Online forex trading brokers

Maximum leverage: 50:1 on major currencies, 20:1 on minors pricing: spread

Top-3 forex bonuses

Best online brokers for forex trading in january 2021

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world's most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

Popular searches

If you're looking to get in on this action, you'll need a broker who deals in currency, and many of the big names in stock trading simply don't offer this feature. Because the markets are so different, you'll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you're targeting, you'll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker's spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that's how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won't accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker's highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you'll need to get approval to trade futures, and pricing uses the broker's futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker's STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it's the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don't intend to actually trade. Given the difficulty of forex trading, that's a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it's open to american investors. It's a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn't offer traditional currency trading, but it does bring the slick, easy-to-use interface it's known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You'll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

Forex trading and brokers

The foreign exchange market – also known as forex or just FX – is a decentralized global market for the trading of currencies. In terms of trading volume, this is by far the largest market in the world.

The foreign exchange market is not one specific exchange (such as the new york stock exchange or the london stock exchange). Instead, financial centers around the globe function as hubs or anchors of trading in a network that includes various participants, including large international banks.

The history of foreign exchange trading is very old. As long as there have been different currencies, there have been people wishing to exchange one currency for another. A merchant that traveled from his home to other parts of the world to obtain foreign goods would for instance need to exchange his currency one or more times along the way, both to be able pay for his own needs as he traveled and to make sure he had an accepted currency available when he reached sellers of desirable goods. In major trading hubs, such as capital cities and important ports, professional money changers would be present to cater to these needs and make a profit from the fluctuating exchange rates.

The modern foreign exchange market that we know today emerged in the 1970s, as countries gradually switched from controlled exchange rates to floating exchange rates for their national currency.

FOREX brokers

A FOREX broker is a company that provides retail investors with access to a FOREX trading platform that enables the investors to buy and sell currencies. Most brokers offer a wide selection of different leveraged FOREX products that make it possible to earn high returns from small market movements. The leverage also increases potential loses and leverage trading is a type of high-risk trading.

Your primary goal when comparing FOREX brokers should be to find one which is regulated by a trusted financial institution, and that has a good reputation on the market. You should also compare the spread they charge as well as the overnight fees. A small spread makes it a lot easier to make money. If you want to be able to use a certain FOREX trading platform then you need to make sure that the broker allows you to use said platform. Not all brokers provide access to the same platforms. Metatrader4 is by many considered the best forex trading platform for beginners but other platforms such as ninjatrader and algotrader are also popular.

Characteristics of the foreign exchange market

- Huge trading volume

- High liquidity, especially for the most frequently traded currency pairs

- Trading from 22:00 GMT on sunday to 22:00 GMT on friday.

- Decentralization and geographical dispersion

- Low margins of relative profit

- Using leverage is very common among traders

The interbank market

The interbank market is the top-level foreign exchange market. This is where major banks exchange currencies with each other, either directly or through electronic brokering platforms. The two major platforms are the electronic broking services (EBS) and thomson reuters dealing. Together, they have over 1,000 banks as their clients.

The interbank market is decentralized; there is no specific building that you can visit where the transactions are taking place.

The thee main constituents of the interbank market are the spot market, the forward market and SWIFT.

- The spot marketthis is where currencies are traded for immediate delivery.

- The forward marketthis is where contracts for future delivery is traded.

- SWIFT = society for world-wide internbank financial telecommunications.This is a network used to send and receive information about financial transaction. A majority of the international interbank messages are sent through SWIFT. Data from the year 2015 shows that over 11,000 financial institutions in more than 200 countries and territories use SWIFT.

Currency pairs

The four most frequently traded pairs are:

EUR/USD: the euro and the U.S. Dollar

USD/JPY: the U.S. Dollar and the japanese yen

GBP/USD: the british pound sterling and the U.S. Dollar

USD/CHF: the U.S. Dollar and the swiss franc

Retail foreign exchange trading

Retail foreign exchange trading is a small segment of the foreign exchange market. This segment developed fairly recently, when internet made it feasible to offer platforms for very small-scale forex trading.

