How to make money online forex trading

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades.

Top-3 forex bonuses

They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away. Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How to make money trading forex online

Chances are at one time or another, you’ve been asked by well-meaning friends to join the train of online forex traders. Or your interest has been piqued by the business and you’ve been told by numerous online sources that the best way to make money is trading forex online. Either way, it’s always important to understand the pros and cons of any venture you wish to embark on. Best believe it, it is not always bright and shiny in the online forex trading world.

Pros

- It is easy to trade in online markets

- You have access to a great amount of leverage making it easier for small retail traders to start their journey even with little capital

Con

Are the stories real? Can you make A living trading forex?

The internet today is rife with numerous forex trading victories. Are they just another cheap PR to get unsuspecting victims to embark on forex trading? The truth is there have been plenty of genuine forex trading success stories. But it all depends on you. How willing are you to work? How ready are you to learn the process?

Professional forex trader ezekiel chew has put down some seven noteworthy ways to become an excellent forex trader, beat the majority, and scale to impressive heights.

1. Learn the trade before you trade

Despite how exciting the process of trading may seem, it is always better you look, or in this case study, before you leap. That’s right. The better part of your excitement should be spent learning the art of trading.

Any tom, dick, and harry can open an account and start trading, but it takes so much more to make the money you dream of. Not to mention the tendency to be easily frustrated and to incur huge amounts of debt when you do not understand the process well.

How can you learn? A proper forex trading course is the best place to start your journey towards a successful forex trading path. They’ll teach you all the rudiments of trading independently and provide you with ample knowledge of trading strategies for the long run. You’re also sure to get follow on support when you embark on trading.

Make sure to be wary of scammers who promise quick success in a short period. A simple hack is that a good trading school will never promise such. They’ll only promise to teach you everything you need to know to trade effectively.

2. Set up A demo trading account

If you want to practice the trading process and get accustomed to the nitty-gritty involved, a demo account is an answer to your prayers. It enables you to practice forex trading on a “demo” capital, which is not real capital. This is because a demo account does not require capital to function.

Some of the perks are it helps you to get used to the trading interface and the process of placing orders on dummy trades. So when you do eventually start really trading, your boat would be smooth-sailing. A demo trading account provision is available on several trading platforms.

3. Beginning A piecemeal at A time

Trust us, you do not want to throw in a large amount of money at the initial stage of your trading quest. For one thing, a lot is at stake when you do, plus the emotional upheaval this may cause.

As a newbie, it’s best you start trading with a small amount of money and in the process, master the skill. You'll also have a lesser tendency to risk your account in the process. Leverage and margin also give you the ability to start really small. A good trading school will teach you all you need to know about leverage and margin.

4. Do not feel overwhelmed; price action is all that matters

Do not fall into the bandwagon of nouveau traders who clutter their chart with so many indices. Best believe it, at the end of the day, price action trading is all that matters. This cluttering of your chart also diverts your attention from what matters in the grand scheme of things, and you’re often rendered immobile from the numerous factors to consider.

And of a truth, technical analysis is not hard to decipher. It’s all about buying at very low prices and selling at a high price. The same way a trader would want to purchase goods in a store or from a manufacturer at low prices and sell to customers at a high price.

You will find that a good number of institutional traders do not care to crowd their charts with several indicators. They simply analyze prize levels and make a decision either to buy or sell within these prize ranges.

5. Find A forex trading strategy that works

We like to think that several indicators on a chart are like several stick-it notes on a refrigerator. You most likely placed them there to remind you of important things. But because they are many, they end up confusing and even frustrating you.

A good forex trading strategy that works need not be complicated. What is important is that it gives you an edge in the market. Look at trading in the long run. When your wins are more than your losses, you will be profitable. Finding the right forex trading strategy that is time tested through a series of successful backtesting is highly important.

Start off by mastering one strategy in a single pair. Swing trading strategies are one of them. Only move on to the next pair or strategy when you are profitable in a series of three sets of 20 trades. This way, you have a clear idea on whether or not you are profitable when compared to someone who is trading a range of different strategies and various pairs.

6. Trade within your limit

It is important to remember that a lot could go wrong with any trade at any given time. Do not be tempted to trade outside your accepted risk exposure in a week. Especially as a new trader, you could easily bankrupt your account in a short time when you trade above your limit.

Another advice is to count your losses and never keep a trade beyond the loss of its value. If chances allow, you ought to move to protective stop loss to decrease your losses. You also want to go the extra mile of protecting your profits by taking profits at strong levels.

