How to trade without a broker

The other major advantage to direct access trading is it allows the trader to see more of the market.

Top-3 forex bonuses

With an online broker, you can see the bid and the ask price for a stock. With direct access, you trade using level II quotes, which allows you to see how many buyers and sellers there are at each price, as well as the size of the lot they are trading. This gives the trader a much better picture of a stock trend, as well as how much support or resistance there is at any given price level. This information, if used properly, will allow you to pinpoint the timing of your entry and exit for maximum profits. Direct access trading allows investors to trade directly with market makers and specialists, rather than going through a broker. Direct access trading uses software to link directly to the major stock exchanges and electronic communication networks, or ecns. (an ECN is a completely electronic stock exchange.) having this direct access to the exchanges not only saves the trader on commissions, but it also allows for faster executions and immediate trade confirmations. For active traders, and those who need immediate information, this instantaneous action and reaction is a great value.

How to trade without a broker

In recent years, online trading has become increasingly popular. Many investors are realizing that they can trade on their own without the help, and extra expense, of a traditional stockbroker. Not only are traders becoming empowered by doing their own research and making their own decisions on how to manage their portfolio, but also they are cutting out the middleman, and saving money by trading without having to pay the broker.

When using an online brokerage firm, investors are still trading with a broker. They’re just trading with a less expensive broker who provides less service, support, and advice. When using an online broker, there is still a middleman involved. However, there is a way to eliminate that middleman, too. It’s called direct access trading.

What is direct access trading?

Direct access trading allows investors to trade directly with market makers and specialists, rather than going through a broker. Direct access trading uses software to link directly to the major stock exchanges and electronic communication networks, or ecns. (an ECN is a completely electronic stock exchange.) having this direct access to the exchanges not only saves the trader on commissions, but it also allows for faster executions and immediate trade confirmations. For active traders, and those who need immediate information, this instantaneous action and reaction is a great value.

The other major advantage to direct access trading is it allows the trader to see more of the market. With an online broker, you can see the bid and the ask price for a stock. With direct access, you trade using level II quotes, which allows you to see how many buyers and sellers there are at each price, as well as the size of the lot they are trading. This gives the trader a much better picture of a stock trend, as well as how much support or resistance there is at any given price level. This information, if used properly, will allow you to pinpoint the timing of your entry and exit for maximum profits.

With direct access trading, it is very important to choose the right trading platform. There are many direct access platforms on the market today, but they are not all created equal. They can vary quite a bit in price, features, and even speed. In addition to choosing the right platform, you need to know how to use it properly. Simply having the software on your computer will not make you a more successful trader. You need to have the specific knowledge necessary to use it the same way professional traders do.

Trading without a broker in this fashion is not the best thing for everybody. For a new trader, we would recommend staying away from the complexities of this type of trading until you have a better idea of how the markets work. However, for intermediate and experienced traders, direct access trading will help you maximize your profits.

How to buy stocks without a broker

:strip_icc()/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

Image by britney willson © the balance 2020

While many investors choose to buy and sell investments through a brokerage account, some investors may wonder how they can buy stocks without a broker. Direct investment plans offer the brokerage alternative that those investors are seeking. If your primary investing goal is to acquire a single company's stock as directly as possible, one of these plans can help you achieve that goal, but be aware of the drawbacks that come with avoiding brokerage services before you abandon them completely.

Direct stock plans

Often, the easiest method of buying stocks without a broker is by participating in a company's direct stock plan (DSP). These plans were originally conceived generations ago as a way for businesses to let smaller investors buy ownership directly from the company. Investors buy-in by transferring money from their checking or savings account. The company will establish minimum investment amounts, both for the initial purchase and for any subsequent purchases. sometimes, these mandatory minimums are lower than the price of a single stock, effectively allowing investors without much capital to buy fractional shares of a company.

The plan administrators batch the cash from those participating in the direct stock plan and use it to buy shares of the company at regular intervals and at the average market price. just as you get a statement from the bank, the direct stock purchase plan issues statements with important financial information such as a listing of the number of shares you own, any dividends you have received, and any purchases or sales you have made.

Dividend reinvestment plans

Companies may also offer a dividend reinvestment plan (DRIP). These are similar to direct stock plans, except that they automate the process of buying more stock over the years. Drips automatically take cash dividends paid out by the company you own and use them to buy more shares. Depending on the specifics of the plan, this service may be free or there may be small commission fees.

In the U.S., some brokers traditionally reinvest dividends in certain issues at no cost for clients. If you are fortunate enough to have such an arrangement, drips don't have as much appeal.

