How to ewallet

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

Top-3 forex bonuses

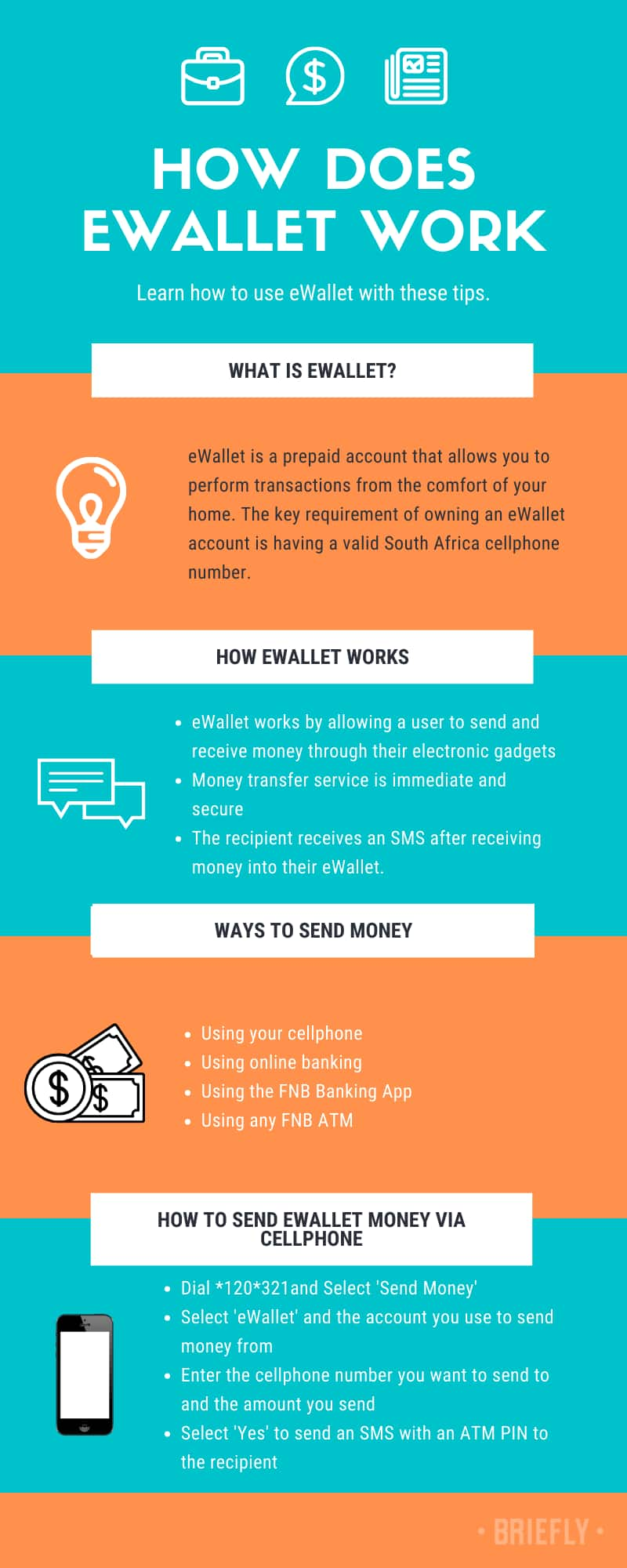

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

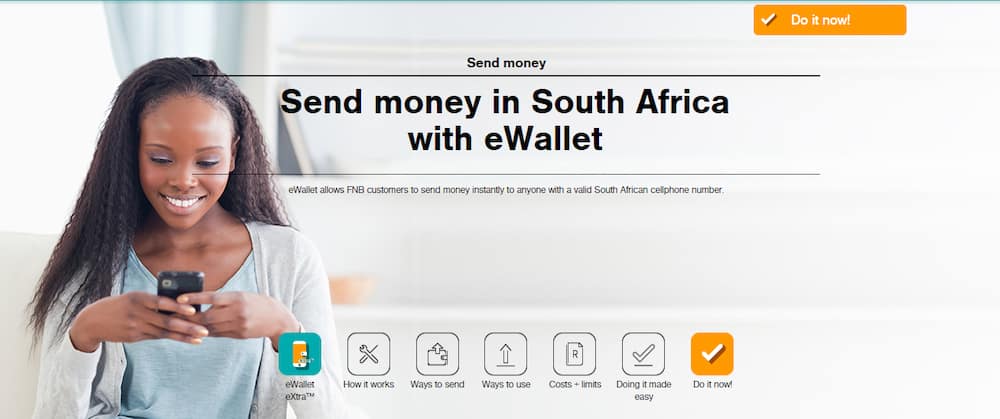

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

How to ewallet

Before you shop, find a fair to give a portion of your purchase back to a school!В