One more thing: you should make use of trailing stops to protect winnings and at the same time creating an avenue for it to grow.

7. Keep track of your trading journey

There’s a reason why companies hire firms to audit their account. While your forex trading may not be the same as a company, they are both business ventures with the aim of making a profit. This way, you can determine how your trading has been going within a period of time. Your losses too should be accurately accounted for.

Keeping a record also serves as a practical lesson. Trading is essentially a lot of learning and a little doing. How fast you learn from your mistakes and apply your newfound knowledge will go a long way in projecting your profits and boosting your morale.

We understand that the art of forex trading can prove to be an emotional rollercoaster especially for the newly indoctrinated. However, it is important to take any losses with a grain of salt, for it is a part of the whole process of trading. Sometimes you win, other times you lose. What is important, however, is that you learn from your losses and wins too.

One strategy is to always make plans and be deliberate about those plans. Try to map out a clear cut pattern to attain any goal you set. Diligence and experience are what make a successful forex trader. And a right attitude to loss is what makes it a learning experience.

Some of the things you could include in your record taking include:

- The date the trade was made

- Screenshot of the chart of every trade

- Explanation of where the trade was taken and reasons for the execution

- Write out your performance in the trade

- Write out how your performance makes you feel.

Creating a word document can help with all this.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

4 ways to make money through forex trading

The forex market size is almost $1.93 quadrillion, which means the market is 2.5X larger than the global GDP.

Nearly 5.3 trillion dollars are traded every day in the forex market. It shows the enormous amount traded on this market to make money. But is it for real or just a fad?

Forex trading is seen as a real currency generator if you are a skilled currency trader. However, if there is excessive leverage in the forex market, then it can lead to losses. Traders need to have the right market strategy to gain an edge over the forex market.

Placing a trade in this market is quite simple, and the financial mechanics found are similar to that of the stock market. People who possess good experience in trading will pick the trading quite quickly. Go through these important ways to know how you can make a good amount through forex trading.

Make money through right trading strategies

You can be a veteran trader or a beginner, just starting with trading. But, be abreast with the right forex trading ways. It is not sensible to put your money at stake without studying the forex market. Now, let’s see a few ways to make money through forex trading.

Study the currency pair-up

You must pick a base currency or a home currency when you get a chance to register as a forex broker. After depositing the amount in your account, you can either choose your home currency or opt for the worldwide currencies. Like, if you possess a US dollar trading account. Here, you can trade the string currencies like euro and UK pound as well. The present-day forex trading does not restrict the currency pairing up for the traders.

Keep an eye on the financial market

The investors, forex traders, organizations, and government agencies transact in the open market to meet their financial needs. Many corporate users might change their currency pairing, watching the rise in other currencies. When you investin the forex market, you need to keep an eye on rising and falling prices. Choose an optimal price before exiting from the financial market.

You must be aware of different financial markets and instruments like indices, commodities, and shares. Learn about the varied types of catalyst approach and market analysis to master the fiancés move in your country’s financial market.

Take broker’s leverage services

A few brokers provide leverage like 1:30, 1:50, 1:100, and it moves accordingly. The leverage may not help you make that much money, but it helps boost profit if used wisely. This technique helps even small forex traders to make money with a nominal amount.

Let’s understand the leverage with this example. You have £100 with no leverage, so if the price moves just 3%, then you will make a £3 profit over this currency. On the other hand, if you have procured leverage services, you will open with a value of £5,000. Here, a 3% move ‘in your favor’ will get you £150.

One thing worth noting here is that you may increase your profits when you use leverage or margin trading but can lose money too. So, choose wisely or opt for it for lesser time.

Go for demo account first

Now, you are aware of the financial market, commodities, indices, etc. The time has come to open a forex account to invest money and start trading to make profits. The veteran traders can begin with a real-money account if they are abreast of new financial rules and trends.

However, beginners must opt for the demo account first. Reputable forex brokers in the united kingdom offer both demo and real-money accounts. But, beginners must start trading with paper money. The market scenario is similar to a real-money account. The prices will be close to real-money accounts.

With a demo account, you will access educational material and forecasts rendered to real-money account traders. You must only switch to a real-money account from the demo account when you feel you are ready. The reason being it involves real capital.

Conclusion

Forex market is not a cakewalk but includes many strategies to understand the performance of the financial market. You cannot invest your hard-earned money landing in losses. The beginners must take the services from reputed brokers.