Many individuals that are engaging in retail foreign exchange trading do it as a hobby, enjoying the excitement that the trading brings while also – hopefully – making some long-term profits.

If you want to try retail foreign exchange trading, you need to sign up with one of the companies that provide this service, and then make a deposit into your trading account. Many providers will offer you the option of partly trading on credit, where the size of the credit is determined by how much money or other valuables you have in your account. This is known as margin trading or leverage, and it means that even if you just deposit $100 into your account, you can start doing fairly big trades on the platform right away. Naturally, using credit to speculate on the currency market is very risk and you can end up owning the provider much more money than what you deposited.

Background

The first trading platforms for retail forex trading began to appear in the mid-1990s as private internet connections became more widespread than before. In the early days, you had to download the trading software and install it on your computer. Eventually, web-based interfaces were developed where you could trade directly in your web browser without the need to download and install a program.

As technical analysis grew increasingly popular among retail traders, more and more trading platforms began to include charting tools and other useful aids for technical analysis. News feeds are another popular feature in modern platforms, as is automated trading tools. During recent years, social trading has started to catch on, but this field is still in its infancy.

Best online brokers for forex trading in january 2021

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world's most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

Popular searches

If you're looking to get in on this action, you'll need a broker who deals in currency, and many of the big names in stock trading simply don't offer this feature. Because the markets are so different, you'll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you're targeting, you'll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker's spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that's how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won't accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker's highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you'll need to get approval to trade futures, and pricing uses the broker's futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker's STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it's the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don't intend to actually trade. Given the difficulty of forex trading, that's a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it's open to american investors. It's a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn't offer traditional currency trading, but it does bring the slick, easy-to-use interface it's known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You'll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

Best US forex brokers 2021

The foreign exchange market is more active than any other financial market in the world, with over $5 trillion swapping hands every day. This guide is focused on assisting US traders in finding the best forex broker for their style of trading.

We break down the best us forex brokers for commissions & spreads, trading platforms, execution, and overall quality. All of the top forex brokers we cover are regulated and licensed in the US by the national futures association (NFA) and meet a strict set of criteria, ensuring protection from forex scams.

For a more in-depth comparison of top US brokers, or if you are trading outside of the US, visit our sister site forexbrokers.Com. Our annual FX broker review covers the top brokers for 2020, with over 50,000 words of research and 5,000+ data points spanning 30 firms.

Best US forex brokers 2021

- IG - best overall

- TD ameritrade - currency trading with thinkorswim

- Forex.Com - best for ease of use

- Interactive brokers - best for professionals

As an early pioneer in offering contracts for difference (cfds) and spread betting, IG was founded in 1974 and has grown to be a global leader in the online trading industry. IG is a london-based public company listed on the london stock exchange’s FTSE 250 (LON: IGG). Read full review

- Total forex pairs offered: 91

- Likes: comprehensive research tools and real-time exchange data; broad range of markets, currency pairs, and multi asset cfds (including cryptocurrencies); licensed in major regulatory jurisdictions; competitive commission-based pricing and spreads on forex.

- Dislikes: web platform trading windows must be resized manually to keep the layout organized; forex direct only available to professional traders within EU.

- Bottom line: forex and CFD traders looking to trade a large number of instruments across multiple asset classes, including exchange-traded securities on international exchanges, will find IG offers an extensive range of tradable products on its platforms.

- Visit site

TD ameritrade's desktop trading platform, thinkorswim, offers an impressive combination of both design and functionality. The platform has virtually anything you could want, including live CNBC tv, trade alerts, real-time scanning, and practically every technical indicator under the sun for charting. Read full review

- Total forex pairs offered: 75

- Likes: powerful desktop charting that syncs with mobile; wide array of premium research and trading tools through thinkorswim platform; futures and options trading on forex and bitcoin futures.

