Robot broker

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD there are two main sources of expert advisors, buying a pre made EA or creating your very own EA from scratch.

Top-3 forex bonuses

Each pathway has its advantages and disadvantages and you must be aware of these before you make a choice on which way to go.

Compare expert advisors (EA) brokers

For our expert advisors (ea) comparison, we found 8 brokers that are suitable and accept traders from united states of america.

We found 8 broker accounts (out of 147) that are suitable for expert advisors (EA).

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Thinkmarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About thinkmarkets

Platforms

Funding methods

Losses can exceed deposits

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Trading with forex expert advisors

Expert advisors, also known as forex robots, offer a way to trade the markets in an automated fashion. Expert advisors eliminate the need of sitting in front of the computer all day, poring through charts, figures, setups, indicators, news, etc, it is possible to use software to do all this for you and then to execute a trade on your behalf, saving you all the trouble.

These robots can then be used to trade the markets while the user attends to some other business. Many traders are actually day workers who use trading as a second income stream, and this category of market players will benefit from the use of forex robots.

What is an expert advisor?

An expert advisor for the forex market is a software system that is built to analyse the currency pairs in the forex market to identify trading opportunities, and then to implement buy or sell signals on the forex charts. Usually trades in forex involve analysing the market by going through several chart setups, then deciding whether to buy or sell, as well as making a decision on which kind of orders will be used to produce the best trade outcomes. These are all automated when a trading robot is used.

Expert advisors (eas) have undergone a lot of modifications from the early days in which they were introduced. These expert advisors have moved from simple robots which did analysis and then traded accounts to complex algorithmic trading software which is used today for advanced forex trading. So we will talk about this experience not just from the standpoint of the simple software, but also from the complex ago trading systems that trading robots are today.

Trading with robots is also known as quantitative trading. The basis for algorithmic trading or trading with robots is for a computer software system to run analyses on several forex pairs and to generate and ultimately implement buy and sell signals on the forex platforms.

Featured EA broker: ETX capital

If you have decided you want to use an expert advisor for your trading strategy and are looking for a broker that supports the use of automated trading with expert advisors, ETX capital is one of the most popular choices. Some of the why people choose ETX capital are:

- Established broker – over 10 years in business (in business since 2002)

- Regulated by the financial conduct authority (UK) #124721

- Tight spreads

- Offers forex, spread betting, cfds, binary, equities, commodities and indices

- Wide range of markets

The two types of forex robot algorithmic trading:

High frequency trading with expert advisors focuses on creating an edge with speed. The speed of the connection is the main advantage that high frequency trading robots confer on the trader. High frequency trading robots aim to make profit from arbitrage. In other words, they scan several exchanges or data centres where there is even the smallest of differences between the prices of the same asset.

The high frequency robots then place a large volume of trades on the lower price (for buy orders) and offload them to other traders in the market at higher prices. For example, a high frequency expert advisor may buy gold at 1,200.30 from one exchange, and re-sell same to other traders at 1,200.35. The price difference is 0.05, which may look very small. However, the high frequency forex robot may place 10,000 lots on this trade, which confers on the pip movement a value of $100,000 per pip.

Considering that this trade moved just 5 pips or 0.05 points, the profit made by the high frequency trading robot would be $100,000 X 5 = $500,000. High frequency trading robots are mostly used by institutional traders and big banks who trade the forex market. These institutional players have access to very large capital and are able to afford the relevant tools and software which can scan the market for such opportunities and execute the trades within milliseconds. These robots can trade several times in a matter of milliseconds. Retail forex traders in general, do not have access to these systems and therefore have to make do with the second model of algorithmic trading, which is low frequency trading.

Low frequency trading is a model which aims to use the soundness of the utilised trading model to gain an advantage. This is not dependent on speed. Therefore, low frequency trading robots are looking to profit from price movement over time. These price movements are determined by:

- Trading fundamentals such as earnings reports and interest rate statements.

- Macroeconomic news such as the non-farm payrolls report, inflation reports, housing data, etc.

- Statistical models e.G. Price correlations, mean regressions, etc.

- Technical analyses e.G. Chart patterns, candlesticks.

Low frequency trading eas are developed from several viewpoints. These viewpoints aim to ensure that:

- That the idea behind the construction of the robot strategy is sound both economically and technically.

- The strategy is based on sound statistical methods

- That the basic principle of using sound models and not speed are what governs our trading robots.

This means that robots must not be used blindly. This is why it is very difficult to make a profitable commercial robot as they cannot be assessed to see if they obey the rules set out above.

How expert advisors work

Eas work with algorithms which are usually programmed with specialised programming languages. The trading platform the trader uses will determine what language will be used to program the forex robot. Here is a list of platforms and the programming languages used in programming the robots:

- The metaquotes language 4 (MQL4) is used to program expert advisors for MT4.

- Tradestation: the lua programming language is used to code expert advisors for the FXCM platform.

- The actfx programming language is used to code robots for the actforex platforms. An example is the avatrader platform.

- Many professional ECN platforms are coded with more specialised languages su ch as C#.

Characteristics of a good expert advisor

A good expert advisor must meet certain basic criteria that enable it to work perfectly. These are listed as follows:

- The parameters for trade entry and exit must be well defined.

- The EA must have acceptable money management parameters.

- The expert advisor must be able to evolve with the market. For this to happen, the creator of the EA must make it amenable to periodic updates.

- A commercially sold EA must have adequate protection from decompiling software. Essentially, it must be hack-proof.

- Code must be bug-free and error-free.

Where can you obtain expert advisors?

There are two main sources of expert advisors, buying a pre made EA or creating your very own EA from scratch. Each pathway has its advantages and disadvantages and you must be aware of these before you make a choice on which way to go.

Buying a pre-made EA

There are literally thousands of expert advisors sold online, and even more which are offered for free either as standalone bonus products or as lead-in products to other forex products. It is very difficult to get a forex robot that works from an online source. This is because there is no way for the trader to know the performance and the risk management profile of any expert advisor before purchase.

It is always a mistake to believe anything written about an expert advisor (EA) on the sales page of the vendor. You must have a way of subjecting the EA to evaluation to see if it meets the parameters for a good robot before you spend your hard-earned money. Usually the way to do this is by making use of any free trial offers provided by vendors of such products.

