Binary option without investment

In addition, there are also no liquidity concerns because the trader doesn't own the underlying asset and brokers can offer innumerable strike prices and expiration times/dates, which is an attractive feature.

Top-3 forex bonuses

The trader can also access multiple asset classes anytime a market is open somewhere in the world. Binary options let traders profit from price fluctuations in multiple global markets, but it's important to understand the risks and rewards of these controversial and often-misunderstood financial instruments. Binary options bear little resemblance to traditional options, featuring different payouts, fees, and risks, as well as a unique liquidity structure and investment process.

What you need to know about binary options outside the U.S

What do you need to know about binary options outside the U.S?

Binary options let traders profit from price fluctuations in multiple global markets, but it's important to understand the risks and rewards of these controversial and often-misunderstood financial instruments. Binary options bear little resemblance to traditional options, featuring different payouts, fees, and risks, as well as a unique liquidity structure and investment process.

Binary options traded outside the U.S. Are also structured differently than those available on U.S. Exchanges. They offer a viable alternative when speculating or hedging but only if the trader fully understands the two potential and opposing outcomes.

The financial industry regulatory authority (FINRA) summed up regulator skepticism about these exotic instruments, advising investors "to be particularly wary of non-U.S. Companies that offer binary options trading platforms. These include trading applications with names that often imply an easy path to riches."

Key takeaways

- Binary options have a clear expiration date, time, and strike price.

- Traders profit from price fluctuations in multiple global markets using binary options, though those traded outside the U.S. Are structured differently than those available on U.S. Exchanges.

- Non-U.S. Binary options typically have a fixed payout and risk, and are offered by individual brokers rather than directly on an exchange.

- While typical high-low binary options are the most common type of binary option, international brokers typically offer several other types of binaries as well.

Binary options outside the U.S. Are an alternative for speculating or hedging but come with advantages and disadvantages. The positives include a known risk and reward, no commissions, innumerable strike prices, and expiry dates. Negatives include non-ownership of the traded asset, little regulatory oversight, and a winning payout that is usually less than the loss on losing trades.

Understanding binary options outside the U.S

What are binary options?

Binary options are deceptively simple to understand, making them a popular choice for low-skilled traders. The most commonly traded instrument is a high-low or fixed-return option that provides access to stocks, indices, commodities, and foreign exchange.

These options have a clearly stated expiration date, time, and strike price. If a trader wagers correctly on the market's direction and price at the time of expiration, they are paid a fixed return regardless of how much the instrument has moved since the transaction, while an incorrect wager loses the original investment.

The binary options trader buys a call when bullish on a stock, index, commodity, or currency pair, or a put on those instruments when bearish. For a call to make money, the market must trade above the strike price at the expiration time. For a put to make money, the market must trade below the strike price at the expiration time.

The broker discloses the strike price, expiration date, payout, and risk when the trade is first established. For most high-low binary options traded outside the U.S., the strike price is the current price or rate of the underlying financial product. Therefore, the trader is wagering whether the price on the expiration date will be higher or lower than the current price.

Binary options outside the US

Foreign versus U.S. Binary options

Non-U.S. Binary options typically have a fixed payout and risk and are offered by individual brokers rather than directly on an exchange. These brokers profit from the difference between what they pay out on winning trades and what they collect on losing trades. While there are exceptions, these instruments are supposed to be held until expiration in an "all-or-nothing" payout structure.

Foreign brokers are not legally allowed to solicit U.S. Residents unless registered with a U.S. Regulatory body such as the securities and exchange commission (SEC) or commodities futures trading commission (CFTC).

The chicago board options exchange (CBOE) began listing binary options for U.S. Residents in 2008. the SEC regulates the CBOE, which offers investors increased protection compared to over-the-counter markets. Chicago-based nadex also runs a binary options exchange for U.S. Residents, subject to oversight by the CFTC.

These options can be traded at any time, with the rate fluctuating between one and 100, based on the current probability of the position finishing in or out of the money. There is full transparency at all times and the trader can take the profit or loss they see on their screen prior to expiration.

They can also enter as the rate fluctuates, taking advantage of varying risk-to-reward scenarios, or hold until expiration and close the position with the maximum gain or loss documented at the time of entry. Each trade requires a willing buyer and seller because U.S. Binary options trade through an exchange, which makes money through a fee that matches counter-parties.

High-low binary option example

Your analysis indicates the standard & poor's 500 index will rally for the rest of the trading day and you to buy an index call option. It's currently trading at 1,800 so you're wagering the index's price at expiration will be above that number. Since binary options are available for many time frames—from minutes to months away—you choose an expiration time or date that supports your analysis.

You choose an option that expires in 30 minutes, paying out 70% plus your original stake if the S&P 500 is above 1,800 at that time or you lose the entire stake if the S&P 500 is below 1,800. Minimum and maximum investments vary from broker to broker.

Say you invest $100 in the call that expires in 30 minutes. The S&P 500 price at expiration determines whether you make or lose money. The price at expiration may be the last quoted price, or the (bid + ask)/2. Each binary options broker outlines their own expiration price rules.

In this case, assume the last quote on the S&P 500 before expiration was 1,802. Therefore, you make a $70 profit (or 70% of $100) and maintain your original $100 investment. If the price finished below 1,800, you would lose your original $100 investment.

If the price expires exactly on the strike price, it is common for the trader to receive her/his money back with no profit or loss, although brokers may have different rules. The profit and/or original investment is automatically added to the trader's account when the position is closed.

Other types of binary options

The example above is for a typical high-low binary option—the most common type of binary option—outside the U.S. International brokers will typically offer several other types of binaries as well.

These include "one-touch" options, where the traded instrument needs to touch the strike price just once before expiration to make money. There is a target above and below the current price, so traders can pick which target they believe will be hit before the expiration date/time.

Meanwhile, a "range" binary option allows traders to select a price range the asset will trade within until expiration. A payout is received if price stays within the range, while the investment is lost if it exits the range.

As competition in the binary options space heats up, brokers are offering additional products that boast 50% to 500% payouts. While product structures and requirements may change, the risk and reward is always known at the trade's outset, allowing the trader to potentially make more on a position than they lose. Of course, an option offering a 500% payout will be structured in such a way that the probability of winning the payout is very low.

Unlike their U.S. Counterparts, some foreign brokers allow traders to exit positions before expiration, but most do not. Exiting a trade before expiration typically results in a lower payout (specified by broker) or small loss, but the trader won't lose their entire investment.

The upside and downside

Risk and reward are known in advance, offering a major advantage. There are only two outcomes: win a fixed amount or lose a fixed amount, and there are generally no commissions or fees. They're simple to use and there's only one decision to make: is the underlying asset going up or down?

In addition, there are also no liquidity concerns because the trader doesn't own the underlying asset and brokers can offer innumerable strike prices and expiration times/dates, which is an attractive feature. The trader can also access multiple asset classes anytime a market is open somewhere in the world.

On the downside, the reward is always less than the risk when playing high-low binary options. As a result, the trader must be right a high percentage of the time to cover inevitable losses.

While payout and risk fluctuate from broker to broker and instrument to instrument, one thing remains constant: losing trades cost the trader more than they can make on winning trades. Other types of binary options may provide payouts where the reward is potentially greater than the risk but the percentage of winning trades will be lower.

