Free credit forex

A credit report includes information on where you live, how you pay your bills, and whether you’ve been sued or have filed for bankruptcy.

Top-3 forex bonuses

Nationwide credit reporting companies sell the information in your report to creditors, insurers, employers, and other businesses that use it to evaluate your applications for credit, insurance, employment, or renting a home. A: you need to provide your name, address, social security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting company may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources.

Free credit reports

Share this page

Visit annualcreditreport.Com to get your free credit report. Through april 2021, everyone in the U.S. Can get a free credit report each week from all three national credit reporting agencies (equifax, experian, and transunion) at annualcreditreport.Com.

The fair credit reporting act (FCRA) requires each of the nationwide credit reporting companies — equifax, experian, and transunion — to provide you with a free copy of your credit report, at your request, once every 12 months. The FCRA promotes the accuracy and privacy of information in the files of the nation’s credit reporting companies. The federal trade commission (FTC), the nation’s consumer protection agency, enforces the FCRA with respect to credit reporting companies.

A credit report includes information on where you live, how you pay your bills, and whether you’ve been sued or have filed for bankruptcy. Nationwide credit reporting companies sell the information in your report to creditors, insurers, employers, and other businesses that use it to evaluate your applications for credit, insurance, employment, or renting a home.

Here are the details about your rights under the FCRA, which established the free annual credit report program.

Q: how do I order my free report?

The three nationwide credit reporting companies have set up a central website, a toll-free telephone number, and a mailing address through which you can order your free annual report.

To order, visit annualcreditreport.Com, call 1-877-322-8228. Or complete the annual credit report request form and mail it to: annual credit report request service, P.O. Box 105281, atlanta, GA 30348-5281. Do not contact the three nationwide credit reporting companies individually. They are providing free annual credit reports only through annualcreditreport.Com, 1-877-322-8228 or mailing to annual credit report request service.

You may order your reports from each of the three nationwide credit reporting companies at the same time, or you can order your report from each of the companies one at a time. The law allows you to order one free copy of your report from each of the nationwide credit reporting companies every 12 months.

A warning about “imposter” websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law — annualcreditreport.Com. Other websites that claim to offer “free credit reports,” “free credit scores,” or “free credit monitoring” are not part of the legally mandated free annual credit report program. In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may be unwittingly agreeing to let the company start charging fees to your credit card.

Some “imposter” sites use terms like “free report” in their names; others have urls that purposely misspell annualcreditreport.Com in the hope that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.Com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from annualcreditreport.Com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam.

Q: what information do I need to provide to get my free report?

A: you need to provide your name, address, social security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting company may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources.

Q: why do I want a copy of my credit report?

A: your credit report has information that affects whether you can get a loan — and how much you will have to pay to borrow money. You want a copy of your credit report to:

- Make sure the information is accurate, complete, and up-to-date before you apply for a loan for a major purchase like a house or car, buy insurance, or apply for a job.

- Help guard against identity theft. That’s when someone uses your personal information — like your name, your social security number, or your credit card number — to commit fraud. Identity thieves may use your information to open a new credit card account in your name. Then, when they don’t pay the bills, the delinquent account is reported on your credit report. Inaccurate information like that could affect your ability to get credit, insurance, or even a job.

Q: how long does it take to get my report after I order it?

A: if you request your report online at annualcreditreport.Com, you should be able to access it immediately. If you order your report by calling toll-free 1-877-322-8228, your report will be processed and mailed to you within 15 days. If you order your report by mail using the annual credit report request form, your request will be processed and mailed to you within 15 days of receipt.

Whether you order your report online, by phone, or by mail, it may take longer to receive your report if the nationwide credit reporting company needs more information to verify your identity.

Q: are there any other situations where I might be eligible for a free report?

A: under federal law, you’re entitled to a free report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you ask for your report within 60 days of receiving notice of the action. The notice will give you the name, address, and phone number of the credit reporting company. You’re also entitled to one free report a year if you’re unemployed and plan to look for a job within 60 days; if you’re on welfare; or if your report is inaccurate because of fraud, including identity theft. Otherwise, a credit reporting company may charge you a reasonable amount for another copy of your report within a 12-month period.

To buy a copy of your report, contact:

- Equifax:1-800-685-1111; equifax.Com

- Experian: 1-888-397-3742; experian.Com

- Transunion: 1-800-916-8800; transunion.Com

Q: should I order a report from each of the three nationwide credit reporting companies?

A: it’s up to you. Because nationwide credit reporting companies get their information from different sources, the information in your report from one company may not reflect all, or the same, information in your reports from the other two companies. That’s not to say that the information in any of your reports is necessarily inaccurate; it just may be different.

Q: should I order my reports from all three of the nationwide credit reporting companies at the same time?

A: you may order one, two, or all three reports at the same time, or you may stagger your requests. It’s your choice. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports.

