Tickmill demo account

On the webpage of tickmill, you will also find trading tutorials on how to use the platform.

Top-3 forex bonuses

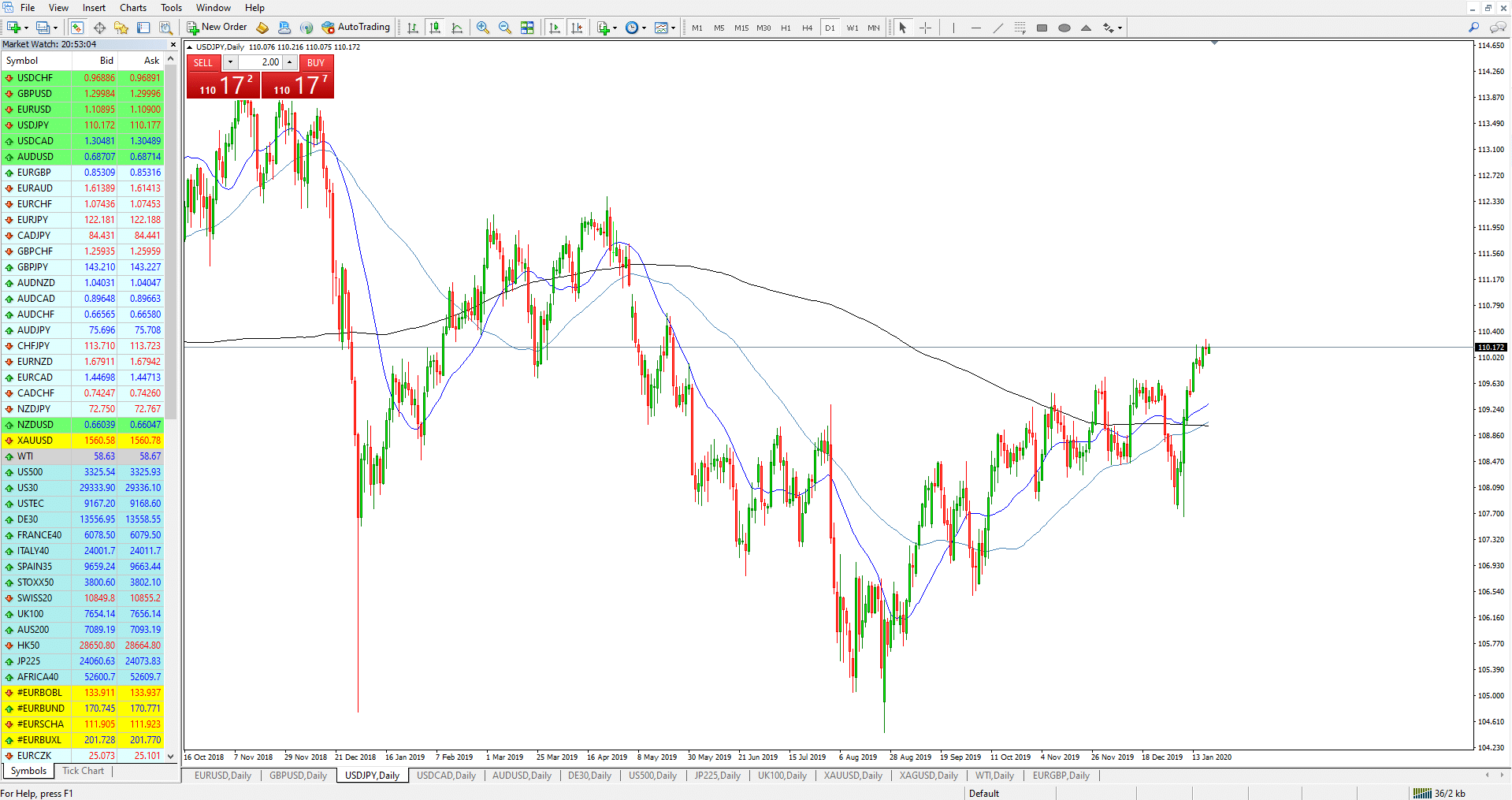

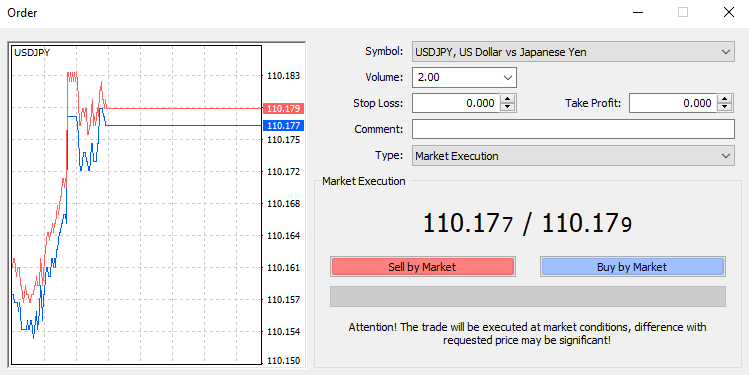

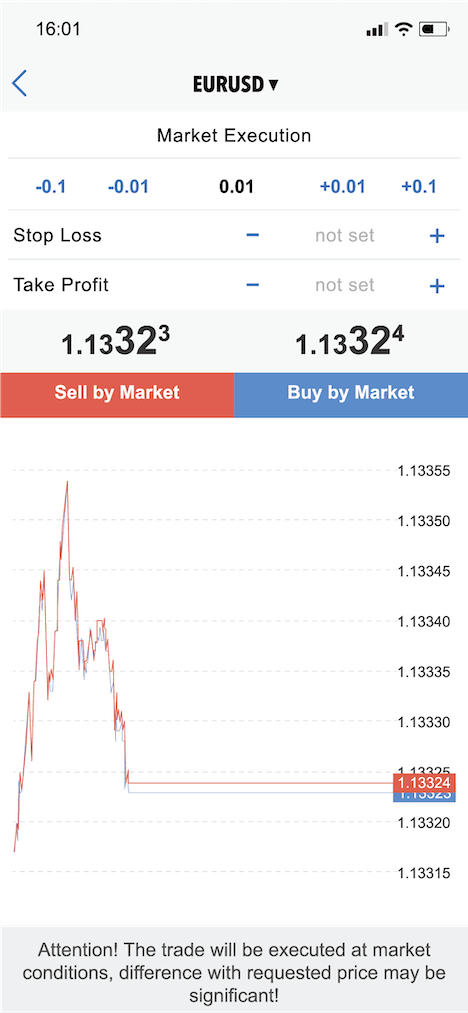

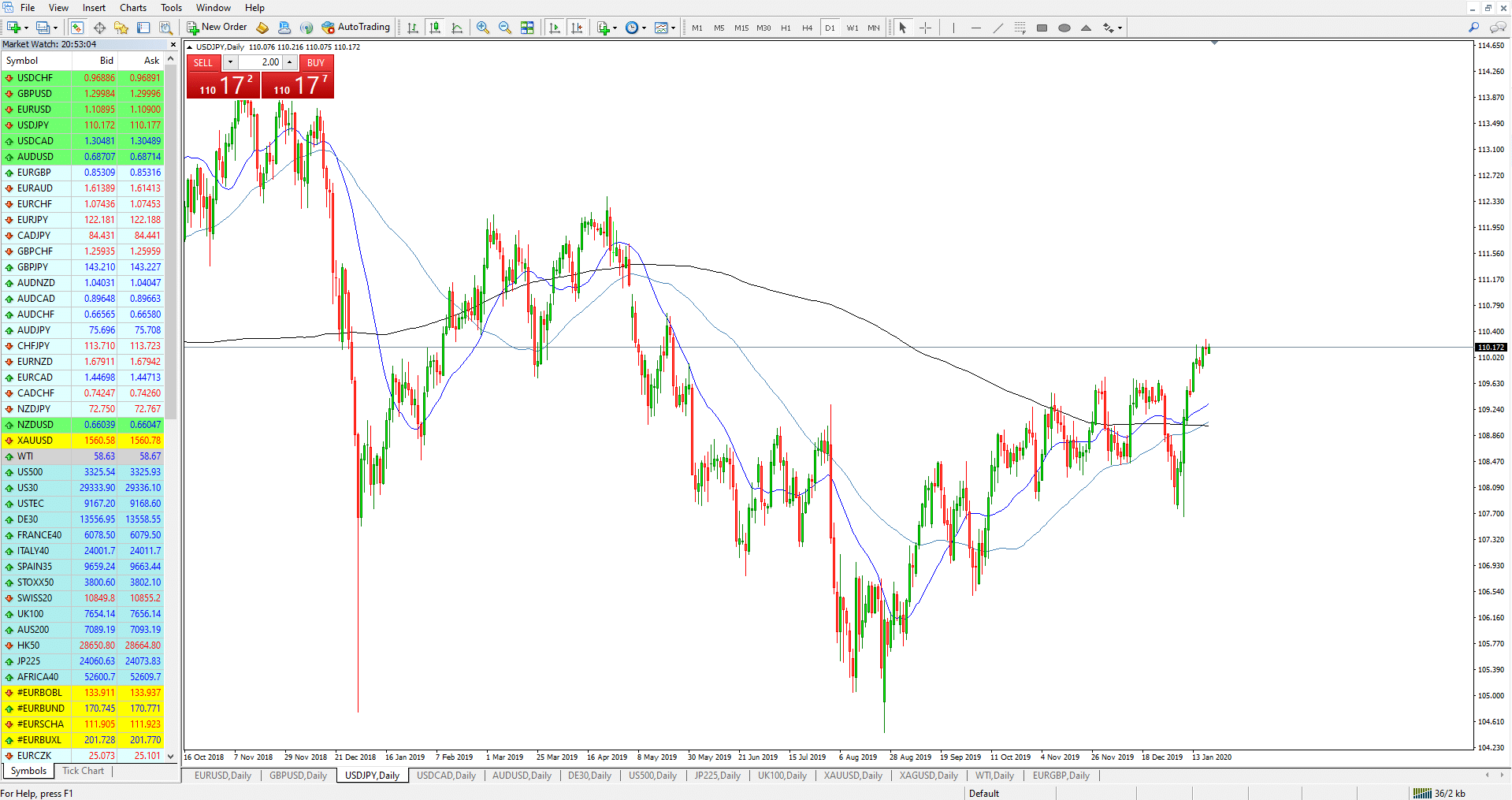

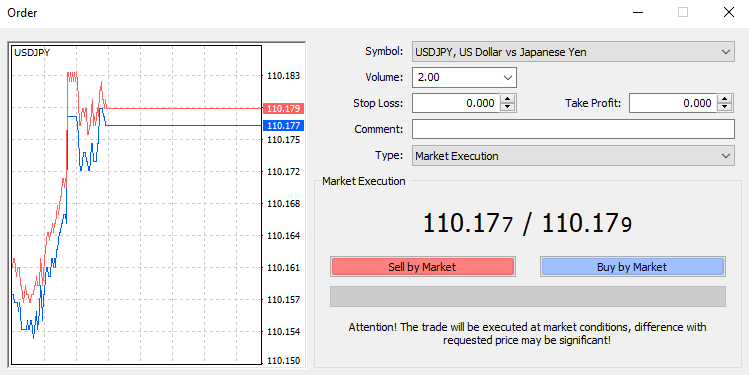

If you got questions about the software you can reach multi-language support. Forex trading is made by opening an order on the market (picture below). You buy or sell currency pairs that are traded against each other. If one currency increases in value you can earn or lose money. (note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

How to use the tickmill demo account

You want to start trading with tickmill? – then you should start with the free demo account first. On this page, we will show you how to open the free demo account and how to use it. Furthermore, as experienced traders for 7 years, we will show you tips and tricks and why you should use the demo account before you start trading live.

Open the tickmill demo account

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Facts about the tickmill demo account:

Tickmill offers you a free demo account to practise or test the trading platform. When you register you can choose the leverage on the account and the virtual deposit. The demo account means that you are trading with virtual money and no risk. Beginners can try out their first trades and advanced traders can practice new strategies or learn how to trade new assets. The demo account is multi-functional.

Virtual deposit:

Choose the deposit amount you want. It can be any number. We recommend using the investment amount of your real deposit later. Use the demo account like it would be real money.

Tickmill offers leveraged financial products like forex and cfds you can choose the leverage of the demo account. It can be up to 1:500.

