Free trading account

Attention investors: 1) stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.E.F september 01, 2020. 2) update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. 3) check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

Top-3 forex bonuses

Zerodha broking ltd.: member of nseвђ‹ &вђ‹ BSE – SEBI registration no.: INZ000031633 CDSL: depository services through zerodha broking ltd. – SEBI registration no.: IN-DP-431-2019 commodity trading through zerodha commodities pvt. Ltd. MCX: 46025 – SEBI registration no.: INZ000038238 registered address: zerodha broking ltd., #153/154, 4th cross, dollars colony, opp. Clarence public school, J.P nagar 4th phase, bengaluru - 560078, karnataka, india. For any complaints pertaining to securities broking please write to [email protected] , for DP related to [email protected] . Please ensure you carefully read the risk disclosure document as prescribed by SEBI | ICF

Free trading account

Zerodha broking ltd.: member of nseвђ‹ &вђ‹ BSE – SEBI registration no.: INZ000031633 CDSL: depository services through zerodha broking ltd. – SEBI registration no.: IN-DP-431-2019 commodity trading through zerodha commodities pvt. Ltd. MCX: 46025 – SEBI registration no.: INZ000038238 registered address: zerodha broking ltd., #153/154, 4th cross, dollars colony, opp. Clarence public school, J.P nagar 4th phase, bengaluru - 560078, karnataka, india. For any complaints pertaining to securities broking please write to [email protected] , for DP related to [email protected] . Please ensure you carefully read the risk disclosure document as prescribed by SEBI | ICF

Procedure to file a complaint on SEBI SCORES: register on SCORES portal. Mandatory details for filing complaints on SCORES: name, PAN, address, mobile number, E-mail ID. Benefits: effective communication, speedy redressal of the grievances

Investments in securities market are subject to market risks; read all the related documents carefully before investing.

Attention investors: 1) stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.E.F september 01, 2020. 2) update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. 3) check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

"prevent unauthorised transactions in your account. Update your mobile numbers/email ids with your stock brokers. Receive information of your transactions directly from exchange on your mobile/email at the end of the day. Issued in the interest of investors. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, mutual fund etc.), you need not undergo the same process again when you approach another intermediary." dear investor, if you are subscribing to an IPO, there is no need to issue a cheque. Please write the bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. As a business we don't give stock tips, and have not authorized anyone to trade on behalf of others. If you find anyone claiming to be part of zerodha and offering such services, please create a ticket here.

Online trading

Buy and sell securities using a wealth of research and advanced tools on our intuitive trading website.

Why trade online with fidelity

- Competitive online commission rates

- Free, independent research from 20+ providers

- Margin, short selling, and options trading tools

Features & benefits

Advanced tools and services

Accounts with online trading

Features & benefits

Pay $0 commission for online U.S. Stock, ETF and options trades, plus $0.65 per contract for option trades.

Get an overview of what’s happening right now in specific markets and sectors, and read news and analysis to help you understand the short- and long-term impact.

Dig into the details with research reports on 4,500+ stocks from more than 20 independent, third-party research firms.

Evaluate your investing ideas using the accuracy-weighted equity summary score provided by starmine.

Take advantage of stock screen strategies from independent third-party experts to research stocks, etfs, and options, or create your own screens using over 140 custom filters.

Create real-time watch lists to track stocks that interest you.

Set alerts to receive balance updates, trade notifications, market news, or stock research messages via email and our mobile apps.

Track real-time profit and loss information on every trade.

Advanced tools and services

Set trailing stops and conditional orders ahead of time to help manage risk and maximize profits.

Monitor, trade, and manage up to 50 stocks as a single entity using basket trading.

Explore advanced account features including margin, short selling, and options trading.

Qualified customers can take advantage of our active trading software to get streaming quotes, directed trading, and more.

Invest in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk.

Compare bonds by coupon rates, yields, call dates, and ratings.

Using up to 10 years of daily historical data, test strategies before you invest. Save strategies and manage trade alerts.

Accounts with online trading

Explore the details of this full-featured brokerage account, consistently rated among the best in the industry.

Pay no taxes on your gains within an IRA until you take withdrawals.

View all of your brokerage account choices including trusts, the fidelity account for businesses, custodial accounts, and more.

Next step

Questions?

Get our free mobile app

Keep up with the changing markets, research, trade, & more, wherever you are.

Research investments

$0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions ® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The equity summary score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. The equity summary score is provided by starmine from refinitiv, an independent company not affiliated with fidelity investments. For more information and details, go to fidelity.Com.

Barron's, february 21, 2020 online broker survey. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Fidelity tied interactive brokers for #1 overall.

Investor's business daily ® , january 2020: best online brokers special report. Fidelity was named best overall online broker, and also first in equity trading tools, research tools, low-cost/ETF trading, investment research, mobile trading platforms/apps, and portfolio analysis & reports. Results based on having the highest customer experience index within the categories composing the survey, as scored by 4,199 respondents. The survey was conducted by investor's business daily's polling partner, technometrica market intelligence. © investor's business daily, inc. All rights reserved.