Q: what if I find errors — either inaccuracies or incomplete information — in my credit report?

A: under the FCRA, both the credit reporting company and the information provider (that is, the person, company, or organization that provides information about you to a consumer reporting company) are responsible for correcting inaccurate or incomplete information in your report. To take full advantage of your rights under this law, contact the credit reporting company and the information provider.

1. Tell the credit reporting company, in writing, what information you think is inaccurate.

Credit reporting companies must investigate the items in question — usually within 30 days — unless they consider your dispute frivolous. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. After the information provider receives notice of a dispute from the credit reporting company, it must investigate, review the relevant information, and report the results back to the credit reporting company. If the information provider finds the disputed information is inaccurate, it must notify all three nationwide credit reporting companies so they can correct the information in your file.

When the investigation is complete, the credit reporting company must give you the written results and a free copy of your report if the dispute results in a change. (this free report does not count as your annual free report.) if an item is changed or deleted, the credit reporting company cannot put the disputed information back in your file unless the information provider verifies that it is accurate and complete. The credit reporting company also must send you written notice that includes the name, address, and phone number of the information provider.

2. Tell the creditor or other information provider in writing that you dispute an item. Many providers specify an address for disputes. If the provider reports the item to a credit reporting company, it must include a notice of your dispute. And if you are correct — that is, if the information is found to be inaccurate — the information provider may not report it again.

Q: what can I do if the credit reporting company or information provider won’t correct the information I dispute?

A: if an investigation doesn’t resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and in future reports. You also can ask the credit reporting company to provide your statement to anyone who received a copy of your report in the recent past. You can expect to pay a fee for this service.

If you tell the information provider that you dispute an item, a notice of your dispute must be included any time the information provider reports the item to a credit reporting company.

Q: how long can a credit reporting company report negative information?

A: A credit reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years. There is no time limit on reporting information about criminal convictions; information reported in response to your application for a job that pays more than $75,000 a year; and information reported because you’ve applied for more than $150,000 worth of credit or life insurance. Information about a lawsuit or an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Q: can anyone else get a copy of my credit report?

A: the FCRA specifies who can access your credit report. Creditors, insurers, employers, and other businesses that use the information in your report to evaluate your applications for credit, insurance, employment, or renting a home are among those that have a legal right to access your report.

Q: can my employer get my credit report?

A: your employer can get a copy of your credit report only if you agree. A credit reporting company may not provide information about you to your employer, or to a prospective employer, without your written consent.

For more information

The FTC works for the consumer to prevent fraudulent, deceptive, and unfair business practices in the marketplace and to provide information to help consumers spot, stop, and avoid them. To file a complaint, visit ftc.Gov/complaint or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters internet, telemarketing, identity theft, and other fraud-related complaints into consumer sentinel, a secure online database available to hundreds of civil and criminal law enforcement agencies in the U.S. And abroad.

Report scams

If you believe you’ve responded to a scam, file a complaint with:

Home page

Spot identity theft early. Review your credit reports.

Suspicious activity or accounts you don't recognize can be signs of identity theft. Review your credit reports to catch problems early.

You've found your dream house. Are your credit reports ready?

People with good credit should check their credit reports too. Regular checks ensure the information stays accurate. Your good credit will be ready when you need it.

Don't be fooled by look-alikes.

Lots of sites promise credit reports for free. Annualcreditreport.Com is the only official site explicitly directed by federal law to provide them.

There's more to the game than a score.

How you play changes your score. Details such as how much credit you have, how much you owe, and how often you pay affect your credit scores. Do you know what else does?

One of these things is not like the others.

You may think you have one credit report and one credit score. But you really have several, and they may differ. You should check all three reports regularly.

Spot identity theft early. Review your credit reports.

Suspicious activity or accounts you don't recognize can be signs of identity theft. Review your credit reports to catch problems early.

You've found your dream house. Are your credit reports ready?

People with good credit should check their credit reports too. Regular checks ensure the information stays accurate. Your good credit will be ready when you need it.

Don't be fooled by look-alikes.

Lots of sites promise credit reports for free. Annualcreditreport.Com is the only official site explicitly directed by federal law to provide them.

There's more to the game than a score.

How you play changes your score. Details such as how much credit you have, how much you owe, and how often you pay affect your credit scores. Do you know what else does?

One of these things is not like the others.

You may think you have one credit report and one credit score. But you really have several, and they may differ. You should check all three reports regularly.

Your credit reports matter.

- Credit reports may affect your mortgage rates, credit card approvals, apartment requests, or even your job application.

- Reviewing credit reports helps you catch signs of identity theft early.

Request your free credit reports

FREE credit reports. Federal law allows you to:

- Get a free copy of your credit report every 12 months from each credit reporting company.

- Ensure that the information on all of your credit reports is correct and up to date.