The account balance is available in USD, GBP, EUR, PLN.

Advantages of the tickmill demo account:

- Free

- Unlimited

- Choose the deposit amount

- Choose the leverage

How to open the free demo account:

In the following steps, we will show you exactly how to open the free demo account with tickmill. From our experience, it is very easy and fast for traders to get access to the financial markets.

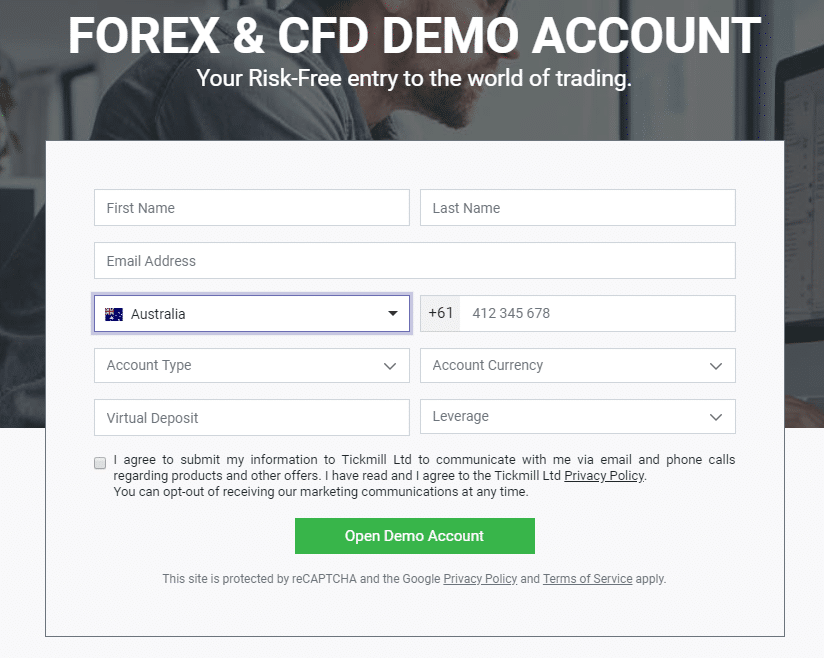

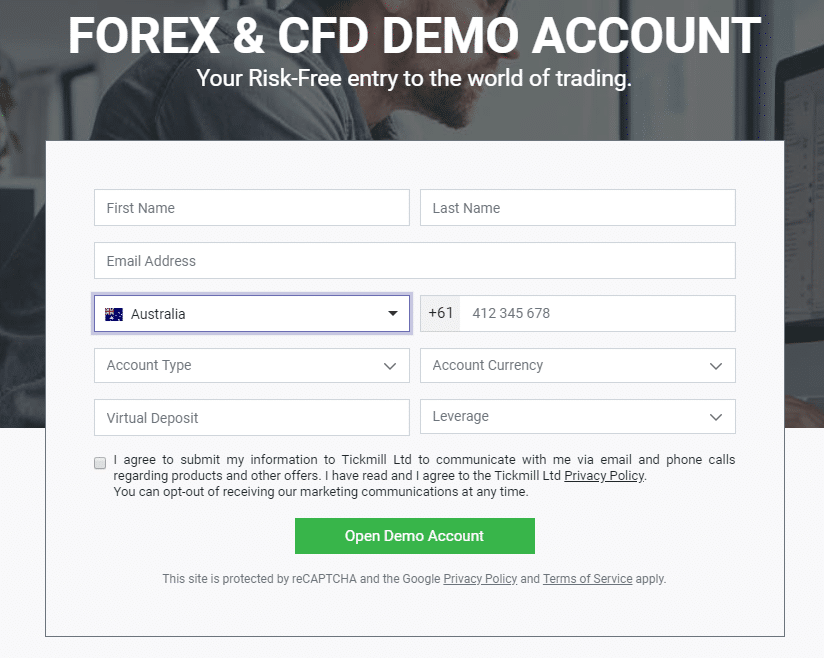

1. Fill your personal data into the form

As you see in the picture above you have to insert your personal data into the form the request the demo account. Make sure your data is correct otherwise you may have problems later if you want to start real money trading. Read also our article about how to deposit on tickmill.