System availability and response times may be subject to market conditions.

Brokerage account

Put your money to work in our easy-to-manage account

Enjoy $0 commissions for online US-listed stock, ETF, and options trades. 2 get easy access to your cash with a free debit card, checking, or bill pay. 3

Open an account in about 10 minutes.

What you get

with an E*TRADE

brokerage account

We have tools to help make investing easy. Youвђ™ll get a full range of investment choices. Ideas of what to invest in. Easy-to-use trading tools. And help whenever you need it.

Start the year with a cash bonus, plus commission-free trades

Got $5,000? Get $50 or add even more and get up to $2,500 when you open and fund a new account. Learn how 1

Trade more, pay less

With E*TRADE, you pay $0 commissions for online US-listed stock, ETF, and options trades.

Hereвђ™s a quick overview of our clear, competitive per-trade pricing.

Stocks

Mutual funds

Prices vary

No load, no-transaction-fee for more than 4,400 funds 4

Options

50вў - 65вў

Bonds

Per bond for online secondary market trades ($10 minimum, $250 maximum) 5

Futures

Per contract, per side вђ”plus fees 6

Investing doesn't need to be confusing

Not sure where to begin? We can help you learn the ins and outs of investing with in-depth tutorials, articles, videos, and more.

Up your game with our trading tools

We have tools for every trading level. Placing a trade is easy with E*TRADE's desktop and mobile platforms. Not new to the game? Power E*TRADE is our innovative platform for traders who are passionate about the markets.

Have questions? Get jargon-free answers.

We're always here if you need help or want to bounce ideas off us. Our team leaves confusing financial jargon at the door, and instead talks to you like a human.

Start investing today

Enjoy $0 commissions on online US-listed stock, ETF, and options trades with no account minimums. 2В

Get up to $2,500 with promo code WINTER21. Learn how 1

ETRADE footer

About us

Service

Quick links

Connect with us

Check the background of E*TRADE securities LLC onв FINRA's brokercheckв andв see

E*TRADE securities LLC and E*TRADE capital management, LLCВ relationship summary.

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

E*TRADE credits and offers may be subject to U.S. Withholding taxes and reporting at retail value. Taxes related to these credits and offers are the customer's responsibility.В

Offer validВ for new E*TRADE securities customers opening one new eligible retirement or brokerage account by 1/31/2021 and funded within 60 days of account opening with $5,000 or more. Promo code 'WINTER21'.

New customer opening one account:В these rules strictly apply to clients who are opening one new E*TRADE account, do not have an existing E*TRADE account and do not open any other new E*TRADE account for 60 days after enrollment in this offer. For other circumstances, please refer to the вђњexisting clients or new clients opening more than one accountвђќ disclosures below. Cash credits will be granted based on deposits of new funds or securities from external accounts made within 60 days of account opening, as follows:$5,000-$9,999 will receive $50; $10,000-$19,999 will receive $100; $20,000-$24,999 will receive $150; $25,000-$99,999 will receive $200; $100,000-$249,999 will receive $300; $250,000-$499,999 will receive $600; $500,000-$999,999 will receive $1,200; $1,000,000 or more will receive $2,500. Reward tiers under $100,000 ($5,000-$9,999; $10,000-$19,999; $20,000-$24,999; $25,000-$99,999) will be paid following the expiration of the 60 day period. However, if you deposit $100,000-$249,999, you will receive a cash credit within seven business days. If you have deposited at least $100,000 in the new account, and you make subsequent deposits in that account to reach a higher tier, you will receive a second cash credit following the close of the 60 day window. For example, if you deposit $150,000, you will receive a cash credit of $300 within seven business days, then if you deposit an additional $100,000 into your new account, you will receive an additional cash credit of $300 at the end of the 60 day window for a total reward of $600. If you deposit between $250,000 and $999,999 in your new account, you will receive a cash credit in two transactions at the end of the 60 day windowвђ”depending on your initial funding amount. If you deposit $1,000,000 in your new account, you will receive two cash credits that will total $2,500 within seven business days.

Existing clients or new clients opening more than one accountв are subject to different offer terms. Please click here to view offer terms.

Offer rules for all participantsВ new funds or securities must be deposited or transferred within 60 days of enrollment in offer, be from accounts outside of E*TRADE, and remain in the account (minus any trading losses) for a minimum of twelve months or the cash credit(s) may be surrendered. For purposes of the value of a deposit, any securities transferred will be valued the first business day following completion of the deposit. Removing any deposit or cash during the promotion period (60 days) may result in lower reward amount or loss of reward. E*TRADE securities reserves the right to terminate this offer at any time. If you are attempting to enroll in this offer with a joint account, the primary account holder may have to fulfill at the tiers noted before the secondary account holder can enroll in this offer. If you experience any issues when attempting to enroll with a joint account, please contact us 800-387-2331 (800-ETRADE-1) and we will be able to assist you with your enrollment.

