Tickmill pro account

*no commission on cfds on stock indices, oil and bonds. Complete registration, log in to your client area and upload the required documents.

Top-3 forex bonuses

PRO ACCOUNT

Designed for experienced traders who expect advanced features and optimal conditions.

Why choose our PRO account?

PRO ACCOUNT

Take advantage of tight spreads and competitive commissions.

| Minimum deposit | 100 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 0.0 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | 2 per side per 100,000 traded |

| all strategies allowed | |

| swap-free islamic account option |

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your pro account, with fluctuating spreads starting from 0.0 pips.

You will pay commission of only 2 currency units per side per lot (0.0020% notional) on your pro account in the base currency of the trading instrument.Our standard commission is one of the lowest in the world.

Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 2 EUR and 4 EUR round turn.

Though many brokers do not allow placing stop and limit orders close to market prices, we allow you to do just that. So stop and limit levels for pro account users are zero.

*no commission on cfds on stock indices, oil and bonds.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

PRO ACCOUNT

Dirancang untuk trader berpengalaman yang mengharapkan fitur canggih dan kondisi optimal.

Mengapa memilih akun PRO kami

AKUN PRO

Manfaatkan spread ketat dan komisi kompetitif.

| Deposit minimum | 100 |

|---|---|

| mata uang dasar tersedia | USD, EUR, GBP |

| spread dari | 0.0 pip |

| leverage maks | 1:500 |

| min lot | 0.01 |

| komisi | 2 per sisi per 100.000 yang ditradingkan |

| semua strategi diizinkan | |

| opsi akun syariah bebas swap |

Tradingkan CFD pada 62 pair mata uang, 15 indeks saham, WTI, logam mulia dan obligasi di akun pro anda, dengan spread berfluktuasi mulai dari 0,0 pips.

Anda akan membayar komisi hanya 2 per sisi per lot (0,0020% nosional) pada akun pro anda dalam mata uang dasar dari instrumen trading. Komisi standar kami adalah salah satu yang terendah di dunia.

Contoh: jika anda tradingkan 1 lot di EURUSD, yang memiliki ukuran kontrak sebesar 100,000 EUR, maka komisi anda per sisi yaitu 2 EUR dan 4 EUR round turn.

Meskipun banyak broker yang tidak mengizinkan menempatkan stop dan limit order dekat dengan harga pasar, kami mengizinkan anda untuk melakukan hal itu. Jadi level stop dan limit untuk pengguna akun pro adalah nol.

* tidak ada komisi di CFD pada indeks saham, WTI dan obligasi.

Manfaat dari kondisi trading yang LUAR BIASA

mata uang dasar tersedia: USD, EUR, GBP model eksekusi: NDD tipe eksekusi: market execution rata-rata kecepatan eksekusi: 0.20 detik margin call / stop-out: 100% / 30%

Akses beberapa

INSTRUMEN TERPOPULAR

di pasar finansial

FOREX

INDEKS SAHAM

LOGAM MULIA

OBLIGASI

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

CLASSIC ACCOUNT

Enter the world of trading in the easiest and simplest way possible.

Why choose our classic account?

CLASSIC ACCOUNT

Get access to global markets and trade commission-free.

| Minimum deposit | 100 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 1.6 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | zero commissions |

| all strategies allowed | |

| swap-free islamic account option |

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your classic account, with variable spreads starting from 1.6 pips and no commissions.

The classic account is suitable for both novice and experienced traders and offers optimal trading conditions, ultra-fast order execution while enabling you to use virtually any trading strategy.

This account type is a great gateway to the world of trading and comes with several perks that add value to your trading experience.

Please note that classic account charts show market and spreads without the mark up.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

AKAUN PRO

Direka untuk peniaga yang berpengalaman yang mengharapkan ciri-ciri canggih dan keadaan optimum.

Kenapa memilih akaun PRO kami

AKAUN PRO

Ambil kesempatan daripada spread yang ketat dan komisyen yang kompetitif.

| Deposit minimum | 100 |

|---|---|

| mata wang pangkalan yang tersedia | USD, EUR, GBP |

| sebaran dari | 0.0 pips |

| maks leveraj | 1:500 |

| min lots | 0.01 |

| suruhanjaya | 2 setiap sisi setiap 100,000 diniagakan |

| semua strategi dibenarkan | |

| pilihan swap akaun islam |

CFD dagangan pada 62 pasangan mata wang, 15 indeks saham, minyak, logam berharga dan bon pada akaun pro anda, dengan sebran turun naik dari 0.0 pips.