Brought to you by

Copyright © 2021 central source, LLC

Secure transaction: for your protection, this website is secured with the highest level of SSL certificate encryption.

Please note

Are you using a cell phone or tablet to reach annualcreditreport.Com?

Although this website is very secure, the wireless network that you are using to get to the site may not be. If you use your mobile device, your personal information, including your social security number, may be at risk.

We recommend that you use a regular computer to get your credit reports.

Trading credits

Trading credits are termless and interest-free, and can be used as equity when effecting forex trading. The obligatory condition for getting a trading credit is an account replenishment with own funds. The amount of credit may be up to 50% of the deposit.

Trading credits terms

- Trading credits are available for the following types of accounts: MT4.Directfx, MT4.Classic+, cent-MT4.Directfx, cent-MT4.Classic+;

- A trading credit may be received for each deposit and the client can choose the amount of credit at the time the account is replenished: 10%, 20%, 30%, 40%, 50% of the deposit;

An example:

In the case of a 1000 USD deposit, the trader chose 10% as a trading credit. In this case, 1100 USD will be credited to the account, while 100 USD will be reflected in the credit field.

An example:

The trader refilled his account for 10 000 USD and got a trading credit in the amount of 1000 USD. In case the equity goes down to level 1000 USD (value in the credit field), all active trading credits (the credit field displays the sum of active credits) will be automatically cancelled, and all positions will be closed forcibly.

Free credit forex

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Forex recent information

Forex featured brokers

Forex is the most popular currency exchange market. It becoming more popular day by day. Currently averaged $6.6 trillion currency traded per day from april 2019.

But, this industry is technical and more professional. So, to make it interesting and easy forex broker offers bonuses and contests for traders.

At forexnewbonus.Com we published all types of bonuses and contests. Here you will get all the latest forex news, bonuses, contests, broker comparison, guide, etc. Mostly forex no deposit bonus and forex deposit bonus.

What is forex no deposit bonus?

Forex broker offers no deposit bonus to start live trading free. This bonus is completely free, broker provides free credit to a live trading account.

You can trade currencies, cfds, stock, indices, metals, gold, silver, oil, commodity, and more. This is a very good opportunity to risk free trading.

What is forex deposit bonus?

Very interesting bonus from brokers. You will fund your account for trading and the broker will give you some free money to enjoy it. This bonus increase trading funds and leverage.

All deposit bonuses are tradable as the offer conditions. Sometimes broker offers deposit bonus include loyalty VIP bonus.

How to find the best forex bonus?

Finding the best bonuses is important for traders. You can visit on the web, read reviews and broker platforms. But this is difficult, so we made it easy for traders.

To finding the best bonus check our website regularly. We publish new and a lot of bonuses offered by brokers.

Your experian credit report is completely free. See it now!

No credit card required. Includes your free credit report updated every 30 days on sign in.

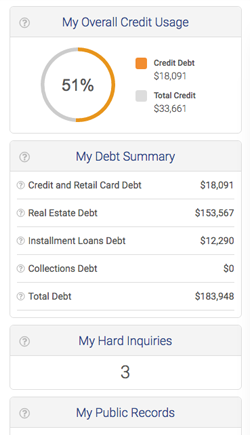

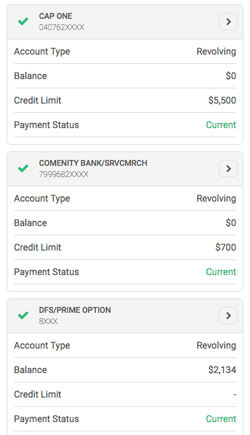

Things you'll see on your free experian credit report.

Account history

This is your payment history and status of all real estate, installment, and revolving credit accounts

Hard inquiries

A credit check by a lender or landlord is called a hard inquiry and will show up on your credit report

Potentially negative information

This includes loan defaults, late payments, delinquencies, charge-offs, collections, and public records.

Find new credit options

Want a lower rate on a credit card? Maybe you're looking for a personal or debt consolidation loan. Either way, our offers marketplace has many attractive offers to choose from.

Quick and easy sign up

No credit card needed, just sign up to get instant online access to your free experian credit report.

- No credit card required

- Free experian credit report

- Updates every 30 days on sign in

- Dispute online for free

sign up now for free

Get the free experian app:

Credit report 101

From the latest information on credit reports, identity theft, to videos and credit calculators, our blog is an excellent resource for helping you navigate "all things credit."

Infographic: reading a credit report

New to checking your credit report information? It can be confusing if you've never checked your credit report before, or it's been a while. Review our list for a quick.

Why checking your credit report is important for all stages in life

Your credit profile is maintained by the three credit bureaus. It's what you could call a living document. Each month, your creditors report how you've managed your financial.

