Open a forex account with $100

Mini forex accounts require a relatively small amount of upfront capital to get started, typically a deposit of between $100 and $500.

Top-3 forex bonuses

The minimum depends upon the forex broker you choose to use. This is ideal for those looking to learn about trading currencies but do not want to risk too much money. Forex mini accounts are useful for experimentation. An experienced forex trader might use one to test out a new strategy or system. For that to work, the trader must treat the account as his regular forex trading account, otherwise, the results will be inaccurate and skewed.

What are the advantages of using a mini forex account for trading?

A mini forex trading account involves using a trading lot that is one-tenth the size of the standard lot of 100,000 units. In a mini lot, one pip of a currency pair based in U.S. Dollars is equal to $1, compared to $10 for a standard-lot trade. Mini lots are available to trade if you open a mini account with a forex dealer and are a popular choice for those who are just learning how to trade.

Advantages of a forex mini account

Mini forex accounts require a relatively small amount of upfront capital to get started, typically a deposit of between $100 and $500. The minimum depends upon the forex broker you choose to use. This is ideal for those looking to learn about trading currencies but do not want to risk too much money.

Although it is an advantage to open an account with a small amount of upfront capital, it is also important to realize that using leverage could make things much riskier if the currency pair makes a small adverse move. This problem can be reduced by starting with more than the account minimum to make the amount of leverage more manageable.

Traders with a forex mini account are not limited to trading one lot at a time. To make an equivalent trade to that of a standard lot, the trader can trade 10 mini lots. By using mini lots instead of standard lots, a trader can customize the trade and have greater control of risk. For example, if a trader wants to trade more than 100,000 units (one regular lot), but 200,000 units (two regular lots) is too risky, the trader using the regular account would not be able to trade. However, by using a mini account, a trader could make the trade by trading between 11 and 19 mini lots.

Retail forex brokers often allow a significant amount of leverage when using mini lots. This minimizes risk on their end by lowering trade amounts. Often forex traders will use mini forex trading to gain the extra leverage available, but they will still trade in units of 100,000 (10 mini lots). The greater customization of risk and the larger amounts of leverage available make forex mini accounts advantageous for many retail forex traders.

Forex mini accounts are not just for novices

Forex mini accounts are useful for experimentation. An experienced forex trader might use one to test out a new strategy or system. For that to work, the trader must treat the account as his regular forex trading account; otherwise, the results will be inaccurate and skewed.

In summary, if you are are looking to get your feet wet in forex trading, a forex mini account will help you minimize your losses while you come up to speed. Similarly, even the experts use mini accounts because they provide a way to try out new strategies while their exposure to risk is less than it would be with normal forex trading.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

