Is tickmill a good broker

Tickmill is a multiple award-winning broker that provides access to forex, cfds, indices, commodities, bonds.

Top-3 forex bonuses

Tickmill allows traders to use the metatrader4 trading platform, but unfortunately not metatrader5 at this point. Tickmill is an award-winning broker, with 5 awards received so far.

Tickmill UK review 2021

| tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

Tickmill is a multiple award-winning broker that provides access to forex, cfds, indices, commodities, bonds. Tickmill allows traders to use the metatrader4 trading platform, but unfortunately not metatrader5 at this point.

Careful traders will be reassured knowing that tickmill is licensed to offer trading services by several regulators, 4 in fact, including the FCA.

Tickmill summary

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Ratings

CFD trading

Trade on 80+ CFD instruments across FX, stock indices, & commodities.

| FTSE spread | 0.9 |

|---|---|

| GBPUSD spread | 0.3 |

| oil spread | 0.4 |

| stocks spread | N/A |

Forex trading

Trade on majors, minors and exotics with up to 1:500 leverage.

| GBPUSD spread | 0.3 |

|---|---|

| EURUSD spread | 0.1 |

| EURGBP spread | 0.4 |

| assets | 62 |

Payment methods

Tickmill accepts the following payment methods:

- Skrill

- Neteller

- Visa

- Webmoney

- QIWI

- Wire transfer

- Fasapay

- Rapid transfer

- Perfect money

- Swift

- Sticpay

- Paysafecard

Awards

Tickmill is an award-winning broker, with 5 awards received so far.

- Best commodities broker 2020 - rankia markets experience expo

- Best trading experience 2020 - forex brokers award

- Best forex execution broker 2019 - CFI.Co awards

- Best CFD broker asia 2019 - international business magazine

- Best forex CFD provider 2019 - online personal wealth awards

Tickmill vs other brokers

If you want to compare tickmill with other brokers, use the detailed comparisons below.

Tickmill review

Our tickmill review found this forex broker has a choice of 2 accounts and 1 forex trading platform with metatrader 4. While they have over 60 currency pairs, the range of markets is limited with 2 metals, 4 bonds, 14 indices but no crypto or shares

| ��️ regulation | UK, europe, south africa, malaysia |

| �� trading fees | low spreads |

| �� trading platforms | MT4 |

| �� minimum deposit | $100 |

| �� deposit/withdrawal fee | $0 |

| ��️ instruments offered | forex, cfds, bonds |

| �� credit card deposit | yes |

Tickmill account types

Tickmill offers you the choice of three account types for trading forex and cfds using a no dealing desk model with ECN style pricing. These include the pro account, the classic account, and the VIP account. Each of these account types will suit a different level of trading experience.

- When trading with tickmill, all accounts include the following features:

- Minimum lot size of 0.01 (micro-lots)

- Available base currencies: USD, EUR, GBP

- Hedging, scalping, arbitrage, expert advisors permitted

- Swap-free islamic account options

Pro account

You can get started with a pro account with a minimum deposit of $100. The pro account offers low spreads from 0.0 pips EURUSD and charges commission fees of $2.00 per side ($4 round-turn) per lot. This account offers the best pricing for retail traders, as it has ECN pricing.

This account is the most popular among traders because of the low commission rate and tight spreads.

Classic account

The classic account is the same as the standard account that many brokers offer. This means you will not pay commission fees. To open a classic account, you will require a minimum deposit of $100. Spreads start from 1.6 pips. The classic account is more suitable for beginner traders with little experience.

VIP account

There is no minimum deposit required for the VIP account, however, you will require a minimum account balance of $50,000 to trade. This makes this trading account more suitable for experienced traders. Spreads start from 0.0 pips, and the commission fees are only $1.00 per side.

Islamic account

Tickmill also offers islamic accounts for traders of the muslim faith. You can select from a pro account, classic account, or VIP account and convert it to an islamic account. Trading conditions remain the same as with the other trading accounts, along with compliance with the sharia law.

Our rating

The overall rating is based on review by our experts

Spreads

Tickmill offers competitive spreads across a range of 62 currency pairs, stock indices, oil, metals, and bonds. The classic account offers slightly higher average spreads on the range of currency pairs. Typical spread data from the pro account and VIP account shows an offering of 0.10 pips on the EUR/USD pair.

Commission spreads

The following table compares the average spreads across a range of commission-based account types, including the pro account and VIP account from tickmill.

Data taken from broker website. Accurate as at 05/01/2021

Non-commission spreads

The following table displays average spreads from non-commission accounts with the classic account from tickmill and others.

Leverage

What is leverage?

Price movements in the forex market can be small. Leverage is a tool that allows you to access borrowed equity to trade with higher without investing an exorbitant amount of using your own funds. For example, trading with 1:100 leverage will allow you to trade up to $100,000 with only $1,000 in your account. Remember that this invokes a high risk as price movements can turn unfavourably in certain trading environments.

What determines leverage?

The maximum leverage that a CFD broker can offer depends on what the regulator of the country you are trading from will permit. Tickmill uses the following regulators: FCA, cysec for clients in the UK and europe, FSCA for clients in south africa, LFSA for malaysia clients and FSA for clients in other regions.

