Jp market demo

8. After removing JP markets metatrader 4 terminal, advanced uninstaller PRO will ask you to run an additional cleanup.

Top-3 forex bonuses

Press next to go ahead with the cleanup. All the items of JP markets metatrader 4 terminal which have been left behind will be found and you will be able to delete them. By uninstalling JP markets metatrader 4 terminal using advanced uninstaller PRO, you are assured that no windows registry items, files or folders are left behind on your computer. Your windows system will remain clean, speedy and ready to take on new tasks.

Publishers

A way to uninstall JP markets metatrader 4 terminal from your system

JP markets metatrader 4 terminal is a windows application. Read more about how to uninstall it from your PC. It is written by metaquotes software corp. . You can read more on metaquotes software corp. Or check for application updates here. Please follow http://www.Metaquotes.Net if you want to read more on JP markets metatrader 4 terminal on metaquotes software corp.'s web page. The program is frequently placed in the C:\program files (x86)\JP markets metatrader 4 terminal directory (same installation drive as windows). You can uninstall JP markets metatrader 4 terminal by clicking on the start menu of windows and pasting the command line C:\program files (x86)\JP markets metatrader 4 terminal\uninstall.Exe. Keep in mind that you might receive a notification for administrator rights. Terminal.Exe is the programs's main file and it takes circa 9.89 MB (10369568 bytes) on disk.

The following executables are incorporated in JP markets metatrader 4 terminal. They take 19.03 MB ( 19951672 bytes) on disk.

- Metaeditor.Exe (8.54 MB)

- Terminal.Exe (9.89 MB)

- Uninstall.Exe (609.26 KB)

This web page is about JP markets metatrader 4 terminal version 6.00 alone. You can find below info on other application versions of JP markets metatrader 4 terminal:

A way to remove JP markets metatrader 4 terminal with advanced uninstaller PRO

JP markets metatrader 4 terminal is a program released by metaquotes software corp.. Some computer users want to remove this application. Sometimes this can be difficult because performing this manually takes some knowledge related to pcs. One of the best QUICK action to remove JP markets metatrader 4 terminal is to use advanced uninstaller PRO. Here are some detailed instructions about how to do this:

1. If you don't have advanced uninstaller PRO already installed on your windows PC, add it. This is a good step because advanced uninstaller PRO is a very efficient uninstaller and all around utility to maximize the performance of your windows system.