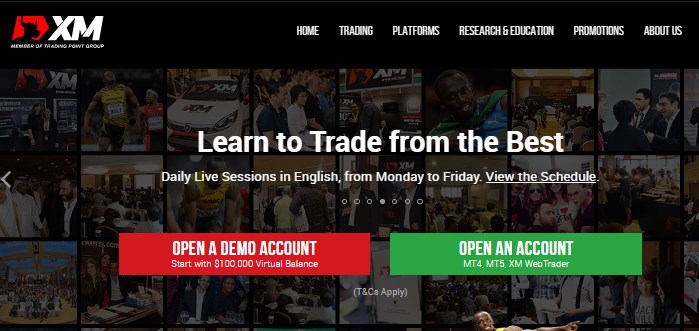

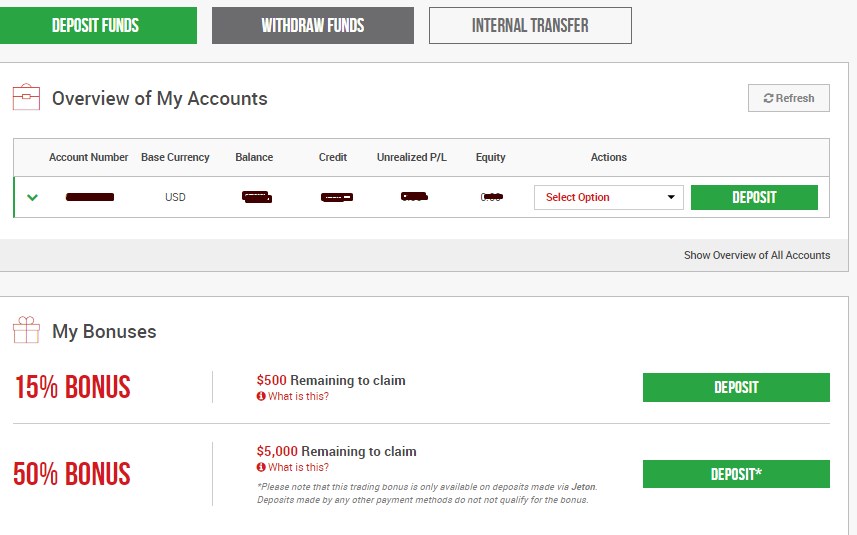

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

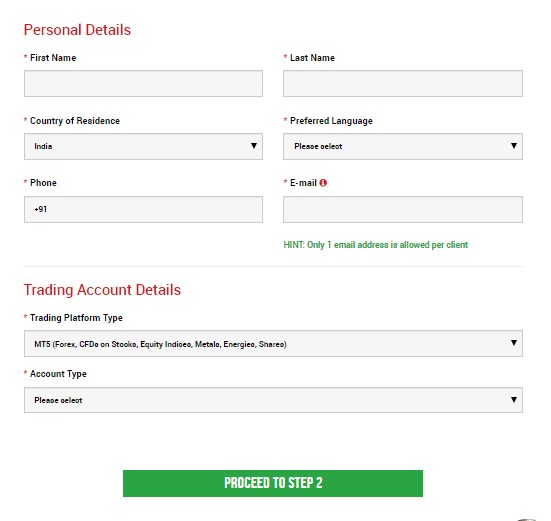

Step 2: filling the personal details

Fill all the box with accurate details

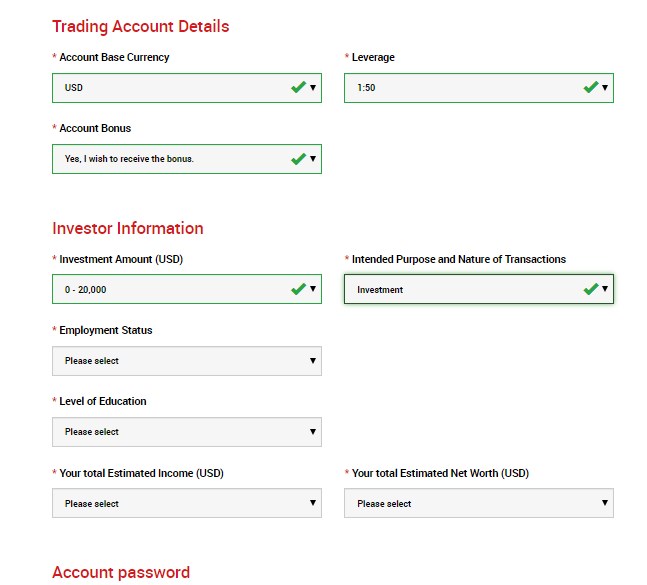

Step 3: investor information & trading account details

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

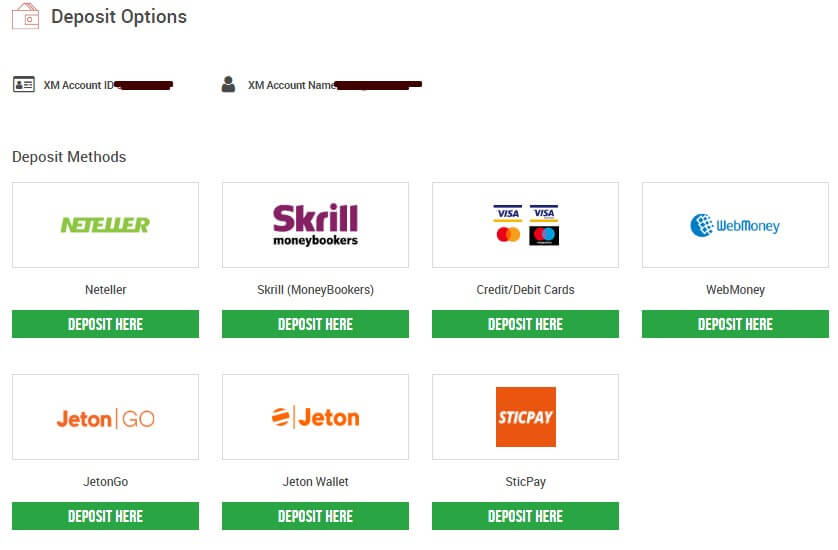

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

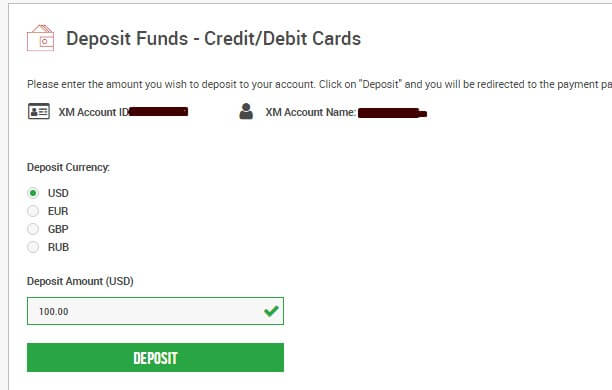

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to open a forex trading account, open a forex account with $100

Open a forex account with $100 is a common way nowadays, forexsq FX experts will show you how to open a forex trading account with $100 or less.

How to open a forex trading account

After selecting the correct broker for you, you can open a forex trading account in 3 easy steps:

- Choosing a type of account

- Registration

- Account activation

Beforehand trading a time of your hard-earned money, you may want to keep thinking about opening demo demo account. In fact, open up 2 or 3 demos – why not? All are FREE! Trial some different brokers to get a feel for the correct one for you.

How to open a forex account with $100, selecting an account type

While you’re prepared to open a live account, you have to select which kind of forex trading account you need: a business account or a personal account.

In the previous, while opening a forex trading account with $100, you’d as well have to select whether you needed to open a micro account, mini account, or a standard account, on micro trading accounts you can open a forex trading account with $100 or even lower.

At present, that isn’t much of a problematic since most brokers permit you to trade custom lots. This is inordinate for inexperienced and newbie traders who simply have a small account of principal. This delivers you great flexibility, as you won’t have to trade greater than you’re comfy with.

Also, at all times keep in mind that: always read the fine print.

Several brokers have a “managed account” choice in their application forms. If you need the broker to trade your account for you, you can choice this. Finally, you didn’t read through the entire school of pips ology just to have somebody else trade for you!