Then you have to choose the account type, deposit amount, and leverage of the account.

2. Confirm your email address and receive the login details

Tickmill will send you an email with the login details for your trading account.

3. Download the trading platform

Download the trading platform metatrader 4 to your mobile or desktop device. Also, you can use the web trader. You just have to log in with your account details now.

Metatrader 4 is one of the most popular software worldwide for retail traders. You get access to the financial markets within a few clicks. Customize the charts as you want. There are many tools and indicators for your personal analysis.

On the webpage of tickmill, you will also find trading tutorials on how to use the platform. If you got questions about the software you can reach multi-language support. Forex trading is made by opening an order on the market (picture below). You buy or sell currency pairs that are traded against each other. If one currency increases in value you can earn or lose money.

Note: it is important to right-click on the markets and choose “view all” to see all assets and markets.

Tickmill demo account trading

4. Start trading

To invest in a market you should open the new order window to open the trade. Insert the trading volume (1 volume/lot is 100.000 units of the base currency) of your position and the risk management (stop loss and take profit). For beginners, it is difficult to calculate the positions. That is why they should the demo account first. But tickmill offers helpful forex calculator tools, so you can learn it easily.

Why you should use the tickmill demo account:

The demo account is an account with a virtual balance. Traders can invest without risk like it is real money.

Beginners:

Beginners should start using the demo account first. If you are new to trading you need to practice strategies, the software, and market behavior. Forex trading is very risky and without knowledge, you can burn a lot of money. If you feel comfortable you can start to trade with a small amount of real money.

Advanced traders.

For advanced traders, the tickmill demo account is perfect to learn more about the conditions of the broker. Also, you can test new strategies and markets to trade.

Conclusion: the tickmill demo account is perfect for everyone

On this page we gave you detailed information about the tickmill demo account. It is a virtual money account for practicing. The account is unlimited and free to use. You can imitate real money trading. The biggest advantages are that you can choose the account balance and trading leverage.

The account opening is also easy and fast. There are no restrictions for you and you can start trading with a trusted forex broker for free. For all traders, we recommend to try out the free demo account before investing real money because you can earn important experience with the demo account.

Advantages:

- Free

- Unlimited

- Change the leverage

- Trade without risk

- Immitate real money trading

We recommend to trader with the trusted broker tickmill. The best way to test the platform by yourself is the demo account.

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to funding@tickmill.Com and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

How to use the tickmill demo account

You want to start trading with tickmill? – then you should start with the free demo account first. On this page, we will show you how to open the free demo account and how to use it. Furthermore, as experienced traders for 7 years, we will show you tips and tricks and why you should use the demo account before you start trading live.

Open the tickmill demo account

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Facts about the tickmill demo account:

Tickmill offers you a free demo account to practise or test the trading platform. When you register you can choose the leverage on the account and the virtual deposit. The demo account means that you are trading with virtual money and no risk. Beginners can try out their first trades and advanced traders can practice new strategies or learn how to trade new assets. The demo account is multi-functional.

Virtual deposit:

Choose the deposit amount you want. It can be any number. We recommend using the investment amount of your real deposit later. Use the demo account like it would be real money.

Tickmill offers leveraged financial products like forex and cfds you can choose the leverage of the demo account. It can be up to 1:500.

The account balance is available in USD, GBP, EUR, PLN.

Advantages of the tickmill demo account:

- Free

- Unlimited

- Choose the deposit amount

- Choose the leverage

How to open the free demo account:

In the following steps, we will show you exactly how to open the free demo account with tickmill. From our experience, it is very easy and fast for traders to get access to the financial markets.

1. Fill your personal data into the form

As you see in the picture above you have to insert your personal data into the form the request the demo account. Make sure your data is correct otherwise you may have problems later if you want to start real money trading. Read also our article about how to deposit on tickmill.

Then you have to choose the account type, deposit amount, and leverage of the account.

2. Confirm your email address and receive the login details

Tickmill will send you an email with the login details for your trading account.

3. Download the trading platform

Download the trading platform metatrader 4 to your mobile or desktop device. Also, you can use the web trader. You just have to log in with your account details now.

Metatrader 4 is one of the most popular software worldwide for retail traders. You get access to the financial markets within a few clicks. Customize the charts as you want. There are many tools and indicators for your personal analysis.