How to make money on binary options without investments

In the second decade of the 21st century, most users of the world wide web became convinced that making money using the internet is not a myth, but a very real opportunity to improve their financial situation. An approximate list of key questions reflecting the attitude of the average user to the specified method of generating income includes the following items:

• numerous offers to earn millions of dollars, without investment, in a short period of time – 100% fraud. Unfortunately, only in a fairy tale do people become billionaires without doing anything.

• making money online is real, but for this you need some knowledge or a lot of start-up capital. Translators, programmers, designers, financiers, copywriters – the list of professions in demand is very large, but they all require the presence of appropriate education, experience and hard work.

• the stereotype that it is much easier to make money on the internet is not true (apart from rare exceptions). A programmer working for a reputable company earns even more than his freelance colleague who does similar work. The exception is when the employer lives in western europe, the USA or japan.

But on the world wide web there are other areas of activity to which it is not always possible to apply the above axioms. For example, own internet projects or trading in the global financial market. The latter direction is inextricably linked with the main topic of this review, which will help readers understand how real money is in binary options without investments. Is it worth the time to study this method of generating income or is it better to search for other activities?

Online trading and binary options

Trading in currency, securities and other liquid assets in our time has become available to almost everyone who wants to test their luck by doing online trading. Brokerage companies that provide the opportunity to work in this direction promise the “golden mountains” even to those users who do not know what a cryptocurrency, stock or spread is. But very soon, newly-minted traders begin to realize that without appropriate education, experience and start-up capital, trading in financial assets is practically no different from a regular casino or bookmaker. In this situation, the emergence of binary options has helped to maintain interest in online trading for ordinary users who do not have the necessary knowledge and experience to successfully work on the services of brokerage companies.

Binary options work according to a simple principle: the trader must make the right financial forecast within the agreed period (for example, indicate the direction of the change in the value of the asset). If the participant’s expectations were correct, he receives a certain amount of money (it is set in advance), and in the case of an incorrect forecast, the trader loses his money. Nothing complicated. The specified financial instrument is called betting (betting) options. In this case, the name perfectly characterizes the presented tool.

Interest in binary options and their popularity in different parts of the world very quickly gave way to angry reviews and the requirements of participants in online trading “to put things in order”. As a result, bos are banned in EU countries, israel and some other countries. But these precautions could not stop those wishing to earn money on trading with options. Access to the financial instruments in question is provided by resources registered in offshore zones or countries where bos have retained legal status. But traders, taught by bitter experience, no longer wanted to risk their savings. Therefore, many of them are beginning to actively study the question: is there earnings on binary options without investment?

Experienced traders and specialists involved in the study of modern financial markets, highlight the following options for making money on binary options without investments:

• the most reliable way to make money using bos is through affiliate programs. Verified brokers who promise financial rewards for each new member do not violate such arrangements.

• no deposit bonuses. The presented method has many “pitfalls”. Often, brokers promise huge rewards for registering on their resource, but then it turns out that turning bonuses into real money is very difficult, and sometimes impossible.

• competitions, promotions and tournaments held by reputable brokerage companies. In this case, the trader, at a minimum, must have the necessary knowledge and experience in concluding deals with bos. Also, you need to carefully study the conditions for such events. Very often, instead of a cash reward, the winner receives unnecessary coupons or bonuses.

• individual offers of brokers.

Despite the fact that many services offer their users interesting options for making profit using binary options, experienced traders do not recommend counting on them in the long run. If you are really interested in bos, it is best to register an account on a proven site, practice using a demo account, and then proceed to conclude real transactions.

“general risk warning: binary options and cryptocurrency trading carry a high level of risk and can result in the loss of all your funds.”

The best binary option trading platforms and brokers of 2020

In this guide, we're going to review the best binary option brokers to help you decide which trading platform is right for you. We've analyzed over 21 different binary brokers on a variety of factors including payouts, trading platform, deposit methods, features, regulation, and company reputation.

It's important to understand that not all binary options trading platforms are created equal. Some binary options sites might have great payouts, while others might have faster withdrawals or bigger deposit bonuses. Picking a trading broker often comes down to what's most important to you.

Below you will find our rankings of the top binary options trading brokers of 2020.

Top 8 best binary options brokers of 2020

- Pocket option - best for USA traders

- Binarycent - best for copy trading

- Raceoption - best bonuses

- IQ option - best trading platform

- Binary.Com - best for beginners

- Expertoption - best for social trading

- Olymp trade - best for traders from india

- Binomo - best for trading tournaments

Review of the top binary option sites and companies

1) pocket option

Pocket option is a binary options brokerage that provides online trading of more than 100 different underlying assets. Pocket option is one of the only sites that accept new traders from the united states and europe. Established in 2017, pocket option is based in the marshall islands and is licensed by the IFMRRC (international financial market relations regulation center).

Pocket option has great terms and conditions for its traders including no commission on deposits and withdrawals, over 100+ payment methods, indicators and signals, social trading, bonuses, high returns, and more. Pocket option provides bonuses of up to 100% when you open an account, which is among the best in the industry.

If you're looking for a binary broker that caters to customers around the world, including USA and europe, then pocket option is one of the best options available.

- Maximum profit: 96%

- Min. Deposit: $50

- Min. Trade: $1

- Assets: 100+ crypto, commodities, stocks, and currency pairs

- Platform: web, android, ios, and windows

2) binarycent

Binarycent is a binary option site that offers forex trading, cfds, and options with payouts up to 95%. Binarycent was established in 2017 and is owned by a company called cent project LTD, which is a subsidairy of the finance group corp. This company is located in vanuatu and accepts international traders including the united states, canada, australia, and the UK. Binarycent is regulated by the VFSC (vanuatu financial services commission).

The biggest advantages of using binarycent include minimum trades of just 10 cents, leverage up to 1:100, and copy trading. Copy trading allows you to follow the most successful traders on the platform and to see their live trades in real-time. By copying other profitable users, you can increase your chances of success.

- Minimum deposit: $250

- Minimum trade: $0.10

- Assets: cfds, forex, and options

- USA friendly: yes

3) raceoption

Raceoption is a binary options broker that is based in the UK and established in 2014. Raceoption processes more than 10,000 trades per day and is one of the only companies that allow clients from the united states, canada, and australia. Raceoption has no restrictions on what country you're located in.

The biggest selling points to raceoption are 1-hour withdrawals, deposit bonuses up to 100%, and weekend trading. This trading platform is available in three versions: web, android, and iphone. They offer CFD trading, 60 seconds, one touch, live charts, and instant execution of trades.

Overall, raceoption is a reliable broker that offers attractive payouts up to 90% and a variety of funding options including credit card and cryptocurrencies such as ethereum and bitcoin. This platform is best suited for beginners that are looking for a simple interface that is easy to understand.

- Minimum deposit: $250

- Payouts: 90% max

- Bonus: 20-100% deposit match

- USA friendly: yes

4) IQ option

IQ option is a broker that is based in cyprus and regulated by the cysec (cyprus securities and exchange commission). Since 2013, IQ option has been one of the most successful online trading platforms with over 43 million registered users, over 1 million trades per day, and clients from over 213 countries.

IQ option has the best trading platform of all the brokers I've reviewed. They have over 250+ assets to trade including binary options, digital options, as well as cfds on stocks, crypto, commodities, and etfs. Their binary options pay up to 95% on successful trades, while their digital options offer return rates up to 900%

The IQ option platform is available on the web or through one of their trading apps (android, ios, mac, and windows). Free demo accounts are available with $10,000 in virtual money to practice with. Their platform comes with everything you'd want and expect including multi-chart layouts, financial indicators, technical analysis, and real-time alerts. They also have several risk management features including stop loss, take profit, negative balance protection, and trailing stop.