- Go to download link

- Download the setup by pressing the green DOWNLOAD NOW button

- Install advanced uninstaller PRO

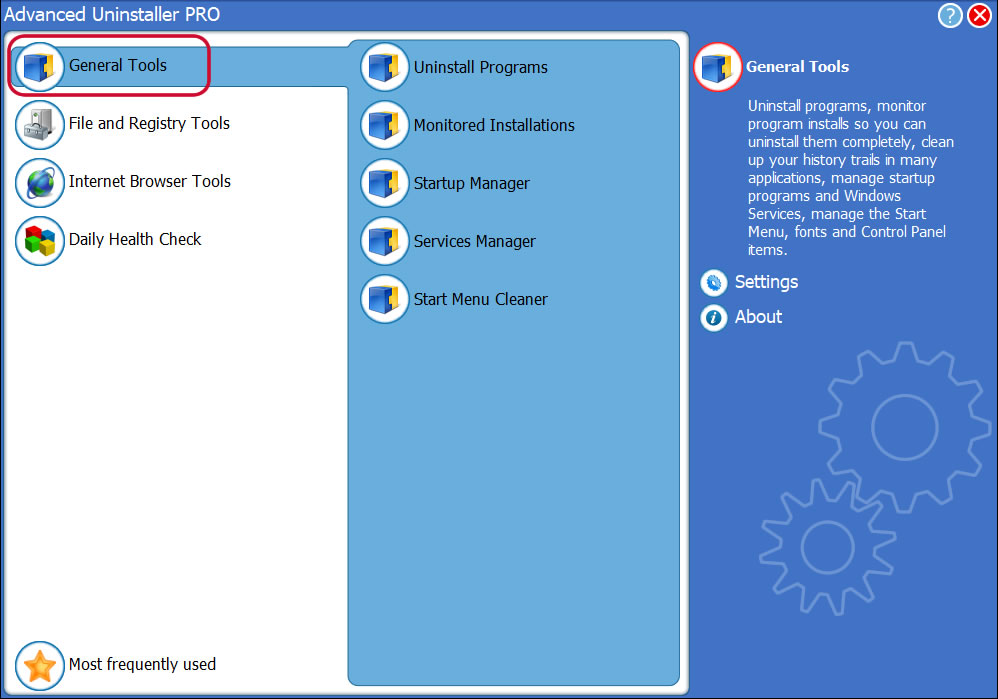

2. Run advanced uninstaller PRO. It's recommended to take your time to admire advanced uninstaller PRO's interface and wealth of tools available. Advanced uninstaller PRO is a powerful system optimizer.

3. Press the general tools button

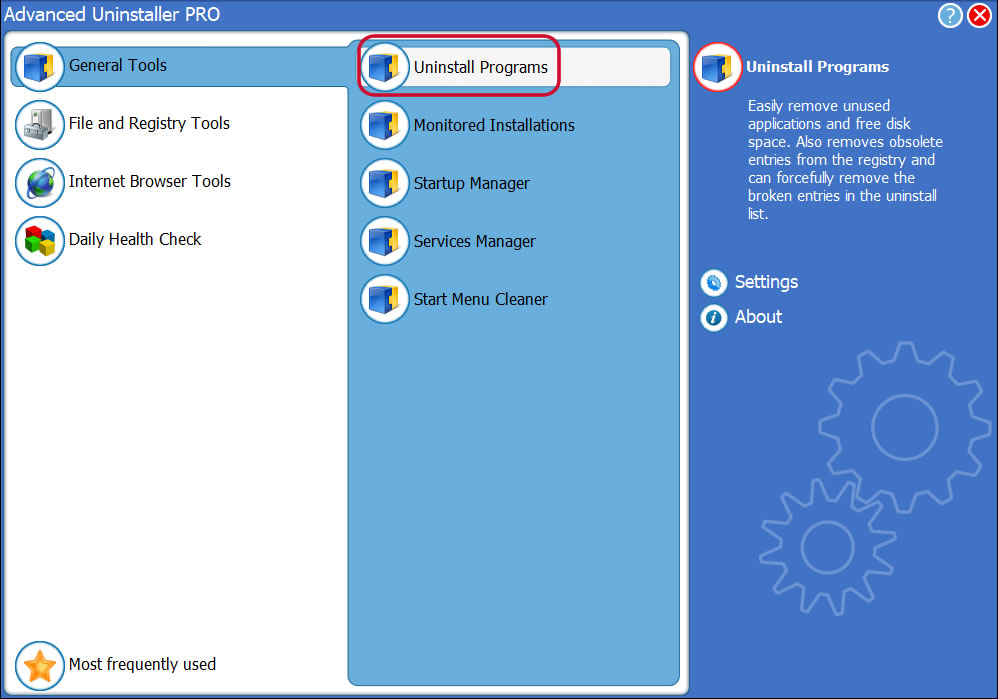

4. Click on the uninstall programs button

5. A list of the applications installed on the computer will be made available to you

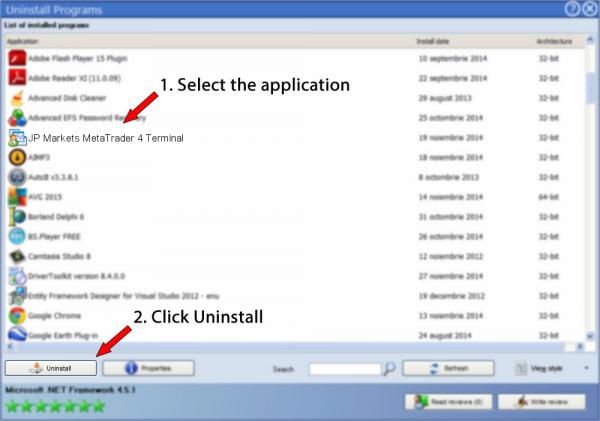

6. Scroll the list of applications until you locate JP markets metatrader 4 terminal or simply activate the search feature and type in "JP markets metatrader 4 terminal". If it is installed on your PC the JP markets metatrader 4 terminal program will be found very quickly. After you select JP markets metatrader 4 terminal in the list of applications, the following information regarding the program is shown to you:

- Star rating (in the left lower corner). The star rating explains the opinion other users have regarding JP markets metatrader 4 terminal, from "highly recommended" to "very dangerous".