Dividend reinvestment plans are often coupled with cash investment options that resemble direct stock purchase plans. This gives you the ability to buy more stock whenever you want, not just the four times a year dividends are issued.

The benefits and drawbacks of direct plans

The primary advantage of avoiding brokers and buying directly from a company is simplicity. Apps and websites have significantly streamlined the broker experience, but an investor still has to choose between securities and make decisions about the type of order to place for those investments. Direct stock purchases and dividend reinvestment plans can be even more simple—just send the money to the right place and you're enrolled in the plan.

Direct stock plans also allow for enhanced communication between the company and its investors. When you invest through a brokerage, any notices from the company will come through the brokerage. For investors with a variety of investments, company notices blend together because they all appear in your inbox as a message from your brokerage, rather than the company. This could lead to some investors skipping messages altogether, potentially missing out on useful information. By communicating directly, the company and its investors remain in better contact.

Institutional investors may have access to extra benefits through direct stock purchase plans, depending on the company issuing the stock. Special "waiver discounts" allow institutional investors to buy shares at a discount that isn't broadly advertised.

The simplicity that direct plan investors enjoy is also the main disadvantage of broker alternatives. If you sign up for a home depot direct stock purchase plan, for example, you will only have the option to buy home depot stock. An investor with a brokerage account and an investor with a direct stock plan could acquire the same home depot stock at the same price, but the investor with the brokerage account could also acquire any other security the brokerage services.

For traders who want to diversify and explore their options, there's no substitute for using a broker.

Traditionally, direct plans have also enjoyed the benefit of commission-free, or low-commission trades, especially when compared to the costs of using a full-service broker. However, that benefit has largely vanished in the digital era. Many brokerages—even major firms like fidelity and charles schwab—have dropped their commission fees for online trades. it's now just as cheap to acquire stock through one of these commission-free brokers as it would be to buy through direct plans—in some cases, using a commission-free broker might be even cheaper.

Direct stock plans also impede an investor's ability to time trades. Cashing out your position isn't as simple as tapping a few buttons on a brokerage app. This is fine for buy-and-hold investors who plan on holding stocks for decades. Investors who mostly care about dividends will also likely feel content with direct plans. Investors who trade often and enjoy regularly rebalancing their portfolio, on the other hand, will be frustrated by the limitations.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How to trade stocks without a broker

6 tips to save using the most popular food delivery apps

Many years ago, having a broker was essential if you wanted to trade stocks. Only a broker had access to expensive research that the small investor needed. Online trading was not available, so you had to go directly to a broker. With the spread of free information by the internet, and cheap online trading, the small investor now can trade stocks just as easily as a professional trader.

Find an online trading company. There are many online trading companies that you can open an account with. The market is so competitive that the commissions are very low. As a result, you can get very good commission rates when you open an account. Compare the customer service of each trading company to make sure you will get adequate service. Consider what services you will need. You will often get better commission rates the more you trade, so know how much you will be trading when comparing firms.

Research stocks you wish to trade. There is much research on stocks that you can get for free so you will not have to rely on a broker to get information. You can also get financial information online or from the company directly. Also, you may want to try a few paid services if your budget allows it. Form a trading strategy before you start trading.

Practice trading strategies. Many trading companies offer a demo account you can use. A demo account trades like a real account but with no actual money being traded. Use the demo account to test your trading strategy for awhile until you are comfortable with how trading works. Make adjustments with your trading strategy as necessary.

Fund your trading account at the trading company you choose. Deposit at least the minimum amount the account requires before you begin trading. Trade with an amount you are comfortable with, and be careful about using margin or borrowing money to trade. It can escalate your losses very quickly if you are not careful.

Evaluate your trading results regularly. See what is working or not. Remain disciplined in your trading strategy, but always try to evaluate and improve upon it.

Maintain good accounting records. Trading stocks is often fast paced, with many trades being placed very rapidly. Maintaining good records of your trading will not only help track your performance, it will also make it much easier for you when you file your taxes at the end of the year.

Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

Warnings

It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

- Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

- It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

Allen young is an experienced writer on such subjects such as real estate investing, mortgages, and personal finance. Young has also written on sports, travel, and parenting. Currently he is the president of crestwood capital group.

Download MT4 and open metatrader 4 demo account without a broker

Want to get free forex demo account fast without registering with any forex broker? Follow this MT4 tutorial and rimantas will teach you how to download MT4 and open MT4 demo account without a broker in a few minutes. In this video guide, you’ll learn exactly how to do that.

Rimantas makes it simple for you to download MT4, install MT4 on PC and open forex demo account without a broker.