5 broker deals that'll pay you to open an account

If you're looking for a new brokerage, consider opening your account with one of these institutions. They’ll pay you a new account bonus on certain account types if you meet minimum deposit requirements and keep your account open for a specified length of time. (all promotional data presented is accurate as of may 2020.)

Key takeaways

- With discount brokers cutting client fees and offering $0 trading commissions, the competitive landscape has never been better for individual investors and savers.

- In order to lure in new clients (or steal them from the competition), many financial firms offer financial incentives to those who qualify.

- Here, we present just five such offers that include cash bonuses, free trading, and higher-than-market incentive rates on savings products.

Charles schwab: $100 bonus or 500 commission-free trades

Charles schwab is offering a $100 referral bonus with a $1,000 deposit into a new schwab brokerage account. You can also get 500 commission-free trades with a $100,000 deposit; this deal is good for two years following the opening of the new account.

Schwab also offers unlimited commission-free online trading on most stocks and etfs for all clients.

Motif investing: 3 free months

On offer now at motif investing is 3 free months of their motif BLUE unlimited automated investment service. The offer is good only for first-time customers and is available when the new brokerage account application is approved.

For subscriptions starting at $4.95 per month, motif BLUE provides automated investing and rebalancing, real-time quotes, unlimited trading, and more.

$100 bonus + 3.75% 40-month IRA CD at navy FCU

Navy federal credit union is offering a $100 bonus, and it's available nationwide. Investors taking advantage of this deal will also have access to an attractive CD rate of 3.75 percent APY when you open a new IRA CD.

To qualify for the bonus, the new account must be funded with an opening balance of at least $100 within 45 days of account opening. The bonus will be deposited into the account within 30 days of the qualifying opening deposit.

Ally invest $3,500 cash bonus + 90 days of commission-free trades

Available at ally is an ally invest $3,500 cash bonus offer, which offers a $3,500 cash bonus and commission-free trades for 90 days when you open a new ally invest account. To qualify, you must do the following:

1. Open a new self-directed trading account by january 31, 2019.

2. Fund your account within 60 days of account opening to earn a bonus based on your deposit amount:

- $3,500 bonus + free trades for $2,000,000+ deposit or transfer

- $2,500 bonus + free trades for $1,000,000+ deposit or transfer

- $1,200 bonus + free trades for $500,000+ deposit or transfer

- $600 bonus + free trades for $250,000+ deposit or transfer

- $300 bonus + free trades for $100,000+ deposit or transfer

- $200 bonus + free trades for $25,000+ deposit or transfer

- $50 bonus + free trades for $10,000+ deposit or transfer

3. Receive the bonus cash credit to your account within 10 business days of meeting the promotional requirements.

4. Once the account is credited, the bonus and initial qualifying deposit are not available for withdrawal for 300 days after the requirements have been met.

Get up to 500 commission-free trades at E*TRADE, plus up to a $600 cash credit

If you decide to go with an E*TRADE account, there are a few things you'll need to know. First, you must fund your account within 60 days by transferring funds from an external source. Here's how it works:

- Deposit at least $10,000 into your new account.

- Get up to 500 commission-free trades for stocks or options within 60 days of funding your new trading account. This excludes options contract fees.

- Your first 29 stock or options trades are charged $6.95 (plus $0.75 cents for each options contract), while trades after that are charged $4.95 (plus $0.50 per options contract) up to 500 trades.

- Commissions are credited back to your account within a week of the settled trade.

- E*TRADE does not compensate for any unused commission-free trades.

- There is a separate commission schedule for stock plan account transactions.

E*TRADE makes credits for cash or securities within 60 days of the account open, depending on deposits to the account from external sources. Credits are made within a week after the 60-period. Here's how the credit is broken down:

- Deposit $1,000,000+, receive $2,500 + commission-free trades

- Deposit $500,000–$999,999, receive $1,200 + commission-free trades

- Deposit $250,000–$499,999, receive $600 + commission-free trades

- Deposit $100,000–$249,999, receive $300 + commission-free trades

- Deposit $25,000–$99,999, receive $200 + commission-free trades

- Deposit $10,000–$24,999, receive only commission-free trades

E*trade offers unlimited commission-free online trading on most stocks and etfs for all clients.

The bottom line

These promotions aren’t a good way to make a quick buck, and the bonuses are relatively small, often 1 percent or less of the amount you’re required to deposit. What's more, in many cases, taxes or commissions will erode the value of your bonus.

An account-opening bonus is, however, a good incentive to give a brokerage, bank or credit union a closer look if you were thinking about opening a new account anyway. Just make sure the account type you’re opening is the best option for your long-term needs, that you’ll still come out ahead after any fees and that you aren’t depositing money you might need in the near term.