If you're looking for the best binary trading platform, IQ option should be near the top of your list.

- Minimum deposit: $10

- Max payout: 95%

- Min. Trade: $1

Note: this broker does not accept clients from the united states, canada, european economic area, japan, israel, australia, and puerto rico.

5) expertoption

Expertoption is a trusted broker that has been around since 2014, offering binary options on over 100+ assets including stocks, cryptocurrency, forex, and commodities. Expertoption is located in saint vincent and the grenadines and is regulated by the VFSC (vanuatu financial services commission) and FMRRC (financial market relations regulation center). This broker serves clients from over 150 countries and has over 32,000,000 registered users on their platform.

Expertoption offers some of the best payouts on the market, with profits as high as 95%. Their platform is very easy to use for beginners and also has some features that even advanced traders will appreciate such as 4 different chart types, 8 indicators, and trend lines. Expertoption also offers social trading, which allows you to trade binary options with your friends or follow other VIP traders and see their active trades in real-time.

Expertoption offers over 20 different payment methods including E-wallets, credit cards, cryptocurrency, and bank transfer. This binary broker also offers a free demo without registration. Overall, if you're looking for a great payouts and a solid trading platform, expertoption is an option worth considering.

- Min. Deposit: $10

- Min. Trade: $1

- Max profit: 95%

Note: this broker does not accept clients from the USA, canada, european economic area, switzerland, israel, new zealand, australia, puerto rico, singapore, bangladesh, vanuatu, yemen, and sudan.

6) olymp trade

Olymp trade is a cyprus-based broker that is regulated by the international financial commission. This license ensures that traders are supported by deposit insurance, comprehensive support, and a prompt resolution of all issues. Olymp trade has been a part of the options market since 2014 and has consistently improved their platform over the years. As of 2020, there are over 25,000 users trading with olymp trade every day.

Like most of the top brokers, olymp trade has a web-based platform and apps available for iphone and android. They have over 75 different underlying assets that you can trade with. Demo accounts are available if you'd like to test-drive the olymp trade platform. This broker has a variety of educational resources available to their clients including trading strategies, webinars, and more.

Note: olymp trade does not accept clients from european economic area, australia, canada, USA, japan, israel, new zealand, russia, spain, sweden, and switzerland.

7) binary.Com

Binary.Com is an online trading platform that offers binary options and CFD trading. Owned by a company called binary group LTD and founded in 1999, this broker is one of the oldest and most respected names in the binary options trading industry with over 1 million registered users worldwide.. Binary.Com has offices in channel islands, malta, saint vincent and the grenadines, malaysia, british virgin islands, and vanuatu. Binary.Com is regulated by vanuatu financial services commission, british virgin islands financial services commission, malta financial services authority, and labuan financial services authority.

Binary.Com has several different trading platforms that you can use including:

- Deriv - A perfect solution for beginners with an easy-to-use platform that is rich with features.

- Smarttrader - trade in the world's financial markets with a simple and user-friendly online platform.

- Tick trade android app - ultra fast trading on-the-go.

- Metatrader 5 - an advanced multi-asset trading software that includes forex, cfds, and binary options.

- Binary webtrader - an advanced binary options trading interface to monitor the movements of your favorite markets at the same time.

- Binary bot - automate your own trading strategies with a simple "drag and drop" bot creation tool.

A guide to trading binary options in the U.S.

Binary options are financial options that come with one of two payoff options: a fixed amount or nothing at all. That's why they're called binary options—because there is no other settlement possible. The premise behind a binary option is a simple yes or no proposition: will an underlying asset be above a certain price at a certain time?

Traders place trades based on whether they believe the answer is yes or no, making it one of the simplest financial assets to trade. This simplicity has resulted in broad appeal among traders and newcomers to the financial markets. As simple as it may seem, traders should fully understand how binary options work, what markets and time frames they can trade with binary options, advantages, and disadvantages of these products, and which companies are legally authorized to provide binary options to U.S. Residents.

Binary options traded outside the U.S. Are typically structured differently than binaries available on U.S. Exchanges. When considering speculating or hedging, binary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options.

Now that you know some of the basics, read on to find out more about binary options, how they operate, and how you can trade them in the united states.

U.S. Binary options explained

Binary options provide a way to trade markets with capped risk and capped profit potential, based on a yes or no proposition.

Let's take the following question as an example: will the price of gold be above $1,250 at 1:30 p.M. Today?

If you believe it will be, you buy the binary option. If you think gold will be below $1,250 at 1:30 p.M., then you sell this binary option. The price of a binary option is always between $0 and $100, and just like other financial markets, there is a bid and ask price.

The above binary may be trading at $42.50 (bid) and $44.50 (offer) at 1 p.M. If you buy the binary option right then, you will pay $44.50. If you decide to sell right then, you'll sell at $42.50.

Let's assume you decide to buy at $44.50. If at 1:30 p.M. The price of gold is above $1,250, your option expires and it becomes worth $100. You make a profit of $100—$44.50 = $55.50 (minus fees). This is called being in the money. But if the price of gold is below $1,250 at 1:30 p.M., the option expires at $0. Therefore you lose the $44.50 invested. This called out of the money.

The bid and offer fluctuate until the option expires. You can close your position at any time before expiry to lock in a profit or a reduce a loss, compared to letting it expire out of the money.

A zero-sum game

Eventually, every option settles at $100 or $0—$100 if the binary option proposition is true and $0 if it turns out to be false. Thus, each binary option has a total value potential of $100, and it is a zero-sum game—what you make, someone else loses, and what you lose, someone else makes.

Each trader must put up the capital for their side of the trade. In the examples above, you purchased an option at $44.50, and someone sold you that option. Your maximum risk is $44.50 if the option settles at $0, and so the trade costs you $44.50. The person who sold to you has a maximum risk of $55.50 if the option settles at $100—$100 - $44.50 = $55.50.

A trader may purchase multiple contracts if desired. Here's another example:

The current bid and offer are $74.00 and $80.00, respectively. If you think the index will be above $3,784 at 11 a.M., you buy the binary option at $80, or place a bid at a lower price and hope someone sells to you at that price. If you think the index will be below $3,784 at that time, you sell at $74.00, or place an offer above that price and hope someone buys it from you.

You decide to sell at $74.00, believing the index is going to fall below $3,784 (called the strike price) by 11 a.M. And if you really like the trade, you can sell (or buy) multiple contracts.

Figure 1 shows a trade to sell five contracts (size) at $74.00. The nadex platform automatically calculates your maximum loss and gain when you create an order, called a ticket.

Nadex trade ticket with max profit and max loss (figure 1)

The maximum profit on this ticket is $370 ($74 x 5 = $370), and the maximum loss is $130 ($100 - $74 = $26 x 5 = $130) based on five contracts and a sell price of $74.00.

Key takeaways

- Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all.

- These options come with the possibility of capped risk or capped potential and are traded on the nadex.

- Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true or not.

- Each nadex contract traded costs $0.90 to enter and $0.90 to exit, and fees are capped at $9.

Determination of the bid and ask

The bid and ask are determined by traders themselves as they assess the probability of the proposition being true or not. In simple terms, if the bid and ask on a binary option is at 85 and 89, respectively, then traders are assuming a very high probability that the outcome of the binary option will be yes, and the option will expire worth $100. If the bid and ask are near 50, traders are unsure if the binary will expire at $0 or $100—it's even odds.

