100% bonus

IR-2020-216, september 21, 2020 for details on claiming the deduction, see the final regulations and the instructions to form 4562, depreciation and amortization (including information on listed property).

Top-3 forex bonuses

IRS finalizes regulations for 100 percent bonus depreciation

More in news

- Topics in the news

- News releases

- Multimedia center

- Tax relief in disaster situations

- Tax reform

- Taxpayer first act

- Tax scams/consumer alerts

- The tax gap

- Fact sheets

- IRS tax tips

- E-news subscriptions

- IRS guidance

- Media contacts

- IRS statements and announcements

IR-2020-216, september 21, 2020

WASHINGTON — the treasury department and the internal revenue service today released the last set of final regulations implementing the 100% additional first year depreciation deduction that allows businesses to write off the cost of most depreciable business assets in the year they are placed in service by the business.

The 100% additional first year depreciation deduction was created in 2017 by the tax cuts and jobs act and generally applies to depreciable business assets with a recovery period of 20 years or less and certain other property. Machinery, equipment, computers, appliances and furniture generally qualify.

The deduction applies to qualifying property (including used property) acquired and placed in service after september 27, 2017. The final regulations provide clarifying guidance on the requirements that must be met for property to qualify for the deduction, including used property.

Additionally, the final regulations provide rules for consolidated groups and rules for components acquired or self-constructed after september 27, 2017, for larger self-constructed property on which production began before september 28, 2017.

For details on claiming the deduction, see the final regulations and the instructions to form 4562, depreciation and amortization (including information on listed property).

In addition, the treasury department and the internal revenue service plan to issue procedural guidance for taxpayers to opt to apply the final regulations in prior taxable years or to rely on the proposed regulations issued in september 2019.

Tom copeland's taking care of business

The nation’s leading expert on the business of family child care

Home › record keeping & taxes › depreciation and home › questions and answers about the new 100% bonus depreciation rule

Questions and answers about the new 100% bonus depreciation rule

In my recent webinars “what the new tax law means for family child care” I discussed the significant tax changes coming in 2018. I’d previously written an article highlighting these changes.

I answered many questions from providers listening to my webinars. I will post their questions and my answers in this article and several upcoming articles so that everyone can learn from them.

100% bonus depreciation rule

This rule allows providers to deduct in one year, rather than depreciating, most every item you buy that is used in your business. It includes everything except purchasing a home, adding an addition to their home, or making a major structural change to your home. The rule also applies to items you purchased that are used, as well as new.

This means you can deduct your time-space percentage of kitchen or bathroom remodeling, a fence, new driveway or patio, flooring, roof, etc. This is a big deal! So, if you remodeled your kitchen and spent $10,000 and your time-space percentage was 35%, your business deduction is $3,500 that you can deduct in one year. In previous years, you would have had to depreciation the $3,500 over 39 years.

Here were the questions related to this rule:

Q: when does this rule go into effect?

A: it starts for items purchased after september 27, 2017. So, if you bought something after that date in 2017, you could use this rule on your 2017 taxes.

Q: can I choose to depreciate items and spread my deductions over a number of years, rather than using this rule?

A: yes. You can choose to use the 50% bonus depreciation rule to depreciate an item purchased after september 27, 2017. In doing so you would claim half the depreciation in 2017 (or 2018) and depreciate the other half using the regular rules of depreciation. Most providers would benefit by claiming deductions as fast as they can. However, you may have your own reasons for wanting to spread the deduction over a number of years.

Q: if I retire after 2018 is there any negative consequences for using the 100% bonus rule?

A: there is no recapture of the depreciation claimed using the 100% bonus depreciation rule. So, you won’t have to pay back any taxes if you go out of business shortly after using this rule.

Q: is a shed or deck considered an addition to a home and thus not eligible for the 100% depreciation rule?

A: A deck would clearly not qualify for this rule because it would be considered an addition to your home. It’s not clear if a shed would qualify as an addition. If the shed is permanently attached to the land, I would probably count this as an addition. If not, I wouldn’t, and thus it would be eligible for this rule. A garage would be considered an addition, as would a barn.