Development your own EA

There are several advantages of using this option. Perhaps the most important is that you will end up with a forex robot for you, by you and created just for you. You get to setup the EA with your strategy, fitted to your trading circumstances, your capital and risk management profile. The challenge is getting a programmer who can adequately translate your performance metrics into an actionable EA without messing up the coding process. Having your own expert advisor also allows you to edit the code as you wish.

Approaches to building a trading robot

No programmer should just wake up blindly and start programming a trading robot. There is a time-tested approach to building a trading robot. The approach to building a trading robot is to:

- Design

- Program

- Backtest

- Execute

In performing this four-step approach to trading a forex robot, the trader must consider the platform to be used, the tools to be used, the platform infrastructure and how the robot can be analysed in future to assess its trading performance.

Designing an EA is where the trader looks at the strategy to be used, the money management parameters and the conditions for buying or selling a currency pair. After design, the programming aspect comes to play. This is where the design of the robot is translated into a programming code. When the code is all done, the EA must then be tested and optimised, before it is finally executed for use.

It is essential to get a skilled programmer to do the job of coding. However building a good EA is usually a multi-disciplinary approach. It requires input from various fields such as statistics, mathematics, programming and a little common sense approach.

Why choose forex.Com

for expert advisors (EA)?

Forex.Com scored best in our review of the top brokers for expert advisors (ea), which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Robot broker

Optionrobot.Com is compatible with these forex & cryptocurrency brokers

Vemarkets robot review which includes available settings and broker details.

Tradear

Vemarkets robot review which includes available settings and broker details.

Tradetoro

Vemarkets robot review which includes available settings and broker details.

Gfcinvestment

Vemarkets robot review which includes available settings and broker details.

Kontofx

Vemarkets robot review which includes available settings and broker details.

Wise banc

Vemarkets robot review which includes available settings and broker details.

Binex

Vemarkets robot review which includes available settings and broker details.

Vemarkets

Vemarkets robot review which includes available settings and broker details.

Brightertrade

Brightertrade robot review which includes available settings and broker details.

CFDS100

CFDS100 robot review which includes available settings and broker details.

Emarketstrade

Emarketstrade robot review which includes available settings and broker details.

Millennium-FX

Millennium-FX robot review which includes available settings and broker details.

Capital traders

Capital traders robot review which includes available settings and broker details.

Kayafx

Kayafx robot review which includes available settings and broker details.

Ashford investments

Ashford investments robot review which includes available settings and broker details.

Greenfields capital

Greenfields capital robot review which includes available settings and broker details.

Trading advantages of roboforex forex broker

No limits in providing outstanding benefits to roboforex clients.

- Tight spreads

from 0 pips - Fastest order

execution - 4 account currencies

(EUR, USD, CNY, GOLD) - Micro accounts with the

minimum lot size of 0.01 - 8 asset

classes - Affiliate program

50% profit sharing

Roboforex bonus programs

Roboforex provides for its clients best promotional offers on financial markets.

Start trading with roboforex now and unleash the powerful benefits!

Profit share bonus

up to 60%

- Bonus up to 20,000 USD.

- Can be used during "drawdown".

- Deposit from 10 USD.

- Withdraw the profit received when trading your own funds.

Get bonus

Classic bonus

up to 120%

- Bonus up to 50,000 USD.

- Сan’t be used during "drawdown".

- Deposit from 10 USD.

- Trade with bonus funds and withdraw the profit.

Get bonus

Cashback (rebates)

up to 15%

- Receive cashback for the trading volume of just 10 lots.

- Available for all verified clients.

- Receive real money as cashback and withdraw it instantly.

Learn more

Up to 10%

on account balance

- Payments for the trading volume starting from 1 lot.

- No restrictions: withdraw instantly.

- Receive % on account balance every month.

Learn more

Account types

- First deposit

- Execution type

- Spreads

- Instruments

- Bonuses

- Platforms

Pro-standard

The most popular account type at roboforex, which is suitable for both beginners and experienced traders.

Prime

"prime" accounts combine all best features of ECN accounts and are suitable for advanced traders.

Pro-cent

Pro-cent accounts provide an opportunity to trade micro lots and is best suitable for beginners, who want to test our trading conditions with minimum investments.

ECN account type is intended for professionals, who prefer the best trading conditions with tight spreads.

R trader

R trader is a multi-asset web platform, which combines modern technologies, a classic but taken to a new level design, and access to the world’s major financial markets.

- First deposit 100 USD

- Execution type market execution

- Spreads floating from 0 points

- Instruments over 12,000 stocks, indices,

forex, etfs, cfds, cryptocurrencies - Bonuses not available

- Platforms R trader - web platform

By opening a demo account at roboforex, you can test our trading conditions - instruments, spreads, swaps, execution speed - without investing real money.

- First deposit not required

- Execution type market execution

- Spreads depends on type of account

- Instruments depends on type of account

- Bonuses limited number of offers

- Platforms

depends on type of account

Trading platforms

The most popular platform for trading on the forex market, which includes a knowledge database, trading robots, and indicators.

- 3 types of order execution

- 9 time frames for trading

- 50 integrated indicators for technical analysis

- Variety of order types

The latest version of metatrader platform with an opportunity to choose between netting and hedging systems.

- 4 types of order execution

- Multi-currency tester

- Market depth

- 6 types of pending orders

Roboforex trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

- Trade from any browser or mobile device (ios, android).

- Get the same functionality as on desktop platforms.

- Control your positions and orders from any place in the world.

Multi-asset web-based trading platform with the fastest in the industry financial charts and advanced technical analysis tools.

- Over 12,000 stocks, indices, FX, etfs, cryptocurrencies.

- Minimum deposit: 100 USD.

- Trading robots builder. No programming skills required.

Trading platforms center

Exclusive trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

Security of client's funds

Your funds are fully secured when you trade with roboforex.

- Regulated activities: IFSC license

no. 000138/107 - Negative balance

protection - Participant of the financial

commission compensation fund - Execution quality certificate

start trading now

8 asset classes

Discover the world’s key markets through roboforex accounts and platforms.

