Trade without investment

Brokers do reward traders who place interesting comments on forex forums.

Top-3 forex bonuses

You can also receive bonuses when you participate in forex opinion polls. Similarly, publishing articles and surveys about forex can earn you bonuses on your real account. Trading forex is in itself risky – that’s why many people shy away from it. There are many scams assuring people that they can earn millions even if they have no capital investment. Don’t let these scams fool you – even a bit!

Fxdailyreport.Com

We are all aware that forex refers to a currency market where traders buy currencies and sell them. For a trader to earn some money at forex, they should have the currency of a country, which they can exchange for another country’s currency. As a result, a trader will either get a profit or loss.

In forex trading, you can decide whether to invest some money or trade without a deposit. Top forex brokers do provide a free no-deposit bonus to traders. In such a case then you can trade at forex with no money.

Whether you opt to trade with or without an investment, the truth is that each case has its own risks. This is true especially if you don’t have the necessary experience and knowledge on how to trade in forex. That is why you should learn some basics on how to start forex trading business with no money.

Forex has a daily trades amounting to 5.3 trillion dollars, making it the top fiscal market across the globe. This alone poses a great chance for traders to earn huge profits. Trading without an investment is risk-free in itself. This article is for anyone who desires to take this path.

Here’s how to begin trading in forex without money

First, you must have a clear understanding that it is not possible to make high profits in forex with no investment. If you desire to be a serious trader and want to gain huge profits in the long-run, then you should open a trading account and deposit some money on it.

Nonetheless, you can still earn money at forex with no investment but the profit will not be as big. The best part with no investment trading is that you’ll not risk your money.

Trading forex is in itself risky – that’s why many people shy away from it. There are many scams assuring people that they can earn millions even if they have no capital investment. Don’t let these scams fool you – even a bit!

Luckily, you can earn money at forex without a deposit. The thing is that it will take a long time to accumulate as much as you would desire.

- Forex trading with zero capital using demo accounts or with no-deposit bonus

Every reputable forex broker will give traders a chance to open new demo accounts. Such an account will let you use virtual currency to trade at forex. But you cannot withdraw this fund as it belongs to your broker, or you can try forex no-deposit bonus and you can withdraw if you make a profit.As an inexperienced and new trader, it is advisable you start with a demo account or no deposit bonus. If you so wish to take this path, then, just be aware that you can make a profit. But it’s a great starting point to learn how to trade when you invest real money.

- Affiliate programs

Besides opening a demo account, you can trade using affiliate programs. This is a chance to make extra money in forex without trading as per se. Just select a broker and promote them. As a result, you’ll get a commission if you happen to attract people. This is a current trend for traders to earn money with no investment.

Participating in an affiliate programs entails attracting new clients. These clients must be willing to trade in forex. That’s how you’ll earn your bonus. Affiliate programs have different terms and conditions. Some will allow you to receive bonuses whether or not the client trades. Therefore, it’s great to check out the terms for your affiliate program and see how much you can get.

Once you attract a client, your broker will automatically transfer your bonus into your trading account. Here you have an option to withdraw the money or trade with it in forex.

- Contests

Some brokers do arrange contests for real and demo accounts on a regular basis. Unlike other competitions, the ones in forex are simple. To become a winner, you must boost the income on your virtual account at least several times within the shortest period possible. As a result, you’ll receive money on your real account – as a reward.

Therefore, you can trade at forex with no investment. If you choose to trade using a demo account, then you should increase profits for a specific amount within a specific time period. And you’ll get a bonus on your real trading account.

So taking part in the contest can make you a great trader at forex even if you don’t have an investment. However, for you to be successful with demo contests, you must know how to trade with cryptocurrency pairs. Cryptocurrency is a great asset for a trader to earn high profits due to its volatility.

- 4. Posts, reviews, and comments on different information portals

Brokers do reward traders who place interesting comments on forex forums. You can also receive bonuses when you participate in forex opinion polls. Similarly, publishing articles and surveys about forex can earn you bonuses on your real account.

Apart from earning money, you can also gain reputation and experience same as that of a professional analyst. Brokers are willing to pay a lot for forex reviews. So you can take advantage and write them some damn good reviews.

The bottom line

Those who make an investment in forex are not the only ones who can gain profit. Even the ones with no money can too. Notably, though, if you want to earn huge amounts of money at forex you should invest money. On the same note, you should have the knowledge and experience of trading in forex.