Q: I had a new driveway poured. Is that a land improvement and can I use the 100% rule?

A: any item that is permanently attached to your land would be considered a land improvement. This would include a fence, patio and driveway. Land improvements are eligible for the 100% rule. The same answer would be if you widened your driveway.

Q: if I bought a land improvement after september 27, 2017 is that a 100% expense for 2017 or 2018?

Q: does a vehicle qualify for the 100% depreciation rule?

A: yes, but vehicles are subject to a limit on how much depreciation you can claim each year. Providers who use the standard mileage rate to claim vehicle expenses cannot depreciate their car. If you use the actual expenses method to claim vehicle expenses you can deduct the business portion of your actual expenses including gas, oil, repairs, car insurance, and vehicle depreciation. The vehicle depreciation deduct is limited to $13,160 in the first year and different limits in subsequent years. So, you can’t claim 100% of the cost in the first year.

Q: if I use the bonus rule on my vehicle that I can no longer claim mileage, true?

Q: how do I claim installing new floors for the main level of my home?

A: the rules are different if you installed them before or after september 27, 2017. If you installed them before that date and the cost was less than $2,500 you can deduct the business portion as a repair and deduct it in one year. If the cost was more than $2,500, and the new floors represented less than half of the total square feet of your home, you can also treat it as a repair and deduct the business portion in one year. If you replaced more than half of the floors, you can use the 50% bonus depreciation rule, claim half the depreciation in 2017 and depreciate the other half over 39 years as a home improvement. If you bought it after september 27, 2017 you can deduct the business portion in one year using the 100% bonus depreciation rule.

Q: does the 100% rule apply to replacing an enclosed porch with a solarium?

A: it sounds like you are remodeling the porch. If so, the 100% rule applies. If you are tearing down the old porch and building a new solarium, this would be a home addition which would not qualify for this rule.

Q: can you claim all the remaining depreciation in 2018 on items you were depreciating in earlier years?

A: no. Once you start depreciating an item under a particular depreciation rule, you must continue to depreciate it under that rule, even if rules change in later years. So, if you were depreciating a kitchen remodeling project from 2010 over 39 years, you must continue to depreciate it under the 39 year rule.

Q: can I depreciate solar panels?

A: yes, you can use the 100% rule on solar panels.

Q: how do I deduct an addition to my home?

A: since an addition is not eligible for the 100% bonus depreciation rule, you must depreciate it over 39 years, but you can use the 50% bonus depreciation rule.

Q: how long is the 100% bonus rule going to last?

A: for five years through 2022. After than the percentage declines. But who knows what congress will do by then!

Upcoming webinars and a special deal

I am doing a series of tax and record keeping webinars over the next several months, sponsored by the national association for family child care. They are offering a special $15 discount if you register for all of these four webinars.

In future articles I will address the other questions asked during these webinars.

Purchase points at 0.5 cents a piece, with hilton 100% bonus promotion

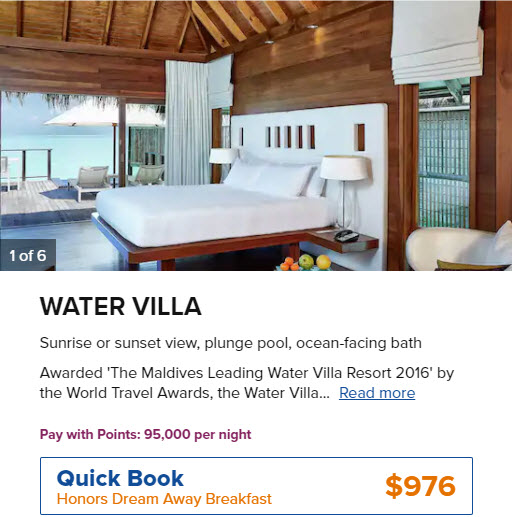

This Q1 promotion, hilton 100% bonus on purchase of 5,000 points or more, is now available until march 5, 2021 . This is as good an opportunity to top up accounts towards a redemption or buy points outright for a planned stay. Purchasing hilton points at 0.5 cents a piece offer great value when redeeming at the highest tier properties – think over water bungalows!