Why would you want to have metatrader 4 demo account without a broker?

There are two mains reasons for that:

- There are many forex brokers with a bad reputation and people usually do not start trading at all because they don’t know which broker to choose. When you can get a demo trading account without a broker you don’t have to stop yourself from learning how to trade forex. Now you can start demo trading without a broker. You can always pick one later when you feel you are ready to begin live trading.

- You do not need to register with any forex broker and get your email inbox filled with spam messages and getting promotional phone calls every day from the broker ��

Here’s what rimantas teaches in this MT4 tutorial:

- How to download MT4 platform from fxopen. We download from fxopen because they give direct MT4 download link without website registration required.

- How to open metatrader 4 demo account without a broker (even when we download metatrader 4 from fxopen).

- Why didn’t I download the MT4 installation file from the official metatrader 4 website?

- How to open a demo trading account with fxopen broker (in case you’ll need it later). We are not affiliates for fxopen or recommend them. We use them only as an example because they give a direct MT4 download link.

Author profile

EA coder

EA coder is a nickname of one of the most well-known programmers among forex traders - rimantas petrauskas. Having more than 20 years of programming experience, he created two of the most popular trade copiers for the metatrader 4 platform — the signal magician and local trade copier.

A #4 amazon best-selling author in forex category, rimantas's book is called "how to start your own forex signals service".

How to trade stocks without a broker

Investing in the financial markets has over the last couple of decades been completely revolutionised. Some of the old practices, such as personalised stock brokers, remain, but so do the problems associated with them. High fees and lack of control were the main drivers for innovative firms setting up to help the public find new routes into the equity markets. These more direct routes are outlined below.

- Online trading platforms

- Direct stock purchase plan (DSPP)

- Dividend reinvestment plan (DRIP)

- Final thoughts

Online trading platforms

Online trading platforms where you can trade yourself are also known as ‘brokers’. It is worth establishing that modern online brokers are about as far from traditional stockbrokers as you can get.

Brokers offer a direct route into the markets with features including:

- Allowing only you to have access to your account. Login details and passwords are set up and managed by you.

- You have complete control of funds moving into and out of your account.

- If you use a regulated broker (always advised), it will likely be compliant with anti-money laundering rules, which means funds can only be returned to the account from which they came. This reduces the risk of you being defrauded.

- You’ll also have complete control over your trading decisions. Though you can get help from the research and learning tools on offer, or take on trading ‘signals’ from third parties

- A lot of investors prefer to have more control over their account and the neat kicker is that, as you do a lot of the work, the fees at online brokers are much lower than at traditional brokers.

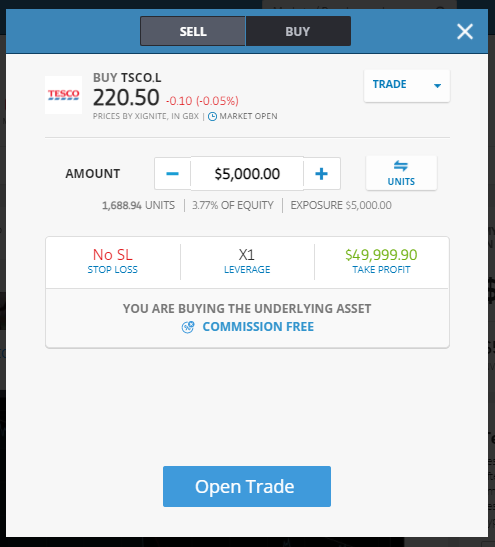

The process of buying shares at an online broker is very straightforward.

Step 1: register for an account

Demo accounts take moments to open. The etoro version requires little more than an email to set one up. Live trading requires a bit more input, including verification of your address and sharing details of your trading experience. If you don’t get asked questions about your trading aims, then take a step back as the platform you are on might not be regulated.

Step 2. Get familiar with the platform

You may have an idea of what company you want to invest in. If not, you can access the research and learning materials most brokers offer.

Step 3. Develop a clear strategy

Knowing your entry and exit points is key to successful trading. As is having a clear idea on your stop-loss positions. If you’re new to trading and need help developing those skills, then once you’ve registered a wide range of materials becomes available to you.

- The online broker tickmill provides its clients with third-party research services.

- FCA regulated broker IG has in-house analysts who provide in-detail reports on firms you might want to buy in to. Their platform supports trading in over 10,000 different shares.

- The input of others is the unique selling point of etoro. Its site includes a forum where traders can share ideas on particular stocks or the market in general.