Nowadays, people can trade with no capital at first and open real accounts later on. And with time, they become successful in trading. As a newbie in this field, it is advisable you begin the first step and proceed as you gain experience/knowledge.

Hopefully, you now have a clue on how you can start forex trading business with no money at all. You can use either of these options as a chance to gain experience on how to trade in forex without risking your money.

Forex trading without investment

Forex is a highly volatile market that dwells in currencies. It remains open for 24 hours a day, 5 days a week. Every investor, whether new or veteran, invests money in this fluctuating currency world with the sole aim to make profits. However, it often turns out that potential traders interested in setting their foot do not have enough monetory resources to take a stride. But, with no deposit account and its associated amenities, forex trading without investment is now possible.

What is no deposit bonus?

To put it simply, brokers make every effort to lure new customers and increase their trading base. To do so, they offer a type of trading account where a new trader can start investing without paying a single penny from his store. His broker provides him a welcome bonus that can be used to perform trades. However, this amount is not immediately refundable. The trader has to close a number of trades successfully in order to be eligible for claiming this gift.

How does forex without investment work?

Once you register yourself and instigate an account, the bonus is provided to you with immediate effect. Most brokers provide enough cash to complete a couple of successful trades. Traders have two options here. Either to trade with the given amount or leverage it; by opting for leverage, he or she can look to escalate his position giving him or her chances of greater profit.

Leverage ratios are normally in the ratio of 10:1, 20:1 or 50:1. For example, john wants to start forex without investment. His welcome bonus reads $2,000. He can opt to trade with the given amount or leverage it with any of the given ratios. A 20:1 ratio will provide him an opening sum of 40,000. Such high amount helps him to trade into bigger currencies and increase his chances of reaping profits.

How to choose a no deposit account?

Since now you have garnered adequate information about no deposit accounts, it must be quite tempting to make your first stride in the market. However, one should perform a few checks so as to ensure that this forex trading without investment goes hassle free.

- the authentic broker

To get the taste of forex without investment, it is essential to sign up with an authentic broker. Legal and trustable brokers such as lite forex guarantee authenticity of all documents and makes sure that your money is safe with their impeccable privacy policies. A reliable broker will be fully transparent with its clauses and will lay out clear statements regarding the use and redeem of its welcome bonus.

- compare to choose

Experts recommend comparing a number of forex brokers before settling for one. Comparison should be preferably made of their bonus sections. It is ideal to choose a perfect blend of special promotions as well as forex trading options. Check out for impractical no deposit bonus amounts. These often turn out to be frauds and can ruin your approach to trade forex without investment.

- forums and review

Participating in forums is an important tool to get idea reliable brokers along with their schemes. Have a talk with eminent and veteran traders who will be able to provide valuable insight on choosing the correct service.

Final words

So, if you are looking to set your foot into forex trading with a no deposit account, it is important to perform a check of the above points in order to assure a successful forex trading without investment plan. Happy trading.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to make money in the forex market without investment?

Six ways of making money with a forex broker

We all know that forex is a currency market where currencies are bought and sold.

In order to earn money at forex, you need to have a currency of one country, which you can exchange for a currency of the other country and make a profit. That is true; however, if you read more about investing at forex you will know that it is possible to earn money at forex without making investments.

You will nevertheless have to invest your time and energy, but it is true - you can start with $0 and make millions. Just like those billionaires. You can always start with demo-contest or an affiliate program.

Read about the ways of earning money at forex without the initial capital.

Trading in forex without investing

First of all, you should understand that it is impossible to make a high profit without making investments. If you decide to become a real trader and earn big money in the long-term prospect, you will need to open an account and deposit money on it.

Do not trust information assuring you that it is possible to earn millions without investing a penny. High profits without investments are impossible and statements promising this are questionable.

And still, it is possible to earn money at forex without making investments, although the profit maybe not too big. In this case, you will earn money not in the market but will receive it from your broker. What are the ways of earning money without making deposits at forex? I have gathered the information from different sources and will review it here. So let's figure out with the ways to make money with forex without investment.

Trading on the account without a deposit

You open an account and your broker deposits some money on it. You cannot withdraw this deposit but you can trade using this fund. If you trade successfully a broker will allow you to withdraw your profit. This option enables a trader to earn at forex without investing money and, which is more important, to gain valuable experience of work on the trading platform.