Forex

We offer transparent and reliale access to trading FX with more than 40 currency pairs

Forex trading benefits

- Institutional spreads from 0 points

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:2000

- Fastest execution possible

read more

Stocks

Access to more than 12,000 stocks through R trader platform and more than 50 via metatrader 4/5 terminals

Stocks trading benefits

- Minimum deposit: 100 USD

- Free stock exchange market data online

- Leverage: up to 1:20

- Metatrader4, metatrader5, R trader platforms

read more

Indices

In its most regularly traded format, an index is defined as a portfolio of stocks that represents a particular market or market sector

Indices trading benefits

- Metatrader4, metatrader5, R trader platforms

- Tight spreads - no mark up

- Leverage: up to 1:100

- Over 10 instruments

read more

Trade fast-growing global ETF industry with over $3 trillion in assets in management

Etfs trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Leverage: up to 1:20

- Сorporate events supported and handled by the system automatically

read more

Soft commodities

Trade etfs on grown commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit

Soft commodities trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Over 100 instruments

- Leverage: up to 1:20

read more

Energies

Trade cfds and commodity etfs on energy market including oil, natural gas, heating oil, ethanol and purified terephthalic acid

Energies trading benefits

- Tight spreads

- Metatrader4, R trader platforms

- Ideal instrument for day traders

- Minimum deposit: 10 USD

- Leverage: up to 1:100

read more

Metals

Trade cfds and commodity etfs on precious metals including gold, platinum, palladium, silver as well as gold/dollar and silver/dollar pairs.

Metals trading benefits

- Hedge against political instability and dollar weakness

- Minimum deposit: 10 USD

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:1000

read more

Cryptocurrencies

Bitcoin, litecoin and ethereum proved to have great potential for investment and speculation

Cryptocurrencies trading benefits

- Metatrader4, metatrader5, R trader platforms

- Over 20 cryptoinstruments

- Leverage: up to 1:50

- Trading 24/7

read more

0% commissions

When our clients deposit their trading accounts, the commission is always 0%. Roboforex covers all expenses. Choose the payment system according to your convenience, not cost effectiveness.

Roboforex also compensates its clients' commission for funds withdrawal twice a month.

Instant withdrawals

- Automatic withdrawal system: withdrawals within a minute for certain payment methods

- System works 24/7

- Simple, reliable, and fast

More than 20 ways to deposit funds

Become an investor on forex

For easy short-term investments

- Choose among over 1,000 traders.

- Get detailed statistics on trader's performance.

- Unsubscribe at any time.

Copyfx platform will be perfect for those, who search for a simple but reliable way to invest on forex.

Roboforex market analytics

Forex analytics

The pound intends to keep rising. Overview for 22.01.2021

Fibonacci retracements analysis 22.01.2021 (BITCOIN, ETHEREUM)

Ichimoku cloud analysis 22.01.2021 (BTCUSD, USDRUB, USDJPY)

Economic calendar

Exclusive market analytics

Claws & horns is an independent analytical company providing brokers with a set of necessary analytical tools.

Fxwirepro™ is a leading analytical company, which provides the participants of financial markets with research reports in the real-time mode.

Company news

Roboforex: changes in trading schedule (martin luther king jr. Day)

Roboforex: changes in trading schedule (christmas and new year holidays)

Roboforex received prestigious awards of the financial sector

Winner of more than 10 prestigious awards

Roboforex was recognized by the most respected experts of the financial industry.

More than 800,000 clients from 169 countries.

Best investment products (global)

Best partnership program (LATAM)

Most trusted

broker

Most transparent

asian forex broker

Best global mobile

trading app

Best broker

of the CIS

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd does not target EU/EEA clients. We don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

Automated trading software

It's not impossible to master binary trading, and like anything else, the more you put in, the more you will get out. To become good at making money, you'll need a great broker, time and some patience. For some people investing this time is not an option, and you never reach your true potential.

Enter the robots! We don't mean physical machines that will sit at your computer and trade for you but binary options robots that come as part of pre-programmed software. This software uses complex mathematical algorithms to examine market data and then uses this data to trade with highly profitable and low-risk results.

Different brokers allow the use of different robot software, and once you have opened an account, you'll be able to view all the compatible brokerages for that provider. You don't need to worry about who to choose. We have done the hard work for you and recommend brokers based on who offers the best trading experiences.

In this article, you will learn:

What binary option trading robots are the benefits of the best trading software how you can make more profit using them

Top rated options sites

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

How robots save time

The mere thought of downloading, installing or setting up a software programme may leave you feeling like it is time-consuming and complicated. You will be surprised at how simple it is and how much time it will save you in the long term. Here are a few simple steps that will have you trading automatically within no time.

Choose a robot service

While you can spend hours carrying out research looking for the best robot trader, you probably don't have the time. That is where our list of recommended services will save you a lot of time that you can spend trading. All you need to do is choose the one for you.

Download the software

Many brokers or software providers will require you to download the software. On a mobile, this may be as simple as downloading the app. You can access some robot trading software via a browser.

Sign-up with a broker

In addition to the free binary robot software, you will need to get a real account with a broker. The software will normally recommend binary options brokers to open an account and deposit with.

Programme the software

We don't mean that you need to be a programmer to operate the software, but you do need to tell it what you want. Set your technical indicators which will include your investing limits, frequency etc. Then leave the rest to the auto trader software.

Sit back, relax and enjoy

That's it. Now you are trading without doing anything. You can carry on with your business and leave the rest to the robot. Just check in now and again to see how your trades are doing and reset the parameters if you need to.

Using a binary robot also removes the anxiety you might get from trading. When you place a trade with an expiry time of an hour sometimes watching what is happening can put the trader through a range of emotions. By using this, you can check in every so often to see how you are doing rather than being glued to the screen for each trade.

I'll find you an awesome options site in seconds. Ready to go?

What type of device do you trade on?

What style of financial bonus suits you best?

How fast do you want to withdraw profits?

What amount are you thinking to deposit?

I'm checking 75+ sites to find your best match.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

How binary robots work

The robot trading software is something that you download to your computer or another device once registered with a broker. A download is not always required; sometimes you can start using them online via a website. Investment using this method is known as automated or auto trading and is used by "auto traders" that want to free up their time and increase their success rate.