Retail investor accounts (for clients in the UK and europe):

- Up to 1:30 on forex in the UK and europe

- Up to 1:20 on stocks indices and oil

- Up to 1:20 on metals

- Up to 1:5 on bonds

FCA and cysec regulations are tighter than most regulators in other countries require. However, if you are in the UK or europe, you may be eligible for a professional account which will allow you to access leverage in line with tickmill clients in other regions.

Professional investor accounts (UK and europe clients) and retail investors accounts (outside the UK and europe):

- Up to 1:500 on forex

- Up to 1:100 on stocks indices and oil

- Up to 1:500 on metals

- Up to 1:100 on bonds

Trading platforms

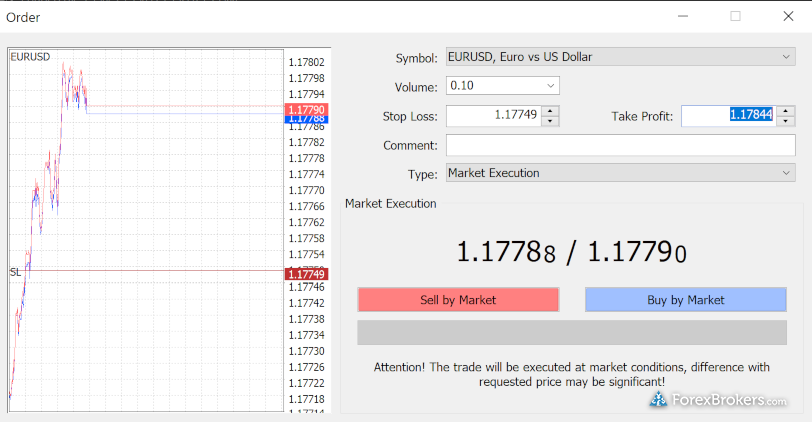

Tickmill only allows you to trade using the most popular trading platform: metatrader 4. Despite the minimal selection of trading platforms, metatrader 4 is the most commonly used system and provides a range of features to help you trade the financial markets.

Metatrader 4

Metatrader 4 is the first and most popular trading platform developed by metaquotes software. Metatrader 4 is user-friendly, customisable, and designed to let you trade with ease on desktop or mobile trading (including ios and android). This platform is the favourite among many forex traders around the world because of its sophisticated level of trading analysis tools, customisable interface, charting functionality, and access to expert advisors through the accompanied metatrader marketplace.

Along with the advanced trading conditions from tickmill, you can enjoy many features from using the metatrader 4 trading platform:

- Fast order execution on a range of cfds including forex, stock indices, commodities, and bonds

- Expert advisor trading facilities and advanced trading signals (run on tickmill VPS) suitable for scalping

- Provision of fundamental and technical analysis tools including over 50 indicators and customisable charting

Metatrader 4 webtrader

The metatrader 4 webtrader platform allows you to access the markets online directly through your web browser. The webtrader trading platform through tickmill makes trading more accessible as the metatrader system is available directly in your browser. Equipped with all the same functions as the original, the webtrader version has enhanced security with data encryption. However, the trade execution time is a little more lagged.

The metatrader 4 webtrader trading platform offers:

- Access to one-click trading through all modern browsers

- Real-time quotes on customisable price charts

- Over 30 indicators to use across 9 different time frames

- Trading history and encrypted data transmission

Other platform

Myfxbook copy trading

If you prefer to copy the trades of other successful traders, then myfxbook is available within your metatrader 4 trading account.

Myfxbook works by providing you with tools to find and follow other traders in their social network. You can then use filters which will allow you to replicate their trades within the conditions you set. Social trading is popular for those that don’t have the experience or time to invest in trading themselves, instead, you can leave the work to other traders.

Third-party tools

Tickmill clients can access third-party technical analysis tool autochartist. This is one of the most comprehensive forex trading tools that can add some value to your trading. Authochartist uses advanced technology to analyze past market trends and identify real-time trading opportunities across a wide selection of CFD instruments.

Some of the best tools included in the autochartist market analysis pack include:

- Automated trade alerts

- Volatility analysis for SL and TP optimization

- Fibonacci patterns

- Market reports delivered 3 times per day

- Historical performance statistics

- The key support and resistance levels

- Customizable searches to only get the data you need

Autochartist is offered free of charge to all tickmill live account holders. This tool is offered as an MT4 plugin as well as a standalone web application.

Financial products

A range of trading instruments including forex, stocks indices and oil, precious metals, and bonds are available.

Tickmill does lack some diversity in the cfds on offer. For example, you cannot trade popular cfds such as cryptocurrencies, stocks, etfs or soft commodities (such as crops and livestock) through tickmill. This can limit your ability to spread your risk through investment diversity.

Forex

The forex market is the most popular financial market because of its volatile price movements and 24/5 availability for trading. When trading forex, you are simultaneously buying and selling currencies for profit. Tickmill offers you access to over 60 currency pairs, allowing you to trade popular currencies such as USD, EUR, and GBP. Spreads start from 0.0 pips, and the average trade execution speed is 0.20 seconds.