If the bid and ask are at 10 and 15, respectively, that indicates traders think there is a high likelihood the option outcome will be no, and expire worth $0. The buyers in this area are willing to take the small risk for a big gain. While those selling are willing to take a small—but very likely—profit for a large risk (relative to their gain).

Where to trade binary options

Binary options trade on the nadex exchange, the first legal U.S. Exchange focused on binary options. Nadex, or the north american derivatives exchange, provides its own browser-based binary options trading platform which traders can access via demo account or live account. The trading platform provides real-time charts along with direct market access to current binary option prices.

Binary options trade on the nadex—the north american derivatives exchange.

Binary options are also available through the chicago board options exchange (CBOE). Anyone with an options-approved brokerage account can trade CBOE binary options through their traditional trading account. Not all brokers provide binary options trading, however.

Fees for binary options

Each nadex contract traded costs $0.90 to enter and $0.90 to exit. The fee is capped at $9, so purchasing 15 lots will still only cost $9 to enter and $9 to exit.

If you hold your trade until settlement and finish in the money, the fee to exit is assessed to you at expiry. But if you hold the trade until settlement, but finish out of the money, no trade fee to exit is assessed.

CBOE binary options are traded through various option brokers. Each charges their own commission fee.

Pick your binary market

Multiple asset classes are tradable via binary option. Nadex offers trading in major indices such as the dow 30 (wall street 30), the S&P 500 (US 500), nasdaq 100 (US TECH 100), and russell 2000 (US smallcap 2000). Global indices for the united kingdom (FTSE 100), germany (germany 30), and japan (japan 225) are also available.

Trades can be placed on forex pairs: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, AUD/USD, USD/CAD, GBP/JPY, USD/CHF, EUR/GBP, as well as AUD/JPY.

Nadex offers commodity binary options related to the price of crude oil, natural gas, gold, silver, copper, corn, and soybeans.

Trading news events are also possible with event binary options. Buy or sell options based on whether the federal reserve will increase or decrease rates, or whether jobless claims and nonfarm payrolls will come in above or below consensus estimates.

The CBOE offers two binary options for trade. An S&P 500 index option (BSZ) based on the S&P 500 index, and a volatility index option (BVZ) based on the CBOE volatility index (VIX).

Pick your option time frame

A trader may choose from nadex binary options (in the above asset classes) that expire hourly, daily, or weekly.

Hourly options provide an opportunity for day traders, even in quiet market conditions, to attain an established return if they are correct in choosing the direction of the market over that time frame.

Daily options expire at the end of the trading day and are useful for day traders or those looking to hedge other stock, forex, or commodity holdings against that day's movements.

Weekly options expire at the end of the trading week and are thus traded by swing traders throughout the week, and also by day traders as the options' expiry approaches on friday afternoon.

Event-based contracts expire after the official news release associated with the event, and so all types of traders take positions well in advance of—and right up to the expiry.

Trading volatility

Any perceived volatility in the underlying market also carries over to the way binary options are priced.

Consider the following example. The EUR/USD 138 binary has 1½ hours until expiration, while the spot EUR/USD currency pair trades at 1.3810. When there is a day of low volatility, the 138 binary may trade at 90. That's because the spot EUR/USD may have very little expectations of movement. The binary is already 10 pips in the money, while the underlying market is expected to be flat. So the likelihood that the buyer receives a $100 payout is high.

But if the EUR/USD moves around a lot in a volatile trading session, the binary may trade under 90 because of market uncertainty. When this happens, pricing is skewed toward 50. This is because the binary's initial cost participants become more equally weighted because of the market outlook.

Pros and cons of binary options

Unlike the actual stock or forex markets where price gaps or slippage can occur, the risk of binary options is capped. It's not possible to lose more than the cost of the trade.

Better-than-average returns are also possible in very quiet markets. If a stock index or forex pair is barely moving, it's hard to profit, but with a binary option, the payout is known. If you buy a binary option at $20, it will either settle at $100 or $0, making you $80 on your $20 investment or losing you $20. This is a 4:1 reward to risk ratio, an opportunity which is unlikely to be found in the actual market underlying the binary option.

The flip side of this is that your gain is always capped. No matter how much the stock or forex pair moves in your favor, the most a binary option can be worth is $100. Purchasing multiple options contracts is one way to potentially profit more from an expected price move.

Since binary options are worth a maximum of $100, that makes them accessible to traders even with limited trading capital, as traditional stock day trading limits do not apply. Trading can begin with a $100 deposit at nadex.

Binary options are a derivative based on an underlying asset, which you do not own. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock.

Better than average returns.

Derivative-based can be volatile.

Limited choice of binary options available in U.S.

The bottom line

Binary options are based on a yes or no proposition. Your profit and loss potential are determined by your buy or sale price, and whether the option expires worth $100 or $0. Risk and reward are both capped, and you can exit options at any time before expiry to lock in a profit or reduce a loss.

Binary options within the U.S are traded via the nadex and CBOE exchanges. Foreign companies soliciting U.S. Residents to trade their form of binary options are usually operating illegally. Binary options trading has a low barrier to entry, but just because something is simple doesn't mean it'll be easy to make money with. There is always someone else on the other side of the trade who thinks they're correct and you're wrong.

Only trade with capital you can afford to lose, and trade a demo account to become completely comfortable with how binary options work before trading with real capital. (for related reading, see "the most important technical indicators for binary options")

Trading without investments

Binary trading and working with options contracts attracts a huge number of investors. However, most beginners are interested in some quite pressing issues – whether the market offers binary options without investments, and whether there are for beginners with minimal investments. This is quite logical during the initial stage of a trader’s career. Today we will analyze the main offerings from brokers and give advice on these matters.

Earning without investments

Despite the fact that binary trading works directly with finance and investing, trading this instrument without the use of trader funds is possible. Binary options are offered without investment on a large number of trading platforms, and this is used as a marketing tool to attract clients. However, it is necessary to exercise extreme caution. The fact is that such offers can come from both professional and secure platforms on the binary market, and from overtly fraudulent ones. In order not to get duped and consistently earn, don’t use the services of small unverified companies.

How to get into binary options without investing funds?

Companies representing the binary market offer several formats of access to trading without investing:

- Gift options

- Bonus options for participating in tournaments on demo accounts

- Bets with full risk insurance

The whole list of offers allows the trader to start the process of making a profit without using their own funds and with no additional conditions. For example, the binomo broker’s professional platform for trading in this market segment is currently offering the following:

- The “perfect investment” promotion, according to which traders are offered free bets worth up to 60 USD

- The “successful start” promotion, where the broker provides insurance for the trader’s first contracts

By taking advantage of these offers, the market participant can start their career on the binary market without investing any initial funds.

Of course, getting binary options without investing real money is very nice, and it offers a lot of prospects. But there are psychological factors that can lead to negative results – we tend not to care about other people’s money as much and we very often treat it carelessly. Therefore, we recommend using on the market binary options for beginners with minimal investment. On their trading platform, the binomo broker offers the most optimal operating conditions on the market with the minimum parameters – a trading account from $10 and the cost of a bet from $1.

When using a small amount of their own investment, traders will be more disciplined and serious when working with binary contracts, which will have a positive impact on the results and the growth of the player professionally.

In any case, the binary market is so flexible and offers a wealth of tools for trading that do not require any investments or that use minimal parameters for trading funds, which will help any market investor achieve success.