Like any computer, the capacity to research, consume and analyse data is much higher than the human mind so the machine can process all the data much quicker than any human being without emotion or instinct. By using this process, more information is gathered at a much quicker pace allowing for more effective, profitable trades using an array of automated trading systems. The capacity to trade becomes much more and the number of successful trades increases.

Why then, wouldn't anyone want to take advantage of this help? To begin using the automated trading software you need to choose a service that is compatible with your broker and start using it. To help you select your provider we have researched hundreds of them across the world to bring you the best and offer up our advice on who you should trade with saving you both time and effort.

Some traders prefer to keep control over their trades rather than giving everything over to the robot, and this is where trading signals can be a viable alternative. Trading signals are services that provide advice and information on which trades to make. You still need to make the trades yourself, so you remain in control but the advice on what trades to place is given to you. It's great for people who might not be good at reading the markets, depending on if the service you use is good, of course.

Best robo-advisors

The top robo-advisors for every kind of investor, ranked by our experts

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

We've spent thousands of hours analyzing the robo-advisor market in order to identify the best options for a wide range of needs and objectives. This list represents our top rated robo-advisors across a number of categories, all driven by our proprietary rating methodology. We focus on highlighting the best robo-advisors possible and do not give any preference to robo-advisors from which we may receive compensation. These are the robo-advisors we'd recommend to our family and friends, and they're the same ones we're recommending to you.

Best robo-advisors:

- Wealthfront: best overall and best for goal setting

- Interactive advisors: best for socially responsible investing and best for portfolio construction

- Betterment: best for beginners and best for cash management

- Personal capital: best for portfolio management

- M1 finance: best for sophisticated investors and best for low costs

- Merrill guided investing: best for education

- E*TRADE core portfolios: best for mobile

Wealthfront: best overall and best for goal setting

:max_bytes(150000):strip_icc()/wealthfront_productcard-5c74508fc9e77c000136a5cb.jpg)

- Account minimum: $500

- Fees: 0.25% for most accounts, no trading commission or fees for withdrawals, minimums, or transfers. 0.42%–0.46% for 529 plans

Best overall: wealthfront is our top choice overall for robo-advisors because it offers the full package of goal-setting, planning, banking, and investing in an elegant, user-friendly platform.

Wealthfront offers fully digital investing for a very competitive price. It has taken huge strides towards its goal of self-driving money with the launch of autopilot, which monitors bank accounts and moves funds above your monthly spending needs into an investing account or wealthfront's high-yield savings account. It’s worth taking a look at the scenarios provided by path, even if you have your primary investment account at another institution. The other pieces of wealthfront’s offering—invest, cash, save, and borrow—can help you accumulate wealth, manage your cash, and open a line of credit without any fuss. Fees for investing are on the lower end of the scale, charging 0.25% of the assets under management.

Best for goal setting: wealthfront is also our top choice for goal setting due to the high quality of its goal-setting and planning technology, which is excellent and should serve as a model for other robo-advisors to emulate.

You can develop a detailed retirement plan, or connect to third-party data to figure out how much you should set aside for a planned home purchase or for college expenses. Setting up a wealthfront account gives you access to path, the free financial planning tool that integrates your account data and uses third-party data to better project your financial situation, whether or not you open an investment account.

Terrific financial planning that helps you see the big picture

Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings

Portfolio line of credit available

If you have multiple goals, path shows you the trade-offs you’ll face

No online chat for customers or prospective customers

Wealthfront carries no excess SIPC insurance

Portfolios under $100,000 are not customizable beyond risk settings

Larger accounts may contain more expensive mutual funds

Interactive advisors: best for sustainable investing and best for portfolio construction

:max_bytes(150000):strip_icc()/interactive_advisors_productcard-8733868980744c809b5f23c4864cba4b.png)

- Account minimum: $100 for 62 of the portfolios; $5,000-50,000 for 27 other portfolios (with the majority of these 27 portfolios having minimums between $5,000-20,000)

- Fees: 0.08-1.5% per year, depending on advisor and portfolio chosen

Best for sustainable investing: interactive advisors is our top choice for sustainable investing due to its special emphasis on socially responsible investing products and the availability of pre-built portfolios invested according to ESG strategies.

A service offered by interactive brokers (IBKR), interactive advisors offers a wide range of portfolios from which to choose. Portfolios invested according to ESG strategies, including some of the smart beta portfolios, are marked in the list with a green leaf. If you choose a portfolio that is not invested according to ESG strategies, you can avoid entire groups of companies that do not share your values, as well as single stock exclusions that automatically apply to all your investments. Each exclusion group typically comprises 25 stocks and is reviewed annually. An interactive brokers feature currently in beta test, the impact dashboard, is available to interactive advisors customers via their brokerage account, and is designed to help clients evaluate and invest in companies that align with their values.

Best for portfolio construction: interactive advisors is also our top choice for portfolio construction because it offers a vast range of asset classes that can be used to build a portfolio.

The portfolio choices at interactive advisors are varied. Most portfolios contain fractional shares of individual stocks. Some portfolios have up to 300 stocks. There are also portfolios made up of etfs from vanguard, wisdom tree, legg mason, state street, and others. Other portfolios follow certain market sectors, including real estate, consumer discretionary spending, and utilities. This allows investors to take sector positions, which is something not many robo-advisories offer. You can also invest in a general global portfolio that includes equities and fixed income from across the globe. This level of portfolio customization is rare within the current robo-advisory industry and it is one of the main reasons that interactive advisors may be a better fit for well-informed investors who want that level of control.

