Tickmill spread

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

Top-3 forex bonuses

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Tickmill review

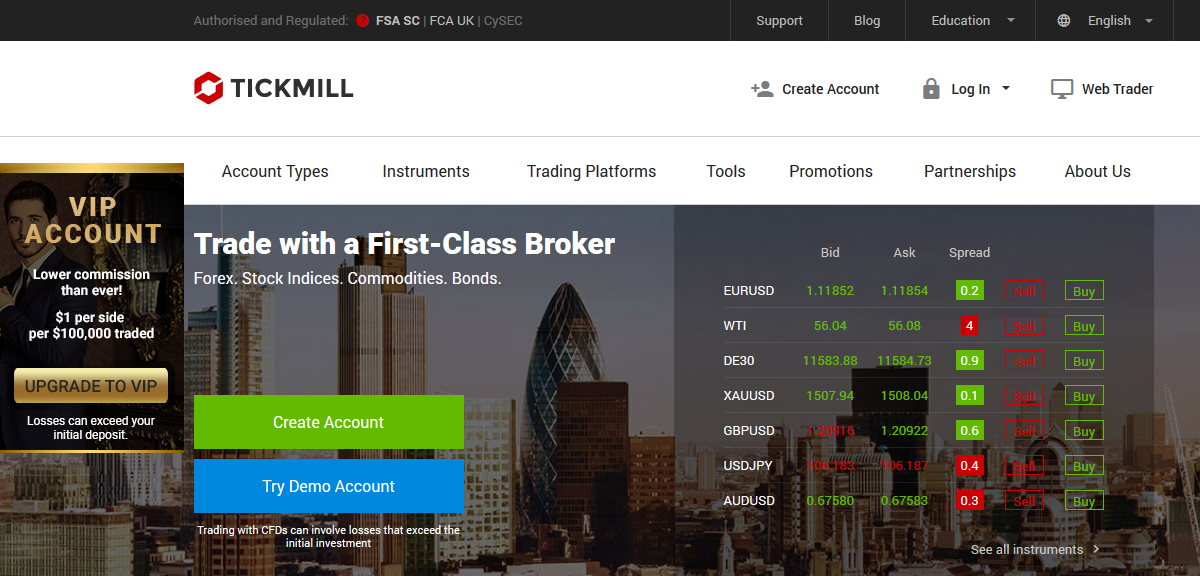

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least $25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