Anda akan membayar komisyen sebanyak 2 per sampingan setiap lot (0.0020% notional) pada akaun pro anda dalam mata wang asas instrumen dagangan. Piawaian komisyen kami adalah salah satu yang paling rendah di dunia.

Contoh: jika anda berdagang 1 lot EURUSD, yang mempunyai saiz kontrak 100.000 EUR, maka komisi anda satu sisi akan menjadi 2 EUR dan 4 EUR pusingan.

Walaupun ramai broker tidak membenarkan pemberhentian dan mengehadkan pesanan yang hampir dengan harga pasaran, kami membenarkan anda berbuat demikian. Oleh itu, tahap henti dan had bagi pengguna akaun pro adalah sifar.

* tiada komisyen pada CFD pada indeks saham, minyak dan obligasi.

Mendapat manfaat dari syarat-syarat perdagangan TERHEBAT

mata wang pangkalan yang tersedia: USD, EUR, GBP model pelaksanaan: NDD jenis pelaksanaan: pelaksanaan pasaran kelajuan pelaksanaan purata: 0.20 saat panggilan / berhenti margin: 100% / 30%

Akses sebahagian daripada

INSTRUMEN POPULAR

dalam pasaran

FOREX

INDEKS STOK

LOGAM

MULA BERDAGANG dengan tickmill

Ia mudah dan pantas untuk menyertai!

DAFTAR

Pendaftaran lengkap, log masuk ke akaun anda kawasan pelanggan dan muat naik dokumen yang diperlukan.

BUAT AKAUN

Setelah dokumen anda diluluskan, buat akaun dagangan langsung.

MEMBUAT DEPOSIT

Pilih kaedah pembayaran, dana akaun dagangan anda dan mula berdagang.

INSTRUMEN DAGANGAN

TRADING CONDITIONS

AKAUN PERDAGANGAN

PLATFORMS

PENDIDIKAN

PERKONGSIAN

PROMOSI

TENTANG KAMI

SOKONGAN

Tickmill adalah nama dagang kumpulan tickmill syarikat.

Tickmill.Com dimiliki dan dikendalikan dalam syarikat kumpulan tickmill. Kumpulan tickmill terdiri daripada tickmill UK ltd, yang dikawal selia oleh financial conduct authority (pejabat berdaftar: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, yang diatur oleh suruhanjaya sekuriti dan bursa cyprus (pejabat berdaftar: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, diatur oleh financial sector conduct authority (FSCA) (pejabat berdaftar: the colosseum, tingkat 1, century way, office 10, century city , 7441, cape town), tickmill ltd, yang dikawal selia oleh financial services authority of seychelles dan anak syarikat 100% miliknya procard global ltd, nombor pendaftaran UK 09369927 (pejabat berdaftar: tingkat 3, 27 - 32 old jewry, london EC2R 8DQ, england ), tickmill asia ltd - dikawal selia oleh lembaga perkhidmatan kewangan labuan malaysia (nombor lesen: MB / 18/0028 dan pejabat berdaftar: unit B, lot 49, tingkat 1, blok F, lazenda warehouse 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Pelanggan mesti berumur sekurang-kurangnya 18 tahun untuk menggunakan perkhidmatan tickmill.

Amaran risiko tinggi: kontrak perdagangan untuk perbezaan (CFD) pada margin mempunyai tahap risiko yang tinggi dan mungkin tidak sesuai untuk semua pelabur. Sebelum memutuskan untuk memperdagangkan kontrak untuk perbezaan (CFD), anda harus mempertimbangkan objektif perdagangan, tahap pengalaman dan selera risiko anda dengan teliti. Adalah mungkin bagi anda untuk menanggung kerugian yang melebihi modal yang anda laburkan dan oleh itu anda tidak seharusnya menyimpan wang yang anda tidak mampu kehilangan. Pastikan anda memahami sepenuhnya risiko dan berhati-hati untuk menguruskan risiko anda.

Laman ini juga mengandungi pautan ke laman web yang dikawal atau ditawarkan oleh pihak ketiga. Tickmill tidak menyemak dan dengan ini menafikan tanggungjawab untuk apa-apa maklumat atau bahan yang dipaparkan di mana-mana laman web yang dipautkan ke laman web ini. Dengan membuat pautan ke laman web pihak ketiga, tickmill tidak menyokong atau mengesyorkan sebarang produk atau perkhidmatan yang ditawarkan di laman web tersebut. Maklumat yang terdapat di laman web ini hanya bertujuan untuk tujuan maklumat sahaja. Oleh itu, ia tidak sepatutnya dianggap sebagai tawaran atau permintaan kepada mana-mana orang dalam mana-mana bidang kuasa di mana tawaran atau permohonan itu tidak diberi kuasa atau kepada mana-mana orang yang akan menyalahi undang-undang untuk membuat apa-apa tawaran atau permintaan, atau dianggap sebagai syor untuk membeli, menjual atau sebaliknya berurusan dengan mana-mana mata wang tertentu atau perdagangan logam berharga. Sekiranya anda tidak pasti tentang mata wang tempatan dan peraturan perdagangan logam maka anda harus meninggalkan laman web ini dengan segera.