Wide range of portfolios offered

Most portfolios include baskets of stocks rather than etfs

Actively managed portfolios are run by boutique wealth managers, and clients mirror their trades

The portfolioanalyst tool lets you consolidate and track all of your financial accounts

Customers can borrow against their non-managed accounts at relatively low-interest rates

Some of the actively managed portfolios have very high minimums

The process of opening and funding an account is more difficult than at other robo-advisories

Not immediately obvious what your actual costs will be

You need a large account and a high cash balance to earn interest on idle cash

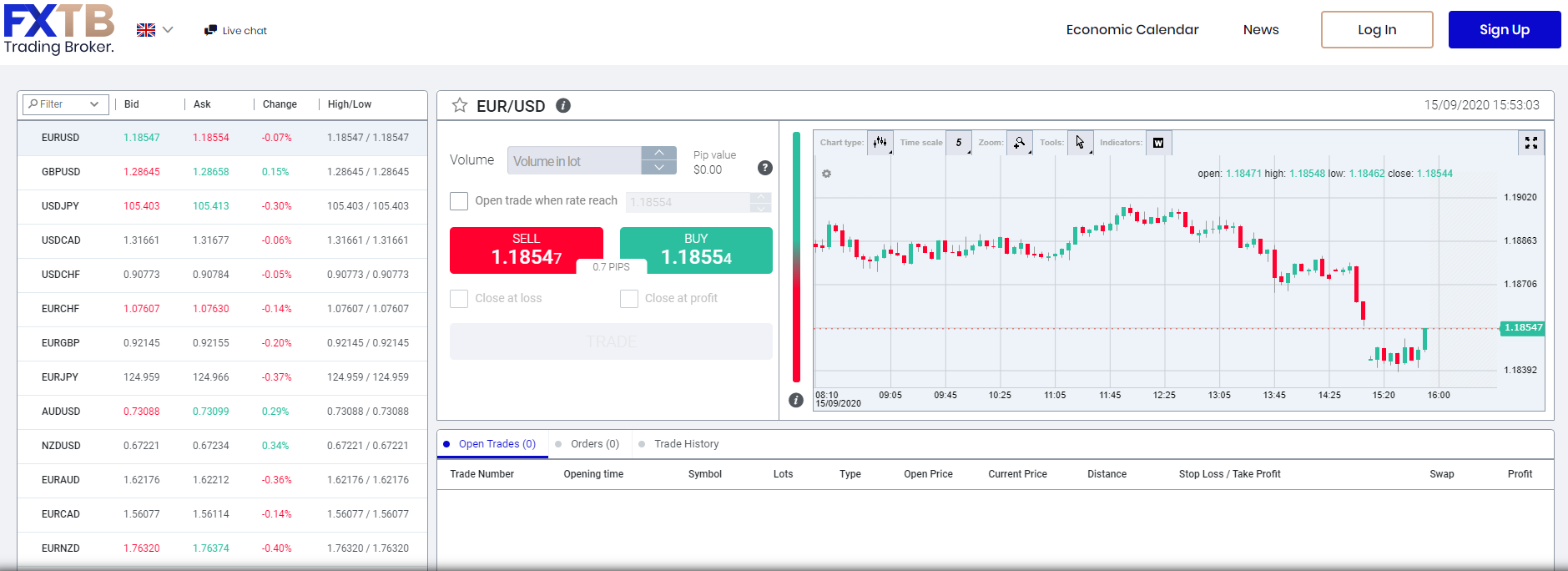

FXTB review 2020: legit or scam robot broker?

We have decided to review the FXTB broker after receiving a lot of requests in the past few weeks. This broker is associated with a viral trading robot known as bitcoin up. For the record, bitcoin up generates a daily profit of up to 400%.

Traders who have tried this trading bot through the FXTB broker, claim that it is easy to use. No trading skill whatsoever is needed to trade with this FXBT through bitcoin up. You only need to create a free account as instructed, deposit the minimum trading capital, and click the live button.

We will discuss the key features of FXTB in this review and trading tips to help you trade with it through bitcoin up. Do not open an account with FXTB before reading this review to the end.

FXTB review – overview!

FXTB is a robot broker offering multiple trading instruments in forex and cfds. Forex involves exchanging national currencies against one another while cfds trading involves trading the direction of a given security over the very short-term.

We therefore strongly recommend that you only trade with FXTB through bitcoin up. The bitcoin up trading robot is powered by powerful AI and ML algorithms. These algorithms are usually 0.001 seconds ahead of the markets and hence generate profitable signals with a 90% win rate.

FXTB broker offers 375+ cfds on stocks, crypto, market indices, and commodities. The cfds on crypto are its most popular product and include over 135 crypto to crypto and crypto to fiat pairs. Most popular crypto cfds pairs include BTC/USD, BTC/EUR, BTC/ETH, and BTC/BCH.

Bitcoin up, FXTB auto-trading partner, detects the most volatile of these pairs and places bets on them. As mentioned earlier, the bitcoin up robot applies the scalping trading approach to make money out of small price movements. Read our comprehensive review of bitcoin up to learn more about this trading robot.

FXTB broker review – trading conditions

FXTB broker ranks among the best in auto-trading. The broker provides some of the best robot trading conditions in the market.

For instance, the broker provides trading leverage of up to 1000:1 for all account types, including the crypto cfds trading account. Leverage refers to the use of borrowed funds to magnify trades. Leverage of 5000:1 means that one can trade a position worth up to 1000 USD for every 1 USD of invested capital.

As a result, a trading account with just $250 in trading capital can generate the profits of a $250k account. Leveraged trading also increases risk since the losses are also magnified. FXTB broker through bitcoin up applies sophisticated risk management technologies to prevent traders from trading into the negative.

The take profit feature, on the other hand, prevents the trader from holding a profitable trade for too long due to greed. Bitcoin up take profit feature automatically ends trading sessions as soon as the predetermined level of profitability is reached.

For instance, you can set the bot to trade until it hits $1500 in daily profits. This means that the bot will automatically stop trading when this goal is achieved.

Getting started with FXTB through bitcoin up

FXTB has partnered with bitcoin up to offer automated trading on its behalf. As mentioned earlier, bitcoin up is among the most revered crypto trading bots in the market today.

The robot is AI-powered and relies on blockchain to ensure a transparent trading environment. Such an environment allows seamless peer to peer transactions where traders can follow and learn from each other.

Bitcoin up trading approach involves the AI algorithms mining trading signals from some of the world most profitable human traders. The robot automatically buys signals from these traders and applies them on a user account depending on their risk appetite.

Users risk appetite is determined through a questionnaire issued by FXTB immediately after deposit. The questionnaire consists of about 15 questions revolving around the trader’s income and their expected rate of return. High risk/high return trading signals are implemented in accounts with high-risk appetite.