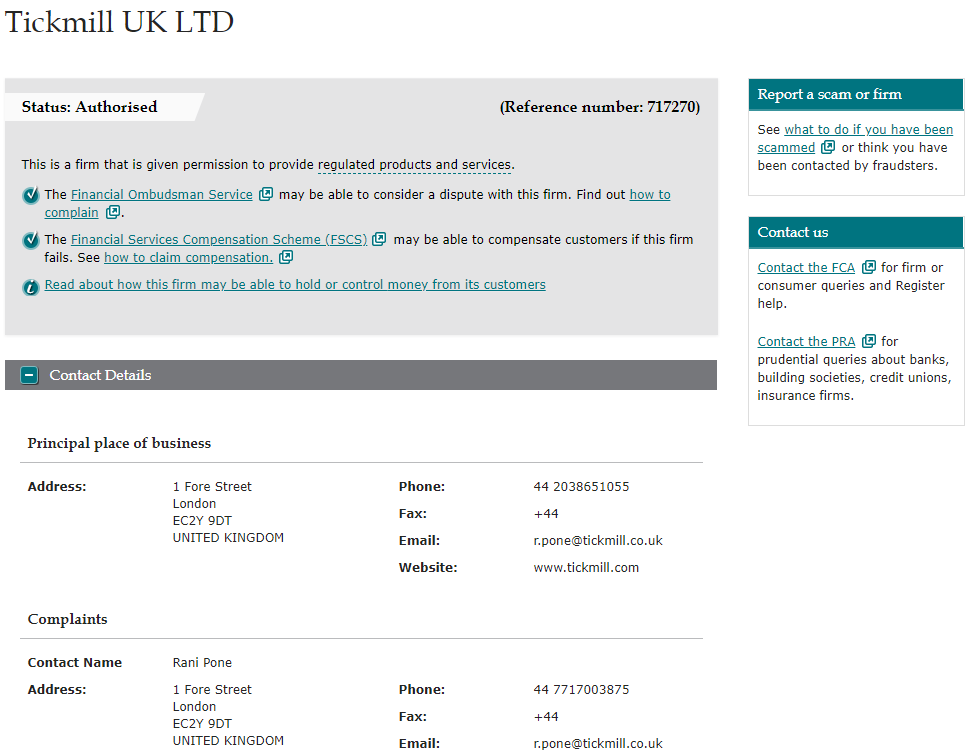

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

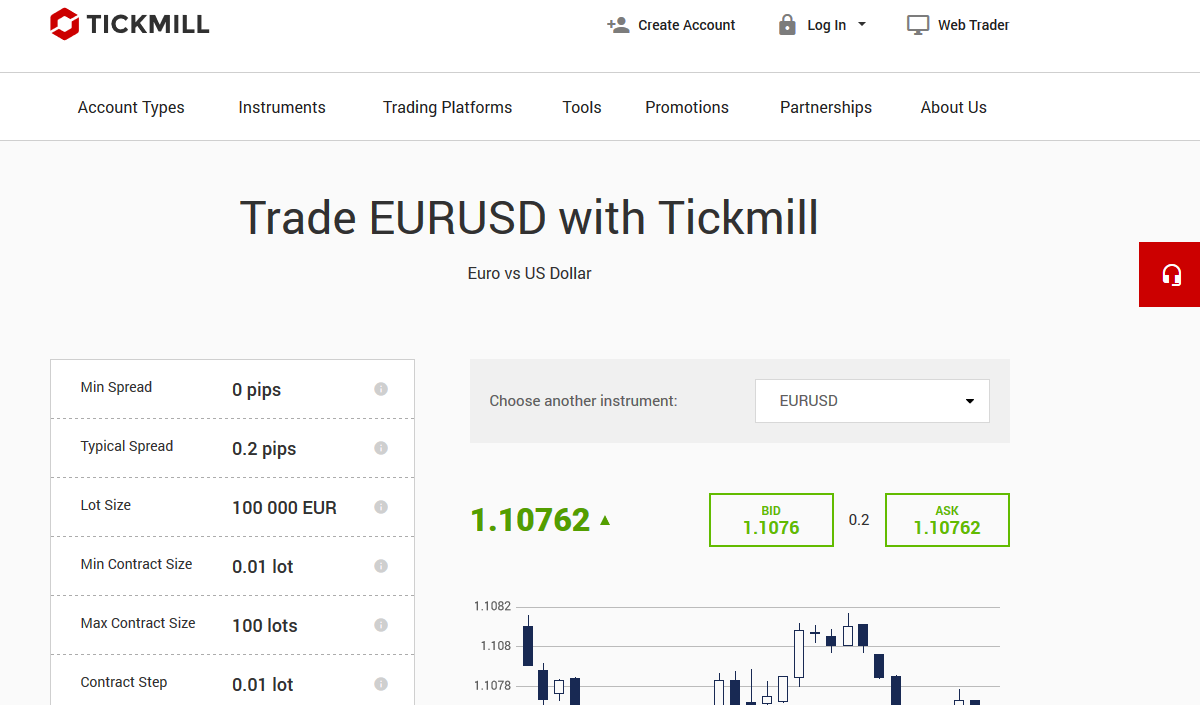

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

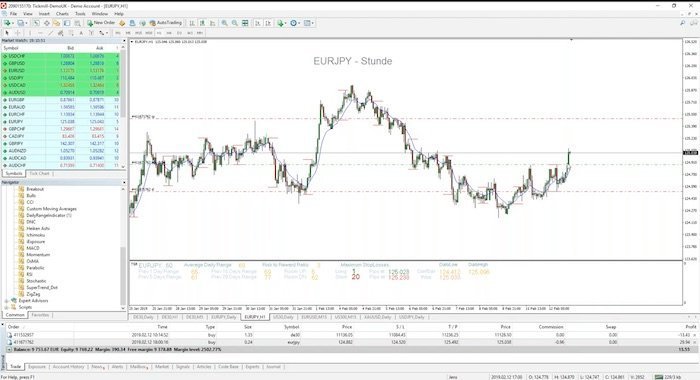

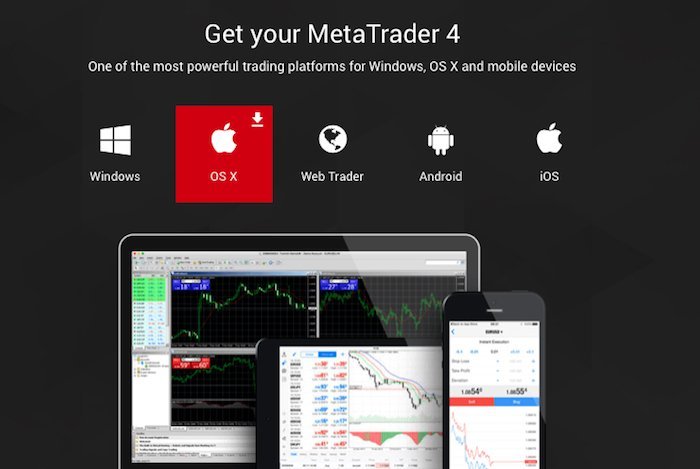

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

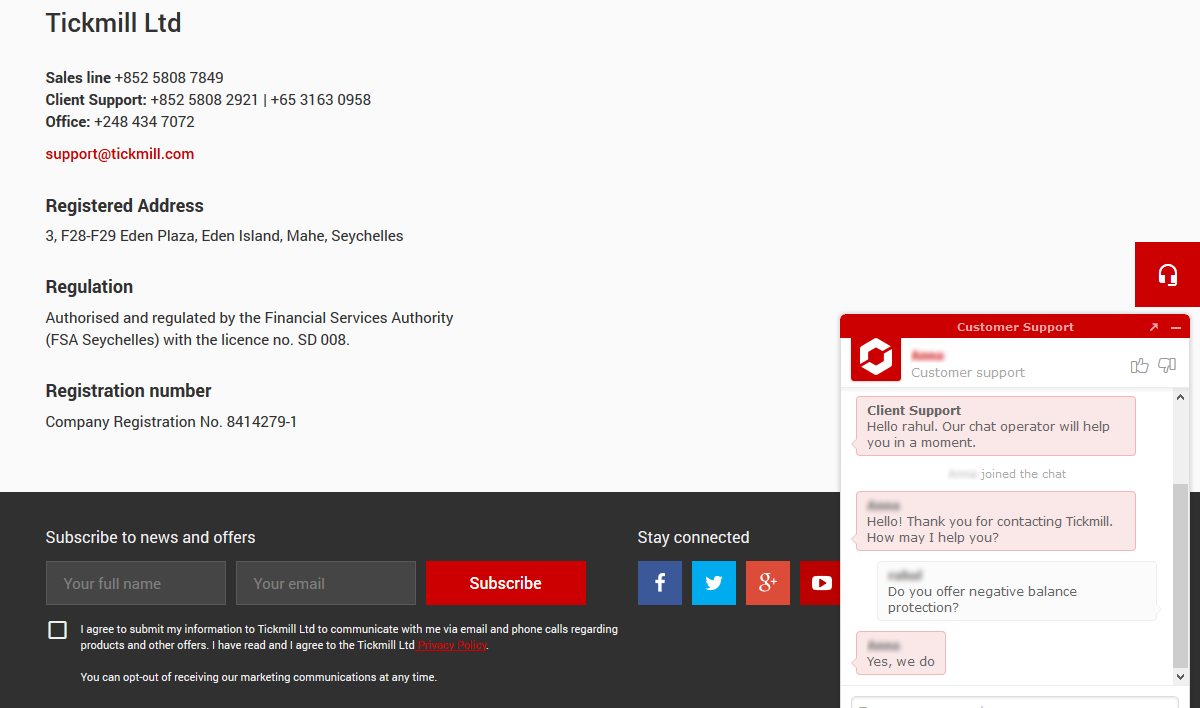

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Spreads & swaps

Knowing the transaction costs associated with your trading

Trading costs

with ultimate transparency

Check out our typical spreads and swaps below.

What are forex spreads?

When you begin trading, you’ll notice that you’re given a ‘bid’ (or ‘sell’) price and an ‘ask’ (or ‘buy’) price. The ‘bid’ is the price at which you sell the base currency, and the ‘ask’ is the price at which you buy the base currency. The difference between these two prices is what we call the spread.

When a trade is opened, there are always third parties who facilitate the opening and closing of that trade, like a bank or a liquidity provider. These third parties must make sure that there is an orderly flow of buy and sell orders, which means that they have to find a buyer for every seller and vice versa.

The third party is accepting the risk of a loss while facilitating the trade, thus the reason the third party will retain a part of each trade – that retained part is called the spread!

How do you

calculate the spread?

How do you calculate your transaction cost?

To work out the cost of a trade itself (not including swaps, commissions etc.), you take the spread and pip value and multiply it by the number of lots that you’re trading:

trade cost = spread X trade size X pip value

For example:

A trade you have opened has 1.2 pips spread. In this example, you’re trading with mini lots which are 10,000 base units.

The pip value is at $1, so the transaction cost is $1.20

As you’ve probably gathered, the bigger the trade, the larger your transaction costs will be!

What are swaps?

Important swap/rollover rate facts

swap rates are applied at 00:00 platform time. Each currency pair has its own swap charge and is measured on a standard size of 1 lot (100,000 base units). Swaps are applied each night onto your open positions and when the position is left open it is given a new ‘value date’. On wednesday night however, the new value date for a trade held open is changed to monday. Due to this, swaps are charged at triple the rate. Check your swaps on your MT4 market watch panel. You simply right click, select ‘symbols’, select the instrument and then select ‘properties’.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spreads e swaps

Conheça os custos associados às suas negociações

Spread e swaps

Confira abaixo, os nossos tipos de spreads e swaps.