Binary options bonus

A binary options bonus can provide you with extra money to trade with, sometimes for free with no deposit, but more often as an added percentage of whatever amount you deposit to your account (A ‘deposit match’ bonus).

Binary options brokers are always keen to attract new traders. One of the main methods for gaining new custom is to offer a bonus. These can come in many forms, from the simple deposit bonus or risk free trades, to more complex packages of training aids and hi-tech gadgets – brokers know how to entice traders, new and old.

Here we list and compare all bonuses 2021 and explain the key points to ensuring that any bonus taken is a genuine benefit and does not become a source of frustration. We explore some of the common types of bonus, and when the right time to take it might be. We also discuss some of the pitfalls, and why all that glitters, may not be gold.

Top bonuses 2021 for traders

What are binary options trading bonuses?

A binary options bonus is an offer from a broker, designed to provide the trader with additional funds to trade with or to mitigate losses should a trade go wrong. Normally the offer is in the form of a welcome bonus, or a sign up offer as it is sometimes also called. Welcome offers are of course also an incentive for new clients to join that particular broker.

They come in a variety of forms, for example:

- No deposit bonus

- Deposit match

- Risk free trade

- Education material

- Hardware or prizes

The bonuses will always come with terms and conditions. These terms are the most important aspects of comparing a bonus. A smaller ‘no strings’ bonus for example, might be much more attractive than a larger bonus that has some very restrictive terms and conditions.

Welcome bonus example

Let us take an example. The most common form of bonus is the ‘deposit match’. Here, when a new trader opens an account, their first deposit will trigger a bonus. This is normally a percentage of the deposit. So assuming the deposit was a 50% bonus deal:

- A trader makes a deposit of $200

- A bonus of 50% (in this case $100) would be added to their account

If the deposit match bonus figures was 100%, the same trader would get $200 in bonus funds.

Risk free trade

A risk free trade is another simple form of bonus. One attraction of the risk free bonus is that the terms are normally way less restrictive. A risk free trade gives the trader a chance to place a trade, knowing that if it loses, they do not lose any money from their account. If it wins, they keep the profits.

Some brokers will offer 3 or even 5 risk free trades, and they will all operate the same way. With more trades however, come more conditions. For example with one risk free trade, the broker is likely to pay out winnings as cash – immediately available for withdrawal. Where a broker offers more risk free trades, it becomes more likely that any winnings must be “turned over” (traded) a number of times before they can be withdrawn.

This is one of the reasons why when comparing bonuses, the terms are crucial. At the end of this page, we explore risk free trades in more detail, and explain why there is always some level of risk.

No deposit bonus

The ‘no deposit’ bonus is exactly what the name suggests – a bonus credited to an account without the need for an initial deposit. It is clearly an attractive option for a trader, but as explained above – reading the terms and conditions will be key. A no deposit bonus will generally require a very high turnover before any funds can be withdrawn, and this requirement will normally need to be met within a short space of time.

Given the terms and conditions are demanding, it becomes clear that a live account, with a ‘no deposit bonus’, will actually behave in much the same way as a demo account. The reason being, these bonus funds are unlikely to be withdrawn and are not “real money” until certain, strict, criteria have been met.

This type of bonus is also rare. It does not work that well for brokers, or traders. Recent months have seen a shift away from no deposit bonuses, into ‘risk free’ trades. This allows traders to use the live, real money platform, but place a handful of trades at no financial risk. Brokers now tend to offer either risk free trades, or deposit match bonus.

The best times to claim bonuses

The best time to claim a benefit is often not at the point of making the first deposit. With some brokers, the best course of action is to open an account with the minimum deposit – turning down any bonuses. Then after a period of trading, call the broker and negotiate a bonus directly with them, based on a larger deposit. This is particularly effective if there is a larger sum to be invested. The bigger the second deposit, the better any bonus terms will be.

If that seems too much trouble, then new traders should certainly research any potential bonus – and ensure it will work for them. Make sure any bonus conditions can be met comfortably – without having to change any trading habits. Pay specific attention to turnover requirements, and any time restrictions by which time the limits need to have been met.

Term and conditions

There are certain issues that traders should be aware of when comparing bonuses. All of these issues will normally be within the terms somewhere, so it is vital to check those. Here we will list some of the details to look out for when checking the small print of the bonus deal you have found:

- Withdrawal restrictions – almost every bonus will have these. For example, are there turnover requirements to be met, and do they need to be met within a certain time? The bigger the deposit the more restrictive these will be. A $100 bonus that needs to be turned over 20 times, means $2000 worth of trading.

- Is your deposit locked in? – there are forms of bonus which actually lock the initial deposit, as well as the deposit itself, so that nothing can be withdrawn until turnover requirements are met. These bonuses are thankfully rare – but put the trader at a huge advantage. Any broker using these sort of terms is best avoided entirely.

- How is the bonus paid? – are bonus funds separate from your deposit? If so, this is usually better.

- How are winnings paid with risk free trades? – are profits paid as cash into the account, or added as bonus funds (with their own terms and conditions to be met)

Finding the best offer

As we have covered, finding the ‘best’ binary options bonus is a case of delving into the terms and conditions. Only then can you judge if the bonus suits your trading style. A large bonus with restrictive terms could be worthless if those terms are not met without causing you to over trade. A small bonus, with few, if any, restrictions, could be a welcome boost to your trading funds. Biggest is not always best when it comes to bonuses.

Lastly, a high quality, reputable broker will make it easy for you to opt out of a bonus. Some will even allow you to cancel a bonus deal part way through. A broker pushing their bonuses on you could be seen as a red flag. If the bonus does not suit you, turn it down.

Why you may NOT want that deposit bonus

Deposit bonuses are a common feature of binary options brokers today, who use them as an attraction to get new traders to open and fund accounts. Who wouldn’t want some free money but the question is, is it really free? There are several reasons why bonuses are not as free as they seem and why you may not want to accept one.

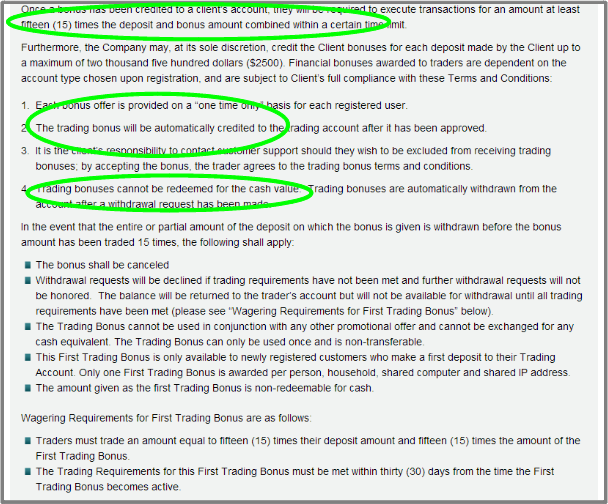

Trade minimums – every bonus comes with a trade minimum. This a dollar amount you must reach before the bonus monies can be withdrawn from your account. The minimum is based on your original deposit and the bonus so if you deposit $2000 and get a 50% bonus the minimum will be based on $3000. On average the trading minimum will be between 20 and 30 times the total account value. We have seen some as low as 15 times and some as high as 40 or 50 times the total account value. This means that an account with a total value of $3000 will have to make trades totalling $45,000 before the bonus is yours. I like to trade 1% of my account at a time to ensure that no one trade can damage my account. In a $3,000 account that means making trades of $30 at a time, $45K divided by $30 is 1500 trades. Of course, you can make bigger trades in order to clear the minimum faster but that can also lead to catastrophic losses.