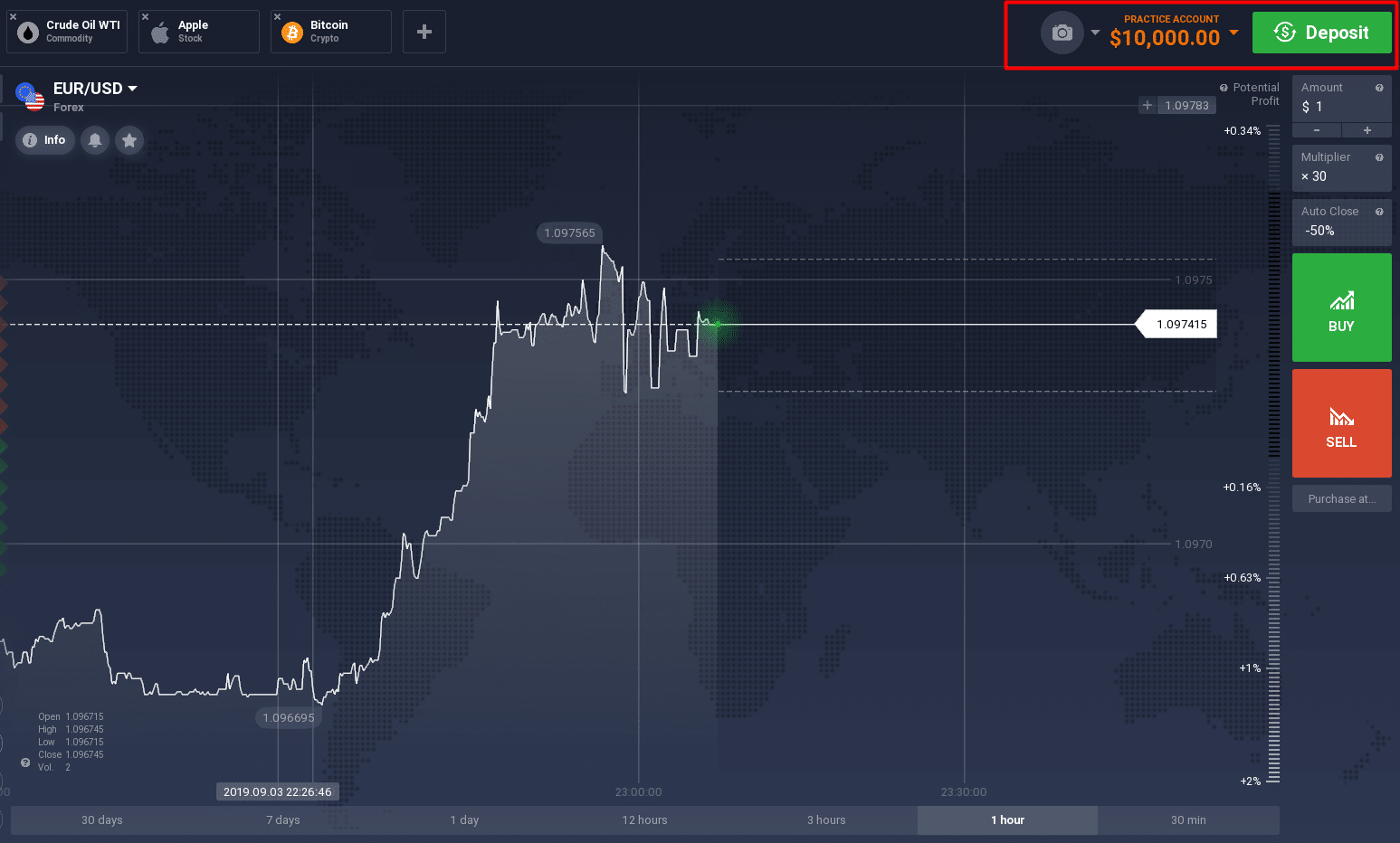

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

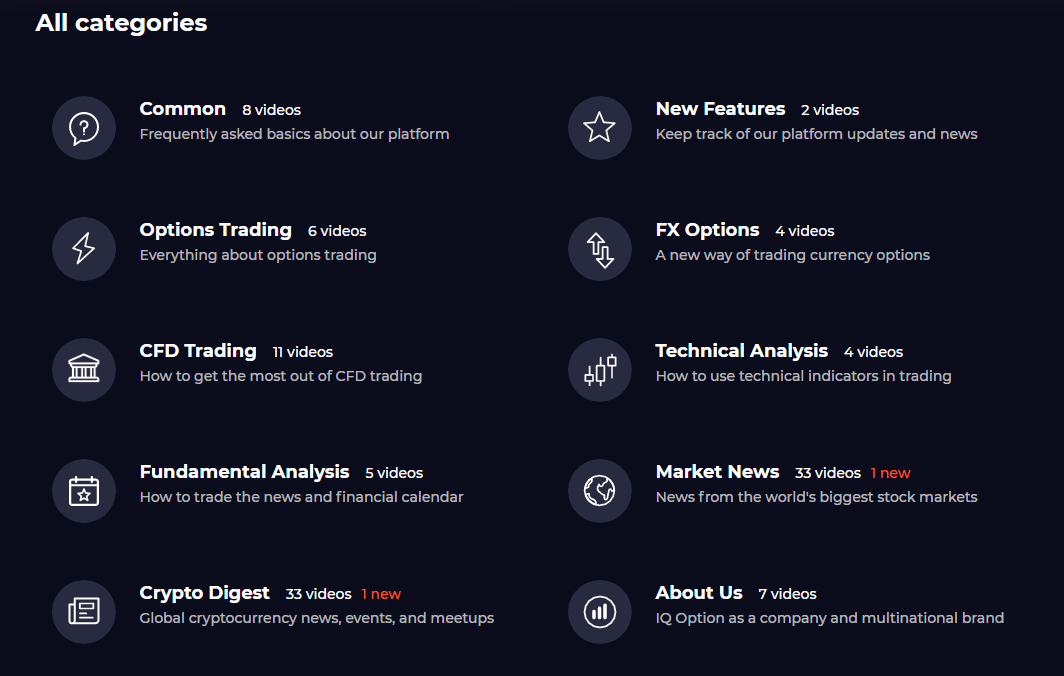

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Online trading

Buy and sell securities using a wealth of research and advanced tools on our intuitive trading website.

Why trade online with fidelity

- Competitive online commission rates

- Free, independent research from 20+ providers

- Margin, short selling, and options trading tools

Features & benefits

Advanced tools and services

Accounts with online trading

Features & benefits

Pay $0 commission for online U.S. Stock, ETF and options trades, plus $0.65 per contract for option trades.

Get an overview of what’s happening right now in specific markets and sectors, and read news and analysis to help you understand the short- and long-term impact.

Dig into the details with research reports on 4,500+ stocks from more than 20 independent, third-party research firms.

Evaluate your investing ideas using the accuracy-weighted equity summary score provided by starmine.

Take advantage of stock screen strategies from independent third-party experts to research stocks, etfs, and options, or create your own screens using over 140 custom filters.

Create real-time watch lists to track stocks that interest you.

Set alerts to receive balance updates, trade notifications, market news, or stock research messages via email and our mobile apps.

Track real-time profit and loss information on every trade.

Advanced tools and services

Set trailing stops and conditional orders ahead of time to help manage risk and maximize profits.

Monitor, trade, and manage up to 50 stocks as a single entity using basket trading.

Explore advanced account features including margin, short selling, and options trading.

Qualified customers can take advantage of our active trading software to get streaming quotes, directed trading, and more.

Invest in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk.

Compare bonds by coupon rates, yields, call dates, and ratings.

Using up to 10 years of daily historical data, test strategies before you invest. Save strategies and manage trade alerts.

Accounts with online trading

Explore the details of this full-featured brokerage account, consistently rated among the best in the industry.

Pay no taxes on your gains within an IRA until you take withdrawals.

View all of your brokerage account choices including trusts, the fidelity account for businesses, custodial accounts, and more.

Next step

Questions?

Get our free mobile app

Keep up with the changing markets, research, trade, & more, wherever you are.

Research investments