At tickmill, trading minor and exotic forex pairs is also available with no requotes and ultra-fast execution speed of 20ms.

Stock indices and oil

Stock indices allow you to track a group of stocks to buy and sell them as an aggregate, rather than picking single stocks. Where stocks show the performance of a company, stock indices are useful to determine the economic health of sectors, industries, or countries. Tickmill offers 14 stock indices with no commission fees.

Trading WTI oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Trading oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Precious metals

Gold and silver metal commodities against the USD are available through tickmill. These trading instruments are relatively uniform across the world and are typically safer assets during periods of market uncertainty. With the metatrader 4 trading platform, you can trade gold and silver from 0.0 pips spreads, no commissions, and an average trade execution speed of 0.20 seconds. Much like the forex market, you can trade precious metals 24/5.

The tickmill range of precious metals is small. Other popular metals such as copper, palladium, platinum are not available.

Bonds

Tickmill offers 4 types of government bonds (also known as treasury cfds) which are agreements between borrowers and lenders that you can trade over the counter. These bonds are futures (cash) contracts. Tickmill provides access to german bonds from 0.0 pips spread and no commissions.

Customer service

Hours of support

Tickmill provides extensive trading services and customer support with the head office in london, united kingdom. You can contact the CFD broker through the client support number or office number during 7:00 to 16:00 GMT monday to friday. Tickmill also provides a support email with a response time within 24 hours on business days. A livechat is also available through their website tickmill.Com, one can choose from 14 different languages.

Education and research

Tickmill provides a range of educational resources to help you improve your trading experience with tickmill. Some of these tools are available for download and some require registration. These tools can help you improve your trading strategies.

- Ebooks – topics include introduction to fibonacci analysis, know your trading costs, risk management, trading forex

- Videos – forex trading, market analysis, trading psychology, trading strategies, social trading, stocks, MT4

- Webinars – hosted by forex experts, these webinars are in a range of languages including english, german, polish, portuguese, turkish

- Seminars – these seem to have stopped at least for 2020 but are allow you to hear from forex experts online

- Infographics – these are visual graphics that visualise data, charts and statistics on trading topics

Minimum deposit – funding

Tickmill has a zero fees policy for deposits and withdrawals. This means there are no costs from the brokers’ end for using when transferring funds. If your wire transfer and your deposit are greater than $5000, tickmill will refund any fees up to $100 with if you can provide a bank statement.

To open an account with tickmill, you will require a minimum deposit of $100. To access a VIP account, your balance will need to be $50,000 to open your position. Tickmill accepts 4 different deposit currencies EUR, GBP, USD and PLN. Deposits made in unsupported currencies will be converted incurring a conversion fee to the previously mentioned currencies.

Tickmill offers a range of deposit and withdrawal methods, and there is a minimum withdrawal requirement of $25. Fund transfer will be instant or up to 1 working day:

- Bank transfer

- Visa and mastercard

- Skrill

- Neteller

- Dotpay

- Paysafecard

- Sofort

- Rapid transfer

- Paypal

- Unionpay

- Fasapay

- Qiwi

Tickmill doesn’t have any official inactivity fees however tickmill may apply charges if they believe you are not actively using your account.

Regulation and risk management

Global regulation

Tickmill has regulation in several countries including:

- Tickmill UK ltd: financial conduct authority (FCA) for the UK (register number 717270)

- Tickmill ltd: seychelles financial services authority (FSA) for seychelles (licence number SD008)

- Tickmill europe ltd: cyprus securities and exchange commission (cysec) for cyprus (licence number 278/15)

- Tickmill asia ltd: labuan financial services authority (LFSA) for labuan (licence number MB/18/0028)

- Tickmill south africa (pty) ltd: financial sector conduct authority (FSCA) for south africa (licence number FSP 49464)

Tickmill asia applies for clients in malaysia, all clients outside tickmill subsidiaries that have FCA, cysec, LFSA and FSCA regulation will have FSA regulation. While tickmill policies for FSA will be in line with other regulators, you need to remember that FSA is an offshore regulator. So if you have any complaints, you may not have the protection you need to settle disputes in case of scams.

If you are australian or from dubai, then you may note that tickmill does not have ASIC or DFSA regulation. We don’t advise using regulators outside your country. So tickmill may not be a suitable broker for your situation.

Risk management features

If an account falls below a zero balance, tickmill will cover the debt by providing negative balance protection. This means that tickmill will cover any losses below a zero balance on your account in the event of trading losses or excessive slippage. The forex broker also uses a risk department to monitor traders’ risk appetite and may notify the client of excessive risk-taking or even reduce the leverage.

Tickmill provides a degree of risk management to improving trading conditions. The range of educational resources and research-based features helps you to improve your trading ability on a demo account before testing your skills with a live account. These tools are a form of risk management as they ensure you understand the nature of trading before getting started.

Furthermore, tickmill allows the maximum leverage depending on the relevant regulatory entity. For retail clients trading forex, leverage is capped at 1:30 whereas professional clients can access leverage up to 1:500. Tickmill also provides a simple and transparent calculation of the required margin for clients to visualize the risk of trades.