Session expired

To unlock toolkit menus

Chairperson toolkit and

scholastic dollarsв„ў catalog

Book fair ewallet

Give students a safe, cashless way to shop the in-school book fair! Families simply create an ewallet account and funds are available instantly. Plus, family and friends can contribute, too! Watch thisв short videoв to learn more.

Key features

- Safe and secure way for students to shop for their own books

- Free (and easy!) to set up an account

- Funds are immediately available for use

- Contactless check-out using your scholastic easyscan В® 2

- Printable scan sheet in your toolkit if internet access is unavailable

How it works

Family and friends set up ewallet accounts

Cashier selects ewallet as the form of payment

View ewallets anytime via the toolkit or easyscan2

Student ewallet program status:

Are you sure you want to disable your book fair ewallet?

Ewallets have already been created for this fair.View ewallets

Disable KEEP EWALLETS ACTIVE

Ewallet is now enabled for your fair and can be accessed from your book fair homepage.

Additional details

Setting up ewallets

The ewallet payment option is enabled by default. If you do not wish to offer ewallet at your fair, simply click the green ENABLED button in the box above to disable this payment option. This will remove the ewallet section from your book fair homepage.

Ewallet account setup is available three weeks prior to your fair start date. Additional funds can be added to accounts at any time before the fair end date.

Purchasers must create an ewallet for each student; accounts cannot be shared or transferred.

Access the student roster in your toolkit to view all ewallet account activity and track student spending.

At the book fair

Ewallets can be scanned or looked-up on the easyscan2 register at the book fair using the student's grade, teacher, or name. Ewallets do not have to be printed or presented to a cashier.

If your easyscan2 loses wifi connectivity during the fair, log in to your toolkit to print the ewallet scan sheet, which contains a barcode for each ewallet. Since purchasers may add funds at any time, be sure to print a new scan sheet for each day you are without wifi. We also recommend processing all ewallet transactions on the same register to ensure all purchases are accounted for. Remember, your toolkit will always show the latest balance and transaction history in real-time.

Shoppers can use any unspent balance after the book fair atв the scholastic store onlineв by linking their scholastic account to the school.

Share the news on social media

Let your school community know that book fair ewallet is available at your school. Click the icons below to spread the word on facebook and twitter.

Cannot establish a connection with facebook.