$0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions ® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The equity summary score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. The equity summary score is provided by starmine from refinitiv, an independent company not affiliated with fidelity investments. For more information and details, go to fidelity.Com.

Barron's, february 21, 2020 online broker survey. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Fidelity tied interactive brokers for #1 overall.

Investor's business daily ® , january 2020: best online brokers special report. Fidelity was named best overall online broker, and also first in equity trading tools, research tools, low-cost/ETF trading, investment research, mobile trading platforms/apps, and portfolio analysis & reports. Results based on having the highest customer experience index within the categories composing the survey, as scored by 4,199 respondents. The survey was conducted by investor's business daily's polling partner, technometrica market intelligence. © investor's business daily, inc. All rights reserved.

System availability and response times may be subject to market conditions.

Free demat account – stock brokers opening demat & trading account for free

Given the choice, I would not open an account only because it is a free demat account. No point in opening a free demat account and only later repenting on paying higher brokerage charges.

Even though some stock brokers in india offer demat account for free, they find some other ways to make out for it.

One need to be very careful and understand that all these are marketing gimmicks.

However, just for the completeness of the topic , I am providing the list of brokers offering free demat and trading account.

What is a demat account?

Demat account is an account meant to hold the shares of the companies in electronic (de-materialized) form.

Previously companies used to issue shares in physical forms and shareholders kept them as certificates.

Physical certificates had their own drawbacks and advent of technology made it possible to transact shares in electronic form. I have written a separate article on benefits of demat account over physical form.

Just like savings bank account which is used to hold our money, demat account is for having the shares.

You need to open the demat account with stock brokers.

Share brokers are participants of depositories (like NSDL and CDSL), help in buying and selling on stock market by charging brokerage charges.

Stock brokers provide trading platforms to users which acts as an interface between exchanges and the users. You can transact by yourself by using the platforms.