A deposit, which a broker puts on your account, usually ranges from $5 to $70. With the help of this fund, you can start trading without investment on the real trading account. What is the benefit of a broker? It is just a promotion, and a broker is prepared to spend some money on it.

Affiliate programs

Do you know how to make money in forex without actually trading? Just choose the broker and promote it to get the commission from people you attract. Today forex affiliate programs are becoming more popular among traders as they give a chance of earning money without investing. Participation in the affiliate program means that you attract new clients, who are ready to work in the forex market and receive a bonus for it. Depending on the terms and conditions of an affiliate program you sometimes receive your bonus regardless of the trader’s success in trading; your interest also depends on the terms of the affiliate program. You can calculate the expected earning here.

If you have your own site or a blog, affiliate programs is a good option of earning money for you, as you can advertise a broker on your site.

You can open an account with a broker where he will transfer money for the clients attracted by you. You also can use this account for trading at forex to make more money. So, you start forex with no money and now you have investments to trade. If you do not know how to trade profitably, you can join the copy trading network and choose the professional trader to start copying his trades to your own account. You can find the traders' list here, draw your attention on profitability, risk level, and the experience when choosing the trader to copy.

So the affiliate programs and copy trading forex system is a good collaboration to earn money in financial markets without investment and make money from forex without trading. Here you can also read a lot of articles about forex programs.

Contests

Some brokers regularly organize contests for demo and real accounts. As with other forms of competition, nature of competition in forex is simple — to come forward in relation to other bidders, increasing your income on a demo account several times in a short period of time, and in the end to get money on the real account as a reward. So, as a participant, you can start trading on forex without any investment. In case of a demo account, you should increase your profit for a certain amount on your account within a certain period of time and finally, you will receive a bonus on your real account. So starting with participating in the contest, you can become a trader at forex without investing money. For now, I found the demo contest with the huge prise finds 10000 USD, and to will this contest you need to trade as good as you can on all cryptocurrency pairs. Cryptocurrencies are very appropriate assets to get high profit because of their volatility. It is really amazing, you can start trading without money on a demo account and if you win you will get the prize money to your live account to trade without investment on it and ear the real profit. To participate in the contest we need to register first here to get an account and then register this account on the contest here. Let's compete? :) let me know in the comments section below about your results.

Comments, reviews and posts on various information portals

Placement of the interesting comments on the forums, participation in the opinion polls devoted to forex and publication of the surveys and articles about forex is often rewarded by brokers. So you can receive a bonus on your real trading account and also gain experience and reputation of a professional market analyst. Brokers are prepared to pay big money for the forex reviews.

Professional forex copy trading and PAMM systems

Some traders are ready to pay interest from their profit to the experienced traders for investing their funds into PAMM-accounts. This is a good incentive for achieving more improvements in trading for the experienced trader at forex. The automated copy-trading systems allow you to duplicate the best traders and communicate on specialized chat with traders community from all of the word.

Hopefully, now you know all about how to make money in forex without investment!

In conclusion, I would like to say that it is possible to trade and gain profit at forex without investing money. Note, however, that for earning large amounts of money a trader should have experience and knowledge of trading and investing money.

It is quite common that traders start to work at forex without making investments, but later they open real accounts and achieve real success in trading. Just remember that it is important to start the first step.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you" :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo-code BLOG for getting deposit bonus 50% on liteforex platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.Me/liteforexengchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, forex reviews, training articles, and other useful things for traders https://t.Me/liteforex

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to day trade with less than $25,000

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/senior-woman-using-tablet-528869921-85aab87d785a4e2c9950c99055185814.jpg)

When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader." your broker will know, based on your trading activity.

The financial industry regulatory authority (FINRA) in the U.S. Established the "pattern day trader" rule, which states that if you make four or more day trades (opening and closing a stock position within the same day) in a five-day period and those day-trading activities are more than 6% of your total trading activity in that five-day period, you're considered a day trader and must maintain a minimum account balance of $25,000.

Background on day trading equity requirement

Back in 1974, before electronic trading, the minimum equity requirement was only $2,000. New technology changed the trading environment, and the speed of electronic trading allowed traders to get in and out of trades within the same day.

Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call—a demand from a broker to increase the amount of equity in their account—during a given trading day. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement.

Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. In this scenario, your brokerage firm would still likely classify you as a day trader and hold you to the $25,000 equity requirement going forward.

You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm.