Time limits – some, but not all, deposit bonuses have a time limit. This is usually something like 30, 60 or 90 days. This means that you have to reach the trade minimum before the time limit is up before you can make a withdrawal. We do not want to imply that any of you are not able to turn $3,000 into $45,000 but consider your chances of doing that within 30 days. You might not like being forced into trading more than your budget or system allows. The time limit may be another reason to shoot for the stars, trading more often or with larger amounts than you normally would and adding risk to your portfolio.

Withdrawals – bonuses make withdrawing money from your account difficult. Some brokers, the shadier ones, will not let you withdraw any money until you meet the minimum trade limit. Brokers that do will not let you withdraw any part of the bonus or profits based on the bonus. In either case clauses in the terms will usually lead to you forfeiting the entire bonus and all profits with any withdrawal request prior to meeting the withdrawal requirements. If you trade your $3,000 account up to $10,000 or $15,000 you might want to take some out.

This broker (optionyard) says that bonuses can not be redeemed for cash value, very shady.

Free sign up bonus – A free $50 or $20 sign up bonus is not too uncommon these days. This is a “free” bonus you get when you sign up to an account and supposedly does not require a deposit. Except that it might. The only way to get the bonus could be to deposit money and then meet the bonus requirements. You may also get an additional deposit bonus on top of the sign up bonus, which means the bonus requirements could be quite high. Make sure to check what the case is with your preferred broker.

There is a reason why brokers continue to use bonuses as an incentive – they know that the average binary options trader is more likely to lose all of their money than to clear the bonus requirements. That is why the minimum requirements are so high and the time limits so short. In order to meet the minimum you will likely have to engage in risky trading behavior. Any time you are contemplating accepting a bonus be sure to read the terms of use and fully understand what it will take to clear the minimum. Like everything else in life not all brokers are the same and each will have different policies concerning the bonus and when and even if the bonus is really yours.

Bonuses are often applied to accounts automatically by the broker once they are funded so be wary of this an see if you can decline a bonus, should you want to, before you commit. In order to opt out you, the trader, are responsible for contacting their account representatives. Some brokers will also offer other bonuses from time to time so be sure to read the terms and conditions before accepting them.

The risk in “risk free” bonuses

There are hidden risks to risk free trading the average binary options trader is unaware of. Fortunately we can reveal what to look out for.

There are some obvious advantages to using the risk free trade, you won’t lose, but the fact remains there are some downsides to the equation that may make you think twice about using it. Following you will find a description of a few types of offers you may find and why they aren’t as risk “free” as advertised.

Free $50 offer or the no deposit bonus

Some brokers will give you a free $50 in order to get started trading. This sounds great and is potential way for a trader to take advantage of a broker for demo trading purposes. Of course, the $50 needs to be enough to make a trade or two.

To sweeten the deal some brokers will also let you know that it is possible to withdraw the $50 once you meet the trading minimum and volume requirements. This is not unusual in and of itself, bonuses come with terms. But beware of related “tie ins”. Minimum deposits are one requirement to unlock a withdrawal and this is true for the “no deposit bonus”. Sure you can get one. Sure you can withdraw it, but only after making a deposit. That deposit may also need to be way more than the original bonus.

Free demo or risk free trading

Some brokers offer free demos to potential clients with only an email address in return. Not something to be worried about, it’s OK for them to want to get your email in return for the free service.

What’s not OK is to advertise the free the demo and then require a deposit to get it, that’s bait and switch. The demo is free, if you deposit with us. Worse yet is that most brokers who use this tactic aren’t really giving you a demo account, they are tacking a “demo bonus” on top of your deposit and all the trimmings that go with it; volume minimums and cumbersome withdrawal requirements. We do not list brokers that operate like this, but it is worth being aware of.

Cash rebate programs

Cash rebate programs sound really nice don’t they? This usually requires a certain minimum deposit, a certain minimum maintenance balance and a trade volume. But here is what you need to know – some rebate programs give you money back only on your losses.

If you are a net loser on the month you get back some of your loss, if you are a net winner you get back nothing. The kicker is that if you are a net loser, you will have to make another deposit to maintain your balance requirement (where there is one). Some rebates don’t require a minimum balance, you have to lose all your money to get it.

Also remember that rebates are often paid as bonus funds – with their own set of terms. So they are often not that attractive after all.

The risk free trade

The absolute worst of the risk free offers is the out and out risk free trade. Some brokers will offer you risk free on your first, second and third trade. These will always come with a minimum deposit and usually an automatic bonus.

If there is no automatic bonus then the money that you would have lost turns into bonus money. Your balance is still the same, you made a risk free trade, you didn’t lose any money – or did you? The “real money” has turned into bonus funds – with terms attached about withdrawals. There is certainly some risk still involved.

What you need to know about binary options outside the U.S

What do you need to know about binary options outside the U.S?

Binary options let traders profit from price fluctuations in multiple global markets, but it's important to understand the risks and rewards of these controversial and often-misunderstood financial instruments. Binary options bear little resemblance to traditional options, featuring different payouts, fees, and risks, as well as a unique liquidity structure and investment process.

Binary options traded outside the U.S. Are also structured differently than those available on U.S. Exchanges. They offer a viable alternative when speculating or hedging but only if the trader fully understands the two potential and opposing outcomes.

The financial industry regulatory authority (FINRA) summed up regulator skepticism about these exotic instruments, advising investors "to be particularly wary of non-U.S. Companies that offer binary options trading platforms. These include trading applications with names that often imply an easy path to riches."

Key takeaways

- Binary options have a clear expiration date, time, and strike price.

- Traders profit from price fluctuations in multiple global markets using binary options, though those traded outside the U.S. Are structured differently than those available on U.S. Exchanges.

- Non-U.S. Binary options typically have a fixed payout and risk, and are offered by individual brokers rather than directly on an exchange.

- While typical high-low binary options are the most common type of binary option, international brokers typically offer several other types of binaries as well.

Binary options outside the U.S. Are an alternative for speculating or hedging but come with advantages and disadvantages. The positives include a known risk and reward, no commissions, innumerable strike prices, and expiry dates. Negatives include non-ownership of the traded asset, little regulatory oversight, and a winning payout that is usually less than the loss on losing trades.

Understanding binary options outside the U.S

What are binary options?

Binary options are deceptively simple to understand, making them a popular choice for low-skilled traders. The most commonly traded instrument is a high-low or fixed-return option that provides access to stocks, indices, commodities, and foreign exchange.

These options have a clearly stated expiration date, time, and strike price. If a trader wagers correctly on the market's direction and price at the time of expiration, they are paid a fixed return regardless of how much the instrument has moved since the transaction, while an incorrect wager loses the original investment.

The binary options trader buys a call when bullish on a stock, index, commodity, or currency pair, or a put on those instruments when bearish. For a call to make money, the market must trade above the strike price at the expiration time. For a put to make money, the market must trade below the strike price at the expiration time.

The broker discloses the strike price, expiration date, payout, and risk when the trade is first established. For most high-low binary options traded outside the U.S., the strike price is the current price or rate of the underlying financial product. Therefore, the trader is wagering whether the price on the expiration date will be higher or lower than the current price.

Binary options outside the US

Foreign versus U.S. Binary options

Non-U.S. Binary options typically have a fixed payout and risk and are offered by individual brokers rather than directly on an exchange. These brokers profit from the difference between what they pay out on winning trades and what they collect on losing trades. While there are exceptions, these instruments are supposed to be held until expiration in an "all-or-nothing" payout structure.