- Reviews by other users - press the read reviews button.

- Details regarding the program you want to uninstall, by pressing the properties button.

For instance you can see that for JP markets metatrader 4 terminal:

- The web site of the application is: http://www.Metaquotes.Net

- The uninstall string is: C:\program files (x86)\JP markets metatrader 4 terminal\uninstall.Exe

7. Press the uninstall button. A confirmation page will appear. Confirm the removal by pressing the uninstall button. Advanced uninstaller PRO will then uninstall JP markets metatrader 4 terminal.

8. After removing JP markets metatrader 4 terminal, advanced uninstaller PRO will ask you to run an additional cleanup. Press next to go ahead with the cleanup. All the items of JP markets metatrader 4 terminal which have been left behind will be found and you will be able to delete them. By uninstalling JP markets metatrader 4 terminal using advanced uninstaller PRO, you are assured that no windows registry items, files or folders are left behind on your computer.

Your windows system will remain clean, speedy and ready to take on new tasks.

Disclaimer

This page is not a recommendation to remove JP markets metatrader 4 terminal by metaquotes software corp. From your PC, we are not saying that JP markets metatrader 4 terminal by metaquotes software corp. Is not a good software application. This text simply contains detailed instructions on how to remove JP markets metatrader 4 terminal in case you want to. The information above contains registry and disk entries that our application advanced uninstaller PRO discovered and classified as "leftovers" on other users' pcs.

2017-01-13 / written by dan armano for advanced uninstaller PRO

Заявление на открытие демо-счета

Global markets at your fingertips

Unfortunately, IC markets do not accept traders from the united states unless they are “eligible contract participants” (“ecps”), as defined in section 1a(18) of the commodity exchange act. If you qualify as an ECP, you may continue to register as a client of IC markets provided you upload the ECP eligibility declaration form duly completed and signed on secure client area upon registration.

Начните торговать на форекс

На платформе ctrader уже сейчас

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of belgium. For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of latvia . For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

Residents of europe that wish to open an account under cysec license, please proceed to www.Icmarkets.Eu

You are now being redirected to internation capital markets pty ltd, a company regulated by the australian regulator ASIC.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to raw trading ltd, a company regulated by the seychelles regulator FSA.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to IC markets (BS) ltd, a company regulated by the bahamas regulator SCB.

Please confirm that you want to be redirected by clicking accept.

We are very sorry, our ASIC licensed entity can accept residents of australia only. We're redirecting you to our SC licensed entity where you can choose to continue your application.

The website you are visiting now is operated by IC markets global, an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Based on your country selection you might want to visit instead www.Icmarkets.Eu

If you want to proceed with onboarding with IC markets global please confirm that, this decision was made independently at your own exclusive initiative and that no solicitation or recommendation ha been made by IC markets or any other entity within the group.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