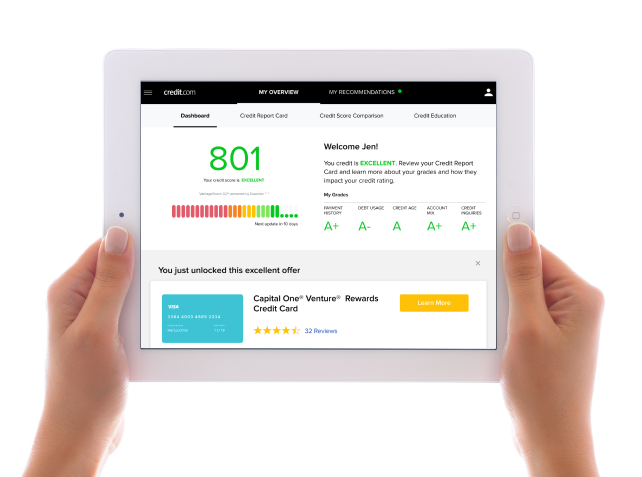

Get your free credit score

Updated every 14 days

Get your free credit score

Getting a handle on your credit is the first step towards financial well-being. You know it, and we at credit.Com know it. Maybe you're looking to improve your bad credit to good credit, or maybe you just want to keep track of things. But where to start? First things first—you need to know where you’re at. That’s why credit.Com provides your free credit score from experian, updated every 14 days. You can stay up-to-date with your very own credit report card, which keeps track of what you’re doing well and what you could improve.

Why do I need to know my credit score?

Your credit score is used for a lot—even if you don’t know it. Sure, you need your credit score to apply for things credit cards, loans and mortgages. But did you know that you need a credit score to rent an apartment? To get decent interest rates? Trust us, you don’t want to apply for any credit line before checking your score. Plus, keeping an eye on your score can help you look out for identity theft and fraud. When it comes to your credit, it’s better safe than sorry. Check out your score today

When and why does my credit score change?

Honestly, your credit score can change whenever. It depends on a lot of things, like if you’ve paid your bills on time, when you pay your balances, if/when you apply for a new line of credit and when you open or close a new account. Plus, it can take anywhere between 30 to 60 days for your creditors to report your information to the credit bureaus. Because your score can really change at any time, it’s important to keep track of it. See what your score is today

Get your score for free—no credit card needed

Getting access to your credit score isn’t always easy. Sure, you could get your credit score somewhere else, but you may have to pay. When you sign up with credit.Com’s free account, there isn’t catch. You can get access to your free credit score without a credit card or hard inquiry. Get your free credit score right now

How does credit.Com get my credit score?

Okay, we’ve established that credit.Com provides your credit score and credit report card completely free of charge. But how exactly do we get your credit score? It comes directly from experian, one of the three major credit bureaus, and is updated every 14 days. Not only that, but you’ll get access to your credit report card. It’ll dig into the five factors that affect your credit score—payment history, credit utilization, credit age, new credit inquiries and account mix—and give you a personalized action plan to help you reach your credit and financial goals.

Need a little extra help?

A free credit score is great tool for understanding, tracking, and building your credit. If you want even more insight into your credit, check out extracredit. For $24.99 a month, you can see 28 of your FICO scores from all three major credit bureaus. In addition to your credit scores, extracredit offers opportunities to add your rent and utilities to your credit reports to add more to your credit profile, cashback rewards when you’re approved for certain offers, exclusive discounts, $1 million identity theft coverage, and more. Check out extracredit today.

Free credit forex

$30 no deposit bonus & 15% bonus, welcome bonus brings real account clients the best rewards available.

Forextime rewards loyalty in up to %200 withdrawable cashback rebates and get $4 cashback back for every lot you trade.

$2000 forex free no deposit trading bonus start trading forex and CFD without deposit and without risks

Free 50% forex bonus with every deposit to all new and existing traders and $35 forex no deposit bonus

Fort financial services is an integral transparent and highly innovative broker. We provide clients with direct access to over 500 instruments, including FX, commodities, equities and stock indexes. Leverage your positions up to 1:1000 to multiply your profits and safeguard your capital with o ur support margin bonus, $35 no deposit bonus if you are new in trading, open a demo account and learn to trade in a risk-free environment. But remember, a real trading account is only $5 away . Diversify your portfolio by copying top performing traders or select a fund manager to administrate your capital. We offer top-tier platforms such as MT4, CQG,ninjatrader. We are authorised and regulated by the IFSC (licence no. 60/256/TS/16)

ITRADER - 24 july 2019 open an account deposit from $250, spreads from 0.1 pips, trading platform metatrader4, multi terminal, mobile trading and more, leverage uo to 1:500 ITRADER broker review

Fxtrading pro - 9 may 2019 open an account deposit from $50, spreads from 1.1 pips, trading platform metatrader4, multi terminal, mobile trading and more, leverage uo to 1:500 FX trading pro review

World trade investment - 6 march 2019 open an account deposit from $100, spreads from 0.1 pips, trading platform metatrader4, web and mobile, leverage uo to 1:500 world trade investment review

Triumphfx - 23 february 2019 open an account deposit from $100, spreads from 0.1 pips, trading platform metatrader4, metatrader5, web and mobile, leverage uo to 1:500 triumphfx broker review

The foreign exchange market may appear to be a daunting and confusing subject, however it does not need to be. We have put together this forex glossary to try and help you better understand the forex market- the key currencies that exist, a glossary full of industry terms, a section on some key terms/acronyms and other information about the market.