- Dislikes: forex only available to US residents; no web-based platform offered for forex; platform complexity may deter beginners.

- Bottom line: for US-based investors and traders, TD ameritrade’s thinkorswim platform is a sophisticated multi-asset desktop experience optimized for securities trading, including off-exchange spot forex and exchange-traded options and futures (including bitcoin).

- Visit site

Forex.Com (gain capital) is known for providing forex traders a well-rounded offering. Like TD ameritrade and interactive brokers, it is also publicly traded and offers fx traders a large variety of trading tools. Beyond offering its own propertiary trading platform, forex.Com also offers metatrader4 (MT4) to customers, making it an ideal choice for investors of all experience levels. Read full review

- Total forex pairs offered: 84

- Likes: licensed in highly regulated jurisdictions; advanced charting capabilities in both desktop and web platforms; platforms feature numerous channels of research content and trading ideas; offers cryptocurrency cfds in the UK, and bitcoin futures in the US.

- Dislikes: MT5 not yet rolled out; ceased business of regulated activities in hong kong.

- Bottom line: FOREX.Com has plenty of options for forex and CFD traders across its regulated offerings globally. With full-feature platforms, diverse trading tools, and comprehensive research, FOREX.Com caters to traders of all experience levels.

- Visit site

Professional currency traders should consider interactive brokers. Interactive brokers is well-known in the US stock and options industry as an active trading broker. IMPORTANT: to trade forex with interactive brokers in the united states, you must be classified as an ECP, "an eligible contract participant is generally an individual or organization with assets of over $10 MM (or $5 MM if trades are hedging)." read full review

- Total forex pairs offered:115

- Likes: regulated in major jurisdictions and publicly traded; extensive range of global markets and asset classes; bitcoin futures trading supported; competitive fees and discounts for high-volume traders.

- Dislikes: retail spot forex only offered to non-U.S. Clients; desktop platform too complex for inexperienced traders; web platform lacks forex charts; monthly minimum activity charges.

- Bottom line: professional traders and highly experienced investors looking for a complete multi-asset forex broker will find interactive brokers offers a comprehensive platform with competitive fees across multiple global financial markets.

- Visit site

Compare US forex brokers at forexbrokers.Com

Compare IG vs TD ameritrade vs forex.Com vs interactive brokers side by side and view an industry-leading comparison based on over 100 different data points.

Read next

Explore our other online trading guides:

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Best online brokers for forex trading in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world’s most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

If you’re looking to get in on this action, you’ll need a broker who deals in currency, and many of the big names in stock trading simply don’t offer this feature. Because the markets are so different, you’ll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you’re targeting, you’ll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker’s spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that’s how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won’t accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker’s highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you’ll need to get approval to trade futures, and pricing uses the broker’s futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker’s STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it’s the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don’t intend to actually trade. Given the difficulty of forex trading, that’s a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it’s open to american investors. It’s a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn’t offer traditional currency trading, but it does bring the slick, easy-to-use interface it’s known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You’ll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

Learn, practice, and master currency trading online

Forex blog

Hawkish yellen lifts dollar…

By hiland doolittle

Janet yellen’s voice might be softer than her predecessor’s but she carries a big stick and pres5rnnted a pro dollar stance in her first press conference that caught equity markets by surprise and lifted the dollar against all major currencies. The new fed chair dissected. Read more»

More recent posts

Forex tool reviews

Market hours and analysis provided by forex trader…

Pros: A great reference tool that displays real time forex market hours of tokyo, sydney, london and new york forex markets. This program also offer the features like forex economic calendar, customizable forex charts, real time major currencies quote ticker, daily high. Read more»

More forex tool reviews

Broker reviews

FX solutions

FX solutions basic detailsfx solutions was founded in 2001 in new jersey with only 5 employees. In 2003 it began live trading on its global trading system (GTS). Now, FX solutions is one of the fastest growing companies in america. FX solutions prides itself on helping. Read more»

More broker reviews

Popular

Trading forex online. Period. Re-launched with information about learning,understanding, and trading with forex tools and software, we've spent an exhaustive amount of time researching and reviewing content to help you become the best trader or broker that you can be.

