Trade forex without a broker

What about problems on the trader’s end of things? Well, this really comes down to the fact that no regulated broker is going to ever be allowed to accept clients into their platform without having them meet the KYC requirements.

Top-3 forex bonuses

Since the very inception of forex trading, KYC (know your customer) documents have been presenting challenges to both traders and brokers alike. These documents are often the one thing that stands between a prospective trader and the platform they need to use to profit from FX trading.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

How to trade forex completely anonymously (without KYC documents)

The reasoning behind KYC requirements is a noble one, but there are problems that the requirements present

Since the very inception of forex trading, KYC (know your customer) documents have been presenting challenges to both traders and brokers alike. These documents are often the one thing that stands between a prospective trader and the platform they need to use to profit from FX trading.

In this article, we’re going to talk about what these document requirements are, why brokers have always asked for them, and how you can now partner with brokers such as eaglefx in order to avoid having to trade off your personal information in exchange for access to a forex trading platform.

KYC documents overview

The foundation of know your customer documents is rooted in an anti-money laundering initiative that was put in place in 2014. The initiative’s goal was to battle money laundering, especially laundering on the part of those who wish to help finance global terrorism.

Clearly, KYC requirements stem from a very noble cause and as such, we cannot refer to them as a “bad” thing exactly.

What we can refer to them as is a challenge, simply because a surprising number of individuals do not have the identification and documents required to meet KYC requirements.

KYC documents are requested from a variety of financial institutions, such as banks, money lenders, and other businesses that deal with incoming and outgoing financial payments.

The document requirements include a legal, government-issued color photo identification card. This could be a passport, driver’s license, military ID card, or other official ID.

They also require proof of one’s residence and could be either a bank account or credit card statement, utility bill, telephone bill, or other official documents that show proof of residency.

This proof must be dated and must be dated no more than 3-months from the day that the document was submitted as proof.

Problems stemming from KYC requirements

As mentioned above, the reasoning behind KYC requirements is a noble one, but the problems that the requirements present are two-fold. On the one hand, the sharing of the documents puts one at risk of identity theft.

On the other, not everyone has them. There are a million and one reasons as to why one might not have one or both of the document types which are required and the fact of the matter is that brokers that adhere to know your customer rules do not care why you do not have them, instead, caring only that you don’t.

Sharing your personal details presents its own set of problems, but when combined with sharing payment method details, the threat grows by leaps and bounds.

When funding an account via credit or debit card, or even by bank wire transfer, you’re going to have to share payment information. This could include card numbers, account numbers, or other information which is best left private.

Often, it is not the broker that requires that you share this information, but instead the payment processors and banks that work with the brokerage in order to accept deposits and issue withdrawals.

Issues with credit/debit and bank wire deposits

When it comes time to make a purchase, most people immediately reach for their wallet or purse to grab a credit or debit card.

Some think nothing of entering their card numbers online, while others go to great lengths to avoid doing so.

When making a card deposit with a forex broker, you will need to share not only the complete card number but also card information such as the expiry date and special CVV code from the backside of the card.

The broker may go one step further in asking you to send a photo of the physical card with all by the last four card numbers covered in order to help establish that you are in fact the owner of the card and payment account.

For larger deposits, in particular, bank wire transfers are often opted for. Wire transfers offer a more secure method of fund transfer but are of course the slowest of the available deposit and withdrawal options.

In some cases, you may be asked to send a wire transfer receipt to the broker, and this receipt may contain a substantial amount of personal information. It should be possible to blackout any private details that are not pertinent to the actual transfer, but even this might not be enough to offer total protection.

Wire transfers also tend to be costly. Even when the broker forgoes any wire deposit fees, the average wire transfer fee charged by a bank is around $30 per outgoing and incoming transfer.

Avoiding know your customer document submission

The most important step to avoiding the KYC process completely will be to select a broker that allows you this right. The aforementioned broker, eaglefx, is one of the most reputable brokerages that now permit their clients to trade FX anonymously. Their registration process requires that one only submit their first and last name, along with their email address.

An email will be used to send important information to you, which includes confirmations, monthly activity statements, and much more.

Because of this, you’ll want to provide a real email address rather than a bogus one.

The next step will be to only deposit and withdraw using a cryptocurrency such as bitcoin. With other payment methods, the broker is required to collect your KYC documents, but are at liberty to bypass the requirement when the trader opts to conduct all of their banking transactions by way of digital coins.

This step is completely necessary, so if you’ve never purchased cryptocurrency in the past, now is the perfect time to become familiar with them. The purchasing and submission processes are actually quite simple and even better, take very little time to complete.

Potential problems?

There are a few potential problems with anonymous FX trading, but the bulk of these fall onto the broker. For example, allowing private trading means that the broker is unable to manage certain controls, such as the location of the trader.

Perhaps the broker doesn’t want to accept clients from china. By not requiring KYC documents to be submitted, they are much less likely to be able to control this. The same applies to a client’s age.

When identification is required, the broker can ensure that the trader does meet their age requirements. These are just two of the risks that the broker accepts when allowing for private forex trading.

What about problems on the trader’s end of things? Well, this really comes down to the fact that no regulated broker is going to ever be allowed to accept clients into their platform without having them meet the KYC requirements.