It will help them learn the fundamental and technical aspects of forex trading. You must get access to the broker who provides enough material and forecasts. It is better to learn on the demo account rather than risking your real money. These are a few ways to make money through forex, but you can hire a good broker to get insightful details.

How to make money in forex: A beginner’s guide

Would you like to know how to make money in forex? That question is asked by day traders every single day.

Forex is the biggest financial market in the world. When you look at the market, you’ll find that it’s run by large corporations and day traders like yourself.

The difference between the corporations and the day traders? Only 4% of day traders make money. The others lose money and quit trading.

As a beginner trader, you’re going to need to know how you can escape the bottom 96% of traders and make it into the upper echelon of day traders.

Keep reading to learn the basics of forex and top strategies used by the pros.

What is forex?

Forex stands for foreign exchange. It’s also known as FX in trading circles. That’s how currencies from all over the world are traded.

You might have traded on forex and not even known it. Have you ever traveled outside the country? You probably had to exchange money, whether for a euros, pounds, or dollars.

That’s part of forex trading and there are $5 trillion traded every day.

When you exchange money, you sell the currency you have and you buy another currency. Everything is bought and sold in pairs.

The value of each currency fluctuates and depending on the timing of your trades, you can either make money or lose money.

For example, if you think the US dollar is going to decline further, then you can sell it now and exchange it for a currency you think will increase, like the euro. This trade will show up as USD/EUR, wince they’re in pairs.

Forex trading goals

If you want to know how to make money in forex, you have to start with your trading goals. After all, if you don’t set goals, forex is just another expensive hobby.

When you first start out, don’t set dollar amounts. Since there’s so much to master in the process, set goals according to learning different processes.

Once you get more experience, then you can set goals based on financial results.

You need a good broker

In order to start trading, you need to sign up with a broker or financial institution. They’ll have the trading platform available to make trades in forex.

When you pick your broker, you need to have 24/7 access to the trading platform. Forex is always running and trades are always being made. Remember, it’s always 5 pm somewhere.

The trading platform you choose is going to play a big role in your ability to learn how to make money in forex.

It’ll be different from trading cryptocurrency software, and there are plenty of platforms to try out. Most brokerages do have demos to test, and it would be wise try out a few before settling on one.

You’ll want to be sure that you choose a broker that offers the types of accounts you want, how you can withdraw money and what the deposit is.

Some brokers offer no deposit bonuses, where you don’t need to make a deposit, but you’ll get a small bonus if you meet certain requirements. You can find out more about that here.

Learn different forex trading strategies

Once you have your broker account set up, you’re going to want to practice and play with different trading strategies before you start trading for real. These are the most common forex trading strategies that you’ll hear other traders talk about.

#1. Analysis trading

Analysis trading is the process of looking at and analyzing data to try to predict currency trends. There are two ways to analyze data: technical analysis and fundamental analysis.

With technical analysis, you look at currency trends. If a currency has been slowly going up, you determine if it will stay on that runes or not. With this type of analysis, you assume that traders buy on emotional factors rather than data.

A fundamental analysis looks at the economic fundamentals of a country. The unemployment rates and GDP are typical indicators traders will use to see if a currency is overpriced or not.

#2. Momentum trading

With momentum trading, traders will examine the ups and downs in a currency. They’ll look at the number of trades and the price of the currency.

If a currency is trading up or down, a trader will assume that momentum will continue. If that momentum starts to shift then the trader assumes the trend will reverse.

#3. Position trading

If you want to make a long-term trade, position trading is for you. You take your fundamental and technical analyses and figure out a currency’s trend over several months or several years.

This is all about the long game. Currencies go up and down several times a day and you will if you be patient and wait through down moments where you’d be tempted to sell.

Pick your account type

When you start trading on forex, you have three account options. They are standard trading accounts, mini trading accounts, and managed trading accounts.

You’ll need to know what the risks are for each account type. Some are better in situations where you’re going to spend a lot of time trading, and others are good if you plan to invest small amounts of money on the market.

The success mindset

If you want to make money trading in the forex market, you’re going to need the right mindset for it. Anything revolving around money can be emotional for people, and it’s not uncommon for people to buy and sell solely on emotion.

How do you take the emotions out of trading? Have a system in place that you can stick to. Know how much you can trade, how much risk you can take, and how much loss you can withstand.

When you make a trade, you have to know why your strategy and goals are and stick to them.

Otherwise, you might as well be playing slot machines at the casino.

How to make money in forex

Learning how to make money in forex is one of the skills traders would love to have.

It doesn’t happen overnight, but with time and practice, you can be a skilled forex trader. You need to know the strategies in play and when to apply them.