Register for free on bitcoin up website

The first step to auto-trading with FXTB is to register a free account on bitcoin up website. The registration happens through the robot since it is the one to conduct all trading on behalf of the user.

The KYC measures are implemented to smoke out money laundering and protect users’ accounts from fraudsters. You can deposit and trade before verification, but your account must be verified to withdraw.

Deposit trading capital of at least 250 USD

Deposit of trading capital happens through FXTB. You need $250+ to trade with this broker through the bitcoin up robot.

FXTB is compliant to regulatory requirements in the UK, australia, asia, and africa. As stated earlier, it is monitored in all these jurisdictions by top-tier regulators such as the australia securities and exchange commission (ASIC) and the UK financial conduct authority (FCA).

The deposit options applicable to this broker include major debit/credit cards and wire transfer. FXTB doesn’t charge any deposit/withdrawal fees.

Read trading instructions and practice on a demo

There are video tutorials on bitcoin up website to help you master the trading process. You need to watch all of them and read the 3-page trading manual on the education section.

The instructional materials are available in layman’s language and hence shouldn’t be a problem to follow for complete beginners. Bitcoin up comes with a demo to help users practise what they learn without risking real money.

You need at least 1 hour of demo practice to understand the live trading platform fully. Bitcoin up trading platform has recently been nominated among the most user-friendly auto-trading platforms for 2020 by the UK association of auto-traders.

Set the trading conditions and go live

Define the trading settings as directed and click the live trading platform. Bitcoin up runs automatically connecting with FXTB in the background to ensure that all trades are executed instantly. The robot seems to generate the most profits when left to run for about 8 hours daily.

You need to ensure that the robot is running during periods of high volatility to get good returns out of it. We insist that you run it when live trading is continuing in wall street since this is when volatility is high. This is specifically between 8:00 AM and 4:00 PM eastern time.

It’s paramount that you end trading sessions at the close of live trading on NYSE. Failure to do so may lead to extra costs in terms of rollover fees. You should also avoid leaving the robot running during weekends and US public holidays.

Is FXTB a scam or not? The verdict!

We have conducted a myriad of tests on the FXTB broker and confirmed that they are trustworthy. This broker provides both manual and automated trading but is popular for the latter through the bitcoin up trading robot.

Bitcoin up is a viral trading robot owned and operated by the international bitcoin council. It’s among the few highly lucrative crypto trading bots that are available to the masses. This robot doesn’t charge any license fees.

You only need to create an account on the robot’s homepage and fund your trading account through FXTB. Click the button below to start trading with FXTB through bitcoin up.

Faqs

Do I need trading skill to trade with FXTB through bitcoin up?

No! You don’t require any expertise to trade with FXBT through the bitcoin up robot. The technical language used in this review is for illustrative purposes only. Consequently, it should not scare you away from trying FXTB through bitcoin up.

Is FXTB broker regulated?

Yes! FXTB is monitored in all of its markets, including the UK, australia, and some parts of asia and africa. The broker is trusted across the globe.

How much can I make with FXTB through bitcoin up?

The earning potential with FXTB through bitcoin up is endless. Some reports estimate that it is possible to generate up to 600% in daily profits.

Information

Registered UK company no. 11705811. For advertising inquiries please reach us via email hello@fxtimes.Com

Note that the content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. This website is free for you to use but we may receive commission from the companies we feature on this site.

Newsletter

Kalau anda mengerti beberapa main dengan referensi dibawah berikut ini, anda akan membuat instruksi bikin dikau buat dapat mainkan bagian pandang pada musuh. Kesudahannya pada saat anda punya satu kartu yg sedikit untung, tentu saja kamu dapat mainkan bagian ranggul itu.

Sampai bikin sampar memahami kemenangan anda tandus langkah mutlak. Tetapi pra anda mengerti bagaimana mainkan bagian pandang, tentu aja anda lalu harus bisa terima bagian pandang dari musuh dengan sesuai beserta. Oleh karenanya anda siap memahami jika pekerjaan ini demikian dapat diuntungkan jika dilihat dari sisi renung yg sesuai dengan. Oleh karena itu, beberapa orang pada kamu tentu saja sadar jika pekerjaan main poker online demikian dapat digunakan bikin memicu keuntungan lewat langkah kusut. Tetapi sebenarnya pekerjaan ini harus anda sadari ada sangat banyak strategi didalamnya yg harus anda dapat aplikasikan.

Beberapa dari anda pasti saja memahami jika ada keuntungan pada saat tiket besar bandar poker online terlihat. Barisan 5 tiket yg terlihat tentu aja ada salah satunya yg besar serta dapat bikin anda dapat memakai bikin membuahkan keuntungan. Oleh sebab main bandar poker online itu permainan itu bisa berikan suport anda memicu keuntungan yg subtansial jika diproses melalui langkah yang sesuai.

Beberapa dari anda yang tentu memahami permainan ini antara satu yang dapat bawa serta dikau membuahkan keuntungan. Dimana di saat anda dapat mainkan bagian pandang dari sampar jika anda menggenggam tiket yg sama besarnya. Karenanya pada saat kartu as yg terlihat tentu aja akan bikin anda kian baik bikin kerjakan all in saja. Meski demikian mungkin masih musuh dikau terlihat namun sebenarnya kamu dapat membuahkan keuntungan yang semakin besar dengan menggetarkan beberapa musuh.

Trick berjalan bandar poker online yang jarang-jarang terlihat

kalau dikau adalah orang yg seringkali main judi online, tetap saja anda mengerti permainan bandar poker online dapat mendatangkan keuntungan yg subtansial. Permainan ini demikian dapat dimenangi pada saat dikau dapatkan gabungan kartu mengelokkan tinggi bikin dapat mengakibatkan keuntungan yg subtansial. Per judian online dengan menggunakan sajian poker online antara wahid yg demikian menarik dalam dunia. Banyak sebagian orang2 yg membuahkan keuntungan daripada permainan ini pada beserta sisi yg dapat beralih jadi seseorang profesional kuat.