If you do not have $25,000 in your brokerage account prior to any day-trading activities, you will not be permitted to day trade. The money must be in your account before you do any day trades and you must maintain a minimum balance of $25,000 in your brokerage account at all times while day trading.

On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. A stock day trader can trade with 4:1 leverage, while typical stock investors (including swing traders and those who tend to buy and hold) can trade with a maximum of 2:1 leverage.

Day trading loopholes

If you don't happen to have $25,000 to day trade, there are ways of getting around that requirement. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal.

- Make only three day trades in a five-day period. That's less than one day trade per day, which is less than the pattern day trader rule set by FINRA. However, this means you'll need to pick and choose among valid trade signals, so you won't receive the full benefit of a proven strategy.

- Day trade a stock market outside the U.S. You'll have to do this with a broker that's also outside the U.S. Not all foreign stock markets have the same account minimums or day trading rules as the U.S. research other markets and see if they offer the opportunities for day trading that fit your needs. Consult both tax and legal professionals to understand the ramifications before considering this approach.

- Join up with a day trader firm. The structure of each firm varies, but typically you deposit an amount of capital (much less than $25,000) and they provide you with additional capital to trade, with your deposit safeguarding them from losses you may take. Otherwise, the firm simply leverages your capital.

- Do swing trading and enter trades that you hold for longer than one day. Swing traders capture trends that play out over days or weeks rather than attempt to time a one-day trend that might last for 20 minutes. While this is less a loophole and more of a change in strategy, it works for traders who want to stay actively involved but don't yet have enough equity to meet the $25,000 requirement for day trading.

- Open multiple day trading accounts with different brokers. This is a less-attractive choice, but, for example, if you open two accounts, you can make six day trades in a five-day period—three trades for each broker. this isn't an optimal solution because, if you already have limited capital, each account is likely to be quite small, and day trading with such small accounts isn't likely to produce much income. With small amounts of capital in each account, you are severely limited in the stocks you can trade, and some brokers may not even accept the small deposit.

Brokers are out to protect themselves and can impose minimum capital restrictions at their discretion if they believe someone is day trading regularly (even if below the four-trade/five-day threshold) or trading in a risky manner.

Day trading on different markets

A better alternative to taking advantage of a loophole or adopting a different trading strategy is to change markets.

Forex

The forex or currencies market trades 24 hours a day during the week. Currencies trade as pairs, such as the U.S. Dollar/japanese yen (USD/JPY). With forex trading, consider starting with at least $500, but preferably more. The forex market offers leverage of perhaps 50:1 (though this varies by broker), so a $500 deposit means you can trade and earn—or lose—off of $25,000 of capital. Profits and losses can mount quickly.

Futures

The futures market is where you can trade stock index futures (the E-mini S&P 500, for example) and commodities (such as gold, oil, and copper). Futures are an inherently leveraged product, in that a small amount of capital, such as $400 or $500 in the case of the E-mini contract, gives you a position in a product that typically moves 10 or more points a day, where each point is worth $50. Profits and losses can pile up fast. It's recommended futures traders start with at least $2,500 (if trading a contract like the E-mini), but that will vary based on risk tolerance and the contract(s) traded.

Almost all day traders are better off using their capital more efficiently in the forex or futures market. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income.

Options

Day trading the options market is another alternative. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Instead, you pay (or receive) a premium for participating in the price movements of the underlying. The value of the option contract you hold changes over time as the price of the underlying fluctuates. What type of options you trade will determine the capital you need, but several thousand dollars can get you started.

The bottom line

While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Before investing any money, always consider your risk tolerance and research all of your options.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

Buying stocks and mutual funds without a broker

Can you be an online investor without a broker? Sure. Some online investors want to buy stocks but don’t want to bother with a broker. There’s nothing that says you need to have a broker to buy and sell stocks or mutual funds.

Stocks: direct investments

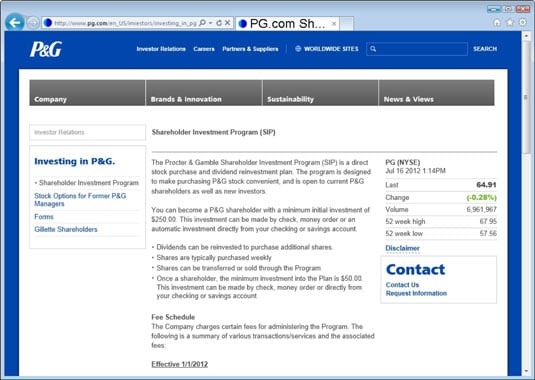

Direct investments are where you buy the stock straight from the company. Many large companies, such as coca-cola, procter & gamble (P&G), and walt disney, allow you to buy and sell your stock with them and avoid a broker. Many direct investment programs are connected with dividend reinvestment plans (drips), where the companies let you use dividend payments to buy, or reinvest, additional shares.