O que são os spreads no forex?

Ao iniciar com as suas negociações, você perceberá que recebe um preço de "bid" (ou "venda") e um preço de "ask" (ou "compra"). O "bid" é o preço pelo qual você vende a moeda base e a opção "ask" é o preço pelo qual você compra a moeda base. A diferença entre esses dois preços é o que chamamos de spread.

Quando uma ordem é aberta, há sempre terceiros que facilitam a abertura e o fecho dessa mesma ordem, como um banco ou um provedor de liquidez. Esses terceiros devem garantir que haja um fluxo ordenado de ordens de compra e venda, o que significa que eles precisam encontrar um comprador para cada vendedor e vice-versa.

O terceiro está a aceitar o risco de uma perda enquanto facilita essas negociações, portanto, a razão pela qual o terceiro reter uma parte dessas negociações - essa parte retida é chamada de spread!

Como é que você poderá

calcular o spread?

Como é que você poderá calcular os seus custos nas negociações?

Para calcular o custo de uma ordem, você pega no valor do spread e no valor do pip e multiplica pelo número de lotes que você está a negociar:

custo da ordem = spread X volume da negociação X valor do pip

Por exemplo:

uma ordem que você abriu tem 1.2 pips de spread. Neste exemplo, você está a negociar com mini-lotes, que são 10.000 unidades base.

O valor do pip é de $1, portanto, o custo da transação é de $1,20

Como você provavelmente verificou, quanto maior o volume de negociação, maiores serão os custos de transação!

O que são os swaps?

Importantes factos sobre a taxa swap/rollover

as taxas de swap são aplicadas às 00:00, no horário da plataforma. Cada par de moedas tem a sua própria taxa de swap e é medida em um volume padrão de 1 lote (100.000 unidades base). Os swaps são aplicados a cada noite, nas suas posições abertas e quando a posição é deixada em aberto, é dada uma nova "data-valor". Na noite de quarta-feira, no entanto, a nova data-valor para uma posição em aberto é alterada para segunda-feira. Devido a isso, as taxas swaps são cobradas a triplicar. Verifique os seus swaps na "observação do mercado" do seu painel MT4. Basta clicar com o botão direito, selecionar "ativo", selecionar o instrumento e selecionar "propriedades"

COMECE A NEGOCIAR com a tickmill

É simples e rápido de começar!

REGISTRAR

Registro completo, inicie sessão na sua área de cliente e carregue os documentos exigidos.

CRIAR UMA CONTA

Depois de os seus documentos serem aprovados, crie uma conta de negociação live.

FAZER UM DEPÓSITO

Selecione um modo de depósito, aporte na a sua conta de negociação e comece a operar.

INSTRUMENTOS PARA NEGOCIAR

CONDIÇÕES DE NEGOCIAÇÃO

CONTAS DE NEGOCIAÇÃO

PLATAFORMAS

EDUCATIVO

FERRAMENTAS

PARCERIAS

PROMOÇÕES

SOBRE NÓS

SUPORTE

Tickmill é o nome comercial do grupo de empresas tickmill.

A tickmill.Com pertence e é operada dentro do grupo de empresas tickmill. Tickmill group é composto por: tickmill UK ltd - regulada pela financial conduct authority (FCA) do reino unido (número de licença: 717270 e sede: 3rd floor, 27 - 32 old jewry, londres EC2R 8DQ, inglaterra), tickmill europe ltd - regulada pela cyprus securities and exchange commission (número da licença: 278/15 e sede: kedron 9, mesa geitonia, 4004 limassol, chipre), tickmill south africa (PTY) LTD, FSP 49464, regulada pela financial sector conduct authority (FSCA) (sede: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd - regulada pela financial services authority de seychelles (número da licença: SD008 e sede: 3, F28- F29 eden plaza, eden island, mahe, seychelles) e sua subsidiária 100% proprietária procard global ltd (número de registro: 09592225 e sede social: 3rd floor, 27 - 32 old jewry, londres EC2R 8DQ, inglaterra), tickmill asia ltd - regulada pela financial services authority de labuan malásia (número da licença: MB/18/0028 e sede social: unidade B, lote 49, 1º andar, bloco F, lazenda warehouse 3, jalan ranca-ranca, 87000 FT labuan, malásia).

Os clientes devem ter pelo menos 18 anos para usar os serviços da tickmill .

Aviso de alto risco: negociar contratos por diferença (cfds) acarreta um alto nível de risco e pode não ser adequado para todos os investidores. Antes de decidir negociar contratos por diferença (cfds), você deverá considerar cuidadosamente os seus objetivos de negociação, nível de experiência e apetite ao risco. É possível que você sustente perdas que excedam o seu capital investido e, portanto, você não deve depositar dinheiro que não pode perder. Por favor, certifique-se que entende completamente os riscos e que toma os cuidados necessários para gerir o risco.

Este website não deverá ser considerado como um meio de publicidade ou de solicitação ,mas sim um canal de distribuição de informação. Nada neste website deverá ser considerado como um anúncio, oferta ou solicitação para o uso dos nossos serviços.

O website contem links para websites oferecidos e controlados por terceiros. A tickmill não inspeccionou e, por este meio, nega a responsabilidade por qualquer informação ou material publicado em qualquer um dos websites vinculados a este website. Ao criar um link para um website de terceiros, a tickmill não confirma, nem recomenda quaisquer produtos ou serviços oferecidos nesse website. A informação contida neste website destina-se somente para fins informativos, portanto não deverá ser considerada como uma oferta ou solicitação a qualquer pessoa, em qualquer jurisdição, em que tal oferta ou solicitação não seja autorizada ou a qualquer outra pessoa a quem seria ilegal fazer tal recomendação ou solicitação, nem considerada como recomendação para comprar, vender ou lidar com qualquer moeda em particular ou negociação de metais preciosos. Se você não tem a certeza de qual é a sua moeda local e quais os regulamentos para a negociação me metais preciosos, então você deverá deixar este website imediatamente.

Será fortemente aconselhável, antes de proceder com a negociação de moedas ou metais preciosos, obter aconselhamento financeiro, jurídico e fiscal de forma independente. Nada neste website deverá ser lido ou interpretado com um conselho por parte da tickmill, ou de qualquer um dos seus afiliados, diretores e colaboradores.

Os serviços da tickmill e as informações contidas neste website, não são dirigidas a cidadãos/residentes dos estados unidos da américa e, não se destinam a ser distribuídos ou, usados por qualquer pessoa, em qualquer país ou jurisdição, onde tal distribuição ou uso, contrariam as leis ou regulamentos locais.

Core spreads vs tickmill

If you're choosing between core spreads and tickmill, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, avatrade, as another alternative to consider.

What would you like to compare?

- Trading services

- Markets & instruments

- Platform & features

- Account features

- Trading conditions

- Risk management

- Funding methods

- Fees

update results

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

Core spreads is regulated by the financial conduct authority. Core spreads have provided forex trading services since 2014.

Tickmill is regulated by FSA SD008. Tickmill have provided forex trading services since 2014.

Avatrade is regulated by the central bank of ireland, ASIC (australia), FSA (japan), FSB (south africa) and BVI. Avatrade have provided forex trading services since 2006.

TRADING SERVICES OFFERED

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

English, spanish, russian, chinese, indonesian, and vietnamese

English, italian, german, french, greek, hebrew, spanish, arabic, malay, russian, chinese, portuguese and dutch

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by core spreads and tickmill

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

All information collected from https://www.Corespreads.Com/. Last updated on 01/01/2021.

All information collected from http://www.Tickmill.Com/. Last updated on 01/01/2021.

All information collected from http://www.Avatrade.Com/. Last updated on 01/01/2021.

Core spreads is an online trading service provider who are regulated by the financial conduct authority. To open an account with core spreads, minimum deposits start from £/$/10.

With core spreads you can trade currencies, stocks, commodities, indices. If you like to trade on the go, core spreads have iphone, ipad and android apps so you can trade from anywhere on your phone.

Core spreads offer their user friendly coretrader and the popular MT4 platforms to make your trades and also offer customer support in english.

The spreads offered by core spreads for the most popular instruments are:

0.7 EUR/USD 0.8 FTSE 100 0.4 GOLD

0.9 GBP/USD 1.0 DOW/JONES 3.0 crude oil

see all spreads

for more information about trading with core spreads, we have put together an indepth core spreads review with all the pros and cons about this broker.

Tickmill is an online forex trading service provider who are regulated by the financial services authority. To open an account with tickmill, minimum deposits start from $25 or equivalent.

With tickmill you can trade forex, stocks, indices, commodities, cfds and metals. If you like to trade on the go, tickmill have iphone, ipad and android apps so you can trade from anywhere on your phone.

Tickmill offer metatrader 4, metatrader 4 for PC & MAC, metatrader 4 for android & ios, virtual private server (VPS) platforms to make your trades and support 6 different languages.

The spreads offered by tickmill for the most popular instruments are:

1 EUR/USD, 3 FTSE 100, 13 GOLD,

1.5 GBP/USD, 4 DOW/JONES, 4 crude oil,

see all the spreads here.

For more information about trading with tickmill, we have put together an indepth tickmill review with all the pros and cons about this broker.

Since 2006, avatrade have attracted over 20,000 traders to their platform. While their spreads are not the most competitive, they do offer traders a range of great features, such as guaranteed stop losses, the ability to hedge / scalp, and low margins.

For more information about trading with avatrade, we have put together an indepth avatrade review with the pros and cons about this broker.

Popular comparisons feat. Core spreads

Popular comparisons feat. Tickmill

Popular comparisons feat. Avatrade

Spread & swap

Mengetahui biaya yang terkait dengan trading anda

Spread & swap

Lihat spread dan swap tipikal kami di bawah ini.

Apa itu spread forex?

Ketika anda mulai trading, anda akan melihat bahwa anda telah diberi harga ‘bid’ (atau ‘jual’) dan harga ’ask’ (atau‘ beli ’). 'bid' adalah harga di mana anda menjual mata uang dasar, dan 'ask' adalah harga di mana anda membeli mata uang dasar. Perbedaan antara kedua harga ini yang disebut spread.

Ketika order dibuka, selalu ada pihak ketiga yang memfasilitasi pembukaan dan penutupan order tersebut, seperti bank atau penyedia likuiditas. Pihak ketiga ini harus memastikan bahwa ada aliran order beli dan jual yang teratur, yang berarti bahwa mereka harus menemukan pembeli untuk setiap penjual dan sebaliknya.

Pihak ketiga menerima risiko kerugian sementara memfasilitasi order tersebut, sehingga alasan pihak ketiga akan mempertahankan bagian dari setiap order – bagian yang dipertahankan disebut spread!

Bagaimana anda

menghitung spread?

Bagaimana anda menghitung biaya trading?

Untuk mengetahui biaya trading itu sendiri, anda mengambil nilai spread dan pip dan mengalikannya dengan jumlah lot yang anda tradingkan:

biaya trading = spread X ukuran order X nilai pip

Sebagai contoh:

perdagangan yang telah anda buka memiliki spread 1,2 pip. Dalam contoh ini, anda trading dengan mini lot yang sebesar 10.000 unit dasar.

Nilai pip pada $1, sehingga biaya transaksi adalah $1,20

Seperti yang mungkin anda kumpulkan, semakin besar tradingnya, semakin besar biaya transaksi anda!

Apa itu swap?

Penting fakta rate swap/rollover

rate swap berlaku pukul 00:00 waktu platform. Setiap pair mata uang memiliki biaya swap tersendiri dan diukur pada ukuran standar 1 lot (100.000 unit dasar). Swap diterapkan setiap malam ke posisi terbuka anda dan ketika posisi dibiarkan terbuka itu diberikan 'tanggal nilai'. Namun pada rabu malam, tanggal nilai baru untuk order yang diadakan berubah menjadi hari senin. Karena ini, swap dibebankan tiga kali lipat dari rate yang ada. Lihat swap anda di panel MT4 market watch. Anda cukup klik kanan, pilih ‘simbol’, pilih instrumen, lalu pilih ‘properties’

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

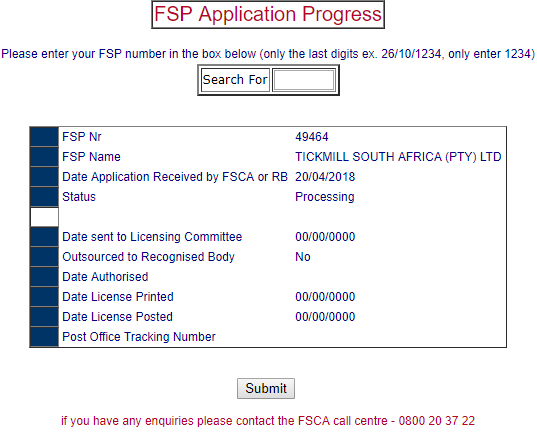

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

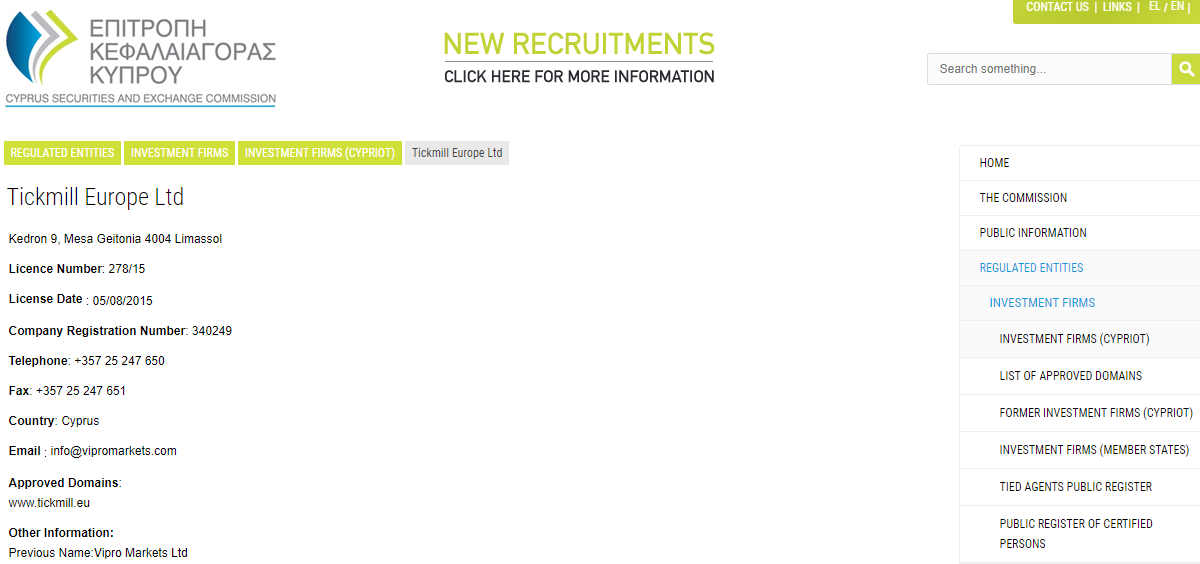

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

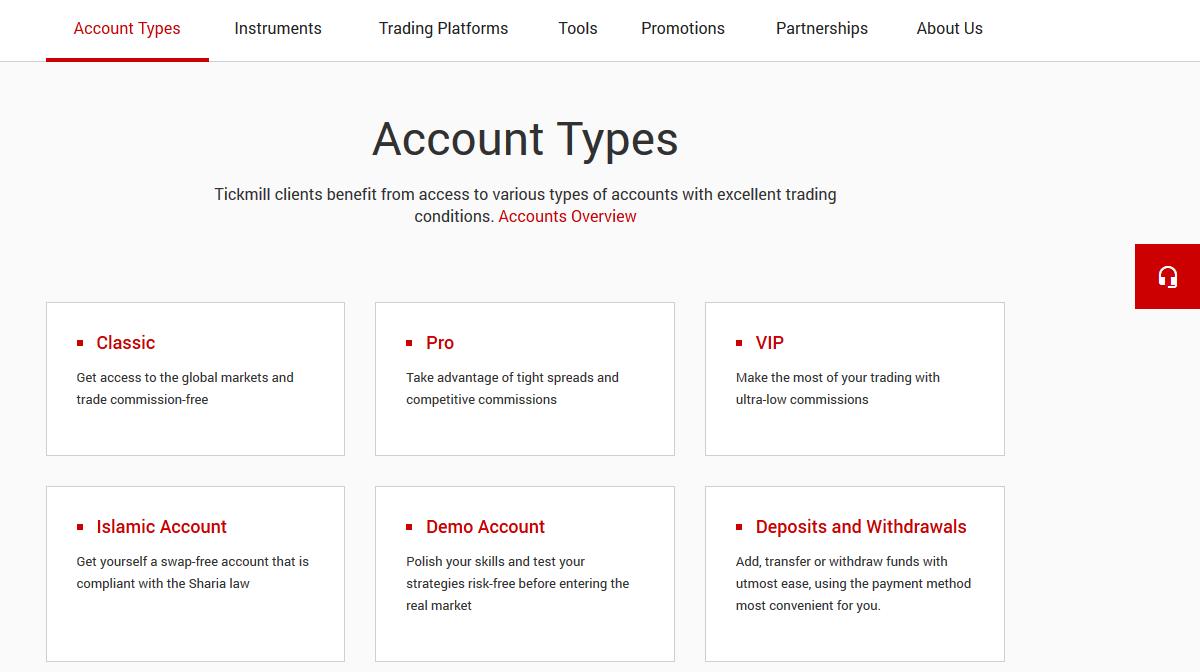

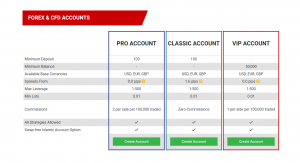

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

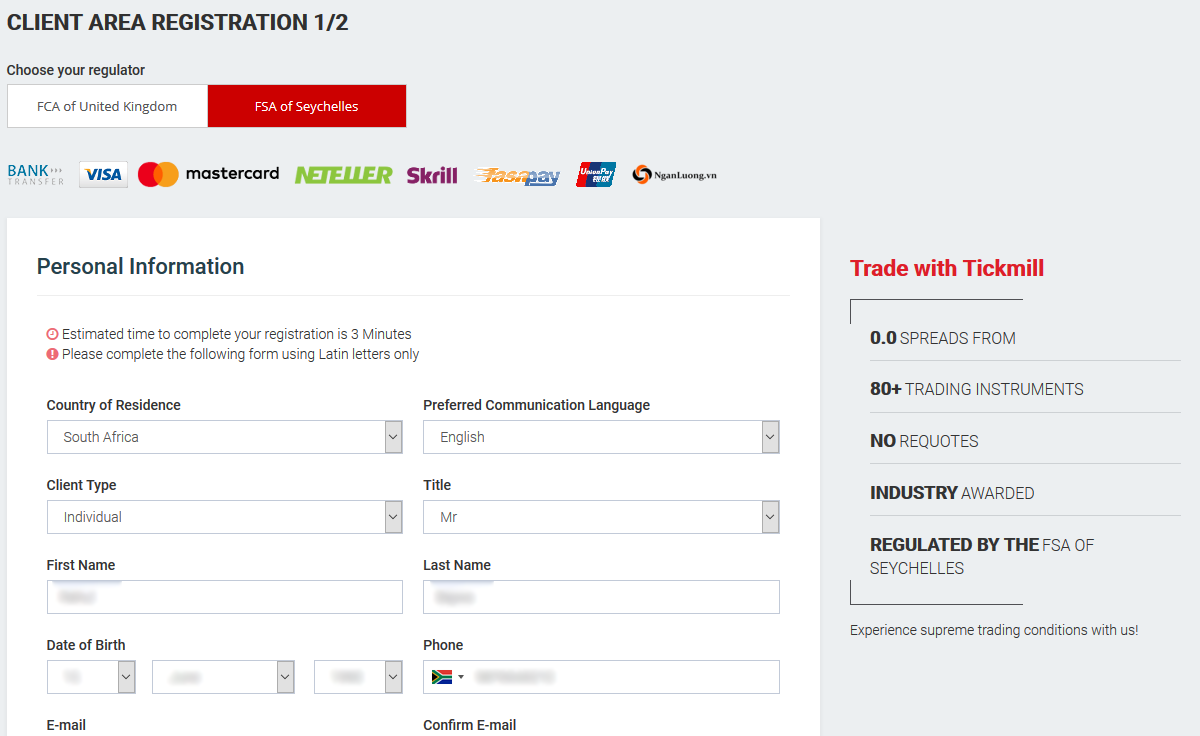

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

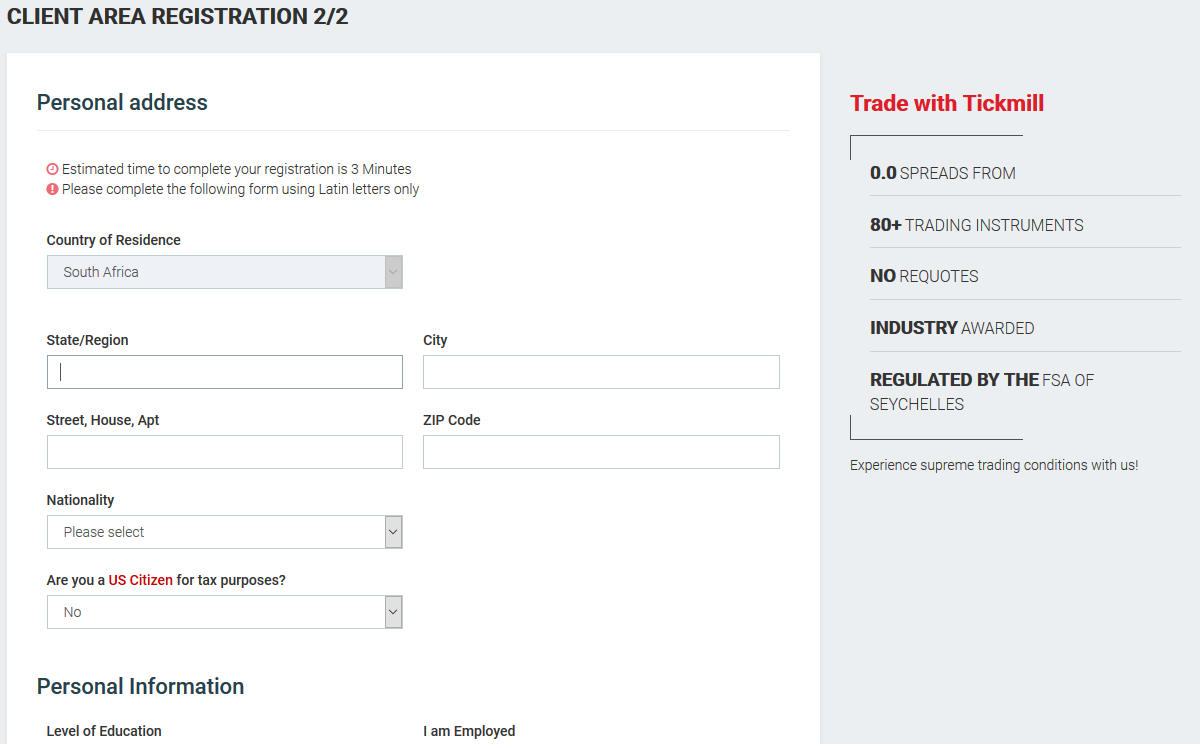

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

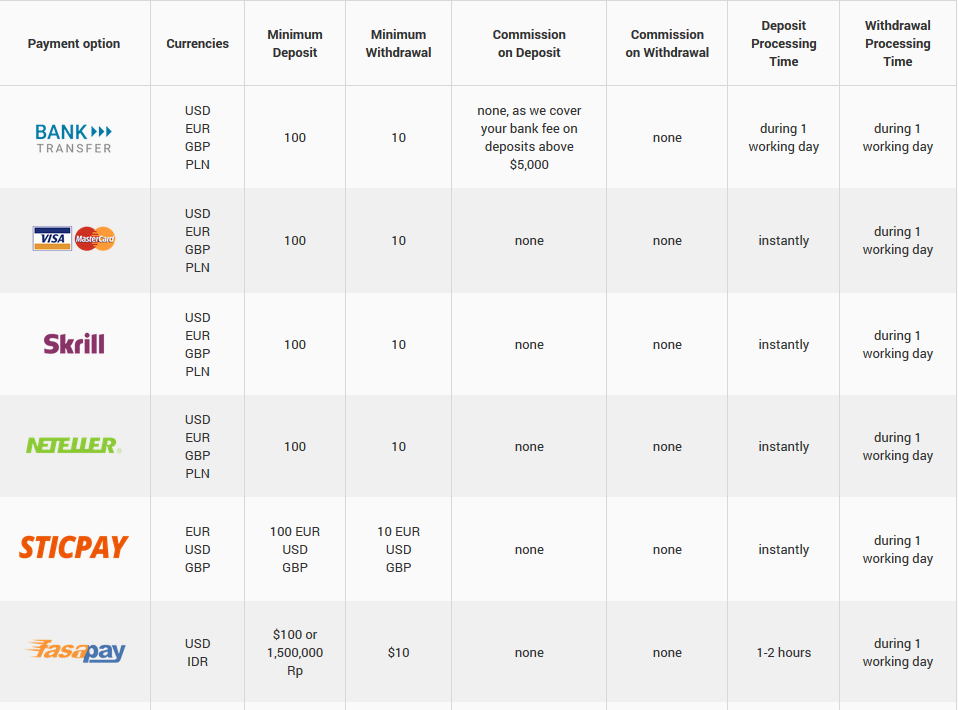

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

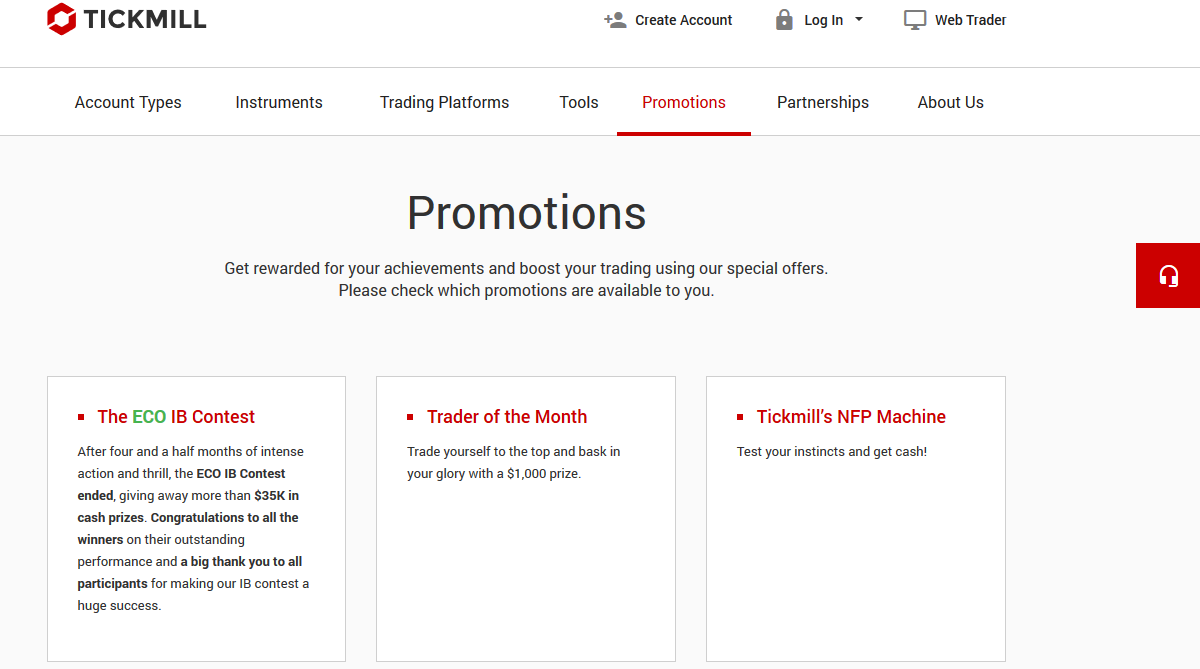

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Tickmill spread

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Indonesian

- Español

- 中文

- Việt nam

- 한국어

- ภาษาไทย

- Portuguese

- العربية

- Türkçe

- Bahasa melayu

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Spread & swap

Mengetahui biaya yang terkait dengan trading anda

Spread & swap

Lihat spread dan swap tipikal kami di bawah ini.

Apa itu spread forex?

Ketika anda mulai trading, anda akan melihat bahwa anda telah diberi harga ‘bid’ (atau ‘jual’) dan harga ’ask’ (atau‘ beli ’). 'bid' adalah harga di mana anda menjual mata uang dasar, dan 'ask' adalah harga di mana anda membeli mata uang dasar. Perbedaan antara kedua harga ini yang disebut spread.

Ketika order dibuka, selalu ada pihak ketiga yang memfasilitasi pembukaan dan penutupan order tersebut, seperti bank atau penyedia likuiditas. Pihak ketiga ini harus memastikan bahwa ada aliran order beli dan jual yang teratur, yang berarti bahwa mereka harus menemukan pembeli untuk setiap penjual dan sebaliknya.

Pihak ketiga menerima risiko kerugian sementara memfasilitasi order tersebut, sehingga alasan pihak ketiga akan mempertahankan bagian dari setiap order – bagian yang dipertahankan disebut spread!

Bagaimana anda

menghitung spread?

Bagaimana anda menghitung biaya trading?

Untuk mengetahui biaya trading itu sendiri, anda mengambil nilai spread dan pip dan mengalikannya dengan jumlah lot yang anda tradingkan:

biaya trading = spread X ukuran order X nilai pip

Sebagai contoh:

perdagangan yang telah anda buka memiliki spread 1,2 pip. Dalam contoh ini, anda trading dengan mini lot yang sebesar 10.000 unit dasar.

Nilai pip pada $1, sehingga biaya transaksi adalah $1,20

Seperti yang mungkin anda kumpulkan, semakin besar tradingnya, semakin besar biaya transaksi anda!

Apa itu swap?

Penting fakta rate swap/rollover

rate swap berlaku pukul 00:00 waktu platform. Setiap pair mata uang memiliki biaya swap tersendiri dan diukur pada ukuran standar 1 lot (100.000 unit dasar). Swap diterapkan setiap malam ke posisi terbuka anda dan ketika posisi dibiarkan terbuka itu diberikan 'tanggal nilai'. Namun pada rabu malam, tanggal nilai baru untuk order yang diadakan berubah menjadi hari senin. Karena ini, swap dibebankan tiga kali lipat dari rate yang ada. Lihat swap anda di panel MT4 market watch. Anda cukup klik kanan, pilih ‘simbol’, pilih instrumen, lalu pilih ‘properties’

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

Tickmill

- Company tickmill ltd, tickmill europe ltd

- Founded in 2014

- Online since 2015

- Offices in

- Credit/debit cards

- Fasapay

- Neteller

- Paypal

- QIWI

- Skrill

- Unionpay

- Webmoney

- Wire transfer

- Bafin, 146511

- Cysec, 278/15

- FCA (UK), 717270

- FSA (seychelles), SD008

- FSCA (south africa), 49464

Account types:

- Hedging

- Overnight interest rates (swaps)

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Forex 1:500

- Gold & silver 1:500

- CFD 1:500

- Oil 1:500

- Stocks 1:500

- Cryptocurrencies 1:20

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type fixed

- Spread on EUR/USD, pips 0

- Commission (one-way) per 1 std. Lot $2

- Trading instruments

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 1.6

- Minimum spread on EUR/USD, pips 1.2

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Minimum account size $50,000

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 0.2

- Minimum spread on EUR/USD, pips 0

- Commission (one-way) per 1 std. Lot $1

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Hedging

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

- Forex 1:300

- Gold & silver 1:300

- CFD 1:300

- Oil 1:300

- Stocks 1:300

- Cryptocurrencies 1:20

- Minimum account size $100

- Minimum position size 0.01 lot

- Spread type variable

- Typical spread on EUR/USD, pips 0.2

- Minimum spread on EUR/USD, pips 0

- Scalping allowed

- Expert advisors allowed

- Trading instruments

- Hedging

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Automated trading

Reviews

22 reviews of tickmill are presented here. All reviews represent only their author's opinion, which is not necessarily based on the real facts.

One of the worst brokers I have used - and I have used MANY!

1. Their platform is literally constantly frozen and very very slow, you cannot do anything , especially there's good chance to trade! They seem to be really scared of you making any profit, so they kind of manually monitor you and cause all kinds of 'obstacles' for you.

2. Their customer service is like, ZERO - sometimes you doubt if they are a professional company or a one-man business.

3. Their trading conditions (spreads) are very mediocre, 2 pips or so for eurusd - you can easily find many others with better spreads but without this 'frozen' conditions.

4. Haven't tried withdrawal yet, as it's only my first day (right, first day only and they're already watching me and makingsure I can't make a profit. )

So good luck achieving anything good tickmill, I'm out asap.

That was just an 'incredible' experience. Should I just a bit exceeded my deposit with profit, and the fun has begun! I asked to withdraw my deposit when there was minimum amount for trading, they didn't give me money within week. I opened several trades in different time, from morning till night, and even with calm market without strong news slippages and execution was terrible! I could not close trade for more than 10 seconds and it led to blowing account. So they don't like traders who make money. It is disappointment instead of trading.

I have experience working on stock exchange in tehran so I started to trade forex with this broker and it has been excellent so far. Spreads are tight and narrow in london session also I avoid trading during low liquidity (asian session), I trade most liquid pairs like EURUSD and GBPUSD, USDJPY and never exceed 0.3 lot size and 50 pips stop loss. This broker treats me fair and pays my profit so I pray they won't change over time. I really like tickmill and recommend it to my stock trading fellows.

I opened account with them yet far long ago, and I was not pleased that they were throwing slippages in my trade after I made +35% of deposit so haven't traded for several months. I decided to check it recently, maybe they got to be more honest. Unfortunately, it is not so. Frankly, the same wonderful story again. After I profited and took my deposit, everything seemed to be fine for some short time and orders were executed approximately with the same execution speed as with my other brokers. When I got used to service of this broker again and started making stable profit by most of my trades, I experienced slippages and severe spread widening that is obviously because of my making profit. That is pretty enough for me so I am not going to check this broker ever again.