Agar anda dapat memicu keuntungan lewat langkah ruwet. Antara dari anda seharusnya pahami jika permainan poker online dapat berikan suport membuahkan keuntungan kalau diproses dengan strategi yg serasi. Sebenarnya begitu banyak kurang lebih macam yg tidak terlihat oleh banyak sebagian orang2 namun seringkali anda dapatkan pada permainan ini.

Tata menang mainkan kesempatan flush

anda harus memahami jika 5 kartu dengan sekar yg sama tipenya siap membuahkan flush. Oleh kesudahannya anda harus pahami dan kemudian jika pekerjaan ini siap membuahkan keuntungan yg subtansial kalau diproses dengan pantas dengan. Pada saat ada 3-4 kartu yg demikian dapat termasuk bikin sampaikan suport anda buat memicu flush, jadi anda bisa membuahkan keuntungan besar.

A forex robot connected to regulated brokers

One thing is certain: forex trading is becoming more and more popular, but not only thanks to increased interest in financial trading, a trend that started in 2007. It took more than a crisis to motivate people to take faith in their own hands and learn about trading and money management. The rise in popularity of forex trading is coinciding with the great boom in internet and mobile technology. Considering how only a few decades ago forex was reserved exclusively for market specialists, it is completely understandable that more people trade it now when they have everything they need in their pockets.

But new technologies didn’t only enable trading from mobile phones but also trading in an automated way. So, what is automated forex trading? Basically, the trader is using a special software that is connected to their forex broker in order to trade automatically based on signals provided by the algorithm integrated into the software. There are different types of software – some of them only deliver signals, and others actually place the trade according to the parameters determined by the trader before the trading process even started.

Before you sign up with a forex robot, make sure to learn all about both good and bad sides of this type of trading, as well as find a good forex trading software.

Why should I use forex trading software?

Forex trading software has many advantages, but the main one is that it makes trading much easier, especially when it comes to beginners. Financial analysis is hard to master, and forex trading software already has an algorithm that is programmed to recognize trading opportunities, so you don’t have to.

The trading software will also enable the trader to activate certain assets, tools, and features and provide more customized trading solutions. For example, they can offer trading on multiple devices or multiple trading accounts for a trader to choose from. Also, bear in mind that your auto trading software has to be connected to a reliable forex broker in order for you to get the best results. Always look for a software that operates in a transparent way and has a solid customer support to avoid any unpleasant surprises.

The conclusion is that forex trading software can help you enter the world of forex trading in a new, more relaxed way as they are simple to use.

How can I tell a good forex software from a bad one?

First and foremost, bear in mind how forex trading software is not harry potter’s wand that will magically make you rich with a single spell. Forex trading is complex and requires your attention and mindful approach even when you use the auto trading software. Thus knowing, avoid all forex trading software that promises you to get rich in a single day, week or a month. Make sure to understand how it is impossible to become a millionaire in a single week, with only $250 deposited.

Also, the safe way to go is to select a forex trading software that allows you to customize trading signals you will be receiving. For example, there are traders who trade only USD pairs, and who don’t want to be bothered with trades that don’t involve this popular currency. The best forex robots will allow them to adjust the trading algorithm to their needs. Also, there are more and less conservative traders that prefer different risk levels or different strategies who will trade only with a certain risk level involved. Some software have a tool for that as well. Good forex trading software will also have a demo account that will allow you to try trading and check out the trading interface before making the first trade with real money. But don’t be intimidated – our reviews will help you find the robot that suits you best.

What is fxmasterbot trading software?

FX master bot is a forex auto trading software. It is the combination of complex trading algorithms and an easy-to-use trading room that is created with traders in mind. Before you start trading with real money, you also get a demo account with $1500 virtual money you can use to find out everything you need about forex trading with FX master bot. Fxmasterbot offers a selection of different account levels that will allow you to unlock more and more useful features as you make progress. Many brokers available with this software are regulated and reputable which only shows that fxmasterbot is a product that operates in compliance with industry trends and trader’s needs. Fxmasterbot is an option for traders who wish to try forex trading in an innovative way. Read more about fxmasterbot.

Olymp trade robot

After registration you can switch between demo and real account

Olymp trade available for traders from all countries except: australia, canada, USA, japan, UK, EU (all countries), israel.

Robots for trading trading on olymp trade

The updated robot from olymp tool developers has reached a new level. The profitability of the robot is over 70%. The robot is a unique tool for trading automation on the olympus trade trading platform. A fully automated program for olymp trade is a more complex version of the same robot. Unlike the previous version, such bots do not just monitor the situation, but open contracts themselves, make decisions: how much, for how long, for a decrease or increase to conclude a deal and so on. In fact, the program trades instead of the trader, leaving him the opportunity to only withdraw money from the deposit. Or top it up, if the program played correctly.

Instruction

Activation is necessary to achieve full functionality and consists of 2 steps.

Step 1. Olymptrade account registration. To activate the robot, you need to register an account olymptrade.

Step 2. Make a deposit of $100 or more. The deposit amount is determined by the strategy used by the robot (a reserve is needed to cover in case of a failed transaction).

Robot. Auto trading

Initial amount – the trade amount at which the robot will begin to trade each lap.

✔ the recommended value is 1 ($/€)

Time (min) – the each trade period.

✔ the recommended value is 1($/€)

Trading asset – the asset from which the robot starts trading.

✔ the recommended asset is the one with a stable winning percentage (>70%).

Auto selection of asset

✔ it is recommended to enable this feature so that if the winning percentage falls, the robot switches to a more profitable asset.

Trading strategies

#1 win every round (optimal)

the robot wins with the first bet, and in case the first bet loses, the next ones are calculated so that in the end you get a deposit equal to the one before the first bet plus % of the starting bet.

✔ the strategy recommended for a balance of between $100 and $1000.

#2 win every bet (aggressive)

according to this strategy, the robot will calculate the rates so that on average every minute you will receive a % of the initial trade assets. This is the most profitable strategy, but at the same time it is riskier, because it takes a lot of time and requires a large deposit.

✔ the strategy is recommended for a balance of $1000.

Use OTA signals (olymptool analytics)

the OTA algorithm determines the trend direction based on the analysis of 12 moving averages and 8 technical indicators.

✔ this setting increases the accuracy of rates by an average of 7%.

