10 lots forex

The value of the pip for 1 lot is roughly $10 based on the EUR/USD. Fairly straight forward, but every broker will do this for you automatically.

Top-3 forex bonuses

What is lots size in forex

What is lots size in forex

Believe it or not but most beginners that start trading real money don’t even grasp this concept.

Yet one small decimal place mistake can have grave consequences.

That is why it is important to understand what is lots size in forex trading, to avoid careless mistakes and protect your capital!

In this article, we are going to break down the question “what is lots size in forex” and help you understand this fundamental concept when trading forex.

After reading this article you should understand what is lots size in forex now and hopefully avoid the careless pitfalls many traders make by inputting too much or too little lot sizes.

So, if you are just a beginner and this is the first time you are reading about what is a lots size in forex or someone who struggles to remember, then this article should be perfect for you.

What are lots in forex?

So, what are lots in forex?

Lots are the number of currency units you want to trade.

It has been used because previously, spot forex was only traded in specific amounts – hence the name lots.

Back in the past, when trading required larger capital to trade with, lots were used to standardise the units.

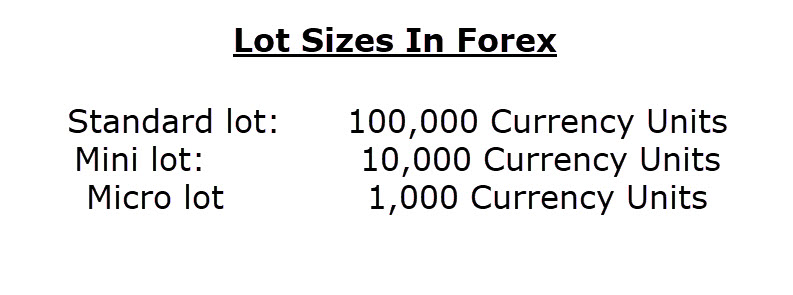

For example, the standard lot size is 100,000 units of a currency value.

So, if you wanted to trade 1 lot of the EUR/USD this would be €100,000 euros worth.

Echoing the above, back in the past by trading 1 lot would generate a return based on the pip value (which is also extremely important to understand about).

Whereas nowadays we have leverage, which allows the broker to loan you the difference based on the margin you put up.

With leveraged trading opened up the world to different lot sizes, because nowadays you can start with $100 easily and start trading.

This introduced 3 new types:

- Mini lot

- Micro lot

- Nano lot

Mini lots – this is the name given to currency deal sizes in the tens-of-thousands – so 1 mini lot = 10,000 units; 2 mini-lots = 20,000 units, etc.

Micro lots – this is the name given to currency deal sizes in the thousands – so 1 micro lot = 1,000 units; 2 micro-lots = 2,000 units, etc.

Nano lots – this is the name given to currency deal sizes in the hundreds – so 1 nano lot = 100 units; 2 nano-lots = 200 units, etc.

You can see the difference between the lot sizes in forex in the image below:

How to calculate lots in forex

This is the beauty of standardisation; you don’t need to learn how to calculate lots in forex at all.

However, if you really must then you can use this formula

Value of lot * 100,000 = how many lots.

1 lot * 100,000 = 100,000 units

2 mini lots (0.2) * 100,000 = 20,000 units

5 nano lots (0.005) * 100,000 = 500 units

Fairly straight forward, but every broker will do this for you automatically.

All you need to know is how much you want to trade.

You do however need to understand the value of the pip, based on the lot size.

To do that you simply follow this formula:

(value of pip/current rate) * lot size.

So, if you wanted to trade the EUR/USD, you would apply the formula like this:

Most currencies value of pip is 0.0001, with a couple of exceptions, so let’s go through a quick example of a 0.0001 value

(value of pip = 4 places behind decimal place/1.1660) * 1 lot (100,000 units)

(0.0001*1.1660) * 100,000 = $11.66 per pip.

So if the market moves 10 pips in your favour, you will be $116.60 in profit.