Tickmill FAQ

Is tickmill an ECN broker or market marker

Tickmill is an ECN pricing. Tickmill doesn’t advertise themselves as an ECN broker or STP broker but they offer ECN pricing because they connect you with forex liquidity providers without a dealing desk. This is why spreads are low. As there is no dealing desk, tickmill is not a market maker.

If you are looking for other forex brokers with ECN pricing then see our best ECN brokers. All these brokers offer ECN trading execution using the MT4 trading platform.

What trading platforms does tickmill offer?

Tickmill only offers one trading platform. This is metatrader 4 (MT4). Metatrader 4 is the world most popular platform with brokers and traders so is a solid choice for a trading platform.

Some traders may wish to consider metatrader 5 over metatrader 4 as metatrader 5 allows you to deal with exchange-traded cfds and has superior trading features and speed.

Is tickmill good for beginners?

Tickmill can be a good option for beginners as they have a commission-free account (called the classic account), negative balance protection ensures you account balance never goes below zero, metatrader 4 trading platform and a demo account.

If you are looking for other suitable trading platforms for beginners, see out best trading platforms for beginners.

Is tickmill a good choice for australian traders?

You can certainly use tickmill if you are in australia, however, you will be using seychelles financial services authority (FSA) as your regulator. Compareforexbrokers never recommend using an offshore regulator. If you are trading in australia then we suggest our best brokers australia who all have regulation with the australia securities investments commissions (ASIC).

Overall

With a choice of a classic account which is commission-free and ECN pricing accounts all which allow hedging, scalping and eas, tickmill is a suitable forex broker for traders of all levels of experience. The $2 commission per lot to open your position is some of the best in the market. However, tickmill has a few weaknesses. The broker only offers the metatrader 4 trading platform, which many consider the gold standard for trading platforms however it would be nice to have another trading platform to choose from. Tickmill also limits the range of cfds you can choose from. Overall, tickmill is one of the better brokers, but pepperstone exceeds the broker in most areas.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

5 key facts about tickmill

- Minimum deposit

- $100 - Forex platforms

- metatrader 4 - Trading fees

- low commissions - Regulated by

- cysec

- FCA

- FSCA

- LFSA - Trading account

- classic

- pro - Tradable instruments

- forex

- cfds

- bond CFD

visit tickmill >>

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

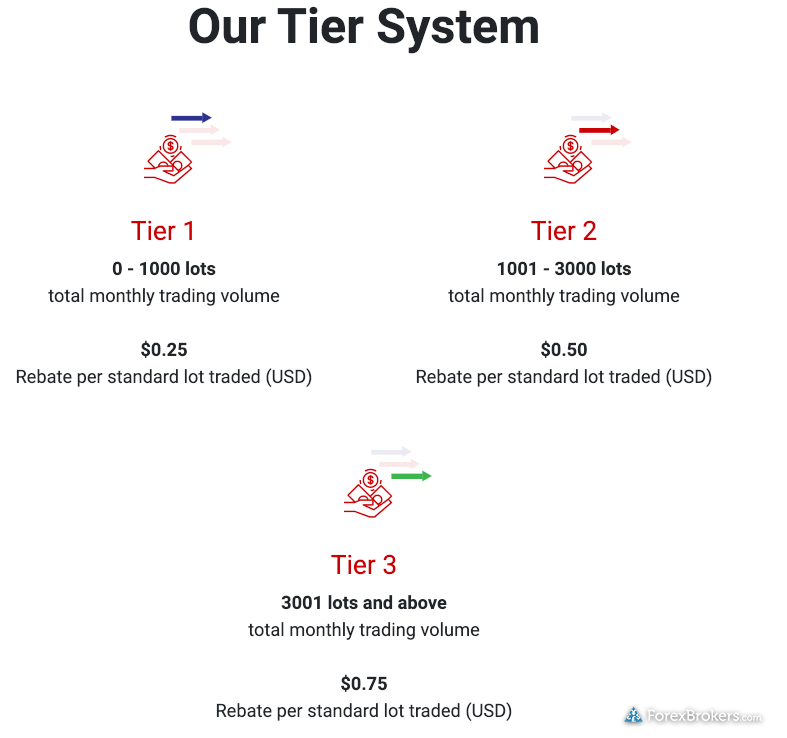

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

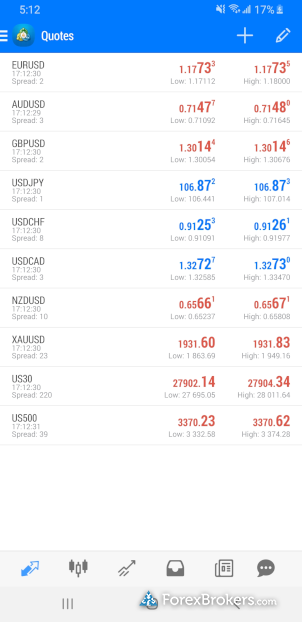

Mobile trading

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Honest tickmill forex broker review – scam or not?

| Review: | regulation: | min. Deposit: | forex pairs: | spreads: |

|---|---|---|---|---|

| (5 / 5) | FCA (UK), cysec (EU), FSA (SE) | 100$ | 50+ | 0.0 pips + 1$ commission per 1 lot |

Are you looking for real experiences and a critical test to the tickmill broker? – then you are exactly right on this page. As traders with more than 7 years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it really worth it to invest in forex broker tickmill money or not? – inform yourself in detail now.