Also, opening a managed account necessitates an appealing big minimum deposit, usually $25,000 or greater. Moreover, the manager will as well take a cut out of any profits.

Finally, confirm you open a spot forex account and not futures or a forwards account.

Registration

You will have to submit official procedure to open an account and the forms will differ from broker to broker. They are generally delivered in PDF format and can be printed and viewed using adobe acrobat reader program.

As well, confirm you know all the related costs, like how much your banks charges for a bank wire transfer. You’d be astonished how much these really costs, and they might actually take up an important portion of your trading principal.

Account activation

When the broker has received all the essential paperwork, you should obtain an email with instructions on finalizing your account activation. Later these steps have been finished, you will obtain a final email with your username, password, and guidelines on how to fund your account.

How to open a forex account conclusion

We sturdily guide you demo trade first. There’s no infamy in demo trading – everybody has to start anywhere.

For at least 6 months, if you have been demo trading, then possibly you can dip your feet into live trading. We suggest you go in the thin end and deliberate how much you need to risk.

Trading live is a dissimilar being overall. No matter how positive you were in demo trading, nothing can substitute the feeling of having real currency on the line.

Now you know how to open a forex account with $100 so tip forexsq experts please by share this article on the social media networks and let other investors know about how to open a forex trading account with $100.

What is forex trading?

What is forex trading home based business? Can open account for $100

Starting forex trading home business basics

Forex trading home based business is another sector of internet based businesses that many ordinary people start. The popularity of this business is increasing rapidly. Now more and more people are interested to start this business. But due to the lack of information available in the market make this market is still not clear for many. Forex trading home based business provides you with lots of opportunities to earn good profits out of this market.