HILTON 100% BONUS ON POINTS PURCHASE

With this promotion you can purchase as little as 5,000 points for $100 or as much as 160K points for $800! Note that you can purchase up to 80,000 hilton honors points in a calendar year, not including the bonus. Since you can combine points across household accounts, you can choose to purchase 80K on each account. I value hilton points at

0.6 CPM and this promotion yields 0.5 CPM, a great value! Purchase of 80K points would yield a total of 160K points for $800.

Given that highest category hilton redemptions can range between 80K-95K per night, it is nice to see that the promotion allows a redemption with outright purchase of points. Very handy for anyone dreaming up a maldives vacation – conrad maldives rangali island, which books directly into the water villa on points – 95,000/nt, can be had for $475 using this points promotion. Compare that to the avg cash price of

There is also incredible value to be had when redeeming low-mid tier category hotels in the hilton portfolio. Remember, the ‘5th night free’ benefit which can add another layer of savings.

‘travel is free’ has a good post on best use of hilton hhonors points, and also worth reading is ‘god save the points’ post on five fantastic hilton bookings for 10K points

Hilton 100% bonus on purchased points @0.5 cpm is as good a sale but please do not buy without a use or plan in mind.

Terms and conditions of the promotion:

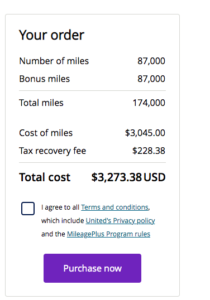

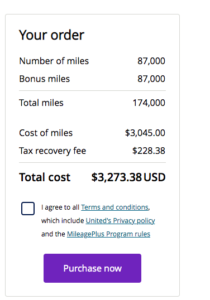

Buy united mileageplus miles with a 100% bonus, @1.88 cpp

Like many recent promotions, this one is also tiered (image courtesy united.Com)

United is currently selling mileageplus miles with up to a 100% bonus. This limited time promotion ends on january 31, 2021. When you max out the whole deal, you’ll get the 100% bonus when you buy mileageplus miles, at a rate of 1.88 cent per point. However, is this a good deal? Let’s have a look.

100% bonus when you buy united mileageplus miles

After logging into my account, I found that I was targeted for a 100% bonus. You can click here to find out which bonus you are targeted for.

Buy miles with up to a 100% bonus

- 30% bonus when you buy 5,000 miles or more

- 60% bonus when you buy 15,000 miles or more

- 100% bonus when you buy 40,000 miles or more

If you max out the promotion, you’ll buy miles at 1.88 cpp

A few things to note before you buy miles with this promotion:

- You can buy a maximum of 175,000 per account per calendar year

- Miles purchased do not count toward elite status

- Mileage purchases are not refundable

Should you buy miles?

Now you may ask whether it makes sense to buy miles or points in advance, even when they’re sold at a discount. Here’s how I view that decision.

You should buy miles/points if you:

- Have an upcoming trip and you’re falling short by a few miles to book it

- Want to buy miles for a very specific trip that will give you outsized value. For example, I often purchase miles during promotional periods when I know I can book a business class ticket which will give me a value of over 5 cpp on miles purchased at 1.5-2 cpp

- Are ineligible for a credit card sign-up bonus for that points currency due to restrictions by the card issuer

You should not buy miles/points if you:

- Can easily transfer flexible points like amex membership rewards or chase ultimate rewards to top up your balance to book an upcoming trip

- Are simply purchasing miles to increase your balance without any specific use on the horizon

- Can easily rack up enough miles or points via credit card sign-up bonuses

The pundit’s mantra

If you have an upcoming trip, then it may make sense to buy miles with this promotion. However, given how travel is shaping up, signing up for credit cards and obtaining welcome bonuses may be a better option.