If you’re interested in going with a direct investment program, you can visit the investor-relations section of the company’s web site to see whether it offers one. P&G, for instance, has an elaborate shareholder investment program that lets you buy as little as $250 in stock and will even reinvest the dividends.

The other way to find direct investment programs is through directory services, such as the moneypaper’s directinvesting.Com.

Here are the upsides to direct investing:

Potential commission savings: the fees charged by direct investment programs can be lower than what some brokers charge. P&G, for instance, charges no fee for investments plus a 2-cents-per-share charge if you buy the stock using money from your bank account and just $2.50 plus 2 cents per share if you mail a check.

Dividend reinvestments: dividends can be reinvested for free. If you’re with a broker, you would often need to incur a commission to reinvest a dividend into the company stock.

As you might suspect, direct investing has some downsides:

Not free for all transactions: some companies even charge commissions that exceed what deep discount brokerages charge for certain services. Be sure to check the company’s web site, usually in a document called a direct stock plan prospectus, and understand all the fees that are charged.

Setup fees: although opening a brokerage account is usually free, some direct investment plans charge a fee to get started. Some plans also have minimum initial deposits. P&G, for instance, requires $250 for a new account.

Limited universe: by using direct investment plans, you’re narrowing your universe of possible investments to the hundreds of the largely older, blue-chip companies that offer these programs.

Administrative hassles: with direct investment plans, you need to manage all your separate accounts, which could be a pain if you have ten or more investments.

Mutual funds: straight from the mutual fund company

You can buy mutual funds with no transaction fee if you deal directly with the mutual fund company. This can be a tremendous advantage, especially if you’re making frequent and regular investments into a fund. After you figure out what fund you want to buy, log on to the mutual fund company’s web site, open an account, and buy it. You’ll save yourself some cash.

Free trade agreement (FTA)

What is a free trade agreement (FTA)?

A free trade agreement is a pact between two or more nations to reduce barriers to imports and exports among them. Under a free trade policy, goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies, or prohibitions to inhibit their exchange.

The concept of free trade is the opposite of trade protectionism or economic isolationism.

Free trade

How a free trade agreement works

In the modern world, free trade policy is often implemented by means of a formal and mutual agreement of the nations involved. However, a free-trade policy may simply be the absence of any trade restrictions.

A government doesn't need to take specific action to promote free trade. This hands-off stance is referred to as “laissez-faire trade” or trade liberalization.

Governments with free-trade policies or agreements in place do not necessarily abandon all control of imports and exports or eliminate all protectionist policies. In modern international trade, few free trade agreements (ftas) result in completely free trade.

Key takeaways

- Free trade agreements reduce or eliminate barriers to trade across international borders.

- Free trade is the opposite of trade protectionism.

- In the U.S. And the E.U., free trade agreements do not come without regulations and oversight.

For example, a nation might allow free trade with another nation, with exceptions that forbid the import of specific drugs not approved by its regulators, or animals that have not been vaccinated, or processed foods that do not meet its standards.

The benefits of free trade were outlined in on the principles of political economy and taxation, published by economist david ricardo in 1817.

Or, it might have policies in place that exempt specific products from tariff-free status in order to protect home producers from foreign competition in their industries.

The economics of free trade

In principle, free trade on the international level is no different from trade between neighbors, towns, or states. However, it allows businesses in each country to focus on producing and selling the goods that best use their resources while other businesses import goods that are scarce or unavailable domestically. That mix of local production and foreign trade allows economies to experience faster growth while better meeting the needs of its consumers.

This view was first popularized in 1817 by economist david ricardo in his book, on the principles of political economy and taxation. He argued that free trade expands the diversity and lowers the prices of goods available in a nation while better exploiting its homegrown resources, knowledge, and specialized skills.

Public opinion on free trade

Few issues divide economists and the general public as much as free trade. Research suggests that faculty economists at american universities are seven times more likely to support free-trade policies than the general public. In fact, the american economist milton friedman said: “the economics profession has been almost unanimous on the subject of the desirability of free trade.”