No deposit forex bonus : no deposit forex bonus is a promotional bonus that many forex brokers often use to entice new clients to try their services. This type of bonus gives you a great opportunity to try the broker’s system and services without spending a single penny.

Deposit bonus : once you have opened an account with a broker, you will be probably provided with a certain bonus. This bonus can provide a little extra safety behind your traders or you can use it to leverage more operational volume. We pay the bonus out over the course of one year and the first payment will be sent to your account as soon as your deposit clears.

Welcome bonus : A ‘welcome bonus’ is a way to reward new traders who sign up for an account, to make them feel welcome and to make it easier for new clients to start trading righty away. A welcome bonus might require you to make a deposit, so make sure you agree with the bonus requirements before you sign up.

Forex trading gifts : you will often see brokers offering smartphones, tablets, and other similar items as a gift for your deposit. This can be an attractive options to a lot of traders.

Demo contest : if are you new to forex trading, and you thinking of trying out a new way to trade? There is a great way you can test your skills and practice different strategies, and that is by participating in demo forex contests. Foex demo trading contest are a way for brokers to bring in new clients, and encourage them to trade on their site.

Live trading contest : simply it is a fight for real traders. Where traders are fighting for the contest price. In this contest, every trader is starting the contest with the same parameters such as the same capital at a time. There is a great chance to win a big prize such as a car, incentive trip or cash prize. But you should remember that you will trade with your money.

Trading bonus : tradable bonus is your support in the time of draw-down. Tradable bonus supports on open position as extra margin for trading and save for getting early margin call. It can be traded like own money. It boosts account's money and added to equity. In addition rescue bonus or tradable bonus provide extra safety in the time of draw-down.

Draw bonus : A forex draw bonus is of course a type of a bonus, and just like the other bonuses it is a particularly tailored gift provided by the broker to the client.

IB (introducing broker): an introducing broker (IB) is essentially an agent which introduces new customers to a forex brokerage. In return for sending custom to a brokerage, the introducing broker receives a fee, when it comes to forex this is normally a certain share of the spread or commission charged by the brokerage.

Rebate :cashback providers refer traders to brokers and share the rebates they earn from each trade made by the client with that client. The model is becoming standard for most brokers in the industry. It’s also attractive a standard tool for traders to reduce costs.

Affiliates program : the forex trading affiliate program is one of the most profitable ways to earn extra money online. How it works, you use online marketing channels to attract new traders to specific broker house system. They register, start trading and they pay you a commission. As their partner, you get either more and more US$ for each qualified trader you brought (forex CPA plan), or a lifetime commission for each deal that the traders you brought did.

Binary options : just like traditional options, binary options have a premium, a hit price, and an ending. The dissimilarity is that, with binary options, the “premium” amount for the option is chosen by the trader (usually determined by the market with traditional options) and the expiration timeframes are much shorter.

Seminars : live in person forex seminar . We can make live presentations to groups of forex traders from 50 to 150 people. In the past, these presentations all have been 4-8 hour long seminars and include complete training on our trading system, and lunch or catering in a classroom environment with WIFI internet.

Friend referring : if you know someone who’s interested in trading currencies, commodities, or indices, direct them to specific brokers. Once your friend opens a real trading account with that brokers via your referral link, you will both receive a free bonus that will help you multiply your trading activities on the platforms. Doing so is easy and hassle-free.

Draw bonus: the draw bonus is a relative new comer, but is increasing in popularity, and that’s not too surprising. Forex draws offer traders a unique opportunity to win a range of prizes or free trading cash. If you are one of the lucky few there is a great chance that you will be entitled to claim some free cash for your trading account, and may be even some amazing gift.

Freebies : if you wish to open a live account with a specific broker then remember always to ask for any free tools they can supply you. They can offer you free eas, free trading analysis, free signals and more.

Free signal : forex signals are, essentially, trade ideas indicating the market trends in real time. Trading signals are used by novice and professional traders alike. Most forex signals include the position type (buy pr sell) as well as the take profit and stop loss levels. Many brokers provides signals on forex pairs, commodities, indices, and cryptocurrencies.