They fully understand that they are missing out on a large segment of the market, but there’s really nothing that they can do to change that.

Who knows what the future may hold, but for now, there’s no immediate solution for regulated brokers who want to allow anonymous trading within their platforms.

The best-case scenario for those who wish to trade forex privately is to select a trusted brokerage that allows it to do their trading with.

Brokerages such as eaglefx are beneficial not only in that they allow clients to trade completely anonymously, but they also offer the perks that all traders want, such as excellent platform conditions, high leverage, 24/7 interactive customer support, same-day withdrawals, low minimum deposit requirements, and much more.

Whether you want to protect your identity and payment information, or simply do not have the documents required to pass the KYC test, you now have a solid option for trading FX on your own terms.

Sign up and start trading 100% anonymously with eaglefx!

Disclaimer: the content of this article is sponsored and does not represent the opinions of finance magnates.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

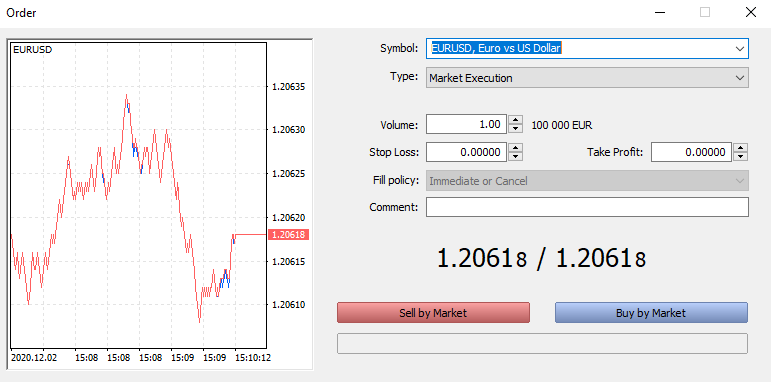

Download MT4 and open metatrader 4 demo account without a broker

Want to get free forex demo account fast without registering with any forex broker? Follow this MT4 tutorial and rimantas will teach you how to download MT4 and open MT4 demo account without a broker in a few minutes. In this video guide, you’ll learn exactly how to do that.

Rimantas makes it simple for you to download MT4, install MT4 on PC and open forex demo account without a broker.

Why would you want to have metatrader 4 demo account without a broker?

There are two mains reasons for that:

- There are many forex brokers with a bad reputation and people usually do not start trading at all because they don’t know which broker to choose. When you can get a demo trading account without a broker you don’t have to stop yourself from learning how to trade forex. Now you can start demo trading without a broker. You can always pick one later when you feel you are ready to begin live trading.

- You do not need to register with any forex broker and get your email inbox filled with spam messages and getting promotional phone calls every day from the broker ��

Here’s what rimantas teaches in this MT4 tutorial:

- How to download MT4 platform from fxopen. We download from fxopen because they give direct MT4 download link without website registration required.

- How to open metatrader 4 demo account without a broker (even when we download metatrader 4 from fxopen).

- Why didn’t I download the MT4 installation file from the official metatrader 4 website?

- How to open a demo trading account with fxopen broker (in case you’ll need it later). We are not affiliates for fxopen or recommend them. We use them only as an example because they give a direct MT4 download link.

Author profile

EA coder

EA coder is a nickname of one of the most well-known programmers among forex traders - rimantas petrauskas. Having more than 20 years of programming experience, he created two of the most popular trade copiers for the metatrader 4 platform — the signal magician and local trade copier.

A #4 amazon best-selling author in forex category, rimantas's book is called "how to start your own forex signals service".

The 10 best forex broker with zero (no) spread accounts

Do you want to pay less trading fees when investing in currency pairs? – then you should choose zero or no spread forex broker. On this page, we will show you the top 10 companies which are offering trading with starting pips at 0.1. Trading fees can be very expensive when you are doing scalping or high volume trading. By choosing one of our recommended forex brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading.

| Broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 0.0 pips + NO COMMISSION ($ 10 deposit) – only on main market hours | cysec (EU) | + leverage up to 1:1000 + personal service + best platform |

Save trading fees by using a low spread forex broker

Overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account. If you do a calculation between these two account types you will always see that the zero (no) spread account is cheaper for you. Less trading fees will bring you a higher profit.

Comparison between a spread and zero (no) spread account:

For example, you want to trade 1 lot with the EUR/USD asset. On the spread account, you got a 1.0 pip spread. The pip value is $10. That means you are paying a fee of $10 by opening and closing the trade. The value of the fees is depending on the asset.

Spread account: 1 lot EUR/USD with 1.0 pip spread = $10 spread fee

On a zero (no) spread account you are paying the most of the time $3.5 per 1 lot trading (commission)

Zero spread account: 1 lot EUR/USD with 0.0 pip spread = $3.5 spread fee

In conclusion, the zero spread account is 65% – 50% cheaper than a normal spread account. So you should definitely use a zero spread account to pay fewer fees.

Advantage of a 0.0 pip account:

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements. The real market prices are traded by the broker. Overall, the trading with a 0.0 pip account is more transparent.

- Payless trading fees

- Better trade execution

- Real market prices

- Transparent trading

- Best for scalping

Disadvantages of a 0.0 pip account:

There is only one disadvantage of a 0.0 pip account. Some forex brokers got no negative balance protection. Forex trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position (big news event overnight). If you got bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible.