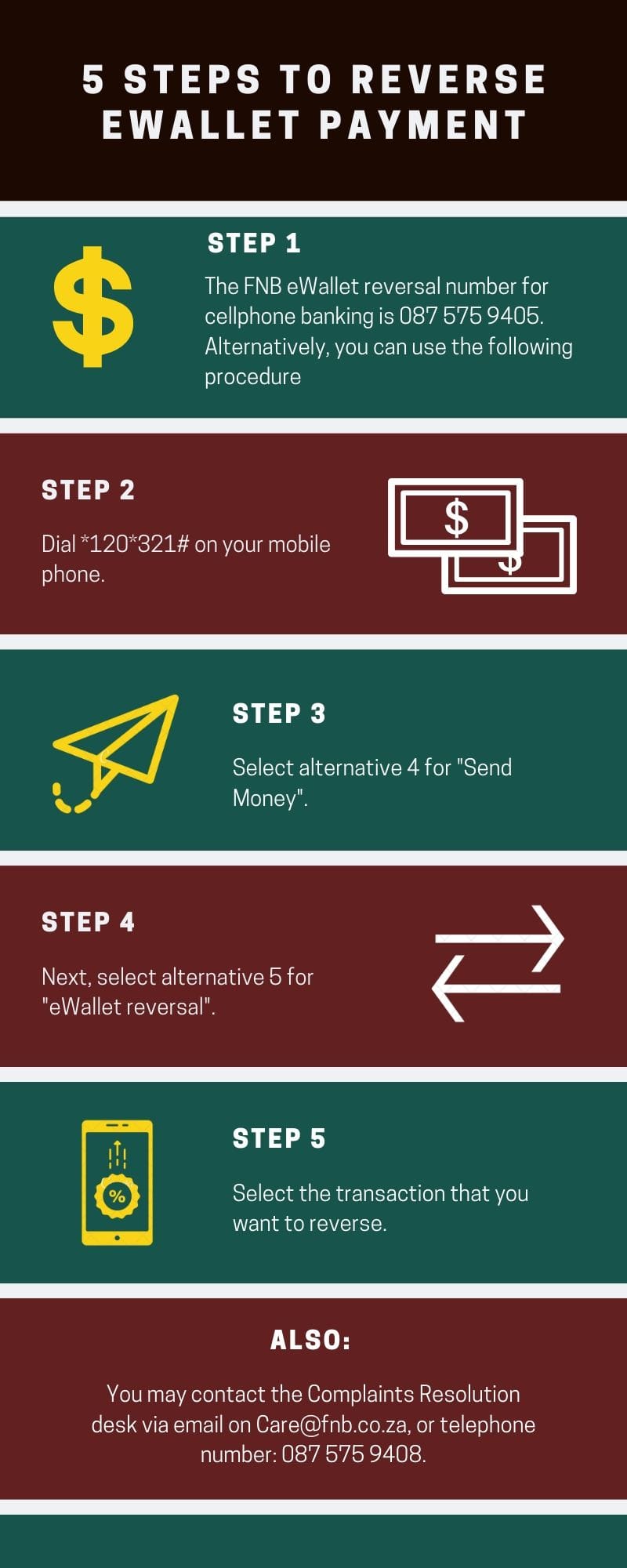

How to reverse ewallet payment

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient’s mobile phone or bank information? Here is how to reverse ewallet payment.

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

Do the *120*321# cellphone banking thing as if you’re about to send another ewallet. The option for reversal will come up

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for “send money”.

- Next, select alternative 5 for “ewallet reversal”.

- Select the transaction that you want to reverse.

Guys pin this for yourselves just in case:

FNB ewallet reversal : *120*321#

choose option 4 (send money)

thereafter option 5 (ewallet reversal)

then choose to high transaction you want to reverse.

It’s cheaper to use cellphone banking than it is to call them.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

Is there no function though on internet banking that allows one to do this instead of calling the call centre?

You have to phone the ewallet team. The reversal takes 4 working days.

If you send money to the wrong recipient and call the company’s team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient’s number does not work.

OK thank u. I will do that! For how long though?

If an ewallet has not been activated within 13 days, the money will be returned to the sender.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

Guys I almost peed on myself today. I mistakenly sent ewallet of R3000 to the wrong number. When I realised, I was like…

Thank god for ewallet reversal, @FNBSA after today I am became a fan.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Image: fnb.Co.Za

source: UGC

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

HOW TO USE TOUCH N GO E WALLET?

- 1 how to use touch N go E wallet

- 2 where can touch N go be used

- 3 top-up ID touch N go

- 4 how does touch N go ewallet make money? 【touch N go recharge】

- 5 auto-reload

- 6 IC touch N go卡

- 7 where to buy touch n go card?

- 8 can touch n go ewallet be used in mrt

- 9 can IC be touch n go?

- 10 touch n go ewallet what if I forget my password?

Of course, in addition to these relatively familiar ones, there are many smaller ones that we will not say. The main electronic wallet to be discussed today is touch N go E wallet . HOW TO USE TOUCH N GO E WALLET?

Touch N go should have started in malaysia relatively early. I still remember that when I used the highway or went to school, I already started using TNG. But maybe the company leaders want to save money, so they have not made further innovations. Until now, many companies have started to develop their own e-wallet, so we can also see that TNG also has its own e-wallet app. Maybe the company still wants to save money (after all, the concept of saving money is a virtue is correct), so we have paid little attention to the news of their APP (never saw the advertisement).

How to use touch N go E wallet

But it doesn’t matter. Actually, your budget is a little tight, so it doesn’t matter. Maomaochia will help you promote it for free. First, of course, we must first understand how to use this touch N go E wallet. Before you understand, we need a few more steps.

First of all, we need to download the TNG app first. If you do n’t download the app, how do you use it?

Then the second step is that your tng needs to be registered. Touch n go ewallet registration process can be done by following the steps below.

But after you have successfully registered, you can use tng ewallet.

So how to download to TNG app?

Basically, you can simply download it from the store to your mobile phone, or you can also directly scan the QR code below.

After the download is complete, it is the registration stage. After entering the APP, click [create account]. At this time, you must enter your phone number, and then you will receive a one-time-password message, enter the password to enter the registration is successful.

After entering the one-time password, you have to create a 6-digit number password, which is used when you want to pay with TNG ewallet. Next, enter your name, country, ID number and email address, and then click next to finish. You can choose to bind your TNG card immediately, or later.

The following is the interface of touch N go app. This is how it looks after entering the software. This app can also transfer funds (that is, transfer money to family and friends), or scan code payment. Then below you can also see the services it supports.

After registration, you can authenticate your ewallet. The advantage is that the upper limit can reach 5000 ringgits, you can transfer money, and finally you can also open fast payment.

Where can touch N go be used

Of course, as with other e-wallets, the most basic thing is to pay for phone bills. The next step is to book movie tickets and air tickets. However, if the airline ticket is airasia, I suggest that you pay through bigpay , because you can get the maximum discount. Of course, the biggest difference of TNG e-wallet is his RFID tag. Now you can pass the toll directly through the APP RFID tag , there is no need to bring a card or the like like before. Although it is not troublesome to bring a card, this is a new feature.

In addition, it is convenient that TNG also has an automatic reload function, which means that you do not need to recharge each time. Now when your e-wallet’s money is lower than a certain amount, it will automatically topup for you, which is very convenient.

- Top up prepare phone charges

- Pay postpaid phone bill

- Pay the bill

- Book movie tickets

- Book an air ticket

- You can buy discount

- RFID

- Paydirect (used by toll)

- Parking (malaysia parking APP)

- Lacing

Top-up ID touch N go

It is very simple to bind your touch N go card to the E-wallet, just click [ADD TNG CARD], then enter the [10 numbers] on your TNG card, and then give you this take a [name] for a TNG card (for example: maomaochia.Com) and click next to add it. But if you want to bind your ID card to use as a TNG card, then you may be more distressed because the ID card number is not displayed on the ID card.

The following will teach you how to do it:

first you go to the gas station, 7-11 is still any place where you can recharge touch N go, use your ID card to recharge, and then remember to take the receipt. At this time, you find [ mfg no ] on the receipt , this is the TNG number on your ID card, and then enter this number in the e wallet to add the TNG card.

How does touch N go ewallet make money? 【touch N go recharge】

While using your TNG E-wallet, you can recharge your e-wallet in several ways. So for the demonstration of touch n go recharge, this article will also demonstrate to you once and teach you how to make money with touch N go ewallet.

- First you open the software and click [reload wallet]

- Enter here and you can fill in the amount you want to recharge.

- Now you fill in the number on your debit card or credit card.

- After filling in, click 【reload now】

- It’s that simple.

There are a few points to add to everyone. If you do n’t want to topup your bank card , then you can click this [ FPX online banking ] option, which allows you to recharge via online transfer such as maybank2u, CIMB click , etc. Convenience.

Also, it is actually better to bind this bank card. Because there is also a function here [ quick payment ] that allows you to pay even when the balance in the e-wallet is not enough. The e-wallet will pay through the bank card you bind. So, even if you want to buy something with more money today, you do n’t have to worry about the money in the e-wallet.

Summarize several ways to make money with touch n go ewallet.

- The first is to use the reload PIN for recharge. These reload pins are all available in supermarkets, 7-11, or gas stations. So it’s very convenient.

- The second one is to recharge through credit card and debit card. So it is also very simple. If you want to use the card, then you can fill in your personal information and card number, and then you can easily pay directly through the internet.

- The third is to recharge through FPX. In the case of FPX, online payment is similar to maybank2u.