Free VPS server : VPS stands for virtual private server and it is a virtual machine provided by a hosting service, where a user has administrator access to the OS and all software installed. With forex brokers offering VPS hosting, it is now widely used as a dedicated remote server to execute trades from a trading platform installed in it. Traders are given full access and control over an amount of RAM, space and transfer which they can use to install systems and different software they want.

Expos events: A forex expo can provide you with great opportunities to learn about new trading strategies, network with other forex traders and become familiar with the latest developments from within the industry. With forex events being hosted worldwide, finding an affordable, relavant forex expo has never been easier.

What is a pip? : pip are the most fundamental unit of measure used when trading currencies, but you need to know much more to become a success forex traders. A pip, short for point in percentage, is a very small measure of change in a currency pair in the forex market. For example, if a pip was 10 points, a non-pip change would cause greater volatility in currency values.

Most households have a scrambled rubik's cube that has never been solved. Use the rubik's solver to calculate the solution in only 20 steps!

What is forex trading?

The foreign exchange market (dubbed forex or FX) is the market for exchanging foreign currencies. Forex is the largest market in the world, and the trades that happen in it affect everything from the price of clothing imported from china to the amount you pay for a margarita while vacationing in mexico.

What is forex trading?

At its simplest, forex trading is similar to the currency exchange you may do while traveling abroad: A trader buys one currency and sells another, and the exchange rate constantly fluctuates based on supply and demand.

Currencies are traded in the foreign exchange market, a global marketplace that’s open 24 hours a day monday through friday. All forex trading is conducted over the counter (OTC), meaning there’s no physical exchange (as there is for stocks) and a global network of banks and other financial institutions oversee the market (instead of a central exchange, like the new york stock exchange).

A vast majority of trade activity in the forex market occurs between institutional traders, such as people who work for banks, fund managers and multinational corporations. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. For example, a forex trader might buy U.S. Dollars (and sell euros) if she believes the dollar will strengthen in value and therefore be able to buy more euros in the future. Meanwhile, an american company with european operations could use the forex market as a hedge in the event the euro weakens, meaning the value of their income earned there falls.

How currencies are traded

All currencies are assigned a three-letter code much like a stock’s ticker symbol. While there are more than 170 currencies worldwide, the U.S. Dollar is involved in a vast majority of forex trading, so it’s especially helpful to know its code: USD. The second most popular currency in the forex market is the euro, the currency accepted in 19 countries in the european union (code: EUR).

Other major currencies, in order of popularity, are: the japanese yen (JPY), the british pound (GBP), the australian dollar (AUD), the canadian dollar (CAD), the swiss franc (CHF) and the new zealand dollar (NZD).

All forex trading is expressed as a combination of the two currencies being exchanged. The following seven currency pairs—what are known as the majors—account for about 75% of trading in the forex market:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CAD

- USD/CHF

- NZD/USD

How forex trades are quoted

Each currency pair represents the current exchange rate for the two currencies. Here’s how to interpret that information, using EUR/USD—or the euro-to-dollar exchange rate—as an example:

- The currency on the left (the euro) is the base currency.

- The currency on the right (the U.S. Dollar) is the quote currency.

- The exchange rate represents how much of the quote currency is needed to buy 1 unit of the base currency. As a result, the base currency is always expressed as 1 unit while the quote currency varies based on the current market and how much is needed to buy 1 unit of the base currency.

- If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1).

- When the exchange rate rises, that means the base currency has risen in value relative to the quote currency (because €1 will buy more U.S. Dollars) and conversely, if the exchange rate falls, that means the base currency has fallen in value.

A quick note: currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. For example, USD to EUR conversions are listed as EUR/USD, but not USD/EUR.

Three ways to trade forex

Most forex trades aren’t made for the purpose of exchanging currencies (as you might at a currency exchange while traveling) but rather to speculate about future price movements, much like you would with stock trading. Similar to stock traders, forex traders are attempting to buy currencies whose values they think will increase relative to other currencies or to get rid of currencies whose purchasing power they anticipate will decrease.

There are three different ways to trade forex, which will accommodate traders with varying goals:

- The spot market. This is the primary forex market where those currency pairs are swapped and exchange rates are determined in real-time, based on supply and demand.

- The forward market. Instead of executing a trade now, forex traders can also enter into a binding (private) contract with another trader and lock in an exchange rate for an agreed upon amount of currency on a future date.

- The futures market. Similarly, traders can opt for a standardized contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. This is done on an exchange rather than privately, like the forwards market.

The forward and futures markets are primarily used by forex traders who want to speculate or hedge against future price changes in a currency. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest of the forex markets and is where a majority of forex trades are executed.

Forex terms to know

Each market has its own language. These are words to know before engaging in forex trading:

- Currency pair. All forex trades involve a currency pair. In addition to the majors, there also are less common trades (like exotics, which are currencies of developing countries).

- Pip. Short for percentage in points, a pip refers to the smallest possible price change within a currency pair. Because forex prices are quoted out to at least four decimal places, a pip is equal to 0.0001.

