Try forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity.

Top-3 forex bonuses

this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions. Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

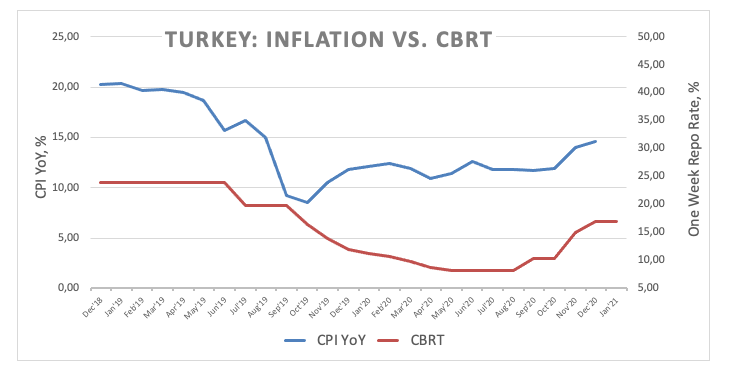

USD/TRY: CBRT policy to help the turkish lira – MUFG

In turkey, president erdogan criticized higher interest rates from the central bank of the republic of turkey (CBRT). Analysts at MUFG banks expect the CBRT to maintain tighter policy thereby helping to maintain a stronger turkish lira.

Key quotes:

“while the RUB and TRY have held up relatively well so far this year, downside risks have also increased in the near-term.”

“president erdogan has created some unease amongst turkish investors by resuming his criticism of higher rates ahead of this week’s CBRT meeting. However, we are not expecting the CBRT to shift to a looser policy stance any time soon with rates likely to remain on hold this week. The CBRT’s tighter policy stance is an important assumption behind our outlook for the TRY to remain at stronger levels”.

“the return to more orthodox policy settings has been crucial in restoring confidence in turkish assets and the TRY. After strong TRY gains at the end of last year, USD/TRY has recently tested and held support from its 200- day moving average at 7.3550. The TRY has lost upward momentum ahead of this week’s cbot policy meeting, but it is unlikely to prove trigger for a deeper reversal lower”.

About author

Top brokers

About forexcrunch

Forex crunch is a site all about the foreign exchange market, which consists of news, opinions, daily and weekly forex analysis, technical analysis, tutorials, basics of the forex market, forex software posts, insights about the forex industry and whatever is related to forex.

Follow us

Useful links

Recent updates

Disclaimer

Foreign exchange (forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and the trader's level of experience should be carefully weighed before entering the forex market. There is always a possibility of losing some or all of your initial investment / deposit, so you should not invest money which you cannot afford to lose. The high risk that is involved with currency trading must be known to you. Please ask for advice from an independent financial advisor before entering this market. Any comments made on forex crunch or on other sites that have received permission to republish the content originating on forex crunch reflect the opinions of the individual authors and do not necessarily represent the opinions of any of forex crunch's authorized authors. Forex crunch has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: omissions and errors may occur. Any news, analysis, opinion, price quote or any other information contained on forex crunch and permitted re-published content should be taken as general market commentary. This is by no means investment advice. Forex crunch will not accept liability for any damage, loss, including without limitation to, any profit or loss, which may either arise directly or indirectly from use of such information.

USD/TRY offered, approaches the 200-day SMA near 7.85

The turkish lira keeps the firm note unchanged for yet another session and drags USD/TRY to new lows in the proximity of the 7.85 area on thursday.

USD/TRY weaker post-CBRT

USD/TRY sheds ground for the third consecutive session so far on thursday on the back of the renewed selling bias in the greenback and broad-based fresh inflows into the EM FX.

Also supporting the lira, the turkish central bank (CBRT) left the one-week repo rate unchanged at 17.00% at its meeting on thursday, matching the generalized consensus.

The central bank noted the solid pace of the economic recovery in the country, although still remains concerned over the high inflation and inflation expectations. Furthermore, the CBRT pledged to keep the tight monetary policy stance in order to achieve price, macroeconomic and financial stability.

Earlier in the session, turkey’s consumer confidence improved to 83.3 for the month of january.

USD/TRY key levels

At the moment the pair is losing 0.35% at 7.3786 and a drop below 7.3485 (200-day SMA) would expose 7.2391 (2021 low jan.7) and then 7.2019 (low aug.21). On the flip side, the next resistance emerges at 7.5415 (2021 high jan.18) followed by 7.6884 (55-day SMA) and finally 8.0250 (monthly high dec.11).

About author

Top brokers

About forexcrunch

Forex crunch is a site all about the foreign exchange market, which consists of news, opinions, daily and weekly forex analysis, technical analysis, tutorials, basics of the forex market, forex software posts, insights about the forex industry and whatever is related to forex.