Free-trade policies have not been as popular with the general public. The key issues include unfair competition from countries where lower labor costs allow price-cutting and a loss of good-paying jobs to manufacturers abroad.

The call on the public to buy american may get louder or quieter with the political winds, but it never goes silent.

The view from financial markets

Not surprisingly, the financial markets see the other side of the coin. Free trade is an opportunity to open another part of the world to domestic producers.

Moreover, free trade is now an integral part of the financial system and the investing world. American investors now have access to most foreign financial markets and to a wider range of securities, currencies, and other financial products.

However, completely free trade in the financial markets is unlikely in our times. There are many supranational regulatory organizations for world financial markets, including the basel committee on banking supervision, the international organization of securities commission (IOSCO), and the committee on capital movements and invisible transactions.

Real-world examples of free trade agreements

The european union is a notable example of free trade today. The member nations form an essentially borderless single entity for the purposes of trade, and the adoption of the euro by most of those nations smooths the way further. It should be noted that this system is regulated by a bureaucracy based in brussels that must manage the many trade-related issues that come up between representatives of member nations.

U.S. Free trade agreements

The united states currently has a number of free trade agreements in place. These include multi-nation agreements such as the north american free trade agreement (NAFTA), which covers the U.S., canada, and mexico, and the central american free trade agreement (CAFTA), which includes most of the nations of central america. There are also separate trade agreements with nations from australia to peru.

Collectively, these agreements mean that about half of all goods entering the U.S. Come in free of tariffs, according to government figures. The average import tariff on industrial goods is 2%.

All these agreements collectively still do not add up to free trade in its most laissez-faire form. Amerian special interest groups have successfully lobbied to impose trade restrictions on hundreds of imports including steel, sugar, automobiles, milk, tuna, beef, and denim.

7 real [not scam] ways you can earn money from home without investment

“earn money from home without investment” – the phrase itself has really a bad reputation in online world. This phrase has been so much abused by bloggers, online marketers and companies. That is why whenever you see “earn money from home without investment” somewhere listed, you ignore it. Because it reflects your mind towards various online scams that promises to give you everything quickly without taking anything from you. Hence you end up ignoring these sure success ways to earn money from home without investment.

Generally, there is a myth that you need to invest money in order to get started in almost any business. And online business is much more tricky where you have to take care of every step. But let me tell you there are many ways to earn money from home without investment.

7 real ways to earn money from home without investment

Today, I’m listing here some sure shot successful ways from which you can easily earn money from home without investment.

1. Affiliate marketing

Affiliate marketing is one of the simplest and easiest way to get started in online money making. Getting started in affiliate marketing doesn’t requires special skills. You can sign up for affiliate programs for free. After joining, you have to spread or promote your affiliate links. And if someone buys any product clicking on your affiliate link, you get a commission for that sale. This is how affiliate marketing works.

The best thing is once you started to get going in affiliate business, then it is something where you make money sleeping. So if interested, I recommend you to refer to these guides where I have already covered basics.

2. Freelancing

Everyone present on this earth has a hidden talent. You too might have some talents and skills. So its time to recognize that hidden talent. Because there are many who are waiting to hire you for that talent.

Freelancing is like online work place where you get paid to perform tasks online. You can easily sign up for free in various freelancing work places. After signing up, all you have to do is to set up a good looking profile and attractive portfolio. Once you got success in bidding on a particular work, you have to complete your project in given time frame. And if your work is satisfactory, you’ll get paid for that.

3. Playing online games

Playing games is very famous among teenagers and children. But who knows, the childish behaviour inside you might be compelling you to play games. And many people (above teen age) are also addicted to play games. If same addiction is with you then you don’t need to worry. Because this can make some serious money for you.

There are many sites who pay you to play games online. But make sure you start with trusted one. One of the most trusted that I have found ever is red flush online cashino. This is the most preferred way to earn money from home without investment.

4. Paid blogging

Blogging is becoming a trend and serious business these days. But the fact is that it requires investment of not only money but also time for professional blogging. So paid blogging can be very handy. Especially, when you are looking to earn money from home without investment.

Many bloggers would be happy to pay you for your blog posts. Thus you are eased from many other aspects and challenges of blogging. This helps you to concentrate only on writing great posts and getting wages for that. You can easily look and grab one of such opportunity in various forums and communities.