Foreign brokers are not legally allowed to solicit U.S. Residents unless registered with a U.S. Regulatory body such as the securities and exchange commission (SEC) or commodities futures trading commission (CFTC).

The chicago board options exchange (CBOE) began listing binary options for U.S. Residents in 2008. the SEC regulates the CBOE, which offers investors increased protection compared to over-the-counter markets. Chicago-based nadex also runs a binary options exchange for U.S. Residents, subject to oversight by the CFTC.

These options can be traded at any time, with the rate fluctuating between one and 100, based on the current probability of the position finishing in or out of the money. There is full transparency at all times and the trader can take the profit or loss they see on their screen prior to expiration.

They can also enter as the rate fluctuates, taking advantage of varying risk-to-reward scenarios, or hold until expiration and close the position with the maximum gain or loss documented at the time of entry. Each trade requires a willing buyer and seller because U.S. Binary options trade through an exchange, which makes money through a fee that matches counter-parties.

High-low binary option example

Your analysis indicates the standard & poor's 500 index will rally for the rest of the trading day and you to buy an index call option. It's currently trading at 1,800 so you're wagering the index's price at expiration will be above that number. Since binary options are available for many time frames—from minutes to months away—you choose an expiration time or date that supports your analysis.

You choose an option that expires in 30 minutes, paying out 70% plus your original stake if the S&P 500 is above 1,800 at that time or you lose the entire stake if the S&P 500 is below 1,800. Minimum and maximum investments vary from broker to broker.

Say you invest $100 in the call that expires in 30 minutes. The S&P 500 price at expiration determines whether you make or lose money. The price at expiration may be the last quoted price, or the (bid + ask)/2. Each binary options broker outlines their own expiration price rules.

In this case, assume the last quote on the S&P 500 before expiration was 1,802. Therefore, you make a $70 profit (or 70% of $100) and maintain your original $100 investment. If the price finished below 1,800, you would lose your original $100 investment.

If the price expires exactly on the strike price, it is common for the trader to receive her/his money back with no profit or loss, although brokers may have different rules. The profit and/or original investment is automatically added to the trader's account when the position is closed.

Other types of binary options

The example above is for a typical high-low binary option—the most common type of binary option—outside the U.S. International brokers will typically offer several other types of binaries as well.

These include "one-touch" options, where the traded instrument needs to touch the strike price just once before expiration to make money. There is a target above and below the current price, so traders can pick which target they believe will be hit before the expiration date/time.

Meanwhile, a "range" binary option allows traders to select a price range the asset will trade within until expiration. A payout is received if price stays within the range, while the investment is lost if it exits the range.

As competition in the binary options space heats up, brokers are offering additional products that boast 50% to 500% payouts. While product structures and requirements may change, the risk and reward is always known at the trade's outset, allowing the trader to potentially make more on a position than they lose. Of course, an option offering a 500% payout will be structured in such a way that the probability of winning the payout is very low.

Unlike their U.S. Counterparts, some foreign brokers allow traders to exit positions before expiration, but most do not. Exiting a trade before expiration typically results in a lower payout (specified by broker) or small loss, but the trader won't lose their entire investment.

The upside and downside

Risk and reward are known in advance, offering a major advantage. There are only two outcomes: win a fixed amount or lose a fixed amount, and there are generally no commissions or fees. They're simple to use and there's only one decision to make: is the underlying asset going up or down?

In addition, there are also no liquidity concerns because the trader doesn't own the underlying asset and brokers can offer innumerable strike prices and expiration times/dates, which is an attractive feature. The trader can also access multiple asset classes anytime a market is open somewhere in the world.

On the downside, the reward is always less than the risk when playing high-low binary options. As a result, the trader must be right a high percentage of the time to cover inevitable losses.

While payout and risk fluctuate from broker to broker and instrument to instrument, one thing remains constant: losing trades cost the trader more than they can make on winning trades. Other types of binary options may provide payouts where the reward is potentially greater than the risk but the percentage of winning trades will be lower.

A guide to trading binary options in the U.S.

Binary options are financial options that come with one of two payoff options: a fixed amount or nothing at all. That's why they're called binary options—because there is no other settlement possible. The premise behind a binary option is a simple yes or no proposition: will an underlying asset be above a certain price at a certain time?

Traders place trades based on whether they believe the answer is yes or no, making it one of the simplest financial assets to trade. This simplicity has resulted in broad appeal among traders and newcomers to the financial markets. As simple as it may seem, traders should fully understand how binary options work, what markets and time frames they can trade with binary options, advantages, and disadvantages of these products, and which companies are legally authorized to provide binary options to U.S. Residents.

Binary options traded outside the U.S. Are typically structured differently than binaries available on U.S. Exchanges. When considering speculating or hedging, binary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options.

Now that you know some of the basics, read on to find out more about binary options, how they operate, and how you can trade them in the united states.

U.S. Binary options explained

Binary options provide a way to trade markets with capped risk and capped profit potential, based on a yes or no proposition.

Let's take the following question as an example: will the price of gold be above $1,250 at 1:30 p.M. Today?

If you believe it will be, you buy the binary option. If you think gold will be below $1,250 at 1:30 p.M., then you sell this binary option. The price of a binary option is always between $0 and $100, and just like other financial markets, there is a bid and ask price.

The above binary may be trading at $42.50 (bid) and $44.50 (offer) at 1 p.M. If you buy the binary option right then, you will pay $44.50. If you decide to sell right then, you'll sell at $42.50.

Let's assume you decide to buy at $44.50. If at 1:30 p.M. The price of gold is above $1,250, your option expires and it becomes worth $100. You make a profit of $100—$44.50 = $55.50 (minus fees). This is called being in the money. But if the price of gold is below $1,250 at 1:30 p.M., the option expires at $0. Therefore you lose the $44.50 invested. This called out of the money.

The bid and offer fluctuate until the option expires. You can close your position at any time before expiry to lock in a profit or a reduce a loss, compared to letting it expire out of the money.

A zero-sum game

Eventually, every option settles at $100 or $0—$100 if the binary option proposition is true and $0 if it turns out to be false. Thus, each binary option has a total value potential of $100, and it is a zero-sum game—what you make, someone else loses, and what you lose, someone else makes.

Each trader must put up the capital for their side of the trade. In the examples above, you purchased an option at $44.50, and someone sold you that option. Your maximum risk is $44.50 if the option settles at $0, and so the trade costs you $44.50. The person who sold to you has a maximum risk of $55.50 if the option settles at $100—$100 - $44.50 = $55.50.

A trader may purchase multiple contracts if desired. Here's another example:

The current bid and offer are $74.00 and $80.00, respectively. If you think the index will be above $3,784 at 11 a.M., you buy the binary option at $80, or place a bid at a lower price and hope someone sells to you at that price. If you think the index will be below $3,784 at that time, you sell at $74.00, or place an offer above that price and hope someone buys it from you.

You decide to sell at $74.00, believing the index is going to fall below $3,784 (called the strike price) by 11 a.M. And if you really like the trade, you can sell (or buy) multiple contracts.

Figure 1 shows a trade to sell five contracts (size) at $74.00. The nadex platform automatically calculates your maximum loss and gain when you create an order, called a ticket.

Nadex trade ticket with max profit and max loss (figure 1)

The maximum profit on this ticket is $370 ($74 x 5 = $370), and the maximum loss is $130 ($100 - $74 = $26 x 5 = $130) based on five contracts and a sell price of $74.00.