For example, you can sign up for chase’s credit cards and transfer miles to united at a 1:1 ratio. Currently, chase’s ink cards are offering some great limited time welcome bonus offers. You can earn a welcome bonus of 100,000 ultimate rewards points with the chase ink business preferred credit card. Similarly, the chase ink cash and the chase ink unlimited cards are also offering amazing welcome bonuses of 75,000 ultimate rewards points or $750 each. On the personal side, the chase sapphire preferred continues to offer a decent welcome bonus offer of 60,000 ultimate rewards points.

Disclosure: our advertising partners may pay us a small commission if you click on some of the links in this blog post, at no extra cost to you. The points pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links . This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Never miss out on the deals, analysis, news and travel industry trends. Like us on facebook , follow us on instagram and twitter and get the latest content!

IRS finalizes regulations for 100 percent bonus depreciation

More in news

- Topics in the news

- News releases

- Multimedia center

- Tax relief in disaster situations

- Tax reform

- Taxpayer first act

- Tax scams/consumer alerts

- The tax gap

- Fact sheets

- IRS tax tips

- E-news subscriptions

- IRS guidance

- Media contacts

- IRS statements and announcements

IR-2020-216, september 21, 2020

WASHINGTON — the treasury department and the internal revenue service today released the last set of final regulations implementing the 100% additional first year depreciation deduction that allows businesses to write off the cost of most depreciable business assets in the year they are placed in service by the business.

The 100% additional first year depreciation deduction was created in 2017 by the tax cuts and jobs act and generally applies to depreciable business assets with a recovery period of 20 years or less and certain other property. Machinery, equipment, computers, appliances and furniture generally qualify.

The deduction applies to qualifying property (including used property) acquired and placed in service after september 27, 2017. The final regulations provide clarifying guidance on the requirements that must be met for property to qualify for the deduction, including used property.

Additionally, the final regulations provide rules for consolidated groups and rules for components acquired or self-constructed after september 27, 2017, for larger self-constructed property on which production began before september 28, 2017.

For details on claiming the deduction, see the final regulations and the instructions to form 4562, depreciation and amortization (including information on listed property).

In addition, the treasury department and the internal revenue service plan to issue procedural guidance for taxpayers to opt to apply the final regulations in prior taxable years or to rely on the proposed regulations issued in september 2019.

Buy united mileageplus miles with a 100% bonus, @1.88 cpp

Like many recent promotions, this one is also tiered (image courtesy united.Com)

United is currently selling mileageplus miles with up to a 100% bonus. This limited time promotion ends on january 31, 2021. When you max out the whole deal, you’ll get the 100% bonus when you buy mileageplus miles, at a rate of 1.88 cent per point. However, is this a good deal? Let’s have a look.

100% bonus when you buy united mileageplus miles

After logging into my account, I found that I was targeted for a 100% bonus. You can click here to find out which bonus you are targeted for.

Buy miles with up to a 100% bonus

- 30% bonus when you buy 5,000 miles or more

- 60% bonus when you buy 15,000 miles or more

- 100% bonus when you buy 40,000 miles or more

If you max out the promotion, you’ll buy miles at 1.88 cpp

A few things to note before you buy miles with this promotion:

- You can buy a maximum of 175,000 per account per calendar year

- Miles purchased do not count toward elite status

- Mileage purchases are not refundable

Should you buy miles?

Now you may ask whether it makes sense to buy miles or points in advance, even when they’re sold at a discount. Here’s how I view that decision.

You should buy miles/points if you:

- Have an upcoming trip and you’re falling short by a few miles to book it

- Want to buy miles for a very specific trip that will give you outsized value. For example, I often purchase miles during promotional periods when I know I can book a business class ticket which will give me a value of over 5 cpp on miles purchased at 1.5-2 cpp

- Are ineligible for a credit card sign-up bonus for that points currency due to restrictions by the card issuer

You should not buy miles/points if you:

- Can easily transfer flexible points like amex membership rewards or chase ultimate rewards to top up your balance to book an upcoming trip

- Are simply purchasing miles to increase your balance without any specific use on the horizon

- Can easily rack up enough miles or points via credit card sign-up bonuses

The pundit’s mantra

If you have an upcoming trip, then it may make sense to buy miles with this promotion. However, given how travel is shaping up, signing up for credit cards and obtaining welcome bonuses may be a better option.