Or to make it so it’s a mini lot you change the 100,000 to 10,000 units (mini=10,000).

(value of pip = 4 places behind decimal place/1.1660) * 1 mini-lot (10,000 units)

(0.0001*1.1660) * 10,000 = $1.16 per pip.

This can be replicated all the way down to the nano-lot.

To make it easier to understand, because it can be complex, let’s do it again but for a different pair.

The USD/JPY pip value is 0.01 – this is where we look to see how many pips the currency pair has moved.

So, let’s input the formula below:

(value of pip = 2 places behind decimal place/121.90) * 1 lot (100,000 units)

(0.01*121.90) * 100,000 = $8.20 per pip.

Does this make sense now?

How much is 0.01 lot in forex

0.0 1 is a micro lot in forex which is 1,000 units of currency.

The value of the pip for a micro-lot is roughly $0.10 based on the EUR/USD.

This is usually the value most beginner traders start with. It is enough for you to risk some capital, but not enough for you to panic when the market goes against you.

In fact, we recommend that traders move on to this trading size and away from a demo account as soon as they are comfortable.

How much is 0.1 lot in forex

0.1 is a mini lot in forex which is 10,000 units of currency.

The value of the pip for a mini lot is roughly $1based on the EUR/USD.

Traders that use mini lots are now more adapted to the markets and are looking to grow their capital further by taking on more risk. The “training wheels” of the micro lot have been taken off.

How much is 1 lot in forex

1 lot in forex is 100,000 units of currency.

The value of the pip for 1 lot is roughly $10 based on the EUR/USD.

Traders who trade in lot sizes are usually experienced and comfortable with the risk associated with it. Although, it’s still not a significant amount – in a place where the markets can be unpredictable – it’s still seen as the standard trading size across the world.

What is 5 lots in forex

5 lots in forex is 500,000 units of currency.

The value of the pip for 1 lot is roughly $50 based on the EUR/USD.

Now if you are trading 5 lots in forex, then you certainly have a decent trading account size to take on larger risks and larger rewards.

How much is 10 lots in forex

10 lots in forex is 1,000,000 units of currency.

The value of the pip for 1 lot is roughly $100 based on the EUR/USD.

Wrapping it up

Hopefully, you’ve come to the end with the understanding of what is lots size in forex trading.

Now you’ve read through the basics of what is lots size in forex and how to calculate them, you can eliminate the simple, yet costly mistakes eager traders do and finally focus on collecting them pips!

The beauty of modern-day trading platforms is that they remember your preferences when it comes to trading, so if you want to trade 0.5 lots then you can allow the system to remember your choice – this speed up trading whilst eliminating careless mistakes.

Choosing a lot size in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

When you first get your feet wet with forex training, you'll learn about trading lots. In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. it is important to note that the lot size directly impacts and indicates the amount of risk you're taking.

Lot size matters

Finding the best lot size with a tool like a risk management calculator or something similar with a desired output can help you determine the best lot size based on your current trading account assets, whether you're making a practice trade or trading live, as well as help you understand the amount you would like to risk.

The trading lot size directly impacts how much a market move affects your accounts. For example, a 100-pip move on a small trade will not be felt nearly as much as the same 100-pip move on a very large trade size.

You will come across different lot sizes in your trading career, and they can be explained with the help of a useful analogy borrowed from one of the most respected books in the trading business.

Trading with micro lots

Micro lots are the smallest tradeable lot available to most brokers. A micro lot is a lot of 1,000 units of your account funding currency. If your account is funded in U.S. Dollars, this means that a micro lot is $1,000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents. micro lots are very good for beginners that want to keep risk to a minimum while practicing their trading.

Moving up to mini lots

Before micro-lots, there were mini lots. A mini lot is 10,000 units of your account funding currency. If you are using a dollar-based account and trading a dollar-based pair, each pip in your trade would be worth about $1.00. If you are a beginner and you want to start trading using mini lots, make sure that you're well-capitalized.

While $1.00 per pip seems like a small amount, in forex trading, the market can move 100 pips in a day, sometimes even in an hour. If the market is moving against you, that adds up to a $100 loss. It's up to you to decide your ultimate risk tolerance. But to trade a mini account, you should start with at least $2,000 to be comfortable.

Using standard lots

A standard lot is a 100,000-unit lot. that is a $100,000 trade if you are trading in dollars. Trading with this size of position means that the trader's account value will fluctuate by $10 for each one pip move. For a trader that has only $2,000 in their account (usually the minimum required to trade a standard lot) it means a 20-pip move can make a 10% change in account balance. So most retail traders with small accounts don't trade in standard lots.

Most forex traders that you come across are going to be trading mini lots or micro-lots. It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term.

A helpful visualization

If you have had the pleasure of reading mark douglas' trading in the zone, you may remember the analogy he provides to traders he has coached, which he shares in the book. In short, douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens.

To illustrate this example, a very small trade size relative to your account capital would be like walking over a valley on a very wide, stable bridge where little would disturb you even if there was a storm or heavy rains. Now imagine that the larger the trade you place the smaller and riskier the support or bridge under you becomes.

When you place an extremely large trade size relative to your account balance, the bridge gets as narrow as a tightrope wire, such that any small movement in the market would be like a gust of wind in the example, and could send a trader the point of no return.

How to calculate lot size in forex? – lot size calculator

How to determine position size when forex trading

For a foreign exchange (forex) trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should determine position size are provided.

Lot size in forex trading

What is lot size in currency trading?

What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of 1000 units of currency, a mini-lot 10.000 units, and a standard lot has 100,000 units. The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup.

Now let us define a standard lot.

What is the standard lot size in forex?

The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

In this video, we will see lot size forex trading example:

How to calculate lot size in forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

Most traders consider specifying the dollar amount or percentage limit risked on each trade as the most crucial step in determining the forex position’s size. Lot size forex calculation is simply because professional and experienced traders will usually risk a maximum of 1% of their account in trade; usually, the amount is lower. While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit.

(max risk per trade position should be 1%-2%)

Determine dollar per pip

A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will change. When currency pairs are considered, the pip is 0.0001 or one-hundredth of a percent. However, if the currency pair includes the japanese yen, the pip is one percentage point or 0.01. Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the japanese yen, the third place is the pipette. M the pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A stop-loss will close a trade when it is losing a specified amount. Traders use this to ensure that their loss does not exceed the account’s loss risk. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

Determine forex lot size position

In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0.0001 of the lot size. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

What information do we need to make a forex position size calculator formula?

Let us repeat all steps once time more:

Account currency: USD

account balance: $5000 for example

risk percentage: 1% for example

stop loss: 200 pips, for example

currency: EURUSD

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: calculate risk in dollars.

Calculate risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the position size calculator.

Lot size calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size:

The risk you can define either using % or either using risk in dollars.

10 lots forex

A lot is the minimum number of currency units in a single trade. The standard lot in most forex futures is 100,000 units of the foreign currency, like the euro, swiss franc, australian dollar, or canadian dollar (£62,500 in the pound and ¥100,000 in the yen). The standard lot in professional interbank forex trading is generally $5 million. If a trader wants to do less, he specifies “small” or the amount when asking for a bid/offer, and if he wants to do more, he will say “size.”

The standard lot for spot retail trading is 100,000 units of foreign currency, but the number of contract specifications has risen in recent years. The retail spot market began to expand only when the mini lot was introduced (10,000 units). A little later, the micro lot was introduced — a mere 1,000 units! The micro lot in the EUR/USD, for example, at €1,000 or $1,350 when the exchange rate is 1.3500, could be traded for as little as $135 in initial margin if the leverage ratio was 1:10.

See the lesson on margin and leverage if you want to learn more about how they work.

Critics of the spot forex market complain that the combination of micro lots and leverage was seducing the public into trading a security they did not understand just because it was the only choice available for a trader with a very small capital stake. This is overall true. You do not see micro lots in oil or corn or equities, although technically you could buy 10 shares of a stock priced at $13.50 with no leverage. Bigger equity players can get 50% margin from the brokerage houses, but if all you have to trade with is a capital stake of $135, the broker is not offering you leverage.

In the USA, regulation constrain leverage to a maximum of 1:50. Brokers in other countries can offer leverage of as much as 1:500, 1:1000, or even 1:2000, meaning that if you have $135, you could trade a face value of $67,500-worth of foreign currency units or more.

We compiled a list of brokers that offer very high leverage. You can use it for reference if at some point you will feel a need for such a tool.

Some brokers offer something called a nano account, where the lot size is 100 units of foreign currency, say €100 or £100. The nano lot is also called the 0.001 lot. While there are companies that do not restrict the size of a trade at all and offer position sizing down to a single currency unit (0.00001 lot).

For your convenience, we offer a list of forex brokers with micro or smaller accounts.. You can use them to test your trading strategy live without risking a lot of money.

Summary

Some people confuse mini lots with micro lot and micro lots with nano lots, but each one is 10 times smaller than the next:

- Standard lot: 100,000 units of foreign currency

- Mini lot: 10,000 units

- Micro lot: 1000 units

- Nano lot: 100 units

In EUR/USD, a one pip move results in the following gain/loss:

- Standard lot: 0.0001 x 100,000 = $10.00

- Mini lot: 0.0001 x 10,000 = $1.00

- Micro lot: 0.0001 x 1,000 = $0.10

- Nano lot: 0.0001 x 100 = $0.01

Since we have four pips plus fractional pips after the decimal point in the price quote, the nano lot is probably a logical development. The promotional idea is that the beginner can learn to trade while risking only pennies, but again, a nano lot is designed to appeal to persons with very low capital stakes. The conventional assumption is that anyone not willing or able to save up enough capital to manage a decent-sized account is not smart enough or capable enough to trade well and manage the vast leverage in forex, but we do not have reports that nano account holders go broke at a faster pace than traders of any other lot size.

Restrictions on availability

Each broker will differ as to what currencies you can trade using a lot size other than the standard or mini. If you wanted to trade the indonesian rupiah against the turkish lira, your broker would probably decline such a trade in the micro or nano lot size. However, for the cross-rates where there is sizeable volume, such as EUR/GBP or EUR/CHF, you may be able to trade in any lot size.

What does 0.01 in forex mean?

Position size in trading is one of the most important things. Beginner traders very often neglect this segment of trading.

1,000 units = 0.01 lot.

0.01 lot size in forex or micro lot is position size in trading. Position size of 0.01 lot for EURUSD currency pair, for every 10 pips gain will give a $1 profit (10 cents per pip). So for EURUSD means that 10 pips for 0.01 lot size profit are $1.

0.01 lot size or 1000 units or micro lot is the smallest position size when we talk about standard forex accounts.

The standard lot size forex is 1 lot, and it is equal 100 000 units or $10 per each pip gain.

Below you can see a table of 3 types of position sizes:

Types of lot size:

Please see figure below:

In the video below is a detailed explanation from our FXIGOR youtube channel:

This methodology can be extended further. So, what is a 1.00 lot in forex?

1.00 lot is a measurement of currency units that traders will buy or sell during the trading, and the standard size for a lot is 100,000 units. For example, if traders trade EURUSD, 10 pips gain for one lot size can generate a profit of $100.

Summary

0.01 lot size profit

0.01 lot size profit is $1 for every 10 pips moves in the direction of a trading position. For example, if a trader trades 1 micro lot (0.01 lot) and buys EURUSD at 1.2340 if the price hits the target of 1.2350, the profit will be $1.

0.1 lot size profit

0.1 lot size profit is $10 for every 10 pips moves in the direction of a trading position. For example, if a trader trades 1 mini lot (0.1 lot) and buys EURUSD at 1.2340 if the price hits the target of 1.2350, the profit will be $10.

1 lot size profit

1 lot size profit is $100 for every 10 pips moves in the direction of a trading position. For example, if a trader trades 1 lot and buys EURUSD at 1.2340 if the price hits the target of 1.2350, the profit will be $100.

The principles behind lots trading and pips calculation

What you will learn:

- Lot definition

- Different lot sizes explained

- USD and EUR practical illustrations

- The correlation between margin and leverage

- Understanding the intrigues in margin call calculation

What is a lot size in forex?

In forex trading, a standard lot refers to a standard size of a specific financial instrument. It is one of the prerequisites to get familiar with for forex starters.

Standard lots

This is the standard size of one lot which is 100,000 units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the EUR and therefore, 1 lot or 100,000 units worth 100,000 eurs.

Mini lots

Now, let’s use smaller sizes. Traders use mini lots when they wish to trade smaller sizes. For example, a trader may wish to trade only 10,000 units. So when a trader places a trade of 0.10 lots or 10,000 base units on GBP/USD, this means that he trades 10,000 british pounds.

Micro lots

There are many beginners or small investors who wish to use the smallest possible lots sizes. In contrary to the mini lots that refer to 10,000 units, traders are welcome to trade 1,000 units or 0.01. For example, when someone trades USD/CHF with a micro lot the trader basically trades 1,000 usds.

Pip value

Now that we understand what lots are, let’s take one step further. We need to calculate the pip value so we can estimate our profits or losses from our trading.

The simplest way to calculate the pip value is to first use the standard lots. You will then have to adjust your calculations so you can find the pip value on mini lots, micro lots or any other lot size you wish to trade.

USD base currency

Our calculations in this sector are when your base currency is the USD. We will provide three different examples.

USD quote currency of the currency pair. You’re trading 1 standard lot (100,000 base units) that the quote currency is the USD such as EUR/USD. The pip value is calculated as below:

100,000*0.0001 (4th decimal)=$10

USD base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) and the base currency is the USD such as USD/JPY. The pip value is calculated as below:

The USD/JPY is traded at 99.735 means that $1=99.73 JPY 100,000*0.01 (the 2nd decimal) /99.735≈$10.03. We approximated because the exchange rate changes, so does the value of each pip.

Finding the pip value in a currency pair that the USD is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY.

The GBP/JPY is traded at 153.320. Because the value changes in the quote currency times the exchange rate ratio as

The pip value => 100,000*0.01JPY*1GBP/153.320JPY = 6.5 GBP

Because the base currency of the account is the USD then we need to take into account the GBP/USD rate which let’s assume that is currently at 1.53560.

6.5 GBP/(1 GBP/1.53560 USD)= $9.98

EUR base currency

Now let’s make our examples when the base currency of our account is the EUR

EUR base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) on EUR/USD. The pip value is calculated as below

The EUR/USD is traded at 1.30610 means that 1 EUR=$1.30 USD so

100,000*0.0001 (4th decimal)/1.30610 ≈7.66 EUR

Finding the pip value in a currency pair that the EUR is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY. From our example before, we know that the value is 6.5 GBP. Now, we need to take into account the EUR/GBP rate in order to calculate the pip value. Let’s assume that the rate is currently at 0.85000. So:

6.5GBP/(1GBP*0.85 EUR)= (6.5 GBP/1 GBP)/0.85 EUR≈7.65 EUR

Leverage – how it works

You are probably wondering how can I trade with lot sizes of 100,000 base units or even 1,000 base units. Well, the answer is very simple. This is available to you from the leverage you have in your account. So let’s assume that your account’s leverage is set at 100:1. This means that for every $1 used, you’re actually trading $100 in the forex market. In order for you to trade a position of $100,000 then the required margin to open such a position will be $1,000. As for any losses or gains these will be deducted or added to the remaining balance in your account.

If your account’s leverage is set at 200:1 this means that for every $1 you use you’re actually trading $200. So for a trade of $100,000 you will require a margin to be at $500.

Margin call – what you should know

Now looking at the examples above regarding the leverage you’re probably thinking that is the best to work with the highest possible leverage. However, you need to take into consideration your margin requirements as well as the risks associated with higher leverages.

Let’s just say that you have deposited first $5,000 to your trading account that the leverage is set at 100:1. Your nominated currency is the USD. The first time you will login to your MT4 trading account you will notice that the balance and the equity is $5,000 and this is due to the fact that you did not place any trades yet.

Now, you have decided to open a position on the USD/CHF of the 1 standard lot which means that you will require use a margin of $1,000. The floating P/L is at -9.55. The account will show the following

| balance | equity | margin | free margin | margin level |

|---|---|---|---|---|

| 5,000 | 4,990.45 (5,000-9.55) | 1,000 | 3,990.45 (4,990.45-1000) | 499.05% (4990.45/1000)*100 |

If your forex broker margin call level is set at 100% this means that when the margin level reaches this percentage it will notify you to add more funds. As you can understand from the example above, the P/L, and your margin will affect your margin level. Now, if your broker sets the stop out level at 50% this means that your position will be closed by the broker when the margin level reaches that level.

Let’s use another example when your leverage is set at 200:1. We will use the same example above to understand how the leverage will affect your margin level. Your account will show the following

By looking at the numbers above, you will prefer to use a higher leverage for your account. However, let’s assume that the market goes against you and you have bought 9 lots of USD/CHF but the pair falls. When you open your position you will have the following numbers:

As we explained above, the broker will give you a margin call when you have 100% margin level. This means that you will receive a margin call when the USD/CHF falls 5 pips only. On the other hand, if you had a leverage set at 100:1 the would not allow you to enter into such a position from the first place and you would have saved your equity.

10 lots forex

A lot is the minimum number of currency units in a single trade. The standard lot in most forex futures is 100,000 units of the foreign currency, like the euro, swiss franc, australian dollar, or canadian dollar (£62,500 in the pound and ¥100,000 in the yen). The standard lot in professional interbank forex trading is generally $5 million. If a trader wants to do less, he specifies “small” or the amount when asking for a bid/offer, and if he wants to do more, he will say “size.”

The standard lot for spot retail trading is 100,000 units of foreign currency, but the number of contract specifications has risen in recent years. The retail spot market began to expand only when the mini lot was introduced (10,000 units). A little later, the micro lot was introduced — a mere 1,000 units! The micro lot in the EUR/USD, for example, at €1,000 or $1,350 when the exchange rate is 1.3500, could be traded for as little as $135 in initial margin if the leverage ratio was 1:10.

See the lesson on margin and leverage if you want to learn more about how they work.

Critics of the spot forex market complain that the combination of micro lots and leverage was seducing the public into trading a security they did not understand just because it was the only choice available for a trader with a very small capital stake. This is overall true. You do not see micro lots in oil or corn or equities, although technically you could buy 10 shares of a stock priced at $13.50 with no leverage. Bigger equity players can get 50% margin from the brokerage houses, but if all you have to trade with is a capital stake of $135, the broker is not offering you leverage.

In the USA, regulation constrain leverage to a maximum of 1:50. Brokers in other countries can offer leverage of as much as 1:500, 1:1000, or even 1:2000, meaning that if you have $135, you could trade a face value of $67,500-worth of foreign currency units or more.

We compiled a list of brokers that offer very high leverage. You can use it for reference if at some point you will feel a need for such a tool.

Some brokers offer something called a nano account, where the lot size is 100 units of foreign currency, say €100 or £100. The nano lot is also called the 0.001 lot. While there are companies that do not restrict the size of a trade at all and offer position sizing down to a single currency unit (0.00001 lot).

For your convenience, we offer a list of forex brokers with micro or smaller accounts.. You can use them to test your trading strategy live without risking a lot of money.