For more great tips on making money online, check out our blog.

Forex training group

With the addition of many new participants in the market, and the advances in electronic trading, the foreign exchange market has become more efficient. And with the considerable number of new traders entering the market, you must be more prepared than ever to make money trading forex.

While the title of this article implies a how-to guide to making money in the forex market, successful trading is a much more profound topic. How money is made in the currency market by traders on a consistent basis, depends largely on the traders themselves. The following sections of this article will answer several questions people often have about how to make a living trading the foreign exchange market.

Can you make money trading forex?

There are some misconceptions around trading, but the simple answer to the above question is “yes”, you can indeed make money trading in the forex market; however, you can also lose significantly as well. Several different options exist to make money trading forex.

The first and easiest option is to find a professional or managed fund to trade for your account. This option is for people with sizable bank accounts that don’t want to have to watch the market themselves. They may have researched a professional trader, CTA, or hedge fund that they consider would do an excellent job managing their account.

One must be aware that due to the mostly unregulated nature of the over the counter currency market, the possibility of dishonesty exists. Therefore, if you trust another trader or company to manage your funds, make sure that you have done your due diligence and vetted the trader completely before giving them your hard-earned money.

The second way to make money in the forex market is by opening an account with an online forex broker. This option is available to most people because an account can be opened with as little as $100 and you can begin trading immediately.

While the second option may seem viable for most people, having a sound knowledge of the forex market and being disciplined is imperative to achieving any kind of success in the retail forex market. To make money trading online, the prospective retail forex trader should really start out by formulating and testing a plan of action commonly called a trading plan.

The trading plan should be easy to follow and include position sizing and money management elements. The plan is specifically designed to avoid having emotions get in the way of your trading. Most successful forex traders use a trading plan and many will credit their success to adhering to it.

One of the best ways to prepare in the forex market is to test and back test your trading plan in an online forex demo account. The demo account allows you to implement your trading plan without committing any real funds. Demo accounts can be opened at most online brokerages with relative ease.

Much like committing funds to a company or professional trader, due diligence should be exercised in the selection of an online forex broker. Ideally, the broker should be regulated by a reputable agency in the united states, the united kingdom, australia or the european union. You may want to avoid unregulated brokers based in places like the cayman islands or other offshore areas.

How much money can you make trading forex?

How much money can you make trading forex?

The amount of money that can be made in the forex market depends on the amount invested and the risk taken.

The spot forex market is one of the few places where a nominal investment can be turned into a sizable account with proper management techniques.

Nevertheless, due to the volatility in the market, holding a position could present a problem if stop loss orders are placed too close. The market tends to locate stop orders and reverse after taking out the stops. This happens often, and could take you out of your position for a loss despite being right on the direction of the market.

In order to start making money in forex trading as a retail trader, you will first need to set up a trading account with an online forex broker and fund it. Remember to only fund your trading account with risk capital that you can afford to lose. You can then work on educating yourself about the forex market and developing a trading plan that you will need to be able to stick to in a disciplined manner.

How to make money trading currency?

Although trading currencies to make money is not exactly easy, several strategy categories have become popular among forex traders and are probably worth exploring to see which best into your lifestyle and personality type.

Some of the more popular ways traders look to make profit in forex include the following strategies that are ordered according to the length of time that positions are typically kept by traders employing those strategies.

Day trading – day trading refers to the process in which all positions are traded and closed out within the same trading day. Since the forex market trades 24 hours from sunday evening until friday evening new york time, the trading day for a specific trader will probably just include the normal business hours in the time zone in which the day trader is located. The idea behind using this forex trading strategy is that the trader’s positions are not exposed to overnight price action fluctuations or the risk of trading on wider dealing spreads in the overnight market.

Another benefit is that the day trader is always awake, alert and available to execute transactions while their positions are open. Day trading positions are generally all closed out before the chosen market’s closing time for each particular trading day. Day trading is quite common among professionals working as bank traders, but online trading has made day trading much more accessible to just about anyone who wishes to trade forex from home.

A specialized type of day trading is known as scalping where the trader’s objective is to capture small profits within a few minutes of initiating a trade. Professional market maker attempt to do something similar when trading out of a position given to them by a client in order to capture as much of the bid offer spread as possible.