Official website of tickmill

What is tickmill? – the company presented

Tickmill is an international broker for trading derivatives financial forex and cfds. The main headquarters are located in london: 1 fore street, london EC2Y 9DT, united kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. Also, there are branches in cyprus and seychelles.

According to the website, tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Facts about tickmill:

- Forex broker from great britain (london)

- Made by traders for traders

- Specialized in forex trading with special conditions and lowest spreads

- Worldwide branches in different countries

- 114 billion average trading volume per month

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Is tickmill a regulated forex broker?

Regulations and licenses are important for traders and brokers so that a trusting relationship can be created. When a broker applies for a license, certain criteria and requirements must be met. A violation of the policy means in most cases a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). It gives us a positive direct impression. European traders have to trade with the english license (FCA) or cysec license, which brings further benefits. On the other side, international traders have to choose the FSA license.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes handle money incorrectly. In order to avoid such a fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the barclays bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of tickmill with the financial services compensation scheme (FSCS) of up to £ 75,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, cysec, and FSA

- Customer funds are managed by barclays bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Review of the tickmill conditions for traders

Tickmill is a true NDD broker (non-dealing desk) with well-known liquidity providers. It is traded herewith excluded conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

There are more than 84 instruments available on the market. The broker is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. The offer is quite manageable and the tickmill tries to specialize with its offer on currencies (forex). Cfds (contracts for difference) are also available for commodities, government bonds or stock indices. Individual shares cannot be traded on this broker, so here’s a small smear in the rating that must be made.

Tickmill is characterized by its extremely tight spreads and low commission. We have compared many providers in recent years and tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true forex broker. This means you will always be able to open and close a position for the next best price in the market. The liquidity is always given by the various liquidity providers and the slippage is also very low on business news.

The best conditions:

- Very low spreads starting at 0.0 pips

- The extreme low commission in pro and VIP account is a huge advantage

- Pay only 2$ (pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 forex pairs

- Max. Leverage of 1:500

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Tickmill trading platform test

As a trading platform, the metatrader 4 is offered to you. This is a proven and worldwide trading platform for private and professional traders. The platform is available for the browser (web), desktop (download), android (app) and ios (app). With the metatrader, you can easily and flexibly access the markets of tickmill from anywhere in the world.

The metatrader is perfect for any trader who wants to earn sustainable money in the markets. Even with small capital can be traded, because there are micro lots available. In addition, there is always a guaranteed execution at tickmill and no partial execution.

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

Available for any device

In addition, tickmill offers education material and webinars for its clients.

Trading tutorial: how do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs. Including many currencies from emerging markets. This is a huge advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

Cfds are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with cfds on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation is sometimes confusing, tickmill offers a forex calculator. With this calculator, you can determine your risk and the position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in london I have a latency of under 30 ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Use a VPS-server for the best connection

The provider allows any strategies and automatic programs. Expert advisors (eas) can run 24 hours a day automatically through a VPS server at tickmill. The latency is very low and the price from $ 22 a month too.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill automated trading is possible

Tickmill allows every strategy and also automated programs. As mentioned above you can rent a VPS server very cheap. In connection with the metatrader 4 it works without problems and the setup is very simple. Program automatic programs for your trading or use provided trading systems. Today, more than 50% of the order executions are made automatically in the forex market.

Here you can see again that tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

VPS-server allows you trading 24/7 on tickmill.

How to open your free tickmill account:

Another plus point for tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can not tell you whether a deposit without verification is possible.

For verification, it is sufficient to upload your ID and proof of address. The broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at tickmill

The free demo account of tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

3 different account types – which one you should choose?

Tickmill offers 3 types of accounts for traders. Interesting for us is only the pro and VIP account. From our experience, it is not worth the classic account to open, because the fees are accordingly higher than in the pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The pro accounts commission is only $2. So you pay only a fee of $4 per completed trade. When you open a VIP account, you save another 50%, because you only pay $2 for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by european servers. Upon request, an islamic account without swaps (interest) can be created.

| Classic | pro | VIP | |

|---|---|---|---|

| min. Deposit: | 100$ | 100$ | 50.000$ |

| spreads: | 1.6 pips | 0.0 pips | 0.0 pips |

| leverage: | max. 1:500 | max. 1:500 | max. 1:500 |

| commission: | 0$ | 2$ per 1 lot traded | 1$ per 1 lot traded |

Info: tickmill also offers its european customers to sign up as a professional trader and keep the high leverage of 1: 500.

The VIP account is the best choice for high volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of 50,000$, you have even cheaper fees. You then only pay $ 1 per traded lot. This makes $ 2 per completed trader. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, tickmill account types offer a great opportunity for every trader. The terms are very good and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, tickmill is the right decision for beginners or advanced traders.

Compare the terms between tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my forex broker comparison. With no other broker, you get so cheap trading fees without conflict of interest.

Review of the deposit and withdrawal of tickmill

At tickmill you can deposit and withdraw using the same methods. Bank transfer, credit card, skrill and neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are very fast and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a very small position size and the risk is in most cases only a few cents high. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Tickmill deposit and withdrawal methods

Questions and tips for your transactions:

- Open your free account at tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – this is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with tickmill safe? – yes, tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: now use sofortüberweisung (klarna) or paysafecard to capitalize your account even faster.

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At tickmill there is no additional funding and you are thus protected against a negative balance.

With tickmill you cannot lose more money than your deposit.

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than 10 different languages (also africa, asia, india, thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, 7 days a week. The support is provided by chat, phone or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example at the world of trading in frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders and tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are giovanni cicivelli or mike seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from tickmill is very good and professional. Our personal concerns were always resolved very quickly and we can make a clear recommendation here. Overall, the overall package is rounded off with a great service.

| Support: | available: | phone number: | special: |

|---|---|---|---|

| phone, chat, email | 24/5 | +44 (0)20 3608 6100 | webinars, 1 to 1 support, events |

Conclusion of my review: tickmill is one of the best forex brokers

My experience and tests show on this page that tickmill is a very good broker. He gets from us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

With the world’s cheapest fees, the broker is currently topping any competitor. The trading experience is unique with this broker and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK regulation and high customer safety

- The cheapest forex broker of the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for forex traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Tickmill is the best forex broker in the world because of the cheap trading fees and good execution. (5 / 5)

Read our other articles about tickmill:

Tickmill UK review 2021

| tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

Tickmill is a multiple award-winning broker that provides access to forex, cfds, indices, commodities, bonds. Tickmill allows traders to use the metatrader4 trading platform, but unfortunately not metatrader5 at this point.

Careful traders will be reassured knowing that tickmill is licensed to offer trading services by several regulators, 4 in fact, including the FCA.

Tickmill summary

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Ratings

CFD trading

Trade on 80+ CFD instruments across FX, stock indices, & commodities.

| FTSE spread | 0.9 |

|---|---|

| GBPUSD spread | 0.3 |

| oil spread | 0.4 |

| stocks spread | N/A |

Forex trading

Trade on majors, minors and exotics with up to 1:500 leverage.

| GBPUSD spread | 0.3 |

|---|---|

| EURUSD spread | 0.1 |

| EURGBP spread | 0.4 |

| assets | 62 |

Payment methods

Tickmill accepts the following payment methods:

- Skrill

- Neteller

- Visa

- Webmoney

- QIWI

- Wire transfer

- Fasapay

- Rapid transfer

- Perfect money

- Swift

- Sticpay

- Paysafecard

Awards

Tickmill is an award-winning broker, with 5 awards received so far.

- Best commodities broker 2020 - rankia markets experience expo

- Best trading experience 2020 - forex brokers award

- Best forex execution broker 2019 - CFI.Co awards

- Best CFD broker asia 2019 - international business magazine

- Best forex CFD provider 2019 - online personal wealth awards

Tickmill vs other brokers

If you want to compare tickmill with other brokers, use the detailed comparisons below.

Tickmill review - is tickmill.Co.Uk scam or good forex broker?

With clients in over 200 countries and an average monthly trading volume of over 120 billion USD tickmill is one of the biggest players in the world of forex. And there is a good reason for this - tickmill is an electronic communication network (ECN) and no-dealing desk (NDD) broker offering premium services and exceptional trading conditions with a choice of several account types and leverage as high as 1:500 for its international clients and all who cover the standards for being professional traders. And all of that comes on the powerful metatradre4 platform.

Licensed in the UK by the financial conduct authority (FCA) and throughout the european union with its cyprus securities and exchange commission (cysec) license and its registrations with the federal financial supervisory authority (bafin) in germany, CONSOB in italy, ACPR in france, and CNMV in spain, tickmill abides by the highest regulatory standards.

Still, as many traders view those standards as overly restrictive, especially when it comes to leverage (in the EU and the UK the maximum leverage allowed for retail traders is 1:30), just like most other major brokers, tickmill operates a subsidiary registered in the seychelles as well, where the regulatory requirements are more relaxed and the broker can offer retail clients much higher leverage and various promotions like a rebate program, trading contests and bonuses.

The company. Security of funds

In the UK tickmill is represented by tickmill UK ltd, which as we noted is licensed and authorized by the local financial conduct authority with a FCA register number 717270.

FCA is one of the most reputable financial watchdogs in the world, overseeing over 59 000 financial service companies. And because the UK is still de facto part of the EU all FCA brokers have to abide by the european markets in financial instruments directive (mifid), which establishes the market rules throughout the union.

According to those rules all FCA brokers have to maintain operational capital of at least 730 000 EUR, readily available to cover all outstanding payments towards clients. Also, FCA brokers have to store all capital, deposited by clients in segregated from their own, protected from creditors trust accounts, to report all trading transactions, to allow regular external audits, to provide traders with a negative balance protection and to participate in the financial services compensation scheme, which in practice guarantees the first 85 000 GBP in your trading account, even if a broker happens to be insolvent.

After january 1st 2021, when the brexit transition period will be over and the UK will finally divorce EU, FCA confirmed that it will retain all EU regulatory requirements, which are currently in place, without relaxing any of them.

Throughout the european union tickmill is represented by tickmill europe ltd, which is duly licensed and authorized by the cyprus securities and exchange commission (cysec) as a cyprus investment firm (CIF) with a license number 278/15.

Along with FCA in the UK and the australian securities and investments commission (ASIC), cysec is one of the three most popular regulators in the forex industry. Its requirements also follow the mifid guidelines and the only difference compared to the FCA requirements, is the amount covered by the local compensation scheme. With cysec as a member of the cyprus investor compensation fund (ICF), tickmill europe guarantees all traders' funds for up to 20 000 EUR.

Tickmill europe is also registered with a number of other european regulators - the federal financial supervisory authority (bafin) in germany, commissione nazionale per le societa e la borsa (CONSOB) in italy, autorite de controle prudential (ACPR) in france, and comision nacional del mercado de valores (CNMV) in spain and abides by the european data protection laws and the general data protection regulation (GDPR).

One of the two international subsidiaries of tickmill - tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA).

As we noted the FSA regulatory requirements are not that strict as those in europe and the UK and that allows the seychelles brokers to be more flexible and to offer various benefits to traders, including higher leverage levels.

The seychelles subsidiary of tickmill for example offers everyone leverage as high as 1:500, while in europe and the UK the leverage for retail traders is caped at 1:30.

Similarly to FCA and cysec FSA has some fiscal requirements - brokers have to register a local company with a share capital of at least 50 000 USD, with at least 2 shareholders and 2 directors, where a single person can be both a shareholder and director.

Unlike cysec and FCA brokers however, seychelles brokers can use their capital for various purposes and not only to cover payments towards clients, which gives them more financial flexibility.

Also, FSA brokers do not have to separate their clients money from the their own funds in segregated account – something which brokers in europe and the UK are obliged to do.

For their clients in asia tickmill has registered tickmill asia ltd., which is licensed and authorized by the labuan financial services authority - the regulatory authority of the international business and financial district of labuan in malaysia.

Trading accounts

| account type | minimum deposit | minimum trade size | maximum leverage | spreads |

| PRO account | $100 | 0.01 lot | 1:500 | from 0.1 pips + $4/lot |

| classic account | $100 | 0.01 lot | 1:500 | from 1,6 pips |

| VIP account | $50 000 | 0.01 lot | 1:500 | 0 pips + $2/lot |

With all of their subsidiaries tickmill offers three account types – pro classic and VIP with an option for an islamic or a swap free account as well. The corresponding accounts with all tickmill subsidiaries offer the same trading conditions with the exception of the leverage, which, as we already noted, is restricted on some markets like europe and the UK.

With all account types tickmill offers a selection of 62 currency pairs, many of which minor and exotic, as well as cfds on gold, silver, 14 major indices like S&P 500 stock index, nikkei 225 stock index and FTSE 100 stock index, brent, WTI crude oil and several types of german government bonds. The maximum leverage for all retail traders is capped at 1:30, but if you can prove that you are a professional trader this restriction will not apply. So if you are a professional trader with tickmill UK you will be offered leverage as high as 1:500, while with tickmill EU – leverage of up to 1:300. The execution is said to be within just 0,15 sec, which is also very attractive.

PRO account comes with spreads starting from 0,1 pip and a small trading commission of just 2 USD per standard lot per side, which when calculated in to the equation yields actual spreads starting from 0,5 pips, which sounds great. With a pro account you can trade with micro lots, the initial deposit requirement is just 100 USD and the account can be opened in USD, euro, british pounds and polish zloty.

The margin call and the stop out are set at 100% and 50% for all retail clients and 100% and 30% for all professional clients respectively.

The classic account comes with spreads starting from 1,6 pips and no trading commission. As with the PRO account you can also trade with micro lots, your minimum deposit requirement is 100 USD and the base account currencies could be USD, EUR, GBP and PLN.

The account is suitable for beginner and professional traders alike as it offers ultra-fast order execution and no dialing desk (NDD) trading environment.

The margin call and the stop out are the same as with the PRO account - 100% and 50% for retail clients and 100% and 30% for professional clients respectively.

The VIP account is created especially for high volume traders, who are looking for competitive trading conditions and other benefits.

The spreads with a VIP account start at virtually zero pips, and you have a symbolic trading commission of just 1 USD per standard lot per side, which when added to your trading costs gives actual spreads starting from just 0,2 pips. Besides, that commission is only applied if you trade forex pairs and precious metals like silver and gold. With cfds on stock indices, oil and bonds you will not pay any trading commission.

The VIP account is also available in USD, EUR, GBP and PLN, and the margin call and the stop - out are also set at 100% and 50% for retail clients and 100% and 30% for professional clients.