5. Selling small services or gigs

Let me ask you a question ! What will you do for $5 ? Yes, a similar service is fiverr where you would be selling small gigs or doing small tasks for $5.

But that is not only limited to fiverr, there are many other places too. Some of the most popular one are fiverr, tennerr, fourerr, SEO clerk and gigbucks etc.

So check out those places, there might be some crazy people willing to pay you for composing a birthday song for them.

6. Tutoring or online teaching

Digital learning is a new way of learning online and visually that mostly students enjoy. Many students finds it really interesting. And that is why it is becoming the first choice of younger generation. This opens up a large opportunity for individuals to make money tutoring.

You might have expertise in any subject. This expertise can really earn huge money for you. One of such sites I came across recently is – instaedu where you can earn up to $20 per hour teaching students online. There are other places like tutorvista too, where you can make money tutoring.

7. Participating in GPT offers

GPT or GET PAID TO offers are really some of interesting ways to earn money. Such offers include a wide range of activities like get paid to promote and get paid to participate in surveys. Also get paid to complete micro tasks, get paid to shop and get paid to sign up etc. Come to these categories.

The reward for such activities ranges between as low as $0.01 to as high as $50 depending upon kind of task you perform. These are some of the easiest and funniest way to make money from home without investment.

The pro review from techreviewpro

Everything that comes to “earn money from home without investment” is not a scam. There are many ways where you can make money without spending a dime. All you need to have is a strong desire to get started in online money making.

Also, don’t forget to share this with your friends.

Hope you enjoyed reading this post. Do let me know via comment section below if I missed any real way to earn money from home without investment.

Also read:

You may also like .

7 best video filter apps for iphone and android

8 cheaper carfax alternatives that are similar to carfax

Top 3 best visual translator apps for android and iphone

Meet author

Rahul is a tech geek, author, blogger, podcaster, youtuber and a keen learner. Rahul enjoys learning, testing, and messing up with new tips and tricks, apps, and gadgets. He has been writing for several years and has even contributed to popular magazines like huffington post. When he is not making this site better or shooting videos for techreviewpro youtube channel, you can find him helping people in groups, forums, and private communities. He is very down to earth person and believes in karma, hence he never misses an opportunity to help others. Got a query? Ask him via email: [email protected]

Comments on this entry are closed.

I have had some success with freelancing and fiverr. What I did was I went to fiverr and found a service that was selling well, then went to elance and found someone who did the same thing for less. Then I made a fiverr ad and sold the service myself. Tiny work once you get it going. I’ve also done the opposite where you go on elance and look for jobs that you can have someone on fiverr do for cheaper.

If you’re starting out, those are two pretty easy ways of making money.

So, let's see, what we have: fxdailyreport.Com we are all aware that forex refers to a currency market where traders buy currencies and sell them. For a trader to earn some money at forex, they should have the currency at trade without investment

Contents of the article

- Top-3 forex bonuses

- Fxdailyreport.Com

- Here’s how to begin trading in forex without money

- Forex trading without investment

- How to make money in the forex market without...

- Six ways of making money with a forex broker

- Trading in forex without investing

- Trading on the account without a deposit

- Affiliate programs

- Contests

- Comments, reviews and posts on various...

- Professional forex copy trading and PAMM systems

- Price chart of EURUSD in real time mode

- How to day trade with less than $25,000

- Background on day trading equity requirement

- Day trading loopholes

- Day trading on different markets

- The bottom line

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- Buying stocks and mutual funds without a broker

- Stocks: direct investments

- Mutual funds: straight from the mutual fund...

- Free trade agreement (FTA)

- What is a free trade agreement (FTA)?

- How a free trade agreement works

- Key takeaways

- The economics of free trade

- Public opinion on free trade

- The view from financial markets

- Real-world examples of free trade agreements

- 7 real [not scam] ways you can earn money from...

- 7 real ways to earn money from home without...

- 1. Affiliate marketing

- 2. Freelancing

- 3. Playing online games

- 4. Paid blogging

- 5. Selling small services or gigs

- 6. Tutoring or online teaching

- 7. Participating in GPT offers

- The pro review from techreviewpro

- Also read:

- You may also like .

- 7 best video filter apps for iphone and android

- 8 cheaper carfax alternatives that are similar to...

- Top 3 best visual translator apps for android and...

- Meet author