The foreign exchange market, also known as forex trading, is the means through which one currency is changed into another. During that process there will be a profit or loss for traders. When trading forex, you are always trading currency pair. Selling one currency while simultaneously buying another. The financial market is one that is always changing. That leaves transactions required to be completed through brokers, and banks.

Cash, stocks, and currency are traded through the foreign exchange markets. The forex market will be present and exist when one currency is traded for another. Think about a trip you may take to a foreign country. Where are you going to be able to trade or exchange your money? To exchange it to the value of the money that is in that other country? This is the basis for forex trading. It is not available in all banks, and it is not available in all financial centers. Forex trade is a specialized trading circumstance.

Anyone can start forex home based business

Every business comes with it own set of advantages and disadvantages. Similarly, forex trading home based business has its own advantages and disadvantages. If you want to start and earn lots and lots of money out of this business then you must know how to get the maximum advantage. You must as well minimize all disadvantages at it best to get success in this market.

Advantage of forex trading home based business

- Low investment: you don’t need to invest lots of money to earn real profits out of this market. You just start your forex internet home based business by opening a forex mini account for just $100.

- Flexible time: forex market is open 24 hours as day. You can choose your best time to trade as per your availability. There is so specific trading time in the forex market.

- Lots of opportunity: forex trading home based business provides you lots of opportunities to earn good profits out of this market. You just need to learn the skills of the forex market and know how to use the forex tools to get the best results out of this market.

Disadvantages of forex trading home based business

- Not getting fixed income: forex trading home based business doesn’t give you regular income. Your income is completely depends upon the tie you have invested into this market and how you are using your skills and forex tools to get the best results out of this market.

- No quick gain: when it comes to forex business , many first time investors want to jump right in with both feet. Unfortunately, very few of those investors are successful. Investing in anything requires some degree of skill. It is important to remember that few investments are profitable in short period of time. In forex trade market there is also risk of losing your money.

- Scammed by forex trading: forex trading is all about making money by exchanging it to another currency. Some investors have found it quite easy to make a large amount of money as the forex market changes daily. It is important that you beware of companies that are popping up online. Often times the offers you get are from foreign countries that are stating they can get you involved in the forex markets and make you successful in trading. Read the fine print, and know whom you are dealing with for the best possible protection.

What is your risk tolerance?

Each individual has a risk tolerance for any activity in life. Determining your risk tolerance involves several different things. First, you need to know how much money you have to invest. What your investment and financial goals are as well. Finally, what amount of money to lose without affecting your daily life.

If you are in your early twenties and you want to start investing for your retirement, your risk tolerance will definitely be low. You can afford to watch your money grow slowly over time. That is very different when one is in middle or advanced age.

Again, a good financial planner or stock broker should help you determine the level of risk that you are comfortable with, and help you choose your investments accordingly. Your risk tolerance should be based on what your financial goals are and how you feel about the possibility of losing your money. It’s all tied in together. If you feel you have the confidence of starting forex trading home based business, this is the right time to do so.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

Best forex managed accounts 2021

A managed forex account is where a money manager handles the investments and trading of the client’s account on their behalf. They manage the client’s account by seeking trading opportunities, adjusting the risk, implementing their own strategies, or even taking input from the client on what they would like to trade on and how.

The world’s most popular FX platforms, the MT4 and the MT5 both feature the possibility of having a money manager manage accounts through them. This is often called a MAMM account.

The brokers below represent the best forex managed accounts brokers.

82% of retail CFD accounts lose money

82% of retail CFD accounts lose money

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

ECN, market maker, no dealing desk

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Your capital is at risk

IRESS, MT4, MT5, webtrader

Your capital is at risk

Here’s a list of the best forex managed accounts brokers.

Regulated by: cysec, FCA, FSC

Headquarters : 30 churchill place, london, E14 5EU, UK

82% of retail CFD accounts lose money

FXTM is also known as forextime, and commenced operations in 2011 from its de facto headquarters in limassol, cyprus. Since then, FXTM has achieved rapid global expansion, driven primarily by its desire to serve specific local markets with strong FX demand.