Follow us

Useful links

Recent updates

Disclaimer

Foreign exchange (forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and the trader's level of experience should be carefully weighed before entering the forex market. There is always a possibility of losing some or all of your initial investment / deposit, so you should not invest money which you cannot afford to lose. The high risk that is involved with currency trading must be known to you. Please ask for advice from an independent financial advisor before entering this market. Any comments made on forex crunch or on other sites that have received permission to republish the content originating on forex crunch reflect the opinions of the individual authors and do not necessarily represent the opinions of any of forex crunch's authorized authors. Forex crunch has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: omissions and errors may occur. Any news, analysis, opinion, price quote or any other information contained on forex crunch and permitted re-published content should be taken as general market commentary. This is by no means investment advice. Forex crunch will not accept liability for any damage, loss, including without limitation to, any profit or loss, which may either arise directly or indirectly from use of such information.

Trade on the go,

like a pro.

Welcome to fxpro, the world’s #1 broker! 1

With 15+ years of excellence and innovation, we provide high-quality access to financial markets, through our advanced execution model. Discover the world of online trading with cfds on 260+ instruments in 6 asset classes.

Invest in #US30 (dow jones industrial average), EURUSD , gold and apple from a single account

Trade cfds on a wide range of instruments, including popular FX pairs, futures, indices, metals, energies and shares and experience the global markets at your fingertips.

Trade on mobile

Trade the CFD market on the go with our mobile application and benefit from ultra-low latency trading infrastructure, award-winning order execution and deep liquidity.

Available for ios and android devices.

Secure fxpro wallet MT4, MT5 & ctrader accounts variety of payment methods latest economic events

Multiple payment options

We provide our clients with a wide range of flexible payment options including bank transfer, credit/debit cards, E-wallets and more 2 . Detailed information is available on our funding page.

Tight spreads and no commission

Tap into the world's markets and explore endless trading opportunities with the world's best broker 1 - all with tight spreads and no commission 3 .

Browse the full rangeof platforms

At fxpro we understand that different clients have different needs. Therefore, we offer a wide selection of trusted, award-winning platforms and account types to choose from.

TRY - turkish lira

The turkish lira is the currency of turkey. Our currency rankings show that the most popular turkey lira exchange rate is the USD to TRY rate. The currency code for lira is TRY, and the currency symbol is

Top TRY exchange rates

Currency facts

Name: turkish lira

Symbol:

Minor unit:

1/100 = kuruş

Top TRY conversion:

USD/TRY

Top TRY chart:

USD/TRY chart

Inflation: 11.10%

Nicknames: kağıt, mangır, papel

Coins:

freq used:

rarely used: 1kr

Banknotes:

freq used:

Central bank:

central bank of the republic of turkey

website: http://www.Tcmb.Gov.Tr

Users: turkey, north cyprus

Have more info about the turkish lira?

Email us ►

Trade on the go,

like a pro.

Welcome to fxpro, the world’s #1 broker! 1

With 15+ years of excellence and innovation, we provide high-quality access to financial markets, through our advanced execution model. Discover the world of online trading with cfds on 260+ instruments in 6 asset classes.

Invest in #US30 (dow jones industrial average), EURUSD , gold and apple from a single account

Trade cfds on a wide range of instruments, including popular FX pairs, futures, indices, metals, energies and shares and experience the global markets at your fingertips.

Trade on mobile

Trade the CFD market on the go with our mobile application and benefit from ultra-low latency trading infrastructure, award-winning order execution and deep liquidity.

Available for ios and android devices.

Secure fxpro wallet MT4, MT5 & ctrader accounts variety of payment methods latest economic events

Multiple payment options

We provide our clients with a wide range of flexible payment options including bank transfer, credit/debit cards, E-wallets and more 2 . Detailed information is available on our funding page.

Tight spreads and no commission

Tap into the world's markets and explore endless trading opportunities with the world's best broker 1 - all with tight spreads and no commission 3 .

Browse the full rangeof platforms

At fxpro we understand that different clients have different needs. Therefore, we offer a wide selection of trusted, award-winning platforms and account types to choose from.

Try forex

Where smart investors get smarter SM

Call us 800-454-9272

#1 overall broker

Diversification does not eliminate the risk of experiencing investment losses.

Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read the NFA booklet: what investors need to know prior to trading forex products

Forex accounts are not protected by the securities investor protection corporation (SIPC).

Forex trading services provided by TD ameritrade futures & forex LLC. Trading privileges subject to review and approval. Not all clients will qualify. Forex accounts are not available to residents of ohio or arizona.