Auto-reload

Regarding the TNG app, I think that the most eye-catching feature is the auto reload function. Because people like us who often use TNG may recharge it once a week. It has been troublesome to recharge it all the time, but sometimes I do n’t want to recharge too much. Now with this automatic recharge function, it is really good. You can set how much less money is in your wallet (for example: 20-100), and then set how much automatic topup, the app will automatically recharge the TNG amount, so you do n’t need to go to topup all the time.

But the embarrassment is that this auto reload is only to reload your wallet, not to reload your TNG card, so when you want to take MRT or toll, if you use a card, the money in the card will not help you reload .

But do n’t be afraid, we also called TNG to confirm that it is currently an ewallet that can only auto reload TNG , but they will have this feature in the future. It is possible to automatically topup your touch n go card as we think, then it ’s true you do n’t need to worry about not enough money in the TNG card.

IC touch N go卡

Maybe you will worry about using IC to bind to touch N go card is not safe or something. In fact, you don’t have to worry about the impact after binding the card, because it will not affect you if it is tied or not. Instead, after adding your TNG card, you can see the usage history of your card.

Here you can perform edit name [change name], remove card [remove bind card] or email TNG statement [send usage record to your email].

If you are worried about what is wrong with your bound card, or if you have not used it, you can remove the bound card immediately. Just select remove card and confirm the removal.

Where to buy touch n go card?

Touch N go cards are sold in many places, generally you can buy them at gas stations, mynews stores, atms, supermarkets and tocuh 'n go customer service stations, train stations, MRT / LRT stations, 7 eleven, etc.

Can touch n go ewallet be used in mrt

The touch N go card can be used to travel in malaysia. However, touch n go ewallet cannot currently use MRT, LRT, or bus directly, or only use cards.

Can IC be touch n go?

The identity card (IC) identity card can be used as a touch n go card, and can also be used to bind touch n go ewallet.

Touch n go ewallet what if I forget my password?

If your touch n go ewallet has forgotten your password, then you can log in to the software, click the head in the upper right corner, then change the pin password, and then click forgot password.

FNB ewallet: the ultimate guide for sending/collecting/reversing ewallet

FNB ewallet is the most convenient way of sending money to friends and family members.

It allows FNB account holders to send money from bank accounts to any registered working cellphone number in south africa.

You're able to reverse ewallet should you send money to the wrong number.

FNB ewallet - send money instantly.

Ewallet is the best when coming to sending money via cellphone banking.

The FNB ewallet enables clients to send money to a cellphone number (your wallet), and the money can be accessed instantly, at any FNB atm.

You can send an e-wallet of up to R3,000.00 per day when using the mobile app or online banking. And up to R1,500.00 using cellphone banking or FNB atms.

It's only going to cost you R10.95 for transfers less than R1,000.00. And R13,95 for any amount over R1,000.00 to R3,000.00.

That's the most cost-effective way of sending money to family.

The person you're sending the money to, don't need to have an FNB account in order to receive the money. They only need a working cellphone number together and the pin to withdraw cash.

Here's how it works:

Sending an ewallet is fairly simple.

- As an account holder, follow these steps to send FNB ewallet:

- Access online banking, mobile app, atm or cellphone banking;

- Choose to send money;

- The select ewallet;

- Enter the cellphone number you want to send the money to;

- Choose whether the app should provide the pin to the recipient or not;

- Enter the amount you'd like to send;

- Confirm and complete the transaction

To withdraw money, the receiver needs to visit any of the nearest FNB atm.

On the screen, they need to choose cardless services.

- Select 'ewallet services'

- Key in your cellphone number and select 'proceed'

- Key in the ATM PIN you received via SMS

- Select the amount you want to withdraw

- Take your cash

- Make sure your transaction has ended or that you select 'cancel' before leaving the ATM.

How to reverse an ewallet payment?

Do you want to know how to reverse ewallet sent to the wrong number?

Here's an example of someone who couldn't reverse the ewallet payment and was dearly frustrated. The person sent a lot of money to the wrong number and it's practically impossible to reverse the transaction over a telephone call.

However, the FNB ewallet reversal is very simple nowadays with cellphone banking.

