will receive $1,000 of bonus and will still have 7,000XMP on your account to convert and withdraw later.

However, there are some details worth mentioning when it comes to withdrawal of XMP from an account. For instance, you have 3,000XMP to redeem and you have gained an additional $1,500 while trading that you are allowed to withdraw. You have decided to withdraw only the part of it, $750, which is 50% of the total sum stored on the account. That means that the same 50% will be removed from your XMP bonus, which will equal $500 (3,000XMP / 3= $1,000). Take a look at the table below to understand the process better:

XM broker account types

There are various account options available while registering with the XM broker. Thus, you can choose between micro, standard and XM ultra low one. They differ depending on the size of lots, as well as the minimum deposit rate and leverage, availability of the bonus.

- The micro account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum deposit can be $5, the minimum trade volume is 0.01 lots, and there is no commission charged. However, you won’t be able to obtain an XM deposit bonus on that account.

- The standard account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum trade volume is 0.01 lots, the minimum deposit is $5 as well. And you can obtain bonus using that account.

- The XM ultra low account has a leverage of 1:1 to 1:888, the spreads can be as low as 0.6 pip, the minimum deposit should be at least $50, the minimum trade volume is 0.01 lots, and there is no commission charged. And you cannot get the bonus on that account as well.

Among the currencies available for trading there are:

- USD

- EUR

- GBP

- JPY

- CHF

- AUD

- HUF

- PLN

- RUB

Advantages

Even though we would recommend you to open an account with XM, there is one big benefit of the XM deposit bonus. It comes with a multi-account availability. When an XM bonus deposit comes to an account and then it’s transferred to another one, the bonus value will be transferred as well! The system calculates the share of the bonuses that should be transferred and makes sure you get an equal proportion on your other account. This is quite comfortable, as many brokers would simply remove your bonus if you try to move funds from one account to another.

Subscribe to receive updates about FX bonuses

Be the first one to find out about available forex trading bonuses that can be trusted

Trading account types

XM CY trading account types

Micro account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 1,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots (MT4)

0.1 lots (MT5)

- Lot restriction per ticket

- 100 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

Standard account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

XM zero accounts

- Base currency options

- USD, EUR, JPY

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 0 pips

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 100$

The figures above should only be regarded as reference. XM is ready to create custom-tailored forex account solutions for every client. If the deposit currency is not USD, the amount indicated should be converted to the deposit currency.

You may be new to forex, so a demo account is the ideal choice to test your trading potential. It allows you to trade with virtual money, without exposing you to any risk, as your gains and losses are simulated. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

What is a forex trading account?

A forex account at XM is a trading account that you will hold and that will work similarly to your bank account, but with the difference that it is primarily issued with the purpose of trading on currencies.

Forex accounts at XM can be opened in micro, standard or XM zero formats as shown in the table above.

Please note that forex (or currency) trading is available on all XM platforms.

In summary, your forex trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

Similarly to your bank, once you register a forex trading account with XM for the first time, you will be required to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details.

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients’ members area are provided and constantly enriched with more and more functionalities and therefore giving our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your trading account login details will correspond to a login on the trading platform which matches your type of account and is ultimately where you will be performing your trades. Any deposits/withdrawals or other changes to settings you make from the XM members area will reflect on your corresponding trading platform.

What is a multi-asset trading account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices cfds, stock cfds, as well as cfds on metals and energies.

Multi-asset trading accounts at XM can be opened in micro, standard or XM zero formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM webtrader.

In summary, your multi-asset trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

- 3. Access to the XM webtrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details that will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including the depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients members area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform which matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM members area will reflect on your corresponding trading platform.

Who should choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, cfds on stock indices, as well as cfds on gold and oil, but it does not offer trading on stock cfds. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.

Access to the MT4 platform is available for micro, standard or XM zero as per the table above.

Who should choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices cfds, gold and oil cfds, as well as stock cfds.

Your login details to the MT5 will also give you access to the XM webtrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for micro, standard or XM zero as shown in the table above.

What is the main difference between MT4 trading accounts and MT5 trading accounts?

The main difference is that MT4 does not offer trading on stock cfds.

Can I hold multiple trading accounts?

Yes, you can. Any XM client can hold up to 8 trading accounts of their choice.

How to manage your trading accounts?

Deposits, withdrawals or any other functions related to any of your trading accounts can be handled in the XM members area.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

XM minimum deposit amount

The minimum deposit at XM is $5.

Check the following comparison table to see how XM stacks up against similar brokers when it comes to minimum deposits:

| XM | XTB | etoro | |

|---|---|---|---|

| minimum deposit | $5 | $0 | $200 |

Besides the XM minimum deposit for standard and micro accounts, there is a $100 minimum for XM zero accounts and $50 for XM ultra low accounts.

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at XM. Here are the main pros and cons when it comes to depositing at XM:

| Pros | cons |

|---|---|

| • credit/debit card deposit | none |

| • no deposit fee | |

| • several account base currencies |

Visit broker

78.04% of retail CFD accounts lose money

Why does XM require a minimum deposit?

Online brokers sometimes require a minimum deposit in order to cover their initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

In some cases, the very high minimum deposit (like the £1 million amount at the VIP account of saxo bank) is there to differentiate the level of services they offer you.

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

XM minimum deposit

XM deposit fees and deposit methods

XM does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about XM fees, check out the fee chapter of our XM review.

While there is no deposit fee at XM, the available deposit methods are also important for you. See how XM deposit methods compare with similar online brokers:

| XM | XTB | etoro | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | yes | yes | yes |

| electronic wallets | yes | yes | yes |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to XM is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to XM on their official website:

Visit broker

78.04% of retail CFD accounts lose money

XM minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| XM | XTB | etoro | |

|---|---|---|---|

| number of base currencies | 11 | 5 | 1 |

Luckily, XM stands out from the majority of online brokers by supporting not only the main currencies but some smaller ones as well. The benefit of this for you is that XM is very likely to support the currency you want to deposit in and won't have to convert it. The conversion would mean extra costs, as a conversion fee is charged.

A convenient way to save on the currency conversion fee if you wish to fund your brokerage account from a currency different from your existing bank account can be to open a multi-currency digital bank account. At revolut or transferwise the account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

XM minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to XM might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.