The MT4 and MT5 are the platforms provided by FXTM. These platforms, however, come in various versions built for the web, for desktops and for mobile devices. The FXTM MT5 is an improvement on the MT4 and can be downloaded from the myfxtm members’ area.

Activtrades

Headquarters : 1 thomas more square london E1W 1YN united kingdom

"all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Activtrades corp is authorised and regulated by the securities commission of the bahamas. Activtrades corp is an international business company registered in the commonwealth of the bahamas, registration number 199667 B. Activtrades corp is a subsidiary of activtrades PLC, authorised and regulated by the financial conduct authority, registration number 434413. Activtrades PLC is a company registered in england & wales, registration number 05367727."

Activtrades was founded in 2001 and was recognised by the sunday times fast track 100 as the 90th fastest growing company in the UK for 2017. The company is regulated by the UK financial conduct authority (FCA), as well as the securities commission of the bahamas and offers CFD and spread betting trading accounts with direct execution (non-dealing desk).

FP markets

Regulated by: ASIC, cysec

Headquarters : level 5, exchange house 10 bridge st sydney NSW 2000, australia

Your capital is at risk

This brokerage offers a massive range of tradable assets through forex, CFD, and share trading accounts. FP markets supports the MT4, MT5, and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spread or commission pricing.

FP markets was founded in 2005 and is headquartered in sydney, australia. It is regulated by the ASIC in australia. Demo accounts are available. While it is suitable for beginners, education resources are limited.

What is a forex managed accounts?

A managed forex account is where a professional trader/money manager manages the trading on the clients’ behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs.

An investor may advise the money manager on strategies and signals to look for while trading on his behalf. An investor may do this to take themselves out of the equation and trade without the psychology and emotions that come with wins and losses. On the other hand, some clients simply choose to let the brokerage/money manager trade the account based on their own systems and strategies.

Forex managed accounts can be compared to traditional investment accounts of equities and bonds, in the way that an investment manager handles the trading logistics. In no instance can a money manager withdraw or add funds to the account, they are granted trade only access to the account, and the investor has full control over their account. Money managers charge a fee or commission for managed accounts, so it is important to research a variety of options, as their prices can vary greatly.

How does a managed forex account work?

For an investor to have a managed trading account, they must first open a trading account at a reputable brokerage firm of their choice. Then allocate the necessary amount of funds for a managed account. The money manager has limited access to the account and operates on a trade only basis. The investor remains in full control of the account and its deposits and withdrawal processes.

Now, if a money manager does not have any control over the investors money, how can they conduct trades? Well, upon setting up a managed account, both the investor and money manager must sign a document called a limited power of attorney agreement (LPOA). This is an agreement for both parties, allowing the trader to trade on an investors account on their behalf, without needing to transfer the investors funds to the traders account. This agreement provides a high level of security, control, and transparency that’s comfortable for the investor.

With the signing of this agreement, the managed account gets placed in what’s called a “master block”, and as stated before, the investor continues to have full control of their account. They can check the balance, deposit or withdraw funds, monitor trade activity, and even revoke the LPOA agreement at any time if they are not happy with the money manager. One thing they can not do is conduct their own trading on the account, unless they revoke the LPOA agreement.

Regarding the money managers aspect of managed forex accounts. They may trade for many investors all from a single master account using PAMM, LAMM, or MAM software and technology. These technical procedures are integrated into most reputable brokerages and various online trading platforms, making it possible for traders to manage investor accounts.

Account types

Investing through a managed account has been around for a long time. In fact, it’s been around for as long as investing. With that in mind, there have generally been 3 types of managed forex accounts that prevail- individual, pooled, and more recently; varieties of PAMM accounts.

Individual account

This type of account is the most simple and standard type of account when you think of a managed account. The account managed is a segregated account where the money manager makes all the trades on your behalf. The traders’ decisions are based solely on your instruction or desire, he/she is trading for you and only you.

Their decisions will be based on your risk level and whether you provide any specific strategy or guidance. Since there are no additional traders’ funds involved in this account, the minimum deposit may be quite high- exceeding $10,000. For this reason, and the fact the manager is trading this account individually for you, you will want to ensure a professional and competent money manager is chosen. A great deal of research and client testimonials will be beneficial when going this route.