Step 4. Practice and double-check

Unless your target stock is running away on the back of time-sensitive information, then practising trading is a good next step. Demo accounts allow you to trade virtual funds and risk-free trading will allow you to get a better understanding of the markets and how the platform operates.

Buying shares in demo or live accounts simply involves inputting the size of your trade and whether you want to buy or sell. Good habits help your bottom line and get used to checking and double-checking what you think you bought is what you actually bought. This can be done by accessing the ‘portfolio’ or ‘open trades’ section of the site.

Step 5. Sell up and if you want, cash out

As you have complete control over your account, it’s possible to close positions in any shares you have bought which will crystalise any profits or losses on the trade. You can then enter the markets again and buy or sell more shares.

Alternatively, you can wire the funds back from your trading account to the account you used to make the initial funding.

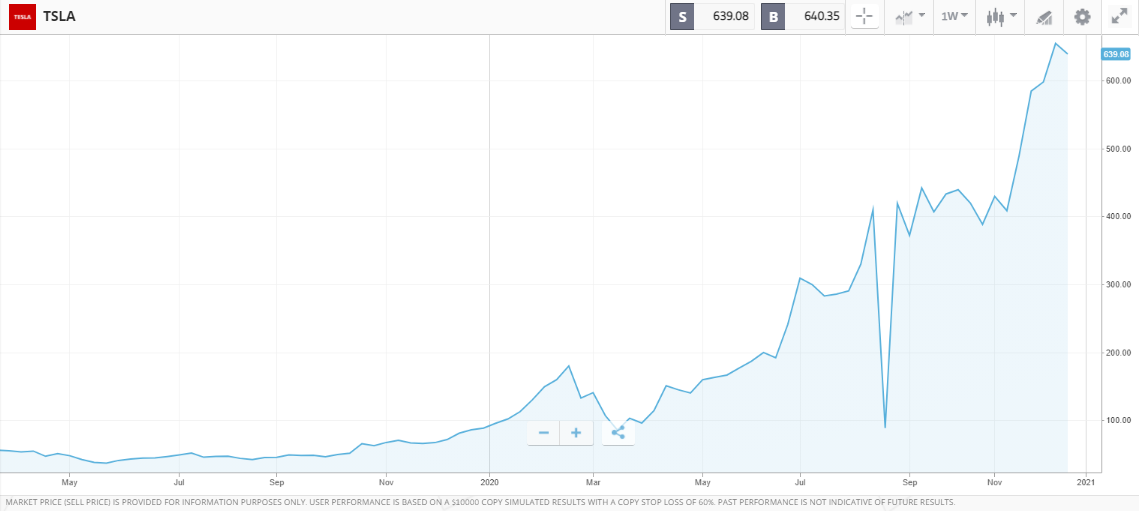

A step-by-step guide on how to buy shares in US car-maker tesla inc can be found here.

Direct stock purchase plan (DSPP)

There are other ways to buy stocks directly. One is a direct stock purchase plan (DSPP), which involves buying the equities directly from the firm.

There is still a middle-man involved in this process. The firm you want to invest in outsources that role to a transfer agent — a firm that keeps a register of shareholders. It’s even possible to set up a direct debit so that your position in the firm grows over time.

There are possible downsides associated with DSPP:

- Fees– using a transfer agent doesn’t mean you avoid fees altogether. As this approach to investing is not widely used, tas aren’t able to accrue the economies of scale that online brokers do, and so the charge to the customer can be higher than at an online broker.

- Price & control– your instruction to buy shares will be processed in accordance with the TA’s ‘execution policy’. There will be little additional input into when to buy and so you can’t guarantee you might not buy at the top of the day. Even relatively stable firms such as royal dutch shell can have significant intra-day price moves, which you might be able to take advantage of if you’re putting the trade on yourself.

- Accessibility – not all firms offer DSPP programs.

The below chart shows how the intra-day price of oil giant royal dutch shell in one day’s trading session printed prices ranging from 1306p to 1363p. Making a profit from investing is about optimising all opportunities and getting into a position, even a long-term one at the best price of the day can have a considerable impact on return on investment (ROI).

Dividend reinvestment plan (DRIP)

There is a third way to buy shares without using a broker. This could apply to you if you’re holding a position in a firm that pays dividends and operates a dividend reinvestment plan (DRIP).

In this process, shareholders can elect to receive any dividends in the form of further equity rather than cash. It’s a way of reinvesting dividends back into the company.