Anda dinasihatkan untuk mendapatkan nasihat kewangan, undang-undang dan cukai bebas sebelum meneruskan dengan sebarang mata wang atau perdagangan logam spot. Tiada apa-apa pun dalam laman web ini yang perlu dibaca atau ditafsirkan sebagai menjadi nasihat di bahagian tickmill atau mana-mana sekutunya, pengarah, pegawai atau pekerja.

Perkhidmatan tickmill dan maklumat di laman web ini tidak diarahkan kepada warganegara / penduduk amerika syarikat, dan tidak bertujuan untuk disebarkan kepada, atau digunakan oleh, mana-mana orang di mana-mana negara atau bidang kuasa di mana pengedaran atau penggunaan sedemikian akan bertentangan dengan undang-undang tempatan atau peraturan.

PRO KONTO

Entwickelt für erfahrene trader, die erweiterte funktionen und optimale bedingungen erwarten.

Warum sollten sie unser PRO konto wählen?

PRO KONTO

Profitieren sie von engen spreads und wettbewerbsfähiger kommission!

| Min. Einzahlung | 100 |

|---|---|

| verfügbare kontowährungen | USD, EUR, GBP |

| spread ab | 0.0 pips |

| max. Hebel | 1:500 |

| min. Lots | 0.01 |

| kommission | 2 pro seite pro gehandelte 100.000 |

| alle strategien erlaubt | |

| swap-freie islamische kontooption |

Handeln sie in ihrem pro-konto cfds auf 62 währungspaare, 15 aktienindizes, öl, edelmetalle und anleihen, mit variablen spreads ab 0,0 pips.

Sie zahlen eine kommission von nur 2 pro seite pro lot (0,0020% fiktiv) auf ihrem pro-konto in der basiswährung des handelsinstruments.Unsere standardkommission ist eine der niedrigsten weltweit.

Beispiel: wenn sie 1 lot EURUSD handeln (entspricht einer kontraktgröße von 100.000 EUR), dann wäre ihre kommission pro seite 2 EUR und 4 EUR round turn.

Obwohl viele broker es nicht erlauben, stop- und limit-orders in der nähe von marktpreisen zu platzieren, erlauben wir ihnen, genau das zu tun. Daher sind die stop- und limit level für pro-konto-benutzer gleich null.

* keine kommission auf cfds auf aktienindizes, öl und anleihen.

Profitieren sie von HERVORRAGENDEN handelsbedingungen

verfügbare kontowährungen: USD, EUR, GBP ausführungsmodell: NDD durchschnittliche ausführungsgeschwindigkeit: 0.20 sekunden margin call / stop out: 100% / 50% (privatkunden), 100% / 30% (professionelle kunden)

Zugang zu den

POPULÄRSTEN INSTRUMENTEN

des marktes

FOREX

AKTIENINDIZES

METALLE

BONDS

STARTEN SIE IHR TRADING mit tickmill

Es geht einfach und schnell!

REGISTRIEREN

Vollständige registrierung: loggen sie sich in ihren

KONTO ERÖFFNEN

Sobald ihre dokumente genehmigt sind, können sie ein live trading konto erstellen.

EINE EINZAHLUNG VORNEHMEN

Wählen sie eine zahlungsart aus, kapitalisieren sie ihr handelskonto und starten sie mit dem handel.

Handelsinstrumente

Handelsbedingungen

Handelskonten

Plattformen

Weiterbildung

Werkzeuge

Partnerschaften

Über uns

Kundendienst

Tickmill ist der handelsname der tickmill group of companies.

Tickmill.Com gehört und wird innerhalb der tickmill-unternehmensgruppe betrieben. Die tickmill group besteht aus tickmill UK ltd, reguliert von der britischen financial conduct authority (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, reguliert von den cyprus securities and exchange commission (eingetragener sitz: kedron 9, mesa geitonia, 4004 limassol, zypern), tickmill südafrika (PTY) ltd, FSP 49464, reguliert von der financial sector conduct authority (FSCA) (eingetragener sitz: the colosseum, 1. Stock, century way, office 10, century city, 7441 kapstadt), tickmill ltd, reguliert von der financial services authority der seychellen und seiner 100% igen tochtergesellschaft procard global ltd, britische registrierungsnummer 09369927 (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - reguliert von der financial services authority of labuan malaysia (lizenznummer: MB/18/0028 und eingetragener sitz: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T., labuan, malaysia).

Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Die website enthält links zu websites, die von dritten kontrolliert oder angeboten werden. Tickmill hat keine überprüfung vorgenommen und lehnt hiermit jegliche haftung für informationen oder materialien ab, die auf einer der mit dieser website verlinkten seiten veröffentlicht wurden. Durch die einrichtung eines links zu einer drittanbieter-website unterstützt oder empfiehlt tickmill keine produkte oder dienstleistungen, die auf dieser website angeboten werden. Die informationen auf dieser website dienen nur zu informationszwecken. Es sollte daher nicht als angebot oder aufforderung an eine person in einer rechtsordnung, in der ein solches angebot oder eine aufforderung nicht zulässig ist, oder an eine person, der ein solches angebot oder eine solche aufforderung unzulässig wäre, oder als empfehlung angesehen werden einen bestimmten währungs- oder edelmetallhandel zu kaufen, zu verkaufen oder anderweitig damit zu handeln. Wenn sie sich nicht sicher sind, ob sie in ihrer lokalen währung handeln und handelsregeln für metalle beachten, sollten sie diese seite sofort verlassen.

Es wird dringend empfohlen, eine unabhängige finanz-, rechts- und steuerberatung einzuholen, bevor sie mit einem devisen- oder spothandel mit metallen beginnen. Nichts auf dieser website sollte als hinweis von tickmill oder einem seiner verbundenen unternehmen, direktoren, leitenden angestellten oder mitarbeitern gelesen oder ausgelegt werden.

Die dienstleistungen von tickmill und die informationen auf dieser website richten sich nicht an bürger / einwohner der vereinigten staaten von amerika und sind nicht zur verteilung an oder nutzung durch eine person in einem land oder einer rechtsordnung bestimmt, in der eine solche verteilung oder verwendung entgegenstehen würde nach lokalen gesetzen oder vorschriften.

PRO ACCOUNT

Dirancang untuk trader berpengalaman yang mengharapkan fitur canggih dan kondisi optimal.

Mengapa memilih akun PRO kami

AKUN PRO

Manfaatkan spread ketat dan komisi kompetitif.

| Deposit minimum | 100 |

|---|---|

| mata uang dasar tersedia | USD, EUR, GBP |

| spread dari | 0.0 pip |

| leverage maks | 1:500 |

| min lot | 0.01 |

| komisi | 2 per sisi per 100.000 yang ditradingkan |

| semua strategi diizinkan | |

| opsi akun syariah bebas swap |

Tradingkan CFD pada 62 pair mata uang, 15 indeks saham, WTI, logam mulia dan obligasi di akun pro anda, dengan spread berfluktuasi mulai dari 0,0 pips.

Anda akan membayar komisi hanya 2 per sisi per lot (0,0020% nosional) pada akun pro anda dalam mata uang dasar dari instrumen trading. Komisi standar kami adalah salah satu yang terendah di dunia.

Contoh: jika anda tradingkan 1 lot di EURUSD, yang memiliki ukuran kontrak sebesar 100,000 EUR, maka komisi anda per sisi yaitu 2 EUR dan 4 EUR round turn.

Meskipun banyak broker yang tidak mengizinkan menempatkan stop dan limit order dekat dengan harga pasar, kami mengizinkan anda untuk melakukan hal itu. Jadi level stop dan limit untuk pengguna akun pro adalah nol.

* tidak ada komisi di CFD pada indeks saham, WTI dan obligasi.

Manfaat dari kondisi trading yang LUAR BIASA

mata uang dasar tersedia: USD, EUR, GBP model eksekusi: NDD tipe eksekusi: market execution rata-rata kecepatan eksekusi: 0.20 detik margin call / stop-out: 100% / 30%

Akses beberapa

INSTRUMEN TERPOPULAR

di pasar finansial

FOREX

INDEKS SAHAM

LOGAM MULIA

OBLIGASI

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

Tickmill – $30 welcome bonus

Tickmill

Promotion name: welcome bonus

Note: this promotion is available to clients of tickmill ltd (FSA SC regulated) only.

How to get:

1. Start registering your client area at tickmill.

2. Tick the “yes” box to the welcome account question.

3. Click the validation link you’ll receive via email.

4. Enjoy trading on your welcome account.

Withdrawal requirements:

you can withdraw 30-100 USD of profits after you pass verification process and make at least $100 deposit.