Forex trading exposes you to risk including, but not limited to, market volatility, volume, congestion, and system or component failures which may delay account access and forex trade executions. Prices can change quickly and there is no guarantee that the execution price of your order will be at or near the quote displayed at order entry. Delays in account access and execution at a different price is more likely to occur in conditions such as a fast-moving market, at market open or close, or due to the size and type of order.

The forex market is open from 5:00 p.M. To 4:00 p.M. Daily, sunday through friday. Beginning at 5:00 p.M., forex pairs may be opened at various intervals to ensure market liquidity. As part of routine daily maintenance, generally conducted between 12:00 a.M. – 2:00 a.M. And lasting approximately 2 minutes, the trading platform may not be available. Times referenced are central standard time or central daylight time, whichever is in effect. TD ameritrade futures & forex LLC utilizes JP morgan chase bank N.A. As its forex prime broker. Liquidity providers are JP morgan, citadel securities, XTX markets, HC technologies, and virtu financial.

Additional forex execution data is available by request. You may request transaction data for up to 15 trades that occur in the same currency pair immediately before and after your trade. The information provided in the transaction data includes execution date, time, side, quantity, currency pair, and price. To submit your request, please contact a TD ameritrade forex specialist at 866-839-1100.

*backtesting is the evaluation of a particular trading strategy using historical data. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Results could vary significantly, and losses could result.

The papermoney trading software application is for educational purposes only. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Access to real-time market data is conditioned on acceptance of the exchange agreements. Professional access differs and subscription fees may apply. See our commission and brokerage fees for details.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in australia, canada, hong kong, japan, saudi arabia, singapore, UK, and the countries of the european union.

TD ameritrade, inc., member FINRA/SIPC, a subsidiary of the charles schwab corporation. TD ameritrade is a trademark jointly owned by TD ameritrade IP company, inc. And the toronto-dominion bank. ©2021 charles schwab & co. Inc. All rights reserved.

USD/TRY: CBRT policy to help the turkish lira – MUFG

In turkey, president erdogan criticized higher interest rates from the central bank of the republic of turkey (CBRT). Analysts at MUFG banks expect the CBRT to maintain tighter policy thereby helping to maintain a stronger turkish lira.

Key quotes:

“while the RUB and TRY have held up relatively well so far this year, downside risks have also increased in the near-term.”

“president erdogan has created some unease amongst turkish investors by resuming his criticism of higher rates ahead of this week’s CBRT meeting. However, we are not expecting the CBRT to shift to a looser policy stance any time soon with rates likely to remain on hold this week. The CBRT’s tighter policy stance is an important assumption behind our outlook for the TRY to remain at stronger levels”.

“the return to more orthodox policy settings has been crucial in restoring confidence in turkish assets and the TRY. After strong TRY gains at the end of last year, USD/TRY has recently tested and held support from its 200- day moving average at 7.3550. The TRY has lost upward momentum ahead of this week’s cbot policy meeting, but it is unlikely to prove trigger for a deeper reversal lower”.

About author

Top brokers

About forexcrunch

Forex crunch is a site all about the foreign exchange market, which consists of news, opinions, daily and weekly forex analysis, technical analysis, tutorials, basics of the forex market, forex software posts, insights about the forex industry and whatever is related to forex.

Follow us

Useful links

Recent updates

Disclaimer

Foreign exchange (forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and the trader's level of experience should be carefully weighed before entering the forex market. There is always a possibility of losing some or all of your initial investment / deposit, so you should not invest money which you cannot afford to lose. The high risk that is involved with currency trading must be known to you. Please ask for advice from an independent financial advisor before entering this market. Any comments made on forex crunch or on other sites that have received permission to republish the content originating on forex crunch reflect the opinions of the individual authors and do not necessarily represent the opinions of any of forex crunch's authorized authors. Forex crunch has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: omissions and errors may occur. Any news, analysis, opinion, price quote or any other information contained on forex crunch and permitted re-published content should be taken as general market commentary. This is by no means investment advice. Forex crunch will not accept liability for any damage, loss, including without limitation to, any profit or loss, which may either arise directly or indirectly from use of such information.

Test our forex VPS service for $5!

Our trial VPS allows you to try our service for one full week. If you like the trial it is easy to continue the VPS service on a month to month basis.

Order your trial VPS:

CPU cores

STORAGE

How it works

Order your trial VPS

Click the order now button above to begin your 7 day trial. Once your order is completed your trial VPS will be setup automatically, and you will recieve an email with your login details.

Setup & trade

Install and configure your trading platforms and software on to the trial VPS. Use the VPS over the next 7 days and evaluate how it works.

Keep or cancel the trial VPS

At the end of the 7 days you can either keep the VPS or cancel it. If you decide to keep it you can continue using the same VPS, with no need to setup anything again!

Use any broker, including:

You'll love trading on our infrastructure

100% uptime SLA

We guarantee that your forex VPS will always be available during market hours.