Pooled account

This type of account is very similar too mutual funds, in where many investors pool their money together in a separate account and share the profits after fees and expenses. With pooled accounts, there are often a variety of pools to choose from. Each may be offering different risk levels, minimum deposits, investment strategies, currencies traded, and fees and expenses. These types of accounts are managed for a variety of investors, requiring you to choose or be advised on which pool suits your needs.

Unlike individual accounts, the manager is trading for numerous investor desires. To help determine an account for you, each fund will have years of past performance for review. A main benefit of pooled accounts is the lower minimum deposit required to enter, being as low as $2000. Although, there are often minimum participation requirements upon entering a pool fund. These are all factors you need to consider before diving in.

PAMM, LAMM, & MAMM accounts

These types of accounts use sophisticated technology to distribute profits, losses, and fees based on percentages of funds each investor has involved in the master account used for trading. These account methods are relatively new in comparison with the other two listed here, and offer the satisfaction of dealing directly with the broker of your choice in a secure and transparent way.

It’s similar to the mirror and copy trading features some brokers offer, because of the automation and technicality. Although, it still has more similarities to a managed account. All these types of accounts are basically pool accounts, in the sense that numerous investors pool their money together and reap the profits or losses of the money manager.

What should you look for in a managed forex account?

There are numerous things to consider when opening a managed forex account and you must always be careful when selecting a money manager. You need to use due diligence ensuring the money manager is reputable and trustworthy. The forex industry is known to have some notable scammers in the past, so extra precautions must be made to guarantee safe and secure management.

Not only do you need to take precaution when choosing your money manager, but also in the type of account that’s suitable for your needs. Below are some things to look for when choosing a managed forex account.

- The risk level of an account or manager is something to consider. When trading with an individual account, you want to choose a money manager who’s trading style and history is at the level of risk you’re comfortable with. You can advise your money manager on how to trade, but by choosing one that trades with your level of risk already can make all the difference. As well, with trading accounts, you want to choose a pool with your appropriate risk level and trading method.

- Another important factor are the fees, expenses, and minimum deposits involved with a trading account. Many firms will charge performance fees to your account. These fees can vary greatly based on the account type, and risk level of such an account. These rates can range from anywhere between 10%-35% and some cases even higher. These rates are in accordance to a principle called the “high water mark”. This protocol is applied to your account if at the end of each month your net balance is higher than a certain percentage. If this is the case, your account will be deducted the performance fee which is a certain percentage. Some brokerages may also charge an account management fee on top of the other fees for following a specific formula. Also in some cases, there can be a fee for the termination of account in the event of transferring all funds.

- An important factor when choosing a reputable managed forex account is the availability of past performance history. Past performance may not be an indicative factor of future results, but at least the history shows experience of the forex account. There should be published history of at least a few years for a reputable brokerage managed account.

How to open a managed forex account?

Opening a managed forex account is more complicated than you might think. That is why we’ve created a detailed list pertaining to the necessary steps involved. Discover the intricate process in great detail below;

- Before you make the necessary steps to opening an account, you must first determine your risk tolerance. You need to know this so you know who to look for in a money manager, you can view their track record and overall risk score. Another point that goes along with this are your goals. If you want to make higher profits in a short amount of time, high risk managed account might be the option for you.

- Spend time networking and searching for the right forex trader. There are lots of options out there, but not everyone is right for you. Use your due diligence and research, reach out, and network to find the best possible forex brokerage.

- Once you have narrowed down your list of forex traders, you need to go over each contract. Make sure you feel comfortable with everything and understand the max drawdowns, liability coverage, fees and expenses, and so on. Your due diligence is key in obtaining a successfully managed forex account.

- Again, ensure everything is up to spec with the trader your interested in. View past performance reports, client testimonials, reviews, and anything you can dig up on the internet.

- Once you have completed the steps above you are ready to select a forex trader to manage your account. You’ll need to complete and sign the necessary documents, and contracts including the signing of a limited power of attorney agreement (LPOA).

- The next step is to receive your account number and transfer funds into the account. The account number is tied to your name, information, and your segregated trading account. Once everything is in order you can go ahead and transfer the funds, knowing you’re with a trusted and secure forex trader by following the steps above.