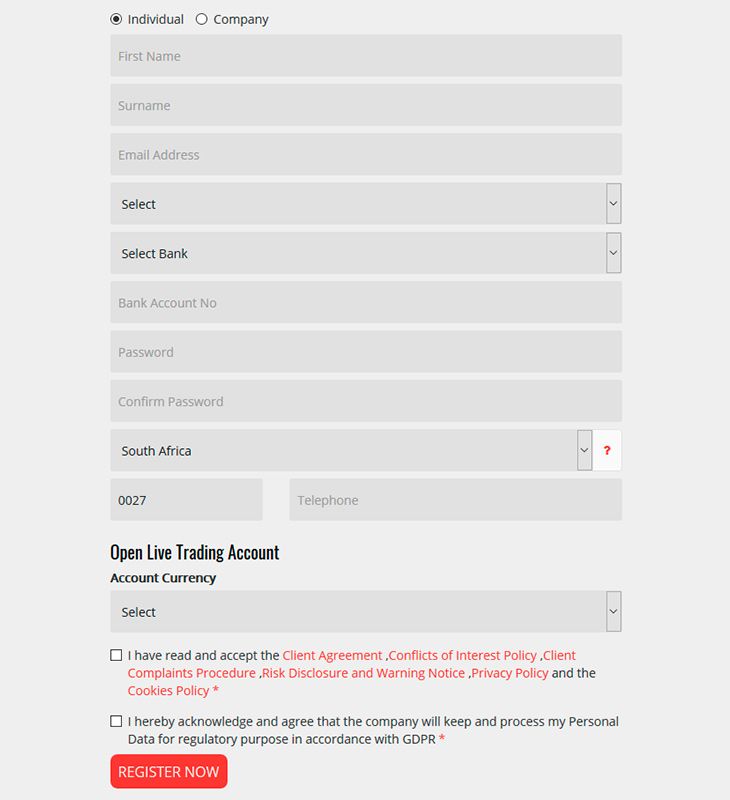

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

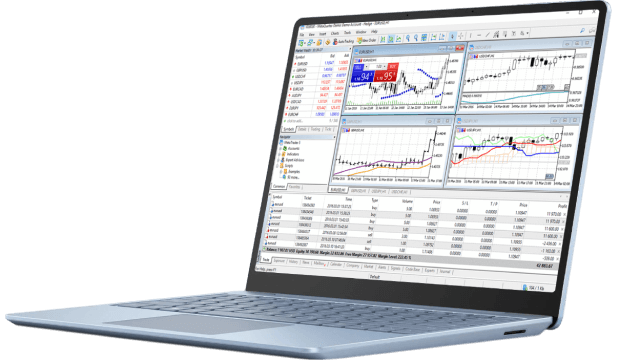

MT4 platform - metatrader 4 PC

Metatrader 4 (MT4): features

- Full technical analysis

- Reliability and security

- Multiple open windows using own settings and indicators

- Multilingual interface

- One click trading

- History of transactions made on various parameters

Metatrader 4 capacities

Metatrader 4 (MT4) platform is a popular trading platform allowing to perform trading operations and technical analysis on currency pairs of the forex market and other financial instruments.Currency and CFD trading platform metatrader 4 offers different trading products. It is an advanced trading software that allows to trade all major, minor and exotic currency pairs, metals as well as index, stock and commodity cfds (contracts for difference). Metatrader 4 platform provides the following functions:

- Fully-fledged technical analysis- large number of built in trading indicators and graphical objecst, possibility of writing own scripts, support of various time frames.

- Automated trading based on the built in metaquotes language 4 (programming language), allowing our clients to create their own trading programs (experts) and indicators

- Secure access and placing of trading operations, as well as additional access for watching trading operations only.

- Administration of local quotations history including import–export operations in the real time manner.

- Signals service - the trader has an opportunity to become a provider of trading signals and a subscriber to the trading signals. For more information about the service, you need to visit the site of the developer:

www.Mql4.Com.

How to download metatrader 4 PC - free trading platform (5.5 mb)

MT4 system requirements

- Processor: 1 ghz or higher

- OS: windows 7 and higher

- RAM: 512 MB

- Storage: free hard disk space 50 MB

- Screen: screen resolution 800x600

Supported browsers

- Chrome: version 2.0 and higher

- Firefox: version 2.0 and higher

- Opera: version 2.0 and higher

- Internet explorer: version 8.0, 9.0, 10.0.

- Safari: version 2.0 and higher

Uninstall MT4 platform

- Go to control panel

- Find and open "remove program"

- Find MT4 platform

- Select the program

- Click on "remove" button.

Deposit $250 or more and get a 30% welcome bonus + take part in tesla car draw

Take part in the draw of the tesla model 3 electric car and many other valuable prizes

Please select how you would like to be contacted:

IFCMARKETS. CORP. Is incorporated in the british virgin islands under registration number 669838 and is licensed by the british virgin islands financial services commission (BVI FSC) to carry out investment business, certificate no. SIBA/L/14/1073

IFC markets ltd is registered under no. LL16237 in the federal territory of labuan (malaysia) and is licensed by the labuan financial services authority (license number MB / 20/0049).

Risk warning notice: your capital is at risk. Leveraged products may not be suitable for everyone.

CALDOW LIMITED is an authorised payment agent of IFCMARKETS. CORP. Incorporated in the republic of cyprus under registration number HE 335779.

IG consulting s.R.O. Is an authorised payment agent of IFCMARKETS. CORP. Incorporated in the czech republic under registration number 284 07 083.

IFCMARKETS. CORP. Does not provide services for united states, japan and russian residents.