The islamic accounts are especially created to service the muslim trading community, as muslims are forbidden to give or receive interest. So with an islamic or a swap free account, as it is also called, you can keep your positions open over night without paying for that. The service is usually compensated with slightly higher spreads, but in the case of tickmill you have a small fee charged if you have a position open for more than three consecutive trading days.

Tickmill seychelles and tickmill asia

As we already noted the international subsidiaries of tickmill offer the same trading accounts as the european subsidiaries of the broker - pro classic and VIP, with one notable exception – all traders, retail and professional alike are allowed to use leverage as high as 1:500.

Also, with tickmill seychelles and tickmill asia you can open trading accounts only in USD, EUR and GBP and your margin call and stop out are 100% and 30% respectively. The execution model is also NDD though.

Maximum leverage

As we already mentioned, depending on whether you are trading with tickmill UK and tickmill EU, or you have chosen one of their international subsidiaries of the broker, the maximum leverage you will be offered will be different.

Tickmill UK and tickmill EU

In an effort to limit the loses many retail traders used to suffer, back in august 2018 the european securities and markets authority (ESMA) - the securities and markets regulator of the european union - restricted the maximum leverage brokers are allowed to offer retail traders.

Henceforth, retail traders in europe are authorized to trade main currency pairs with a leverage of no more than 1:30, and gold and certain other cfds like non- major currency pairs, and the main stock market indices at levels not exceeding 1:20. The leverage on commodities other than gold and non- major market indices is capped at 1:10, while for individual stocks the limit is set at 1: 5. For crypto cfds, the authorized leverage is only 1:2.

As we note however, if you cover the criteria for being a professional trader, you will be offered a much higher leverage – up to 1:500 for traders in the UK and 1:300 for traders in the 27 EU member states.

To qualify for a professional trader you should meet at least two of the following three criteria: 1) you should have executed transactions of a significant size with an average frequency of 10 trades per quarter over the previous four quarters; 2) the size of your portfolio, including cash deposits and financial instruments, should exceed 500 000 EUR; 3) you should have worked in the financial sector for at least one year on a position, requiring knowledge about leveraged products such as cfds.

Tickmill seychelles and tickmill asia

The leverage restrictions on the european market, which followed similar moves by the financial authorities in the U.S. And canada (the maximum leverage allowed in the U.S. Is 1:50, while in canada – 1:75) forced many major brokers to open international subsidiaries, where such restrictions do not apply. Thus, with their seychelles and asia subsidiaries tickmill are able to offer all clients leverage as high as 1:500.

Minimum initial deposit

The minimum deposit requirements for all tickmill accounts are the same, no matter with which of their subsidiaries you trade.

You can open a pro or a classic account with just 100 USD, while for a VIP account you should maintain a trading balance of no less than 50 000 USD.

Myfxbook copy trading with tickmill

With its international subsidiaries tickmill offers its clients the opportunity to join a well known copy trading platform – myfxbook. To join it you should have a demo or a live account, which should be linked to myfxbook autotrade on the myfxbook website. Than you simply go to the autotrade section, click 'manage' and choose the trading system you want to follow. Trades will be copied instantaneously and you can adjust your trading risk by changing the multiplier value, which will show you immediately the hypothetical return and risk you could be exposed to, based on the data gathered so far. A multiplier value of 1 means you are getting the same risk ratio as the trader you follow.

Similarly, if you are an experienced trader with a proven track record, you can offer your trading strategies and join myfxbook, where your trades can be copied by over 90 000 followers. Besides, you can earn as much as 0.5 pips per a winning trade.

The requirements to join myfxbook and to offer your trading system to other traders, are to have a live metatrader 4 account with at least three months history; your drawdown should not exceed 50%; your returns for the past three months should be at least 10% or higher than your drawdown; your average pip per trade for that past three months should be at least 3; your average trade time should be over 5 minutes; you should not be using any martingale or grid techniques; for the past three months of trading your account balance should be at least 1000 USD; and you should have executed at least 100 trades in three months.

Trading platforms

Tickmill supports the metatrader4 (MT4) platform, available for mac and windows PC, android & ios devices and as a web-based version.

MT4 is a powerful platform that has been holding the title of the most popular forex trading terminal ever since 2005 and continues to be preferred by most investors and brokerages. It has a user-friendly interface, and offers all a trader needs: advanced charting package, a number of technical indicators, extensive back-testing environment and a variety of expert advisors (eas).

What is more, tickmill has partnered with myfxbook to offer its clients advanced automatic trading options via the autotrade platform.

VPS service is also available with tickmill, so that traders can install their favorite EA applications and have them running around the clock without requiring their PC to be on. VPS is porvided by one of the largest forex VPS providers – beeksfx.

Promotions

If you succeed to become the most successful trader of the month you will get a 1000 USD price. This promotion is also available only with the international subsidiaries of the broker. When deciding on the winner, tickmill takes into account not only your profits, but also your money and risk management skills.

Tickmill's NFP machine

If you follow the US labor market you can win up to 500 USD every week a non- farm payroll report is released. During every NFP week tickmill chooses one trading instrument and challenges all traders to guess its price on the metatradre4 platform at 16:00 – exactly 30 minutes after the NFP release.