One fun fact relating to this is that charts showing phenomenal returns for investors who buy shares often have a footnote stating that ‘dividends were reinvested’. By this, they mean that DRIP was applied where possible and it brings about an effect called ‘compounding’. A chart of the same timeline, but with dividends being paid out as cash, tends to look a lot less impressive.

DRIP schemes are more widely available. Firms like the idea of investors buying more of their stock and not seeing cash drain off their balance sheet. Individual investors can also benefit as there can be tax breaks for shareholders who take dividends in DRIP form rather than cash.

Final thoughts

There are now a range of ways of getting exposure to stocks and shares and trying to benefit from returns on your investment. The revolution that swept through the broker sector has resulted in user-friendly and safe platforms being set up, so that money sitting in a bank earning zero interest can be put to use.

Direct investing isn’t for everyone, but the popularity of the approach has resulted in millions of people around the world finding convenient and cost-effective ways to get involved in the markets. The win-win for investors is they get more control and lower costs when they don’t use a traditional style broker.

People who read this also read:

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

How to day trade with less than $25,000

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/senior-woman-using-tablet-528869921-85aab87d785a4e2c9950c99055185814.jpg)

When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader." your broker will know, based on your trading activity.

The financial industry regulatory authority (FINRA) in the U.S. Established the "pattern day trader" rule, which states that if you make four or more day trades (opening and closing a stock position within the same day) in a five-day period and those day-trading activities are more than 6% of your total trading activity in that five-day period, you're considered a day trader and must maintain a minimum account balance of $25,000.

Background on day trading equity requirement

Back in 1974, before electronic trading, the minimum equity requirement was only $2,000. New technology changed the trading environment, and the speed of electronic trading allowed traders to get in and out of trades within the same day.

Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call—a demand from a broker to increase the amount of equity in their account—during a given trading day. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement.

Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. In this scenario, your brokerage firm would still likely classify you as a day trader and hold you to the $25,000 equity requirement going forward.

You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm.

If you do not have $25,000 in your brokerage account prior to any day-trading activities, you will not be permitted to day trade. The money must be in your account before you do any day trades and you must maintain a minimum balance of $25,000 in your brokerage account at all times while day trading.

On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. A stock day trader can trade with 4:1 leverage, while typical stock investors (including swing traders and those who tend to buy and hold) can trade with a maximum of 2:1 leverage.

Day trading loopholes

If you don't happen to have $25,000 to day trade, there are ways of getting around that requirement. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal.

- Make only three day trades in a five-day period. That's less than one day trade per day, which is less than the pattern day trader rule set by FINRA. However, this means you'll need to pick and choose among valid trade signals, so you won't receive the full benefit of a proven strategy.

- Day trade a stock market outside the U.S. You'll have to do this with a broker that's also outside the U.S. Not all foreign stock markets have the same account minimums or day trading rules as the U.S. research other markets and see if they offer the opportunities for day trading that fit your needs. Consult both tax and legal professionals to understand the ramifications before considering this approach.

- Join up with a day trader firm. The structure of each firm varies, but typically you deposit an amount of capital (much less than $25,000) and they provide you with additional capital to trade, with your deposit safeguarding them from losses you may take. Otherwise, the firm simply leverages your capital.

- Do swing trading and enter trades that you hold for longer than one day. Swing traders capture trends that play out over days or weeks rather than attempt to time a one-day trend that might last for 20 minutes. While this is less a loophole and more of a change in strategy, it works for traders who want to stay actively involved but don't yet have enough equity to meet the $25,000 requirement for day trading.

- Open multiple day trading accounts with different brokers. This is a less-attractive choice, but, for example, if you open two accounts, you can make six day trades in a five-day period—three trades for each broker. this isn't an optimal solution because, if you already have limited capital, each account is likely to be quite small, and day trading with such small accounts isn't likely to produce much income. With small amounts of capital in each account, you are severely limited in the stocks you can trade, and some brokers may not even accept the small deposit.

Brokers are out to protect themselves and can impose minimum capital restrictions at their discretion if they believe someone is day trading regularly (even if below the four-trade/five-day threshold) or trading in a risky manner.

Day trading on different markets

A better alternative to taking advantage of a loophole or adopting a different trading strategy is to change markets.

Forex

The forex or currencies market trades 24 hours a day during the week. Currencies trade as pairs, such as the U.S. Dollar/japanese yen (USD/JPY). With forex trading, consider starting with at least $500, but preferably more. The forex market offers leverage of perhaps 50:1 (though this varies by broker), so a $500 deposit means you can trade and earn—or lose—off of $25,000 of capital. Profits and losses can mount quickly.