➕the trading is available only after activation.

Stop filters

Min winning % – the winning percentage, below which the robot will stop trading.

✔ it\’s recommended setting the value to 60.

Max balance – the amount of balance, after which the robot will stop its work

✔ it\’s not recommended to limit this item to get the maximum income.

➕the trading is available only after activation. Without activation, the robot will stop as soon as it earns $20 or €20 on the demo account.

Go to the first step

Trading using the bot does not guarantee 100% profit. Be careful and watch the actions of the bot.

General information

FAQ: frequently asked questions

The amount of the deposit is determined by the strategy used by the robot (a reserve is needed to cover in case of a failed transaction).

Initially, the tool was created for personal use and to this day we ourselves actively use it. After registering this site, the broker provides us with 1% of the acquitted transactions. You do not lose anything. These are the planned expenses of the platform for promotion.

After registration you can switch between demo and real account

Forex robots

Forex robot scams encompass expert advisors (also famously known as eas) and other automated trading systems.

What is a forex robot?

In the forex world, a “robot” is a program that strictly uses technical signals to enter into trades and lets the human sleep in a hammock on a beach while he “makes” money.

In other words, they run automated mechanical systems, whether or not the user is in front of the computer or not.

The problem is that forex robots and their pre-wired thinking do not compensate for ever-changing market conditions.

Market behavior is dynamic, constantly moving in an infinite variation of three movements: up, down, or sideways.

Now, the scam isn’t the forex robot itself but how they are marketed. Scammers will often try to sell these robots and automated systems as the “holy grail” of trading, promising you’ll retire sometime next week.

And they sell them at “human affordable” prices ranging from $20 to $5000.

All right, stop. Collaborate and listen.

If the creator is making big bucks with the system, why would he/she try to sell it and share the profit?

And why for only $20?! You can barely get a decent meal at chick-fil-A for you and your sweetums with $20!

The only real profit for these fraudulent people is the revenue generated from the sales of their forex “R2-d2s.”

The scammer will try to entice you with historical data and back-testing logs.

It’s back-tested!! It must work. And it’s only $20!! That’s less than a PS4 game!

All right, stop. Collaborate and listen. Again.

Sure, it might look highly profitable. However, in the forex market, there is no such thing as a consistent market. Conditions are changing all the time. The past has little effect on the future in a changing market.

We don’t know for certain that what happened in past will happen again in the future. There are too many variables to consider.

Plus, you don’t know if these scammers are making up the results anyways. They could just input random numbers into an excel file as most people wouldn’t bother checking if they are accurate or not.

Stay away from automated systems and robots until you become a master trader AND programmer.

It is best to actually learn how to trade consistently before you make the decision to let a program do it for you.

Think about it this way: would you give a total stranger (with no brain to boot!) your hard earned money to invest without having a clue on what he/she was doing?

Forex robots can be a great tool, but let’s be real -there is no perfect “one” that will work in all environments, all the time.

So, let's see, what we have: forex expert advisors (eas) are robots/algorithms that allow you to automate a trading strategy on MT4 based, but not all brokers allow EA trading. Here, we've compared the top brokers that do allow expert advisors & forex trading robots as of january 2021. At robot broker

Contents of the article

- Top-3 forex bonuses

- Compare expert advisors (EA) brokers

- We found 8 broker accounts (out of 147)...

- Forex.Com

- Thinkmarkets

- Trading with forex expert advisors

- What is an expert advisor?

- The two types of forex robot algorithmic trading:

- How expert advisors work

- Characteristics of a good expert advisor

- Where can you obtain expert advisors?

- Why choose forex.Com for expert advisors...

- Robot broker

- Tradear

- Tradetoro

- Gfcinvestment

- Kontofx

- Wise banc

- Binex

- Vemarkets

- Brightertrade

- CFDS100

- Emarketstrade

- Millennium-FX

- Capital traders

- Kayafx

- Ashford investments

- Greenfields capital

- Trading advantages of roboforex forex broker

- Roboforex bonus programs

- Profit share bonus up to 60%

- Classic bonus up to 120%

- Cashback (rebates) up to 15%

- Up to 10% on account balance

- Account types

- Trading platforms

- Roboforex trading platforms

- Exclusive trading platforms

- Roboforex bonus programs

- Security of client's funds

- 8 asset classes

- 0% commissions

- Instant withdrawals

- Become an investor on forex

- Roboforex market analytics

- Forex analytics

- The pound intends to keep rising. Overview for...

- Fibonacci retracements analysis 22.01.2021...

- Ichimoku cloud analysis 22.01.2021 (BTCUSD,...

- Economic calendar

- Exclusive market analytics

- Company news

- Roboforex: changes in trading schedule (martin...

- Roboforex: changes in trading schedule (christmas...

- Roboforex received prestigious awards of the...

- Forex analytics

- Winner of more than 10 prestigious awards

- Best investment products (global)

- Best partnership program (LATAM)

- Most trusted broker

- Most transparent asian forex broker

- Best global mobile trading app

- Best broker of the CIS

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- 8 asset classes

- Automated trading software

- How robots save time

- Choose a robot service

- Download the software

- Sign-up with a broker

- Programme the software

- Sit back, relax and enjoy

- How binary robots work

- Best robo-advisors

- The top robo-advisors for every kind of investor,...

- Best robo-advisors:

- Wealthfront: best overall and best for goal...

- Interactive advisors: best for sustainable...

- FXTB review 2020: legit or scam robot broker?

- FXTB review – overview!

- FXTB broker review – trading conditions

- Getting started with FXTB through bitcoin...

- Register for free on bitcoin up website

- Deposit trading capital of at least 250 USD

- Read trading instructions and practice on a...

- Set the trading conditions and go live

- Is FXTB a scam or not? The verdict!

- Faqs

- A forex robot connected to regulated brokers

- Why should I use forex trading software?

- How can I tell a good forex software from a bad...

- What is fxmasterbot trading software?

- Olymp trade robot

- Robots for trading trading on olymp...

- Instruction

- Activation is necessary to achieve full...

- Robot. Auto trading

- Trading strategies

- Stop filters

- Go to the first step

- General information

- Forex robots

- What is a forex robot?