Nowadays, mobile apps are more popular way of transacting. ( read: best mobile trading apps in india).

Free demat account providers in india

Let us go through in details of each stock brokers offering free demat account.

#1 zerodha free demat account

Zerodha does NOT provide free demat account. That means they levy some charges on demat account opening and yearly annual maintenance charges (AMC).

However, I have included zerodha in the list since they offer zero brokerage demat account.

Zerodha charges zero brokerage for all the investments. ( no brokerage for all the transaction in which you don’t sell the share you purchased same day)

That means no brokerage whether you invest rs 10 or rs 10 crores worth of shares.

Hence, we tend to save tons of money in terms of brokerage which can offset account opening fees(one time) and yearly fee of rs 400.

Below table shows the details of zerodha brokerage charges, across the segments.

You can explore more about them by going through below articles.

Zerodha account can be opened instantly online using aadhaar. Use below link to open your account.

#2 5paisa free demat account

Unlike zerodha, they do not offer zero brokerage. They charge rs 10/executed order, irrespective of volume of trade.

Their account opening fee is rs 650 and AMC is rs 400/year.

However, they refund the account opening free if you deposit rs 5000 in your trading account while opening the account.

You can utilise that amount for trading and investment purpose.

Best thing I like with them is, they provide research reports and intraday trading tips for free.

Below table shows the brokerage charges of 5paisa.

#3 sharekhan free demat account

Sharekhan is third largest stock broker of india as on today (first two are zerodha and ICICI direct)

You will find the outlet of sharekhan at every major cities and towns of india.

Sharekhan has waived of account opening fee.

They have also waived off AMC for the first year and it will be rs 400/year from second year onwards.

Only negative point is thatt, heir brokerage charges are on higher side. Being a full service broker, they charge on the percentage of traded value.

Below table has the details of sharekhan brokerage charges

#4 ICICI direct free demat account

ICICI direct was the biggest stock broker of india until replaced by zerodha.

ICICI direct also offers free demat account , but only on meeting below criteria.

Those who intends to avail free demat account with ICIC direct,

- Should have demat with any other broker and value of the holding should be more than zero

- Should be ICICI bank customers with silver, gold and titanium categories

The best part of ICICI direct is , it is a 3-in-1 demat account. That means, demat account, trading account and ICICI bank savings account are interlinked.

And the worst part is their brokerage charges.

Just compare the below brokerage table of ICICI direct with any other broker and you will make out what I am saying.

#5 angel broking free demat account

Angel broking is one of the leading share broker of india with more than 3 dacades into stock broking.

They also have waived off the account opening fee. You will get free AMC for lifetime by paying rs 2500 as one time charges.

However, this amount is not refundable.

Angel broking brokerage charges are on lower side when compared to other brokers. However, they are still high in comparison to discount brokers.

Recently they have also introduced rs15/executed trade plan owing to cut throat competition from top discount stock brokers.

Below table illustrates the brokerage charges of angel broking

#6 FYERS free demat account

FYERS securities is a bengaluru based discount stock broker.

The demat account opening fee is NIL for FYERS demat account. However, they charge rs 400/year annual maintenance charges.

The brokerage structure of FYERS is exactly same as that of zerodha. They also don’t charge on delivery based trades.

#7 prostocks free demat account

Prostocks is mumbai based stock broker offering free demat account to their customers.

They don’t charge any account opening fee and annual maintenance charges (AMC) is also waived off.

The AMC is free only when you deposit rs 1000 while opening the demat account. This amount is refundable.

They have both flat brokerage and unlimited brokerage plans.

In flat brokerage plan, you will pay rs 15/executed order for all the segments.

In monthly unlimited plan, one can place unlimited trades for rs 899 in equity and rs 499 per month in currency.

It will be rs 8999 and rs4999 per year for equity and currency segment respectively if you choose annual plan.

Free demat and trading account : final thoughts

In my view and also based on my experience in the stock market, I can definitely vouch for the good customer service any day over free demat account.

Demat account opening fee and AMC charges are significant. But they are one time and yearly once kind of charges.

So you should be less worried about them always choose best demat account. Let me explain you with an example

Lets say you trade shares of worth rs 1lakh and pay 0.5% as brokerage. So it will be rs 500 on purchase and rs 500 on sale.

If I had opened demat account with a broker who charges rs0, then I would have saved rs1000 straight away.

Because of this, my recommendation for you is to focus on brokerage charges and customer support instead of preferring free demat account

If you are still confused and need any specific advice, you can always contact me.

Alternatively, you can fill out below form with your queries.

Stock market game

Compete, risk free with $100,000 in virtual cash

Start with $100,000 in virtual cash and put your trading skills to the test! Compete with thousands of investopedia traders and trade your way to the top!

Connect with over 700,000 worldwide

Interact with other traders from diverse backgrounds and experiences, and learn the methods behind their trades to become a better investor.

A stepping stone to the real markets

The ideal platform to get your financial feet wet! Submit trades in a virtual environment before you start risking your own capital.