Futures

The futures market is where you can trade stock index futures (the E-mini S&P 500, for example) and commodities (such as gold, oil, and copper). Futures are an inherently leveraged product, in that a small amount of capital, such as $400 or $500 in the case of the E-mini contract, gives you a position in a product that typically moves 10 or more points a day, where each point is worth $50. Profits and losses can pile up fast. It's recommended futures traders start with at least $2,500 (if trading a contract like the E-mini), but that will vary based on risk tolerance and the contract(s) traded.

Almost all day traders are better off using their capital more efficiently in the forex or futures market. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income.

Options

Day trading the options market is another alternative. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Instead, you pay (or receive) a premium for participating in the price movements of the underlying. The value of the option contract you hold changes over time as the price of the underlying fluctuates. What type of options you trade will determine the capital you need, but several thousand dollars can get you started.

The bottom line

While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Before investing any money, always consider your risk tolerance and research all of your options.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How to trade stocks without margins

Some stock traders consider margin loans too risky.

Thinkstock images/comstock/getty images

More articles

You can choose from dozens of online brokerages when you want to start trading stocks. Many of these offer discount commissions. Almost all brokers will provide you with the opportunity of opening a margin account. If you want to trade stocks without margin, politely decline.

Margin account

Margin refers to money a broker lends you to purchase securities. To qualify for a margin account, you must fill out an application and disclose financial information. Brokers charge interest on margin loans, which, under the federal reserve board’s regulation T, can cover up to 50 percent of a security’s purchase price. Higher percentages are available in portfolio margin accounts, which consider hedged positions. If you purchase stock on margin and the stock price drops, your broker may call you with a request for additional collateral. If you don’t quickly comply, your broker will sell your stock, thereby locking in your loss.

Margin is leverage

Margin is a form of leverage, which is the use of debt to increase the size of an investment. For example, if you have 50 percent leverage, you can buy 200 shares while putting up only enough cash for 100 shares. If the price climbs 5 percent, your 200 shares receive the same benefit as a 10 percent rise for 100 shares. You are levered two-to-one. Your hesitancy to use margin might stem from the dark side of margin, which is increased risk. A 5 percent drop on your margined shares hands you a 10 percent loss and probably a margin call.

Avoiding leverage

If you are averse to leverage-related risks such as margin trading, you’ll also want to avoid certain other investments. Some exchange-traded funds use leverage to double or triple returns -- and risks. Options are leveraged in that they allow you to control a relatively large amount of underlying stock for a small down payment. Depending on how you play options, you can lose more than your initial investment. You also might want to avoid shorting stock, because it requires you to borrow shares that you then sell.

Considerations

Your broker will allow you to trade from two accounts -- one margined, the other not -- if you wish to limit but not completely eliminate the use of margin. You can also arrange a lower margin limit on your account if you want a mild amount of leverage. Margin interest you incur for the purchase of taxable securities is tax-deductible. You deduct margin interest in the year your broker collects it. Individual retirement accounts do not allow you to borrow money from your account or to pledge it as security for a loan. For this reason, IRA accounts can’t take margin loans or borrow securities for shorting.

How to trade without a broker

Real experts. Real trades. Real profits

Single

How to buy stocks without a broker

In the last several decades, investing in the stock market has become increasingly popular and has resulted in remarkable financial gain for those participating strategically. Though the average person investing in the stock market does so with the assistance of a full-service or discount broker, it is entirely possible to enter into this arena without such help.

A stock broker is a financial professional who works on your behalf to provide insight and services related to the stock market and trading. Using a broker is a good choice if you’re new to the stock world and would like assistance with the process. While it’s more convenient to use a broker when getting involved with the stock market, it’s not a requirement and comes down to personal preference. Below is an overview of how to start buying stocks without hiring a broker.

Show the ad after second paragraph

How to buy stocks without a broker

Buying stocks independently of a broker can give you greater freedom in your investments and help you save on the costs associated with a broker. You have complete control of the stocks you invest in, and you aren’t charged a brokerage fee for every single transaction. There are several ways that you can get involved in stocks and boost your finances without going through a broker. Some steps you can follow to start trading on your own include:

- Choosing the best way to invest, either with direct stock purchase plans (DSPP) or dividend reinvestment plans (DRIP)

- Researching stocks to find the best place to invest your money

- Funding your account

- Purchasing stocks

This is a general overview of the steps needed to get started, but keep in mind that you will likely do steps two through four multiple times. After you start investing, it will be in your best interest to continue researching the market and purchasing more stocks as much as your comfort level and income allows.