For example, you can sign up for chase’s credit cards and transfer miles to united at a 1:1 ratio. Currently, chase’s ink cards are offering some great limited time welcome bonus offers. You can earn a welcome bonus of 100,000 ultimate rewards points with the chase ink business preferred credit card. Similarly, the chase ink cash and the chase ink unlimited cards are also offering amazing welcome bonuses of 75,000 ultimate rewards points or $750 each. On the personal side, the chase sapphire preferred continues to offer a decent welcome bonus offer of 60,000 ultimate rewards points.

Disclosure: our advertising partners may pay us a small commission if you click on some of the links in this blog post, at no extra cost to you. The points pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links . This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Never miss out on the deals, analysis, news and travel industry trends. Like us on facebook , follow us on instagram and twitter and get the latest content!

Get 100% bonus

Start trading forex with double deposit

100% BONUS*

Loyalty program

* limited offer

Promocode:

BONUS100

Exceptional trading conditions

1:1000

Double your deposit in 3 simple steps

Register and open

live account

Use the promocode

while deposit

That is it. Enjoy

the trading with tifia

100% BONUS terms and conditions

- Promo-code for getting a bonus is BONUS100.

- To get a 100% bonus, a client must activating the promocode by entering the promo-code when depositing via tifia client’s profile. The bonus will be paid into the account automatically right after the account has been topped up.

- By activating the promo-code for bonus getting clients automatically confirm that they have read and agreed with these terms and conditions.

- The promo-bonus applies to the following types of account: START, ECN CLASSIC.

- The promo-code may be activated till 31.12.2021.

- A client may use this promo-code for each deposit more than $10.

- The bonus is credited only for external deposits. The bonus will not be credited for internal transfers between client’s trading accounts.

- Participation in the promotion is available to all registered tifia's clients from next countries: brunei, china, hong kong, india, indonesia, macao, malaysia, nigeria, the philippines, singapore, south africa, sri lanka, thailand, timor-leste, united arab emirates, vietnam, costa rica, el salvador, guatemala, honduras, mexico, nicaragua, panama, argentina, bolivia, brazil, chile, colombia, ecuador, guyana, paraguay, peru, uruguay, venezuela, cuba, dominican republic, haiti, puerto rico.

- One trading account can only have one type of bonus credited at a time.

- Maximum leverage on trading accounts participating in the promotion cannot exceed 1:1000.

- The bonus funds are added to the field "credit" of trading account and may be used for trading as additional margin.

- The bonus is company's own funds credited to a trading account as a percentage of its deposit. The maximum total bonus amount credited to one trading account under this promotion is $5000 (or the equivalent in the currency of a trading account).

- Any profit made on account with bonus funds may be immediately withdrawn without any limitations.

- The bonus validity period is 90 calendar days from the day it was accrued to the account.

- If, after the withdrawal, the available balance on the account is less than that amount of the deposit, which the bonus was accrued on, the bonus size is being reduced proportionally to the available funds on the account.

- The bonus funds will be deducted if stop out happens in the account.

- The bonus will be cancelled automatically as soon as the trading account's funds (in the equity field) reach or become less than the level of 120% of the received bonus amount.

- Tifia has the right to cancel the bonus promotion or change promotion terms at any time without prior notice.

- Tifia has the right to request client’s any identity information and documents for verification. If client refuse to provide such information, tifia has a right to cancel the bonus and all trades made after getting a bonus funds.

- Tifia has the right to correct the results of a client’s trades on suspicion of "bonus hunting" activities or any other fraudulent actions as to bonus funds. A part of a trading result which was earned by use of bonus funds shall be cancelled. An insufficient trading activity in the account, such as execution of a single high-volume trade or several trades of lower volume conducted at the same rate and at nearly the same time, which represents a subdivision of a big trade into smaller ones, may serve as the reason for revising the results. As a rule, there is no sufficient trading history in such accounts. In case of detecting such trades, the company may cancel the bonus at any time and without preliminary notice.