- Bid-ask spread. As with other assets (like stocks), exchange rates are determined by the maximum amount that buyers are willing to pay for a currency (the bid) and the minimum amount that sellers require to sell (the ask). The difference between these two amounts, and the value trades ultimately will get executed at, is the bid-ask spread.

- Lot. Forex is traded by what’s known as a lot, or a standardized unit of currency. The typical lot size is 100,000 units of currency, though there are micro (1,000) and mini (10,000) lots available for trading, too.

- Leverage. Because of those large lot sizes, some traders may not be willing to put up so much money to execute a trade. Leverage, another term for borrowing money, allows traders to participate in the forex market without the amount of money otherwise required.

- Margin. Trading with leverage isn’t free, however. Traders must put down some money upfront as a deposit—or what’s known as margin.

What moves the forex market

Like any other market, currency prices are set by the supply and demand of sellers and buyers. However, there are other macro forces at play in this market. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question.

The forex market is open 24 hours a day, five days a week, which gives traders in this market the opportunity to react to news that might not affect the stock market until much later. Because so much of currency trading focuses on speculation or hedging, it’s important for traders to be up to speed on the dynamics that could cause sharp spikes in currencies.

Risks of forex trading

Because forex trading requires leverage and traders use margin, there are additional risks to forex trading than other types of assets. Currency prices are constantly fluctuating, but at very small amounts, which means traders need to execute large trades (using leverage) to make money.

This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade.

On top of all that, you should keep in mind that those who trade foreign currencies are little fish swimming in a pond of skilled, professional traders—and the securities and exchange commission warns about potential fraud or information that could be confusing to new traders.

Perhaps it’s a good thing then that forex trading isn’t so common among individual investors. In fact, retail trading (a.K.A. Trading by non-professionals) accounts for just 5.5% of the entire global market, figures from dailyforex show, and some of the major online brokers don’t even offer forex trading. What’s more, of the few retailer traders who engage in forex trading, most struggle to turn a profit with forex. Compareforexbrokers found that, on average, 71% of retail FX traders lost money. This makes forex trading a strategy often best left to the professionals.

Why forex trading matters for average consumers

While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad.

If the value of the U.S. Dollar strengthens relative to the euro, for example, it will be cheaper to travel abroad (your U.S. Dollars can buy more euros) and buy imported goods (from cars to clothes). On the flip side, when the dollar weakens, it will be more expensive to travel abroad and import goods (but companies that export goods abroad will benefit).

If you’re planning to make a big purchase of an imported item, or you’re planning to travel outside the U.S., it’s good to keep an eye on the exchange rates that are set by the forex market.

Start investing with these offers from our partners

advertiser disclosure

No deposit bonus forex 2021 malaysia

Entering the world of forex trading can be a little disconcerting for the newcomers of the market. So, what better way than using a вђњno deposit bonus forexвђќ for the malaysian traders to get over the uneasiness?

New traders are afraid of risking their money which is not an issue with a free bonus such as no deposit bonus. The traders are just required to register with the broker for an account and become a member. Forex brokers often provide such bonuses in order to get the clients familiarized with their services and also add to their potential clients.

As the name suggests, forex no deposit bonus requires no pre-funding on your part; you just receive the bonus and start trading. Plus, any profits you manage to earn will be yours fully, provided that you fulfill the terms and conditions of the bonus. All in all, itвђ™s a win-win, there is no version of this in which you can lose your money; additionally, youвђ™ll get more proficient in your trading while earning some extra bucks. So, think of it as a practice in the real market using real money!

Below you can find the list of forex brokers that offer вђњforex no deposit bonusвђќ to their malaysian clients.

The malaysian clients should bear in mind that there are quite a few forex no deposit bonuses out there, but not all of them are a good choice for trading and must be approached carefully. Therefore, the clients should develop a keen eye for spotting the ones that could be beneficial.

The no deposit bonus that you choose ought to be considered from different perspectives such as:

The legitimacy of the broker - in terms of their background, reputation, and whether or not theyвђ™re well-regulated by prominent regulatory authorities.

The pre-requisites and conditions of the promotions - you should know what you agree to by clicking that вђњacceptвђќ button. For example, how many lots youвђ™re required to trade, how much time you have, and how limited your options are. So read the terms it in depth until you understand them fully.

The bonus amount should give you enough room to trade - at least an amount above $20, so you can maneuver in your trades.

And lastly a leverage amount (usually 1:100 - 1:500 depending on the broker) that can help you make bigger trades and gain more profits while engaging in fewer trades.

Forex no deposit bonus in 2021

Risk warning: losses could exceed deposits.

Haroun kola

Questions?

Risk warning: losses could exceed deposits.