On the webpage of tickmill, you will also find trading tutorials on how to use the platform. If you got questions about the software you can reach multi-language support. Forex trading is made by opening an order on the market (picture below). You buy or sell currency pairs that are traded against each other. If one currency increases in value you can earn or lose money.

Note: it is important to right-click on the markets and choose “view all” to see all assets and markets.

Tickmill demo account trading

4. Start trading

To invest in a market you should open the new order window to open the trade. Insert the trading volume (1 volume/lot is 100.000 units of the base currency) of your position and the risk management (stop loss and take profit). For beginners, it is difficult to calculate the positions. That is why they should the demo account first. But tickmill offers helpful forex calculator tools, so you can learn it easily.

Why you should use the tickmill demo account:

The demo account is an account with a virtual balance. Traders can invest without risk like it is real money.

Beginners:

Beginners should start using the demo account first. If you are new to trading you need to practice strategies, the software, and market behavior. Forex trading is very risky and without knowledge, you can burn a lot of money. If you feel comfortable you can start to trade with a small amount of real money.

Advanced traders.

For advanced traders, the tickmill demo account is perfect to learn more about the conditions of the broker. Also, you can test new strategies and markets to trade.

Conclusion: the tickmill demo account is perfect for everyone

On this page we gave you detailed information about the tickmill demo account. It is a virtual money account for practicing. The account is unlimited and free to use. You can imitate real money trading. The biggest advantages are that you can choose the account balance and trading leverage.

The account opening is also easy and fast. There are no restrictions for you and you can start trading with a trusted forex broker for free. For all traders, we recommend to try out the free demo account before investing real money because you can earn important experience with the demo account.

Advantages:

- Free

- Unlimited

- Change the leverage

- Trade without risk

- Immitate real money trading

We recommend to trader with the trusted broker tickmill. The best way to test the platform by yourself is the demo account.

Tutorial – open a demo account on tickmill

In this article about the forex broker tickmill, we will talk about all the necessary steps for opening a demo account with this company. Demo accounts have virtual funds that can be used by the trader to invest in the markets without any risk. They also present exactly the same information and market prices in real-time as in real accounts.

The benefits of opening a practice demo account before a live account are significant (if used properly). Among these advantages we can highlight the following:

- Know the broker’s trading platform and services.

- Virtual funds for simulated trades.

- Know the assets, their prices and the spreads offered by the broker

- The novice trader can practice constantly and without restrictions to gain more experience without risking real money.

Tickmill is a broker that offers various types of forex trading accounts for clients of different profiles.

- Classical

- Pro

- VIP

- Islamic account (no swap)

Each of these accounts has characteristics designed for various types of traders. They are trading accounts that adjust to various types of needs.

You can get more information about the company tickmill and its brokerage services in the following guide about this broker: review of tickmill broker

Demo account opening process

The first thing to do is visit the official tickmill page , there you can see the corresponding button to open a demo account.

When we click on the “ demo account ” button we are immediately redirected to the registration process, where we must fill out the corresponding form in order to open a tickmill practice demo account.

Here, we must indicate the following data:

-account type (these accounts emulate tickmill’s real trading accounts.).

– desired account leverage (1: 1 to 1: 500).

In addition, we must check the boxes that indicate that we agree to receive the tickmill newsletter and information about special offers and the one that indicates that we understand the broker’s privacy policy.

Once we complete the data in the demo account form, we must click on the “ open demo account ” button.

Immediately, tickmill opens the demo account, sends the information to the customer’s email, with the account access data. At the same time, it displays the following message:

The message we receive in our email is as follows:

In this message, tickmill indicates the account details, including the number and password. In addition, the message includes a link to download the platform (metatrader 4) and the server to connect to this software and start trading.

If you think you have gained enough experience practicing on a demo account, you can open a live account with tickmill. For this, you can click on the “ apply for a live account ” link at the end of the message.

This brings us to the following page on the broker’s website:

Here we can enter our secure client area if we already have a real account with tickmill. Otherwise, we can register and open a real account with this broker by clicking on the “open account” tab, which leads us to the following form where we can start the registration process.

In another article, we will explain how to complete this process.