- Tifia has the right to refuse a bonus providing or cancel a bonus and void the results of each trades made by using bonus funds without explanation. The reasons may include the following violations:

- violation of these conditions of the promotion or any provisions of the main regulatory documents of the company;

- suspicion of fraudulent activities with an aim of bonus hunting;

- suspicion of registration of several client profiles by one individual for bonus using;

- incorrect personal data indicated in the client profile and/or the absence of full profile verification;

- imitation of trade using locked positions on the trading account;

- opening of opposite positions of equal volume approximately and at the same time approximately on different trading accounts belonging to the same individual.

Risk warning. Trading on financial markets carries risks. Contracts for difference (‘cfds’) are complex financial products that are traded on margin. Trading cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Click here for our full risk disclosure.

Our company’s service is not provided to the citizens (residents) of the united states of america, canada, israel, belgium, japan and the republic of vanuatu and citizens of any state or country where the service is not made available.

- tifia markets limited is licensed as a "dealer in securities" (registration number 40209) by the "ministry of finance and economic management" and regulated in accordance with the "dealers in securities (licensing) act [CAP.70]" of the republic of vanuatu. The company address: govant building, BP 1276 port vila, the republic of vanuatu.

- About us

- Why us?

- Our news

- Legal information

- Contact us

- Feedback

- Contacts

- Forex trading

- Trading accounts

- Try on demo

- Trading instruments

- ECN system

- MT4 trading platform

- MT5 trading platform

- Financial markets analysis

- Analytics from claws & horns

- Promotions

- All promotions

- Forex cashback

- Forex tools

- Trader's calculator

- Economic calendar

- Deposit/withdrawal

- Partnership

- For partners

- Partners' commissions

- Regional representative

- The bonus can only be received on a standard account.

- The bonus will be available to everyone who makes a deposit of N20,000 or more. I.E.. Anytime you make a deposit (of N20,000 or more) you will get the 100% bonus provided you do not have an active 100% bonus.

- All profit from trading with the bonus can be withdrawn without any condition.

- No part of the bonus can be withdrawn.

- No part of the bonus can be lost.

- Once the client has lost/withdrawn all but an amount equal to 15% of the given bonus amount, of their own funds, the bonus will be canceled.

- The bonus will basically be claimable at the point of making a deposit of N20,000 or more.

- No other bonus can be applied for while the 100% bonus is active.

- Withdrawing a part of the client's capital will lead to cancelling a part of the bonus such that the bonus will equal the client's own fund.

- The company reserves the right to amend or modify the campaign terms without prior notice.

- PRIMUS MARKETS promotes a 100% credit and USD 4 (for ECN premier accounts) and USD 2 (for variable spread accounts) cashback on every standard lot traded (whereby a lot represents 100,000 units) for ECN and variable spreads respectively (the “offer”) to its clients. The offer is subject to the terms and conditions contained in the present document and subject to all existing PRIMUS MARKETS terms and conditions.

- By registering, opening a live account, and or accepting the terms and conditions within the applicable landing pages and/or client member’s area, the trader is acknowledging that they have read, understood and agree to be bound by the terms and conditions of this offer.

- This offer is eligible to existing and new clients of PRIMUS MARKETS who deposit or redeposit into their live individual, joint, or corporate ECN premier or variable trading account, and who trade with any instrument offered by PRIMUS MARKETS excluding US equities. Micro accounts are excluded.

- If the clients account is being managed within a multi-account-manager (MAM) or PAMM, in order to participate in this offer, the client must register and open a new separate self-directed trading account.

- US equity trading instruments will NOT be paid a rebate on any trading volume as part of this offer.