- Finally, you wait for the money to be transferred, and it’s complete. It really is a simple process. You can have a managed forex account up and running within a few days. Now, you can analyze your account and even learn from the trades that are being made.

Leverage your growth

With zero commission and ultra-low spreads, the road to success has never been simpler.

Explore the worldвђ™s financial markets with competitively low spreads and no commission on six asset classes.

FX MAJORS

| AUD/USD | loading | loading | loading |

| EUR/USD | loading | loading | loading |

| GBP/USD | loading | loading | loading |

| USD/JPY | loading | loading | loading |

CRYPTOS

| BTC/USD | loading | loading | loading |

| ETH/USD | loading | loading | loading |

| LTC/USD | loading | loading | loading |

| XRP/USD | loading | loading | loading |

We empower traders by simplifying the withdrawal process. Weвђ™ve eliminated excess waiting periods and unnecessary steps, and our team processes all withdrawal requests within 24 hours.

Our aim is to help traders grow by providing all the support you need to flourish. We offer over 170 assets to trade on through the metatrader 4 platform, 24/7 support for all clients, as well as informative materials to help you get started.

Since we donвђ™t charge any commission, traders can use their full deposit to trade forex, crypto, stocks, indices and commodities. With 0% commission, we make trading fair and accessible to all.

Free demo and live MT4 accounts

Whether youвђ™re looking to practise trading risk-free, or to open a live trading account to start earning, we offer free demo and live accounts on the renowned metatrader 4 platform. You can even perfect your strategy and acquaint yourself with the platform through a demo account before depositing any funds. Both account types present identical market conditions, helping you get ready to go live!

Benefit from 0% commission, ultra-low spreads and free transactions today

Drop us a line in the form below and one of our support agents will get back to you shortly.

Thank you, we'll email you back to resolve your query shortly.

Contact us via our live chat service, weвђ™re available to answer your questions 24/7!

В© copyright 2020 all rights reserved. Cedar LLC, st. Vincent and the grenadines.

*this website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.**risk warning: trading leveraged products such as forex and cryptos may not be suitable for all investors as they carry a degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary seek independent advice. Read more here

Open a forex account with $100

Where smart investors get smarter SM

Call us 800-454-9272

#1 overall broker

Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Please read the forex risk disclosure before trading this product.

A forex dealer can be compensated via commission and/or spread on forex trades. TD ameritrade is subsequently compensated by the forex dealer.

Forex accounts are not protected by the securities investor protection corporation (SIPC).

Education center content is provided for illustrative and educational use only and is not a recommendation or solicitation to purchase or sell any specific security.

Investools, inc. And TD ameritrade, inc. Are separate but affiliated companies and are not responsible for each other’s services or policies.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in australia, canada, hong kong, japan, saudi arabia, singapore, UK, and the countries of the european union.

TD ameritrade, inc., member FINRA/SIPC, a subsidiary of the charles schwab corporation. TD ameritrade is a trademark jointly owned by TD ameritrade IP company, inc. And the toronto-dominion bank. ©2021 charles schwab & co. Inc. All rights reserved.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

So, let's see, what we have: mini lots are available to trade if you open a mini account with a forex dealer, and they are popular with new traders. At open a forex account with $100

Contents of the article

- Top-3 forex bonuses

- What are the advantages of using a mini forex...

- Advantages of a forex mini account

- Forex mini accounts are not just for novices

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to open a forex trading account, open a forex...

- How to open a forex trading...

- How to open a forex account with $100,...

- Registration

- Account activation

- How to open a forex account conclusion

- What is forex trading?

- What is forex trading home based business? Can...

- Starting forex trading home business basics

- Anyone can start forex home based business

- Advantage of forex trading home based business

- Disadvantages of forex trading home based business

- What is your risk tolerance?

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- Best forex managed accounts 2021

- Activtrades

- FP markets

- What is a forex managed accounts?

- How does a managed forex account work?

- Account types

- What should you look for in a managed forex...

- How to open a managed forex account?

- Leverage your growth

- With zero commission and ultra-low...

- Open a forex account with $100

- Fxdailyreport.Com