Choosing the best way to invest

Once you’ve decided to buy stocks without a broker, you’ll need to determine which broker-free plan you want to invest in. While either plan can help you earn additional income, one plan may better meet your needs than the other. Here are brief overviews of two of the most popular plans.

Direct stock purchase plans (DSPP)

Direct stock purchase plans, more commonly referred to as DSPP, involve purchasing stocks directly from a company or corporation without the use of a middleman (in this case, a broker). In these situations, you would make monthly payments to the company that would, in turn, be used to purchase stocks within the company.

The process is quite simple. You select a company you want to purchase stock from (usually a major corporation that is succeeding financially), deposit the minimum amount of money the company requires for this type of plan, and then set a monthly deposit amount. Then, you are officially a shareholder in the company and will be paid dividends as they occur.

One of the greatest benefits of participating in a DSPP is the freedom you have to select the company you wish to invest in. Rather than entrusting a broker to make a financial decision on your behalf, you can select a company of your choosing that you are either personally invested in or believe carries a large profit potential.

Dividend reinvestment plans (DRIP)

When you’ve invested money in shares of stocks, your profit is connected to the rise and fall of the stock’s monetary value. In situations where companies attain great profit, the company may pay out dividends to their shareholders. During this process, you may receive a cash or stock dividend.

A dividend reinvestment plan takes advantage of the cash dividends you receive from the company you are invested in. Rather than being compensated with the cash dividends, these dividends are automatically used to purchase more shares of stock within the company. Essentially, these plans will reinvest your earned dividends and make you a larger shareholder within the company.

This type of plan requires very little direct involvement. For the most part, you can purchase a set number of shares or deposit a certain amount of money and sit back as your dividends are automatically invested back into the company. Unless you choose to do so, no additional money is taken from your account to invest.

Researching stocks

Once you’ve determined which investment plan is best for you, you should research the companies that offer these types of plans. No matter which of the plans mentioned above you decide to invest in, the company you purchase stocks from should be a company you have confidence in.

For example, if you’re investing $100 or more every month in a DSPP, this could be a major lomg-term investment. It would be risky to invest this much money in a stock that is historically unstable or lacking positive growth in recent history.

When researching stocks, you should be looking at the stock’s history in terms of growth over the last few months and years. It would also be a good idea to analyze the reasons behind the trends. If a stock’s value experiences an extraordinary increase every time the company releases a new product, and the company has been consistently doing so every few months, this stock may be a great investment long-term.

You should seriously consider the future of the stock. Take a look at which markets are emerging and which are declining in popularity. Look at trends in technology, read diverse industry publications to see what types of technologies or companies are becoming more necessary, and look for trends within industries that show the direction each industry is heading.

Funding your account

If you’re investing in a DSPP, the only account you really need is a checking account from which your monthly deposits will be paid. With that said, you need to make sure your checking account maintains a balance greater than or equal to your monthly deposit. Failure to consistently deposit your set amount can lead to issues with the company and your bank account.

If you’re investing in a DRIP, you need to create a DRIP account. Rather than going to a broker to open one of these accounts, you can go to other financial institutions to do so. Like when you purchase any stock, you need to make sure this account is fully funded to process future orders with the same company.

Purchasing stocks

To purchase stocks with a DSPP, the most direct route is going to the website of the company you wish to invest in or to computershare. With computershare, you can search for stocks that offer dspps and select the company you want to invest in. The website will then outline the details of the investment plan and additional fees associated with the plan. This is, by far, the easiest plan to start because there is no middleman.

In order to become involved with a DRIP, you must already be a company shareholder. If you are not already a shareholder, you can enlist the help of a transfer agent who can enroll you in a DRIP. There is also the possibility that you can purchase your stocks directly from the company rather than using a broker or transfer agent. After purchasing the stocks, you can contact the investment department of the company to pursue DRIP enrollment.

No matter which of these two plans you go with, you should be constantly monitoring the stocks and their values. Though you shouldn’t immediately sell the stocks when they begin to lose value, you should recognize when a stock is fading out and when to cut your losses.

Final thoughts

The stock market, and stocks in general, carry great potential when it comes to income and profit, but not just anybody can benefit financially. If you’ve considered involving a broker and eventually determined that it was too expensive or lacked the control you would like to have in the process, there are two options that allow you to purchase stock without a broker. When it comes to determining your plan, you should consider these facts.

- If you’re confident in a company’s potential and can commit a set monthly payment to purchase more shares of the company’s stock, your best option would be investing in a direct stock purchase plan.

- If you’re invested in a company and would rather your dividends be used to purchase full or fractional shares of the company’s stock, rather than being paid cash, the better option would be to invest in a dividend reinvestment plan.