- The minimum deposit to apply for the offer is USD 500 or currency equivalent. Additional deposits of any amount will increase the bonus amount by the respective amount deposited, the maximum credit that can be obtained via the offer is USD 10,000.00 or currency equivalent. After the account has received USD 10,000 in bonus credit funds, additional deposits will not increase the bonus amount.

- The maximum leverage offered with this offer is 300:1. If your existing account leverage is greater than the maximum leverage (300:1), by accepting the terms and conditions, you agree that your account leverage will be instantly reduced to 300:1. PRIMUS MARKETS is not liable for any loss due to the reduction in leverage.

- This offer is limited to one (1) account per client and per IP address only, regardless of the numbers of accounts held by the client.

- The offer may be used as a method to increase the maximum potential net position.

- The stop-out level for accounts included in this promotion is at 30%. Once your margin level reaches 30% the system will start closing your positions automatically, the position with the highest loss will close first.

- Each time 1.0 lot is traded, the respective spread cashback (USD 4 or USD 2) or currency equivalent will be transferred from ‘credit’ to ‘balance’. Cashbacks are applied when a trade is closed (a trade must be closed for the cashback to be triggered). Should the bonus be lost and open positions remain, the client will not receive cashback for those open positions upon closing.

- Positions open for less than one minute are not eligible to get cashback; positions open for more than one minute, but less than two minutes qualify for 50% of the stated cashback amount.

- Should the account equity equal the offer amount, then the credited amount will be automatically removed from the client’s account.

- The english version of this document shall supersede, in the incidence of any discrepancy in the terms of this offer, once translated into other languages.

- The 100% bonus part of the offer is for trading purposes only and cannot be withdrawn nor be lost.

- Any withdrawal made from the client’s account will result in the bonus credit being fully removed.

- Internal MT4 to MT4 transfers, to or from the offer account, are not permitted. If an internal transfer is requested, the 100% bonus part of the offer will be removed.

- Under no circumstances shall PRIMUS MARKETS be liable for any consequences of any offer cancelation or decline, including, but not limited to order(s) closure by stop out.

- Table of examples of the 100% bonus part of the offer:

- This offer cannot be combined with any other bonus or cashback based on trading volume which PRIMUS MARKETS may offer. Should a client’s trading account already have an existing bonus, then they will not be able to opt in to this promotion OR by accepting these terms and conditions, the client also accepts that the previous bonus will be removed prior to the new offer being applied.

- If PRIMUS MARKETS suspects or has reason to believe that a client has abused or attempted to abuse the terms of this offer or any other offer presented by PRIMUS MARKETS, or has acted in bad faith, PRIMUS MARKETS reserves the right, at its sole discretion, to deny, withhold, withdraw or terminate from that client the offer and, if necessary: (i) to withhold, cancel and subtract from that client’s account(s), (ii) to terminate that client’s access to services provided by PRIMUS MARKETS and/or terminate the contract between PRIMUS MARKETS and the client for the provision of services (iii) to block that client’s account(s) (however, save it where otherwise required by a relevant authority) and to arrange for the transfer of any unused balance, less the offer amount as well as any profits which the company deems to have been gained via abusive behavior, to the client. Where abusive behavior includes but is not limited to:

- A) where a client, by himself or acting with others (including an business introducer/ affiliate) established a trading position or positions which have the purpose or effect of extracting the credit provided and/ or profits generated by the offer, without exposure to economic risk, including without limitation loss of the offer or the client’s capital (or the capital of others).

- B) where the client, by himself or acting with others (including an business introducer/ affiliate) hedges his positions, including without limitation, holding open position(s) in one direction, including by way of illustration only, single or correlated currencies, at given periods, internally (using other trading accounts held with PRIMUS MARKETS or externally (using other trading accounts held with other brokers).

- In the event an account has open positions or a floating profit/loss and the offer amount is removed for any reason, PRIMUS MARKETS will not be liable for any adverse effects.

- In the event that an account qualifies as inactive all bonuses and promotion credits will be automatically removed.

- It is important that eligible clients are aware that their risks are not limited to their deposit(s) and that by making a qualifying trade it is possible to lose more than their deposit. In some circumstances, losses may be considerably more than any initial or minimum deposit.