The current lineup of the site includes forex software reviews in a variety of different categories including:

You'll also find out how to get an education on forex trading with our forex glossary of terms. Here you can answer any of the questions you have about specific terminology that you may find in our learn to trade forex section.

So if you're an market maker, introducing broker, part time trader, talentless hack, or curious student, we hope that you'll find the information that you need to be a better more informed trader here on our site. If you have comments, questions, or concerns, you can always contact us here.

Would you like to be contacted to receive more information about opening a trading account?

Choose the brokers you would like more information on. We recommend starting with at least 2.

OFXT is here to help you in your path to becoming a forex trader or broker. Our goal is to help you learn, practice, and master the art of currency trading. It's important to understand currency pairs such as the EUR/USD, USD/CAD, GBP/USD, USD/JPY, or other major currencies, and how the economies of each country impact one another. There is a high amount of risk involved in FX trading, for more information, please see our risk disclosure policy. Choosing a forex brokerage, signal provider, or charting software are difficult decisions, so we've established a set of reviews based on a variety of criteria for evaluating their credibility. Foreign currency trading is different from futures, options, or stock trading, and it's important to understand the terminology. We hope you will continue to learn to trade with us, and if you ever have questions, please drop us a line.

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Forex trading and brokers

The foreign exchange market – also known as forex or just FX – is a decentralized global market for the trading of currencies. In terms of trading volume, this is by far the largest market in the world.

The foreign exchange market is not one specific exchange (such as the new york stock exchange or the london stock exchange). Instead, financial centers around the globe function as hubs or anchors of trading in a network that includes various participants, including large international banks.

The history of foreign exchange trading is very old. As long as there have been different currencies, there have been people wishing to exchange one currency for another. A merchant that traveled from his home to other parts of the world to obtain foreign goods would for instance need to exchange his currency one or more times along the way, both to be able pay for his own needs as he traveled and to make sure he had an accepted currency available when he reached sellers of desirable goods. In major trading hubs, such as capital cities and important ports, professional money changers would be present to cater to these needs and make a profit from the fluctuating exchange rates.

The modern foreign exchange market that we know today emerged in the 1970s, as countries gradually switched from controlled exchange rates to floating exchange rates for their national currency.

FOREX brokers

A FOREX broker is a company that provides retail investors with access to a FOREX trading platform that enables the investors to buy and sell currencies. Most brokers offer a wide selection of different leveraged FOREX products that make it possible to earn high returns from small market movements. The leverage also increases potential loses and leverage trading is a type of high-risk trading.

Your primary goal when comparing FOREX brokers should be to find one which is regulated by a trusted financial institution, and that has a good reputation on the market. You should also compare the spread they charge as well as the overnight fees. A small spread makes it a lot easier to make money. If you want to be able to use a certain FOREX trading platform then you need to make sure that the broker allows you to use said platform. Not all brokers provide access to the same platforms. Metatrader4 is by many considered the best forex trading platform for beginners but other platforms such as ninjatrader and algotrader are also popular.

Characteristics of the foreign exchange market

- Huge trading volume

- High liquidity, especially for the most frequently traded currency pairs

- Trading from 22:00 GMT on sunday to 22:00 GMT on friday.

- Decentralization and geographical dispersion

- Low margins of relative profit

- Using leverage is very common among traders

The interbank market

The interbank market is the top-level foreign exchange market. This is where major banks exchange currencies with each other, either directly or through electronic brokering platforms. The two major platforms are the electronic broking services (EBS) and thomson reuters dealing. Together, they have over 1,000 banks as their clients.

The interbank market is decentralized; there is no specific building that you can visit where the transactions are taking place.