Tickmill demo account features

Virtual deposit

It is the amount of virtual funds required to start the demo account. These funds are necessary to be able to place simulated orders. For example, we can trade with a simulated deposit of $10000. It is recommended to use a number of virtual funds similar to the amount of real funds that we are going to deposit.

Account type

In the tickmill demo account, we can test the characteristics of the types of real accounts available in the broker. For this purpose, we must indicate the type of trading account that we want to simulate.

Account currencies

The type of currency with which we are going to trade in the demo account. We can choose between a large number of currencies, including the main currencies, such as the USD, EUR, GBP, and AUD, among others.

Leverage

In this section, we can choose the amount of leverage that we want or with which we feel more comfortable, something that regularly cannot be done in other brokers.

It should be noted that high leverages carry greater risks since the greater the leverage the greater the margin required to trade safely.

In general terms, greater leverage implies greater profits as well as can cause greater losses, and in summary, implies greater trading risk.

Trading platform

Tickmill uses metatrader 4 as its default trading platform in its downloadable versions for PC, as well as in its web version. Below is the webtrader version of metatrader4:

You can get more information about the tickmill broker and open a practice demo account at no cost, through the following link:

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least $25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Tickmill reviews – guide

This is how tickmill allows you to start a demo account, i.E. A demo account that you can use to learn or check the platform. The demo account also requires verification by e-mail, so you should provide such an e-mail to which we have access because the acceptance of your account is possible by receiving a special link that should be clicked on to verify your account in tickmill.

Starting a real account – investing real money

Creating an account at tickmill, step 1/2

In order to set up an account in tickmill, you must complete all required boxes on the registration page. You must provide all the correct data if you want to connect a real account to this account, because this account associated with the email address will receive all very important information connected with the account. Also the password reminder or changing data will require receiving emails that will be combined with the account.

Payment and withdrawal methods

At tickmill, there are various deposit and withdrawal options. After opening the account you will be able to check which option is the most advantageous for you. Depositing money is done by selecting a payment method, selecting a deposit and depositing funds. If we want to withdraw our money, we do the same. We select the method of payment, order the appropriate amount available on the platform and accept the transfer.

Registration step 2/2

In step two, you have to complete almost all boxes. In this step you should also answer all the questions that are to verify your knowledge. It is worth changing the language of the platform at the top of the page so that the questions are in your native language. The important thing is understanding these questions and honest answers.

Completing the registration

After completing the filling out the boxes, accept the regulations and information about the risk and correctness of the entered data. After this step, we will receive an email with a link to the verified your account. After clicking on it your account will be active and you will be able to log in with the entered data.

Verifying the account on the tickmill website.

After logging into your tickmill account, you have to verify your account by submitting the two required documents. Your account will not be active without verifying these two required documents. In order to do this, please attach a scan of the document with a photo in the first window, and a document confirming your home address in the second. Complete guidelines concerning documents are available after logging into the platform. It is important that the document is legible and the picture clearly visible. After adding the photo we send it through the platform and we wait for someone to activate our account. Account activation takes from several hours to several days. After accepting the documents we will receive a message about the correctness or rejection of the application. If the documents are correct, our account will be activated, if not- our application is rejected. If it is rejected, check what was wrong, what document was incorrect, correct it and send back again.

Tickmill demo account

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Indonesian

- Español

- 中文

- Việt nam

- 한국어

- ภาษาไทย

- Portuguese

- العربية

- Türkçe

- Bahasa melayu

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Review of tickmill

Tickmill review

In our tickmill review, we cover tickmill bonus, mt4, ttickmill forex, deposit & withdrawal, and tickmill account types. Compare it to other forex brokers before deciding if tickmill has the features you are looking for in a forex broker and give your rating after reading the full reviews. Tickmill broker is a well-known and popular online broker in the currency and CFD markets, which offers competitive differentials in a wide range of assets in global markets. Tickmill was founded in 2007. Tickmill, located in sydney, australia, owns and operates it.

Tickmill bonus offers a cost-effective online trading solution suitable for almost any type of trader when factored with all their great features.

The company's headquarters are located at 6 309 kent street, sydney, NSW 2000. This is mainly because IC markets is trying to close the gap between traders and large institutional investors. Our tickmill review shows they offer investment solutions that were once provided only by investment banks.