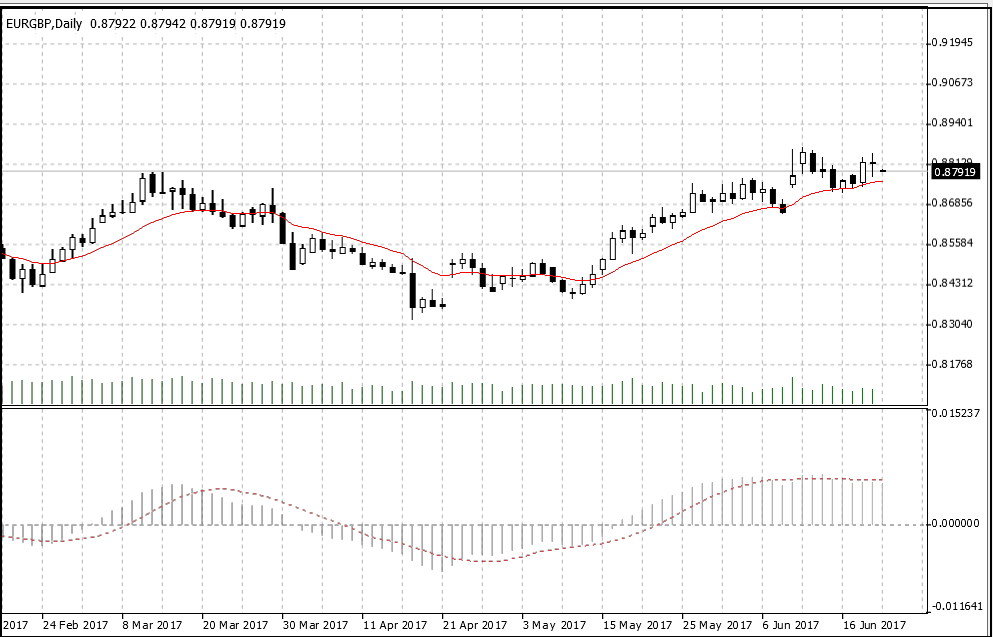

Momentum trading – when using a momentum or impulse trading strategy, a trader identifies suitable position entry points by using price action analysis or a combination of technical indicators. As the chart shown in figure 1 below shows, the first indicator might be an exponential moving average that measures the inertia of the market and helps identify up and down trends as it respectively rises and falls. The strategy can then use another indicator that measures the market’s momentum, such as the moving average convergence divergence or MACD histogram.

This sort of trading strategy might be described as “going with the flow” once the direction of market momentum has been identified. The oscillating indicator’s slope reflects the shifting preponderance of buyers compared with sellers in the forex market. When the slope of the MACD rises, buyers increasingly predominate, but when it falls, then sellers tend to predominate. A trade entry signal is generated by this momentum system when both the moving average and MACD indicators are moving together in the same direction, while an exit signal is generated whenever they diverge and move in opposite directions. The time frame of MACD and moving average indicators is generally set at a level that is consistent with the trading horizon a trader wishes to operate in.

Figure 1 – daily chart of EURGBP with an exponential moving average superimposed over the exchange rate in red and the MACD displayed in the indicator box.

Swing trading – swing trading involves the often-elusive attempt by forex traders to “buy low and sell high”. Swing traders will use technical analysis and various indicators with overbought or oversold levels that are often used to determine what exchange rates are priced high and which are priced low. Such technical studies can also be used to determine the optimum stop loss or take profit order levels that can also be strategically situated around key support and resistance areas identified by the trader on the exchange rate chart. Swing traders generally keep their positions open for more than a single day, but for less time than would be typical with most of the trend following trading strategies that will be discussed in the next section. Many traders prefer swing trading because they can profit from both trend following moves and subsequent counter-trend corrections.

Trend trading – trend trading has to be one of the most popular of the long term forex trading strategies and would best be described by the financial market maxim: “the trend is your friend.” A trend trader will often use technical analysis techniques. They might draw trend lines based on observed sequences of highs and lows. This helps them identify the underlying trend and observe the existence of chart patterns, as well as identify channel breakouts when they occur.

They might also overlay price charts with short and long term moving averages in order to find crossovers that signal the short-term trend in the exchange rate is changing relative to the longer-term trend.

In such systems, when the short moving average crosses above the longer moving average, then that generates a buy signal, while when it crosses below the longer term moving average, it generates a sell signal.

The forex market often display notable trends due to underlying changes in the business cycle and benchmark interest rates that reflect the monetary policy set by central banks. If a trader identifies such a trend, they generally plan on taking a position on a correction or counter trend move within the overall trend. They then can plan on riding the market in the direction of the trend for as long as they can until they are stopped out via their trailing stop. Trailing stop loss orders are an effective trade management tool for trend traders, as it acts to move or ratchet up in the direction of the trend accumulated profits, so that it can be protected from sudden pullbacks in the market.