Summary

Some people confuse mini lots with micro lot and micro lots with nano lots, but each one is 10 times smaller than the next:

- Standard lot: 100,000 units of foreign currency

- Mini lot: 10,000 units

- Micro lot: 1000 units

- Nano lot: 100 units

In EUR/USD, a one pip move results in the following gain/loss:

- Standard lot: 0.0001 x 100,000 = $10.00

- Mini lot: 0.0001 x 10,000 = $1.00

- Micro lot: 0.0001 x 1,000 = $0.10

- Nano lot: 0.0001 x 100 = $0.01

Since we have four pips plus fractional pips after the decimal point in the price quote, the nano lot is probably a logical development. The promotional idea is that the beginner can learn to trade while risking only pennies, but again, a nano lot is designed to appeal to persons with very low capital stakes. The conventional assumption is that anyone not willing or able to save up enough capital to manage a decent-sized account is not smart enough or capable enough to trade well and manage the vast leverage in forex, but we do not have reports that nano account holders go broke at a faster pace than traders of any other lot size.

Restrictions on availability

Each broker will differ as to what currencies you can trade using a lot size other than the standard or mini. If you wanted to trade the indonesian rupiah against the turkish lira, your broker would probably decline such a trade in the micro or nano lot size. However, for the cross-rates where there is sizeable volume, such as EUR/GBP or EUR/CHF, you may be able to trade in any lot size.

How to calculate lot size in forex? – lot size calculator

How to determine position size when forex trading

For a foreign exchange (forex) trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should determine position size are provided.

Lot size in forex trading

What is lot size in currency trading?

What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of 1000 units of currency, a mini-lot 10.000 units, and a standard lot has 100,000 units. The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup.

Now let us define a standard lot.

What is the standard lot size in forex?

The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

In this video, we will see lot size forex trading example:

How to calculate lot size in forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

Most traders consider specifying the dollar amount or percentage limit risked on each trade as the most crucial step in determining the forex position’s size. Lot size forex calculation is simply because professional and experienced traders will usually risk a maximum of 1% of their account in trade; usually, the amount is lower. While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit.

(max risk per trade position should be 1%-2%)

Determine dollar per pip

A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will change. When currency pairs are considered, the pip is 0.0001 or one-hundredth of a percent. However, if the currency pair includes the japanese yen, the pip is one percentage point or 0.01. Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the japanese yen, the third place is the pipette. M the pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A stop-loss will close a trade when it is losing a specified amount. Traders use this to ensure that their loss does not exceed the account’s loss risk. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

Determine forex lot size position

In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0.0001 of the lot size. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

What information do we need to make a forex position size calculator formula?

Let us repeat all steps once time more:

Account currency: USD

account balance: $5000 for example

risk percentage: 1% for example

stop loss: 200 pips, for example

currency: EURUSD

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: calculate risk in dollars.

Calculate risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the position size calculator.

Lot size calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size:

The risk you can define either using % or either using risk in dollars.

Pips and lot sizes in forex explained

Last updated on september 23rd, 2020

When trading forex, traders should understand that price moves in pips, not points, as well as what lot size means.

What are pips and lots in forex?

A pip is the smallest amount a currency can move. An example would be EURUSD changing from 1.1777 to 1.1777 is one pip. In most pairs, a pip is 0.0001 of the current quote. In yen pairs, a pip is equal to 0.01. A lot size is the minimum amount you can buy or sell of a currency.

However, some brokers offer fractional pips and will quote to 1/10 th of the standard pip size which means that instead of 0.0001, in most cases they might quote to 0.00001 for example.

Lot sizes + pips = $$

Trading forex does mean you need to trade a certain “lot” size. This really just means that you are buying and selling a minimum number of the base currency (the first in the pair) against the quote currency.

Depending on the account you have, you may be able to trade in standard, mini or micro lots. A standard lot is 100,000 whereas mini and micro lots are 10,000 and 1,000 respectively. So you can see that although a pip represents minimum price change, what it means to an individual trader does vary.