They also offer the highest leverage available in australia, low margins and rates, an excellent education center, and much more.

Tickmill MT4

Our tickmill review revealed the following details in terms of platforms you can use. They offer you the globally recognized and accepted MT4 platforms that are available in windows, mac, and webtrader. The features you will get with a platform like this one includes access to:

- Cfds on indices, forex, commodities, and bonds.

- You can execute orders with no partial fills and have more liquidity depth

- EA trading facilities are available using the VPS service

- Advanced technical analysis is available with 50+ indicators and customizable charts in 39 languages.

There is not a lot that is left to be desired when they have the MT4 platform available for you to use. The MT4 mobile app provides as a tickmill bonus feature will give you access to the following things:

- A view of the real-time quotes

- Access to asset classes

- Technical trading indicators

- Trading directly from the chart

You will also have access to autochartist, a plugin for mt4 on windows only that detects key chart patterns and price analysis patterns and other offers.

Tickmill demo

Just like all reputable brokers, our tickmill review shows the broker has provisions for new traders. When you are new in the market, you will need to acclimate to the latest technology that you use when trading.

The demo account tickmill broker providers are what will show you what is available and what you can do with it as a trader. There is a lot to learn, and you will need to know all the details before you get started with live trading.

Ticmill broker

As a broker, our tickmill review shows that they are well-regulated, have no scandals, or other issues, and will serve you well. Any of the payments you make to tickmill accounts are held in a segregated bank account.

To add more security to this as a tickmill bonus feature, they use tier-1 banks. As you may have gathered, the tier-1 banks are on the official measure of a bank’s financial health and strength. This will ensure that the tickmill bonus feature works as a measure to safeguard your money.

Using tickmill forex, you can trade over 60+ currency pairs. At the moment, there are no tickmill bonus offers or promotions because the EU regulations and other regulators forbid them. However, a tickmill bonus you can get is a trader of the month promo, a $30 welcome bonus, and a few other things.

Tickmill account types

Three core accounts are offered, as shown in our tickmill review. They include a pro account, a classic account, and a VIP account. They all have different minimum balances, maximum leverage, and spreads/commissions.

It all depends on which regulator you opened your account. The details are available here: https://www.Tickmill.Com/trading/accounts-overview.

Tickmill customer service

One of the things in which tickmill stands out is at the level of customer service. Because tickmill is an international online broker, we provide our clients with multilingual assistance 24 hours a day, five days a week.

Tickmill is a secure system that protects your data via encryption. Also, they have many years of experience in the online trade industry. They offer competitive services and provide a wide range of sophisticated commercial platforms.

You can open an account at tickmill by completing the application form via the tickmill website, providing personal details, and topping up a minimum of USD 200 mind.

Tickmill details overview

so, let's see, what we have: how to use and open the tickmill demo account in 2021 ✔ tutorial for beginners and new traders ✔ tips and tricks ➜ read more about it now at tickmill demo account

Contents of the article

- Top-3 forex bonuses

- How to use the tickmill demo account

- Facts about the tickmill demo account:

- How to open the free demo account:

- 1. Fill your personal data into the form

- 2. Confirm your email address and receive the...

- 3. Download the trading platform

- 4. Start trading

- Why you should use the tickmill demo account:

- Conclusion: the tickmill demo account is perfect...

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Welcome account

- A special welcome to the world of...

- Your perfect start with...

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- How to use the tickmill demo account

- Facts about the tickmill demo account:

- How to open the free demo account:

- 1. Fill your personal data into the form

- 2. Confirm your email address and receive the...

- 3. Download the trading platform

- 4. Start trading

- Why you should use the tickmill demo account:

- Conclusion: the tickmill demo account is perfect...

- Tutorial – open a demo account on tickmill

- Demo account opening process

- Tickmill demo account features

- Trading platform

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Tickmill reviews – guide

- Starting a real account – investing real money

- Creating an account at tickmill, step 1/2

- Payment and withdrawal methods

- Registration step 2/2

- Completing the registration

- Verifying the account on the tickmill website.

- Tickmill demo account

- Client area registration 1/2

- Review of tickmill

- Tickmill review