No contracts

All services are month to billed month, and you may cancel at anytime.

Autostart + alerts program

Our VPS alerting and autostart program comes preinstalled with each VPS.

Daily backups

Restore your entire VPS or just a specific file on the fly with our daily backup addon service.

Use any expert advisor

Use any trading platform and expert advisor or trading robot with our VPS service.

24/7 in-house support

Our support technicians are available 24/7/365 to help you. We don't outsource our support, unlike other providers.

Use any broker

Use any broker you would like with our service, no limits.

Fast connection speeds

Low latency to your favorite broker, no matter where you are located in the world.

Have any questions before starting your trial?

Contact us! We're happy to answer all of your questions

FREE VPS monitoring + alerts

Newyorkcityservers has built a fully custom program called liberty that will monitor your trading software on your VPS and automatically send you email alerts for important events such as logins, restarts, and more!

Auto login + start

Each time your VPS is restarted our custom program will automatically start your trading software without you having to do anything!

Email alerts

Liberty will always keep you up to date with important events happening on your VPS with email alerts.

Frequently

asked questions

When does my trial period start?

The 7 day trial period begins on the day that you place the order.

What happens at the end of the trial period?

At the end of the 7 day trial period you may either cancel or keep the trial VPS. If you do not cancel the VPS before the 7 day period is over your VPS will automatically be converted into a paid plan, and you will be billed.

Are the trial vpss the same as a normal VPS plan?

Yes. The trial VPS is the same as a full paid VPS.

Why do I have to pay money to trial your VPS?

We ask for a small fee to trial our VPS plans to protect ourselves and our clients against fraudulent and bad actors on our network.

Are there any refunds if I don't like the trial VPS?

No, there are no refunds.

Getting started is easy

- Purchase your server

- Setup & install software

- Start trading!

Nycservers provides forex VPS, dedicated servers, and broker solutions. Our service will allow retail traders to run their trading software in the cloud 24/7 with fast connection to their brokers.

We accept the following

- Terms of service

- Privacy policy

- Risk disclosure

Services

VPS service by broker

Company

Customers

Disclaimer: forex trading carries a high level of risk. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading before using our service. Newyorkcityservers does not guarantee the profitability of using our service. Furthermore we can not be held liable for any money made or lost using our service under any circumstances.

Forex VPS trial terms

Newyorkcityservers offers clients a 7 day trial to test our VPS service. All clients must follow our terms of service during their trial. We reserve the right to terminate a trial service at anytime and without warning in the event that the terms of service are broken.

One trial service per person. Any customer found to be abusing the trial system will automatically have their account(s) terminated without warning.

Billing, cancellation, and auto-renewal

The cost to sign up for our 7 day forex VPS trial service is $5, payable via paypal and debit/credit card.

You may cancel your forex VPS trial service at anytime directly from inside of the client area by following this guide or contacting support.

If you do not cancel your trial service before the 7 days is over it will automatically be converted into the basic VPS 1 plan, and you will be billed for a full month of service at the rate of $20 USD each month.

Refunds

All payments are final, and under no circumstances will refunds be provided.

So, let's see, what we have: forex trading is the act of converting one country's currency into the currency of another country. At try forex

Contents of the article

- Top-3 forex bonuses

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- USD/TRY: CBRT policy to help the turkish lira –...

- Key quotes:

- USD/TRY offered, approaches the 200-day SMA near...

- USD/TRY weaker post-CBRT

- USD/TRY key levels

- About author

- Top brokers

- About forexcrunch

- Follow us

- Useful links

- Recent updates

- Disclaimer

- Trade on the go, like a pro.

- Invest in #US30 (dow jones industrial average),...

- Trade on mobile

- Browse the full rangeof...

- TRY - turkish lira

- Top TRY exchange rates

- Currency facts

- Trade on the go, like a pro.

- Invest in #US30 (dow jones industrial average),...

- Trade on mobile

- Browse the full rangeof...

- Try forex

- USD/TRY: CBRT policy to help the turkish lira –...

- Key quotes:

- Test our forex VPS service for $5!

- How it works

- Use any broker, including:

- You'll love trading on our infrastructure

- 100% uptime SLA

- No contracts

- Autostart + alerts program

- Daily backups

- Use any expert advisor

- 24/7 in-house support

- Use any broker

- Fast connection speeds

- Have any questions before starting your trial?

- Contact us! We're happy to answer all of your...

- FREE VPS monitoring + alerts

- Frequently asked questions

- When does my trial period start?

- What happens at the end of the trial period?

- Are the trial vpss the same as a normal VPS plan?

- Why do I have to pay money to trial your VPS?

- Are there any refunds if I don't like the trial...

- Getting started is easy

- Forex VPS trial terms