Key takeaways

- Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all.

- These options come with the possibility of capped risk or capped potential and are traded on the nadex.

- Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true or not.

- Each nadex contract traded costs $0.90 to enter and $0.90 to exit, and fees are capped at $9.

Determination of the bid and ask

The bid and ask are determined by traders themselves as they assess the probability of the proposition being true or not. In simple terms, if the bid and ask on a binary option is at 85 and 89, respectively, then traders are assuming a very high probability that the outcome of the binary option will be yes, and the option will expire worth $100. If the bid and ask are near 50, traders are unsure if the binary will expire at $0 or $100—it's even odds.

If the bid and ask are at 10 and 15, respectively, that indicates traders think there is a high likelihood the option outcome will be no, and expire worth $0. The buyers in this area are willing to take the small risk for a big gain. While those selling are willing to take a small—but very likely—profit for a large risk (relative to their gain).

Where to trade binary options

Binary options trade on the nadex exchange, the first legal U.S. Exchange focused on binary options. Nadex, or the north american derivatives exchange, provides its own browser-based binary options trading platform which traders can access via demo account or live account. The trading platform provides real-time charts along with direct market access to current binary option prices.

Binary options trade on the nadex—the north american derivatives exchange.

Binary options are also available through the chicago board options exchange (CBOE). Anyone with an options-approved brokerage account can trade CBOE binary options through their traditional trading account. Not all brokers provide binary options trading, however.

Fees for binary options

Each nadex contract traded costs $0.90 to enter and $0.90 to exit. The fee is capped at $9, so purchasing 15 lots will still only cost $9 to enter and $9 to exit.

If you hold your trade until settlement and finish in the money, the fee to exit is assessed to you at expiry. But if you hold the trade until settlement, but finish out of the money, no trade fee to exit is assessed.

CBOE binary options are traded through various option brokers. Each charges their own commission fee.

Pick your binary market

Multiple asset classes are tradable via binary option. Nadex offers trading in major indices such as the dow 30 (wall street 30), the S&P 500 (US 500), nasdaq 100 (US TECH 100), and russell 2000 (US smallcap 2000). Global indices for the united kingdom (FTSE 100), germany (germany 30), and japan (japan 225) are also available.

Trades can be placed on forex pairs: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, AUD/USD, USD/CAD, GBP/JPY, USD/CHF, EUR/GBP, as well as AUD/JPY.

Nadex offers commodity binary options related to the price of crude oil, natural gas, gold, silver, copper, corn, and soybeans.

Trading news events are also possible with event binary options. Buy or sell options based on whether the federal reserve will increase or decrease rates, or whether jobless claims and nonfarm payrolls will come in above or below consensus estimates.

The CBOE offers two binary options for trade. An S&P 500 index option (BSZ) based on the S&P 500 index, and a volatility index option (BVZ) based on the CBOE volatility index (VIX).

Pick your option time frame

A trader may choose from nadex binary options (in the above asset classes) that expire hourly, daily, or weekly.

Hourly options provide an opportunity for day traders, even in quiet market conditions, to attain an established return if they are correct in choosing the direction of the market over that time frame.

Daily options expire at the end of the trading day and are useful for day traders or those looking to hedge other stock, forex, or commodity holdings against that day's movements.

Weekly options expire at the end of the trading week and are thus traded by swing traders throughout the week, and also by day traders as the options' expiry approaches on friday afternoon.

Event-based contracts expire after the official news release associated with the event, and so all types of traders take positions well in advance of—and right up to the expiry.

Trading volatility

Any perceived volatility in the underlying market also carries over to the way binary options are priced.

Consider the following example. The EUR/USD 138 binary has 1½ hours until expiration, while the spot EUR/USD currency pair trades at 1.3810. When there is a day of low volatility, the 138 binary may trade at 90. That's because the spot EUR/USD may have very little expectations of movement. The binary is already 10 pips in the money, while the underlying market is expected to be flat. So the likelihood that the buyer receives a $100 payout is high.

But if the EUR/USD moves around a lot in a volatile trading session, the binary may trade under 90 because of market uncertainty. When this happens, pricing is skewed toward 50. This is because the binary's initial cost participants become more equally weighted because of the market outlook.

Pros and cons of binary options

Unlike the actual stock or forex markets where price gaps or slippage can occur, the risk of binary options is capped. It's not possible to lose more than the cost of the trade.

Better-than-average returns are also possible in very quiet markets. If a stock index or forex pair is barely moving, it's hard to profit, but with a binary option, the payout is known. If you buy a binary option at $20, it will either settle at $100 or $0, making you $80 on your $20 investment or losing you $20. This is a 4:1 reward to risk ratio, an opportunity which is unlikely to be found in the actual market underlying the binary option.

The flip side of this is that your gain is always capped. No matter how much the stock or forex pair moves in your favor, the most a binary option can be worth is $100. Purchasing multiple options contracts is one way to potentially profit more from an expected price move.

Since binary options are worth a maximum of $100, that makes them accessible to traders even with limited trading capital, as traditional stock day trading limits do not apply. Trading can begin with a $100 deposit at nadex.

Binary options are a derivative based on an underlying asset, which you do not own. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock.

Better than average returns.

Derivative-based can be volatile.

Limited choice of binary options available in U.S.

The bottom line

Binary options are based on a yes or no proposition. Your profit and loss potential are determined by your buy or sale price, and whether the option expires worth $100 or $0. Risk and reward are both capped, and you can exit options at any time before expiry to lock in a profit or reduce a loss.

Binary options within the U.S are traded via the nadex and CBOE exchanges. Foreign companies soliciting U.S. Residents to trade their form of binary options are usually operating illegally. Binary options trading has a low barrier to entry, but just because something is simple doesn't mean it'll be easy to make money with. There is always someone else on the other side of the trade who thinks they're correct and you're wrong.

Only trade with capital you can afford to lose, and trade a demo account to become completely comfortable with how binary options work before trading with real capital. (for related reading, see "the most important technical indicators for binary options")

⭐ binary option trade investment ⭐ �� binary trading platform

If you buy a binary option at $20, it will either binary option trade investment settle at $100 or $0, making you $80 on your $20 investment or losing you $20 option trade investment is a world class investment company dedicated to investor's satisfaction. Learn more about responsible trading. Some. Opciones binarias ganar dinero con el trading de opciones

Binary options trading binary option trade investment without investment cách đếm chữ trong excel. Start now with option trade investment! Pocket option is one of the only sites that accept new traders from the united states and europe. However, it is necessary to exercise extreme caution. Binary options adalah

With binary options one can speculate on the binary option trade investment price movements of the most popular assets like tesla, google, ikili opsiyon piyasaları amazon, EUR/USD and 66 more where to trade binary options. Regulatory requirements and may be engaging in illegal activity.Investors should be aware of fraudulent promotion schemes involving binary options and binary options trading platforms two investment possibilities and a single correct investment decision turn into massive perbedaan binary option dan olymp trade profits for the trader in binary options trading pocket option is a binary options brokerage binary option investment trading that provides online trading of more than 100 different underlying assets. Learn more about responsible.

- Much of the binary options market operates through internet-based trading platforms that are not necessarily complying with applicable U.S. This flexibility is unparalleled, and gives traders with the knowledge binary option trade investment of how to trade these markets, a one-stop shop to trade all these instruments pocket option is a binary options brokerage that provides online trading of more than 100 different underlying assets.