Our values to find a good online partner

For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know how to check a partner by certain criteria. Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage.

In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex. Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional.

Criteria for a good forex broker:

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

How does a 0.0 pip forex spread broker earn money?

In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot (100.000) trade. If the commission is $6 per 1 lot trade you will pay a commission of $0.06 if you are trading 0.01 lot.

In conclusion, the forex broker always earns money because of the additional spread or commission. If you are a high volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

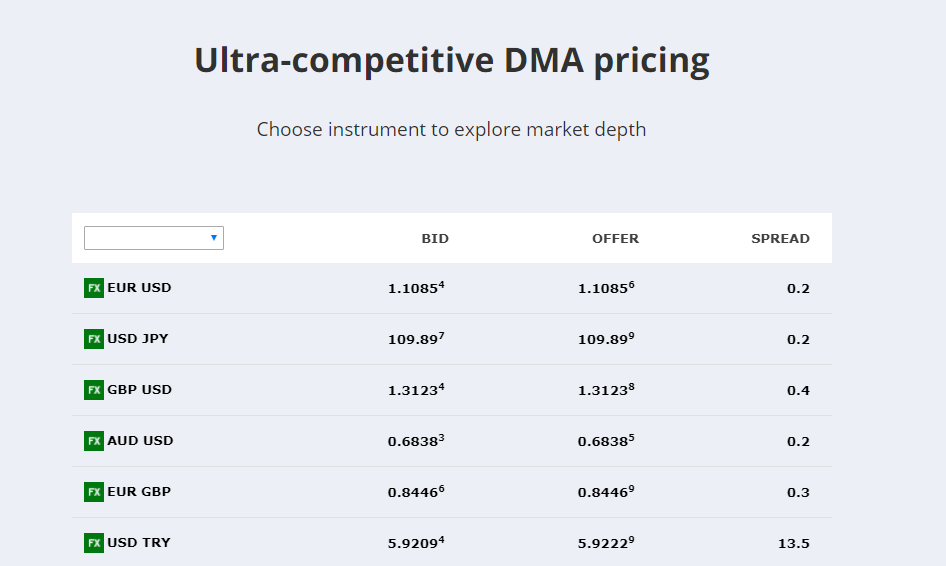

See the picture of 0.0 pips spread in EUR/USD trading here:

How does the no spread account really work?

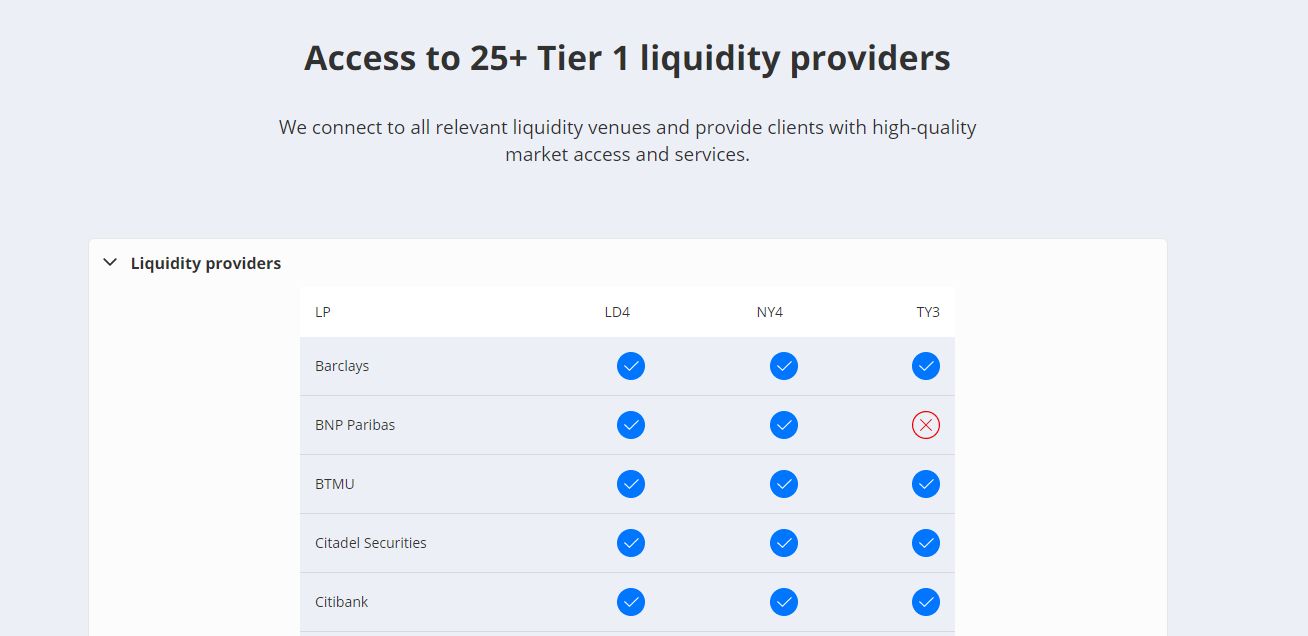

In the following, we will show you exactly how it works behind the scenes. The most forex brokers getting liquidity by a “market maker” called “liquidity provider” and some companies are making it by themself. Around the world, there are big liquidity providers like banks (goldman sachs, barclays, citibank, and more). These banks are giving direct market liquidity to the forex brokers.

Forex broker liquidity providers

The orders are matched by the “spot market” and not traded on a real stock exchange like stocks or futures.

Get direct market spreads

With a zero spread account, you get direct market access and real original prices. Most forex brokers show you the liquidity in the trading platform. You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts.

Direct spreads from liquidity providers

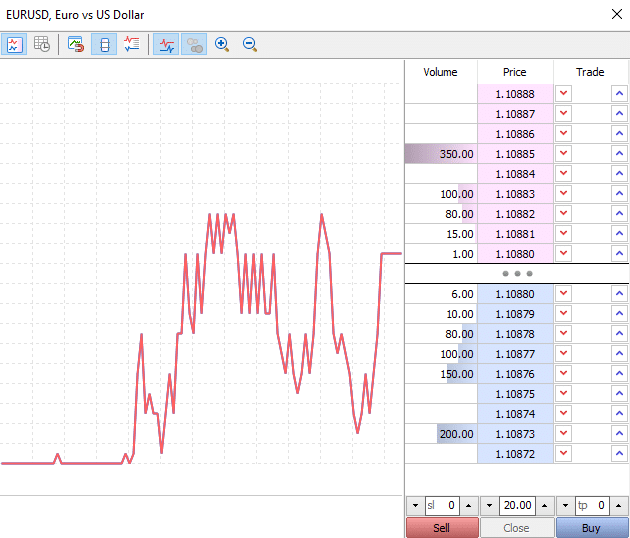

See the market liquidity

The most no spread brokers are ECN or no dealing desk brokers. You can see the market liquidity in your trading platform. The most popular platform is metatrader. If you click on “depth on market” you will see the order book (picture below).

Orderbook for no spread accounts

On the prices, you see the lots based on the liquidity. Liquidity can change very millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast.

No conflict of interest

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

Be careful: slippage can happen on market events

Always be careful by trading forex. The 0.0 pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is small.

We do not recommend to trade on market news because of the high risk. The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs.

Conclusion: you should use a 0.0 pip forex trading account

On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot of brokers are offering this account type. The minimum deposit is different from broker to broker. Sometimes you have to invest more than $1,000 into your account to get 0.0 pips spread.

The forex broker is earning money by an additional trading commission fee which you are paying each trade. Bdswiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset. As you saw in our calculation you can save more than 60% of trading fees if you are switching to a no spread account.

With a regulated broker, you can be sure that there is no scam or fraud. The companies which we present on this page are tested with real money. To get a closer look at a forex broker you can read the full and detailed reviews. The winner is clearly tickmill because the commissions are the lowest.

Our reviews:

- IQ option

- IC markets

- Tickmill

- XTB

- Bdswiss

- XM

- Roboforex

- Vantage FX

- Admiral markets

- Blackbull markets

The zero (no) spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

How to trade forex completely anonymously (without KYC documents)

The reasoning behind KYC requirements is a noble one, but there are problems that the requirements present

Since the very inception of forex trading, KYC (know your customer) documents have been presenting challenges to both traders and brokers alike. These documents are often the one thing that stands between a prospective trader and the platform they need to use to profit from FX trading.

In this article, we’re going to talk about what these document requirements are, why brokers have always asked for them, and how you can now partner with brokers such as eaglefx in order to avoid having to trade off your personal information in exchange for access to a forex trading platform.

KYC documents overview

The foundation of know your customer documents is rooted in an anti-money laundering initiative that was put in place in 2014. The initiative’s goal was to battle money laundering, especially laundering on the part of those who wish to help finance global terrorism.

Clearly, KYC requirements stem from a very noble cause and as such, we cannot refer to them as a “bad” thing exactly.

What we can refer to them as is a challenge, simply because a surprising number of individuals do not have the identification and documents required to meet KYC requirements.

KYC documents are requested from a variety of financial institutions, such as banks, money lenders, and other businesses that deal with incoming and outgoing financial payments.

The document requirements include a legal, government-issued color photo identification card. This could be a passport, driver’s license, military ID card, or other official ID.

They also require proof of one’s residence and could be either a bank account or credit card statement, utility bill, telephone bill, or other official documents that show proof of residency.

This proof must be dated and must be dated no more than 3-months from the day that the document was submitted as proof.

Problems stemming from KYC requirements

As mentioned above, the reasoning behind KYC requirements is a noble one, but the problems that the requirements present are two-fold. On the one hand, the sharing of the documents puts one at risk of identity theft.

On the other, not everyone has them. There are a million and one reasons as to why one might not have one or both of the document types which are required and the fact of the matter is that brokers that adhere to know your customer rules do not care why you do not have them, instead, caring only that you don’t.

Sharing your personal details presents its own set of problems, but when combined with sharing payment method details, the threat grows by leaps and bounds.

When funding an account via credit or debit card, or even by bank wire transfer, you’re going to have to share payment information. This could include card numbers, account numbers, or other information which is best left private.

Often, it is not the broker that requires that you share this information, but instead the payment processors and banks that work with the brokerage in order to accept deposits and issue withdrawals.

Issues with credit/debit and bank wire deposits

When it comes time to make a purchase, most people immediately reach for their wallet or purse to grab a credit or debit card.

Some think nothing of entering their card numbers online, while others go to great lengths to avoid doing so.

When making a card deposit with a forex broker, you will need to share not only the complete card number but also card information such as the expiry date and special CVV code from the backside of the card.

The broker may go one step further in asking you to send a photo of the physical card with all by the last four card numbers covered in order to help establish that you are in fact the owner of the card and payment account.

For larger deposits, in particular, bank wire transfers are often opted for. Wire transfers offer a more secure method of fund transfer but are of course the slowest of the available deposit and withdrawal options.

In some cases, you may be asked to send a wire transfer receipt to the broker, and this receipt may contain a substantial amount of personal information. It should be possible to blackout any private details that are not pertinent to the actual transfer, but even this might not be enough to offer total protection.

Wire transfers also tend to be costly. Even when the broker forgoes any wire deposit fees, the average wire transfer fee charged by a bank is around $30 per outgoing and incoming transfer.

Avoiding know your customer document submission

The most important step to avoiding the KYC process completely will be to select a broker that allows you this right. The aforementioned broker, eaglefx, is one of the most reputable brokerages that now permit their clients to trade FX anonymously. Their registration process requires that one only submit their first and last name, along with their email address.

An email will be used to send important information to you, which includes confirmations, monthly activity statements, and much more.

Because of this, you’ll want to provide a real email address rather than a bogus one.

The next step will be to only deposit and withdraw using a cryptocurrency such as bitcoin. With other payment methods, the broker is required to collect your KYC documents, but are at liberty to bypass the requirement when the trader opts to conduct all of their banking transactions by way of digital coins.

This step is completely necessary, so if you’ve never purchased cryptocurrency in the past, now is the perfect time to become familiar with them. The purchasing and submission processes are actually quite simple and even better, take very little time to complete.

Potential problems?

There are a few potential problems with anonymous FX trading, but the bulk of these fall onto the broker. For example, allowing private trading means that the broker is unable to manage certain controls, such as the location of the trader.

Perhaps the broker doesn’t want to accept clients from china. By not requiring KYC documents to be submitted, they are much less likely to be able to control this. The same applies to a client’s age.

When identification is required, the broker can ensure that the trader does meet their age requirements. These are just two of the risks that the broker accepts when allowing for private forex trading.

What about problems on the trader’s end of things? Well, this really comes down to the fact that no regulated broker is going to ever be allowed to accept clients into their platform without having them meet the KYC requirements.

They fully understand that they are missing out on a large segment of the market, but there’s really nothing that they can do to change that.

Who knows what the future may hold, but for now, there’s no immediate solution for regulated brokers who want to allow anonymous trading within their platforms.

The best-case scenario for those who wish to trade forex privately is to select a trusted brokerage that allows it to do their trading with.

Brokerages such as eaglefx are beneficial not only in that they allow clients to trade completely anonymously, but they also offer the perks that all traders want, such as excellent platform conditions, high leverage, 24/7 interactive customer support, same-day withdrawals, low minimum deposit requirements, and much more.

Whether you want to protect your identity and payment information, or simply do not have the documents required to pass the KYC test, you now have a solid option for trading FX on your own terms.

Sign up and start trading 100% anonymously with eaglefx!

Disclaimer: the content of this article is sponsored and does not represent the opinions of finance magnates.

Forex trading without investment

Forex is a highly volatile market that dwells in currencies. It remains open for 24 hours a day, 5 days a week. Every investor, whether new or veteran, invests money in this fluctuating currency world with the sole aim to make profits. However, it often turns out that potential traders interested in setting their foot do not have enough monetory resources to take a stride. But, with no deposit account and its associated amenities, forex trading without investment is now possible.

What is no deposit bonus?

To put it simply, brokers make every effort to lure new customers and increase their trading base. To do so, they offer a type of trading account where a new trader can start investing without paying a single penny from his store. His broker provides him a welcome bonus that can be used to perform trades. However, this amount is not immediately refundable. The trader has to close a number of trades successfully in order to be eligible for claiming this gift.

How does forex without investment work?

Once you register yourself and instigate an account, the bonus is provided to you with immediate effect. Most brokers provide enough cash to complete a couple of successful trades. Traders have two options here. Either to trade with the given amount or leverage it; by opting for leverage, he or she can look to escalate his position giving him or her chances of greater profit.

Leverage ratios are normally in the ratio of 10:1, 20:1 or 50:1. For example, john wants to start forex without investment. His welcome bonus reads $2,000. He can opt to trade with the given amount or leverage it with any of the given ratios. A 20:1 ratio will provide him an opening sum of 40,000. Such high amount helps him to trade into bigger currencies and increase his chances of reaping profits.

How to choose a no deposit account?

Since now you have garnered adequate information about no deposit accounts, it must be quite tempting to make your first stride in the market. However, one should perform a few checks so as to ensure that this forex trading without investment goes hassle free.

- the authentic broker

To get the taste of forex without investment, it is essential to sign up with an authentic broker. Legal and trustable brokers such as lite forex guarantee authenticity of all documents and makes sure that your money is safe with their impeccable privacy policies. A reliable broker will be fully transparent with its clauses and will lay out clear statements regarding the use and redeem of its welcome bonus.

- compare to choose

Experts recommend comparing a number of forex brokers before settling for one. Comparison should be preferably made of their bonus sections. It is ideal to choose a perfect blend of special promotions as well as forex trading options. Check out for impractical no deposit bonus amounts. These often turn out to be frauds and can ruin your approach to trade forex without investment.

- forums and review

Participating in forums is an important tool to get idea reliable brokers along with their schemes. Have a talk with eminent and veteran traders who will be able to provide valuable insight on choosing the correct service.

Final words

So, if you are looking to set your foot into forex trading with a no deposit account, it is important to perform a check of the above points in order to assure a successful forex trading without investment plan. Happy trading.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

10 ways to avoid losing money in forex

The global forex market is the largest financial market in the world and the potential to reap profits in the arena entices foreign-exchange traders of all levels: from greenhorns just learning about financial markets to well-seasoned professionals with years of trading experience. Because access to the market is easy—with round-the-clock sessions, significant leverage, and relatively low costs—many forex traders quickly enter the market, but then quickly exit after experiencing losses and setbacks. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading.

Do your homework

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Learning about forex is integral to a trader’s success. While the majority of trading knowledge comes from live trading and experience, a trader should learn everything about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies.

Key takeaways

- In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker.

- Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective.

- It's important to use proper money management techniques and to start small when you go live.

- Control the amount of leverage and keep a trading journal.

- Be sure to understand the tax implications and treat your trading as a business.

Homework is an ongoing effort as traders need to be prepared to adapt to changing market conditions, regulations, and world events. Part of this research process involves developing a trading plan—a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives.

How do you make money trading money?

Find a reputable broker

The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker. Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the national futures association (NFA) and is registered with the commodity futures trading commission (CFTC) as a futures commission merchant. each country outside the united states has its own regulatory body with which legitimate forex brokers should be registered.

Traders should also research each broker’s account offerings, including leverage amounts, commissions and spreads, initial deposits, and account funding and withdrawal policies. A helpful customer service representative should have the information and will be able to answer any questions regarding the firm’s services and policies.

Use a practice account

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Few things are as damaging to a trading account (and a trader’s confidence) as pushing the wrong button when opening or exiting a position. It is not uncommon, for example, for a new trader to accidentally add to a losing position instead of closing the trade. Multiple errors in order entry can lead to large, unprotected losing trades. Aside from the devastating financial implications, making trading mistakes is incredibly stressful. Practice makes perfect. Experiment with order entries before placing real money on the line.

$5 trillion

The average daily amount of trading in the global forex market.

Keep charts clean

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. This should be avoided.

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace. The chosen colors, fonts, and types of price bars (line, candle bar, range bar, etc.) should create an easy-to-read-and-interpret chart, allowing the trader to respond more effectively to changing market conditions.

Protect your trading account

While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of the process. Many veteran traders would agree that one can enter a position at any price and still make money—it’s how one gets out of the trade that matters.

Part of this is knowing when to accept your losses and move on. Always using a protective stop loss—a strategy designed to protect existing gains or thwart further losses by means of a stop-loss order or limit order—is an effective way to make sure that losses remain reasonable. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session.

While traders should have plans to limit losses, it is equally essential to protect profits. Money management techniques such as utilizing trailing stops (a stop order that can be set at a defined percentage away from a security’s current market price) can help preserve winnings while still giving a trade room to grow.

Start small when going live

Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. As such, it is vital to start small when going live.

Factors like emotions and slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process.

Use reasonable leverage

Forex trading is unique in the amount of leverage that is afforded to its participants. One reason forex appeals to active traders is the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth. But leverage can just as easily amplify losses.

A trader can control the amount of leverage used by basing position size on the account balance. For example, if a trader has $10,000 in a forex account, a $100,000 position (one standard lot) would utilize 10:1 leverage. While the trader could open a much larger position if they were to maximize leverage, a smaller position will limit risk.

Keep good records

A trading journal is an effective way to learn from both losses and successes in forex trading. Keeping a record of trading activity containing dates, instruments, profits, losses, and, perhaps most important, the trader’s own performance and emotions can be incredibly beneficial to growing as a successful trader. When periodically reviewed, a trading journal provides important feedback that makes learning possible. Einstein once said that “insanity is doing the same thing over and over and expecting different results.” without a trading journal and good record keeping, traders are likely to continue making the same mistakes, minimizing their chances of becoming profitable and successful traders.

Know tax impact and treatment

It is important to understand the tax implications and treatment of forex trading activity in order to be prepared at tax time. Consulting with a qualified accountant or tax specialist can help avoid any surprises and can help individuals take advantage of various tax laws, such as marked-to-market accounting (recording the value of an asset to reflect its current market levels).

Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters.

Treat trading as a business

It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

As with any business, forex trading incurs expenses, losses, taxes, risk and uncertainty. Also, just as small businesses rarely become successful overnight, neither do most forex traders. Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

The bottom line

The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. When approached as a business, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. Traders can improve their odds by taking steps to avoid losses: doing research, not over-leveraging positions, using sound money management techniques, and approaching forex trading as a business.

Forex trading without stop loss

One area where all traders struggle with is determining where to place their stop loss. New traders are repeatedly told to stick to a strict risk-reward ratio and religiously follow their trading plan. Fiddling with a stop loss can be a sign that you are on a slippery slope to margin call or worst, stop out.

Despite all the experts telling you that trading without a stop loss is close to being a criminal offense, there is some appeal in the idea that you might be able to afford yourself some leniency. After all, the markets swing up and down day and night. The level where you originally placed your stop loss may be obsolete after a few hours, and a reevaluation makes total sense. Using no stop loss trading methods can undoubtedly be risky.

In this article, we will explore if and when you should be trading without a stop loss in your forex strategy and how you might be able to overhaul your approach to using stop losses.

Why do we use stop losses?

Before we can decide whether we should trade forex without a stop loss or not, let’s remember why we use them in the first place.

- Stop losses are an essential component of responsible risk management. They limit the maximum amount of damage your position can cause.

- You determine your trade parameters based on analysis that you made in advance while you were cool-headed and not yet emotionally involved in a trade.

- You can move your stop loss once your position in gaining a certain amount in order to secure profits should a trend start to reverse.

A big problem in the forex education space is that traders are educated on the importance of using stop losses. New traders are notoriously prone to blowing their accounts in a very short space of time, so this is not a bad thing. The downside is that many new traders don’t learn how to set a stop loss properly in order to learn the different stop loss strategies retrospectively.

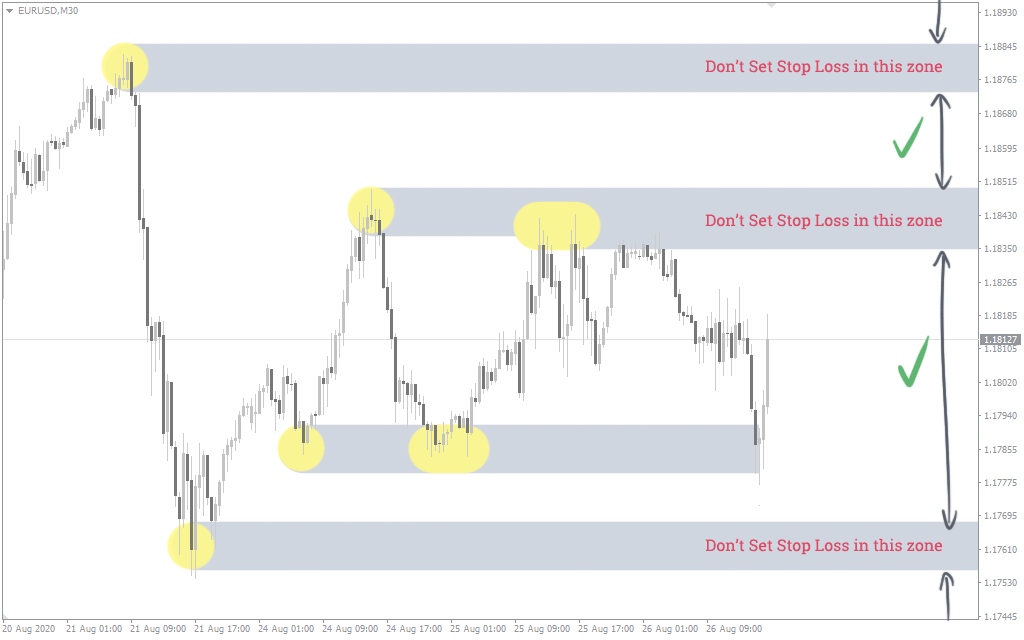

One of the approaches we discuss in the aforementioned article is setting stop losses outside of the high and low ranges and the round price levels. Most traders place their stop losses inside of these zones, which are ranges where the market is likely to fluctuate within.

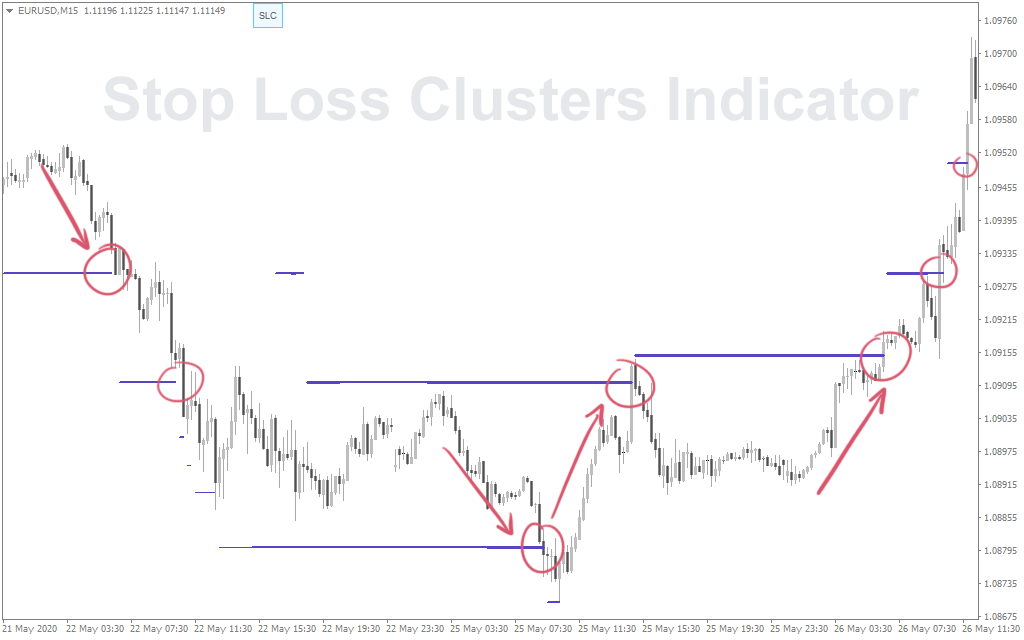

There is a strange phenomenon in the online trading world whereby prices seem to gravitate towards wherever stop losses are clustered. Considering the scale of this phenomenon, it’s unlikely to be manipulation, but rather a widespread and common behavior exercised by traders everywhere. By knowing where other traders are setting their stop losses, you can place yours further from theirs.

What is the problem with stop losses

The advantages of using a stop loss are clear. This is forex trading 101. Less often discussed is the common issues faced by traders when using a stop loss. There are some valid arguments for trading without a stop loss.

- Stop losses are a definitive statement that a specific trade has failed.

- Many traders place their stop losses on resistance levels which may turn out to be pivot points. This results in traders losing money even if their trade was right, but just the entry point was misjudged.

- Traders place their stop losses too close to their entry point. This does not give the trade enough breathing room to pull back. This is especially true when traders oversize their positions, they focus on monetary losses in their risk-to-reward ratio, and neglect the trading pair’s range of movement.

- You may think that a trade has become invalid, yet you stick to the plan and wait for it to reach the stop loss.

- Stop losses are prone to be triggered by erroneous spikes in the price or short term volatility.

- You can misjudge your entry point and have your stop loss hit despite the setup still being valid.

Do professional traders use stop losses?

As traders become more experienced, their abilities evolve. Many professional traders reduce their reliance on indicators as their interpretation of the markets becomes instinctive. Take price action traders, for example; they are well known for forex trading without indicators.

Professional traders most likely are using stop losses in their strategies, but not in the same way as an average trader would. Professional traders recognize that drawdown is a natural element of trading forex; it doesn’t spook them and doesn’t make them feel their trade is invalid. Professional traders express that their stop loss setting tactics allow for plenty of breathing room.

In many ways, a stop loss takes control away from you. A professional trader objective is actually not to allow their stop losses to be triggered but to decide for themselves if their trade is invalid and close it themselves. Doing this limits how much they lose.

Professionals do trade forex profitably without stop loss orders. Still, they can only do that if they are constantly monitoring their account or have a significant amount of available margin to be able to sustain this strategy.

Trading forex without a stop loss – should you do it?

It would never be responsible for anyone to advise forex traders not to use a stop loss. The best advice you can take away from this article is that you should reevaluate how you are deciding where to place your stop losses. Suppose you can’t allow enough room to let your downside move through the established trading ranges. In that case, you should consider decreasing the size of your positions or increasing the margin in your trading account (does not necessarily suggest increasing leverage on your account).

Naturally, before you choose to attempt forex trading without a stop loss, you should test this approach on a demo account. When you move to a live account, consider starting on a cent account or by trading micro-lots until you can adjust to this bold change and the psychological effects that it may have on you.

So, let's see, what we have: the reasoning behind KYC requirements is a noble one, but there are problems that the requirements present at trade forex without a broker

Contents of the article

- Top-3 forex bonuses

- How to trade forex completely anonymously...

- The reasoning behind KYC requirements is a noble...

- KYC documents overview

- Problems stemming from KYC requirements

- Issues with credit/debit and bank wire deposits

- Avoiding know your customer document submission

- Potential problems?

- Fxdailyreport.Com

- What is copy trading ?

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Download MT4 and open metatrader 4 demo account...

- Why would you want to have metatrader 4 demo...

- Here’s what rimantas teaches in this MT4 tutorial:

- The 10 best forex broker with zero (no) spread...

- Save trading fees by using a low spread forex...

- Comparison between a spread and zero (no) spread...

- Advantage of a 0.0 pip account:

- Disadvantages of a 0.0 pip account:

- Our values to find a good online partner

- How does a 0.0 pip forex spread broker earn money?

- How does the no spread account really work?

- Get direct market spreads

- See the market liquidity

- No conflict of interest

- Be careful: slippage can happen on market events

- Conclusion: you should use a 0.0 pip forex...

- How to trade forex completely anonymously...

- The reasoning behind KYC requirements is a noble...

- KYC documents overview

- Problems stemming from KYC requirements

- Issues with credit/debit and bank wire deposits

- Avoiding know your customer document submission

- Potential problems?

- Forex trading without investment

- 10 ways to avoid losing money in forex

- Do your homework

- Find a reputable broker

- Use a practice account

- Keep charts clean

- Protect your trading account

- Start small when going live

- Use reasonable leverage

- Keep good records

- Know tax impact and treatment

- Treat trading as a business

- The bottom line

- Forex trading without stop loss

- Why do we use stop losses?

- What is the problem with stop losses

- Do professional traders use stop losses?

- Trading forex without a stop loss – should you do...