Take for example the EURUSD pair trading at 1.3578.

As the minimum lot standard size is €100,000 (base currency) the way you work out the pip value dollar is as follows:-

€100,000 x 1.3578 = $135,780 → $135,780 ÷ 13,578 (1.3578 ÷ 0.0001 = the total number of pips) = $10

So a move of just 0.1% or 14 pips is worth $140 per pip (1.3578 x 0.1% = 0.0014).

Doesn’t sound too much does it?

But when you take into account the fact that it’s not unusual to see 100 pip (0.0100) day ranges or more it starts to look a little more expensive.

How much is 50 pips worth?

Using the same numbers and trading one standard lot: 50 pip move X $10 = 50 pips equals $500

Add this to the fact that by trading multiple lots you are actually better able to control your risk on a relative basis, things can really start to add up when you do take losses.

Mini and micro lot sizes

This is where mini and micro lots come in. In the same example, if you were trading mini lots you would be risking $1 per pip movement. For a micro lot it would be $0.1. And this kind of lot size makes it easy to get started in trading forex.

Risking even an entire day’s range at 100 pips is only equal to $10 for a micro lot. And with mini or micro lots, you’ll have more exits available to you per trade than with a standard lot if you choose to trade more lots per trade.

But then why even bother if you have to trade €10,000 or €1,000 per shot? This is where leverage comes in.

Leverage in forex trading

Leverage is the ability to trade based on a marginal amount of the capital required to trade. So in the same example, let’s say that we wanted to sell a single EURUSD lot at 1.3578. That means selling €100,000 x 1.3578 = $135,780.

Unleveraged that would mean having €100,000 in an account to make just $10 per pip! But when you trade on margin, you might be able to get 50:1 leverage for example. This means you only have to put down 1/50 th of the amount normally required for the trade.

So the same position would only take €2,000 worth of margin to trade. Not that leverage is all good news. Trading on margin allows a trader to lose more than the value of their margin account, so a non-risk savvy trader can easily get themselves into hot water.

Although a pip is just the minimum standard price fluctuation for a currency pair, depending on the lot size and the leverage on offer it can mean something very different from one trader to the next. Utilize the tools at your disposal wisely and make the pip manageable – not too much risk but enough to let you profit from your winners.

So, let's see, what we have: read & understand what is lots size in forex and how you can quickly calculate and tell the difference between them. No more confusion when it comes to lots. At 10 lots forex

Contents of the article

- Top-3 forex bonuses

- What is lots size in forex

- What is lots size in forex

- What are lots in forex?

- How to calculate lots in forex

- How much is 0.01 lot in forex

- How much is 0.1 lot in forex

- How much is 1 lot in forex

- What is 5 lots in forex

- How much is 10 lots in forex

- Wrapping it up

- Choosing a lot size in forex trading

- Lot size matters

- Trading with micro lots

- Moving up to mini lots

- Using standard lots

- A helpful visualization

- How to calculate lot size in forex? – lot size...

- Lot size in forex trading

- Lot size calculator

- 10 lots forex

- Summary

- Restrictions on availability

- What does 0.01 in forex mean?

- Summary

- The principles behind lots trading and pips...

- What you will learn:

- What is a lot size in forex?

- Standard lots

- Mini lots

- Micro lots

- Pip value

- USD base currency

- 100,000*0.0001 (4th decimal)=$10

- The pip value => 100,000*0.01JPY*1GBP/153.320JPY...

- 6.5 GBP/(1 GBP/1.53560 USD)= $9.98

- EUR base currency

- Leverage – how it works

- Margin call – what you should know

- 10 lots forex

- Summary

- Restrictions on availability

- How to calculate lot size in forex? – lot size...

- Lot size in forex trading

- Lot size calculator

- Pips and lot sizes in forex explained

- What are pips and lots in forex?

- Lot sizes + pips = $$

- Mini and micro lot sizes

- Leverage in forex trading