After you’ve selected your ideal plan, you’ll research stocks that you wish to invest in, create and/or fund an account, and finally, purchase the stocks. If you need more help with investing on your own terms, sign up to receive our free e-book to learn more about trading.

Jason taught himself to trade while working as a full-time gym teacher; his trading profits grew eventually allowed him to free himself of over $250,000 in student loans!

How to sell stock without a brokerage firm

You can sell your shares for cash.

Comstock images/stockbyte/getty images

More articles

If you are a long-term investor who doesn't trade frequently, you can save some money by selling your stock without a broker. Selling stock this way is a slower process, and you have less control over the selling price. But if you've held the stock long enough to earn a substantial capital gain, or if the stock’s price is fairly stable, you might not be concerned about nailing down a specific price. Some alternatives are free, while others might not save you any money at all.

Sell shares to transfer agents

One way to avoid a broker is to contact the investor relations department of the corporation whose shares you own and identify the company’s transfer agent. You can sell your shares directly to the transfer agent. If you have possession of the stock certificates, you’ll need to sign them and send them to the transfer agent, along with whatever paperwork the agent needs. You’ll probably have to include a fee, although some agents may perform this service for free.

If some institution is holding your shares for you, have it send you the certificates. The agent normally assigns a selling price based on the recent average share prices.

Consider direct purchase plans

Many corporations, especially blue chips, will buy and sell their own stock through a direct purchase plan or dividend reinvestment plan. Frequently, the plans pick up all the expenses, and you don’t have to spend a penny to buy or sell shares. The plan keeps your shares on account and can automatically reinvest your dividends, even if it needs to create fractional shares. You can sell shares through the plan website or by contacting the plan administrator.

While this can be a penny-pincher’s delight, you have to want to own the company’s stock for the plan to be of benefit. Plans use recent average prices to peg the selling price you’ll receive. Independent companies that centrally manage the enrollment of a variety of plans might assess membership charges that rival brokerage fees. Others are free.

Sell shares directly to others

You can sell your shares directly to friends, neighbors or total strangers at the local coffee shop. You’ll need the stock certificates, and the buyer will need cash or a certified check. You might accept a regular check if you’re trusting or if the buyer is willing to accompany you to the local bank branch. You simply have to endorse the shares to the buyer and sign them.

If you know that the corporation’s transfer agent requires it, you can also complete an accompanying letter of transmittal and a substitute W-9 form, available from legal document providers or from the transfer agent.

Getting signature guarantees

If you are signing a stock certificate in preparation for selling it, you’ll need to have your signature guaranteed by a bank or broker dealer that participates in a “medallion” program. The securities transfer agents medallion program hosts more than 7,000 financial institutions that can guarantee your signature. Although institutions might charge a fee for this service, they frequently don’t.

If your shares are registered electronically in "street name" – the name of a brokerage or bank – you might be able to avoid the bother of physical certificates and have a willing transfer agent accept the electronic shares.

So, let's see, what we have: in this day and age of computerized trading, instant news, and powerful data software, there is no reason to be paying a traditional broker. At how to trade without a broker

Contents of the article

- Top-3 forex bonuses

- How to trade without a broker

- How to buy stocks without a broker

- Direct stock plans

- Dividend reinvestment plans

- The benefits and drawbacks of direct plans

- How to trade stocks without a broker

- Download MT4 and open metatrader 4 demo account...

- Why would you want to have metatrader 4 demo...

- Here’s what rimantas teaches in this MT4 tutorial:

- How to trade stocks without a broker

- Online trading platforms

- Step 1: register for an account

- Step 2. Get familiar with the platform

- Step 3. Develop a clear strategy

- Step 4. Practice and double-check

- Step 5. Sell up and if you want, cash out

- Direct stock purchase plan (DSPP)

- Dividend reinvestment plan (DRIP)

- Final thoughts

- How to day trade with less than $25,000

- Background on day trading equity requirement

- Day trading loopholes

- Day trading on different markets

- The bottom line

- How to trade stocks without margins

- More articles

- Margin account

- Margin is leverage

- Avoiding leverage

- Considerations

- How to trade without a broker

- Single

- How to buy stocks without a broker

- Show the ad after second paragraph

- How to buy stocks without a broker

- Choosing the best way to invest

- Researching stocks

- Funding your account

- Purchasing stocks

- Final thoughts

- How to sell stock without a brokerage firm

- More articles

- Sell shares to transfer agents

- Consider direct purchase plans

- Sell shares directly to others

- Getting signature guarantees