How to trade forex for free

If you always wanted to trade forex, but just don’t have the money to start or you want to try out the live servers instead of demo servers then these brokers have made it possible for you to do just that.

These accounts come with their own terms and conditions and I urge you to read each of them so that you know exactly what to expect from these accounts.

Don’t expect to be able to withdraw this amount, you may be able to withdraw profits, but there WILL be trading volume restrictions and most of them (ALL I think) will want you to make a deposit of your own cash before they make any of the proceeds of this bonus available to you.

Tigerwit

Tigerwit have just announced a new $25 no deposit bonus for ALL new traders to try out their live trading conditions. It could also be a celebration of liverpool winning the EPL after a 30 year wait, but whatever the reason, I’m thrilled they’re doing this.

They have a copy trading solution and in partnership with an EA provider we’re experimenting to see how profitable it could be. More details will be provided to every trader that signs up for this free trading account.

Markets.Com

My favourite broker for this kind of bonus is markets.Com who are offering a R250 in trading credit.

Now I’ve never tried one of these accounts myself, I’d much rather learn with at least a reasonable amount of funds to see me through any consecutive number of losing trades, but I definitely know that other’s are looking for this. So, if you take this up, I’d love to know what your experiences are.

Tickmill

Experience one of the best trading environments in the industry risk-free with tickmills $30 welcome account.

- No need to deposit funds

- No risk of losing your money

- Profits earned can be withdrawn

Trade for free with XM

XM is offering a $30, no deposit bonus to try out their services. Many brokers are now offering this risk free way to give you a taste of their services.

You probably won’t get rich from this free account, you’ll need a decent size account of at least $500 if you want to start making some real money but if you haven’t ever traded before or you want to see what their service is like, sign up with XM.

Instaforex offers A no deposit bonus

Instaforex, asia’s favourite broker also offers a no deposit bonus. There’s is one of the most generous at $1000, but before you get too excited, listen up to what their terms and conditions are.

As soon you reach a 10% profit, ie. $100 in profit, your account won’t allow you to trade any longer until you make a deposit of at least $100.

If you’d like to take advantage of this, then open an account here.

$10 free from fxopen

It’s very easy to apply for the $10 no deposit bonus from fxopen. All you need to do is register an fxopen ewallet. Verify your mobile no and finally, open an STP trading account.

You may withdraw all profits after trading 2 standard lots. The initial $10 USD bonus can’t be withdrawn though, it’s not your money, honey.

I must re-iterate, these trading accounts won’t make you rich for free. You’ll have to make a deposit and trade a certain amount to be able to withdraw either the free deposit amount or

so, let's see, what we have: how, why, and when to order copies of your free annual credit report. At free credit forex

Contents of the article

- Top-3 forex bonuses

- Free credit reports

- Share this page

- A warning about “imposter” websites

- Q: what information do I need to provide to get...

- Q: why do I want a copy of my credit report?

- Q: how long does it take to get my report after I...

- Q: are there any other situations where I might...

- Q: should I order a report from each of the three...

- Q: should I order my reports from all three of...

- Q: what if I find errors — either inaccuracies or...

- Q: what can I do if the credit reporting company...

- Q: how long can a credit reporting company report...

- Q: can anyone else get a copy of my credit report?

- Q: can my employer get my credit report?

- For more information

- Report scams

- Home page

- Spot identity theft early. Review your credit...

- You've found your dream house. Are your credit...

- Don't be fooled by look-alikes.

- There's more to the game than a score.

- One of these things is not like the others.

- Spot identity theft early. Review your credit...

- You've found your dream house. Are your credit...

- Don't be fooled by look-alikes.

- There's more to the game than a score.

- One of these things is not like the others.

- Your credit reports matter.

- FREE credit reports. Federal law allows you to:

- Brought to you by

- Please note

- Are you using a cell phone or tablet to reach...

- Trading credits

- Trading credits terms

- Free credit forex

- Forex recent information

- Forex featured brokers

- What is forex no deposit bonus?

- What is forex deposit bonus?

- Your experian credit report is...

- Things you'll see on your free experian credit...

- Find new credit options

- Quick and easy sign up

- Credit report 101

- Get your free credit score

- Updated every 14 days

- Get your free credit score

- Why do I need to know my credit score?

- When and why does my credit score change?

- Get your score for free—no credit card needed

- How does credit.Com get my credit score?

- Need a little extra help?

- Free credit forex

- What is forex trading?

- What is forex trading?

- How currencies are traded

- How forex trades are quoted

- Three ways to trade forex

- Forex terms to know

- What moves the forex market

- Risks of forex trading

- Why forex trading matters for average consumers

- No deposit bonus forex 2021 malaysia

- Forex no deposit bonus in 2021

- Questions?

- How to trade forex for free

- Tigerwit

- Markets.Com

- Tickmill

- Trade for free with XM

- Instaforex offers A no deposit bonus

- $10 free from fxopen