I've opened account with their FCA regulated entity. Everything in trading terms is good although its additional safety from FCA so now I can trade not worrying about safety. Lets see how they will keep up consistency of their good trading platform

Made 80 pip on may NFP with tickmill, +$300 profit from two trades on USD/JPY and EUR/USD. What I can say about them is. PERFECT BROKER. I've never have seen such fast NFP execution before.

To be honest as a newbie ,

Trading with ECN broker like tickmill is a new experience for me.

Because i am usually trade with fixed spreads broker that provide cent lot trading.

I heard rumors if in ECN brokers -spreads will be widening like crazy when financial event /news announced,

And ECN broker spreads will be bigger than any fixed spreads broker.

But i did not experience that with tickmill, in fact, i only had around 2.6 spreads widening with tickmill ecn when NFP .

And to compare with my old broker, i can say they have great server with fast executions.

Never encountered any delay . Trade with them with $75 deposit, and already withdrawed total $100 .

And i do not feel their server and excecutions become slower, like my old broker.

Over all , i am satisfied with them. |

However, if they have cent trading account / cent lot, many newbie traders will trade with them.

Perhaps one day , tickmill will provide such trading account

To be honest , i do not even care what is a brokers business models. Are they ECN, MM, STP DMA,

For me , forex trading is we are trade the quotes. If we are buy EURO/USD. Where the euro goes?

I mean. Come on. I only deposit few dollars in my trading account, and what i can expect?My order can move the market?Lol.

Sometimes it makes me laugh when an investor/trader. Said something high and sophisticated wheh they talk about broker.Like we must trade with ECN/DMA broker, because they forward trader order into the market? What kind of market?Lol. Fruit market?Fish market?

We are retail trader, trade the OTC instruments, decentralized market. So do not expect too much

For me, a good broker is they provide great trading conditions and paid my WD fast . That is why i stay with tickmill .

Trading here since 2015. For those who like to try FX or just for those who have it just a hobby, rather than earning money - it's was a good broker. Nice support, good conditions, but now - there are a lot of slippages happens, constant delays with withdraws.

I'd rather take a consideration not to deposit large amount of money. It's berable to trade here with depo not more than $100. Everything higher that point - say goodbye to your money.

I already tried many kind of brokers.

Some of them are scam, some of them are restrict certain trading strategies

I have many profit cancellations, and some of them dared not to pay my deposit.

I am not a good trader with average accuracy with intraday trading strategies but in my experience i have seen many traders complaining the brokers

But i think if a trader is a good trader. His strategy should work in every broker.

My strategy works perfectly with tickmill, the difference is i think tickmill provide cheaper trading cost,

I mean less slipage during volatile trades.

Demo testing has approx same results as on live

My previous ones, there was subsantial difference because of slipage at SL's

Never had any complaining to them if i make profit with news trading strategy, or even close my trade under a minute.

Never had any single WD problems. Good broker

I had have 6 months experience trading by demo account, and I was nervous at first when deciding to open a live account. Will it be different from my demo account? My friend suggested tickmill to me. I only deposited 300$ to check the trading environment. I was afraid that my order will be re-quoted, but it haven't happened since the day I traded. Everything is good, I love the low spread and acceptable commission. Can't say that I've earned so much money, or I win every battle. I lose as well, but not because of unreasonable things. It's a fair broker and I think my choice is absolutely right.

As you show the tickmill broker something good feature but the broker tickmill have some hidden condition to caught the people money around. There customer support and there manager also not professional meant they always give you a harassing support and waste your time specially and my personal analysis i can see this broker is so much risky to work with them. They will also cheat with you so my suggestion is leave this broker and tell to others that don't use it.

I have been trading with tickmill nearly around 7months with their classic account

I have gone through some profits and losess in my trading account.

I can say they are really have good spreads start from 1.2pips for EURUSD in their classic account.

I think their trading platform for offshore broker are really awesome, and I noticed in 7months I trade with tickmill, I never has disconnecting problem, or freezing chart problem.

Customer service are polite. Wide range payment methods, including famous e-payment methods in my country.

However they have issue with their regulation, and I’d like to see in near future if they consider add more regulation . And sadly they do not have swap free account.

Usually I don't post reviews for forex brokers . But this broker really something.

I have a ECN account with them.

The execution is fast and the spread is very good, never had an issue with trading , like delayed order, freezing chart , or any other problems that usually happen with another brokers, if you are a news trader, you need to adjust your stoploss with their widening spreads.

Depositing money in any brokers are always smooth ,however tickmill withdrawing process is fast.

A good forex broker with good attitude so far.

Read about tickmill in a forum , people are talking about their tiny spreads and very low commission.

Do some research and i read so many positive feedback out there. Seems they deliver what they promise.

Deposited 2K lets see how it goes.

Will update my review later

Submit your review

To submit your own forex broker review for tickmill fill the form below. Your review will be checked by a moderator and published on this page.

By submitting a forex broker review to earnforex.Com you confirm that you grant us rights to publish and change this review at no cost and without any warranties.Make sure that you are entering a valid email address. A confirmation link will be sent to this email. Reviews posted from a disposable e-mail address (e.G. Example@mailinator.Com) will not be published. Please submit your normal e-mail address that can be used to contact you.

Please, try to avoid profanity and foul language in the text of your review, or it will be declined from publishing.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

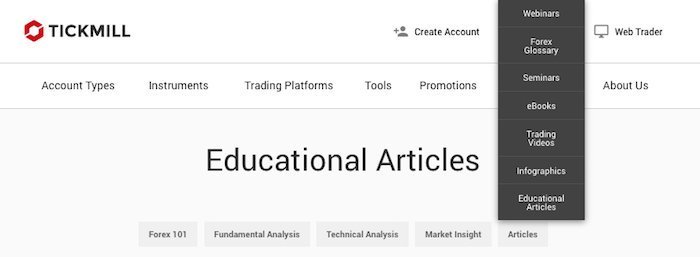

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

So, let's see, what we have: registered in the seychelles, you might be wondering is tickmill legit? Since 2016, tickmill have been FCA regulated in the UK. They offer a low minimum deposit, a vast range of accounts and more. Learn more in our in-depth review of tickmill. At tickmill spread

Contents of the article

- Top-3 forex bonuses

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Spreads & swaps

- Trading costs with...

- What are forex spreads?

- How do you calculate the...

- How do you calculate your transaction...

- What are swaps?

- Important swap/rollover rate...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Spreads e swaps

- Spread e swaps

- O que são os spreads no forex?

- Como é que você poderá calcular o...

- Como é que você poderá calcular os seus...

- O que são os swaps?

- Importantes factos sobre a taxa...

- COMECE A NEGOCIAR com a tickmill

- É simples e rápido de começar!

- REGISTRAR

- CRIAR UMA CONTA

- FAZER UM DEPÓSITO

- INSTRUMENTOS PARA NEGOCIAR

- CONDIÇÕES DE NEGOCIAÇÃO

- CONTAS DE NEGOCIAÇÃO