The thee main constituents of the interbank market are the spot market, the forward market and SWIFT.

- The spot marketthis is where currencies are traded for immediate delivery.

- The forward marketthis is where contracts for future delivery is traded.

- SWIFT = society for world-wide internbank financial telecommunications.This is a network used to send and receive information about financial transaction. A majority of the international interbank messages are sent through SWIFT. Data from the year 2015 shows that over 11,000 financial institutions in more than 200 countries and territories use SWIFT.

Currency pairs

The four most frequently traded pairs are:

EUR/USD: the euro and the U.S. Dollar

USD/JPY: the U.S. Dollar and the japanese yen

GBP/USD: the british pound sterling and the U.S. Dollar

USD/CHF: the U.S. Dollar and the swiss franc

Retail foreign exchange trading

Retail foreign exchange trading is a small segment of the foreign exchange market. This segment developed fairly recently, when internet made it feasible to offer platforms for very small-scale forex trading.

Many individuals that are engaging in retail foreign exchange trading do it as a hobby, enjoying the excitement that the trading brings while also – hopefully – making some long-term profits.

If you want to try retail foreign exchange trading, you need to sign up with one of the companies that provide this service, and then make a deposit into your trading account. Many providers will offer you the option of partly trading on credit, where the size of the credit is determined by how much money or other valuables you have in your account. This is known as margin trading or leverage, and it means that even if you just deposit $100 into your account, you can start doing fairly big trades on the platform right away. Naturally, using credit to speculate on the currency market is very risk and you can end up owning the provider much more money than what you deposited.

Background

The first trading platforms for retail forex trading began to appear in the mid-1990s as private internet connections became more widespread than before. In the early days, you had to download the trading software and install it on your computer. Eventually, web-based interfaces were developed where you could trade directly in your web browser without the need to download and install a program.

As technical analysis grew increasingly popular among retail traders, more and more trading platforms began to include charting tools and other useful aids for technical analysis. News feeds are another popular feature in modern platforms, as is automated trading tools. During recent years, social trading has started to catch on, but this field is still in its infancy.

Online forex trading brokers

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

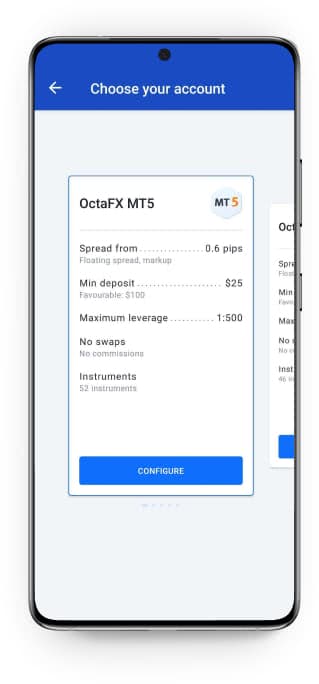

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

so, let's see, what we have: trillions in currency are zipping around the world, making foreign exchange markets the world’s most active. At online forex trading brokers

Contents of the article

- Top-3 forex bonuses

- Best online brokers for forex trading in january...

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- Forex trading and brokers

- FOREX brokers

- Characteristics of the foreign exchange market

- The interbank market

- Currency pairs

- Retail foreign exchange trading

- Best online brokers for forex trading in january...

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- Best US forex brokers 2021

- Best US forex brokers 2021

- Compare US forex brokers at forexbrokers.Com

- Read next

- Best online brokers for forex trading in january...

- Advertiser disclosure

- How we make money.

- Editorial disclosure.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- Learn, practice, and master currency trading...

- Forex blog

- Forex tool reviews

- Broker reviews

- Popular

- Would you like to be contacted to receive more...

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Forex trading and brokers

- FOREX brokers

- Characteristics of the foreign exchange market

- The interbank market

- Currency pairs

- Retail foreign exchange trading

- Online forex trading brokers

- Forex trading accessibility for everyone

- Why choose forex trading with octafx