Test your skills with trading challenges

Join or create challenges with your friends and other investors. Compete to see who has the best investment results daily.

Have you thought about buying stock in a certain company but just didn’t have the cash to make a trade? Or perhaps you heard news about a company and thought to yourself that the stock price was poised to rise? Or maybe you have always just wanted to know more about picking stocks? Thanks to virtual stock exchange technology, stock market simulators (aka stock market games) that let you pick securities, make trades and track the results — all without risking a penny—are as close as your keyboard or cell phone.

What is a stock market game?

Online stock market games are simple, easy-to-use programs that imitate the real-life workings of the equities markets. Most stock market games give users $100,000 in pretend money to start. From there, players pick to purchase; most of the stocks are those that are available on the new york stock exchange (NYSE), nasdaq and the american stock exchange (AMEX).

Most online stock simulators try to match real-life circumstances and actual performance as much as possible. Many even charge broker fees and commissions. These charges can significantly affect an investor's bottom line, and including these in simulated trading helps users learn to factor these costs in when making purchasing decisions. Along the way, they’ll also learn the basics of finance and learn the basic terminology of investing, such as momentum trading, shorts and P/E ratios.

Some caveats

These useful skills can be applied to an actual trading account. Of course, in the real world, there are numerous factors that affect trading and investment decisions, such as one's risk tolerance, investment horizon, investment objectives, taxation issues, need for diversification, and so on. It is impossible to take investor psychology into account because actual hard cash is not at risk.

Also, while the investopedia stock simulator comes close to replicating the real-life experience of trading, it does not currently offer a real-time trading environment with live prices. However, for most users, the 15-minute lag in trade execution will not be an impairment to their learning experience.

Investopedia’s stock simulator: play your way to profits

The investopedia stock simulator is well integrated with the site’s familiar educational content. Using real data from the markets, the trading occurs in context of a game, which can involve joining an existing game or the creation of a custom game that allows the user to configure the rules. Options, margin trading, adjustable commission rates and other choices provide a variety of ways to customize the games. From there, an easy-to-navigate menu lets users update their profiles, review holdings, trade and check their rankings, research investments and review their awards (which can be earned for completing various activities).

Open trading account

OPEN YOUR FREE TRADING ACCOUNT WITH EASE

Open trading account online with arihant capital & start trading with our best hassle-free process.

We're glad you chose to start your investment journey with arihant capital. Opening a paperless trading account and getting started is easy, just choose from one of the following 3 options and take control of your financial future.

Fill your information in the below form for an online trading account opening

Get a call back

Arihant ekyc

Now you can use ease way to open an online account through arihant ekyc with no paperwork.

Arihant ekyc is a paperless know your customer( KYC) process, wherein the identity and address of the subscriber are verified electronically through aadhaar authentication.

Download and print

A SMARTER WAY TO MANAGE YOUR INVESTMENTS

When it comes to investments we don't want you to leave anything to chance. We have the tools, resources, and personalized support to help you make the right investment decisions.

TOOLS & SUPPORT

Whether you are looking for self-assisted or broker-assisted trading, you get access to our expert investment advisors and powerful trading tools

GET IDEAS

Investment education and tools that will make it really simple for you to plan your investments

DIVERSIFY

Get the benefit of diversification with our full range of investment options , free research and innovative tools

1. How long does it take to open an account?

Once we receive your signed forms and proper documents, your account will be opened within 24 working hours, assuming everything is in order. At any point of time you can check the status of your account by e-mailing us or calling us and any of your queries will be responded promptly.

2. What documents do you need?

You need to submit the following in order to open an account with us along with the application form (for individuals):

- PAN card (compulsory)

- Address proof (ration card / passport / driving license, electricity/telephone bill)

- Bank statement

- Demat account statement or slip (if any)*

- Latest passport size photograph (one)

*if you do not have a demat account, you would also be required to open a demat account to start trading.

3. Will you send someone to my house?

We try to make it convenient for you to open an account. I fyou cannot come to our office, we can try to send someone at your place to help you with the documentation process. However at certain locations we may not be able to send an advisor to distance or unavailability of staff. In such instance we can schedule a video chat on a convenient date and time, wherein our advisor will help you with the form and also conduct the mandatory in-person verification (IPV) to verify that your identity proof match yourself.

4. Why do you need these documents and an IPV?

As per SEBI regulations the know your customer (KYC) formalities that includes the documentation and in-person verification (IPV) are mandatory for every client. Being a financial services company we are subject to strict laws and regulations just like banks. These processes allow us to identify who you are, how to contact you and your general profile and also prevents any potential frauds.

5. Can a foreign national invest in india?

Yes. Foreign citizens can invest in equity markets under foreign portfolio investors regulations, 2014 by registering themselves with a designated depository participant. For more details please write to us at contactus@arihantcapital.Com .

Trade your way

Online, mobile, on the phone, trade the way you want, from where you want

How it works

Have a query?