Here's how you can do it:

- Dial *120*321# on your mobile phone [USSD]

- Select alternative 4 for "send money" next

- Select alternative 3 for "ewallet reversal"

- Select the transaction that you want to reverse.

Thus far, that's the only quickest way of reversing the ewallet transaction.

There are no options to reverse ewallet on the app or online - unfortunately.

For further assistance, you must contact the ewallet call centre on 087 575 9405 to reverse the money.

How long does ewallet reversal take?

Unfortunately, your ewallet transaction reversal won't immediate.

According to experienced customers, it takes 4 working days for FNB to complete the ewallet reversal process and pay the money back to the sender.

That's if the recipient's number is working, imagine if you've sent money to a cellphone number that doesn't work.

Well, they'll still help you however it will take about 15 business days for the ewallet reversal to complete.

So, before clicking that sent button, double-check the cellphone is correct to avoid penalties

How much does it cost to reverse the ewallet transaction?

Now that you've managed to reverse an ewallet payment, how much is the bank going to charge you for the mistake?

The amount you'll be charged varies depending on the amount you've sent but charges the same amount as when you were sending.One client claimed was charged R50 fee to reverse an ewallet.

To avoid these inconveniences, always double-check and cross-check the cellphone number of the receiver of the money.

It's super easy to send ewallet via the app because it has access to your cellphone contact list to choose from.

Please note there may be a charge when requesting a reversal. If that (wrong-) person had already collected the money, unfortunately, FNB will not be held responsible and does not guarantee you'll get your money back.

How to ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

Pay your bills safely online with ewallet, and enjoy up to AED 50 cashback.

Easy, fast and secure

Now you can go cashless without needing a bank account. Ewallet is the app to handle all your payments. Send and receive money on your UAE mobile number. Pay etisalat bills and complete your purchases through a secure smartphone application.

Pay with ewallet at your favourite outlet!

Ewallet connects customers and brands with just a click. Shop from your favourite outlets with a network that includes multiple industries including fine dining, casual dining, hospitality, healthcare and much more.

NO registration fees, NO minimum balance and NO bank account required.

Introducing international remittance

In addition to local transfers, ewallet allows you to send money to your loved ones wherever they are. With over 200 countries and territories globally, ewallet ensures that you are covered with three options:

- Send money directly to a bank account

- Send money directly to a mobile wallet

- Traditional over-the-counter transfer

Special offer

Get up to AED 100 cash back when you send money to your loved ones in your home country. No more waiting in queues for international money transfers with ewallet.

Limited time offer! T&cs apply.

For more information, call 800ewallet.

How do I send money?

Benefits

Watch this short how-to video of international money remittance using our ewallet app.

This service is open to all registered ewallet customers. All you need to do is:

- Log into the app

- Select 'transfers'

- Select 'international remittance'

- Enter the recipient’s destination

- Select the product and currency (where applicable)

- Enter the amount (you can enter it in AED or the receiving currency)

- Accept the fraud warning and terms & conditions

- Enter the required recipient details

- Confirm the transaction with your PIN

The confirmation message will include a tracking number. You can share this with your loved ones via email, SMS or whatsapp.

Important to know

The must-know details about this service.

Terms of use:

No transaction fees and VAT will be applied to the sender. The recipient might be charged according to their country's fees and taxes.

Please make sure to read the updated terms and conditions.

So, let's see, what we have: south africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips. what is ewallet? Ewallet is a prepaid account that allows y at how to ewallet

Contents of the article

- Top-3 forex bonuses

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to ewallet

- Book fair ewallet

- How it works

- Additional details

- Share the news on social media

- How to reverse ewallet payment

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- HOW TO USE TOUCH N GO E WALLET?

- How to use touch N go E wallet

- Where can touch N go be used

- Top-up ID touch N go

- How does touch N go ewallet make money? 【touch N...

- Auto-reload

- IC touch N go卡

- Where to buy touch n go card?

- Can touch n go ewallet be used in mrt

- Can IC be touch n go?

- Touch n go ewallet what if I forget my password?

- FNB ewallet: the ultimate guide for...

- FNB ewallet - send money instantly.

- How to reverse an ewallet payment?

- How to ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- Pay your bills safely online with ewallet, and...

- How do I send money?

- Important to know