More information:

welcome bonus is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya and european union countries. This no-deposit promotion is available to new clients. Hedging trading is prohibited.

Information about the broker:

tickmill is a forex broker operated by tickmill ltd. Located in seychelles and regulated by the financial services authority of seychelles. Tickmill is also a trading name of tmill UK limited a company regulated by the financial conduct authority (FCA). Broker offers classic, ECN pro and VIP accounts. The minimum starting deposit is $€£100, spreads start from 0.0 pips, maximum leverage is 1:500. Broker review.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

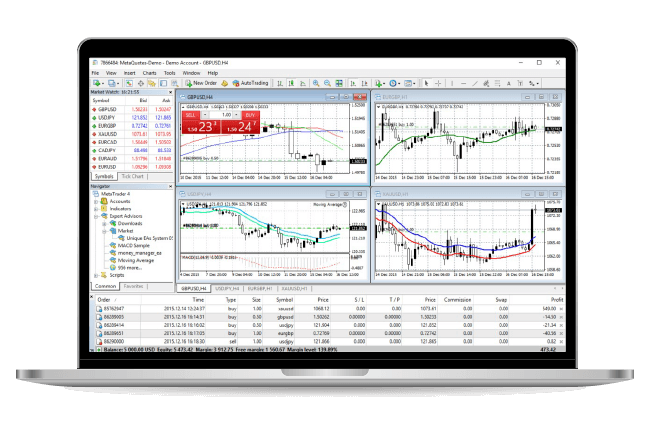

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill pro account

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Indonesian

- Español

- 中文

- Việt nam

- 한국어

- ภาษาไทย

- Portuguese

- العربية

- Türkçe

- Bahasa melayu

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

So, let's see, what we have: designed for traders who expect advanced features and optimal conditions, our pro account is an ideal stepping stone to the world of CFD trading. At tickmill pro account

Contents of the article

- Top-3 forex bonuses

- PRO ACCOUNT

- Why choose our PRO account?

- PRO ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- PRO ACCOUNT

- Mengapa memilih akun PRO kami

- AKUN PRO

- Akses beberapa INSTRUMEN...

- MULAI TRADING dengan tickmill

- Mudah dan cepat untuk bergabung!

- REGISTER

- BUAT AKUN

- BUAT DEPOSIT

- INSTRUMEN TRADING

- KONDISI TRADING

- AKUN TRADING

- PLATFORM

- EDUKASI

- KEMITRAAN

- PROMO

- TENTANG KAMI

- SUPPORT

- Mudah dan cepat untuk bergabung!

- CLASSIC ACCOUNT

- Why choose our classic account?

- CLASSIC ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- AKAUN PRO

- Kenapa memilih akaun PRO kami

- AKAUN PRO

- Akses sebahagian daripada ...

- MULA BERDAGANG dengan tickmill

- Ia mudah dan pantas untuk menyertai!

- DAFTAR

- BUAT AKAUN

- MEMBUAT DEPOSIT

- INSTRUMEN DAGANGAN

- TRADING CONDITIONS

- AKAUN PERDAGANGAN

- PLATFORMS

- PENDIDIKAN

- PERKONGSIAN

- PROMOSI

- TENTANG KAMI

- SOKONGAN

- Ia mudah dan pantas untuk menyertai!

- PRO KONTO

- Warum sollten sie unser PRO...

- PRO KONTO

- Zugang zu den POPULÄRSTEN...

- STARTEN SIE IHR TRADING mit...

- Es geht einfach und schnell!

- REGISTRIEREN

- KONTO ERÖFFNEN

- EINE EINZAHLUNG VORNEHMEN

- Handelsinstrumente

- Handelsbedingungen

- Handelskonten

- Plattformen

- Weiterbildung

- Werkzeuge

- Partnerschaften

- Über uns

- Kundendienst

- Es geht einfach und schnell!

- PRO ACCOUNT

- Mengapa memilih akun PRO kami

- AKUN PRO

- Akses beberapa INSTRUMEN...

- MULAI TRADING dengan tickmill

- Mudah dan cepat untuk bergabung!

- REGISTER

- BUAT AKUN

- BUAT DEPOSIT

- INSTRUMEN TRADING

- KONDISI TRADING

- AKUN TRADING

- PLATFORM

- EDUKASI

- KEMITRAAN

- PROMO

- TENTANG KAMI

- SUPPORT

- Mudah dan cepat untuk bergabung!

- Tickmill – $30 welcome bonus

- Tickmill

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill pro account

- Client area registration 1/2