PRODUCTS AND SERVICES

MEDIA CENTER

OTHER LINKS

Connect with us on

ATTENTION INVESTORS :- a) prevent un authorised transactions in your account. Update your mobile numbers/email ids with your stock brokers. Receive information of your transactions directly from exchange on your mobile/email at the end of the day; b) KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, mutual fund etc.), you need not undergo the same process again when you approach another intermediary; c) prevent unauthorized transactions in your demat account. Update your mobile number with your depository participant. Receive alerts on your registered mobile for all debit and other important transactions in your demat account directly from NSDL / CDSL on the same day. (issued in the interest of investors). Please read the risk disclosure document and do's & dont's prescribed by the exchanges carefully before investing.

Arihant group companies are registered broker and dealer. SEBI registration number for NSE & BSE :- INZ000180939; NSDL - IN-DP-127-2015 DP ID-IN301983; CDSL DP ID-43000; NCDEX - 00080; MCX - 10525; AMFI - ARN 15114; SEBI merchant banking regn. No. - MB INM 000011070; SEBI research analyst regn. No. - INH000002764. Arihant capital markets ltd provides services with respect to commodities derivatives trading through its group company arihant futures and commodities ltd. Please carefully read the risk disclosure document as prescribed by SEBI & FMC and do's & don'ts by NCDEX. Existing customers can send in their grievances to compliance@arihantcapital.Com. And for DP related queries & complaints please write us to depository@arihantcapital.Com if you want to register your complaints through SEBI score portal please click here.

ARIHANT CAPITAL IFSC LIMITED | SEBI regid. No. : INZ000157539

address: unit no. 424, 4 th floor, the signature building, block 13B, road 1C, zone 1, GIFT SEZ, GIFT city, gandhinagar, gujarat - 382355. | tel: 079-40701700

Disclaimer: arihant capital markets limited and arihant futures & commodities limited are engaged in client based and proprietary trading on various stock and commodity exchanges. Arihant capital IFSC limited is engaged in proprietary trading in NSE IFSC stock exchange and india INX stock exchange.

#1011 solitaire corporate park, andheri ghatkopar link road, chakala, andheri (E), mumbai - 4000093. Email: contactus@arihantcapital.Com

Copyright © 2021 arihant capital markets ltd. All rights reserved.

COVID-19 important update: we are experiencing high call volumes and we appreciate your continued patience. We strongly encourage you to use our digital tools for self-servicing. You can download arihant mobile or trade online through invest ease (web trading) or ari trade speed (ODIN) and access your backoffice reports through client login dashoboard or arihant backoffice mobile app

so, let's see, what we have: open a trading and demat account online instantly and start investing for free on kite at free trading account

Contents of the article

- Top-3 forex bonuses

- Free trading account

- Online trading

- Why trade online with fidelity

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Next step

- Questions?

- Brokerage account

- Put your money to work in our easy-to-manage...

- What you get with an E*TRADE

- Start the year with a cash bonus, plus...

- Trade more, pay less

- Investing doesn't need to be confusing

- Up your game with our trading tools

- Have questions? Get jargon-free answers.

- Start investing today

- ETRADE footer

- About us

- Service

- Quick links

- Connect with us

- Check the background of E*TRADE securities LLC...

- PLEASE READ THE IMPORTANT DISCLOSURES...

- 5 broker deals that'll pay you to open an account

- Charles schwab: $100 bonus or 500 commission-free...

- Motif investing: 3 free months

- $100 bonus + 3.75% 40-month IRA CD at navy FCU

- Ally invest $3,500 cash bonus + 90 days of...

- Get up to 500 commission-free trades at E*TRADE,...

- The bottom line

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners...

- Free and unlimited demo account

- No difference between real money and virtual...

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to...

- Online trading

- Why trade online with fidelity

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Next step

- Questions?

- Free demat account – stock brokers opening demat...

- What is a demat account?

- Free demat account providers in india

- #1 zerodha free demat account

- #2 5paisa free demat account

- #3 sharekhan free demat account

- #4 ICICI direct free demat account

- #5 angel broking free demat account

- #6 FYERS free demat account

- #7 prostocks free demat account

- Free demat and trading account : final thoughts

- Stock market game

- Compete, risk free with $100,000 in virtual cash

- Connect with over 700,000 worldwide

- A stepping stone to the real markets

- Test your skills with trading challenges

- What is a stock market game?

- Open trading account

- OPEN YOUR FREE TRADING ACCOUNT WITH EASE

- Get a call back

- Arihant ekyc

- Download and print

- A SMARTER WAY TO MANAGE YOUR INVESTMENTS

- TOOLS & SUPPORT

- GET IDEAS

- DIVERSIFY

- 1. How long does it take to open an account?

- 2. What documents do you need?

- 3. Will you send someone to my house?

- 4. Why do you need these documents and an IPV?

- 5. Can a foreign national invest in india?

- Trade your way

- How it works

- Have a query?