Not all of these strategies will feel right for every trader depending on their personality, so you might want to try several of them out to see which one is the best fit for you.

Professional forex trader vs. Self employed forex trader

Professional forex trader vs. Self employed forex trader

The amount of money that forex traders can make depends on many factors – whether they are employed by a financial institution, a fund management firm, or if they are a self-employed retail forex trader with extensive experience, or a novice trader just starting out.

Generally, professional forex traders who are working for a bank or other financial institution generally earn a salary plus a performance related bonus from their employers. Their trading activities tend to revolve around market making, scalping and day trading, although some do take longer term strategic positions. Due to the benefit they experience by acting as market makers to clients who deal on their spreads, most bank traders are quite profitable, or they rather quickly find themselves out of a job.

Professional fund managers who trade foreign exchange with funds under management will also typically receive a salary from their firms. Nevertheless, unlike bank traders, they might have a bonus calculation to determine their total earnings that is more explicitly expressed as a certain percentage of profits actually earned in the funds they are managing, such as 20 percent of profits for example.

Although some fund managers do take short term positions, most of them tend to take longer term positions based on a proprietary trading strategy or system. They have the support of their firm and can allocate money into developing winning strategies and automating their trading plans. Also, the large size of their trading positions can often move the market in their favor, at least initially.

In contrast to the professional traders mentioned, most retail forex traders are usually self-employed when it comes to their trading activities, and so they only make money if their trading efforts are actually profitable. Some especially good retail traders with a strong track record can also earn money from the associated profitability of their trading followers if they allow others to follow them using a social trading platform.

Most retail forex traders typically only trade in small sizes, so they cannot move the market like fund managers. Also, they are forced to pay away the bid offer spread each time they deal, so they do not share the ability of market makers to profit from quoting prices to clients.

Perhaps as a result, estimates of the profitability of retail forex traders is actually very low, with some sources reporting that as many as 90 percent of private operators fail to earn money in forex trading.

How stressful is trading forex for a living?

Professional forex traders and market makers can be very busy quoting prices for customers and managing the risk associated with trading on those prices. It can certainly be a fast paced and stressful environment. Professional traders also usually have a number to meet in terms of their overall annual profitability, so if they fall short of that amount, they may risk losing their jobs or getting a reduced performance related bonus.

The same sort of position-taking stress level can affect fund managers who often take considerably greater risks over longer periods of time. Nevertheless, they usually are not as active when it comes to trading, so they can relax and watch the market between deals.

For retail forex traders, their hurdle and main stress factor involves how well they can cope with losing money on trades. Their stress level may also vary depending on how often they put themselves in risky situations or the number of open positions that they actively manage.

Most traders will deal with stress differently as they trade, but there are certain psychological profiles that many traders fall within. Some people with a more impulsive personality type may be psychologically less suitable for a risk-taking profession like trading and may find it more difficult to deal with uncertainty inherent in the market.

Other traders, like those with the strategic trader personality type for example, seem to be more careful about taking only good trades that fall within a well-planned out trading strategy. And so, their stress level is often lower because they know exactly what they are going to do in a particular circumstance that might arise

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

So, let's see, what we have: here is a scenario for how much money a simple and risk-controlled forex day trading strategy can make, and guidance on how to achieve that level of success. At how to make money online forex trading

Contents of the article

- Top-3 forex bonuses

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- How to make money trading forex online

- Pros

- Con

- Are the stories real?...

- 1. Learn the trade before you...

- 3. Beginning A piecemeal at A...

- 4. Do not feel overwhelmed; price action...

- 5. Find A forex trading strategy that...

- 6. Trade within your limit

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- Fxdailyreport.Com

- What is copy trading ?

- Fxdailyreport.Com

- What is copy trading ?

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- 4 ways to make money through forex trading

- The forex market size is almost $1.93...

- Make money through right trading strategies

- Study the currency pair-up

- Keep an eye on the financial market

- Take broker’s leverage services

- Go for demo account first

- Conclusion

- Make money through right trading strategies

- How to make money in forex: A beginner’s guide

- What is forex?

- Forex trading goals

- You need a good broker

- Learn different forex trading...

- Pick your account type

- The success mindset

- How to make money in forex

- Forex training group

- Can you make money trading forex?

- How to make money trading...

- How stressful is trading forex for a...

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion: