Superforex account types

Компания superforex - это международный биржевой брокер, лицензированный комиссией по международным финансовым услугам (IFSC).

Top-3 forex bonuses

Мы предоставляем финансовые и инвестиционные услуги высшего качества частным и корпоративным клиентам, обеспечивая доступ к более 100 рынкам европы, азии и ближнего востока. Мы предлагаем клиентам большой выбор финансовых инструментов для алгоритмической или самостоятельной торговли, управления капиталом и инвестициями. Наша высокообразованная и опытная команда профессионалов, преданных своему делу, занимается постоянным усовершенствованием и развитием услуг компании superforex. Профессиональные услуги, инновации в технологиях, открытость и лояльность - это лишь некоторые из причин выбора наших клиентов. Наша страсть и преданность своему делу и индустрии, то что отличает нас от наших конкурентов. В компании superforex мы стремимся к разработке и реализации первоклассных технологий для обеспечения высокого уровня услуг, который способен удовлетворить даже самых требовательных клиентов. Мы осознаем важность ведения бизнеса в безопасной и стабильной среде, поэтому вся наша деятельность основана на прозрачности и честности. Мы предоставляем нашим клиентам большой выбор финансовых услуг и инвестиционных продуктов для успешной торговли и предлагаем различные ее варианты, для удовлетворения потребностей как частных, так и корпоративных клиентов.

Superforex account types

Вы можете попробовать работу всех сервисов компании superforex, открыв полноценно функционирующий демо-счет. Этот тип счета отлично подходит, чтобы попробовать на практике существующие торговые стратегии и создать свою. Однако вы не сможете получить реальную прибыль с демо-счетом. Когда вы будете готовы торговать реальными деньгами, вы сможете открыть реальный счет.

Компания superforex - это международный биржевой брокер, лицензированный комиссией по международным финансовым услугам (IFSC). Мы предоставляем финансовые и инвестиционные услуги высшего качества частным и корпоративным клиентам, обеспечивая доступ к более 100 рынкам европы, азии и ближнего востока. Мы предлагаем клиентам большой выбор финансовых инструментов для алгоритмической или самостоятельной торговли, управления капиталом и инвестициями. Наша высокообразованная и опытная команда профессионалов, преданных своему делу, занимается постоянным усовершенствованием и развитием услуг компании superforex.

Профессиональные услуги, инновации в технологиях, открытость и лояльность - это лишь некоторые из причин выбора наших клиентов. Наша страсть и преданность своему делу и индустрии, то что отличает нас от наших конкурентов. В компании superforex мы стремимся к разработке и реализации первоклассных технологий для обеспечения высокого уровня услуг, который способен удовлетворить даже самых требовательных клиентов. Мы осознаем важность ведения бизнеса в безопасной и стабильной среде, поэтому вся наша деятельность основана на прозрачности и честности. Мы предоставляем нашим клиентам большой выбор финансовых услуг и инвестиционных продуктов для успешной торговли и предлагаем различные ее варианты, для удовлетворения потребностей как частных, так и корпоративных клиентов.

Мы, в компании superforex, знаем ценность денег; мы знаем также, как важны они для трейдеров. Поэтому мы разработали систему безопасности, благодаря которой у клиентов есть уверенность в том, что их депозиты будут доступны только им. Клиенты могут выбрать среди большого количества безопасных платежных систем, наиболее удобную для себя. Наш сайт использует SSL сертификат, который обеспечивает сохранность ваших данных. Ваши деньги защищены благодаря нашей политике сегрегированных счетов. Кроме того, мы предлагаем программу страхования депозита, которая позволяет трейдерам хеджировать инвестиции от убытков.

Superforex – great forex brokers review

Superforex.Com in short

Superforex is the trade name of the superfin corp, which is authorized and regulated by the international financial services commission (IFSC) in belize. The company claims to have a professional attitude, high-quality service, innovative technologies, and transparent policies. Superforex is aimed at both retail and corporate clients and therefore offers a constantly expanding range of trading assets. Customers can trade cfds on currency pairs, commodities, indices, shares and cryptocurrencies via the popular metatrader 4 (MT4) terminal.

Regulation

According to the provided legal documents on the website, superfin corp., operating under the trading name superforex is registered in belize under number 137723 and is authorized and regulated by the international financial services commission (IFSC) of belize under license number 00160/141. In 2016, IFSC increased its capital requirements so that the minimum required funds for a broker to operate is now USD 500,000.

Account types

There are two main types of live accounts – STP accounts and ECN accounts, which you can open with superforex. Each type consists of several subtypes.

STP accounts:

Standard – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. In addition, the copy trading feature is included.

Swap free – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. In addition, the copy trading feature is included. The only difference is that the swap is not included.

No spread – the minimum deposit amount is USD100 and the maximum leverage is up to 1:1000. The spread is zero for all instruments at the expense of some commission. The copy trading feature is not included.

Micro cent – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The maximum deposit is limited to USD3,000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. The copy trading feature is not included. One lot has a value of 10,000 cents.

Profi STP – the minimum deposit amount is USD500 and the maximum leverage is up to 1:2000. The maximum deposit is unlimited. The spread is zero for all instruments at the expense of some commission. The copy trading feature is not included. One lot has a value of 100,000 USD.

Crypto – the minimum deposit amount is USD100 and the maximum leverage is up to 1:10. You can trade only cryptocurrencies. The spreads are fixed and the value for the BTC/USD is USD500 and for the LTC/USD it is USD60. The copy trading feature is not included.

ECN accounts:

ECN standard – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 166 instruments with floating spreads and the value for the EUR/USD pair is nearly zero. The lot size is 100,000 USD and copy trading features are not included.

ECN standard mini – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 100 instruments with floating spreads (shares and indices). The lot size is 10,000 USD and copy trading features are not included.

ECN swap-free – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 166 instruments with floating spreads and the value for the EUR/USD pair is nearly zero. The lot size is 100,000 USD and copy trading features are not included.

ECN swap-free mini – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 100 instruments with floating spreads (shares and indices). The lot size is 10,000 USD and copy trading features are not included.

ECN crypto – the minimum deposit amount is USD100 and the maximum leverage is up to 1:10. The lot size is 10 BTC and the copy trading feature is not included.

Market maker or STP brokerage?

Legal documents provided on the web page will show how the company acts against the client. The order execution policy file shows that the company will always act as principal (counterparty) when executing orders by clients. Superforex acts as principal and not as an agent on the client’s behalf; therefore, superforex is the sole execution venue for fulfillment of client’s orders. In other words, the company is a market maker that generally makes its money from the spreads that are embedded in the price of the instruments and from the commission charged. However, being a market maker involves a conflict of interest because when the company executes orders, it keeps the risk to itself. Despite the claim that superforex uses a straight through processing model, the order execution policy document shows that the company may transmit customer orders to hedge the risk, but it may not do so. When an order is not hedged, any loss to customers is a profit for the company.

The same document explains that superforex does not guarantee that the exact requested price will be obtained at all times and in any event. It warns that there may be cases in which stop loss orders are not so effective, for example where there are rapid price movements. This means that market orders are subject to slippage and will be filled at the first available market price. In addition, stop loss orders are not guaranteed.

The risk disclosure document informs that customers must be able to bear financial losses significantly more than margin or deposits, as they may lose the total value of the contract, not just the margin or deposit. However, the website claims that the company is implementing a so-called auto-reset balance program. According to the information, this program serves as a shield to prevent your balance from becoming negative. If this happens, the auto-reset balance system will compensate your losses and keep your account at zero.

There are common fees such as spreads and rollovers. We were unable to find information about the so-called inactivity fee, so you can pause trading for as long as you like.

Deposits and withdrawals

There are multiple deposit methods available including bank transfer, credit or debit cards, and e-wallets such as neteller, skrill, sticpay, and by cryptocurrencies. The minimum first deposit is USD1 for standard accounts. The company does not charge any deposit fees. Processing times depend on the payment method and for example bank transfers will be processed within 2-4 business days.

Withdrawals must be made by the same payment method with which the customer’s trading account is credited. There are withdrawal fees for each payment method. If a customer deposits by credit or debit card, the applicable fee is 3% of the deposit amount plus USD7 and the minimum withdrawal amount is USD20. If a bank transfer is used as the method of payment, the withdrawal fee is 3% plus EUR35. The applicable fee for deposits via skrill is 1.5% and for those via neteller is 2%. Processing times depend on the payment method and for example bank transfers will be processed within 2-4 business days, while credit card transfers will be processed within 1-3 hours.

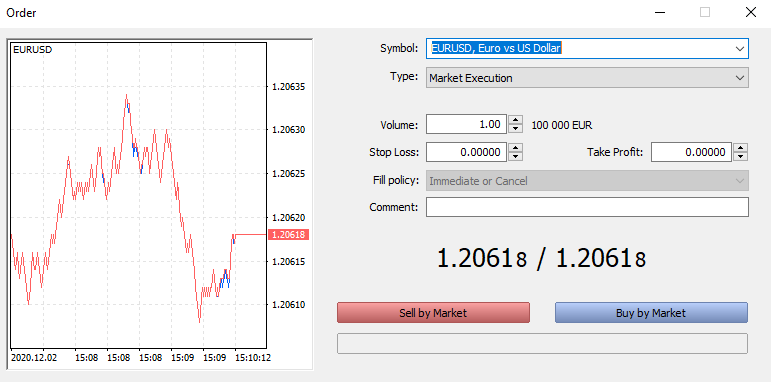

Trading platforms

Customers can trade via one of the most reliable platforms for online trading – metatrader 4 (MT4). MT4 is an award winning terminal that is the preferred choice of all kinds of traders. The terminal offers a customizable interface, a wide range of market and pending orders, different chart types and many technical indicators. If you prefer to place orders using automated trading, you have several tools you can use, called expert advisors (eas).

In addition, traders can use the company’s own trading application called superforex. Unfortunately, it is only available for android devices.

You can trade more than 330 assets with superforex.

Currency pairs – more than 80 major, minor, and exotic currency pairs can be traded. The spread for the EUR/USD pair depends on the trading account and cab be fixed at 2 pips or floating from 0 pips.

Indices – clients can trade cfds on 21 global indices, such as DJIA, nikkei225, euro stoxx 50 etc. The spread for the DAX index can be fixed at 10 points or floating from 0 points.

Commodities – cfds on 120 commodities are available including crude oil and gold, as well as agricultural and grain foods. The spread for gold can be fixed at USD0.80 or floating from USD0.10. The spread for the crude oil can be fixed at USD0.25 or floating from USD0.

Shares – you can trade cfds on 86 US shares. The spread for the apple share is USD1 (fixed) and starts from USD0 (floating). The fixed spread for the tesla share is USD6.

Cryptocurrencies – 9 cryptocurrencies such as bitcoin, litecoin, ethereum, dash, neo, etc. Are available as cfds for online trading in the crypto account. The spread for bitcoin is fixed at USD500.

Copy trading

Opening a standard account allows customers to copy the transactions of more experienced investors. To start using copy trading, you will need to deposit just USD10. Then you can join the community of traders where you can find out the appropriate investor. The investor and followers then negotiate a system of commissions for the copied deals.

Superforex is the trade name of the superfin corp, which is authorized and regulated by the international financial services commission (IFSC) in belize. The documents show that the company acts as a market maker, which leads to some conflict of interest. There are many accounts and trading instruments available. The company provides the popular terminal MT4 and its own mobile application for android devices. You can open a real account with just USD1.

Superforex review

Founded in 2013 and based in belize, superforex is an online forex broker that offers online trading services on over 300 trading instruments across multiple asset classes, such as forex, indices, stocks, cryptocurrency, commodities, energies, and metals. The broker provides clients with the metatrader 4 trading platform, offering competitive spreads, high leverage, and low minimum deposit.

Superforex is a “no dealing desk” (NDD) broker that has partnered with premium liquidity providers (lps). They have also won some industry awards including “the fastest growing broker” in 2015 and the “best forex broker “ in 2016 in the MENA region; both awards were courtesy of showfxworld.

Superforex review introduction

In this superforex review, we will take a look at some of the most important factors worth considering when choosing a forex broker for your online trading needs. This includes trading platforms, trading tools, research and education, account funding options, customer support and broker regulation.

You may also wish to view my best forex brokers based on countless hours that I have spent researching and testing hundreds of brokers, all of which you can see in my forex broker reviews. You can also use my free trading tool to compare forex brokers including superforex.

Superforex platforms & tools

The broker provides traders with the popular metatrader 4 trading platform. The MT4 is versatile and has the webtrader version, windows desktop application, and the mobile app versions for android and ios devices. The mobile app version has almost all of the same features of the MT4 desktop and integrates seamlessly with the MT4 accounts. It can be downloaded from relevant app stores for trading on the go.

There is also the superforex trading cabinet, an android app that is developed by superforex; it integrates with the client’s cabinet area of the website and also has other features, including:

- Funding or withdrawing from your accounts right from the app.

- Viewing the complete trading history

- Full access to the client support desk

The broker also provides clients with useful trading tools, in addition to those built into the metatrader 4 platform, and they include market analysis, superforex bank, pattern graphix, and forex copy, which helps traders to automatically copy the trades of master traders.

Superforex research & education

Superforex provides traders with trading seminars and educational materials, such as educational videos and a trading glossary of over 200 trading terms and their detailed explanations.

Superforex trading accounts

Superforex provides multiple account types to suit the different needs and experience levels of traders. All of the accounts are grouped into either STP or ECN accounts; they have minimum required deposits that range from just $1 to $5000. The following are the STP account types:

- Micro account

- Standard account

- Swap free account

- No spread account

- Profi STP

- Crypto account

The ECN accounts are similar to the STP accounts except for a few features. There are no maximum deposits, all spreads are floating, but forex copy is not available. The following are the ECN account types:

- ECN standard mini

- ECN standard

- ECN swap-free mini

- ECN swap-free

- ECN crypto

Demo accounts are available to all clients at no cost.

Superforex account funding

The broker offers a variety of account funding methods that are aimed at localizing payments. The following funding methods are accepted: local bank transfers, bank wire transfer, debit/credit cards, electronic payments, cryptocurrencies, and superforex money. Deposits are free but withdrawal commissions are charged depending on the method used.

Superforex customer service

The broker offers a customer support desk 24/5 during market hours. They can be reached via online web chat, telephone, and email. There is a FAQ section on the broker’s website, which gives instant answers to clients’ questions.

Superforex regulation

Superforex is authorized and regulated by the international financial services commission (IFSC) of belize.

Superforex review summary

Superforex is an online broker that is committed to satisfying traders. They offer multiple account types to suit every trader’s investment size and experience level, and they provide clients with the metatrader 4 trading platform and a good selection of educational materials.

It is worth mentioning that some of the trading products and services in this superforex review may differ or not be available to traders in some countries due to regulations. As brokers terms can change over time, please verify all information is up to date directly from the superforex broker website which you can visit by using the link below.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Superforex

Spreads

Liquidity

Commissions

Support

Regulation

Features

- Metatrader 4 platform

- Multiple trading tools

- Over 300 trading instruments

- A good choice of educational materials

Best forex robots

Forex robotron

Forex cyborg

Forex flex EA

Forex scalping EA

5 pips A day

Get my free forex robot!

Sign up now and receive instant access to my free forex robot download with over 40 technical indicators and 11 candlestick patterns built in. *please use a real email address as you will be sent the download link*

Best forex brokers

Pepperstone

IC markets

Pages

- Best forex robots 2021

- Forex robot reviews

- Forex robot ratings

- Free forex robot download

- Best forex brokers 2021

- Forex broker reviews

- Forex broker ratings

- Compare forex brokers

- Forex trading system reviews

- Forex trading system ratings

- Forex trading tool reviews

- Forex trading tool ratings

- Forex signal reviews

- Forex signal ratings

- Forex trading course reviews

- Forex trading course ratings

- Contact me

- Privacy policy

- Terms & conditions

Categories

- Forex brokers

- Forex robots

- Forex signals

- Forex trading courses

- Forex trading guides

- Forex analysis

- Forex basics

- Forex indicators

- Forex strategies

- General trading

- Trading psychology

- Trading software

- Forex trading systems

- Forex trading tools

Recent posts

- Bitcoin VS forex – which one is the best option

- Cedarfx lends support to combat climate change

- Cedarfx review

- Bitcoin exchange: what to consider for choosing the right bitcoin exchange?

- The different methods to acquire bitcoin

- What are the challenges faced by bitcoin and its users and need to be overcome?

- Forex robotron review

- Forex cyborg review

- Forex scalping EA review

- Forex flex EA review

All information on the forex geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the forex geek and any authorized distributors of this information harmless in any and all ways. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Superforex – great forex brokers review

Superforex.Com in short

Superforex is the trade name of the superfin corp, which is authorized and regulated by the international financial services commission (IFSC) in belize. The company claims to have a professional attitude, high-quality service, innovative technologies, and transparent policies. Superforex is aimed at both retail and corporate clients and therefore offers a constantly expanding range of trading assets. Customers can trade cfds on currency pairs, commodities, indices, shares and cryptocurrencies via the popular metatrader 4 (MT4) terminal.

Regulation

According to the provided legal documents on the website, superfin corp., operating under the trading name superforex is registered in belize under number 137723 and is authorized and regulated by the international financial services commission (IFSC) of belize under license number 00160/141. In 2016, IFSC increased its capital requirements so that the minimum required funds for a broker to operate is now USD 500,000.

Account types

There are two main types of live accounts – STP accounts and ECN accounts, which you can open with superforex. Each type consists of several subtypes.

STP accounts:

Standard – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. In addition, the copy trading feature is included.

Swap free – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. In addition, the copy trading feature is included. The only difference is that the swap is not included.

No spread – the minimum deposit amount is USD100 and the maximum leverage is up to 1:1000. The spread is zero for all instruments at the expense of some commission. The copy trading feature is not included.

Micro cent – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. The maximum deposit is limited to USD3,000. The spreads are fixed and the value for the EUR/USD pair is 2 pips and for crude oil it is USD0.25. The copy trading feature is not included. One lot has a value of 10,000 cents.

Profi STP – the minimum deposit amount is USD500 and the maximum leverage is up to 1:2000. The maximum deposit is unlimited. The spread is zero for all instruments at the expense of some commission. The copy trading feature is not included. One lot has a value of 100,000 USD.

Crypto – the minimum deposit amount is USD100 and the maximum leverage is up to 1:10. You can trade only cryptocurrencies. The spreads are fixed and the value for the BTC/USD is USD500 and for the LTC/USD it is USD60. The copy trading feature is not included.

ECN accounts:

ECN standard – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 166 instruments with floating spreads and the value for the EUR/USD pair is nearly zero. The lot size is 100,000 USD and copy trading features are not included.

ECN standard mini – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 100 instruments with floating spreads (shares and indices). The lot size is 10,000 USD and copy trading features are not included.

ECN swap-free – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 166 instruments with floating spreads and the value for the EUR/USD pair is nearly zero. The lot size is 100,000 USD and copy trading features are not included.

ECN swap-free mini – the minimum deposit amount is USD1 and the maximum leverage is up to 1:1000. You can trade 100 instruments with floating spreads (shares and indices). The lot size is 10,000 USD and copy trading features are not included.

ECN crypto – the minimum deposit amount is USD100 and the maximum leverage is up to 1:10. The lot size is 10 BTC and the copy trading feature is not included.

Market maker or STP brokerage?

Legal documents provided on the web page will show how the company acts against the client. The order execution policy file shows that the company will always act as principal (counterparty) when executing orders by clients. Superforex acts as principal and not as an agent on the client’s behalf; therefore, superforex is the sole execution venue for fulfillment of client’s orders. In other words, the company is a market maker that generally makes its money from the spreads that are embedded in the price of the instruments and from the commission charged. However, being a market maker involves a conflict of interest because when the company executes orders, it keeps the risk to itself. Despite the claim that superforex uses a straight through processing model, the order execution policy document shows that the company may transmit customer orders to hedge the risk, but it may not do so. When an order is not hedged, any loss to customers is a profit for the company.

The same document explains that superforex does not guarantee that the exact requested price will be obtained at all times and in any event. It warns that there may be cases in which stop loss orders are not so effective, for example where there are rapid price movements. This means that market orders are subject to slippage and will be filled at the first available market price. In addition, stop loss orders are not guaranteed.

The risk disclosure document informs that customers must be able to bear financial losses significantly more than margin or deposits, as they may lose the total value of the contract, not just the margin or deposit. However, the website claims that the company is implementing a so-called auto-reset balance program. According to the information, this program serves as a shield to prevent your balance from becoming negative. If this happens, the auto-reset balance system will compensate your losses and keep your account at zero.

There are common fees such as spreads and rollovers. We were unable to find information about the so-called inactivity fee, so you can pause trading for as long as you like.

Deposits and withdrawals

There are multiple deposit methods available including bank transfer, credit or debit cards, and e-wallets such as neteller, skrill, sticpay, and by cryptocurrencies. The minimum first deposit is USD1 for standard accounts. The company does not charge any deposit fees. Processing times depend on the payment method and for example bank transfers will be processed within 2-4 business days.

Withdrawals must be made by the same payment method with which the customer’s trading account is credited. There are withdrawal fees for each payment method. If a customer deposits by credit or debit card, the applicable fee is 3% of the deposit amount plus USD7 and the minimum withdrawal amount is USD20. If a bank transfer is used as the method of payment, the withdrawal fee is 3% plus EUR35. The applicable fee for deposits via skrill is 1.5% and for those via neteller is 2%. Processing times depend on the payment method and for example bank transfers will be processed within 2-4 business days, while credit card transfers will be processed within 1-3 hours.

Trading platforms

Customers can trade via one of the most reliable platforms for online trading – metatrader 4 (MT4). MT4 is an award winning terminal that is the preferred choice of all kinds of traders. The terminal offers a customizable interface, a wide range of market and pending orders, different chart types and many technical indicators. If you prefer to place orders using automated trading, you have several tools you can use, called expert advisors (eas).

In addition, traders can use the company’s own trading application called superforex. Unfortunately, it is only available for android devices.

You can trade more than 330 assets with superforex.

Currency pairs – more than 80 major, minor, and exotic currency pairs can be traded. The spread for the EUR/USD pair depends on the trading account and cab be fixed at 2 pips or floating from 0 pips.

Indices – clients can trade cfds on 21 global indices, such as DJIA, nikkei225, euro stoxx 50 etc. The spread for the DAX index can be fixed at 10 points or floating from 0 points.

Commodities – cfds on 120 commodities are available including crude oil and gold, as well as agricultural and grain foods. The spread for gold can be fixed at USD0.80 or floating from USD0.10. The spread for the crude oil can be fixed at USD0.25 or floating from USD0.

Shares – you can trade cfds on 86 US shares. The spread for the apple share is USD1 (fixed) and starts from USD0 (floating). The fixed spread for the tesla share is USD6.

Cryptocurrencies – 9 cryptocurrencies such as bitcoin, litecoin, ethereum, dash, neo, etc. Are available as cfds for online trading in the crypto account. The spread for bitcoin is fixed at USD500.

Copy trading

Opening a standard account allows customers to copy the transactions of more experienced investors. To start using copy trading, you will need to deposit just USD10. Then you can join the community of traders where you can find out the appropriate investor. The investor and followers then negotiate a system of commissions for the copied deals.

Superforex is the trade name of the superfin corp, which is authorized and regulated by the international financial services commission (IFSC) in belize. The documents show that the company acts as a market maker, which leads to some conflict of interest. There are many accounts and trading instruments available. The company provides the popular terminal MT4 and its own mobile application for android devices. You can open a real account with just USD1.

Superforextz

Super IB bonus

Double deposit in the amount from $100 to $1000.

1:2000

Partner's info

Deogratius medadi michael

About superforex

Superforex is a globally operating broker with regulation by the international financial services commission (IFSC). Since 2013 we have been offering top-tier services that cover trading and investment on the financial markets for both individual and corporate clients in over 150 countries from all over the world!

Types of account

You can choose the type of account that best suits your trading strategy. All accounts can be used by both beginners and professional traders. There are several types of accounts that differ in terms of trading on them and each type of account is suitable for a specific task that the trader has set himself.

Standard mini

The most versatile account that is suitable for traders from all levels of experience.

Swap free

The swap-free (a.K.A. Islamic) account by superforex is similar to our standard account but has no swaps.

No spread

No spread fees are applied to the deals you open and the full transaction costs are instantly visible.

Micro cent

An account for small deposits where you don’t have to worry about equity and margin calls.

Standard mini

The most versatile account that is suitable for traders from all levels of experience.

Swap free

The swap-free (a.K.A. Islamic) account by superforex is similar to our standard account but has no swaps.

No spread

No spread fees are applied to the deals you open and the full transaction costs are instantly visible.

Micro cent

An account for small deposits where you don’t have to worry about equity and margin calls.

No deposit

Our double no deposit bonus will be useful for newcomers, it will allow you to try your strength and not risk personal funds.

Easy deposit

This bonus amounts to the shocking 2000% of the deposit you choose to make. It allows you to operate with a much greater volume than your deposit would normally allow.

Welcome+

For an unlimited period all of our new clients have the chance to receive our welcome+ bonus on each initial deposit. You can get up to 50% extra funds.

Energy

If you are very active, you will probably like our 60% energy bonus, which many traders consider to be an ideal offer matching their style.

Our 202% bonus will more than double the funds to your accounts. This offer is ideal for those of you who want to make orders with large volume and get more profit.

Dynamic

The dynamic bonus is a convenient solution for traders which provides a tradeable income and withdrawable funds up to $250.

Our bonuses

With superforex you have a wide choice of bonuses you are welcome to take advantage of. Our bonuses are a great opportunity to successfully start trading without the risk of losing investments.

Special offers

Superforex provides you a lot of special offers, which give you: more free time, more profit, more benefits. View our current offers here or login to your account to see all the offers available to you. We are constantly adding new offers, so do not forget to check them.

Deposit protection

Do you ever worry whether a deal might turn against you and cost you your deposit? Not anymore! Superforex has developed an innovative deposit insurance program that allows you to save your deposit even if things go amiss.

Forex copy

Our forex copy service is a unique feature that allows you to browse a database of successful traders and copy their trades for your own benefit. Forex copy can save you countless hours of trying to understand the markets - it is a true shortcut to success.

Contests

We invite you to take part in exciting forex contests on demo and real accounts! We hold both regular and one-time competitions for traders. All demo contests are absolutely free, but for a small entrance fee you can try your hand at real contests with great prizes.

Distance education

To help you become better acquainted with forex trading, superforex has prepared a special distance education course for you. Over the span of these lectures you would be able to learn the basics of forex trading and become a more proficient trader.

Mobile cabinet

Your trading experience with superforex can now be more compact than ever with our newly developed mobile cabinet. Using this application you can look after your trades and manage your account from your mobile device.

SF bank

When using free capital to work and make a profit, there are many options where you can invest money - one of them is SF bank. You can invest in various trading instruments (currencies, cfds, metals, and cryptocurrencies) and get profits.

Trading platform MT4

The superforex metatrader 4 platform is the most reliable and innovative trading technology service out there. An award-winning trading platform, MT4 is the preferred choice of trading professionals. It is designed to provide fast and accurate brokerage services to customers on the FX, cfds and futures markets.

Download:

Contacts

Superforex company provides to its customers high-quality online support 24/5. If you have any problems - our support team will help you solve them.

Compare accounts

Live trading accounts

Each of FXTM’s live trading accounts have their own conditions, tailored to different types of traders depending on their individual needs, investment goals and financial background. Whatever your level of experience and wherever your market interests lie, we’re confident you’ll find an account to suit you.

Demo trading accounts

We offer standard, cent, ECN and ECN zero accounts in demo formats as a perfect way to experiment with different strategies and practice under real market conditions. These demo accounts are funded with virtual cash, meaning you can prepare yourself for real trading by building your skills with none of the risk (but none of the profits either).

| Account type |  |  |  |

|---|---|---|---|

| cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. | Live demomore | live demomore | live more |

| trading platforms | metatrader 4 | metatrader 4 | metatrader 4 |

| account currency | USD / EUR / GBP | US cent / EU cent / GBP pence | USD / EUR / GBP |

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. | Leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. | Fixed leverage 1:5 for US shares and 1:3 for european shares |

| maximum deposit |  |  |  |

| minimum deposit | $/€/£ 100 | $/€/£ 10 | $/€/£ 100 |

| commission |  |  |  |

| order execution | instant execution | instant execution | instant execution |

| spread | from 1.3 3 | from 1.5 3 | from 0.1 3 |

| margin call | 80% | 80% | 80% |

| stop out | 50% | 50% | 50% |

| swap-free |  |  |  |

| limit & stop levels | 1 spread | 1 spread | 1 spread |

| pricing | 5 decimals for FX (3 on JPY pairs), spot metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD | 5 decimals for FX (3 on JPY pairs), spot metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD | 2 decimals |

| trading instruments | majors, minors, exotics 4 — 59, spot metals — 5, spot cfds - 14 13, 14 |

Standard account

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. |

|---|---|

| Maximum deposit | |

| minimum deposit | $/€/£ 100 |

| order execution | instant execution |

| live | demo |

Cent account

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. |

|---|---|

| Maximum deposit | |

| minimum deposit | $/€/£ 10 |

| order execution | instant execution |

| live | demo |

ECN account

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. |

|---|---|

| Maximum deposit | |

| minimum deposit | $/€/£ 500 |

| order execution | market execution 6 |

| live | demo |

ECN zero account

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. |

|---|---|

| Maximum deposit | |

| minimum deposit | $/€/£ 200 |

| order execution | market execution 6 |

| live | demo |

Stock cfds account

| leverage / margin requirements | fixed leverage 1:5 for US shares and 1:3 for european shares |

|---|---|

| maximum deposit | |

| minimum deposit | $/€/£ 100 |

| order execution | instant execution |

| live |

FXTM pro account

| leverage / margin requirements | leverage is set based on the trading instrument and limited with 1:30 max. Refer here for more info. |

|---|---|

| Maximum deposit | |

| minimum deposit | $/€/£ 25 000 6 |

| order execution | market execution 7 |

| live |

New FXTM invest allows investors to connect with your strategy for a fee. Read more about FXTM invest.

Trading leveraged products has the potential to increase losses as well as profits. Click here to read more and please trade carefully.

Please note:

1 leverage is offered based on your knowledge and experience. The leverage / margin requirements may be subject to change as a result of applicable regulations in your country of residence.

2 please bear in mind that the company may at its sole discretion change, within the hour before the close of the trading session on every friday, the stop out and margin call levels from 50% to 100% and from 80% to 130% respectively, for all ECN MT4/MT5 accounts. Moreover, kindly note that the company may extend these amendments for as long as it deems necessary after the market opening, by providing the client with prior written notice.

3 spreads are floating and they may increase during specific periods of the day depending on the market conditions.

4 exotic pairs are not available for swap-free accounts.

5 institutional-level spreads are offered on FXTM pro accounts on the condition that a minimum account balance of 25,000 EUR/GBP/USD is maintained at all times. If the balance of an FXTM pro account drops below the required amount, the spread offering may revert back to retail pricing until the account is topped up. In this case, the client will be notified in advance.

6 please note that on all MT4 market execution accounts (ECN, ECN zero and pro), preset SL/TP levels are not permitted. If a client wishes to add SL/TP levels, the client can modify the existing position after the order is opened.

7 for spot indices and spot commodities on ECN MT4 account the maximum volume per trade is 5 lots; for spot indices the maximum volume of lots per trade is 50 lots on ECN zero.

8 for spot indices and spot commodities on ECN MT4 account: the maximum volume of all orders for spot indices is 15 lots and 50 lots for spot commodities.

9 commission on ECN MT4 is taken only when a position is opened, at double the levels listed in the table above (accounting for both the opening and the closing of the position). For further details of the commission charges for ECN MT4 account, please refer to the commissions page. For ECN MT5 commission is fixed at $4 per lot, $2 are being charged when position is opened and $2 when position is closed.

10 please note that margin requirements may vary between symbols and servers. For further information please refer to the leverage and margin requirements section.

11 on cent server 1 lot size is 0.01 standard lots or 1,000 units. The maximum volume per trade on our cent server is 100 cent lots which is equal to 1 standard lot or 100,000 units.

12 FXTM applies dividend adjustments on stocks and spot indices when positions remain open at the close of the trading session, on the business day before the ex-dividend date. However, kindly note that the dividend adjustment takes place before the market opening of the ex-dividend date. If a client is holding buy positions his/her account will be credited with the fixed dividend amount. If a client is holding sell positions then the dividend amount will be debited from his/her account.

13 for spot indices and spot commodities on standard MT4 account: the maximum volume per trade is 5 lots; the maximum volume of all orders for spot indices is 15 lots and 50 for spot commodities.

14 please note that during the daily rollover starting from 23:59:59 (MT server time) and for a few seconds, our servers stop accepting any requests due to data processing in regards to the preparation of daily and monthly statements.

The 10 best forex broker with zero (no) spread accounts

Do you want to pay less trading fees when investing in currency pairs? – then you should choose zero or no spread forex broker. On this page, we will show you the top 10 companies which are offering trading with starting pips at 0.1. Trading fees can be very expensive when you are doing scalping or high volume trading. By choosing one of our recommended forex brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading.

| Broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 0.0 pips + NO COMMISSION ($ 10 deposit) – only on main market hours | cysec (EU) | + leverage up to 1:1000 + personal service + best platform |

Save trading fees by using a low spread forex broker

Overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account. If you do a calculation between these two account types you will always see that the zero (no) spread account is cheaper for you. Less trading fees will bring you a higher profit.

Comparison between a spread and zero (no) spread account:

For example, you want to trade 1 lot with the EUR/USD asset. On the spread account, you got a 1.0 pip spread. The pip value is $10. That means you are paying a fee of $10 by opening and closing the trade. The value of the fees is depending on the asset.

Spread account: 1 lot EUR/USD with 1.0 pip spread = $10 spread fee

On a zero (no) spread account you are paying the most of the time $3.5 per 1 lot trading (commission)

Zero spread account: 1 lot EUR/USD with 0.0 pip spread = $3.5 spread fee

In conclusion, the zero spread account is 65% – 50% cheaper than a normal spread account. So you should definitely use a zero spread account to pay fewer fees.

Advantage of a 0.0 pip account:

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements. The real market prices are traded by the broker. Overall, the trading with a 0.0 pip account is more transparent.

- Payless trading fees

- Better trade execution

- Real market prices

- Transparent trading

- Best for scalping

Disadvantages of a 0.0 pip account:

There is only one disadvantage of a 0.0 pip account. Some forex brokers got no negative balance protection. Forex trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position (big news event overnight). If you got bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible.

Our values to find a good online partner

For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know how to check a partner by certain criteria. Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage.

In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex. Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional.

Criteria for a good forex broker:

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

How does a 0.0 pip forex spread broker earn money?

In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot (100.000) trade. If the commission is $6 per 1 lot trade you will pay a commission of $0.06 if you are trading 0.01 lot.

In conclusion, the forex broker always earns money because of the additional spread or commission. If you are a high volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

See the picture of 0.0 pips spread in EUR/USD trading here:

How does the no spread account really work?

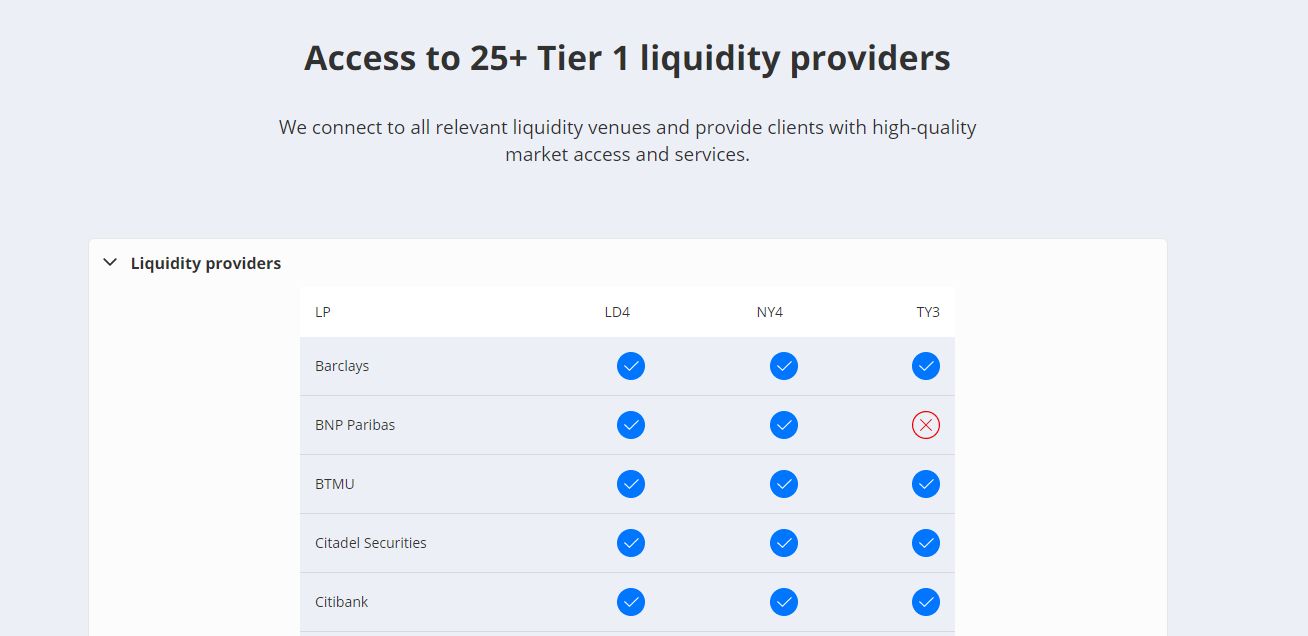

In the following, we will show you exactly how it works behind the scenes. The most forex brokers getting liquidity by a “market maker” called “liquidity provider” and some companies are making it by themself. Around the world, there are big liquidity providers like banks (goldman sachs, barclays, citibank, and more). These banks are giving direct market liquidity to the forex brokers.

Forex broker liquidity providers

The orders are matched by the “spot market” and not traded on a real stock exchange like stocks or futures.

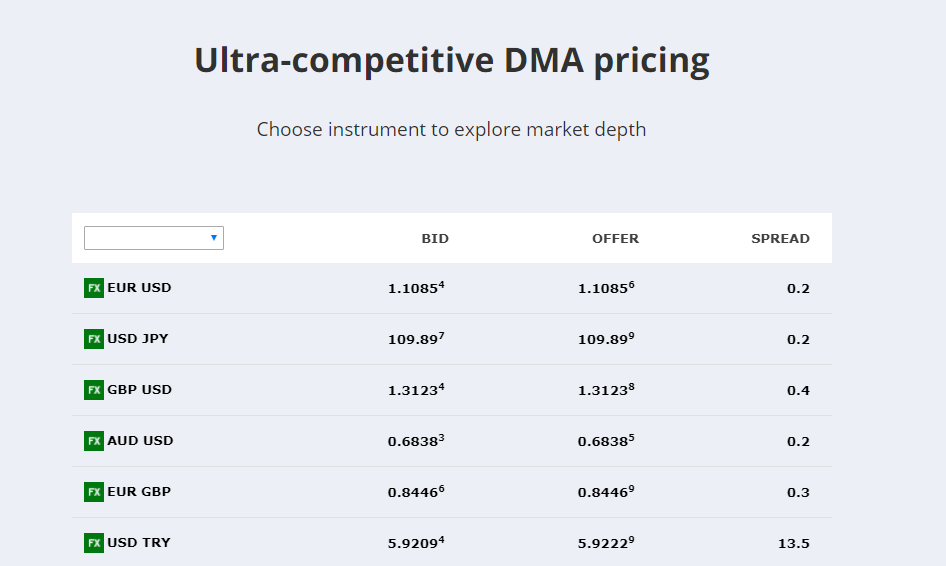

Get direct market spreads

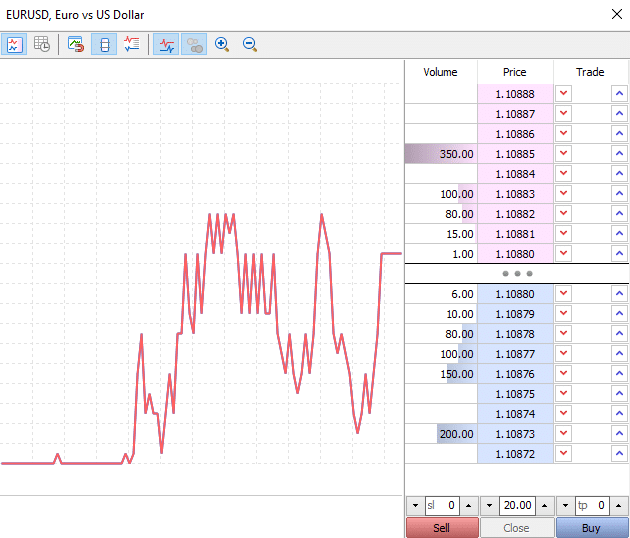

With a zero spread account, you get direct market access and real original prices. Most forex brokers show you the liquidity in the trading platform. You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts.

Direct spreads from liquidity providers

See the market liquidity

The most no spread brokers are ECN or no dealing desk brokers. You can see the market liquidity in your trading platform. The most popular platform is metatrader. If you click on “depth on market” you will see the order book (picture below).

Orderbook for no spread accounts

On the prices, you see the lots based on the liquidity. Liquidity can change very millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast.

No conflict of interest

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

Be careful: slippage can happen on market events

Always be careful by trading forex. The 0.0 pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is small.

We do not recommend to trade on market news because of the high risk. The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs.

Conclusion: you should use a 0.0 pip forex trading account

On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot of brokers are offering this account type. The minimum deposit is different from broker to broker. Sometimes you have to invest more than $1,000 into your account to get 0.0 pips spread.

The forex broker is earning money by an additional trading commission fee which you are paying each trade. Bdswiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset. As you saw in our calculation you can save more than 60% of trading fees if you are switching to a no spread account.

With a regulated broker, you can be sure that there is no scam or fraud. The companies which we present on this page are tested with real money. To get a closer look at a forex broker you can read the full and detailed reviews. The winner is clearly tickmill because the commissions are the lowest.

Our reviews:

- IQ option

- IC markets

- Tickmill

- XTB

- Bdswiss

- XM

- Roboforex

- Vantage FX

- Admiral markets

- Blackbull markets

The zero (no) spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity.

Superforex

Superforex

User reviews

*3 stars are standard line.

Superforex global menu

Recommended contents

Overview of superforex

Superforex has a number of bonus promotions and trading contests, while offering attractive trading conditions through a number of account types.

*subject to superforex's order execution rules

Total 9 currencies

*all information on this website is referred from original ones where each forex broker's official homepage describes at the time. Some information on the website are summarised to make viewers understand each service better. It maybe different from the service provided to you depends on the account type and platform you use. Although we strive to provide the newest and correct information at anytime, we do not guarantee the accuracy of those information. Please make sure checking terms and conditions and other trading options on yourself.

Top pages

- How to withdraw tickmill $30 no deposit bonus on MT4? What's the requirement/conditions?

- What happens if I withdraw funds from XM $30 bonus account?

- Octafx $1,000 instagram contest

- Completed the verification but I didn't get XM's $30 bonus. Why is that?

- Verified my account but I can't get XM $30 bonus. Why is that?

- XM 100% deposit bonus

- Instaforex $1000 no deposit bonus

- Fxgiants $70 no deposit bonus

- FBS $140 level up bonus

- Hotforex MT4 christmas & new year holiday market hours

Superforex latest promotions

Welcome bonus & no-deposit bonus

Superforex $50 no deposit bonus

Superforex is now welcoming all new traders by giving away 50 USD for free.

Deposit bonus

Superforex membership club bonus

Join superforex's membership club to for extra benefit you can get.

Superforex 1000% easy deposit bonus

Get superforex's 1000% easy deposit bonus to get

Superforex 50% welcome+ bonus

Get superforex's 50% welcome+ bonus together with 25% dynamic bonus to increase your trading margin.

Superforex 25% dynamic bonus

Receive 25% bonus on every deposit you make and withdraw them all by trading every standard lot.

Superforex 60% energy bonus

Superforex's 60% energy bonus for the unlimited amount and number of accounts.

Superforex 202.0% hot bonus

Superforex offers 202.0% hot bonus for the unlimited amount. You can get it on every live account you open.

Other promotions & campaigns

Superforex 5% annual interest income

Start earning 5% annual interest just by making a deposit to superforex.

Superforex deposit protection program

Superforex's deposit protection program will save you from losses.

Superforex table of contents

Who is superforex?

Superforex is an online forex and CFD broker with a number of bonus promotions and trading contests.

Superforex brand was founded in 2013, and has been offering the service to traders from more than 150 countries.

Along with the number of bonus promotions and trading contests, superforex has everything traders need for online trading.

With superforex, you can also start trading using your mobile phones such as android, tablet, iphone and ipad.

Superforex offers more than dozens of fund deposit and withdrawal methods through its secure client portal.

For novice traders, superforex has a complete set of educational materials and also forex copy trading system where you can copy profitable trades of professional traders in real time.

Superforex’s trading account types

With superforex, you can choose from more than 10 different account types.

See the table below for the list and the comparison of superforex’s all account types.

| STP account type | standard | swap free | no spread | micro cent | profi STP | crypto |

|---|---|---|---|---|---|---|

| account base currencies | USD, EUR, GBP, RUB, ZAR, NGN, CNY, BDT, INR, THB | USD, EUR, GBP, RUB, IDR, MYR, AED, ZAR, NGN, BDT | USD, EUR, GBP | USD, EUR | USD | USD (BTC) |

| required minimum deposit | $1 | $1 | $100 | $1 | $5000 | $100 |

| maximum account balance | unlimited | unlimited | unlimited | up to $3000 | unlimited | unlimited |

| maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:200 | 1:10 |

| 1 lot size | 10 000 USD | $100,000 | $100,000 | $100,000 | $10,000 cents | 10 BTC |

| swap points | credited and charged | none | none | none | credited and charged | none |

| spread type | fixed | fixed | variable | fixed | variable | fixed |

| forex copy | available | available | none | none | none | none |

| available bonuses | all bonuses | all bonuses | welcome, energy, hot, dynamic | welcome, energy, hot, dynamic | welcome, energy, hot, dynamic | welcome, energy, hot, dynamic |

The above table shows only the STP account types of superforex MT4.

There are also ECN account types of superforex.

Go to superforex official website to see the full list of all account types.

Superforex’s bonus promotions and contests

Superforex runs various bonus promotions and trading contests for traders.

See the comparison table of superforex’s all bonus promotions below.

| Bonus promotion | no deposit bonus | easy deposit | welcome | energy | hot | dynamic |

|---|---|---|---|---|---|---|

| required deposit | none | $1 | $1 | $1 | $1 | $100 |

| maximum deposit | none | $10 | unlimited | unlimited | unlimited | unlimited |

| maximum leverage | 1:200 | 1:200 | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| maximum volume | 0.5 lots | 1 lot | unlimited | unlimited | unlimited | unlimited |

| withdrawal of bonus | unavailable | unavailable | unavailable | unavailable | unavailable | possible |

| withdrawal of profit | available | available | available | available | available | available |

| account verification | required | required | not required | not required | not required | not required |

| withdrawal canceling bonus | in full | partly | partly | in full | in full | partly |

| number of bonuses | once | once | once per account | once per account | once per account | once per account |

| bonus credited for | once | once | on each deposit | on each deposit | once | on each deposit |

| compatibility | incompatible | incompatible | dynamic | hot | energy | welcome |

| available for | all superforex traders | all superforex traders | all superforex traders | all superforex traders | all superforex traders | all superforex traders |

With superforex, you can also open multiple trading accounts to receive each bonus for each account.

Check out more details of each bonus promotion, and get all the benefits from superforex.

Visit superforex’s FAQ website to find answers to all your questions.

Posted by FXBONUS.Info

Comments & reviews

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

This page has no comments yet.

Popular faqs

- How can I start trading FX and cfds with superforex?

- When swap point is charged? How to calculate it beforehand?

- Does superforex provide free education/tutorials for beginners?

- Is superforex a safe and trustworthy FX broker?

Page navigation

Recent comments

Comment by trust

I come here as a XM client ,I have created an account but I didn't not get my bonus

Comment by amas

My experience with xtrade was terrible. Fbs is great because I manage my bonus online everything is smooth.

Comment by fraz

Great tool for forex! Love how easy market help us trade to profit so i recomend easy market for you

Comment by ramsy

I login but no place to request bonus for free. Why is that. How to get no deposit bonus?

Comment by purple

Everyone your fbs loyalty points expires in a month so be careful. Better use it now than later.

Comment by dan

WCX possible fraud! WCX does not allow payouts (disable account). We have deposited our funds, traded them (30 BTC)! When trying to withdrawal we lost the welcome bonus accor.

Forex brokers

Here you can find the list of online forex & CFD brokers which run bonus promotions.

3 types of accounts in IQ option

As a customer oriented broker we know how important it is to let you choose. Thus, we have divided the types of our accounts into 3 variations to let you manage your trading preferences.

IQ option believes that every trader should begin with a demo account in order to gain valuable experience and knowledge . Only when you are able to understand the risks involved, should you proceed with a real account.

These are:

- Training account

- Real account

- VIP account

Training account

Is a totally free demo, which allows you to enjoy all the real account features and you have a $1000 for a start but these are renewable. No credit card details needed (unless you decide to deposit using this payment method) and you can deactivate such account at any time.

Real accoun t

Offers you full trading experience with more than 500 assets to trade with and real withdrawals within minutes to your bank card or e-wallet (the time to process a withdrawal vary depending on the method used. Requests are processed within 24 hourson our side.)

Real accounts also participate in our weekly tournaments* and have a support live chat feature.

*tournaments are subject to the terms and conditions.

Once you open a real account, you still have access to the training balance, you are free to switch between them and train even more.

IQ option vips

Enjoy a number of perks unavailable to other traders:

Higher profitability rates

VIP traders have an average of 3%* advantage over the rest of the clients. Higher profitability rates may assist in making their goals more achievable.

*amount to be credited to account in case of successful trade.

Personal managers

VIP account managers are extremely competent in all matters IQ option. They are hands-on approach guys, who will always be there for you, will help you resolve any issue with your account.

Free tournament participation

Free entry into any tournament is a VIP’s privilege and our pleasure to grant.

You can become an IQ option VIP by depositing $3000.

NOTE: this article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future.

In accordance with european securities and markets authority’s (ESMA) requirements, binary and digital options trading is only available to clients categorized as professional clients.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

84% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

So, let's see, what we have: superforex account types вы можете попробовать работу всех сервисов компании superforex, открыв полноценно функционирующий демо-счет. Этот тип счета отлично подходит, чтобы попробовать на at superforex account types

Contents of the article

- Top-3 forex bonuses

- Superforex account types

- Superforex – great forex brokers review

- Superforex review

- Superforex review introduction

- Superforex platforms & tools

- Superforex research & education

- Superforex trading accounts

- Superforex account funding

- Superforex customer service

- Superforex regulation

- Superforex review summary

- Superforex

- Features

- Best forex robots

- Get my free forex robot!

- Best forex brokers

- Superforex – great forex brokers review

- Superforextz

- Partner's info

- About superforex

- Types of account

- Our bonuses

- Special offers

- Trading platform MT4

- Contacts

- Compare accounts

- Live trading accounts

- Demo trading accounts

- Standard account

- Cent account

- ECN account

- ECN zero account

- Stock cfds account

- FXTM pro account

- The 10 best forex broker with zero (no) spread...

- Save trading fees by using a low spread forex...

- Comparison between a spread and zero (no) spread...

- Advantage of a 0.0 pip account:

- Disadvantages of a 0.0 pip account:

- Our values to find a good online partner

- How does a 0.0 pip forex spread broker earn money?

- How does the no spread account really work?

- Get direct market spreads

- See the market liquidity

- No conflict of interest

- Be careful: slippage can happen on market events

- Conclusion: you should use a 0.0 pip forex...

- User reviews

- Superforex global menu

- Recommended contents

- Overview of superforex

- Superforex latest promotions

- Welcome bonus & no-deposit bonus

- Deposit bonus

- Superforex membership club bonus

- Superforex 1000% easy deposit bonus

- Superforex 50% welcome+ bonus

- Superforex 25% dynamic bonus

- Superforex 60% energy bonus

- Superforex 202.0% hot bonus

- Other promotions & campaigns

- Welcome bonus & no-deposit bonus

- Superforex table of contents

- Who is superforex?

- Superforex’s trading account types

- Superforex’s bonus promotions and contests

- Posted by FXBONUS.Info

- Comments & reviews

- Popular faqs

- Page navigation

- Recent comments

- Forex brokers

- 3 types of accounts in IQ option

- Training account

- Real accoun t

- IQ option vips