Cookie policy: we use cookies to provide you with a personalised browsing experienceclose

JP markets review

JP markets is among the many forex markets that are increasing in popularity. It gives its clients a single type of account with variable spreads, as well as additional benefits. However, the site does not allow the use of (EA) automated strategies, scalping and hedging.

Who is behind JP markets?

Established in 2016, JP markets is a forex broker that has its base in south africa, and happens to be the leading african and south african forex broker, with services expanding into other countries such as bangladesh, swaziland, kenya and pakistan.

The company operates under approval from the financial services board (FSB), south africa, FSP 46855. This gives the technology and platform allowing african-based clients to trade successfully in forex markets around the world.

JP markets focuses on assisting clients at a localized level through customer service as well as tools that can assist in succeeding on that front. The company prides itself on being the only brokerage worldwide that gives interest on trading accounts (this is subject to a specific minimum balance), as well as other industry firsts and benefits to various clients.

The founder is a south african entrepreneur, justin paulsen. He has extensive knowledge on the financial sector, having obtained a degree in economics and finance from the university of cape town. He has also worked with several brokers and forex agencies before setting up the company.

Trading services offered

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform.

You may wonder why the base is in south africa. One reason is that many investors view south africa as a country with great potential, since it is among the most developed countries on the continent. The regulator, FSA, has enforcing powers that allow it to deal with breaches in forex brokerage, while it also runs the office of the omud for financial services providers, which is a customer complaints service.

Regulation within the country is not among the best in the world, though there is some level of reliability in the sector. If you are a local broker with a trading license, you need to keep all your client funds in recognized banks in the country within segregated accounts.

Advantages of MT4 trade platform

As the industry standard platform, MT4 lends itself to various traders as an easier alternative, thanks to the richness of its features. It places itself among the leading platform in online trading due to its foreign exchange agency model implementation, unconventional organization of trading, as well as competitive assessments.

You can use algorithmic traders as well as expert advisors (eas), which automate your exchange and make the process easier for you. MT4 allows you to see the marketplace you are dealing with, all within real time, highly accurate and impeccably judge all your exits and entrances.

Accounts available on the platform

Clients have a single account type to choose, and this account comes with no commission fees imposition, fixed spreads, STP (straight through processing) market execution and leverage that reaches a maximum of 1:500. You can get PAMM services as well.

Straight through processing

This service means that the forex broker will send the customer’s order directly to larger brokers or banks without the order passing through a dealing desk. That implies that there are no delays in the process and the processing of transactions is faster.

It has several advantages, which include:

STP brokers make their money through addition of small commissions, which are markups to the spreads

The losses of the client are not the profits of the broker

When the trader loses or wins, the exact markup will go to the broker, so this eliminates conflict of interest

A related aspect to STP is NDD (no dealing desk), which gives brokers access to the inter-bank forex markets. In addition, this eliminates conflict of interest, filling orders and re-quotes.

Deposit and withdrawal options

The platform does not offer a wide range of deposit options. The bank option is ned bank, with the deposit details. Keep in mind that the south african reserve bank (SARB) will always convert international payments to their base rate. Other options include bitcoin, credit and debit cards, neteller and skrill.

You need an initial deposit minimum of R3500, and this is a reasonable amount especially when you compare it to other south african brokers. In addition, allocations of payments can take a maximum of 24 hours on business days (from monday to friday).

An interesting aspect to JP markets is the allowance for sending withdrawal requests through whatsapp, which is unseen on other platforms. The withdrawals are easy and fast to process (the process takes about 24 hours), and you can do the process on official working days from 9am to 5pm.

The platform uses secure and safe ways to send you your money, while all transactions undergo rigorous processing to ensure your money stays safe.

The option is through local bank transfer, as the site does not allow e-wallets or any other mediums of withdrawal. The time it takes to receive funds depends on the bank you use. For instance, standard bank, ABSA, nedbank and FNB allow you to get your money within the same day, while other banks could take up to two days.

As with any other withdrawal process, you need to have proof of documentation before you submit your withdrawal request. This includes scanned copies of your ID, bank statements and proof of address, all confirming your details as per regulations from the FSB.

Keep in mind that all withdrawals that you make through credit cards have an extra fee of R50. For the case of bank transfers, there are no charges for withdrawals, but you are liable for any fees that the individual bank charges in the transaction, including the use of intermediaries.

Commissions, leverages and spreads

The maximum amount of leverage you can get is 1:500, which many investors consider high, even with other brokers offering higher or similar rates.

Note that with higher leverage comes higher risks of losses, and this is the reason many jurisdictions set caps on leverage rates.

Any promotional bonuses?

There are a few promotions that the company offers, which include:

30% welcome on deposit bonus, and this is valid for 60 days

Currently, the minimum amount that qualifies you for any bonus is R3000. There is also not much information regarding bonuses.

The platform does not charge you extra commission fees, which may be a good thing. However, we do not like the spreads, as we find them too wide to be competitive – they are 2.4 pips on average for USD/EUR.

Even though fixed spreads are wider than floating ones generally, many other brokers will offer you a better deal.

Pros of the JP markets platform

The FSB regulates its activities

MT4 is available on the site

Same day deposits and withdrawals are possible

You can trade in rand, other than USD or EUR

There is a limited choice of trading platforms

The spreads are too wide

You cannot use eas, hedging or scalping techniques on the platform

Final thoughts

JP markets is a CFD south african broker and forex company that the FSA regulates actively. They support the MT4 platform, making them easy to use for many traders. However, the spreads are higher than the average, and this unfortunately places many restrictions on trade.

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

Demo trading account

Trade forex and cfds on shares & indices with a risk-free demo account

Are you new to trading and would like to see what forex is all about or you are just looking to test a new strategy? Sign up for our free demo account today and experience the markets with a risk-free demo account. It only takes a few minutes

Free market data and real-time news

Open a demo trading account via your messenger or telegram app

Trade execution

Our STP technology lets you trade in live market conditions and removes the risk of any conflict of interest on our behalf.

Regulated broker

You can be certain - our reputation and our business practices are aligned with the appropriate regulation.

Live support

Our customer service puts you first. You can reach us by social media anytime, or global phone support from 09:00 to 18.00 EET.

- Open a live trading account and your demo account(s) won`t expire.

Metatrader 4

Forex & CFD trading platform

Iphone app

Metatrader 4 for your iphone

Metatrader 5

The next-gen. Trading platform

MT4 for OS X

Metatrader 4 for your mac

Android app

MT4 for your android device

MT webtrader

About us

Start trading

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

Products

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

Platforms

Analytics

Education

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Partnership

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Please enable cookies in your browser

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our privacy policy.

Торговая платформа metatrader 4

IC markets предоставляет возможность торговать на передовой платформе metatrader 4. Это, несомненно, самая популярная в мире торговая платформа для форекс-трейдеров благодаря простоте использования, многофункциональной среде и возможности автоматической торговли.

Из торговой платформы МТ4 превратилась в глобальное сообщество, где технологии и инновации всегда к услугам любого трейдера. IC markets является партнером множества поставщиков технологий и с гордостью представляет платформу metatrader 4 нового поколения, предназначенную для того, чтобы вывести торговлю на новый уровень.

Торговать с помощью metatrader 4 можно как на стандартном счете IC markets, так и на счете raw spread.

Системные требования

Для клиентского терминала metatrader 4 требуется ОС windows 7 или выше. Также МТ4 работает на mac OSX.

Чем отличается metatrader 4 от IC markets от обычного МТ4?

Система raw pricing

IC markets предлагает лучшие условия торговли на платформе MT4, предоставляя клиентам наиболее выгодные курсы по системе raw pricing.

Система raw pricing позволяет выйти на уровень институциональной ликвидности от ведущих мировых инвестиционных банков, хедж-фондов и прочих поставщиков. Исполняемые потоковые цены (ESP) отправляются поставщиками цен на IC markets, и наши клиенты торгуют напрямую, без манимуляций и реквотинга. Благодаря тому, что в нашу сеть одновременно могут входить до 25 различных поставщиков котировок, IC markets является идеальным решением для трейдеров с большим объемом операций, скальперов и тех, кто пользуется советниками, ведь именно в таких случаях наиболее важен минимальный спред и быстрое исполнение ордеров.

Сверхбыстрое исполнение ордеров

Сервер IC markets metatrader 4 расположен в дата-центре equinix NY4 в нью-йорке. Эта финансовая экосистема обеспечивает более 600 бирж, торговых площадок и прочих поставщиков финансовых услуг. Сервер взаимно подключен к нашей сети, что обеспечивает минимальную задержку и быстрое исполнение ордеров.

Сервер IC markets metatrader 4 имеет задержку менее 1 мс относительно основных поставщиков VPS, расположенных либо в центре обработки данных NY4, либо на выделенных линиях в близлежащих центрах, что идеально подходит для автоматической и высокочастотной торговли и скальпинга.

Отсутствие ограничений на торговлю

На платформах IC markets metatrader 4 и 5 нет ограничений на торговлю. Мы предоставляем лучшие условия торговли для скальпинга и высокочастотной торговли, что позволяет трейдерам размещать ордера внутри спреда, поскольку минимальной дистанции ордера нет. Это означает, что ордера, в том числе стоп-лоссы, можно разместить на любом расстоянии от рыночной цены.

Трейдеры также могут хеджировать позиции, поскольку в IC markets нет правила очереди на ордера. Трейдеры не платят маржу по хеджируемым сделкам и пользуются преимуществами нетто-маржи.

Спред от 0 пунктов

IC markets может похвастаться одним из наиболее низких спредов среди всех брокеров мира. Спред начинается с 0,0 пунктов на платформе metatrader 4, при этом среднее значение спреда EURUSD составляет 0,1 пункта. В настоящее время это самый низкий средний спред EURUSD в мире.

Наши котировки формируются из 25 различных источников; это значит, что мы всегда можем обеспечить наших клиентов ликвидностью и не прибегать к значительному увеличению спреда даже особенно в периоды высокой волатильности (например, при выходе важных новостей).

Удобные способы пополнения счета и вывода средств

Открыв счет, вы можете пополнить счет любым из 10 доступных способов, в том числе банковской картой, банковским переводом и через системы skrill, bpay, china union pay, neteller и fasapay.

Гибкий выбор объема сделки

У нас нет ограничений по объему сделки, вы можете размещать ордера размером от одного микролота (0,01). Таким образом, вы сможете освоить платформу с минимальным риском и управлять объемом сделок в соответствии с балансом счета.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

Demo trading account

Trade forex and cfds on shares & indices with a risk-free demo account

Are you new to trading and would like to see what forex is all about or you are just looking to test a new strategy? Sign up for our free demo account today and experience the markets with a risk-free demo account. It only takes a few minutes

Free market data and real-time news

Open a demo trading account via your messenger or telegram app

Trade execution

Our STP technology lets you trade in live market conditions and removes the risk of any conflict of interest on our behalf.

Regulated broker

You can be certain - our reputation and our business practices are aligned with the appropriate regulation.

Live support

Our customer service puts you first. You can reach us by social media anytime, or global phone support from 09:00 to 18.00 EET.

- Open a live trading account and your demo account(s) won`t expire.

Metatrader 4

Forex & CFD trading platform

Iphone app

Metatrader 4 for your iphone

Metatrader 5

The next-gen. Trading platform

MT4 for OS X

Metatrader 4 for your mac

Android app

MT4 for your android device

MT webtrader

About us

Start trading

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

Products

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

Platforms

Analytics

Education

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Partnership

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Please enable cookies in your browser

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our privacy policy.

So, let's see, what we have: how to uninstall JP markets metatrader 4 terminal version 6.00 by metaquotes software corp.? Learn how to remove JP markets metatrader 4 terminal version 6.00 from your computer. At jp market demo

Contents of the article

- Top-3 forex bonuses

- Publishers

- A way to uninstall JP markets metatrader 4...

- A way to remove JP markets metatrader 4 terminal...

- Disclaimer

- Заявление на открытие демо-счета

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- MT4 platform - metatrader 4 PC

- Metatrader 4 (MT4): features

- Metatrader 4 capacities

- How to download metatrader 4 PC - free trading...

- MT4 system requirements

- Supported browsers

- Uninstall MT4 platform

- Deposit $250 or more and get a 30% welcome bonus...

- Take part in the draw of the tesla model 3...

- Please select how you would like to be contacted:

- JP markets review

- Who is behind JP markets?

- Trading services offered

- Accounts available on the platform

- Deposit and withdrawal options

- Commissions, leverages and spreads

- Pros of the JP markets platform

- Final thoughts

- Leave a reply cancel reply

- ������top broker 2020 SA������

- Demo trading account