- PRIMUS MARKETS reserves the right, at its sole discretion, to alter, amend or terminate the offer, or any aspect of it, at any time and without prior notice.

- Top-3 forex bonuses

- IRS finalizes regulations for 100 percent bonus...

- Tom copeland's taking care of business

- The nation’s leading expert on the business of...

- Questions and answers about the new 100% bonus...

- Purchase points at 0.5 cents a piece, with hilton...

- Buy united mileageplus miles with a 100% bonus,...

- IRS finalizes regulations for 100 percent bonus...

- Buy united mileageplus miles with a 100% bonus,...

- Get 100% bonus

- Start trading forex with double deposit

- Exceptional trading conditions

- Double your deposit in 3 simple steps

- 100% boom bonus

- 100% boom bonus

- 100% BONUS ON ALL DEPOSITS " > 100% BONUS ON ALL...

- Receive a $4 cashback on every lot traded." >up...

- Take advantage of this incredible offer!

100% boom bonus

100% boom bonus

The 100% boom bonus gives experienced forex traders like you the exclusive access to more trading funds in order to be able to trade higher lot sizes and take bigger profits.

The bonus is available to both new and existing standard account holder on a deposit of N20,000 and above!

As an existing trader with 7bforex, you only need to initiate a minimum deposit of N20,000 and claim the bonus from your client cabinet.

However, if you are new to 7bforex, you need to open a live account and complete your verification to enjoy the bonus.

Note: bonus is available for trading purposes only, hence, it cannot be withdrawn.

TERMS & CONDITIONS

Clicking 'apply for 100% boom bonus' means you also accept the 7bforex client agreement

100% BONUS ON ALL DEPOSITS " > 100% BONUS ON ALL DEPOSITS

Receive a $4 cashback on every lot traded." >up to $10,000 per account!

Receive a $4 cashback on every lot traded.

Join FXPRIMUS and we’ll match your deposits

Up to $10000 plus up to $4 cashback on every lot traded

Take advantage of this incredible offer!

PRIMUS MARKETS is delighted to present our valued clients with the incredible 100% deposit bonus on up to $10,000 plus up to $4 cashback for every lot traded!

Be rewarded with this incredible offer which is available for a limited time. Trade forex, commodities, energies, indices and cryptocurrencies with PRIMUS MARKETS, and benefit from one of the safest and most rewarding online trading environments, powered by the 100% deposit bonus.

We look forward to supporting you through your trading journey to success! Scroll down to the bottom of this page to see the T&C of this promotion.

Terms & conditions

This 100% bonus is open to new and existing clients who deposit or redeposit into their live individual, joint, or corporate ECN or variable trading account with PRIMUS MARKETS INT limited (hereinafter ‘PRIMUS MARKETS). With the 100% bonus PRIMUS MARKETS will deposit 100% credit into the trading account of the client and offer a cashback on every lot traded, subject to the terms and conditions below.

This offer commences on 1st february 2016 and is valid until the 30th of april 2021, whereby the promotion will expire.

Terms and conditions:

| your deposit | bonus (credit) calculation | your bonus (credit) | your equity |

| USD 500 | 100% on USD 500 | USD 500 | USD 1000 |

| USD 1,000 | 100% on USD 1,000 | USD 1,000 | USD 2,000 |

| USD 10,000 | 100% on USD 10,000 | USD 10,000 | USD 20,000 |

| USD 30,000 | maximum USD 10,000 | USD 10,000 | USD 40,000 |

| USD 50,000 | maximum USD 10,000 | USD 10,000 | USD 60,000 |

Copyright © 2020 PRIMUS MARKETS. All rights reserved

so, let's see, what we have: IR-2020-216, september 21, 2020 — the treasury department and the internal revenue service today released the last set of final regulations implementing the 100% additional first year depreciation deduction that allows businesses to write off the cost of most depreciable business assets in the year they are placed in service by the business. At 100% bonus